Market Overview

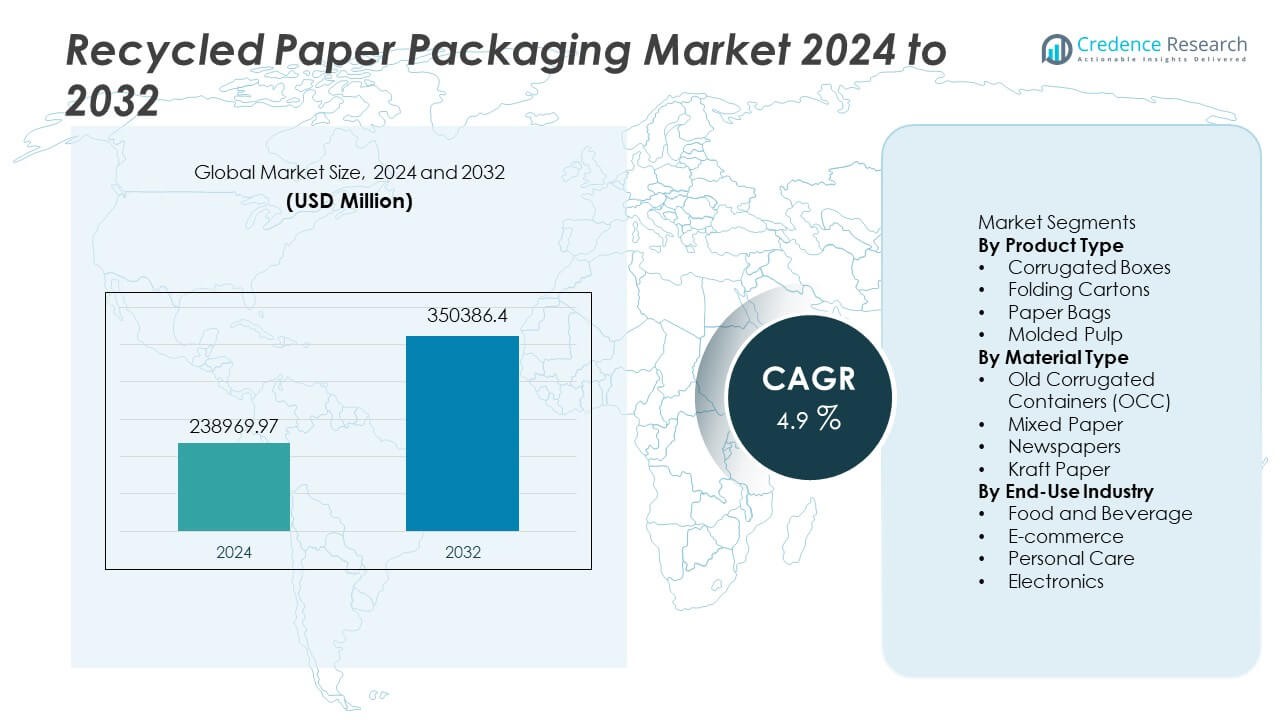

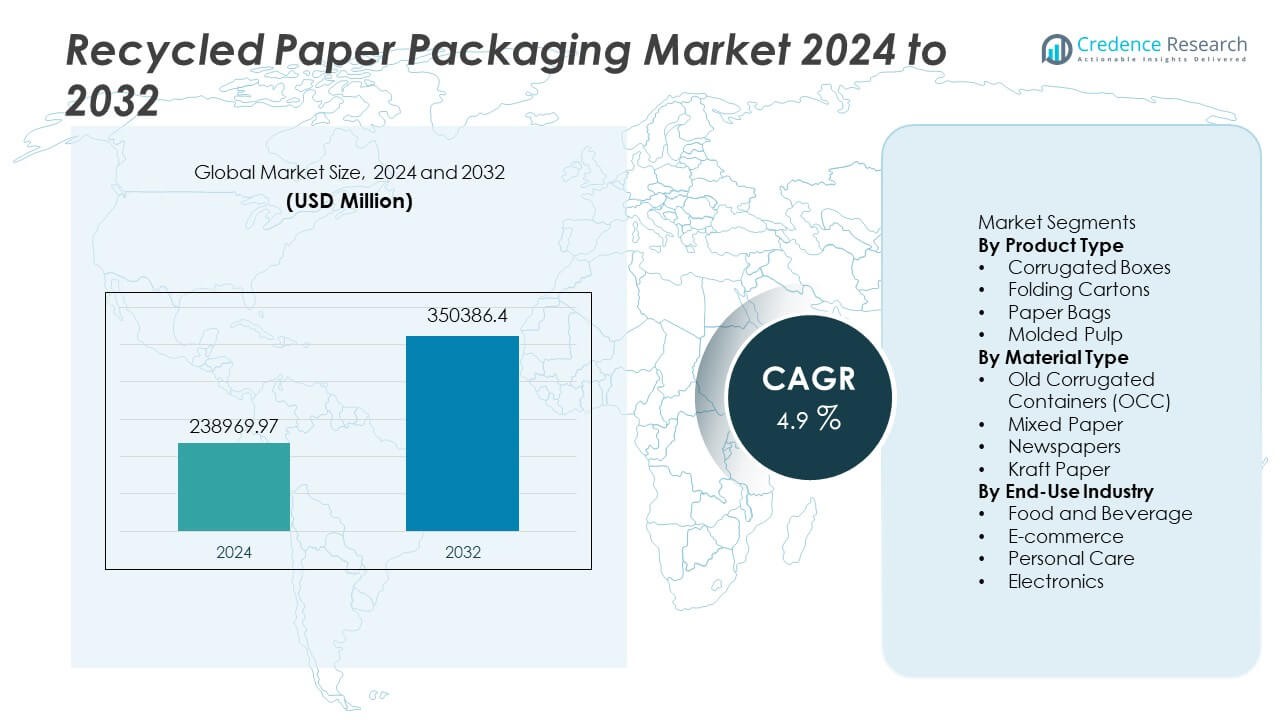

The Recycled Paper Packaging Market was valued at USD 238,969.97 million in 2024 and is projected to reach USD 350,386.4 million by 2032, growing at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Recycled Paper Packaging Market Size 2024 |

USD 238,969.97 Million |

| Recycled Paper Packaging Market, CAGR |

4.9% |

| Recycled Paper Packaging Market Size 2032 |

USD 350,386.4 Million |

Top players in the Recycled Paper Packaging market include International Paper Company, WestRock Company, Smurfit Kappa Group, Mondi Group, DS Smith Plc, UPM-Kymmene Corporation, Georgia-Pacific LLC, Oji Holdings Corporation, Pratt Industries, and Nine Dragons Paper Holdings. These companies invest in containerboard capacity, fiber recycling technologies, and circular packaging partnerships with large retail and e-commerce platforms. North America leads the market with 31% share, supported by advanced recovery systems and strong e-commerce shipping demand, followed by Europe at 28%, driven by strict recycling regulations and high consumer awareness. Asia Pacific holds 27% due to rapidly growing industrial production and packaging consumption supported by expanding fiber collection networks.

Market Insights

Market Insights

- The market reached USD 238,969.97 million in 2024 and is projected to reach USD 350,386.4 million by 2032 at 4.9% CAGR, supported by growing adoption of eco-friendly packaging across global industries.

- Strong sustainability rules and rising e-commerce shipping volumes drive recycled corrugated boxes, which lead product type share with 58%, while food and beverage dominate end use with 39% owing to high consumption of shipping and shelf-ready packaging.

- Key trends include plastic substitution in retail, lightweight corrugated development, and increased use of molded pulp trays for electronics and food, supported by technology investments in printing, forming, and barrier grades.

- Competitive activity remains strong as major paper producers expand recycled capacity, improve fiber cleaning, and integrate digital sourcing systems; partnerships with global e-commerce companies sustain high demand for corrugated cartons.

- North America holds 31% share, followed by Europe at 28% and Asia Pacific at 27%, supported by advanced recovery networks and rising consumer preference for sustainable packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Corrugated boxes lead the product segment with near 58% share, driven by heavy use in shipping, foodware, and retail packaging. Strong strength-to-weight balance and high recycling potential support continued industrial adoption. Folding cartons hold near 22% share due to wide use in personal care and FMCG goods that require printed branding. Paper bags account for near 12% share helped by growing bans on plastic bags in retail stores. Molded pulp holds near 8% share, supported by protective packaging needs in electronics and food containers. Demand rises as brands replace virgin paper grades with recycled alternatives in global supply chains.

- For instance, Smurfit Kappa’s patented “TopClip” solution has been introduced by customers, such as a major Dutch brewer, as a paper-based alternative to plastic shrink-wrap, which in their application removes a significant quantity of plastic annually and results in a lower carbon footprint.

By Material Type

Old Corrugated Containers (OCC) dominate the material segment with near 63% share, supported by steady retail returns and high recovery rates from logistics networks. Mixed paper captures near 18% share, driven by availability from households and commercial waste streams. Newspapers account for near 11% share, but decline due to falling print consumption in developed markets. Kraft paper accounts for near 8% share, supported by light packaging and retail carry bags. Strong recycling systems in developed markets help secure OCC feedstock and improve long-term supply for manufacturers.

- For instance, International Paper processes a substantial volume of recovered fiber annually across its global network, helping supply OCC to mill operations. Their recycling business collects, consumes, and markets a significant amount of paper recovered each year in several countries, including the United States and Mexico, making it one of the world’s major recyclers of corrugated boxes.

By End-Use Industry

Food and beverage lead with near 39% share, supported by corrugated shipping boxes and molded pulp trays. E-commerce follows with near 31% share, driven by rapid parcel shipping growth and sustainability goals across online platforms. Personal care holds near 17% share, helped by folding carton adoption for high-volume retail brands. Electronics captures near 13% share, where molded pulp trays replace plastic cushioning. Regulations that restrict plastic waste encourage substitution across consumer categories. Growing sustainability labeling and recycled content goals support wider adoption across regional retail and industrial segments.

Key Growth Drivers

Expanding Sustainability Regulations

Governments introduce recycling goals that increase adoption of recycled paper packaging across food, retail, and e-commerce categories. Plastic reduction programs encourage switching from plastic mailers toward corrugated boxes and folding cartons. Procurement rules in public and private sectors also include minimum recycled content targets that support long-term demand. Many countries support municipal collection programs for corrugated waste, improving supply of old corrugated containers. These actions drive steady growth in recycled grades across global packaging chains and encourage brand commitment toward circular products that offer lower environmental impact and improved recovery performance.

- For instance, Mondi increased its kraftliner production capacity at its Świecie mill after its paper machine upgrade in late 2024, helping customers meet packaging demands for heavy-duty applications and enhancing product quality.

Growth of E-Commerce and Shipping Needs

Rapid online retail expansion increases demand for corrugated boxes and molded pulp that protect goods during transport. E-commerce platforms prefer recycled paper due to lower cost and wide availability from regional supply chains. Rising parcel volumes support high use of light corrugated grades in developed and developing markets. Shipping companies adopt eco-friendly packaging to meet sustainability commitments and reduce plastic usage. These factors sustain corrugated demand even during shifting consumer cycles. Growth continues as retailers introduce returnable and recyclable packaging formats linked with brand responsibility goals.

- For instance, WestRock expanded automated box operations for major e-commerce clients and produced automated packaging systems across customer sites, thereby significantly reducing manual handling in shipping lines.

Corporate Focus on Circular Packaging

Large consumer brands invest in recycled folding cartons and molded pulp trays to support their sustainability commitments. Retailers promote eco labels that highlight recycled content and support customer choice. Many FMCG companies redesign packaging to reduce virgin fiber usage across core product lines. Circular initiatives encourage reuse, optimized weight, and easier recycling, which drive steady adoption of recycled paper variants. Corporate reporting on sustainability also strengthens brand action and increases visibility of circular solutions in competitive markets. These programs support long-term demand for recycled paper packaging across global supply chains.

Key Trends and Opportunities

Rise of Plastic Substitution in Retail Packs

Retail bans on plastic bags encourage adoption of recycled paper bags across supermarkets and specialty stores. Brands design carton-based multipacks that replace plastic shrink wraps in FMCG goods. Many retailers test molded pulp for food containers and protective packaging, reducing dependence on petroleum-based formats. Sustainability awareness increases willingness to pay for greener solutions. These actions create strong opportunities in light packaging and retail carry bags, especially in developed markets. Growing plastic-free campaigns also push faster adoption of recycled alternatives across food and household product categories.

- For instance, Smurfit Kappa’s TopClip has replaced a significant volume of plastic shrink-wrap units across Europe and the combined group uses a substantial amount of recovered fiber for its corrugated production.

Adoption of Advanced Recycling and Sorting Systems

Sorting systems improve separation of corrugated grades and enable higher-quality recycled fibers. Many regional mills invest in de-inking, cleaning, and odor-control systems to upgrade recovered fiber performance for food and personal care packaging. Digital tracking of bale sources enhances transparency and supports responsible sourcing programs. Improving fiber strength enables recycled paper to replace virgin grades in multiple end uses. These opportunities expand supply for high-volume packaging and reduce dependence on global virgin pulp markets. Strong investment in recycling infrastructure strengthens the long-term availability of recycled paper across industrial regions.

- For instance, International Paper processes a large amount of recovered fiber across its recycling operations and focuses on expanding capacity for corrugated materials within North America.

Key Challenges

Quality Variation and Fiber Contamination

Mixed waste streams contain contaminants that degrade recovered fiber quality and limit performance in sensitive uses. Mills require extensive cleaning and sorting, which increase processing cost and reduce efficiency. Quality variation makes it difficult to secure consistent supply for food contact packaging and high-grade folding cartons. Declining newspaper volumes reduce availability of clean short fibers used in recycled blends. These issues create supply instability, especially in regions with limited recycling infrastructure. Industry investment in quality control remains essential for wider adoption in regulated packaging markets.

Supply Constraints During Demand Peaks

High demand in e-commerce and retail shipping can exceed available recycled fiber supply during peak seasons. Limited recovery rates in developing regions restrict access to old corrugated containers, creating sourcing challenges. Volatile fiber pricing impacts cost-sensitive brands and slows adoption in less-regulated markets. Mills depend on strong municipal collection networks, which vary widely across regions. Seasonal supply gaps increase reliance on imported recovered paper in several countries. These constraints challenge long-term price stability and raise cost pressures across large packaging buyers.

Regional Analysis

North America

North America holds near 31% share supported by mature recycling systems and strong municipal collection networks for corrugated waste. The United States leads due to high packaging consumption and large e-commerce shipments that rely on corrugated boxes. Canada invests in recycling infrastructure that increases recovered fiber supply for folding cartons and molded pulp trays. Buyers favor recycled labeling due to sustainability awareness, which supports wider adoption across retail and personal care. Packaging producers benefit from advanced technology and established fiber recovery processes. Regional growth remains stable with strong focus on circular packaging standards in public and private sectors.

Europe

Europe captures near 28% share driven by strict regulatory rules for recycled content in packaging and strong industrial recycling rates across major economies. Germany, France, and the United Kingdom lead adoption of recycled corrugated boxes for shipping and shelf-ready display applications. European retailers support reduction of single-use plastics and promote substitution with recycled paper bags and molded pulp. The region benefits from advanced collection systems and strong consumer awareness of sustainability labeling. Continuous technology upgrades enhance recovered fiber quality and boost supply across major industries. This trend supports long-term growth in recycled packaging formats across FMCG categories.

Asia Pacific

Asia Pacific holds near 27% share supported by expanding industrial production and high packaging demand in China, India, and Japan. Growing e-commerce platforms increase consumption of corrugated boxes and shipping cartons. China invests in domestic recycling capacity that improves fiber quality and reduces imports of recovered paper. India develops municipal collection systems but still faces supply challenges for high-grade recycled fiber. Strong growth in food packaging and personal care supports wider use of recycled folding cartons and paper bags. Regional sustainability commitments encourage replacement of plastic formats in many retail applications. The market expands as regional brands adopt circular packaging goals.

Latin America

Latin America holds near 8% share influenced by growing sustainability awareness and expanding retail networks. Brazil leads adoption of recycled corrugated boxes in food and household product shipping. Mexico increases recycling initiatives that support fiber availability for folding cartons. Limited infrastructure challenges broader adoption in several countries, yet sustainability programs improve collection in urban regions. Retail buyers adopt paper bags to replace plastic formats in supermarkets. Seasonal supply variations remain a concern across regions with low recycling penetration. Continued government support for recycling programs is expected to strengthen long-term growth across packaging users.

Middle East and Africa

Middle East and Africa account for near 6% share, driven by early-stage recycling programs and rising demand for corrugated boxes in consumer goods. South Africa leads regional recovery networks and supports supply of recycled fiber for molded pulp trays. Gulf regions test recycling solutions that enable circular usage in packaging. Many countries face limited infrastructure, which restrains recovery of corrugated fiber at industrial scale. Regional buyers show interest in eco-friendly packaging that reduces plastic waste. Slow improvement in collection systems remains a key challenge for expansion. Growing retail consumption will support long-term market development in major urban areas.

Market Segmentations:

By Product Type

- Corrugated Boxes

- Folding Cartons

- Paper Bags

- Molded Pulp

By Material Type

- Old Corrugated Containers (OCC)

- Mixed Paper

- Newspapers

- Kraft Paper

By End-Use Industry

- Food and Beverage

- E-commerce

- Personal Care

- Electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape includes International Paper Company, WestRock Company, Smurfit Kappa Group, Mondi Group, DS Smith Plc, UPM-Kymmene Corporation, Georgia-Pacific LLC, Oji Holdings Corporation, Pratt Industries, and Nine Dragons Paper Holdings. Leading companies focus on recycling capacity expansion, high-strength corrugated grades, and circular packaging partnerships with major e-commerce and FMCG brands. Several global producers invest in advanced pulping, de-inking, and cleaning technologies to enhance recovered fiber quality for food and personal care applications. Strategic acquisitions strengthen regional presence and improve supply reliability across North America, Europe, and Asia Pacific. Many companies introduce lightweight corrugated solutions that reduce material use without sacrificing performance. Digital tools and traceability programs improve sourcing transparency and support sustainability reporting. Long-term strategies emphasize reduced virgin fiber reliance and expanded recycled paper offerings across high-volume packaging segments.

Key Player Analysis

- International Paper Company

- WestRock Company

- Smurfit Kappa Group

- Mondi Group

- DS Smith Plc

- UPM-Kymmene Corporation

- Georgia-Pacific LLC

- Oji Holdings Corporation

- Pratt Industries

- Nine Dragons Paper Holdings

Recent Developments

- In 2025, Smurfit Westrock published its first sustainability report since the merger. This report, titled the “2024 Sustainability Report,” covered the combined company’s performance for the calendar or fiscal year 2024.

- In 2025, the firm Mondi Group was highlighted among leaders in sustainable innovation in paperboard and packaging. This reflects growing market recognition for its efforts in recycled-content and eco-friendly packaging solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material Type, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as brands increase circular packaging commitments.

- Recycling investments will improve supply of high-quality recovered fiber.

- Lightweight corrugated grades will expand use in shipping applications.

- Molded pulp solutions will replace plastic trays in many sectors.

- Digital printing will support branding on recycled folding cartons.

- Food contact approvals will enable wider use in sensitive packaging.

- Retailers will promote paper bags to replace plastic carry bags.

- E-commerce platforms will accelerate adoption of recycled corrugated boxes.

- Regional collection programs will strengthen recovered paper availability.

- Sustainability regulations will drive higher recycled content targets across packaging.

Market Insights

Market Insights