Market Overview:

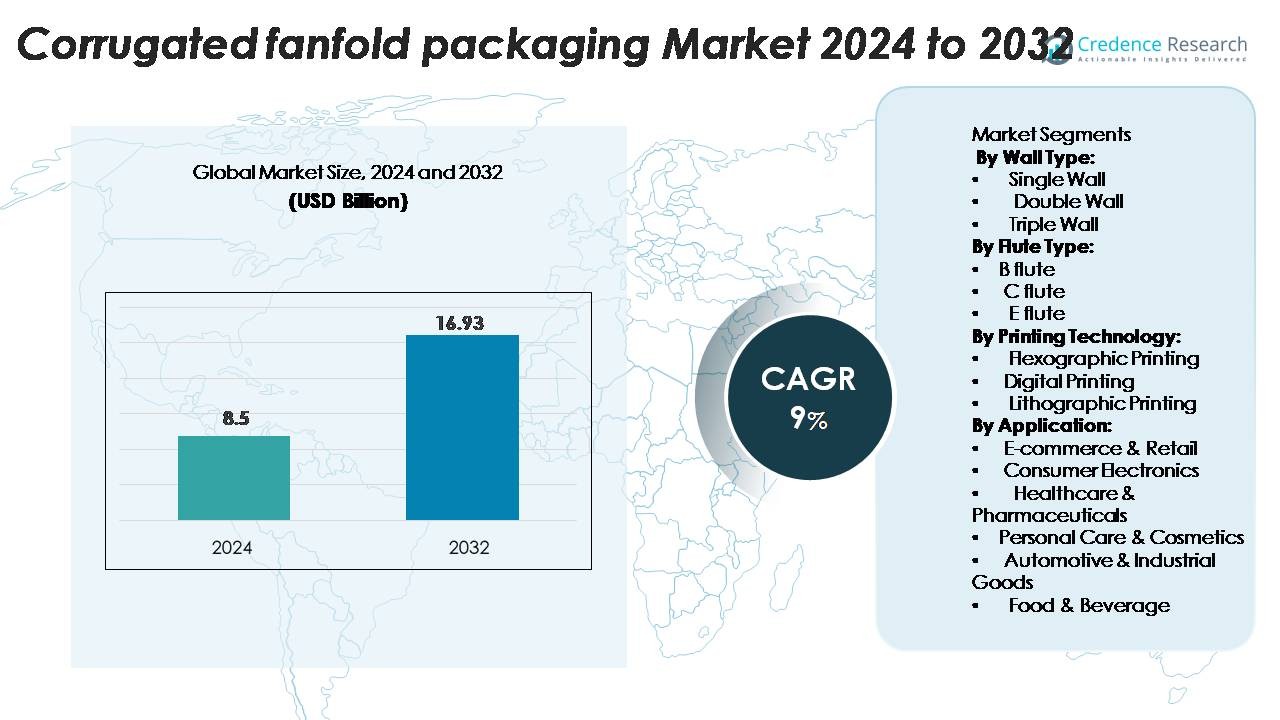

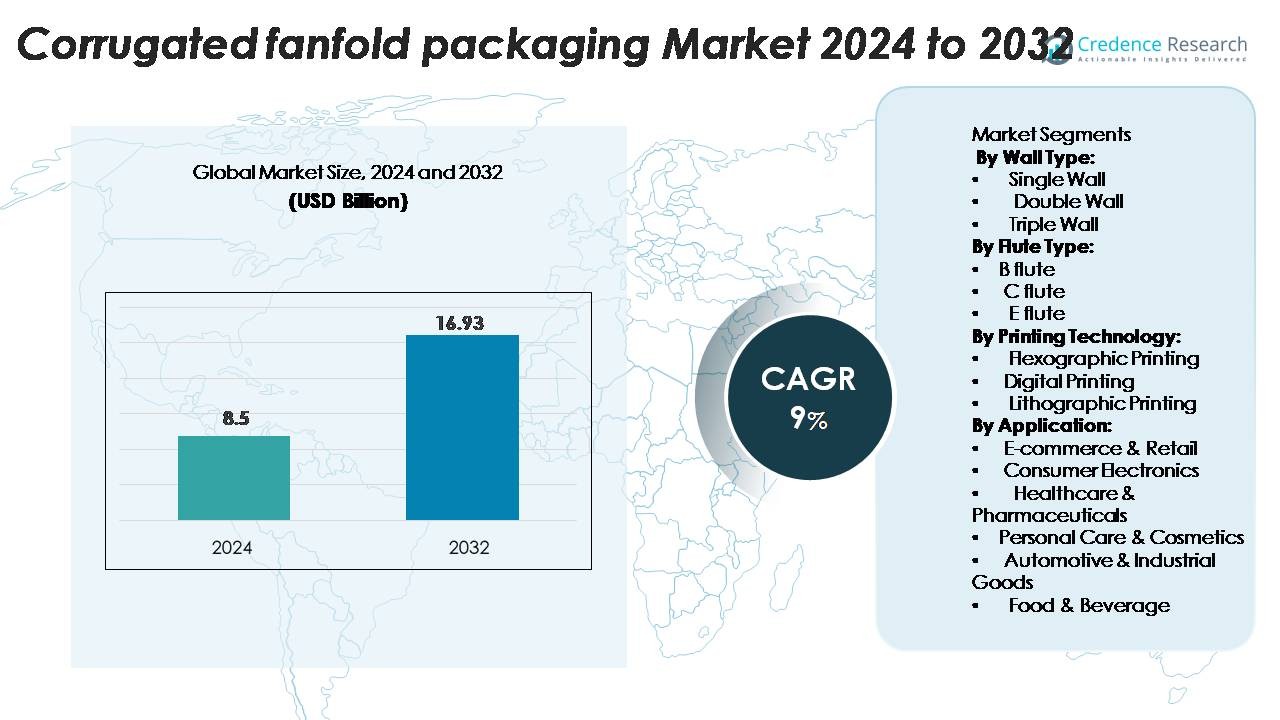

The corrugated fanfold packaging market was valued at USD 8.5 billion in 2024 and is projected to reach USD 16.93 billion by 2032, growing at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Corrugated Fanfold Packaging Market Size 2024 |

USD 8.5 Billion |

| Corrugated Fanfold Packaging Market, CAGR |

9% |

| Corrugated Fanfold Packaging Market Size 2032 |

USD 16.93 Billion |

The global Corrugated Fanfold Packaging market features several major players including International Paper Company, DS Smith Plc, Mondi Plc, Hinojosa Packaging Group, Kite Packaging, Papeles y Conversiones de Mexico, Papierfabrik Palm GmbH & Co KG, Ribble Packaging Ltd and Corrugated Supplies Company. The top three International Paper, DS Smith and WestRock (not listed) account for approximately 38% of global market share. Regionally, North America leads the market with a 38.54% share in 2024, driven by strong e‑commerce growth and automated packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market value of corrugated fanfold packaging reached USD 8.5 billion in 2024 and is projected to grow at a CAGR of 9.2%.

- Segment-wise, the single wall segment held over 50% share in 2024 and the C‑flute type accounted for approximately 40% share.

- Key drivers include the rise of e‑commerce‑related packaging demand, stricter sustainability regulations and the push for right‑sized packaging to reduce waste.

- Major trends and opportunities include greater adoption of digital printing for customization, integration of smart packaging technologies (like RFID/QR) and growth in Asia‑Pacific where high growth rates are expected.

- Primary challenges are volatile raw material prices impacting margins and the complexity of recycling and waste management for high‑volume fanfold systems.

Market Segmentation Analysis:

By Wall Type

The corrugated fanfold packaging market is segmented by wall type into single wall, double wall, and triple wall. Among these, the double wall sub-segment holds the largest market share due to its enhanced durability and protective qualities, making it ideal for heavy-duty packaging applications. This segment’s dominance is driven by the increasing demand for secure packaging in industries such as electronics, automotive, and consumer goods. The superior strength and cushioning properties of double-wall corrugated packaging are key factors that contribute to its widespread adoption.

- For instance, Smurfit Kappa notes that its double-wall boxes are custom-designed using scientific methods to calculate the exact strength required across the supply chain considering transport, storage, handling, temperature and humidity conditions.

By Flute Type

The flute type segment of the corrugated fanfold packaging market includes B flute, C flute, and E flute. B flute is the dominant sub-segment, accounting for a significant share due to its balanced performance in terms of strength and printability. It is widely used in packaging fragile products, including food and beverages, due to its excellent protection against impact. The increasing consumer preference for eco-friendly and recyclable packaging materials also boosts the demand for B flute, which offers optimal protection with less material use.

- For instance, one product listing for a B-flute white corrugated board sheet of size 1600 × 2600 mm records a weight of 495 g/m² and 3 mm nominal thickness (consistent with B-flute dimension) for a clay-coated virgin-Kraft base.

By Printing Technology

Corrugated fanfold packaging also includes a segment by printing technology, consisting of flexographic printing, digital printing, and lithographic printing. Flexographic printing is the dominant technology, as it provides cost-effective and high-quality prints, making it ideal for large-volume production. The demand for attractive and informative packaging to enhance brand visibility and consumer engagement is a key driver for flexographic printing’s dominance. This technology’s ability to print on various substrates with high efficiency and color accuracy further strengthens its position in the market.

Key Growth Driver

Increased Demand for E-Commerce Packaging

The growth of e-commerce has significantly driven the demand for corrugated fanfold packaging. With the surge in online shopping, packaging solutions that ensure product protection during transit have become a priority. E-commerce businesses, especially those in the retail and electronics sectors, rely heavily on robust packaging to minimize product damage and improve customer satisfaction. Fanfold packaging, with its ability to provide multiple layers of protection, is ideal for fragile and high-value items. The rise of direct-to-consumer sales channels further boosts the need for cost-effective and sustainable packaging solutions. As more businesses prioritize secure, environmentally friendly packaging options, the demand for corrugated fanfold solutions continues to rise.

- For instance, Smurfit Kappa’s e-commerce-grade fanfold board, used within its Modulo and e-Pack portfolios, is produced using high-performance liners engineered to deliver Box Compression Strength (BCT) increases of 15–20% compared to standard grades, according to the company’s performance packaging documentation.

Shift Toward Sustainable Packaging Solutions

Sustainability has emerged as a key growth driver for the corrugated fanfold packaging market. With increasing pressure from consumers and regulations regarding environmental impact, businesses are shifting towards eco-friendly packaging materials. Corrugated packaging, being recyclable, biodegradable, and made from renewable resources, aligns with the growing consumer demand for sustainable alternatives to plastic packaging. This shift is particularly evident in industries like food and beverages, electronics, and consumer goods, where brands are adopting green practices to align with corporate social responsibility (CSR) goals. The rising focus on reducing the carbon footprint and waste is accelerating the adoption of corrugated fanfold packaging, which offers both sustainability and practicality in bulk packaging applications.

- For instance, DS Smith’s Circular Design Metrics confirm that its corrugated packaging solutions including fanfold materials achieve over 95% recyclability and incorporate an average of ~80% recycled fiber content, supported by its company-wide fibre optimization program across 34 paper mills.

Advancements in Packaging Machinery

Advancements in packaging machinery and automation are driving the growth of the corrugated fanfold packaging market. New technologies in packaging machinery allow for faster production times, more precise cutting, and more efficient use of materials, which helps manufacturers meet the increasing demand for customized and high-quality packaging. Additionally, the integration of automated systems into packaging lines enhances productivity and reduces labor costs. With improved production speeds and customization capabilities, businesses can cater to a wide variety of packaging needs, such as bespoke sizes and designs, which appeals to the e-commerce and consumer electronics markets. The continuous development of packaging machinery that supports higher production volumes and reduces material waste is a crucial factor in expanding the market.

Key Trend and Opportunities:

Integration of Smart Packaging Technologies

One of the key trends in the corrugated fanfold packaging market is the integration of smart packaging technologies. With the advent of the Internet of Things (IoT), packaging solutions now have the ability to track and monitor products during transit. Smart packaging solutions, such as those incorporating RFID tags or QR codes, allow businesses to provide real-time data on the location and condition of goods. This trend is gaining traction in industries where product integrity during transportation is crucial, such as pharmaceuticals, electronics, and food. The ability to track products enhances the customer experience and provides businesses with valuable insights into logistics and supply chain operations. As consumer demand for transparency and product safety increases, smart packaging technologies are expected to become more prevalent in the market.

- For instance, Avery Dennison Smartrac reports that its latest AD Slim DF inlay combines NFC and UHF RFID in a single dual-frequency chip, enabling typical UHF read ranges of up to 7 meters (23 ft) while supporting ISO/IEC 15693 NFC communication for consumer smartphone interaction. The maximum theoretical range for passive UHF RFID can be up to 10 meters, or in very specialized circumstances with high-power readers, up to 15-20 meters, but “over 20 meters” is not the typical performance for this specific passive inlay.

Customization and Branding in Packaging Design

Another prominent trend in the corrugated fanfold packaging market is the growing emphasis on packaging customization and branding. Companies are increasingly focusing on creating unique, branded packaging that enhances customer engagement and promotes brand recognition. Fanfold packaging provides ample space for vibrant printing and design, which appeals to brands looking to differentiate themselves in a crowded marketplace. The use of attractive, functional packaging that reflects the brand’s identity has become an essential marketing tool, especially in the e-commerce sector. This trend not only enhances consumer appeal but also strengthens brand loyalty. As businesses look for ways to stand out, the demand for customized corrugated packaging solutions that combine aesthetics with functionality continues to grow.

- For instance, HP’s PageWide C500 press prints at a native resolution of 1200 nozzles per inch (npi). It uses water-based inks that comply with EU regulations for food contact applications.

Fluctuating Raw Material Prices

A significant challenge facing the corrugated fanfold packaging market is the fluctuation in raw material prices. The cost of materials such as paperboard, kraft paper, and adhesives is subject to market volatility, which can impact the profitability of manufacturers. These fluctuations are often influenced by factors such as changes in global supply chains, natural disasters, and shifts in demand for raw materials. As raw material prices increase, packaging manufacturers may face pressure to either absorb the additional costs or pass them on to customers, which could lead to reduced competitiveness in the market. Managing these price fluctuations while maintaining affordable pricing for end users is a key challenge for businesses in the packaging industry.

Key Challenge:

Environmental Impact of Packaging Waste

Despite the sustainability of corrugated packaging compared to other materials, the environmental impact of packaging waste remains a challenge. As consumer demand for eco-friendly packaging grows, there is increasing scrutiny of packaging waste, especially in industries with high volumes of single-use packaging. While corrugated fanfold packaging is recyclable, improper disposal and low recycling rates in some regions can result in environmental harm. The pressure to reduce packaging waste and develop more sustainable packaging solutions is intensifying. Packaging manufacturers must address this challenge by continuing to innovate and improve the recyclability and sustainability of their products, while also educating consumers on proper disposal methods.

Regional Analysis:

North America

In 2024 the North American region captured 38.54% of the global corrugated fanfold packaging market revenue. The market benefits from robust e‑commerce growth, strong logistics infrastructure and stringent packaging waste regulations pushing fibre‑based formats. Manufacturers are increasing automated production capacity to meet demand for custom fanfold solutions in fulfilment and shipping. In addition, regulatory pressure in the U.S. drives substitution of EPS and plastic, favouring corrugated fanfold formats. The region’s mature market base provides stable demand and supports incremental innovation in printing and materials for improved sustainability.

Europe

Europe holds a significant share of the global corrugated fanfold packaging market, supported by high recycling rates and regulatory drivers toward fully recyclable packaging. Regional demand stems from established manufacturing and e‑commerce sectors seeking lightweight, customisable fanfold formats to optimise transport efficiency. EU Levels of packaging waste regulation push brand‑owners toward fibre‑based fanfold solutions, reinforcing uptake. While growth is moderate relative to emerging regions, Europe’s structural drivers and strong sustainability orientation secure a stable outlook for the fanfold segment.

Asia‑Pacific

The Asia‑Pacific region is the fastest‑growing market for corrugated fanfold packaging, with projected CAGRs around 7.88% or higher. Rapid industrialisation, large‑scale manufacturing expansion and booming e‑commerce activity in China, India and Southeast Asia drive demand. Increasing domestic consumption, logistics infrastructure upgrades and rising adoption of sustainable packaging formats further accelerate the segment. Emerging markets in the region present high potential for customised fanfold solutions, especially in export‐oriented industries and online retail.

Latin America & Middle East & Africa

The combined Latin America and Middle East & Africa (MEA) region currently holds a smaller portion of the global corrugated fanfold packaging market but exhibits above‑average growth potential. Growth is driven by growing e‑commerce penetration, infrastructure investment in logistics and increased awareness of recyclable packaging formats. Key markets such as Brazil, Mexico, South Africa and parts of the Gulf region are upgrading packaging supply chains, offering opportunities for converters to introduce fanfold solutions. However, progress is tempered by raw‑material constraints and price sensitivity in certain countries, which slows faster adoption.

Market Segmentations:

By Wall Type:

- Single Wall

- Double Wall

- Triple Wall

By Flute Type:

By Printing Technology:

- Flexographic Printing

- Digital Printing

- Lithographic Printing

By Application:

- E-commerce & Retail

- Consumer Electronics

- Healthcare & Pharmaceuticals

- Personal Care & Cosmetics

- Automotive & Industrial Goods

- Food & Beverage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the corrugated fanfold packaging market shows moderate fragmentation, with large integrated players and a multitude of regional converters active globally. Two of the leading players International Paper Company and Smurfit Kappa Group combine significant scale with vertical integration across containerboard production, corrugated sheet manufacturing and packaging conversion. These firms capture a sizeable share of the market among the top three players they hold roughly 38% of global revenue. Meanwhile smaller converters differentiate through agility, regional niche focus, digital printing capabilities and sustainability credentials. Acquisitions, partnerships and technology upgrades such as advanced digital/inkjet presses and data‑driven production lines characterise competition in the sector. As a result, competitive strength depends on scale, cost leadership, product innovation and alignment with sustainability mandates.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- International Paper Company

- Mondi

- Papeles y Conversiones de Mexico

- Kite Packaging

- Ribble Packaging

- DS Smith

- Papierfabrik Palm

- Hinojosa Packaging Group

- Abbe

- Corrugated Supplies Company

Recent Developments:

- In November 2025, Hinojosa Packaging Group completed the full acquisition of ASV Packaging, a French company specializing in folding cartons for the food and consumer goods sectors, with over 34 years of expertise. This acquisition, finalized on November 3, 2025, culminated the integration process initiated in July 2023 when Hinojosa acquired a 49% stake. The completed acquisition brought Hinojosa to seven production sites in France (one paper mill, three corrugated board plants, and three folding carton facilities) and added 200 professionals to the company’s workforce, bringing total employees to nearly 3,000. The integration strengthened both companies’ commitment to sustainable packaging innovation, particularly through HALOPACK®, a cardboard tray replacing traditional rigid plastic trays for fresh food.

- In November 2025, Mondi launched an extended corrugated and solid board portfolio specifically for the food packaging industry on November 18, 2025. The comprehensive sustainable packaging solutions address key priorities for food industry customers including handling efficiency, shelf visibility, brand differentiation, and compliance with European Union regulations. This expansion, strengthened through the Schumacher Packaging acquisition, enhanced Mondi’s regional supply network with additional production sites and digital printing capabilities.

- In October 2025, Abbe Group announced the acquisition of Oji Fibre Solutions’ Australian operations, marking a major expansion for the privately owned corrugated packaging manufacturer on October 2, 2025. The acquisition encompasses four packaging facilities in Victoria, New South Wales, and Queensland, along with distribution centers in key regional horticultural hubs including Mildura, Innisfail, Bundaberg, and Mareeba. Completion was expected by November 1, 2025, strengthening Abbe Group’s position in the Australian corrugated packaging market while maintaining the company’s focus on early adoption of technology, including digital printing on corrugated cardboard and fanfold technology for e-commerce packaging automation.

Report Coverage:

The research report offers an in-depth analysis based on Wall type, Flute type, Printing technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Manufacturers will expand production of lightweight and high‑strength fanfold sheets to meet sustainability and logistics demands.

- Corrugated fanfold packaging will gain higher adoption in right‑sized e‑commerce fulfilment, reducing void fill and lowering freight costs.

- Growth in Asia‑Pacific will outpace other regions, as industrialisation, urbanisation, and packaging needs rise rapidly.

- Digital printing and variable-data graphics will become standard, enabling brand owners to personalise fanfold packaging for direct‑to‑consumer channels.

- Automation in on‑demand box‑making (fit‑to‑product systems) will elevate fanfold standards, integrating with high‑speed converters and reducing wasted stock.

- Sustainable materials and mono‑material fibre formats will dominate, driven by regulatory pressure and corporate‑responsibility programmes.

- Heavy‑duty triple‑wall and specialised flute types will grow in sectors like automotive, electronics and cold‑chain logistics.

- Smart‑packaging features (QR codes, IoT sensors, tracking) will increasingly appear on fanfold sheets to serve brand interaction and supply‑chain visibility.

- Smaller converters will access equipment‑as‑a‑service models and hybrid flexo/digital presses, enabling niche players to compete in custom fanfold runs.

- Raw‑material and recycling‑system constraints will push firms toward closed‑loop fibre sourcing and vertically integrated supply‑chains in the fanfold segment.