Market Overview

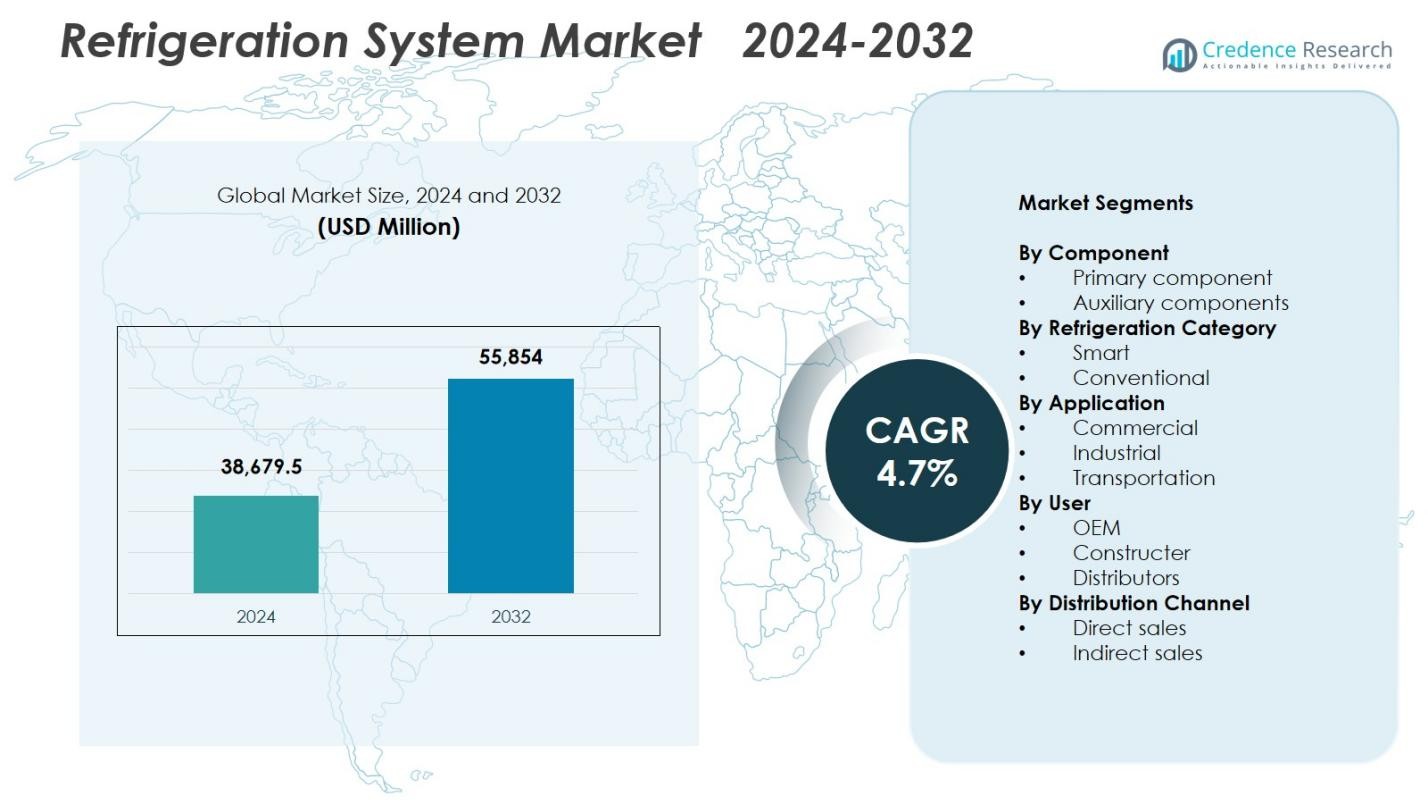

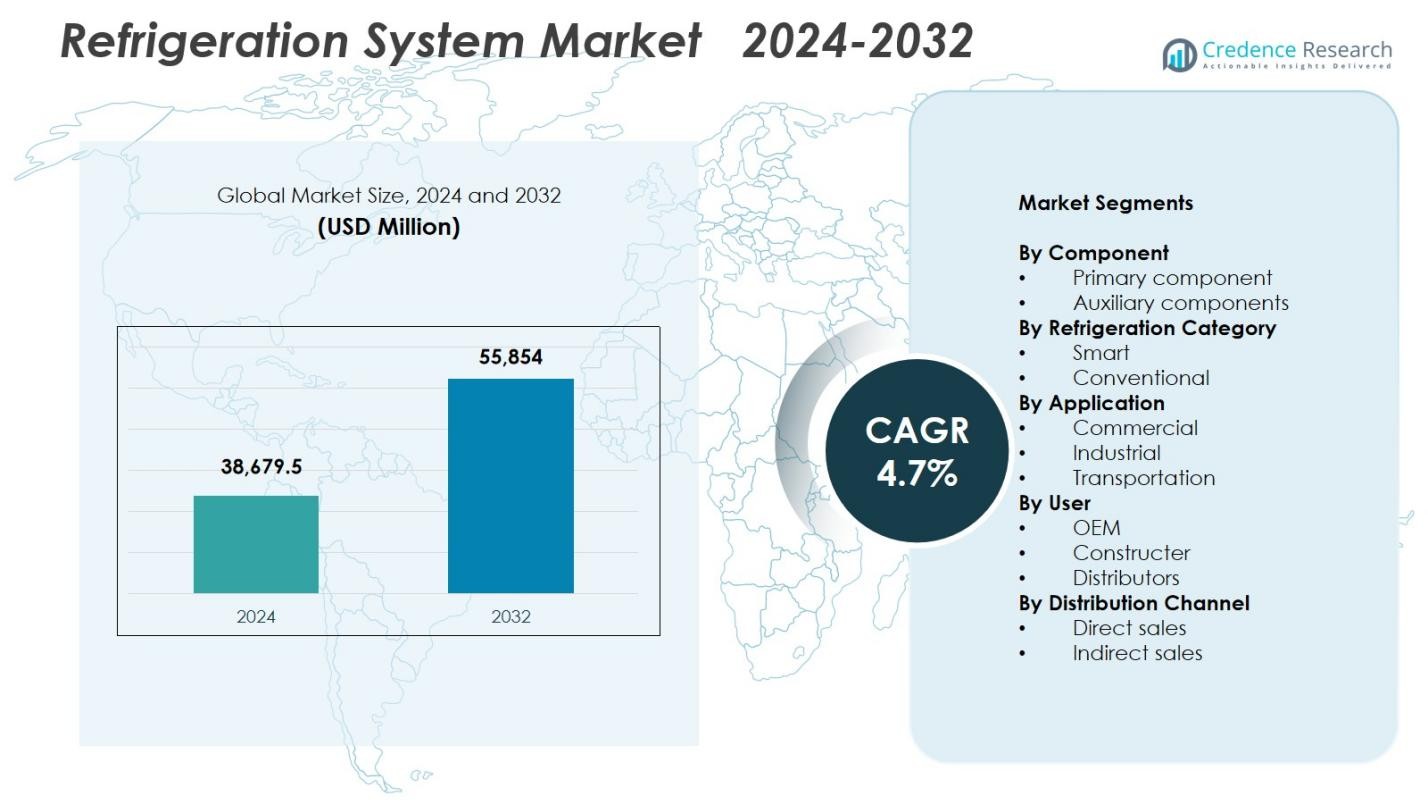

Refrigeration System Market size was valued at USD 38,679.5 million in 2024 and is anticipated to reach USD 55,854 million by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Refrigeration System Market Size 2024 |

USD 38,679.5 Million |

| Refrigeration System Market, CAGR |

4.7% |

| Refrigeration System Market Size 2032 |

USD 55,854 Million |

Refrigeration System Market is shaped by leading players such as Carrier Global Corporation, Daikin Industries Ltd., BITZER Kühlmaschinenbau GmbH, Danfoss A/S, Emerson Electric Co., GEA, Embraco (Nidec Corporation), Dorin, Grundfos, and Frick India Limited, all focusing on advanced, energy-efficient, and low-emission cooling technologies. These companies strengthen their presence through product innovation, natural refrigerant systems, and smart refrigeration solutions that support reliability and operational efficiency across commercial, industrial, and transportation applications. Regionally, Asia-Pacific dominated the Refrigeration System Market with 34.7% share in 2024, driven by rapid urbanization, expanding cold-chain networks, and rising demand for temperature-controlled logistics and retail infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Refrigeration System Market was valued at USD 38,679.5 million in 2024 and is set to grow at a CAGR of 4.7% through 2032.

- Strong demand from cold-chain expansion, rising food retail activity, and adoption of energy-efficient systems drives the Refrigeration System Market, with the primary component segment leading at 61.4% share.

- Key trends include rapid integration of smart, connected, and IoT-enabled refrigeration systems, along with increasing transition toward natural refrigerants across commercial and industrial applications.

- Major players such as Carrier, Daikin, BITZER, Danfoss, Emerson, GEA, Embraco, Dorin, Grundfos, and Frick India enhance market growth through technology upgrades, natural refrigerant solutions, and expanded product portfolios.

- Regionally, Asia-Pacific leads the Refrigeration System Market with 34.7% share, followed by North America at 31.2% and Europe at 28.6%, supported by retail expansion, industrial cooling needs, and stringent regulatory adoption across mature markets.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Component:

The Refrigeration System Market is dominated by the primary component segment, which accounted for 61.4% share in 2024, driven by its essential role in ensuring core system functionality across compressors, condensers, evaporators, and expansion devices. Increasing demand for energy-efficient and low-emission refrigeration technologies strengthens adoption of advanced compressors and heat exchangers in supermarkets, cold storage, and industrial processing facilities. Meanwhile, auxiliary components, including controls, valves, and monitoring systems, are gaining momentum as end users invest in reliability, predictive maintenance, and system optimization aligned with sustainability and regulatory compliance goals.

- For instance, Danfoss provides ejectors in SCM Frigo’s CO₂ refrigeration system for a Dominican supermarket, where high ambient temperatures prevail. The solution lifts CO₂ pressure before the compressor, achieving an average lift of 4°C with peaks up to 6.5°C for a 12-15% energy efficiency boost.

By Refrigeration Category:

The conventional refrigeration category led the market with 67.8% share in 2024, supported by widespread use across commercial and industrial facilities that depend on proven, cost-effective refrigeration architectures. Conventional systems remain preferred due to established operational reliability, long equipment life, and extensive service availability. Demand is further reinforced by rapid expansion of food retail, logistics, and industrial cooling infrastructure. Smart refrigeration is expanding at a faster pace as IoT-enabled systems, real-time monitoring, automation, and energy management technologies gain adoption among users seeking efficiency improvements and lower lifecycle costs.

- For instance, Carrier Transicold equipped Big Y supermarket chain’s trailers with X4™ 7300 refrigeration units, enabling remote monitoring of temperature and precooling time to minimize fuel waste and optimize performance during grocery distribution.

By Application:

The commercial application segment dominated the Refrigeration System Market with 52.6% share in 2024, fueled by strong demand from supermarkets, hypermarkets, restaurants, and convenience stores. Growth is driven by global expansion of retail chains, rising need for fresh and frozen food preservation, and increasing investment in display cases, walk-in coolers, and centralized refrigeration units. Industrial applications continue to grow as manufacturing, pharmaceuticals, cold-chain infrastructure, and food processing sectors adopt advanced refrigeration solutions. Transportation refrigeration also strengthens, supported by rising e-commerce penetration and stricter temperature-controlled logistics requirements.

Key Growth Drivers

Rising Demand for Cold Chain Expansion

Growing global consumption of perishable foods, pharmaceuticals, and biologics continues to accelerate cold chain infrastructure expansion, fueling strong demand for high-performance refrigeration systems. Retailers, food processors, and logistics companies are investing in temperature-controlled warehouses, reefer fleets, and advanced refrigeration units to maintain quality and reduce spoilage. Government initiatives supporting food safety, vaccination programs, and export-oriented supply chains further strengthen market uptake. As companies prioritize operational reliability and consistent temperature compliance, the need for durable, scalable, and energy-efficient refrigeration solutions expands across emerging and developed markets.

- For instance, SureChill’s off-grid refrigeration systems have facilitated the safe delivery of 180 million vaccine doses, enabling medical centers in remote regions to store temperature-sensitive medicines without constant power.

Shift Toward Energy-Efficient and Low-Emission Technologies

Stringent global regulations targeting refrigerant emissions and energy consumption are a major driver boosting adoption of eco-friendly refrigeration systems. Industries increasingly shift toward natural refrigerants such as CO₂, ammonia, and hydrocarbons, supported by rising environmental mandates and carbon-reduction goals. Manufacturers respond with high-efficiency compressors, heat exchangers, and advanced control systems designed to optimize performance while minimizing operational costs. Incentives for green technologies, along with sustainability commitments from retailers and industrial users, accelerate market growth as companies upgrade legacy systems to meet evolving regulatory and ESG expectations.

- For instance, Hillphoenix deployed its Advansor CO₂ transcritical booster systems for industrial applications in cold storage, food processing, and pharmaceuticals, using a single sustainable CO₂ refrigerant with non-ozone-depleting properties.

Rapid Growth in Retail and Food Service Industries

Expansion of supermarkets, hypermarkets, quick-service restaurants, and convenience chains significantly drives demand for advanced refrigeration systems. These end users rely on reliable cooling technologies to preserve fresh produce, dairy, meat, and frozen products while supporting appealing product displays. Rising urbanization, increasing disposable incomes, and modernization of food distribution networks amplify demand for large-scale commercial refrigeration installations. Additionally, investments in plug-in display cases, walk-in coolers, multi-deck chillers, and remote refrigeration systems continue to grow as retailers enhance energy efficiency and strengthen product quality across their networks.

Key Trends & Opportunities

Integration of Smart, Connected, and IoT-Enabled Refrigeration

Digital transformation is creating major opportunities as refrigeration systems integrate IoT sensors, cloud platforms, and advanced analytics. Smart refrigeration enables real-time monitoring, predictive maintenance, remote diagnostics, and automated temperature adjustments, improving operational efficiency and reducing downtime. Retail and industrial users increasingly adopt connected systems to ensure compliance, streamline energy consumption, and optimize inventory management. As interest grows in AI-based optimization and predictive asset management, technology vendors gain significant opportunities to deliver intelligent refrigeration solutions tailored to modern cold chain and commercial requirements.

- For instance, Arneg uses Amazon Forecast and Amazon SageMaker to analyze IoT data from freezers and refrigerators, predicting maintenance needs with over 80 percent accuracy and issuing notifications to prevent breakdowns.

Increasing Adoption of Natural Refrigerants

The shift toward natural refrigerants presents substantial opportunities for manufacturers developing sustainable refrigeration technologies. CO₂ transcritical systems, ammonia-based industrial refrigeration, and hydrocarbon solutions are witnessing accelerating adoption as companies reduce reliance on high-GWP synthetic refrigerants. Regulatory frameworks such as F-Gas phase-downs and Kigali Amendment commitments drive rapid adoption globally. Industries focused on ESG performance are transitioning to climate-friendly systems that deliver superior efficiency and reduced lifecycle emissions. This trend creates strong market potential for suppliers offering innovative low-GWP, high-efficiency refrigeration equipment across retail, industrial, and logistics sectors.

- For instance, Shambaugh & Son constructed a 1,700-ton refrigeration system for a food facility using both anhydrous ammonia (NH3) and CO₂ refrigerants, leveraging specialized expertise to handle the complex integration.

Key Challenges

High Capital and Maintenance Costs

Refrigeration systems require substantial capital investment, particularly advanced industrial and energy-efficient installations that use natural refrigerants or smart technologies. High upfront equipment costs, complex installation requirements, and the need for specialized workforce expertise often limit adoption among small and mid-sized enterprises. Additionally, long-term maintenance, refrigerant handling, and system monitoring add to operational expenses. These financial barriers can delay replacement of outdated systems, affecting overall modernization rates. As a result, cost-sensitive markets struggle to transition to next-generation refrigeration technologies despite clear efficiency and sustainability benefits.

Regulatory Compliance and Refrigerant Transition Complexity

Evolving global regulations on refrigerants and emissions create significant compliance challenges for manufacturers and end users. Transitioning from high-GWP synthetic refrigerants to natural or low-GWP alternatives requires redesigning equipment, updating components, and ensuring workforce readiness for safe handling. Variations in regional regulatory timelines and certification standards further complicate market adoption. Businesses operating large refrigeration networks face operational disruptions and added costs during system conversion. This regulatory uncertainty, combined with technical complexities of new refrigerants, creates hurdles for seamless implementation of future-ready refrigeration systems across multiple industries.

Regional Analysis

North America

North America held 31.2% share in 2024, driven by strong demand from supermarkets, food processing, pharmaceuticals, and cold-chain logistics providers. The region benefits from advanced infrastructure, rapid adoption of natural refrigerant systems, and strong regulatory enforcement encouraging energy-efficient technologies. Growth is further supported by expansion in refrigerated transportation and rising investment in vaccine storage and biologics distribution. The U.S. leads market consumption due to the presence of major retailers and foodservice chains upgrading to low-GWP and IoT-enabled refrigeration solutions. Continued modernization of cold warehouses and distribution hubs sustains long-term system demand.

Europe

Europe accounted for 28.6% share in 2024, supported by stringent F-Gas regulations and early adoption of natural refrigerants such as CO₂ and ammonia across commercial and industrial facilities. The region’s food retail sector drives significant installation of advanced refrigeration units, particularly in Germany, the U.K., France, and Italy. Strong emphasis on sustainability, carbon neutrality, and energy efficiency accelerates system upgrades in supermarkets and cold storage networks. Industrial users in food processing and pharmaceuticals further contribute to market expansion. Ongoing investments in green refrigeration technologies strengthen Europe’s leadership in low-emission cooling solutions.

Asia-Pacific

Asia-Pacific dominated the Refrigeration System Market with 34.7% share in 2024, propelled by rapid urbanization, expanding retail networks, and significant cold-chain development across China, India, Japan, and Southeast Asia. Rising consumption of packaged foods, seafood, dairy, and frozen products drives strong demand for commercial and industrial refrigeration systems. Government programs supporting food safety, agricultural exports, and pharmaceutical logistics further boost adoption. The region experiences high investment in warehouses, distribution centers, and refrigerated transport fleets. APAC’s growing manufacturing base and strong economic growth reinforce its position as the fastest-expanding market for refrigeration systems.

Latin America

Latin America recorded 3.4% share in 2024, influenced by increasing modernization of food retail chains, rising demand for frozen and processed foods, and expanding cold storage capacity for agricultural exports. Countries such as Brazil, Mexico, and Chile are investing in upgraded refrigeration systems to support meat, seafood, and fresh produce supply chains. Infrastructure development and improvements in logistics networks are enhancing market penetration. However, high capital costs and economic fluctuations limit large-scale adoption. Growing interest in energy-efficient and natural refrigerant systems presents opportunities for manufacturers targeting sustainability-focused customers in the region.

Middle East & Africa

The Middle East & Africa region captured 2.1% share in 2024, driven by rising demand for temperature-controlled storage supporting food imports, pharmaceuticals, and hospitality sectors. GCC countries, particularly the UAE and Saudi Arabia, are expanding cold-chain logistics to reduce spoilage and strengthen food security. Industrial applications in chemicals and energy also contribute to refrigeration demand. Africa experiences gradual adoption, led by South Africa, due to growing supermarket penetration and cold storage investments. Challenges such as limited infrastructure and high installation costs slow market progression, yet increasing investment in modern refrigeration solutions offers long-term growth potential.

Market Segmentations:

By Component

- Primary component

- Auxiliary components

By Refrigeration Category

By Application

- Commercial

- Industrial

- Transportation

By User

- OEM

- Constructer

- Distributors

By Distribution Channel

- Direct sales

- Indirect sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive analysis in the Refrigeration System Market highlights the presence of leading players such as Carrier Global Corporation, Daikin Industries Ltd., BITZER Kühlmaschinenbau GmbH, Danfoss A/S, Emerson Electric Co., GEA, Embraco (Nidec Corporation), Dorin, Grundfos, and Frick India Limited. These companies focus on developing energy-efficient, low-GWP, and environmentally compliant refrigeration technologies to meet evolving regulatory standards and sustainability goals. Market participants increasingly invest in advanced compressors, natural refrigerant systems, smart controls, and IoT-enabled monitoring platforms to enhance performance and reduce operational costs. Strategic initiatives such as capacity expansions, technological upgrades, and collaborations with cold-chain, commercial, and industrial end users further strengthen their global footprint. Product innovation remains a core competitive differentiator, with manufacturers emphasizing durability, precision cooling, and lifecycle efficiency. As retailers, logistics providers, and industrial facilities modernize infrastructure, key players continue to expand portfolios tailored to diverse applications across commercial, industrial, and transportation refrigeration.

Key Player Analysis

- Dorin

- Grundfos

- GEA

- Carrier Global Corporation

- Frick India Limited

- Embraco (Nidec Corporation)

- Danfoss A/S

- Daikin Industries Ltd.

- Emerson Electric Co.

- BITZER Kühlmaschinenbau GmbH

Recent Developments

- In August 2025, Embraco (Nidec Global Appliance) acquired scroll-compressor manufacturer Xecom, expanding its scroll compressor portfolio and enhancing its offerings for commercial cold rooms, rooftop chillers, and packaged refrigeration units.

- In July 2025, Daikin Industries Ltd. signed a landmark five-year cooperation agreement with Greater Manchester Combined Authority to deploy Daikin’s advanced heat-pump and energy-efficient building climate solutions across the region.

- In April 2024, Mitsubishi Heavy Industries Thermal Systems introduced the KXZ3 Series, a new range of building-use multi-split air conditioners using R32 refrigerant. This launch marks a significant development in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Refrigeration Technology, Application, User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as cold-chain expansion accelerates across food, pharmaceutical, and logistics sectors.

- Adoption of natural refrigerants will rise as industries prioritize sustainability and regulatory compliance.

- Smart, connected, and IoT-enabled refrigeration systems will gain wider acceptance for efficiency and predictive maintenance.

- Retail modernization will drive increasing installation of energy-efficient commercial refrigeration units.

- Industrial applications will strengthen as food processing, chemicals, and pharmaceuticals expand production capacity.

- Transportation refrigeration demand will grow with the rise of e-commerce and temperature-sensitive deliveries.

- Manufacturers will invest more in low-emission technologies to meet global decarbonization targets.

- System retrofitting and upgrades will increase as end users replace aging equipment with high-efficiency alternatives.

- Asia-Pacific will continue to lead industry expansion due to urbanization and rapid infrastructure development.

- Strategic partnerships and technology collaborations will intensify as companies compete to enhance performance and global reach.

Market Segmentation Analysis:

Market Segmentation Analysis: