Market Overview

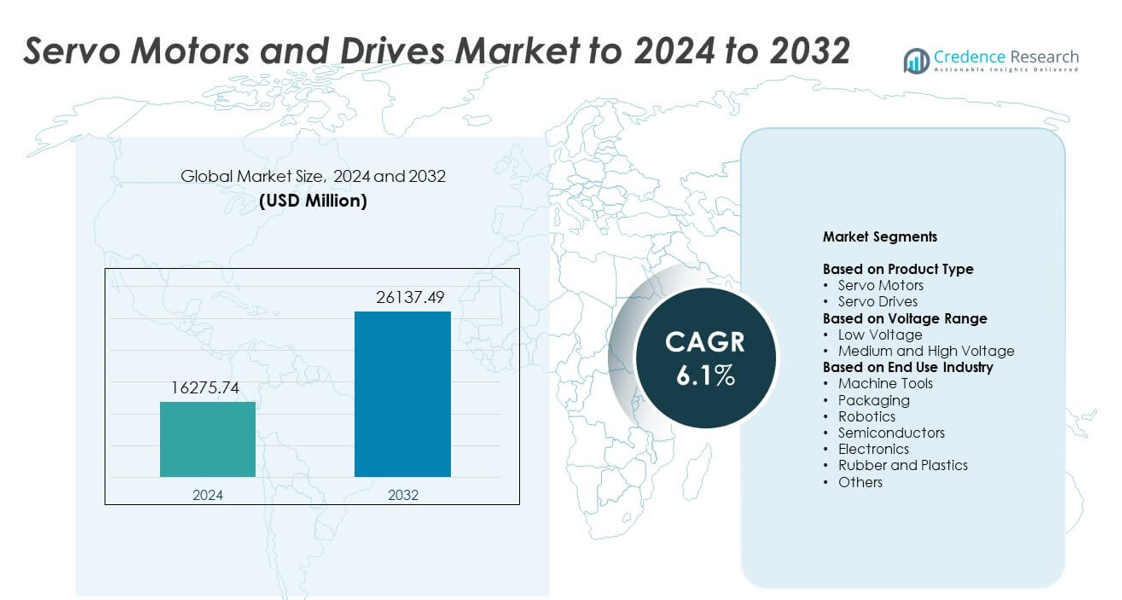

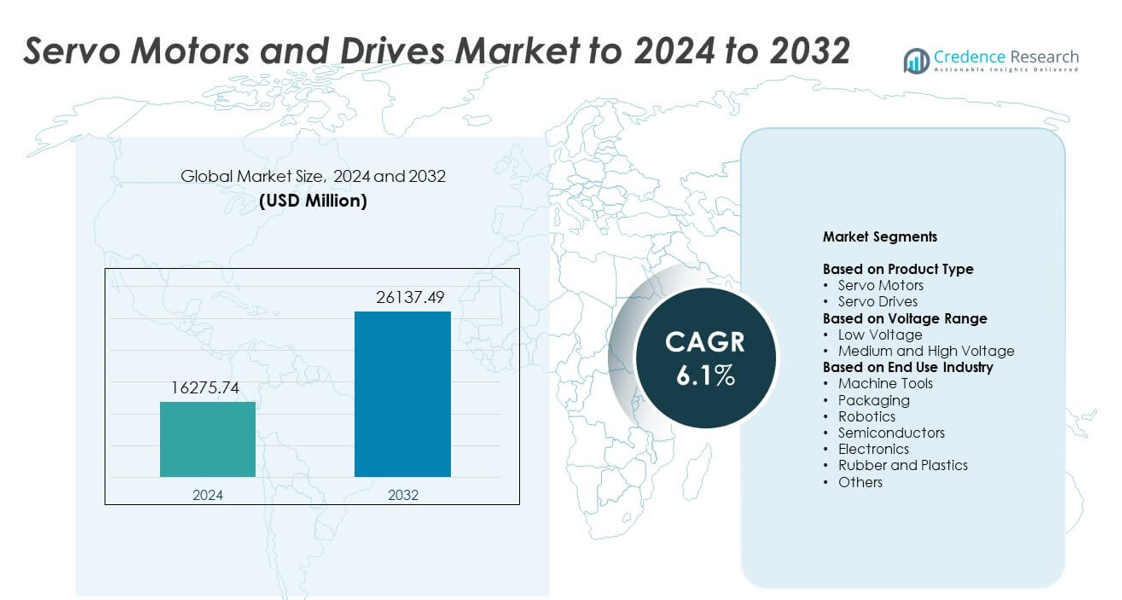

Servo Motors and Drives Market size was valued USD 16275.74 million in 2024 and is anticipated to reach USD 26137.49 million by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| SServo Motors and Drives Market Size 2024 |

USD 16275.74 million |

| Servo Motors and Drives Market, CAGR |

6.1% |

| Servo Motors and Drives Market Size 2032 |

USD 26137.49 million |

The Servo Motors and Drives Market includes leading players such as ABB, Delta Electronics, Fuji Electric, Danfoss, Bosch Rexroth, Advanced Motion Controls, Hitachi, Baumueller, Allied Motion, and Ingenia Cat. These companies compete through high-precision motion systems, energy-efficient drives, and digital control platforms designed for modern automation. Their focus on robotics, semiconductor tools, and advanced manufacturing lines supports steady global demand. Asia Pacific led the market in 2024 with about 34% share due to large-scale industrial expansion, followed by North America with roughly 32% share and Europe with nearly 29% share, reflecting strong adoption across mature automation ecosystems.

Market Insights

- The Servo Motors and Drives Market reached USD 16275.74 million in 2024 and is projected to reach USD 26137.49 million by 2032, growing at a CAGR of 6.1%.

- Rising automation in robotics, packaging, machine tools, and semiconductor equipment drives strong demand, with robotics holding the largest end-use share at about 28% in 2024.

- Key trends include adoption of smart servo drives with real-time monitoring, growing demand for compact high-torque designs, and wider use of energy-efficient systems across digital factories.

- The market remains competitive as major vendors expand digital control platforms, improve encoder accuracy, and form partnerships with automation integrators to strengthen global presence.

- Asia Pacific led the market with 34% share in 2024, followed by North America at 32% and Europe at 29%, while servo drives dominated the product segment with about 58% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Servo drives held the dominant position in 2024 with about 58% share. Strong adoption came from rising demand for precise motion control across automated production lines. Servo drives support faster response, higher torque accuracy, and better energy use, which helped manufacturers upgrade legacy systems. Servo motors saw steady growth due to increased use in compact machinery and robotics, but their share stayed lower than drives because many industries replaced only control units rather than full motor-drive assemblies.

- For instance, Mitsubishi Electric’s MELSERVO-J5 servo amplifiers provide 3.5 kHz speed frequency response. They support rated outputs from 0.1 kW to 7 kW for servo drive control.

By Voltage Range

Low-voltage units led the Servo Motors and Drives Market in 2024 with nearly 71% share. Broad use in packaging, electronics assembly, and light industrial systems supported this lead. Low-voltage solutions offer safer operation, easier integration, and lower installation costs, which encourages adoption in small and mid-scale automation projects. Medium and high-voltage units grew in heavy industries but remained smaller due to higher cost and limited use in specialized high-power applications such as metal forming and large conveyor systems.

- For instance, Omron’s 1S servo system covers a power range from 50 W to 15 kW. It uses a 23-bit high-resolution absolute encoder for precise low-voltage motion control.

By End Use Industry

Robotics emerged as the leading end-use segment in 2024 with nearly 28% share. Strong demand came from rising factory automation, growing cobot installations, and higher precision needs in electronics and automotive assembly. Robotics applications rely heavily on servo systems for accuracy, repeatability, and smooth motion, which boosted segment growth. Machine tools, packaging, and semiconductor equipment followed due to rapid modernization of production lines, while rubber, plastics, and other industries continued gradual adoption with lower volumes.

Key Growth Drivers

Rising Industrial Automation Demand

Automation expansion across manufacturing, electronics, and logistics drives strong uptake of servo motors and drives. Companies modernize plants to improve accuracy, reduce waste, and boost speed, which increases reliance on high-precision motion systems. Growth in robotics, CNC tools, and automated packaging lines also strengthens demand. Many industries shift from manual processes to smart production, and this shift positions servo systems as essential components for stable, efficient, and repeatable motion control.

- For instance, Panasonic’s MINAS A6 servo drives reach a 3.2 kHz response bandwidth for fast control. Selected A6 motors run at speeds up to 6500 rpm with 23-bit encoders.

Advancement in Precision Motion Technologies

Improved encoder systems, compact motor designs, and digital control platforms support wider use of servo solutions. Modern production requires tighter tolerances and dynamic speed control, which increases the appeal of advanced servo architectures. High-resolution feedback and real-time monitoring enhance performance across various machines. These innovations reduce downtime, sharpen accuracy, and help operators maintain product quality, pushing businesses to replace older technologies with new servo-based motion systems.

- For instance, Renishaw’s RESOLUTE absolute encoder offers linear resolution down to 1 nm. It maintains this fine resolution at speeds up to 100 m/s in servo axes.

Growth in Robotics Across Industries

Rising use of industrial and collaborative robots strengthens demand for servo motors and drives. Robotics applications depend on fast response, high torque density, and stable multi-axis control, which match servo capabilities. Automotive, electronics, and warehousing firms deploy robots to boost efficiency and handle repetitive or high-risk tasks. This rise in robot installations, combined with expanding small-scale automation projects, places servo systems at the core of modern robotic motion control.

Key Trends and Opportunities

Shift Toward Energy-Efficient Servo Systems

Manufacturers adopt energy-saving servo drives with regenerative features to cut power use and support sustainability goals. This trend aligns with rising electricity costs and environmental standards across regions. Advanced motors with lower heat loss and higher efficiency attract industries aiming to reduce operational expenses. Growing government focus on energy-efficient machinery expands opportunities for vendors offering optimized servo technologies.

- For instance, Bosch Rexroth’s IndraDrive M power units span from 18 kW to 120 kW. They use energy-saving line regeneration to feed braking energy back into the supply network.

Integration of IIoT and Smart Monitoring

Servo systems increasingly connect with industrial networks to support predictive maintenance and real-time diagnostics. Smart drives help operators track load conditions, speed patterns, and fault history, improving production planning and reducing downtime risks. Adoption of cloud-linked and Ethernet-based servo platforms grows as factories shift toward digital workflows. This integration creates new opportunities for advanced analytics and remote control capabilities.

- For instance, Rockwell Automation’s Kinetix 5700 with Integrated Motion supports a 1 ms minimum base update rate. This fast EtherNet/IP cycle enables tight servo monitoring and real-time diagnostics for each axis.

Expansion of Compact and Lightweight Designs

Miniaturized servo motors address the needs of electronics assembly, medical devices, and compact robotics. Manufacturers seek smaller devices with high torque density and stable positioning accuracy. This trend supports flexible production layouts and space-constrained machines. Growing demand for portable automation tools and precision micro-machinery accelerates adoption of these compact servo solutions.

Key Challenges

High Initial Investment in Advanced Systems

Servo motors and drives carry higher upfront costs than conventional motion equipment, which limits adoption among small and mid-scale manufacturers. Installation, tuning, and integration require specialized skills, adding to the overall project cost. Companies with limited budgets delay upgrades despite efficiency gains. This cost barrier slows modernization in developing regions and affects replacement cycles.

Complex Installation and Technical Expertise Needs

Servo systems require precise setup, parameter tuning, and continuous monitoring for optimal performance. Many facilities lack trained technicians, which increases the risk of errors and downtime during deployment. Compatibility issues with older machines also create integration challenges. These technical hurdles slow adoption in industries transitioning from basic automation to advanced motion control.

Regional Analysis

North America

North America held about 32% share in the Servo Motors and Drives Market in 2024. Strong adoption came from advanced automation in automotive, electronics, and aerospace manufacturing. The region benefits from widespread use of robotics, CNC machines, and motion control platforms across large production facilities. Growing investments in digital factories and rising demand for high-precision equipment continue to support market expansion. The presence of major technology providers and strong industrial modernization trends keeps North America a leading contributor to servo system deployment.

Europe

Europe captured nearly 29% share in 2024, driven by strong automation maturity in Germany, Italy, and France. High demand in automotive plants, packaging lines, and semiconductor operations supports servo adoption. The region’s focus on energy-efficient machinery and Industry 4.0 accelerates upgrades to advanced servo drives. Strong regulatory pressure for high-performance, low-emission industrial equipment boosts the use of precision motion systems. Heavy manufacturing and robotics deployment further reinforce Europe’s position as a key market for servo technologies.

Asia Pacific

Asia Pacific led growth momentum with about 34% share in 2024, supported by large-scale manufacturing hubs in China, Japan, South Korea, and India. Expanding electronics production, rising robotics installations, and strong investment in factory automation drive rapid adoption. The region’s growing semiconductor and packaging sectors rely heavily on high-precision servo systems. Government incentives for smart factories and increasing labor cost pressures encourage faster mechanization. These factors make Asia Pacific the most dynamic and fast-expanding regional market.

Latin America

Latin America accounted for around 3% share in 2024, with demand rising steadily across automotive parts, food processing, and packaging plants. Countries such as Brazil and Mexico continue to automate production lines to improve efficiency and reduce operational losses. Adoption remains gradual due to budget constraints, but modernization programs in industrial clusters support market expansion. Growing import of industrial robots and CNC machinery also increases the need for advanced servo drives and motors in regional manufacturing.

Middle East and Africa

Middle East and Africa held nearly 2% share in 2024, reflecting early-stage but growing adoption of automation. Demand strengthens in sectors such as oil and gas, metals, and logistics, where precision control enhances operational safety and productivity. Investments in new manufacturing zones, especially in Gulf countries, support increased use of servo systems. Limited technical expertise and higher installation costs slow broader penetration, but ongoing industrial diversification efforts continue to create long-term growth opportunities.

Market Segmentations:

By Product Type

- Servo Motors

- Servo Drives

By Voltage Range

- Low Voltage

- Medium and High Voltage

By End Use Industry

- Machine Tools

- Packaging

- Robotics

- Semiconductors

- Electronics

- Rubber and Plastics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Servo Motors and Drives Market features key players such as ABB, Delta Electronics, Fuji Electric, Danfoss, Bosch Rexroth, Advanced Motion Controls, Hitachi, Baumueller, Allied Motion, and Ingenia Cat. The market shows strong competition as companies focus on advanced motion control technologies, energy-efficient architectures, and digital drive platforms that support real-time monitoring. Vendors strengthen their portfolios through improved torque density, faster response systems, and compact motor designs suited for automated equipment. Many manufacturers invest in software-driven control features and integrated safety functions to meet modern production needs. Strategic partnerships with robotics firms, machine builders, and automation integrators help widen their market reach. Continuous upgrades in encoder accuracy, communication protocols, and power optimization also support stronger differentiation in a rapidly evolving industrial automation environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ABB

- Delta Electronics

- Fuji Electric

- Danfoss

- Bosch Rexroth

- Advanced Motion Controls

- Hitachi

- Baumueller

- Allied Motion

- Ingenia Cat

Recent Developments

- In 2025, Allient launched the Pyxmos servo drive family to expand its high-performance motion-control portfolio for robotics and industrial automation

- In 2025, Bosch Rexroth introduced the ctrlX DRIVE cabinet-free IP65 servo drive system, which moves drives out of the control cabinet and cuts space and cabling needs by up to 90 %.

- In 2024, ABB issued an updated ACS180 machinery-drive catalog, positioning the compact drive platform for precise speed and torque control in small machinery and OEM motion applications.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Voltage Range, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as factories increase automation across production lines.

- Robotics adoption will rise and boost demand for high-precision servo systems.

- Compact and lightweight servo designs will gain wider use in space-limited machinery.

- Energy-efficient drives will see stronger uptake due to rising power-saving needs.

- Smart servo platforms with real-time monitoring will grow with digital factory adoption.

- Semiconductor and electronics manufacturing will drive higher multi-axis servo demand.

- Growth in electric vehicle production will increase servo use in assembly and testing.

- Replacement of legacy motion systems will accelerate in aging industrial plants.

- Servo vendors will expand service-based models such as predictive maintenance support.

- Emerging markets will adopt servo systems faster as labor costs and automation needs