Market Overview

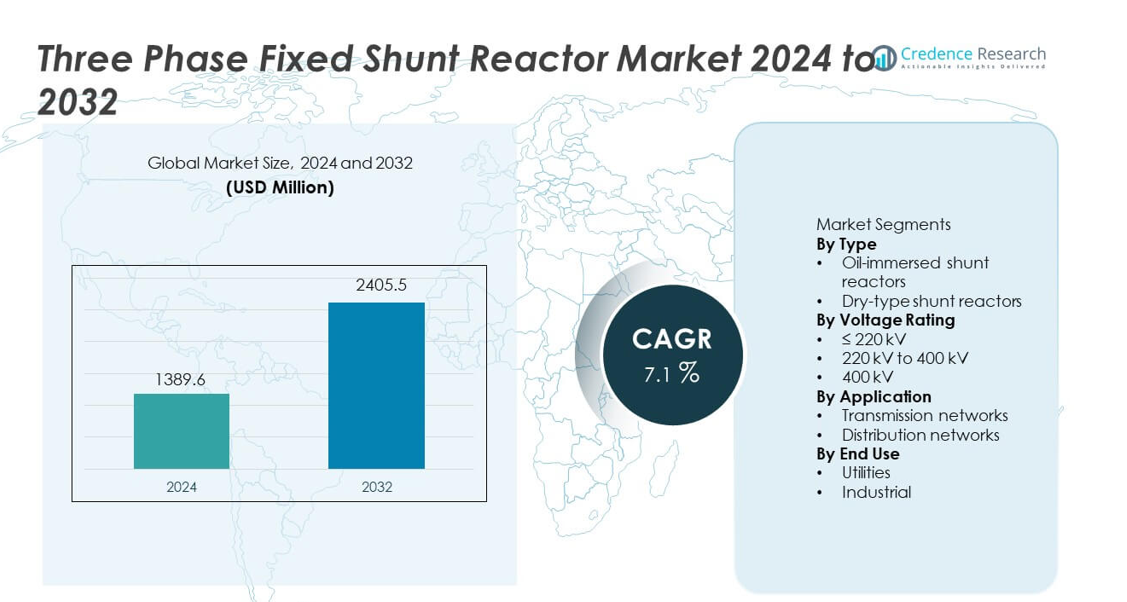

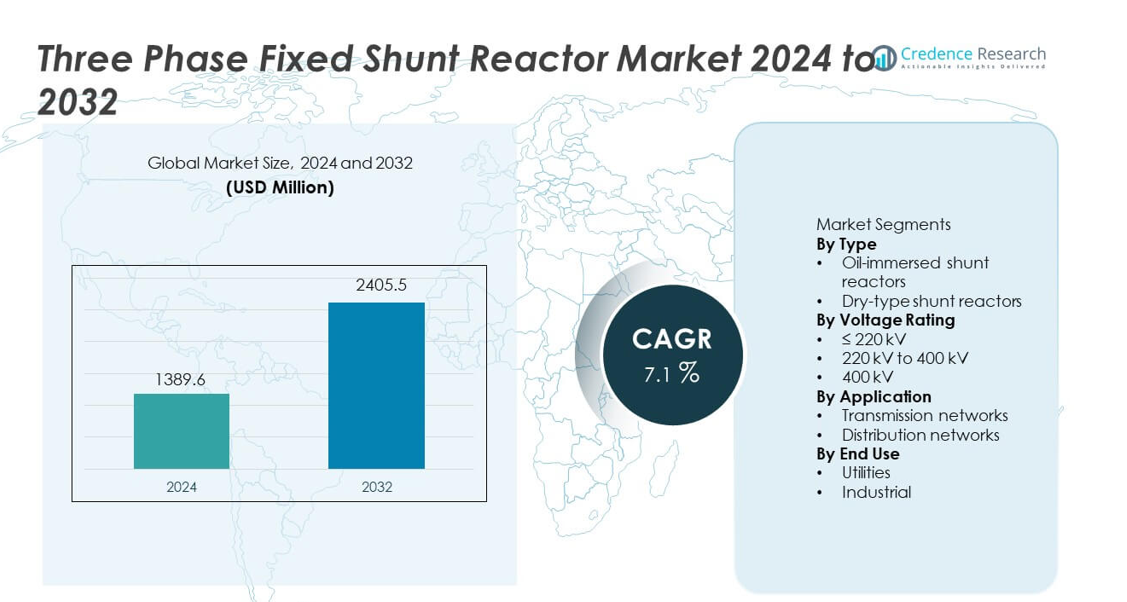

The Three Phase Fixed Shunt Reactor market was valued at USD 1,389.6 million in 2024 and is projected to reach USD 2,405.5 million by 2032, registering a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Three Phase Fixed Shunt Reactor Market Size 2024 |

USD 1,389.6 million |

| Three Phase Fixed Shunt Reactor Market, CAGR |

7.1% |

| Three Phase Fixed Shunt Reactor Market Size 2032 |

USD 2,405.5 million |

The Three Phase Fixed Shunt Reactor market features strong participation from leading players such as ABB Ltd., Siemens Energy, GE Vernova, Hitachi Energy, Toshiba Energy Systems & Solutions, Mitsubishi Electric Corporation, Hyosung Heavy Industries, Hyundai Electric & Energy Systems, CG Power and Industrial Solutions Ltd., and TBEA Co., Ltd. These companies compete through advanced high-voltage reactor designs, strong utility partnerships, and proven transmission expertise. Asia Pacific leads the market with an exact share of 38.4%, driven by rapid expansion of high-voltage and ultra-high-voltage transmission networks and large-scale renewable energy integration. North America follows with a 24.6% share, supported by grid modernization and long-distance transmission upgrades. Europe holds a 22.1% share, supported by cross-border interconnections and renewable energy projects. The competitive landscape remains focused on grid stability, reliability, and high-voltage performance.

Market Insights

- The Three Phase Fixed Shunt Reactor market was valued at USD 1,389.6 million in 2024 and is projected to grow at a CAGR of 7.1% during the forecast period.

- Expansion of high-voltage transmission networks, renewable energy integration, and rising grid stability requirements act as primary drivers for the Three Phase Fixed Shunt Reactor market.

- Oil-immersed shunt reactors lead the type segment with a market share of 69.2%, supported by higher cooling efficiency, durability, and suitability for high-voltage transmission applications.

- Competitive dynamics remain strong, with global players focusing on ultra-high-voltage capability, advanced insulation, and long-life reactor designs, while regional manufacturers compete on cost and localized engineering support.

- Asia Pacific dominates regional demand with a 38.4% market share, followed by North America at 24.6% and Europe at 22.1%, driven by transmission expansion, renewable evacuation projects, and cross-border grid interconnections.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Three Phase Fixed Shunt Reactor market, by type, includes oil-immersed and dry-type shunt reactors, with oil-immersed shunt reactors dominating with a market share of 69.2%. Utilities and transmission operators prefer oil-immersed reactors due to superior cooling efficiency, higher reactive power handling, and longer operational life. These reactors perform reliably in high-voltage environments and support continuous operation in outdoor substations. Growing investments in high-voltage transmission infrastructure and long-distance power corridors further strengthen demand. Dry-type shunt reactors find use in indoor or space-constrained installations, but higher costs and limited voltage handling restrict wider adoption.

- For instance, Hitachi Energy has deployed oil-immersed shunt reactors rated at 150 MVAr and 400 kV, designed for continuous operation above 30 years under IEC standards.

By Voltage Rating

Based on voltage rating, the market segments into ≤220 kV, 220 kV to 400 kV, and >400 kV, with the 220 kV to 400 kV segment leading at a market share of 45.6%. This voltage range aligns with expanding regional and interregional transmission networks. Utilities deploy these reactors to manage reactive power and control voltage rise in medium-to-high voltage lines. Rising grid interconnections and renewable power evacuation projects drive demand. ≤220 kV reactors serve sub-transmission networks, while >400 kV systems grow steadily with ultra-high-voltage transmission expansion.

- For instance, Siemens Energy has supplied 245 kV and 420 kV fixed shunt reactors with ratings up to 200 MVAr for transmission operators managing renewable integration.

By Application

Application segmentation includes transmission networks and distribution networks, with transmission networks accounting for 76.4% market share. Fixed shunt reactors play a critical role in controlling voltage fluctuations in long-distance and lightly loaded transmission lines. Expansion of cross-border transmission, renewable energy integration, and grid stability requirements drive strong adoption. Transmission operators prioritize fixed shunt reactors to maintain voltage profiles and reduce losses. Distribution networks show limited adoption due to lower voltage requirements, keeping transmission-focused applications as the primary demand driver.

Key Growth Drivers

Expansion of High-Voltage Transmission Networks

Rapid expansion of high-voltage and ultra-high-voltage transmission lines strongly drives demand for three phase fixed shunt reactors. Utilities deploy these reactors to control overvoltage conditions on long-distance and lightly loaded lines. Growing interregional power transfer and cross-border grid projects increase installation requirements. Grid reinforcement programs focus on improving voltage stability and reducing transmission losses. Rising electricity demand from urbanization and industrial growth further supports network expansion. Fixed shunt reactors remain essential components for maintaining reliable voltage profiles across modern transmission systems.

- For instance, ABB has supplied fixed shunt reactors rated at 420 kV with reactive power capacity of 200 MVAr for long-distance AC transmission lines exceeding 300 km.

Rising Integration of Renewable Energy Sources

Large-scale integration of wind and solar power increases reactive power imbalance across grids. Variable generation creates voltage fluctuations, especially in remote transmission corridors. Three phase fixed shunt reactors help absorb excess reactive power and stabilize voltage levels. Utilities install reactors near renewable evacuation points to ensure grid compliance. Expansion of offshore wind farms and solar parks accelerates adoption. Renewable energy targets and decarbonization policies further reinforce demand. Grid operators increasingly rely on fixed shunt reactors to maintain system reliability.

- For instance, Mitsubishi Electric has supplied three phase fixed shunt reactors rated at 275 kV with a reactive power rating of 120 MVAr for utility substations linked to large solar parks.

Focus on Grid Stability and Power Quality Improvement

Power quality management has become a priority for transmission operators. Voltage rise during low-load conditions threatens equipment safety and grid reliability. Fixed shunt reactors provide a cost-effective solution for continuous reactive power compensation. Utilities deploy these systems to protect transformers and transmission assets. Aging grid infrastructure replacement also supports new installations. Investments in grid automation and monitoring strengthen the role of fixed shunt reactors. Stability-focused upgrades continue to drive market growth.

Key Trends and Opportunities

Deployment in Ultra-High-Voltage Transmission Projects

Utilities increasingly invest in ultra-high-voltage transmission lines to move power efficiently over long distances. These projects require high-capacity fixed shunt reactors for voltage control. Expansion of UHV corridors in developing and developed regions creates strong opportunities. Manufacturers focus on designing reactors for higher voltage ratings and improved thermal performance. Long-term transmission planning supports sustained demand. This trend opens opportunities for suppliers with advanced high-voltage capabilities.

- For instance, TBEA has supplied three phase fixed shunt reactors rated at 750 kV with a capacity of 300 MVAr for long-distance transmission corridors.

Technological Improvements in Reactor Design and Materials

Manufacturers adopt advanced insulation materials and improved cooling designs. These enhancements increase efficiency and extend operational life. Compact designs support space-constrained substations. Improved reliability reduces maintenance requirements for utilities. Demand grows for reactors with lower losses and enhanced durability. Innovation-driven differentiation creates opportunities for premium product offerings. Technology upgrades strengthen competitive positioning.

- For instance, Toshiba Energy Systems & Solutions has developed oil-immersed shunt reactors that utilize radial block iron cores and ceramic gap spacers to ensure long-term reliability and high performance during continuous operation.

Key Challenges

High Capital Cost and Long Project Cycles

Three phase fixed shunt reactors involve high upfront capital investment. Large transmission projects require long planning and approval cycles. Budget constraints delay procurement decisions for utilities. Installation timelines often depend on broader grid expansion schedules. Long equipment lifecycles reduce replacement frequency. These factors slow short-term market turnover. Manufacturers face pressure to manage costs while maintaining performance.

Complex Installation and Site-Specific Engineering Requirements

Fixed shunt reactor deployment requires detailed grid studies and customization. Incorrect sizing impacts voltage control effectiveness. Installation demands skilled engineering and site-specific design. Space availability and environmental conditions add complexity. Utilities rely on specialized vendors for system integration. These technical challenges increase project risk and execution time. Complexity remains a barrier for rapid deployment.

Regional Analysis

North America

North America holds a market share of 24.6% in the Three Phase Fixed Shunt Reactor market. Demand is driven by grid modernization and expansion of long-distance transmission networks across the United States and Canada. Utilities deploy fixed shunt reactors to manage voltage rise on lightly loaded transmission lines. Growing integration of wind and solar energy increases reactive power compensation needs. Replacement of aging transmission infrastructure further supports installations. Regulatory focus on grid reliability and power quality strengthens adoption. Investments in cross-state and interregional transmission corridors sustain steady regional market growth.

Europe

Europe accounts for 22.1% of the global market share. Strong renewable energy integration across Germany, the United Kingdom, France, and Nordic countries drives demand for fixed shunt reactors. Expansion of offshore wind farms and cross-border transmission lines increases reactive power control requirements. Utilities invest in grid reinforcement to maintain voltage stability. Aging transmission assets replacement also contributes to demand. Strict grid codes and power quality standards influence procurement decisions. Focus on energy transition and grid resilience supports stable market expansion across the region.

Asia Pacific

Asia Pacific leads the market with a share of 38.4%. Rapid expansion of high-voltage transmission networks across China, India, Japan, and Southeast Asia drives strong demand. Large-scale renewable energy evacuation projects increase deployment of fixed shunt reactors. Governments invest heavily in ultra-high-voltage corridors to meet rising electricity demand. Grid stability concerns in long-distance transmission further support adoption. Growing industrialization and urbanization accelerate infrastructure development. Strong utility spending positions Asia Pacific as the dominant and fastest-growing regional market.

Latin America

Latin America holds a market share of 8.7%. Expansion of transmission infrastructure in Brazil, Chile, and Mexico supports demand for fixed shunt reactors. Renewable energy projects, especially wind and solar, increase voltage control requirements. Utilities invest in reactive power compensation to improve grid stability. Long transmission distances in remote generation zones drive installations. Budget constraints limit rapid adoption, but steady infrastructure upgrades support moderate growth. Focus on reducing transmission losses strengthens long-term regional demand.

Middle East & Africa

The Middle East & Africa region accounts for 6.2% of the global market share. Demand is driven by expansion of high-voltage transmission networks in Gulf countries. Large renewable energy projects and interconnection initiatives increase need for voltage regulation. Harsh climatic conditions require robust grid stability solutions. In Africa, gradual electrification and transmission expansion support adoption. Investment remains concentrated in major infrastructure projects. Long-term power sector development sustains stable growth across the region.

Market Segmentations:

By Type

- Oil-immersed shunt reactors

- Dry-type shunt reactors

By Voltage Rating

- ≤ 220 kV

- 220 kV to 400 kV

- 400 kV

By Application

- Transmission networks

- Distribution networks

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis highlights a technology-driven market led by ABB Ltd., Siemens Energy, GE Vernova, Hitachi Energy, Toshiba Energy Systems & Solutions, Mitsubishi Electric Corporation, Hyosung Heavy Industries, Hyundai Electric & Energy Systems, CG Power and Industrial Solutions Ltd., and TBEA Co., Ltd. These companies compete on reactor efficiency, voltage handling capability, and long-term operational reliability. Leading players focus on high-voltage and ultra-high-voltage reactor designs to support expanding transmission networks. Investments in advanced insulation systems, improved cooling technologies, and compact designs strengthen product performance. Strong relationships with utilities and transmission operators support large project contracts. Regional manufacturers compete through cost efficiency, localized production, and faster delivery timelines. Compliance with grid codes and power quality standards remains critical. Continuous innovation, engineering expertise, and expansion into emerging transmission markets shape competitive positioning across the Three Phase Fixed Shunt Reactor market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ABB Ltd.

- Siemens Energy

- GE Vernova

- Hitachi Energy

- Toshiba Energy Systems & Solutions

- Mitsubishi Electric Corporation

- Hyosung Heavy Industries

- Hyundai Electric & Energy Systems

- CG Power and Industrial Solutions Ltd.

- TBEA Co., Ltd.

Recent Developments

- In October 2025, ABB (Switzerland) concluded its acquisition of a controlling interest (93%) in BrightLoop, a French pioneer in advanced power electronics.

- In August 2025, Siemens Energy announced the delivery of its first shunt reactor manufactured entirely with 100% recycled copper to TenneT Germany.

- In May 2025, GE Vernova (a spin-off of General Electric focusing on energy) secured a major order from the Power Grid Corporation of India Limited (POWERGRID) to supply over 70 extra high-voltage transformers and shunt reactors for transmission projects across India that support renewable energy corridors

Report Coverage

The research report offers an in-depth analysis based on Type, Voltage Rating, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Expansion of high-voltage transmission networks will sustain reactor demand.

- Renewable energy integration will increase reactive power compensation needs.

- Ultra-high-voltage projects will drive adoption of high-capacity reactors.

- Utilities will prioritize grid stability and voltage control solutions.

- Technological improvements will enhance reactor efficiency and lifespan.

- Asia Pacific will remain the leading growth region.

- Grid modernization programs will support replacement demand.

- Long-distance power transmission will increase installation volumes.

- Engineering customization will remain critical for project execution.

- Competition will intensify through technology, cost efficiency, and service quality.