Market Overview

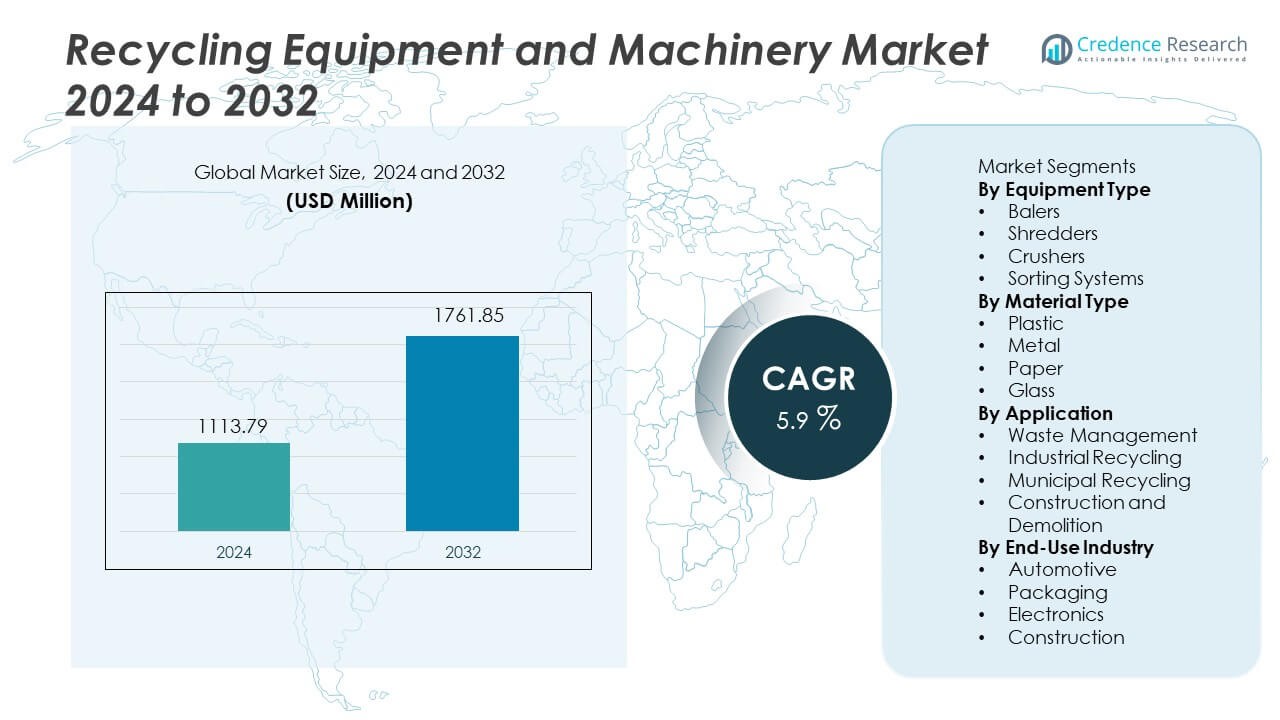

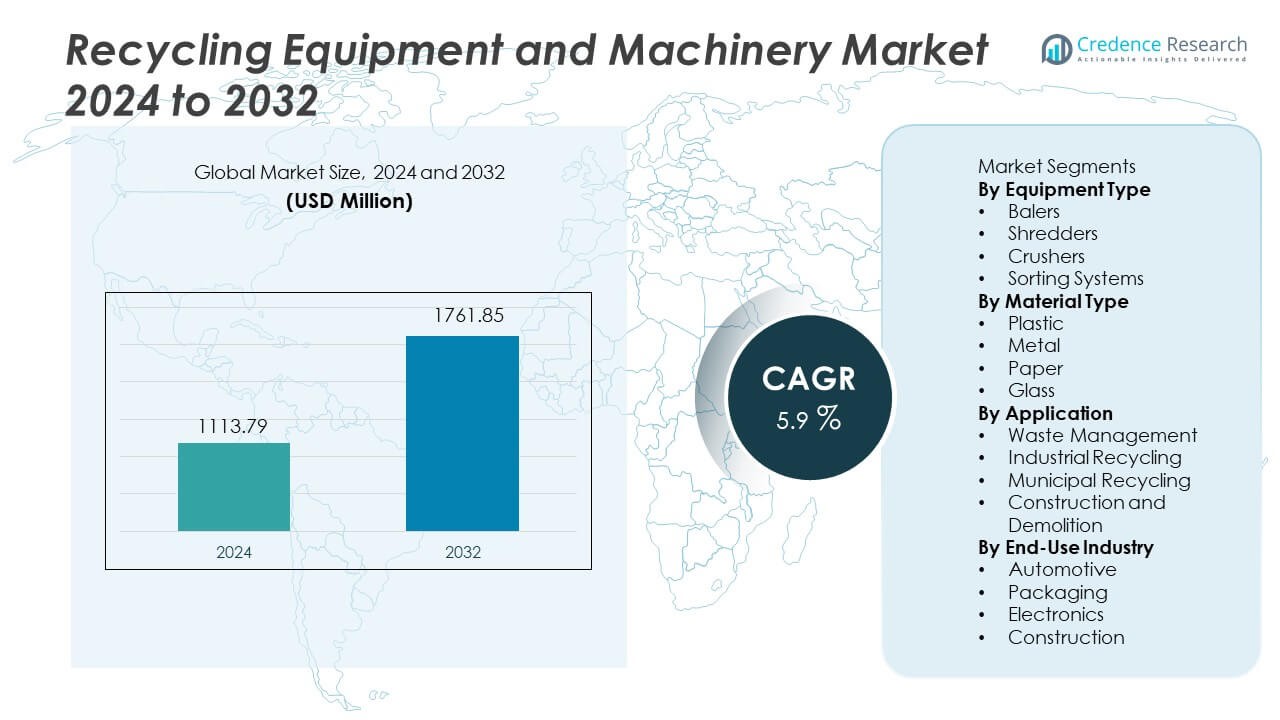

The Recycling Equipment and Machinery Market was valued at USD 1,113.79 million in 2024 and is expected to reach USD 1,761.85 million by 2032, growing at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Recycling Equipment and Machinery Market Size 2024 |

USD 1,113.79 Million |

| Recycling Equipment and Machinery Market, CAGR |

5.9% |

| Recycling Equipment and Machinery Market Size 2032 |

USD 1,761.85 Million |

Top players in the Recycling Equipment and Machinery market include ANDRITZ AG, SSI Shredding Systems Inc., Eldan Recycling A/S, Vecoplan AG, Metso Outotec Corporation, Kiverco Ltd., Danieli Centro Recycling, Komatsu Ltd., CP Manufacturing Inc., and Green Machine LLC. These companies invest in high-capacity shredders, smart sorting equipment, and automated waste processing technologies that improve material recovery efficiency. North America leads the market with 34% share, supported by strong regulatory pressure and advanced municipal recycling infrastructure, followed by Europe at 30%, driven by strict waste management rules and high circular economy targets. Asia Pacific holds 28%, supported by rising industrial waste volumes and expanding recycling capacity across China, Japan, and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 1,113.79 million in 2024 and is projected to reach USD 1,761.85 million by 2032 at 5.9% CAGR, supported by rising global waste generation and landfill reduction targets across industrial and municipal sectors.

- Strong waste regulations and circular economy focus drive demand for balers that hold 37% share, while plastic remains the leading material segment with 41% share, driven by rapid growth of post-consumer plastic waste and rising adoption of automated shredding systems.

- Key trends include adoption of smart sorting systems, AI-based material identification, and automation in municipal facilities aimed at improving material purity and reducing labor requirements, with strong movement toward digital monitoring and predictive maintenance.

- Competitive activity remains strong as major manufacturers expand shredding and baling equipment portfolios, secure long-term service contracts, and invest in advanced sorting technology; partnerships with municipalities support large-scale installations.

- North America holds 34% share, followed by Europe at 30% and Asia Pacific at 28%, supported by strong regulations, industrial growth, and expanding municipal recycling infrastructure across major urban centers.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Equipment Type

Balers lead this segment with near 37% share, supported by broad use in plastic, paper, and metal compaction across municipal and industrial sites. Shredders hold near 31% share, driven by high-volume processing in plastic and metal recycling. Crushers account for near 18% share due to strong use in construction waste and glass recovery. Sorting systems capture near 14% share, supported by automated identification and optical scanning that improve purity of recovered material. Growth comes from rising waste volumes, need for automated handling, and upgrades in recycling infrastructure that help operators reduce landfill loads and improve material recovery rates.

- For instance, Metso Outotec supplied M&J PreShred units that process up to 70,000 tons each year at a single Danish recycling plant.

By Material Type

Plastic dominates the material segment with near 41% share, driven by rapid growth of plastic waste collection and rising adoption of shredders and balers. Metal holds near 26% share supported by industrial scrap and automotive recycling requirements. Paper accounts for near 21% share, driven by commercial and municipal recovery programs. Glass captures near 12% share due to crusher deployment in beverage and construction waste streams. Growth follows extended producer responsibility policies and rising investment in automated equipment that increases throughput and recycled output across regulated waste categories.

- For instance, Kiverco glass recovery modules achieve purity up to 98 based on optical separation, which supports bottle-to-bottle production in regulated markets.

By Application

Waste management leads with near 39% share, driven by expanding municipal recycling programs and growing landfill diversion targets. Industrial recycling holds near 28% share as manufacturers invest in on-site shredders and balers to handle production scrap. Municipal recycling accounts for near 21% share, supported by smart sorting systems and material recovery facilities that manage mixed waste. Construction and demolition capture near 12% share, driven by crushers and shredders used for concrete and metal recovery. Rising collection volumes and regulatory pressure encourage equipment upgrades and long-term expansion across regional waste and recycling networks.

Key Growth Drivers

Rising Waste Volumes and Landfill Restrictions

Growing global waste generation places pressure on governments and industries to expand recycling infrastructure, creating strong demand for balers, shredders, and sorting systems. Landfill restrictions and disposal taxes encourage organizations to increase recycling rates and invest in advanced machinery. Municipal waste management programs adopt automated sorting and compacting equipment to improve recovery efficiency and reduce landfill usage. These initiatives support widespread deployment of recycling machinery in both developed and developing regions. Increasing industrial waste from packaging, electronics, and construction drives equipment modernization and replacement across major sectors.

- For instance, Komatsu manufactures equipment used in waste solutions that help manage materials in municipal and industrial plants.

Government Regulations and Circular Economy Policies

Strict environmental regulations promote recycling of plastics, metals, and construction waste, encouraging the installation of shredders, crushers, and sorting machines across municipal and industrial sites. Circular economy targets accelerate adoption of recycling technology across key material streams, particularly in packaging and metal recovery. Extended producer responsibility programs force manufacturers to manage end-of-life materials, increasing demand for industrial recycling equipment. Government incentives support investment in modern sorting systems that increase material purity, reduce contamination, and improve recycled feedstock quality. These policies drive long-term demand for advanced recycling machinery.

- For instance, Eldan Recycling cable separation technology upgrades purity to 99 with electrostatic separators used in electronic waste facilities in Europe.

Growth of Industrial and Commercial Recycling

Manufacturers adopt on-site recycling equipment to manage production scrap, reduce waste handling costs, and improve sustainability performance. Industrial recycling systems integrate shredders and balers into production lines, enabling closed-loop material recovery. Commercial recycling expands across retail, logistics, and foodservice sectors, increasing demand for compacting and sorting solutions. High-value metal and electronic scrap encourage investment in advanced machinery capable of processing complex waste streams. Digital monitoring and automation also support operational reliability and throughput. These developments expand the role of recycling machinery across industrial processes and supply chains.

Key Trends and Opportunities

Automation and Smart Sorting Systems

Advanced optical sorting, AI-based inspection, and robotic picking systems improve purity and throughput in recycling facilities. Automation reduces manual labor and increases processing speed for plastics, metals, and mixed waste. Equipment suppliers integrate digital controls, wear monitoring, and predictive maintenance systems that reduce downtime and improve disposal efficiency. These innovations expand opportunities in high-volume municipal recycling and industrial facilities. Smart sorting supports large-scale recycling goals and enables material grading that meets high-quality feedstock requirements across packaging and manufacturing industries.

- For instance, ZenRobotics robotic pickers installed in Finland operate using advanced artificial intelligence for object recognition.

Expansion of Construction and Demolition Recycling

Construction and demolition waste offers strong potential due to high concrete, metal, and mixed material volumes. Crushers and shredders help recover usable aggregates and metals, reducing landfill disposal and supporting circular construction practices. Regulatory pressure encourages adoption of advanced recycling systems that support building material reuse. Rising infrastructure projects generate large waste streams that benefit from specialized machinery. Growing sustainability commitments in construction promote investment in recycling systems that help reduce environmental impact and support material circularity across the building sector.

- For instance, Rubble Master impact crushers deployed in Austria process 200 tons per hour of mixed concrete.

Key Challenges

High Capital Cost of Recycling Machinery

Advanced shredders, balers, and sorting systems require significant investment, creating barriers for small municipalities and businesses. High installation costs, maintenance, and operational requirements limit adoption in developing regions. Many recycling facilities rely on outdated equipment due to limited budgets and slow return on investment. Financing limitations create challenges for widespread deployment, especially for emerging waste management companies. Cost concerns also impact adoption of automation and AI-enabled sorting technologies.

Limited Recycling Infrastructure in Developing Regions

Several countries lack strong waste collection networks and sorting facilities, limiting access to recovered materials and slowing the adoption of recycling equipment. Limited public funding and low recycling awareness restrict installation of advanced machinery. Absence of reliable supply chains reduces investment in industrial-scale equipment. These challenges slow progress toward circular waste systems and reduce opportunities for recycling equipment suppliers in emerging markets. Continuous infrastructure development remains critical for long-term market expansion.

Regional Analysis

North America

North America holds near 34% share driven by strong regulatory pressure and rising adoption of automated recycling systems across municipal and industrial sectors. The United States leads due to strict landfill rules and strong investment in balers, shredders, and smart sorting systems. Canada supports recycling initiatives that increase material recovery rates and reduce landfill waste. Large waste management firms deploy advanced optical sorting machines and compactors to improve throughput and efficiency. Rising electronic waste collection and strict plastic reduction programs support continuous equipment upgrades. Growth continues as governments encourage circular economy projects and sustainable waste solutions.

Europe

Europe captures near 30% share due to strong environmental policies, advanced recycling infrastructure, and strict waste reduction targets. Germany, the United Kingdom, and France invest in smart sorting platforms that enhance material purity and support high recycling rates. The European Union drives adoption of advanced machinery through circular economy directives and extended producer responsibility schemes. Heavy waste volumes from packaging, construction, and industrial sectors boost demand for shredders and crushers. Growing focus on automation and digital monitoring supports long-term adoption of advanced recycling machinery across major regional facilities.

Asia Pacific

Asia Pacific holds near 28% share supported by rising waste generation from rapid urbanization and industrial growth in China, India, and Japan. China invests heavily in recycling facilities and advanced sorting technology to manage large plastic and metal waste streams. Japan maintains advanced recycling systems with strong emphasis on material separation and reuse. India expands municipal collection systems but still faces gaps in automated processing and infrastructure. Growing awareness of waste management and government sustainability targets drive long-term adoption across the region.

Latin America

Latin America holds near 5% share influenced by increasing recycling awareness and early-stage adoption of automated machinery across industrial sectors. Brazil leads demand for shredders and balers used in packaging, metals, and plastic recycling. Mexico invests in sorting systems for municipal waste and industrial scrap. Limited infrastructure in several countries restricts adoption of high-cost equipment, although government initiatives improve waste collection in urban areas. Industrial sectors explore machinery that supports sustainability goals and reduces landfill dependency.

Middle East and Africa

Middle East and Africa account for near 3% share driven by early-stage recycling programs and rising waste management regulations. Gulf countries invest in waste-to-energy and recycling projects that require advanced machinery and sorting systems. South Africa expands municipal collection and recycling infrastructure supported by regulatory pressure. Several countries face limited funding for high-cost equipment, slowing broader adoption. Urbanization increases waste volumes, creating long-term opportunities for machinery deployment across municipal and industrial segments.

Market Segmentations:

By Equipment Type

- Balers

- Shredders

- Crushers

- Sorting Systems

By Material Type

- Plastic

- Metal

- Paper

- Glass

By Application

- Waste Management

- Industrial Recycling

- Municipal Recycling

- Construction and Demolition

By End-Use Industry

- Automotive

- Packaging

- Electronics

- Construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape includes ANDRITZ AG, SSI Shredding Systems Inc., Eldan Recycling A/S, Vecoplan AG, Metso Outotec Corporation, Kiverco Ltd., Danieli Centro Recycling, Komatsu Ltd., CP Manufacturing Inc., and Green Machine LLC. Leading manufacturers focus on advanced shredding, baling, and sorting technologies that support high-volume recycling and material purity across industrial and municipal operations. Many companies invest in automation, AI-based recognition, and digital monitoring that reduce downtime and improve throughput. Strategic partnerships with waste management firms and municipalities help secure long-term equipment installations and service agreements. Several players expand their product offerings to meet rising demand for recycling of plastics, metals, paper, and construction waste. Technology upgrades and research on smart sorting systems strengthen competitive positions and support adoption of advanced machinery in global waste processing markets. Continuous investments in circular economy solutions help major companies maintain strong presence across growing waste and recycling sectors.

Key Player Analysis

- ANDRITZ AG

- SSI Shredding Systems Inc.

- Eldan Recycling A/S

- Vecoplan AG

- Metso Outotec Corporation

- Kiverco Ltd.

- Danieli Centro Recycling

- Komatsu Ltd.

- CP Manufacturing Inc.

- Green Machine LLC

Recent Developments

- In August 2025, Kiverco Ltd. delivered a new recycling plant for Dunmow Group at its main recycling centre in Chelmsford (UK).

- In January 2024, Eldan Recycling A/S announced a co-ownership agreement and “historic partnership” with Picvisa Machine Vision Systems. This step adds advanced optical-sorting (infrared and AI-based) capability to Eldan’s portfolio, resulting in new product lines such as the MPS (Multi-Purpose Sorter) and SPS (Small Purpose Sorter).

- In October 2023, General Kinematics recently announced the completion of a 42,000-square-foot expansion of their primary manufacturing space in Illinois, which includes high bay ceilings for 80-ton cranes, additional space for capital equipment, and storage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Material Type, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automation adoption will increase across municipal and industrial recycling plants.

- Smart sorting systems will improve material purity and reduce manual handling.

- AI-driven recognition will support higher recovery of plastics and metals.

- Investments in circular economy projects will expand equipment demand.

- Construction and demolition waste processing will gain wider adoption.

- Digital monitoring will support predictive maintenance and lower downtime.

- High-capacity shredders will expand in large industrial recycling sites.

- Municipal programs will install advanced compacting and baling systems.

- Recycling capacity in emerging markets will expand with infrastructure funding.

- Environmental regulations will continue to drive machinery upgrades globally.

Market Segmentation Analysis:

Market Segmentation Analysis: