Market Overview

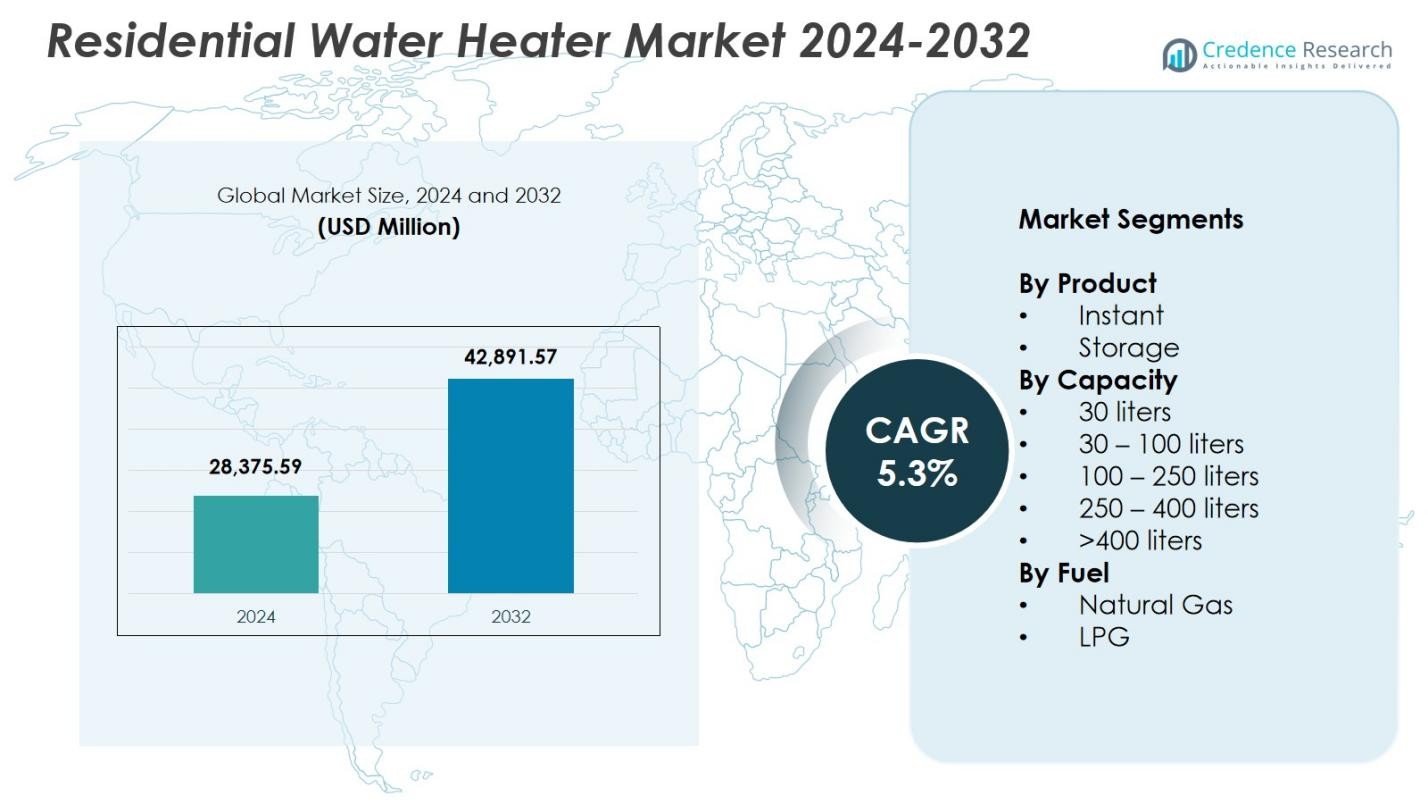

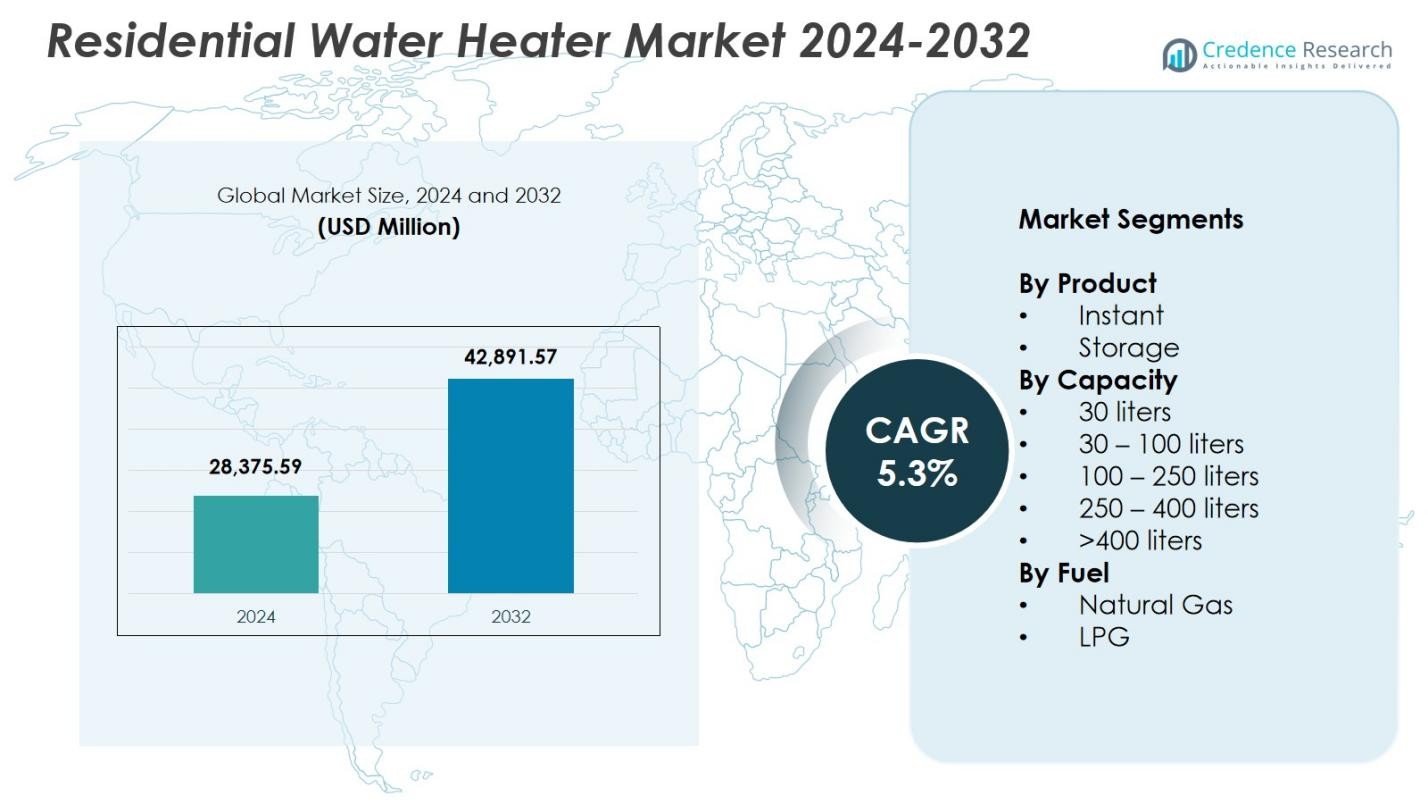

Residential Water Heater Market size was valued at USD 28,375.59 million in 2024 and is anticipated to reach USD 42,891.57 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Water Heater Market Size 2024 |

USD 28,375.59 Million |

| Residential Water Heater Market, CAGR |

5.3% |

| Residential Water Heater Market Size 2032 |

USD 42,891.57 Million |

Residential Water Heater Market is shaped by leading players such as A. O. Smith India Water Products Pvt. Ltd., Ariston Holding N.V., American Standard Water Heaters, Bosch Thermotechnology Corp., Bradford White Corporation, Ferroli S.p.A, GE Appliances, Haier Inc., Havells India Ltd., and Lennox International Inc., all of whom strengthen their presence through energy-efficient technologies and expanded portfolios. Asia-Pacific led the market with 33.8% share in 2024, driven by rapid urbanization, rising residential construction, and strong adoption of both instant and storage systems. North America and Europe follow, supported by high-efficiency regulations and growing demand for smart, connected water heating solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Residential Water Heater Market reached USD 28,375.59 million in 2024 and will grow at a CAGR of 5.3% through 2032.

- Market growth is driven by rising adoption of energy-efficient heaters, strong residential construction activity, and increasing consumer shift toward smart, IoT-enabled systems.

- Key trends include expanding demand for heat pump, hybrid, and solar-integrated heaters, along with advanced insulation, digital controls, and predictive maintenance features.

- Leading players focus on product innovation, enhanced distribution, and localized manufacturing, with the storage segment dominating at 71.4% share and natural gas leading fuel type with 58.7% share.

- Asia-Pacific led with 33.8% share, followed by North America at 32.6% and Europe at 27.4%, driven by strong replacement demand, regulatory efficiency mandates, and expanding gas infrastructure.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product:

In the Residential Water Heater Market, the storage segment dominated with 71.4% share in 2024, driven by its higher suitability for multi-point water usage, consistent hot-water availability, and strong adoption across urban and semi-urban households. Storage heaters benefit from improved insulation technologies, faster heating coils, and enhanced energy-efficiency ratings that meet regulatory standards. Manufacturers continue to innovate with corrosion-resistant tanks, smart temperature controls, and long-life heating elements, supporting stronger replacement demand. The instant segment grows steadily due to compact designs and lower electricity consumption, but storage systems retain clear leadership due to wider functional versatility.

- For instance, Bradford White uses Vitraglas tank lining with Microban antimicrobial protection alongside the Hydrojet Total Performance System to minimize sediment buildup and enhance efficiency.

By Capacity:

The 30–100 liters segment led the Residential Water Heater Market with 46.2% share in 2024, supported by its optimal suitability for nuclear families and widespread installation in apartments and mid-sized homes. This capacity range offers the right balance of water volume, energy efficiency, and installation flexibility, making it the preferred choice for both new construction and renovation projects. Growing availability of BEE-rated models, rapid urbanization, and rising middle-class adoption further strengthen demand. Segments such as 100–250 liters gain traction in larger households, but the 30–100 liters range continues to dominate due to its broad applicability.

- For instance, Crompton Arno Neo 25L storage water heater delivers 2000 W heating at 8 bar pressure with BEE 5 Star rating and 3-level safety features.

By Fuel:

The natural gas segment dominated the Residential Water Heater Market with 58.7% share in 2024, driven by its lower operating cost, faster heating capability, and strong penetration across regions with established gas pipeline infrastructure. Consumers prefer natural gas heaters for long-term cost savings and higher thermal efficiency compared to alternative fuels. Government initiatives expanding residential gas connectivity and rising adoption of dual-safety valve systems further support segment leadership. LPG-based heaters remain relevant in off-grid and semi-urban areas, but the natural gas segment holds a clear lead due to wider accessibility and superior performance in continuous-use households.

Key Growth Drivers

Rising Adoption of Energy-Efficient and Smart Water Heaters

Growing consumer preference for energy-efficient appliances significantly drives the Residential Water Heater Market. Households increasingly adopt smart heaters equipped with features such as Wi-Fi connectivity, remote temperature control, leakage detection, and energy-usage insights. Regulatory mandates promoting high-efficiency models and the introduction of BEE-rated and ENERGY STAR-certified products further accelerate demand. Manufacturers are investing heavily in heat pump technologies, improved insulation materials, and faster-heating elements, enabling substantial reductions in electricity consumption. This shift toward intelligent, eco-friendly systems continues to strengthen market expansion across urban and semi-urban regions.

- For instance, Rheem’s Smart Electric Water Heater features LeakSense™ detection that identifies leaks in as little as 15 seconds and LeakGuard™ automatic shut-off, limiting water loss to under 20 ounces while enabling Wi-Fi app control for temperature and usage monitoring.

Rapid Urbanization and Expansion of Residential Construction

The ongoing surge in urban housing development stimulates strong demand for residential water heaters. Increasing construction of apartments, gated communities, and modern homes boosts installation rates of both storage and instant models. Rising disposable incomes and lifestyle upgrades encourage consumers to opt for premium, multi-mode water heating systems. Additionally, government initiatives supporting affordable housing and rapid penetration of piped gas networks provide a solid foundation for market growth. As home renovation and replacement cycles shorten, the need for durable, high-efficiency heaters further drives consistent demand across major population centers.

- For instance, Voltas launched its Aqua Prime series storage water heaters featuring Quartzline technology with a 100% copper heating element and 8-bar pressure rating for high-rise buildings, supported by 6-level safety features including a multi-function valve.

Growing Penetration of Natural Gas and Renewable Heating Technologies

Expanding natural gas infrastructure plays a vital role in accelerating market adoption, especially in regions prioritizing low-cost and efficient fuel options. Natural gas heaters gain momentum due to faster heating capability, reduced operational costs, and enhanced safety features. Simultaneously, renewable heating technologies such as solar water heaters and hybrid heat pump systems attract eco-conscious consumers aiming to reduce energy bills and carbon footprints. Supportive government incentives, tax credits, and net-metering policies encourage broader deployment of these technologies, strengthening their contribution to long-term market growth.

Key Trends & Opportunities

Shift Toward Smart, IoT-Enabled Water Heating Ecosystems

A major trend reshaping the market is the accelerated integration of IoT, AI, and cloud-based monitoring into water heating systems. Smart heaters increasingly allow predictive maintenance, consumption analytics, remote operation, and automated scheduling, enabling households to optimize energy usage. Manufacturers invest in app-connected diagnostics and adaptive heating algorithms that improve performance and safety. As consumers demand greater control and convenience, opportunities rise for vendors offering intelligent heating platforms that seamlessly integrate with home automation ecosystems and deliver enhanced user experiences.

- For instance, A.O. Smith’s HeatBot Wifi water heater integrates with the A.O. Smith Smart App for remote operation from anywhere, Alexa voice control, and timer modes to deliver hot water on demand while tracking energy consumption.

Strong Market Opportunity for Solar and Heat Pump Water Heaters

Growing emphasis on sustainability and global carbon-reduction targets creates significant opportunities for solar and heat pump water heaters. These systems deliver high-efficiency heating with substantially lower operating costs, aligning with rising consumer awareness and government-led clean energy initiatives. Advancements in hybrid designs, improved heat exchangers, and low-ambient performance capabilities make renewable heaters more suitable for diverse climates. As utility incentives and subsidies expand, adoption increases across environmentally conscious households, opening strong avenues for manufacturers developing durable, high-performance green heating solutions.

- For instance, Tata Power Solar Systems Ltd offers flat plate collector solar water heaters with capacities from 150-300 liters, designed for varied Indian climatic conditions with high efficiency suited to residential use.

Key Challenges

High Upfront Costs and Installation Complexities

Despite long-term cost savings, many high-efficiency water heaters especially solar, heat pump, and advanced gas models face adoption barriers due to their elevated upfront costs. Installation complexities such as space requirements, piping adjustments, and professional setup further discourage budget-sensitive consumers. In regions with low electricity tariffs or limited infrastructure support, traditional heaters remain preferred. Manufacturers must address cost optimization, simplified installation, and consumer awareness gaps to accelerate the shift toward advanced technologies and reduce resistance among first-time buyers.

Infrastructure Limitations and Fuel Availability Gaps

Market expansion is constrained in areas lacking stable electricity supply, piped natural gas networks, or adequate rooftop space for solar systems. Fuel availability disparities directly impact consumer choices, limiting adoption of efficient gas or renewable-based heaters in many developing regions. Variations in regulatory frameworks, building codes, and safety standards further add complexity for manufacturers and installers. Overcoming these challenges requires coordinated infrastructure development, improved distribution networks, and supportive policy frameworks to ensure wider accessibility of modern water heating solutions.

Regional Analysis

North America

North America held 32.6% share in 2024, driven by strong adoption of energy-efficient and smart water heaters across the U.S. and Canada. Demand is supported by stringent efficiency regulations, high residential replacement rates, and increasing preference for natural gas and heat pump systems. Growth in single-family housing construction and consumer shifts toward IoT-enabled models further strengthen market expansion. Manufacturers benefit from mature distribution channels and rising investment in tankless technologies. Federal incentives promoting sustainable heating solutions also accelerate the transition toward high-performance, low-emission residential water heating systems across the region.

Europe

Europe accounted for 27.4% share in 2024, largely influenced by stringent environmental regulations, widespread adoption of renewable heating solutions, and rapid expansion of heat pump water heaters. Countries such as Germany, the U.K., France, and Italy lead demand due to strong replacement cycles and rising household investments in energy-efficient appliances. The region’s push toward decarbonization and reduced reliance on fossil fuels supports growing deployment of solar-integrated and hybrid systems. Smart home adoption further enhances demand for connected heaters, while government-backed subsidy programs continue to drive upgrades to high-efficiency models across residential properties.

Asia-Pacific

Asia-Pacific dominated the Residential Water Heater Market with 33.8% share in 2024, driven by rapid urbanization, rising middle-class income levels, and large-scale residential construction across China, India, Japan, and Southeast Asia. Expanding electrification, stronger gas pipeline networks, and increasing preference for storage and instant heaters fuel market growth. Manufacturers benefit from high-volume demand, particularly in emerging economies undergoing modernization of household infrastructure. Government initiatives promoting energy-efficient appliances and expanding renewable water heating solutions further accelerate adoption. The region remains the fastest-growing market due to strong demographics and sustained residential development.

Latin America

Latin America captured 4.1% share in 2024, supported by rising demand for affordable electric and gas-based water heaters across Brazil, Mexico, Argentina, and Chile. Growth is driven by expanding urban housing, increasing adoption of mid-capacity storage heaters, and rising availability of branded, energy-efficient models at competitive pricing. Economic recovery and infrastructure improvements strengthen installation rates in multi-family dwellings. While renewable heaters gain gradual traction, traditional systems continue to dominate due to cost sensitivity. Manufacturers see opportunities in durable, low-maintenance models tailored to varying climate conditions and evolving household energy usage patterns across the region.

Middle East & Africa

The Middle East & Africa region held 2.1% share in 2024, driven by expanding residential construction, rising electrification, and increasing adoption of electric storage heaters across the Gulf countries and parts of Africa. Hot water demand continues to grow due to lifestyle modernization, higher living standards, and rapid urban development. Solar water heaters witness strong interest, particularly in sun-rich markets such as the UAE, Saudi Arabia, and South Africa, supported by renewable energy policies. Despite infrastructure disparities in parts of Africa, the region offers long-term potential as affordability improves and energy-efficient technologies gain wider penetration.

Market Segmentations:

By Product

By Capacity

- 30 liters

- 30 – 100 liters

- 100 – 250 liters

- 250 – 400 liters

- >400 liters

By Fuel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Residential Water Heater Market features leading players such as A. O. Smith India Water Products Pvt. Ltd., Ariston Holding N.V., American Standard Water Heaters, Bosch Thermotechnology Corp., Bradford White Corporation, Ferroli S.p.A, GE Appliances, Haier Inc., Havells India Ltd., and Lennox International Inc. These companies strengthen their market presence through continuous product innovation, energy-efficient technologies, and expanded distribution networks. Manufacturers increasingly invest in smart, IoT-enabled heaters with advanced diagnostics, remote control, and predictive maintenance capabilities to meet rising consumer expectations. Strategic initiatives—including capacity expansions, partnerships with utilities, and enhanced after-sales service—help brands improve customer retention and strengthen competitive positioning. Growing emphasis on regulatory compliance and sustainability drives companies to adopt low-emission heating technologies, corrosion-resistant materials, and high-efficiency heat pump and hybrid systems. As demand surges across urban and developing regions, players focus on localized manufacturing, multi-tier pricing strategies, and digital retail channels to capture wider consumer segments.

Key Player Analysis

- Havells India Ltd.

- American Standard Water Heaters

- GE Appliances

- Ferroli S.p.A

- Lennox International Inc.

- A. O. Smith India Water Products Pvt. Ltd.

- Bosch Thermotechnology Corp.

- Haier Inc.

- Bradford White Corporation, USA

- Ariston Holding N.V.

Recent Developments

- In May 2025 Ariston Group and Lennox International Inc. announced a joint venture to introduce Lennox-branded residential water heaters in North America by 2026.

- In November 2025 Apparent Inc. launched a DC-powered solar water heater for residential use that can operate entirely off-grid using standard photovoltaic panels.

- In June 2025, GE Appliances launched the GE Profile GEOSPRING Smart Hybrid Heat Pump Water Heater, offering up to 4.7× the energy efficiency of standard electric heaters and up to 60% more hot water capacity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Capacity, Fuel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness accelerated adoption of energy-efficient and smart water heaters across residential households.

- Heat pump and hybrid systems will gain momentum as consumers prioritize sustainability and lower operating costs.

- IoT-enabled heaters with remote monitoring and predictive maintenance will become standard offerings.

- Expansion of natural gas infrastructure will drive increased installation of gas-based water heating systems.

- Solar-integrated water heaters will grow steadily as renewable energy policies strengthen globally.

- Manufacturers will invest more in corrosion-resistant materials and long-life heating components to enhance durability.

- Replacement demand will rise as aging residential systems are upgraded with high-efficiency models.

- Urban housing development will continue to create substantial demand for compact, instant, and mid-capacity heaters.

- Regional brands will expand through localized manufacturing and cost-effective product portfolios.

- Digital retail channels and service platforms will play a bigger role in influencing consumer purchasing decisions.

Market Segmentation Analysis:

Market Segmentation Analysis: