Market Overview

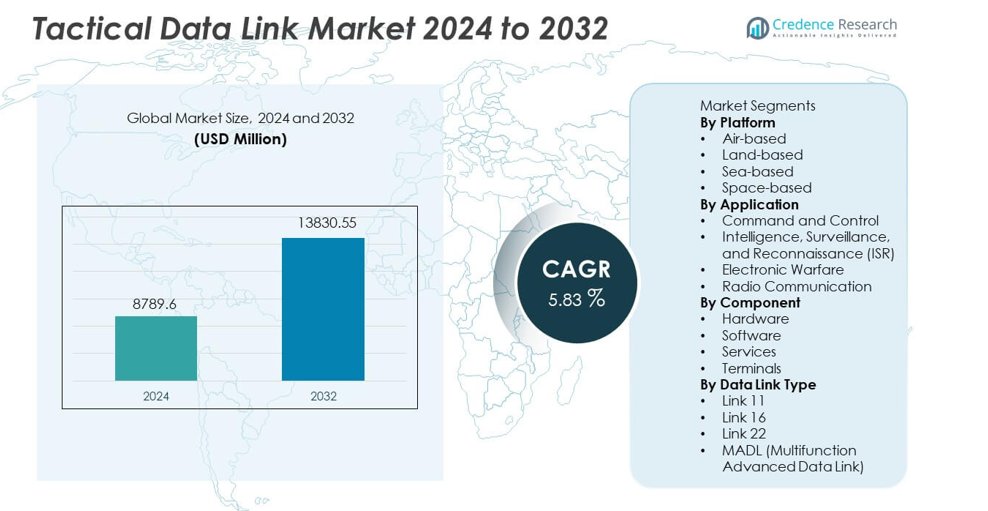

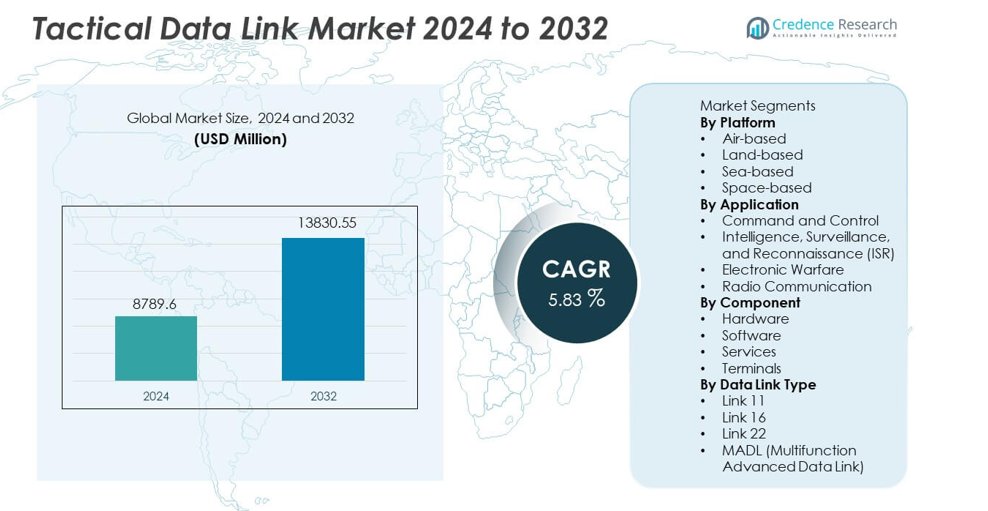

Tactical Data Link market size was valued at USD 8,789.6 million in 2024 and is projected to reach USD 13,830.55 million by 2032, registering a CAGR of 5.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tactical Data Link market Size 2024 |

USD 8,789.6 million |

| Tactical Data Link market, CAGR |

5.83% |

| Tactical Data Link market Size 2032 |

USD 13,830.55 million |

The top players in the Tactical Data Link market include L3Harris Technologies, Northrop Grumman Corporation, Raytheon Technologies, Thales Group, BAE Systems, Leonardo S.p.A, Saab AB, General Dynamics Corporation, Collins Aerospace, and Elbit Systems. These companies lead through strong defense partnerships, advanced secure communication technologies, and continuous innovation in anti-jamming and encrypted data-sharing capabilities. North America remains the dominant region with a 39% market share, driven by extensive modernization programs, large defense budgets, and widespread deployment of advanced air, land, and naval platforms. Europe and Asia Pacific follow with growing investments in ISR capabilities, network-centric systems, and interoperable tactical communication networks.

Market Insights

- The Tactical Data Link market reached USD 8,789.6 million in 2024 and will grow at a CAGR of 5.83 percent through 2032.

- Increasing focus on network-centric warfare drives adoption, with air-based platforms holding a 42 percent share due to rising deployment of advanced aircraft and UAV fleets.

- Multi-domain operations and secure communication trends support demand for encrypted, anti-jamming systems used across ISR, command and control, and electronic warfare missions.

- Leading players enhance competitiveness by developing resilient terminals, advanced waveforms, and cybersecurity upgrades to meet modern battlefield requirements.

- North America leads with a 39 percent share, followed by Europe at 27 percent and Asia Pacific at 25 percent, supported by defense modernization, expanded ISR capabilities, and growing investments in secure tactical communication networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Platform

Air-based platforms dominate this segment with a 42% share, driven by rising adoption of next-generation fighter jets, UAVs, and airborne early-warning systems that require real-time data exchange. Modern air forces prioritize seamless communication for targeting, threat detection, and coordinated missions. Land and sea platforms also gain traction as militaries upgrade armored vehicles and naval fleets with secure network-centric systems. Space-based links grow steadily due to expanding satellite constellations supporting global defense connectivity. Increasing defense modernization programs strengthen demand across all platforms.

- For instance, L3Harris integrated its Multifunctional Information Distribution System into fighter aircraft, providing secure, high-capacity, jam-resistant digital communications for command, control, communications, computers, and intelligence (C4I) through multiple secure networks.

By Application

Command and Control leads the application segment with a 37% share, supported by increasing need for fast decision-making, situational awareness, and coordinated mission execution. ISR applications also expand as drones, sensors, and reconnaissance aircraft rely on high-speed data links for real-time intelligence transfer. Electronic warfare systems integrate tactical links to strengthen threat detection and countermeasure deployment. Radio communication remains vital for secure voice and data exchange across joint operations. Rising multi-domain operations drive demand for interoperable and resilient communication networks.

- For instance, Raytheon delivered command-and-control systems capable of fusing data from many sources in a single operational picture.

By Component

Hardware dominates the component segment with a 46% share, as defense agencies invest in secure terminals, antennas, transceivers, and encryption modules that support advanced tactical communication. Software gains momentum with growing demand for cybersecurity, waveform upgrades, and network management tools. Service offerings expand due to rising maintenance, system integration, and training requirements. Terminals also see increased adoption across aircraft, naval platforms, and ground stations. Ongoing modernization of command networks and rising cyber threats continue to push hardware and software upgrades within tactical data link systems.

Key Growth Drivers

Rising Demand for Network-Centric Warfare

Modern defense forces prioritize interconnected battlefield operations, driving strong adoption of Tactical Data Links that support real-time communication and mission coordination. These systems enhance situational awareness by linking aircraft, ships, and ground units through secure data networks. Governments invest in advanced command systems to improve joint-force capabilities. Growing deployment of drones and ISR platforms further increases demand for reliable and fast data-sharing tools. Militaries continue upgrading legacy systems to maintain operational superiority in multi-domain environments.

- For instance, Northrop Grumman’s Integrated Battle Command System created a single uninterrupted composite track of each threat and presented a single actionable picture of the full battlespace during joint-force trials.

Expanding Deployment of Unmanned and Autonomous Systems

The rising use of UAVs, UGVs, and autonomous naval systems accelerates demand for robust Tactical Data Links capable of transmitting high-speed intelligence, surveillance, and mission data. These platforms rely on secure communication channels to function in contested environments. Increasing integration of AI-driven functions requires stronger connectivity and encrypted data pathways. Defense programs worldwide expand unmanned fleets, boosting procurement of advanced terminals and waveform technologies that support long-range coordination and remote operations.

- For instance, General Atomics integrated tactical data links on MQ-series UAVs enabling real-time sensor streaming at high rates.

Growing Modernization Programs Across Defense Forces

Countries invest heavily in upgrading command and control networks, aircraft avionics, naval systems, and armored vehicles. Tactical Data Links form a core part of these modernization initiatives, enabling seamless interoperability across allied forces. Upgrades focus on enhancing bandwidth, strengthening cyber protection, and supporting multi-link operations. Rising geopolitical tensions accelerate defense spending, prompting faster adoption of advanced communication systems. Long-term procurement cycles ensure steady demand for hardware, software, and integration services.

Key Trends & Opportunities

Shift Toward Multi-Domain and Joint-Force Operations

Defense agencies emphasize coordinated operations across land, air, sea, cyber, and space domains. This shift increases demand for Tactical Data Links that connect diverse platforms under unified command structures. Advanced waveforms improve data capacity and resistance to jamming. Multi-domain combat readiness supports adoption of interoperable systems across NATO and aligned forces. This trend opens opportunities for cross-platform integration, networked sensors, and scalable communication architectures.

- For instance, Thales deployed interoperable data link gateways supporting simultaneous connectivity for aircraft, naval vessels, and command centers.

Advancements in Secure and Anti-Jamming Technologies

Rising electronic warfare threats push development of resilient Tactical Data Links with strong encryption, frequency hopping, and anti-jamming capabilities. Modern systems use adaptive waveforms that adjust to hostile environments. Investments grow in cybersecurity and secure communication software that protects mission-critical data. These advancements create opportunities for vendors offering next-generation secure communication solutions for air, naval, and ground forces.

- For instance, Elbit Systems develops multi-band, multi-waveform software defined radios (SDR) with advanced electronic counter-countermeasures (ECCM) and robust frequency hopping to provide high immunity to jamming and interference, ensuring reliable data exchange in contested environments and across diverse terrains.

Key Challenges

High Procurement and Integration Costs

Tactical Data Link systems involve expensive hardware, encryption modules, and integration efforts across complex defense platforms. Upgrading legacy aircraft, armored vehicles, and naval systems increases costs further. Budget constraints in developing regions delay procurement cycles. Complex interoperability requirements add engineering challenges and extend deployment timelines. These factors restrain market expansion, especially among nations with limited modernization budgets.

Vulnerability to Cyber and Electronic Warfare Threats

As communication networks become more advanced, they also face increased risks from cyberattacks, jamming, and signal interception. Adversaries invest in electronic warfare tools that can disrupt or degrade Tactical Data Link performance. Ensuring secure, resilient connectivity requires continuous updates to encryption, waveforms, and cybersecurity protocols. This ongoing threat environment creates operational challenges and increases maintenance demands for defense forces.

Regional Analysis

North America

North America holds a 39% share, driven by strong defense modernization programs, high military spending, and rapid adoption of advanced communication systems across air, land, and naval forces. The United States leads the region with extensive deployment of Link 16, Link 22, and next-generation tactical networking systems across fighter jets, drones, and naval fleets. Expansion of unmanned platforms and joint-force operations continues to increase demand for secure, high-speed Tactical Data Links. Ongoing upgrades to command and control networks and rising electronic warfare capabilities further support market growth.

Europe

Europe accounts for a 27% share, supported by rising defense collaboration among NATO members and large-scale modernization of air and naval assets. Countries deploy advanced Tactical Data Links to enhance interoperability in joint missions and meet evolving security requirements. Growing procurement of fighter aircraft, ISR drones, and naval systems drives adoption of Link 22 and encrypted communication platforms. Increased focus on situational awareness, border surveillance, and electronic warfare strengthens demand. Investments in secure networking and digital battlefield infrastructure continue to expand market presence across the region.

Asia Pacific

Asia Pacific holds a 25% share, fueled by rising geopolitical tensions, increasing defense budgets, and rapid military modernization across major economies. Countries invest in advanced aircraft, UAVs, and naval vessels that rely on Tactical Data Links for secure communication and real-time mission coordination. Expansion of indigenous defense programs and development of network-centric warfare capabilities support strong adoption. Upgrades to surveillance networks and growing interest in multi-domain operations further drive demand for high-speed, resilient communication systems across the region.

Latin America

Latin America captures a 5% share, driven by steady investments in surveillance aircraft, border security systems, and naval modernization programs. Regional forces adopt Tactical Data Links to strengthen coastal monitoring, counter-smuggling efforts, and ISR operations. Budget limitations slow large-scale modernization, yet select countries continue upgrading communication frameworks for improved situational awareness. Growing interest in UAVs and integrated command networks supports gradual market expansion. Partnerships with global defense suppliers help accelerate technology adoption.

Middle East & Africa

The Middle East & Africa region holds a 4% share, supported by rising defense spending, expanding air fleets, and growing use of modern surveillance and reconnaissance platforms. Gulf nations invest heavily in Tactical Data Links to improve real-time coordination across air and missile defense systems. Africa shows increasing adoption for border security and counterterrorism missions, though at a slower pace due to budget constraints. Upgrades to command and control centers and the deployment of advanced fighter jets and naval assets continue to strengthen market growth across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Platform

- Air-based

- Land-based

- Sea-based

- Space-based

By Application

- Command and Control

- Intelligence, Surveillance, and Reconnaissance (ISR)

- Electronic Warfare

- Radio Communication

By Component

- Hardware

- Software

- Services

- Terminals

By Data Link Type

- Link 11

- Link 16

- Link 22

- MADL (Multifunction Advanced Data Link)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Tactical Data Link market is shaped by leading companies such as L3Harris Technologies, Northrop Grumman Corporation, Raytheon Technologies, Thales Group, BAE Systems, Leonardo S.p.A, Saab AB, General Dynamics Corporation, Collins Aerospace, and Elbit Systems. These firms compete by enhancing secure communication capabilities, expanding product portfolios, and integrating advanced waveforms with anti-jamming and encryption features. Defense modernization programs worldwide drive strong demand for interoperable systems, prompting companies to invest in R&D and long-term government contracts. Many players focus on upgrading terminals, improving network resilience, and supporting multi-domain operations. Strategic partnerships with military agencies and platform manufacturers strengthen market presence. Continuous innovation in cyber protection and real-time data sharing further reinforces their competitive advantage.

Key Player Analysis

Recent Developments

- In October 2025, L3Harris Technologies was selected by the U.S. Army to supply software-defined data devices for the Next Generation Command and Control (NGC2) program.

- In 2025, Thales Group, Leonardo S.p.A, and Airbus signed a Memorandum of Understanding (MoU) to combine their respective space activities into a new company, rather than partnering specifically on tactical data link solutions.

- In December 2024, Northrop Grumman Corporation was selected by the U.S. Marine Corps to modernize secure tactical data links in LITENING pods on aircraft.

Report Coverage

The research report offers an in-depth analysis based on Platform, Application, Component, Data Link Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of advanced tactical waveforms will rise as defense forces modernize communication networks.

- Airborne and unmanned platforms will drive strong demand for high-speed, secure data links.

- Multi-domain operations will push development of interoperable systems across land, air, sea, and space.

- Anti-jamming and encrypted communication technologies will gain priority amid growing electronic warfare threats.

- Software-defined solutions will expand as militaries seek flexible, upgradeable communication architectures.

- Integration of AI will enhance data processing, threat detection, and decision-making speed.

- Coalition and joint-force missions will accelerate demand for standardized and compatible data link systems.

- Space-based communication assets will grow to support global, persistent battlefield connectivity.

- Cybersecurity enhancements will remain essential as digital battlefield networks expand.

- Emerging economies will increase procurement of tactical communication systems to strengthen national defense capabilities.