Market Overview

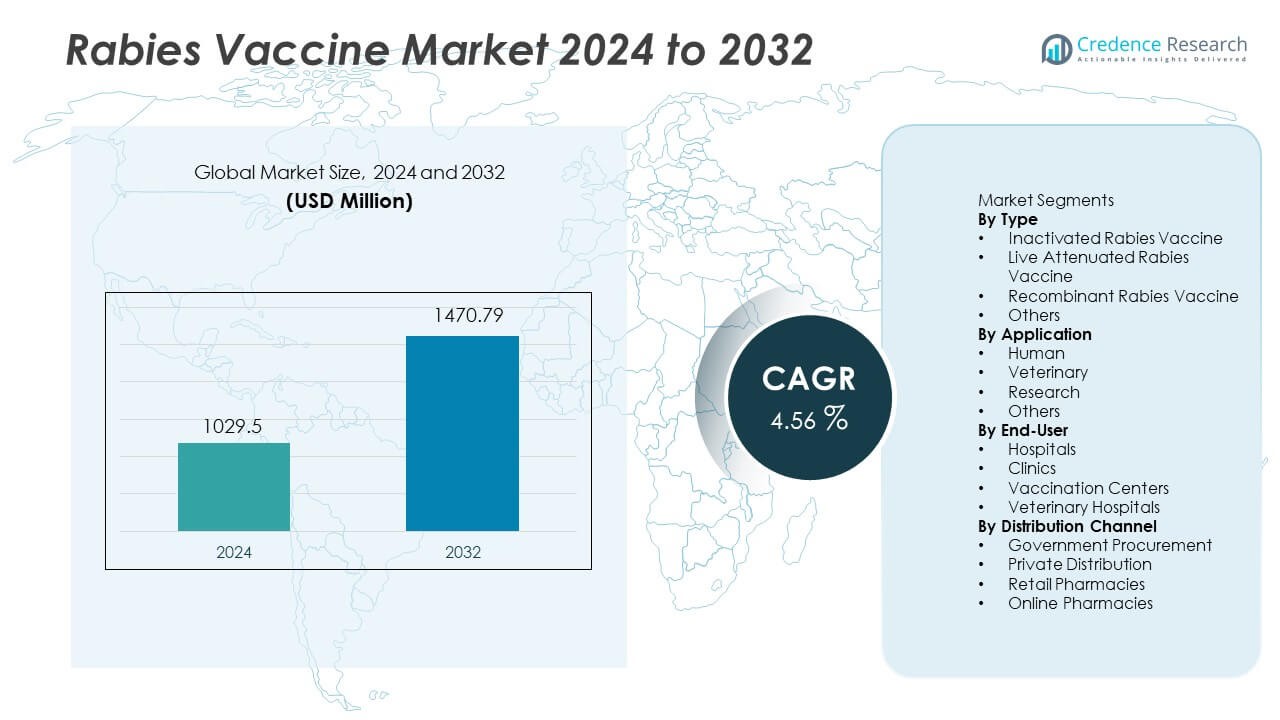

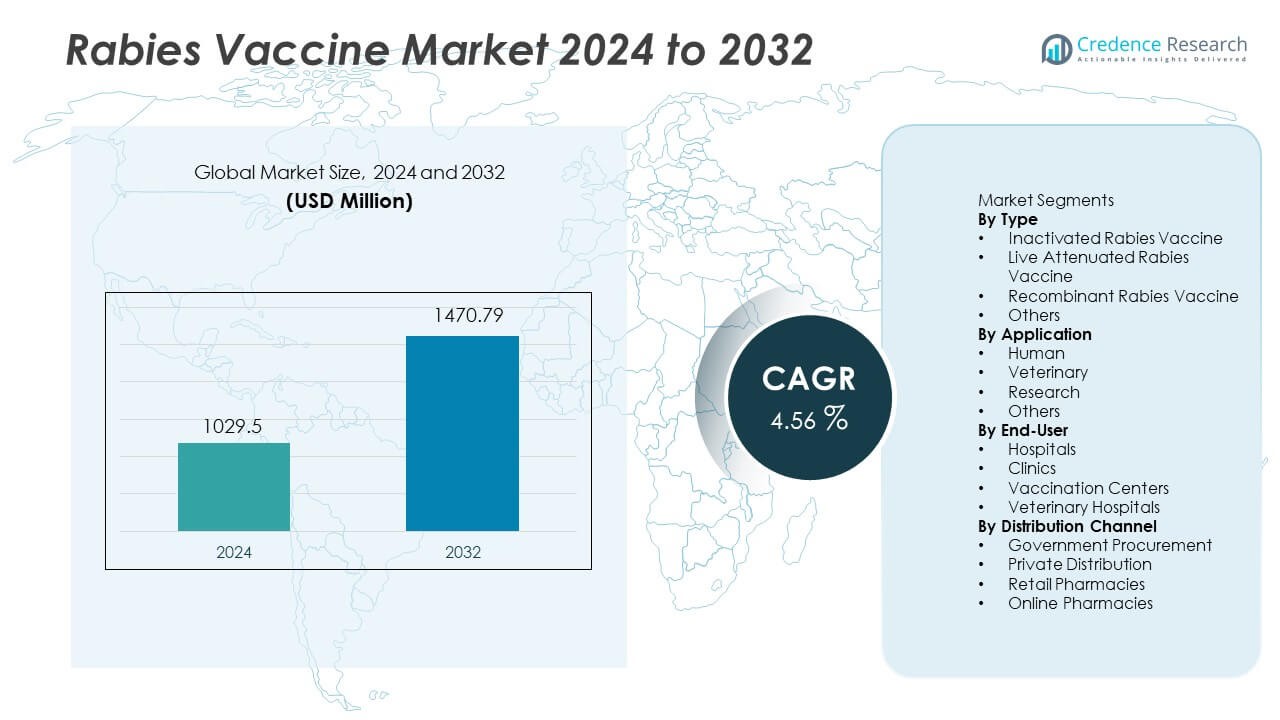

The Rabies Vaccine market was valued at USD 1,029.5 million in 2024. The market is expected to reach USD 1,470.79 million by 2032, growing at a CAGR of 4.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rabies Vaccine market Size 2024 |

USD 1,029.5 Million |

| Rabies Vaccine market, CAGR |

4.56% |

| Rabies Vaccine market Size 2032 |

USD 1,470.79 Million |

Top players in the Rabies Vaccine market include Sanofi, Merck & Co., GSK, Bharat Biotech, Zoetis, Boehringer Ingelheim, CSL Seqirus, Cadila Pharmaceuticals, Serum Institute of India, and Bioveta, with strong portfolios in human and veterinary immunization. These companies expand government supply contracts and invest in expanded manufacturing to serve high-burden nations. Asia Pacific leads the global market with 38% share, driven by the highest exposure levels, strong government vaccination programs, and increasing veterinary immunization initiatives. North America and Europe maintain sizeable shares through established procurement systems, strong hospital infrastructure, and controlled post-exposure treatment pathways.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Rabies Vaccine market reached USD 1,029.5 million in 2024 and is expected to reach USD 1,470.79 million by 2032 at a CAGR of 4.56% over the forecast period.

- Higher human exposure cases and increasing dog vaccination programs drive demand, with the inactivated vaccine segment holding 50–55% share due to widespread regulatory acceptance and strong clinical outcomes.

- Key trends include expansion of recombinant technology and veterinary immunization efforts, alongside increasing government tender participation that supports long-term supply programs in high-burden countries.

- Competitive analysis reflects strong participation from global manufacturers that invest in research, procurement partnerships, and distribution capacity, while regional companies supply affordable products in emerging markets.

- Regional analysis shows Asia Pacific holding 38% share, followed by North America at 25%, Europe at 22%, Latin America at 9%, and Middle East and Africa at 6%, driven by varying exposure levels and healthcare infrastructure readiness.

Market Segmentation Analysis:

By Type

The inactivated rabies vaccine remains the leading sub-segment and holds 55% market share. Widespread regulatory approval and strong clinical safety records continue to support large-scale adoption across human immunization programs. Demand rises in endemic countries that depend on proven post-exposure protection and mass vaccination strategies. Live attenuated and recombinant options expand within veterinary and research areas, yet their adoption pace stays slower due to safety concerns and limited program availability. The dominance of inactivated formulations is reinforced by government procurement and their long track record in reducing rabies transmission in high-risk settings.

- For instance, Sanofi developed Verorab with a reported neutralizing antibody result above 0.5 IU per milliliter after the full dose series, as documented in WHO prequalification data.

By Application

Human vaccination accounts for nearly 65% share and remains the largest application area in the global market. National immunization guidelines, higher post-exposure prophylaxis volumes, and increased public health spending continue to boost demand for human doses. The segment benefits from heightened awareness and access to vaccination across regions with high animal exposure rates. Veterinary and research segments grow steadily through pet vaccination initiatives and institutional studies, but human post-exposure requirements drive most revenue. Expanded campaigns from health authorities and international public health bodies further support this dominant share.

- For instance, Serum Institute of India supplies Rabivax-S to several countries, with the product recently licensed in India and data submitted for World Health Organization prequalification to facilitate its use in developing countries in Asia and Africa.

By End-User

Hospitals contribute 45% of the overall market and lead distribution across major economies. Hospitals manage critical post-exposure treatments and administer vaccines under controlled conditions supported by trained medical staff. Clinics and vaccination centers gain traction through improved accessibility, though hospitals remain the first point of care for confirmed exposure cases. Veterinary hospitals address animal immunization demand, yet this remains a relatively smaller portion of total revenue. Hospital leadership continues due to trust in institutional care, wider reach, and advanced storage infrastructure that supports large immunization volumes.

Key Growth Drivers

Rising Human and Animal Exposure Risks

Global rabies exposure remains high in Asia and Africa. Human travel and expanding pet ownership raise bite risks in urban locations. Governments run vaccination drives for humans and animals across high-burden countries. These programs raise post-exposure prophylaxis demand and long-term immunization coverage. Increased reporting of animal bites also pushes urgent vaccination in hospitals and clinics. Campaigns by global health agencies encourage early response and responsible animal vaccination practices.

- For instance, Zoetis has supported the supply of many veterinary rabies doses through programs like the OIE Rabies Vaccine Bank and the Afya Program for use across Asia and Africa, contributing to the global initiative to eliminate canine-mediated rabies deaths by a target date.

Government Immunization Programs and Procurement Support

Public procurement programs secure vaccine supply for national immunization plans. Health ministries distribute vaccines through hospitals, clinics, and outreach units. Subsidized pricing supports broad access in low-income groups. Regional tenders create steady purchasing cycles and predictable volume demand. Partnerships with health organizations improve distribution and storage in remote regions. These initiatives support continuous product uptake and strengthen preventive healthcare measures.

- For instance, Bharat Biotech expanded annual capacity at its Genome Valley site based on official statements.

Strong Safety Record of Inactivated Vaccines

Inactivated formulations hold wide regulatory approvals in major countries. Long clinical use builds strong physician confidence and public acceptance. Their safety record remains suitable for repeated dosing in human exposure cases. Hospitals prefer these formulations for controlled post-exposure treatment. Health authorities rely on proven storage and distribution standards. This sustained preference supports high sales in endemic regions worldwide.

Key Trends & Opportunities

Shift Toward Recombinant and Next-Generation Platforms

Recombinant technologies attract interest for improved safety and production control. These platforms support scalable manufacturing and lower contamination risks. Research groups evaluate novel antigen designs for broader immune protection. Recombinant solutions aim to reduce supply pressure on traditional plasma-based inputs. Investment from biotech companies increases pilot studies and development programs. These technologies open new commercial opportunities over the long term.

- For instance, Cadila Pharmaceuticals developed its recombinant rabies vaccine “ThRabis” produced in CHO cells with an antigen potency above 2 IU per human dose as stated in Indian drug regulatory filings.

Growing Focus on Veterinary Prevention Programs

Veterinary vaccination programs expand across emerging markets. Pet adoption rises in urban centers with higher exposure risks. Livestock vaccination protects animal health and reduces disease spread in rural zones. Governments promote responsible pet vaccination through awareness campaigns. Veterinary hospitals see steady growth in demand from pet owners. Preventive focus creates future market opportunities across private and public channels.

- For instance, Boehringer Ingelheim provides high-quality rabies vaccine doses through its “STOP Rabies” program for use in global elimination campaigns, collaborating with partners to deliver millions of doses to communities in need, rather than strictly recording them as commercial sales within its animal health division.

Key Challenges

Uneven Access in Low-Income Regions

Limited vaccination budgets restrict coverage in low-income populations. Infrastructure shortages reduce distribution in remote settings. Cold-chain gaps create logistical barriers for long-distance supply. Many rural clinics lack trained vaccination staff for proper administration. Donation programs improve reach but remain inconsistent. Uneven access slows progress toward global disease elimination goals.

High Disease Burden in Endemic Regions

Endemic countries experience continuous human exposure and high mortality. Poor animal control increases rabies circulation in rural areas. Delayed medical response after bites leads to treatment gaps. Limited awareness causes underreporting and insufficient post-exposure protection. These conditions raise long-term healthcare pressure and fatalities. High disease burden remains a critical public health challenge.

Regional Analysis

North America

North America holds 25% market share supported by strong healthcare spending and consistent post-exposure prophylaxis demand. The United States leads due to established vaccine procurement systems, structured hospital administration, and clear clinical guidelines for exposure cases. Rabies infection remains rare, yet rising global travel and importation of animals sustain vaccination needs. Private distribution channels and continuous awareness programs strengthen recurring human vaccination uptake. Canada benefits from strong veterinary regulations and preventive control in wildlife, helping reduce infection risk. Advanced research activities also encourage long-term development of recombinant formulations in academic and biotech environments.

Europe

Europe accounts for 22% market share driven by effective public vaccination frameworks and strict veterinary control laws. Western European countries have strong surveillance and reporting systems that support early intervention in confirmed bite cases. Demand is stable and concentrated in human vaccination through public healthcare access. Regional health authorities implement rules for pet vaccination and international animal movement, sustaining commercial uptake. Eastern Europe shows higher preventive vaccine procurement given wider animal exposure risks. Awareness programs and structured hospital pathways help maintain consistent purchase patterns for inactivated vaccines.

Asia Pacific

Asia Pacific represents 38% market share and remains the largest revenue contributor due to very high disease burden. India, China, and Southeast Asian countries report frequent exposure cases across urban and rural areas. Human vaccination demand grows through public immunization programs and expanded post-exposure treatment availability. Veterinary vaccination receives increasing attention as governments target domestic animal control and responsible pet ownership. Rapid population growth, high animal density, and limited rural awareness continue to drive strong hospital-based vaccination. International support organizations partner with national agencies to improve supply and education across endemic locations.

Latin America

Latin America holds 9% market share supported by regional vaccination campaigns and rising public awareness. Countries including Brazil, Mexico, and Argentina record significant progress in human immunization but still face rural exposure concerns. Public health programs increase post-exposure treatment availability in government hospitals, while veterinary campaigns aim to control domestic and stray animal risks. Budget constraints and local regulatory delays influence procurement speed, although awareness initiatives remain active. Expanded pet ownership in cities also increases veterinary vaccination demand. Regional progress continues as authorities integrate surveillance systems and education campaigns in high-risk communities.

Middle East & Africa

Middle East and Africa account for 6% market share yet face the highest endemic exposure challenges. Many rural regions lack structured hospital access or trained vaccination staff. International health organizations support donation programs and awareness campaigns. Rising urbanization increases human and pet interaction, raising vaccination needs in urban centers. Veterinary vaccination remains limited, contributing to persistent transmission cycles in animal populations. Supply chain challenges and limited cold-chain infrastructure slow wider immunization. Despite lower revenue share, long-term demand remains strong due to continuous human exposure and high disease burden across developing nations.

Market Segmentations:

By Type

- Inactivated Rabies Vaccine

- Live Attenuated Rabies Vaccine

- Recombinant Rabies Vaccine

- Others

By Application

- Human

- Veterinary

- Research

- Others

By End-User

- Hospitals

- Clinics

- Vaccination Centers

- Veterinary Hospitals

By Distribution Channel

- Government Procurement

- Private Distribution

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis highlights key participation from Sanofi, Merck, GSK, Bharat Biotech, Zoetis, Boehringer Ingelheim, CSL Seqirus, Cadila Pharmaceuticals, Serum Institute of India, and Bioveta. Most leading companies focus on inactivated formulations due to strong regulatory acceptance and high global usage in post-exposure prophylaxis. Large pharmaceutical firms invest in clinical validation, broader distribution, and government procurement partnerships, while regional manufacturers expand affordable vaccine supply for high-burden countries. Research activities continue around recombinant platforms to improve immune protection and scalable production, although adoption remains limited at present. Contract manufacturing agreements support supply continuity across developing regions, while tender-based government procurement remains the primary sales route in Asia and Africa. Veterinary vaccine providers expand product ranges to address pet immunization and livestock control, while multinational firms enhance pipeline development to strengthen long-term market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Sanofi received an FDA update for Imovax Rabies PrEP. The update added a two-dose primary series option.

- In June 2024, Merck & Co., Inc. (MSD Animal Health) launched Nobivac NXT Rabies in Canada. The portfolio uses an RNA-particle platform for pets.

- In March 2024, Merck Animal Health extended rabies vaccine donations to Mission Rabies. The commitment covers multiple years of supply.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as exposure cases continue across high-burden countries.

- Human vaccination programs will expand under national health initiatives.

- Veterinary immunization will grow with increasing pet ownership in cities.

- Inactivated vaccines will retain dominance through strong clinical acceptance.

- Recombinant platforms will gain long-term interest for improved safety.

- Research investments will increase to support next-generation formulations.

- Government procurement will continue as the primary sales channel.

- Contract manufacturing will expand to meet regional supply needs.

- Awareness campaigns will improve early post-exposure treatment uptake.

- Asia Pacific will remain the key revenue center driven by higher exposure risks.