Market Overview:

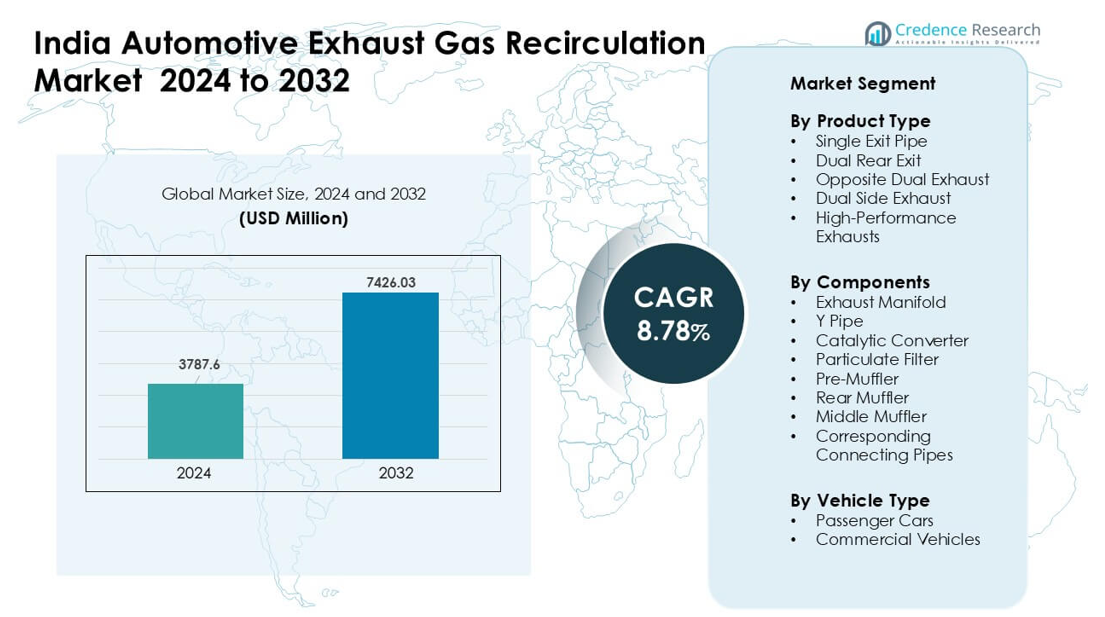

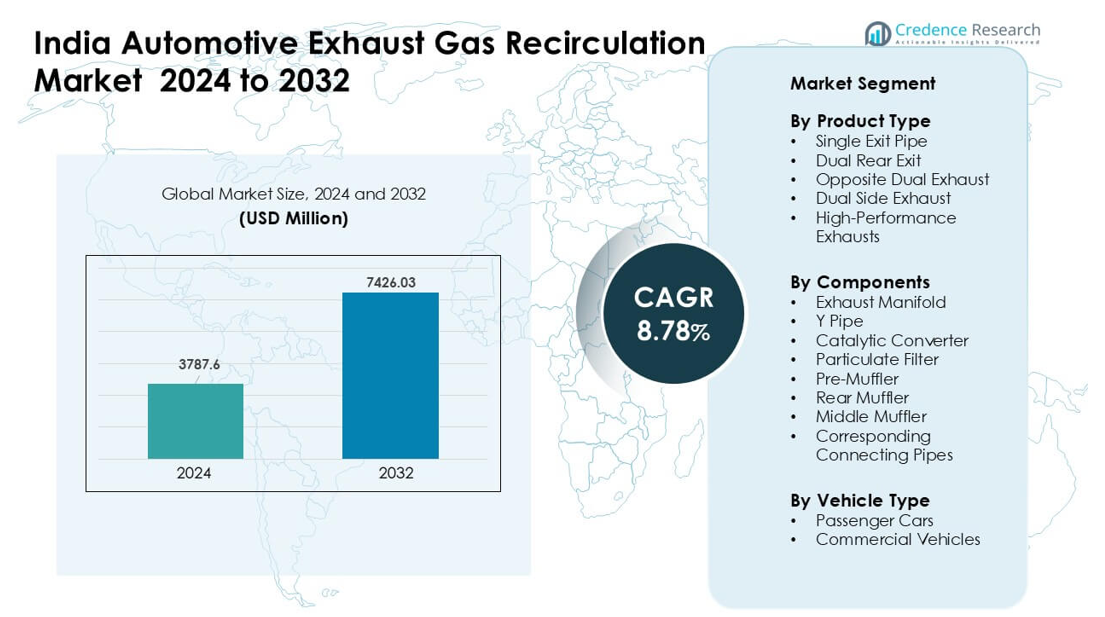

India Automotive Exhaust Gas Recirculation Market was valued at USD 3787.6 million in 2024 and is anticipated to reach USD 7426.03 million by 2032, growing at a CAGR of 8.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Automotive Exhaust Gas Recirculation Market Size 2024 |

USD 3787.6 million |

| India Automotive Exhaust Gas Recirculation Market, CAGR |

8.78% |

| India Automotive Exhaust Gas Recirculation Market Size 2032 |

USD 7426.03 million |

The India Automotive Exhaust Gas Recirculation Market is shaped by key players such as Continental AG, Marelli (India) Private Limited, Boysen India Private Limited, Delphi Technologies PLC, BENTELER International AG, Cummins Inc., Futaba Industrial Co., Ltd., Faurecia SE, Eberspächer Gruppe GmbH & Co. KG, and Tenneco Inc. These companies strengthen market growth through advanced EGR valves, high-efficiency coolers, and integrated exhaust assemblies designed for BS6 and upcoming BS7 compliance. North India emerged as the leading region in 2024 with a 32% share, supported by dense OEM clusters, strong passenger car output, and expanding logistics activity across major industrial corridors.

Market Insights:

- The India Automotive Exhaust Gas Recirculation Market reached USD 3787.6 million in 2024 and is projected to grow at a CAGR of 8.78 % through 2032.

- Demand grows due to strict BS6 norms, rising vehicle production, and the strong shift toward fuel-efficient engines that rely on advanced cooled-EGR systems.

- Key trends include wider use of integrated EGR–aftertreatment layouts, lightweight thermal materials, and compact modules for new petrol-turbo and diesel platforms.

- Competition remains strong with Continental AG, Marelli, Boysen, Delphi Technologies, BENTELER, Cummins, Futaba, Faurecia, Eberspächer, and Tenneco focusing on durable valves, high-efficiency coolers, and localized production.

- North India led with a 32% share in 2024, while single exit pipe designs held the largest product segment share at 41%, supported by high passenger car manufacturing and strong OEM clusters.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Single exit pipe led the product type segment in India in 2024 with about 41% share. Carmakers used this layout because it keeps the system light, cost-effective, and easy to package in small and mid-size cars. The design also supports lower backpressure, which helps meet national emission rules without major structural change. Dual rear and dual side exhausts grew in premium models due to rising interest in sporty sound and higher engine output. High-performance exhausts expanded slowly but gained attention among tuned-vehicle buyers in major cities.

- For instance, the Hyundai i20 N Line sold in India uses a twin tip muffler rather than a heavy dual rear exit setup. This design helps the 1.0-litre T-GDi petrol version (producing 118 bhp / 172 Nm) retain compact underbody packaging and remain sub-4-metre manageable (specifically, 3,995 mm in length) to qualify for significant Indian tax benefits on small cars.

By Components

The catalytic converter dominated the component segment in 2024 with nearly 46% share. Strong demand came from strict BS6 norms that pushed automakers to adopt higher-grade substrates and advanced coating designs. The converter’s central role in lowering NOx and hydrocarbon levels kept its share ahead of mufflers and filters. Particulate filters also grew as diesel models required tighter soot control. Exhaust manifolds and connecting pipes held steady volumes due to their wide use across both passenger and commercial fleets.

- For instance, Faurecia announced the development of a new lightweight exhaust manifold made from high-strength aluminum alloy in 2024.

By Vehicle Type

Passenger cars held the largest share in 2024 with about 63%. Buyers in India favored compact and mid-size cars, which use lighter exhaust layouts and faster EGR feedback systems. Rising urban demand and higher production volumes helped passenger cars stay ahead of commercial vehicles. Emission compliance, fuel-efficiency upgrades, and model refresh cycles increased exhaust system replacement and integration needs. Commercial vehicles showed stable growth as fleet owners sought stronger durability and improved particulate handling for long-haul and cargo routes.

Key Growth Drivers:

Stringent Emission Norms Accelerating EGR Adoption

India’s shift toward stricter BS6 and upcoming BS7 norms continues to push automakers to adopt advanced exhaust gas recirculation systems. These regulations demand sharp cuts in NOx and particulate emissions, which increase the need for precise EGR control in both diesel and new-generation turbocharged petrol engines. Carmakers focus on cooled EGR units, improved valves, and compact layouts that reduce thermal load while maintaining combustion stability. Growing compliance requirements strengthen demand across passenger and commercial vehicles. The regulatory pathway also encourages investment in calibration tools, improved aftertreatment pairing, and integrated EGR–DPF–SCR setups that support steady market expansion.

- For instance, research published in 2024 showed that applying a 30% EGR rate on a diesel engine reduced NOx emissions by 59%, while only reducing engine thermal efficiency by about 5.6%.

Rising Production of Passenger and Commercial Vehicles

India’s expanding automotive output boosts the EGR market as both segments rely on efficient emission-control systems to meet national standards. Passenger car growth drives higher installation volumes, especially in compact diesel and small turbo-petrol models where EGR helps balance power and fuel economy. Commercial vehicles further support demand due to long-duty cycles that require durable and thermally stable EGR components. OEMs increase sourcing of stainless-steel EGR coolers, valves, and pipes to handle higher exhaust temperatures. Urban fleet expansion, last-mile logistics growth, and rural mobility projects reinforce sustained demand across the sector.

- For instance, in heavy‑duty diesel engines used for commercial transport, EGR systems are commonly combined with other aftertreatment devices like Selective Catalytic Reduction (SCR) or particulate filters, to meet emission norms effectively demonstrating that EGR adoption is not limited to passenger cars but spans commercial fleets as well.

Shift Toward Fuel Efficiency and Thermal Management

Automakers adopt EGR systems to improve fuel economy by lowering combustion temperatures and reducing pumping losses. Growing interest in cleaner engines, rising fuel prices, and consumer preference for affordable operation support wider use of EGR across new models. Engineers also redesign combustion chambers and integrate high-performance coolers that maintain consistent thermal profiles during varied drive cycles. These efforts enhance drivability and reduce knock in modern petrol engines, supporting the transition to more efficient powertrains. The market gains further momentum from lightweight EGR components that improve engine responsiveness while meeting durability targets.

Key Trends & Opportunities:

Growth of Integrated EGR and Aftertreatment Architectures

A major trend in India involves closer integration of EGR systems with DPF, SCR, and advanced catalysts to achieve stable emissions across diverse driving conditions. OEMs deploy variable-flow EGR valves, electronically assisted coolers, and redesigned manifolds that improve exhaust routing. This synergy lowers soot load, reduces NOx spikes, and improves regeneration efficiency. The shift toward hybrid powertrains also creates opportunities for compact EGR modules that fit tighter engine bays. Suppliers find new scope in modular architectures that simplify installation and support future BS7 and RDE (Real Driving Emissions) compliance.

- For instance, Cummins Inc. offers a Modular Aftertreatment System that combines a Diesel Oxidation Catalyst (DOC), a Diesel Particulate Filter (DPF), and a Selective Catalytic Reduction (SCR) unit providing a ready‑to‑install modular package for OEMs and machine builders.

Opportunities in Lightweight Materials and Thermal Systems

Strong interest in weight reduction and thermal efficiency creates opportunities for aluminum, high-grade stainless steel, and coated alloys in EGR components. Lighter coolers and durable valve housings improve heat transfer and cut fuel losses. Suppliers explore brazed structures, multi-channel passages, and thin-wall tubing that support higher temperature cycles without failure. Rising electrification does not eliminate EGR demand, as hybrid engines still require thermal management during engine-on cycles. Tier-1 suppliers gain additional opportunity by offering compact EGR solutions that enhance packaging flexibility for future powertrain platforms.

- For instance, Pierburg GmbH developed an entirely pressure-die‑cast aluminum EGR cooler module that reportedly reduces exhaust gas temperature by over 600 °C (depending on operating point) compared to gas routing without such cooling enabling integration of EGR cooler, EGR valve and bypass valve into a single compact module.

Key Challenges:

Thermal Stress and Component Durability Issues

EGR components in Indian driving conditions face high thermal load, frequent stop-go cycles, and dust-heavy environments. These factors cause valve sticking, cooler clogging, and manifold fatigue over time. OEMs must address material degradation, soot deposition, and temperature spikes that reduce system reliability. Ensuring long-term durability requires investment in coated surfaces, robust coolant pathways, and advanced valve actuators. These needs raise production costs and extend development timelines. The challenge is more significant in high-mileage commercial fleets where sustained exhaust flow accelerates wear.

High System Cost and Integration Complexity

EGR systems require precision engineering, high-quality materials, and advanced calibration tools, which raise costs for OEMs. Integrating EGR with other emission devices increases design complexity and often demands reworking engine layouts. Smaller manufacturers struggle with the added expense of tooling, testing, and regulatory validation. Cost sensitivity in India’s mass-market vehicle segment limits the adoption of high-end EGR designs. Balancing affordability with compliance creates ongoing pressure on suppliers and automakers, especially as new norms introduce tighter NOx thresholds and real-world testing requirements.

Regional Analysis:

Northern Region

Northern India held about 32% share of the India Automotive Exhaust Gas Recirculation Market in 2024. The region saw strong demand due to high vehicle density in Delhi NCR, Haryana, and Punjab, where stricter emission controls pushed OEMs to adopt advanced EGR systems. Rising production of passenger cars and light commercial vehicles also helped expand local integration of cooled EGR units. Tier-1 suppliers increased partnerships with automotive clusters in Gurugram and Manesar, which strengthened supply chains. Growing awareness of air pollution drove faster compliance with BS-VI norms, keeping the region in a leading position.

Western Region

Western India accounted for nearly 29% share in 2024, supported by major automotive hubs across Maharashtra and Gujarat. High manufacturing activity in Pune, Chakan, Sanand, and Ahmedabad encouraged wider adoption of EGR modules in diesel and gasoline models. OEMs upgraded engines to meet BS-VI Phase-II norms, which increased the use of high-temperature EGR valves and coolers. Strong export-linked production also raised quality standards across suppliers. Expanding SUV and commercial vehicle output helped maintain steady demand, while investment across component parks strengthened the region’s share in India’s EGR market.

Southern Region

Southern India captured about 27% share in 2024, driven by strong automotive manufacturing in Tamil Nadu, Karnataka, and Telangana. Chennai remained a key production base for passenger cars, prompting higher uptake of advanced EGR coolers in compact and mid-segment models. Bengaluru and Hosur expanded component capabilities, supporting OEM needs for reliable emission-control integration. Technology upgrades across BS-VI engines boosted local sourcing of precision EGR valves. Rising electric vehicle adoption slowed diesel output, but steady demand in LCVs and tractors helped balance growth. Supplier ecosystems across the region continued to invest in design and testing capacity.

Eastern Region

Eastern India held around 12% share in 2024, reflecting developing automotive activity across West Bengal, Odisha, Jharkhand, and Bihar. The region saw moderate demand due to lower vehicle manufacturing density, but aftermarket sales for EGR parts remained stable. Growing commercial fleet movement along logistics corridors increased replacement needs for EGR valves and coolers. State programs targeting cleaner transport encouraged gradual upgrades in older diesel vehicles, boosting retrofit interest. Expansion of small-scale component units in Odisha and West Bengal supported cost-effective supply. Although smaller in scale, the region showed steady growth potential as emission rules tightened.

Market Segmentations:

By Product Type

- Single Exit Pipe

- Dual Rear Exit

- Opposite Dual Exhaust

- Dual Side Exhaust

- High-Performance Exhausts

By Components

- Exhaust Manifold

- Y Pipe

- Catalytic Converter

- Particulate Filter

- Pre-Muffler

- Rear Muffler

- Middle Muffler

- Corresponding Connecting Pipes

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Geography

- Northern

- Western

- Southern

- Eastern

Competitive Landscape:

The India Automotive Exhaust Gas Recirculation Market features strong competition among leading suppliers such as Continental AG, Marelli (India) Private Limited, Boysen India Private Limited, Delphi Technologies PLC, BENTELER International AG, Cummins Inc., Futaba Industrial Co., Ltd., Faurecia SE, Eberspächer Gruppe GmbH & Co. KG, and Tenneco Inc. These companies focus on durable EGR valves, high-efficiency coolers, optimized manifolds, and lightweight connecting pipes that support BS6 and future BS7 compliance. Many suppliers invest in improved thermal coatings, precision actuators, and compact layouts to enhance reliability under India’s variable driving and climatic conditions. Partnerships with OEMs enable localized production, reduced costs, and faster model integration. Firms also strengthen aftermarket networks to serve high-mileage commercial fleets that require frequent maintenance and replacement. Growing pressure for low-NOx engines drives continued innovation in variable-flow systems, integrated aftertreatment modules, and advanced calibration support, shaping a competitive and technology-driven market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In November 2025, Marelli (India) Private Limited Opened a new technical R&D site in Bengaluru (Embassy Manyata Tech Park) to expand engineering capability in India (350-seat site added to Marelli’s existing Indian R&D footprint).

- In August 2025, Faurecia SE: FORVIA Faurecia Clean Mobility India commissioned a new JIT plant in Anantapur, Andhra Pradesh, to supply locally manufactured emission-control and clean-mobility components for Hyundai-Kia programmes. The facility expands Faurecia’s India footprint in exhaust and aftertreatment hardware that supports stricter emission norms relevant to EGR systems.

- In June 2025, Continental AG Announced a strategic realignment in India (June 2025): ending truck & bus radial (TBR) tyre production at its Modipuram plant and committing investments to refocus operations in India; Continental’s Indian powertrain/sensor activities continue to supply exhaust-related sensors (DPF/differential-pressure sensors) used in Indian exhaust-aftertreatment systems.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Components, Vehicle Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- EGR demand will rise as India prepares for tighter BS7 and RDE norms.

- Automakers will adopt more compact and lightweight EGR modules for new engine platforms.

- Hybrid powertrains will continue using EGR to control combustion temperature during engine-on cycles.

- OEMs will invest in higher-efficiency coolers to reduce thermal load and improve durability.

- Variable-flow EGR valves will gain wider use to manage NOx spikes in urban driving.

- Suppliers will expand localized manufacturing to lower costs and speed model integration.

- Advanced coatings and alloys will improve component life under high-soot and high-heat conditions.

- Integrated EGR–DPF–SCR systems will see stronger adoption in commercial vehicles.

- Aftermarket replacements will grow as fleet operators upgrade older engines for compliance.

- Digital calibration tools and diagnostics will support more precise EGR control across drive cycles.