Market Overview

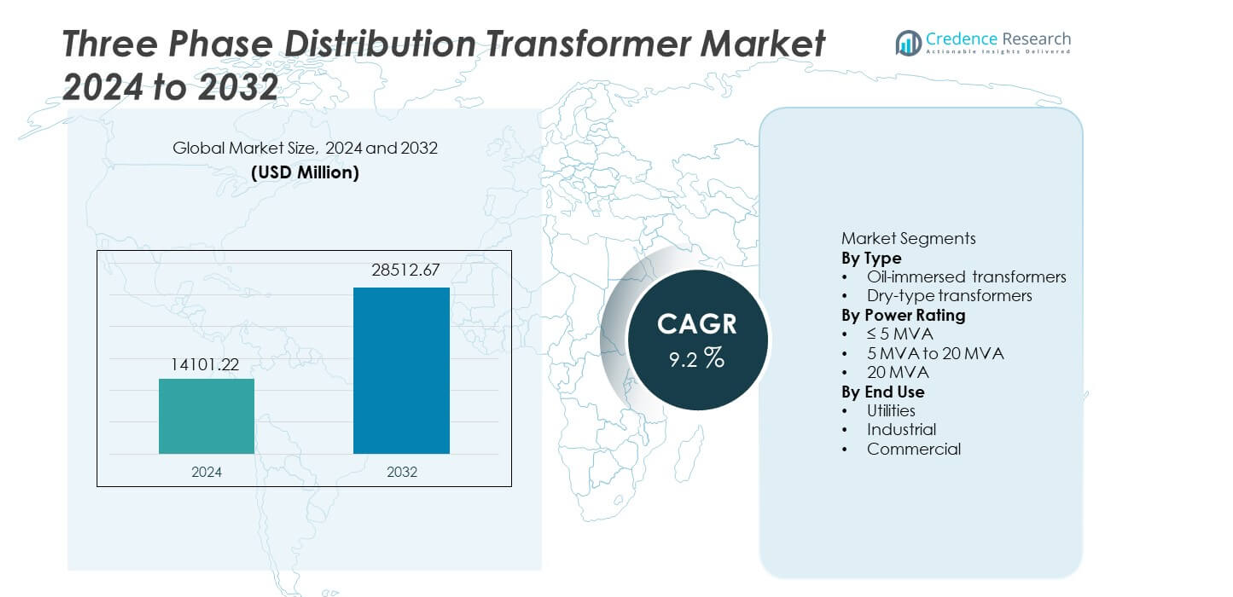

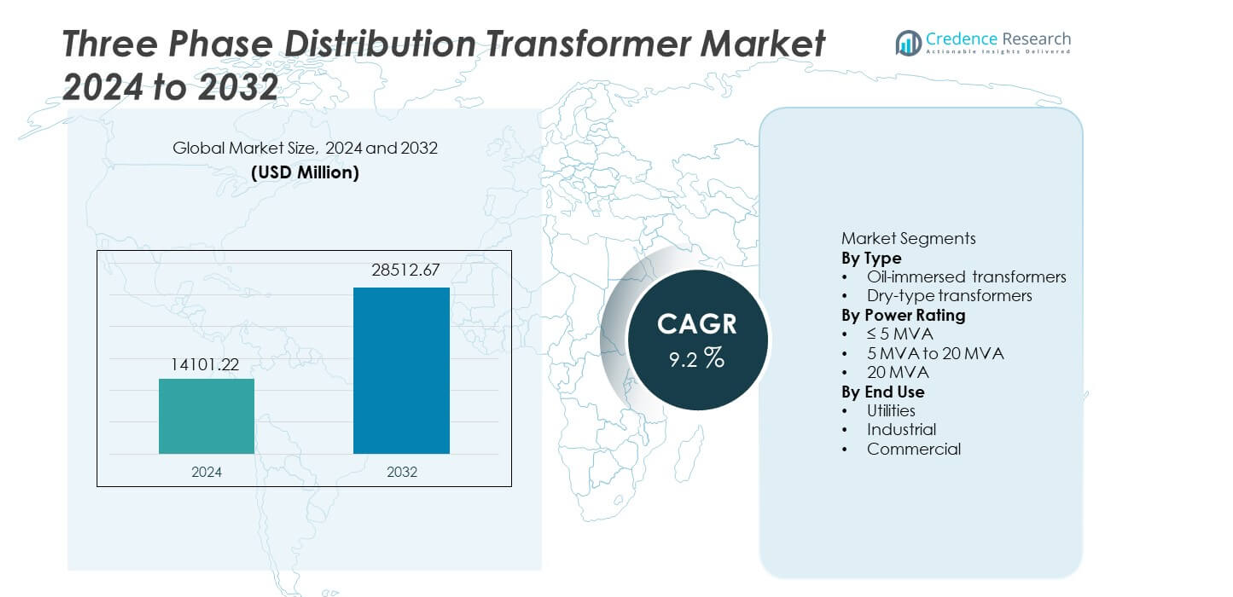

The Three Phase Distribution Transformer market was valued at USD 14,101.22 million in 2024 and is projected to reach USD 28,512.67 million by 2032, registering a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Three Phase Distribution Transformer Market Size 2024 |

USD 14,101.22 million |

| Three Phase Distribution Transformer Market, CAGR |

9.2% |

| Three Phase Distribution Transformer Market Size 2032 |

USD 28,512.67 million |

The Three Phase Distribution Transformer market features strong participation from leading players such as ABB Ltd., Siemens Energy, Schneider Electric, Eaton Corporation, General Electric, Hitachi Energy, Mitsubishi Electric Corporation, Toshiba Energy Systems & Solutions, Hyundai Electric & Energy Systems, and CG Power and Industrial Solutions Ltd. These companies compete through energy-efficient designs, grid-ready technologies, and strong utility relationships. Asia Pacific leads the market with an exact share of 36.4%, driven by large-scale grid expansion, urbanization, and electrification programs across China and India. North America follows with a 26.9% share, supported by grid modernization and replacement of aging infrastructure. Europe holds a 23.7% share, supported by renewable integration and strict efficiency regulations. The competitive landscape remains focused on efficiency, reliability, and smart grid alignment.

Market Insights

- The Three Phase Distribution Transformer market was valued at USD 14,101.22 million in 2024 and is projected to grow at a CAGR of 9.2% through the forecast period.

- Grid expansion, urbanization, renewable integration, and rising electricity demand from utilities and industries act as key growth drivers for the Three Phase Distribution Transformer market.

- Oil-immersed transformers lead the type segment with a market share of 68.5%, supported by high efficiency, durability, and suitability for large-scale distribution networks.

- Competitive dynamics remain strong, with global players focusing on low-loss designs, smart monitoring, and compliance with energy efficiency standards, while regional players compete on cost and delivery speed.

- Asia Pacific dominates regional demand with a 36.4% market share, followed by North America at 26.9% and Europe at 23.7%, driven by grid modernization, electrification programs, and renewable energy adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Three Phase Distribution Transformer market, by type, includes oil-immersed and dry-type transformers, with oil-immersed transformers holding a dominant market share of 68.5%. Utilities and industrial users prefer oil-immersed units due to higher thermal efficiency, superior overload capacity, and longer service life. These transformers support outdoor installations and high-load distribution networks effectively. Growing investments in power transmission upgrades and rural electrification projects further strengthen demand. Dry-type transformers gain traction in indoor and fire-sensitive applications, but higher costs and lower capacity handling limit broader adoption. Reliability, cost efficiency, and proven field performance continue to drive oil-immersed transformer dominance.

- For instance, ABB developed an oil-immersed distribution transformer platform designed for continuous operation at elevated winding temperatures, validated through extensive thermal aging tests and real-world performance in utility networks.

By Power Rating

Based on power rating, the market segments into ≤5 MVA, 5 MVA to 20 MVA, and >20 MVA, with the 5 MVA to 20 MVA segment leading at a market share of 46.9%. This range aligns with distribution requirements of urban substations, industrial plants, and commercial zones. Utilities favor this segment for balanced load handling, grid flexibility, and cost optimization. Rising urbanization and expansion of medium-voltage networks support sustained demand. ≤5 MVA units serve localized distribution needs, while >20 MVA transformers grow steadily with large industrial parks and renewable energy integration projects.

- For instance, Siemens Energy supplied distribution transformers for medium-voltage networks, each unit qualified to withstand substantial short-circuit currents during factory acceptance testing.

By End Use

End-use segmentation includes utilities, industrial, and commercial sectors, with utilities accounting for the largest share at 57.6%. Utility providers deploy three phase distribution transformers extensively for grid expansion, network reinforcement, and replacement of aging infrastructure. Government-led electrification programs and smart grid investments further support utility dominance. Industrial users adopt transformers to support manufacturing expansion and stable power supply. Commercial adoption grows across data centers, hospitals, and commercial complexes, but utility-driven volume installations continue to anchor overall market demand.

Key Growth Drivers

Expansion of Power Transmission and Distribution Infrastructure

Rapid investment in power transmission and distribution networks drives strong demand for three phase distribution transformers. Governments and utilities focus on grid expansion, modernization, and capacity upgrades to meet rising electricity demand. Urbanization and industrial growth increase load density in distribution networks. Three phase transformers support stable voltage delivery across medium- and low-voltage systems. Replacement of aging transformers also contributes to market growth. Electrification projects in developing regions further strengthen demand. These infrastructure-focused investments remain a core driver for sustained market expansion.

- For instance, Hitachi Energy has supplied three-phase transformers for national grid upgrade projects, with each unit engineered to withstand extreme short-circuit forces and validated through rigorous full-scale impulse testing.

Rising Industrialization and Urban Development

Industrial expansion and urban growth significantly increase electricity consumption. Manufacturing plants, industrial parks, and urban residential zones require reliable power distribution. Three phase distribution transformers support continuous operations and reduce power losses. Rapid development of smart cities increases transformer deployment across substations. Industrial automation and electrification of processes further boost demand. Utilities install higher-capacity transformers to manage peak loads efficiently. This combination of industrial and urban development continues to accelerate market growth.

- For instance, Schneider Electric deployed three phase distribution transformers with a maximum efficiency exceeding 99.2% at rated load, enabling industrial substations to reduce annual energy losses by more than 18,000 kWh per installed unit.

Integration of Renewable Energy Sources

Growth in renewable energy generation drives transformer demand across distribution networks. Solar and wind projects require transformers to integrate variable power into grids. Three phase distribution transformers manage bidirectional power flow and voltage stability. Utilities upgrade substations to support distributed energy resources. Grid balancing and energy storage integration further support adoption. Renewable energy policies and clean energy targets reinforce this driver. These factors expand the role of advanced distribution transformers.

Key Trends and Opportunities

Adoption of Energy-Efficient and Smart Transformers

Manufacturers increasingly develop energy-efficient transformers to reduce losses. Smart transformers with monitoring sensors enable real-time performance tracking. Utilities adopt these systems to improve grid reliability and maintenance planning. Digital diagnostics reduce downtime and operational risks. Regulatory focus on energy efficiency accelerates adoption. This trend creates opportunities for advanced transformer technologies. Smart grid initiatives further support this transition.

- For instance, Eaton engineered smart three-phase distribution transformers integrated with monitoring systems, such as the VaultGard™ platform and Transformer Ruggedized Telemetry Link (TRTL), which utilize specialized sensors to capture load current, top-oil temperature, and ambient conditions.

Growing Demand from Emerging Economies

Emerging markets invest heavily in electrification and grid expansion. Population growth and industrialization increase power demand. Three phase distribution transformers support rural and urban electrification programs. Infrastructure funding and government initiatives create new opportunities. Utilities in developing regions prioritize durable and cost-effective solutions. Market expansion in Asia, Africa, and Latin America remains strong. This trend offers long-term growth potential.

- For instance, CG Power supplied three phase distribution transformers rated at 16 MVA for rural electrification projects, with field-tested operational lifespans exceeding 30 years under continuous load conditions.

Key Challenges

High Capital Investment and Long Replacement Cycles

Distribution transformers require high upfront investment. Utilities often face budget constraints and long approval cycles. Transformer replacement intervals remain lengthy due to long service life. These factors slow short-term market turnover. Procurement processes add complexity to new installations. Cost pressures impact adoption of advanced technologies. Manufacturers must balance innovation with affordability.

Supply Chain and Raw Material Price Volatility

Transformer manufacturing depends on copper, steel, and insulating materials. Price fluctuations affect production costs and margins. Supply chain disruptions delay project execution. Utilities face challenges in cost forecasting and procurement planning. Manufacturers manage risks through sourcing strategies and inventory control. Volatility remains a key operational challenge. This uncertainty impacts overall market stability.

Regional Analysis

North America

North America holds a market share of 26.9% in the Three Phase Distribution Transformer market. Strong demand comes from grid modernization, replacement of aging transformers, and rising electricity consumption. Utilities in the United States and Canada invest heavily in upgrading distribution networks to improve reliability and efficiency. Growth in data centers, electric vehicle charging infrastructure, and industrial facilities further supports demand. Renewable energy integration also increases transformer deployment across substations. Regulatory focus on energy efficiency and grid resilience sustains long-term market growth across the region.

Europe

Europe accounts for 23.7% of the global market share. Grid modernization and energy transition initiatives strongly support transformer demand. Countries such as Germany, France, and the United Kingdom invest in upgrading distribution networks to accommodate renewable energy sources. Aging infrastructure replacement remains a key driver across Western Europe. Expansion of electric mobility and smart grid projects further boosts installations. Strict efficiency standards influence procurement decisions. High focus on reducing transmission losses and improving grid stability supports steady market expansion.

Asia Pacific

Asia Pacific leads the market with a share of 36.4%. Rapid urbanization, industrial growth, and electrification projects drive strong demand across China, India, Japan, and Southeast Asia. Governments invest heavily in power infrastructure to meet rising electricity consumption. Expansion of manufacturing hubs and smart city projects increases transformer installations. Renewable energy integration further supports grid upgrades. Rural electrification programs also contribute to volume demand. Strong infrastructure spending positions Asia Pacific as the dominant and fastest-growing regional market.

Latin America

Latin America holds a market share of 7.8%. Growth is supported by power distribution upgrades in Brazil, Mexico, and Chile. Utilities focus on reducing power losses and improving grid reliability. Industrial expansion and urban development increase electricity demand across major cities. Renewable energy projects also require transformer upgrades for grid integration. Budget constraints slow large-scale deployments, but steady investment in distribution infrastructure supports moderate growth. Replacement of outdated transformers remains a key contributor to regional demand.

Middle East & Africa

The Middle East & Africa region accounts for 5.2% of the global market share. Demand is driven by power infrastructure expansion in Gulf countries. Large-scale urban projects, industrial zones, and renewable energy installations support transformer deployment. High electricity demand from commercial and residential developments increases grid load. In Africa, electrification initiatives and grid expansion projects drive gradual growth. Investment remains concentrated in urban and industrial centers. Long-term infrastructure development supports stable regional market progress.

Market Segmentations:

By Type

- Oil-immersed transformers

- Dry-type transformers

By Power Rating

- ≤ 5 MVA

- 5 MVA to 20 MVA

- 20 MVA

By End Use

- Utilities

- Industrial

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis highlights a competitive and technology-driven market led by ABB Ltd., Siemens Energy, Schneider Electric, Eaton Corporation, General Electric, Hitachi Energy, Mitsubishi Electric Corporation, Toshiba Energy Systems & Solutions, Hyundai Electric & Energy Systems, and CG Power and Industrial Solutions Ltd. These players compete on transformer efficiency, reliability, and compliance with international energy standards. Leading manufacturers focus on developing low-loss and energy-efficient transformers to meet tightening regulatory requirements. Investments in digital monitoring, condition-based maintenance, and smart transformer technologies strengthen competitive positioning. Global players benefit from strong utility relationships and wide service networks, while regional manufacturers compete through pricing, localized manufacturing, and faster delivery. Strategic contracts with utilities, grid modernization projects, and renewable energy integration remain key growth strategies. Continuous product innovation, supply chain optimization, and expansion in emerging markets define the competitive dynamics of the Three Phase Distribution Transformer market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ABB Ltd.

- Siemens Energy

- Schneider Electric

- Eaton Corporation

- General Electric

- Hitachi Energy

- Mitsubishi Electric Corporation

- Toshiba Energy Systems & Solutions

- Hyundai Electric & Energy Systems

- CG Power and Industrial Solutions Ltd.

Recent Develpments

- In September 2025, Schneider Electric (France) unveiled the Accelerating Resilient Infrastructure Initiative, a collaboration with more than 20 partners including Microsoft, Sunrock, and AlphaStruxure, to rapidly deploy resilient, community-based energy systems such as microgrids and solar-plus-storage projects across the U.S..

- In February 2025, Schneider Electric approved a plan to expand medium-power transformer manufacturing capacity at its India unit.

- In September 2023, Hitachi Energy officially opened its cutting-edge transformers manufacturing facility in the Liangjiang New Area of Chongqing Municipality in southwest China.

Report Coverage

The research report offers an in-depth analysis based on Type, Power Rating, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Grid modernization programs will continue to drive transformer replacement and upgrades.

- Renewable energy integration will increase demand for flexible distribution transformers.

- Urbanization will raise electricity loads across distribution networks.

- Utilities will prioritize low-loss and energy-efficient transformer designs.

- Smart transformers with monitoring features will gain wider adoption.

- Emerging economies will remain key growth markets.

- Electrification of transport will increase distribution load requirements.

- Industrial expansion will support steady transformer demand.

- Local manufacturing will grow to improve supply chain resilience.

- Competition will intensify through technology, pricing, and service capabilities.