Market Overview

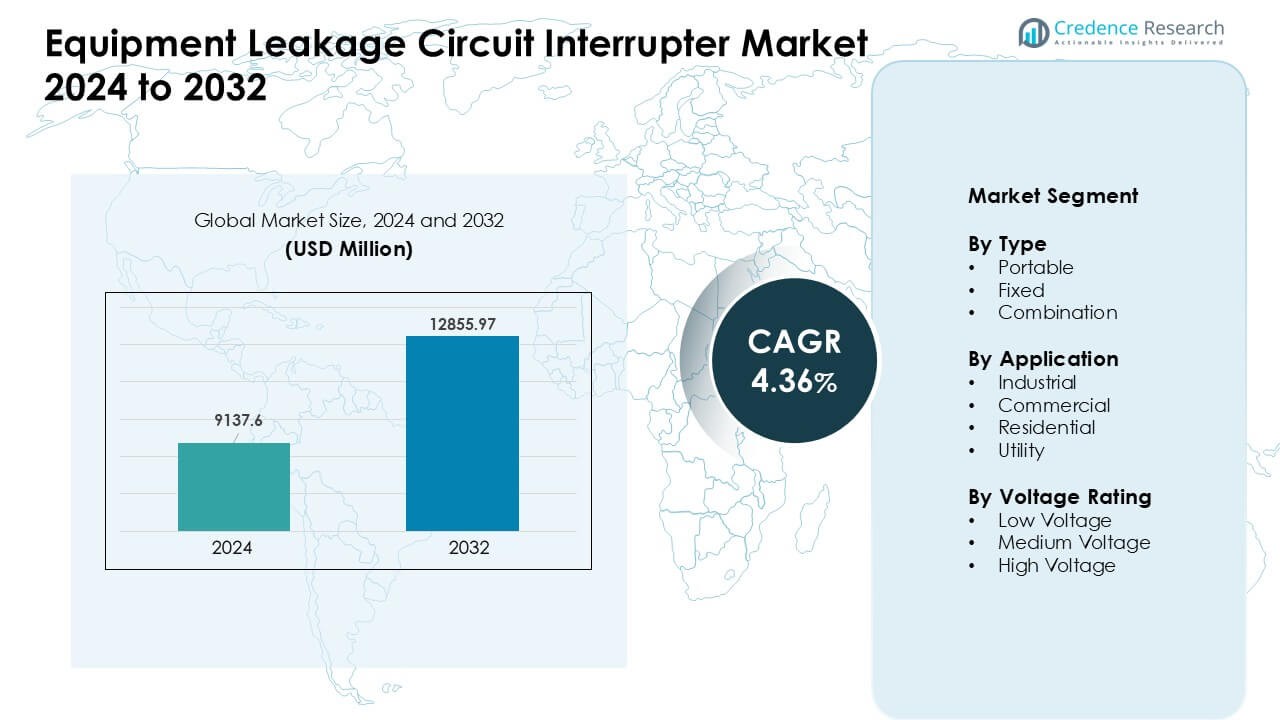

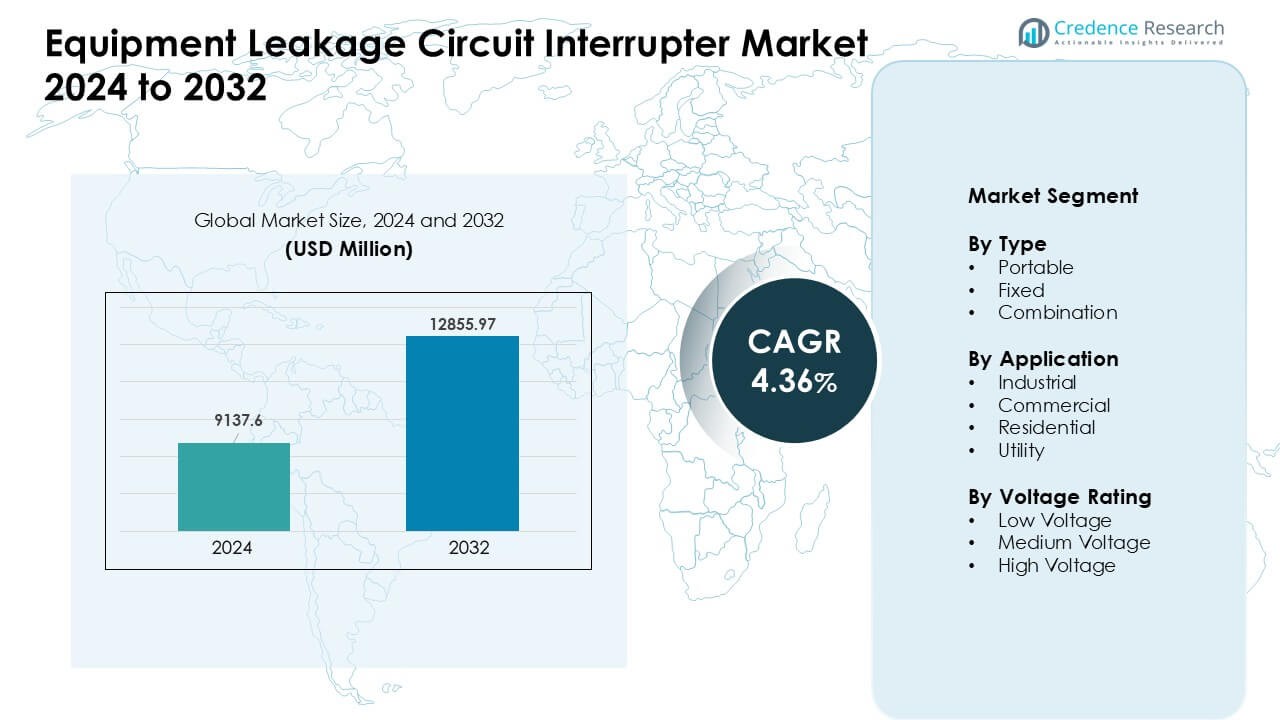

Equipment Leakage Circuit Interrupter Market was valued at USD 9137.6 million in 2024 and is anticipated to reach USD 12855.97 million by 2032, growing at a CAGR of 4.36 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Equipment Leakage Circuit Interrupter Market Size 2024 |

USD 9137.6 Million |

| Equipment Leakage Circuit Interrupter Market, CAGR |

4.36 % |

| Equipment Leakage Circuit Interrupter Market Size 2032 |

USD 12855.97 Million |

The Equipment Leakage Circuit Interrupter Market is shaped by major players such as ABB Ltd., Eaton Corporation plc, Fuji Electric Co., Ltd., Havells India Limited, Honeywell International Inc., Legrand SA, Mitsubishi Electric Corporation, Rockwell Automation, Inc., Schneider Electric SE, and Siemens AG. These companies strengthen their position through wide product lines, strong global distribution, and steady innovation in smart protection devices. North America led the market in 2024 with about 34% share, supported by strict electrical safety codes, high upgrade activity, and strong adoption across industrial, commercial, and residential sites.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Equipment Leakage Circuit Interrupter Market reached an estimated value USD 9137.6 million in 2024 and is projected to grow at a steady CAGR of 4.36% through 2032, driven by rising safety compliance needs.

- Strong demand comes from industrial sites that led the application segment with about 39% share in 2024 due to increased automation and strict electrical standards.

- Key trends include rising use of smart and connected interrupters, compact modular designs, and wider adoption in renewable and utility projects across global markets.

- Leading players such as ABB, Eaton, Siemens, Schneider Electric, and Honeywell compete through advanced sensing technologies, broader portfolios, and strong service networks.

- North America held about 34% share in 2024, supported by strict regulatory enforcement and high upgrade activity, while Asia Pacific expanded rapidly due to urban growth and large-scale industrial development.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Portable units led the type segment in 2024 with about 46% share. Buyers preferred portable leakage circuit interrupters due to easy deployment and broad use in temporary worksites. These units offered quick protection during maintenance and outdoor tasks, which boosted demand across small industries. Growth also came from rising safety mandates that pushed firms to adopt plug-and-play protection devices. Fixed and combination types grew at a steady pace as large sites upgraded panels and integrated smart monitoring features.

- For instance, ABB’s compact RCDs, such as the F200 series or DS201 RCBOs, weigh under 500 grams (e.g., around 415g for a 4-pole RCCB).

By Application

Industrial use dominated the application segment in 2024 with nearly 39% share. Factory floors, heavy machinery zones, and hazardous areas needed strong fault protection, which drove wider adoption. Many manufacturers invested in leakage interrupters to reduce downtime and meet strict compliance rules. Commercial and residential demand rose as buildings added advanced safety gear and improved wiring systems. Utility providers also expanded usage to protect grids and reduce fault-related losses in substations and distribution networks.

- For instance, Siemens manufacture and offer industrial-grade Residual Current Circuit Breakers (RCCBs) and Residual Current Operated Circuit Breakers (RCBOs) with a 10kA breaking capacity, suitable for demanding industrial applications. These products are designed to enhance safety and operational continuity in industrial settings.

By Voltage Rating

Low-voltage systems held the leading position in 2024 with about 58% share. These systems supported common wiring setups in homes, shops, and small industries, which expanded their reach. Demand increased as governments promoted electrical safety and set tighter installation rules. Medium- and high-voltage interrupters gained traction in power plants, transmission sites, and large factories as operators aimed to prevent arc faults and leakage events. Wider installation of renewable assets also pushed adoption in medium-voltage circuits.

Key Growth Drivers

Growing Demand for Advanced Electrical Safety

Demand for stronger electrical safety measures drives rapid adoption of leakage circuit interrupters. Many countries enforce strict codes to reduce shocks, short circuits, and fire hazards, which pushes upgrades across homes, factories, and commercial sites. Rising urban growth leads to dense power use, and this increases the need for high-reliability protection devices. Industries also boost spending on compliance after repeated safety audits highlight gaps in aging wiring systems. As electric tools and sensitive machines rise in number, the need for fast fault detection grows. These factors support steady demand for modern interrupters with quick response times.

- For instance, ABB’s “F200” series RCCBs are offered with a sensitivity of 10 mA up to 500 mA and rated current options up to 125 A, making them suitable for both light-duty circuits and heavier installations requiring reliable leakage detection.

Expansion of Industrial and Infrastructure Projects

Large infrastructure activity plays a major role in market growth. New industrial parks, metro systems, renewable plants, and utility grids need strong leakage protection to avoid costly downtime. Contractors prefer modern interrupters because they reduce operational risk and help meet tender rules that now include safety scores. Many factories upgrade old systems as automation increases, since robotic lines require stable and protected circuits. Urban development also pushes demand for structured electrical layouts that rely on integrated protection solutions. This broad use across construction and industry boosts overall market growth.

- For instance, ABB supplied RCCBs with breaking capacities up to 10 kA (for models like 2CSR275480R3164) a specification critical for large-scale industrial switch-boards and utility-grid distribution panels subject to high fault currents.

Rising Adoption of Smart and Connected Systems

Smart interrupters gain traction as industries and buildings shift to digital control. These devices track faults, alert users, and support remote monitoring, which cuts maintenance time. Facility managers prefer connected systems because they detect early leakage patterns before failures occur. Companies also link interrupters with building management systems to improve energy and safety performance. The wider rollout of IoT devices in commercial spaces drives more upgrades toward intelligent protection gear. Falling sensor costs and higher awareness of predictive maintenance support this shift toward smart leakage protection.

Key Trends & Opportunities

Shift Toward Compact and Modular Designs

Manufacturers develop compact and modular interrupters to support flexible installation. These designs suit modern buildings with tight panel space and dense wiring. Modular styles also help technicians replace parts faster, cutting downtime during upgrades. Growing use in portable tools and temporary sites supports small and lightweight designs. As more industries adopt mobile workstations and outdoor applications, compact interrupters become key options. This trend drives broader acceptance across varied environments.

- For instance, Schneider Electric offers its Acti 9 series RCBOs in various configurations. While standard 1P+N models typically occupy 36mm of space (equivalent to 4 standard 9mm modules), the company also produces specific ultra-slim, space-saving variants for certain markets (such as the UK). These particular miniature RCBOs utilize a narrow, 1-module (18mm) width design for single-phase + neutral circuits, enabling installation in distribution boards with highly constrained space.

Growth Opportunities in Renewable and Utility Applications

Renewable plants and utility grids create strong growth areas for leakage interrupters. Solar and wind sites rely on stable circuits to protect inverters and storage systems from leakage faults. Utilities also face higher pressure to reduce outages, pushing investment in advanced protection gear. Microgrids and energy-storage systems expand this need as operators seek fault-tolerant setups. These emerging sectors offer long-term opportunities for providers of medium-voltage and high-reliability interrupters.

- For instance, ABB and other major manufacturers market specialized RCDs (e.g. “Type B” RCDs) designed for PV and micro-grid environments these detect not only AC leakage currents but also smooth DC fault currents, which are common in renewable setups thus offering reliable protection in inverter-based systems.

Key Challenges

High Installation and Upgrade Costs

High upfront installation costs pose a key challenge for many users. Older buildings need rewiring or panel changes to support advanced interrupters, which raises project budgets. Small firms often delay upgrades because they lack funds for full system replacement. Utility networks also face large expenses when shifting to digital and monitored systems. These financial limits slow wider adoption, especially in developing regions with tight capital spending.

Limited Awareness in Low-Income Markets

Low awareness of electrical safety reduces demand in several regions. Many users still rely on basic breakers and ignore leakage risks due to limited knowledge. Small contractors often skip safety upgrades to cut costs, leaving systems exposed. Weak enforcement of electrical codes also slows change. These gaps keep adoption uneven, especially in rural areas with informal wiring practices. This challenge requires stronger training programs and policy action to raise safety standards.

Regional Analysis

North America

North America led the Equipment Leakage Circuit Interrupter Market in 2024 with about 34% share. Strong electrical safety codes and frequent upgrades in commercial and industrial buildings supported demand. The United States saw rising adoption in data centers and automated factories, which required stable and protected circuits. Canada increased installations across residential projects due to stricter fire-safety rules and renovations of aging wiring. Growing investment in renewable plants and utility modernization also boosted the need for advanced leakage protection devices across both countries.

Europe

Europe accounted for nearly 29% share in 2024, driven by strict regulatory standards across industrial and public infrastructure. Countries like Germany, France, and the U.K. upgraded electrical systems in factories, transport hubs, and commercial facilities. The region’s push for energy-efficient buildings and digital monitoring tools also increased adoption of smart leakage interrupters. Renovation of older housing stock created steady demand for compact and modular devices. Rising focus on workplace protection and machine-safety compliance further strengthened the European market presence.

Asia Pacific

Asia Pacific held the fastest expansion pace and captured about 28% share in 2024. China, India, Japan, and South Korea invested heavily in industrial parks, smart cities, and renewable projects, driving strong demand for leakage protection. Rapid urban growth led to higher residential installations, especially in high-rise housing. Expanding manufacturing activity increased the need for reliable circuits that support automated lines. Government safety programs and stricter electrical rules also boosted adoption. The region’s high construction volume ensured strong demand for both low- and medium-voltage interrupters.

Latin America

Latin America accounted for nearly 5% share in 2024 as electrical upgrades gained traction across commercial and light industrial sites. Brazil and Mexico saw rising adoption due to safety compliance efforts and investment in new construction. Growth in small manufacturing spaces and retail formats increased need for reliable protection devices. Residential uptake remained moderate but improved as awareness of shock and fire hazards grew. Ongoing modernization of utility grids also supported demand for medium-voltage interrupters in select urban areas.

Middle East & Africa

The Middle East & Africa region held about 4% share in 2024, supported by infrastructure development in the UAE, Saudi Arabia, and South Africa. Large commercial and industrial projects required advanced safety systems, lifting demand for leakage interrupters. Utility networks introduced upgrades to improve grid stability and reduce circuit failures. Residential adoption increased slowly but benefitted from new housing policies in Gulf economies. Expansion of oil, gas, and mining facilities also created opportunities for robust protection devices suited for harsh operating conditions.

Market Segmentations:

By Type

- Portable

- Fixed

- Combination

By Application

- Industrial

- Commercial

- Residential

- Utility

By Voltage Rating

- Low Voltage

- Medium Voltage

- High Voltage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Equipment Leakage Circuit Interrupter Market features strong participation from leading companies such as ABB Ltd., Eaton Corporation plc, Fuji Electric Co., Ltd., Havells India Limited, Honeywell International Inc., Legrand SA, Mitsubishi Electric Corporation, Rockwell Automation, Inc., Schneider Electric SE, and Siemens AG. These firms expand their market position through wide product portfolios, advanced sensing technologies, and strong service networks. Many players focus on smart and connected interrupters to support predictive maintenance and digital monitoring in industrial and commercial sites. Global suppliers also invest in modular and compact designs to meet rising demand in residential construction and retrofit projects. Partnerships with utility providers and construction firms help improve reach across high-growth regions. Continuous R&D spending strengthens product reliability and supports compliance with evolving electrical safety regulations.

Key Player Analysis

Recent Developments

- In 2025, Rockwell Automation, Inc. introduced the 140ME motor protection circuit breaker at Automation Fair 2025, giving industrial users stronger defense against overloads, short circuits and phase failures in critical equipment.

- In 2025, ABB Ltd. as part of broader expansion into low‑voltage / safety devices, ABB completed the acquisition of the wiring‑accessories business of Siemens in China. This adds a wide distribution network (230 cities) and expands ABB’s offering in building‑electric safety and smart‑building segment which may include ELCI / circuit‑protection devices.

- In February 2024, Schneider Electric SE unveiled its Acti9 Active modular circuit protection range for the UK, integrating an RCD, MCB, AFDD and over-voltage protection in one device to improve safety, monitoring and energy efficiency in higher-risk buildings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Voltage Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as countries update electrical safety rules across all sectors.

- Smart leakage interrupters will gain wider use with growth in connected buildings.

- Industrial automation will drive higher adoption in factories and processing plants.

- Renewable energy projects will expand demand for medium-voltage protection devices.

- Residential installations will grow as users upgrade old wiring and panels.

- Compact and modular designs will support faster installation and retrofit work.

- Utility networks will adopt advanced interrupters to reduce outage risks.

- Manufacturers will invest more in sensing accuracy and predictive maintenance features.

- Emerging markets will show strong uptake as awareness of shock and fire risks increases.

- Competition will intensify as global brands expand portfolios and strengthen regional presence.

Market Segmentation Analysis:

Market Segmentation Analysis: