Market Overview

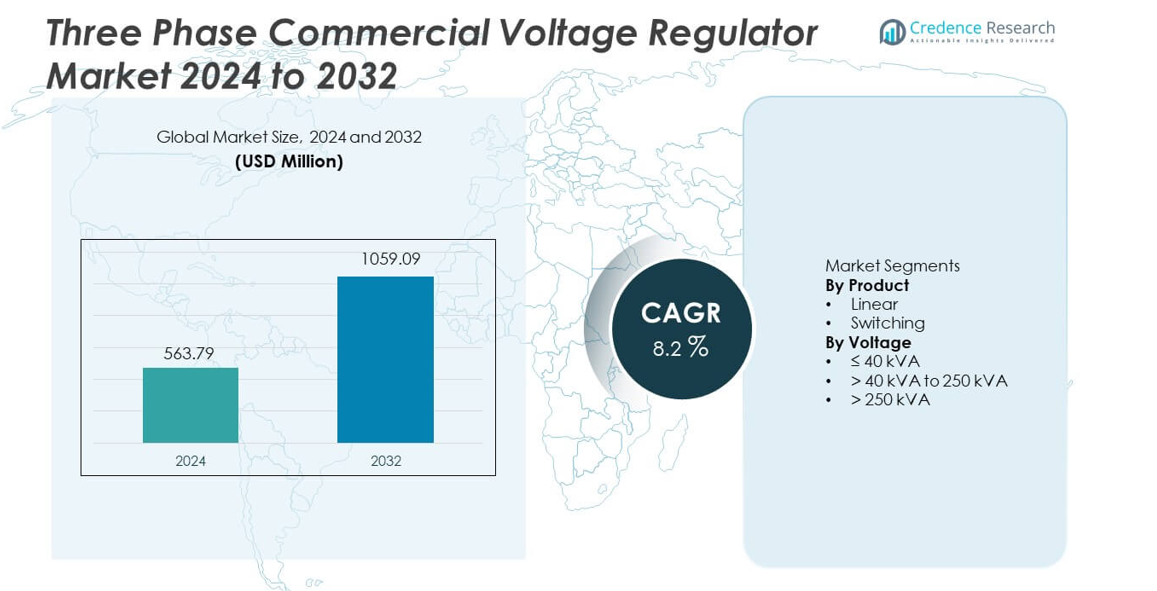

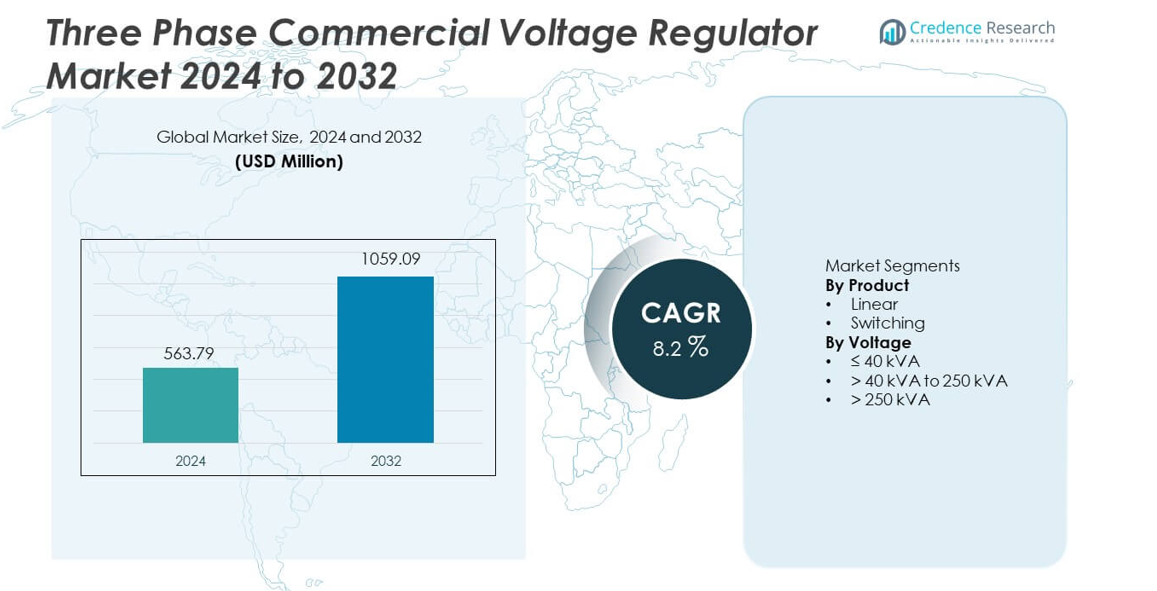

The Three Phase Commercial Voltage Regulator market was valued at USD 563.79 million in 2024 and is projected to reach USD 1,059.09 million by 2032, registering a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Three Phase Commercial Voltage Regulator Market Size 2024 |

USD 563.79 million |

| Three Phase Commercial Voltage Regulator Market, CAGR |

8.2% |

| Three Phase Commercial Voltage Regulator Market Size 2032 |

USD 1,059.09 million |

The Three Phase Commercial Voltage Regulator market features strong participation from leading players such as Schneider Electric, Siemens AG, ABB Ltd., Eaton Corporation, Mitsubishi Electric Corporation, General Electric, Vertiv Group Corp., Legrand, Delta Electronics, and Larsen & Toubro. These companies compete through advanced product portfolios, global distribution networks, and strong after-sales support. Asia Pacific leads the market with an exact share of 34.8%, driven by rapid commercial infrastructure expansion, grid instability, and rising data center investments. North America follows with a 28.6% share, supported by data center growth and replacement of aging electrical systems. Europe holds a 22.4% share, supported by energy efficiency regulations and smart building adoption. The competitive environment remains technology-driven, with emphasis on efficiency, reliability, and digital integration.

Market Insights

- The Three Phase Commercial Voltage Regulator market reached USD 563.79 million in 2024 and is forecast to reach USD 1,059.09 million by 2032, registering a CAGR of 8.2% during the forecast period.

- Rising commercial infrastructure, growing data center deployment, and increased use of sensitive electrical equipment drive steady demand for stable three phase voltage regulation across offices, hospitals, and retail facilities.

- Switching voltage regulators dominate the product segment with a market share of 64.3%, supported by higher efficiency, faster response time, and suitability for modern commercial electrical loads.

- Competitive analysis shows leading players focusing on smart monitoring, energy efficiency, and scalable capacity solutions, while regional manufacturers compete through pricing and localized customization strategies.

- Asia Pacific leads regional demand with a 34.8% market share, followed by North America at 28.6% and Europe at 22.4%, driven by commercial construction growth, power quality concerns, and regulatory efficiency standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The product segmentation includes linear and switching voltage regulators, with switching regulators dominating the market at a share of 64.3%. Commercial facilities prefer switching regulators due to higher efficiency, faster voltage correction, and compact design. These systems handle wide input voltage fluctuations while reducing energy losses during operation. Data centers, hospitals, and large office buildings increasingly deploy switching regulators to protect sensitive electronic equipment. Linear regulators maintain relevance in low-noise and stable-load environments, but limited efficiency at higher capacities restricts adoption. Rising focus on energy efficiency, reduced heat generation, and lower operational costs continues to drive switching regulator dominance.

- For instance, Schneider Electric’s Altivar-based commercial regulators achieve high efficiency levels and support a range of input voltages.

By Voltage

The voltage-based segmentation covers ≤40 kVA, >40 kVA to 250 kVA, and >250 kVA categories, with the >40 kVA to 250 kVA segment leading at 47.8% market share. This range aligns with power needs of malls, hospitals, educational institutions, and mid-sized commercial complexes. Facilities select this segment for balanced performance, scalability, and cost efficiency. Growing construction of commercial buildings and rising installation of centralized HVAC and IT systems support demand. The ≤40 kVA segment serves small offices and retail outlets, while >250 kVA systems expand steadily due to rising data center capacity additions.

- For instance, ABB’s three-phase regulators in typical kVA ranges are designed to support continuous loads with high efficiency and provide tight voltage accuracy for generator excitation systems, or offer continuous regulation across a specified operational band for distribution systems.

Key Growth Drivers

Expansion of Commercial Infrastructure

Rapid growth in commercial construction strongly drives demand for three phase commercial voltage regulators. Offices, malls, hospitals, and hotels require stable power to support continuous operations. Rising urbanization increases deployment of HVAC systems, elevators, and IT equipment. These systems remain highly sensitive to voltage fluctuations and power disturbances. Voltage regulators protect equipment and reduce operational downtime. Public and private investments in commercial real estate continue to rise. Power quality management now forms a core part of building electrical design strategies.

- For instance, Siemens commercial voltage regulators support load capacities up to 250 kVA and maintain output voltage within ±1.

Rising Dependence on Sensitive Electrical and Electronic Systems

Commercial facilities increasingly rely on advanced electronic and automated systems. Data centers, medical devices, and digital workspaces demand consistent voltage supply. Even minor voltage instability can cause system failure or data loss. Three phase voltage regulators ensure steady output and equipment protection. Hospitals and mission-critical facilities drive strong adoption due to zero-tolerance for power disruption. Growing digitization across businesses further strengthens this driver. Equipment protection remains a top priority for cost control.

- For instance, Eaton three phase electronic voltage regulators (such as specific models like the Power-Sure series) respond to voltage changes typically within a single electrical cycle or faster, protecting server racks and control systems.

Emphasis on Energy Efficiency and Operational Cost Reduction

Energy efficiency remains a major focus for commercial building operators. Voltage regulators reduce energy waste caused by unstable input supply. Stable voltage improves system performance and extends equipment lifespan. Facility managers adopt regulators to lower maintenance and replacement costs. Regulatory focus on energy efficiency supports adoption. Sustainability targets also influence electrical infrastructure investments. These factors collectively sustain long-term market growth.

Key Trends and Opportunities

Adoption of Smart and Digitally Enabled Voltage Regulators

Manufacturers increasingly integrate digital controls and monitoring features. Smart regulators enable real-time voltage monitoring and fault alerts. Remote management improves operational control and response time. Integration with building management systems enhances energy optimization. Predictive maintenance capabilities reduce downtime risks. Demand rises from modern smart buildings and large commercial complexes. This trend creates strong opportunities for advanced regulator solutions.

- For instance, Delta Electronics smart regulators provide cloud-enabled monitoring with onboard memory storing a significant amount of fault and event logs.

Rising Demand from Data Centers and Critical Commercial Facilities

Data center expansion accelerates due to cloud and digital service growth. These facilities require precise and high-capacity voltage regulation. Three phase regulators protect servers from voltage instability. Hospitals and laboratories also increase adoption for critical operations. Investments in digital infrastructure support sustained demand. Vendors offering reliable and scalable systems gain strong opportunities. This trend supports premium product penetration.

- For instance, Vertiv three phase uninterruptible power supply systems support continuous loads across a wide power range and deliver rapid voltage correction response.

Key Challenges

High Initial Investment and Installation Costs

Three phase commercial voltage regulators require significant upfront investment. High-capacity systems involve complex installation and skilled labor. Small and mid-sized commercial users face budget constraints. Cost sensitivity limits adoption in emerging markets. Ongoing maintenance adds to ownership costs. These factors slow market penetration in price-driven regions. Vendors face pressure to offer cost-efficient solutions.

Technical Complexity in System Selection and Integration

System selection requires detailed load and voltage assessment. Incorrect sizing reduces efficiency and system reliability. Integration with existing electrical networks remains challenging. Many commercial users lack technical expertise. Dependence on external consultants increases project timelines. Limited awareness delays purchasing decisions. This complexity acts as a barrier to faster adoption.

Regional Analysis

North America

North America holds a market share of 28.6% in the Three Phase Commercial Voltage Regulator market. Strong demand comes from office buildings, data centers, hospitals, and educational institutions. Aging power infrastructure and frequent voltage fluctuations increase adoption across the United States and Canada. Commercial facilities invest in voltage regulators to protect sensitive IT and medical equipment. Data center expansion and cloud service growth further support demand. Energy efficiency regulations also influence purchasing decisions. Replacement of legacy electrical systems in commercial buildings sustains steady market growth across the region.

Europe

Europe accounts for 22.4% of the global market share. Strict energy efficiency standards and power quality regulations drive adoption across commercial facilities. Countries such as Germany, the United Kingdom, and France show strong demand from offices, retail centers, and healthcare facilities. Growing focus on smart buildings increases integration of advanced voltage regulation systems. Renovation of older commercial infrastructure supports replacement demand. High penetration of automated systems and digital workplaces strengthens market presence. Sustainability goals further encourage adoption of efficient voltage regulation solutions.

Asia Pacific

Asia Pacific leads the market with a share of 34.8%. Rapid commercial construction across China, India, Southeast Asia, and Japan drives strong demand. Expansion of malls, IT parks, hospitals, and educational campuses increases regulator installations. Power grid instability in developing economies accelerates adoption to protect equipment. Growth in data centers and digital services further supports demand. Government investments in urban infrastructure strengthen market penetration. Rising awareness of power quality management positions Asia Pacific as the fastest-growing regional market.

Latin America

Latin America holds a market share of 8.1%. Commercial development in Brazil, Mexico, and Chile supports steady adoption. Voltage fluctuations and inconsistent grid reliability increase reliance on voltage regulators. Retail centers, offices, and hospitality projects remain key demand drivers. Investment in data centers and telecom infrastructure contributes to market growth. Budget constraints limit adoption of high-capacity systems, but mid-range regulators see strong uptake. Gradual modernization of commercial electrical infrastructure supports long-term regional expansion.

Middle East & Africa

The Middle East & Africa region accounts for 6.1% of the global market share. Growth is driven by commercial construction in the Gulf countries. Shopping malls, hotels, airports, and healthcare facilities require stable power supply. Harsh climatic conditions increase stress on electrical systems, boosting regulator demand. Investments in smart cities and large infrastructure projects support adoption. In Africa, urban development and commercial electrification create gradual growth opportunities. Demand remains concentrated in major urban and industrial hubs.

Market Segmentations:

By Product

By Voltage

- ≤ 40 kVA

- > 40 kVA to 250 kVA

- > 250 kVA

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis highlights strong competition among global and regional manufacturers, including Schneider Electric, Siemens AG, ABB Ltd., Eaton Corporation, Mitsubishi Electric Corporation, General Electric, Vertiv Group Corp., Legrand, Delta Electronics, and Larsen & Toubro. These players compete through product reliability, technological innovation, and wide service networks. Leading companies focus on developing energy-efficient and digitally controlled voltage regulators to meet modern commercial power quality needs. Investments in smart monitoring, compact designs, and high-capacity systems strengthen market positioning. Strategic partnerships with EPC contractors and commercial developers support project-based sales. Established brands benefit from strong after-sales support and global distribution reach. Regional players compete on pricing and customization for local grid conditions. Continuous product upgrades, compliance with energy standards, and expansion in emerging commercial markets remain key competitive strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schneider Electric

- Siemens AG

- ABB Ltd.

- Eaton Corporation

- Mitsubishi Electric Corporation

- General Electric

- Vertiv Group Corp.

- Legrand

- Delta Electronics

- Larsen & Toubro

Recent Developments

- In December 2024, Schneider Electric announced the Galaxy VXL three-phase UPS for large electrical workloads.

- In April 2024, Infineon announced the expansion of its automotive portfolio by introducing the PSoC 4 HVMS (High Voltage Mixed Signal) series of microcontrollers to address the increasing demand for security and functional safety in low-end automotive applications.

- In April 2024, STMicroelectronics introduced its latest voltage regulators, the LDQ40 and LDH40, designed to meet the demanding requirements of automotive applications. These low-dropout (LDO) regulators are engineered to operate from an input voltage as low as 3.3V and can operate with a maximum input voltage of up to 40V.

Report Coverage

The research report offers an in-depth analysis based on Product, Voltage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Commercial infrastructure expansion will sustain steady demand for three phase voltage regulators.

- Data center growth will increase adoption of high-capacity regulation systems.

- Smart and digitally controlled regulators will gain wider commercial acceptance.

- Energy efficiency requirements will shape product design and purchasing decisions.

- Hospitals and critical facilities will drive demand for reliable voltage stability.

- Integration with building management systems will become more common.

- Asia Pacific will remain the fastest-growing regional market.

- Retrofit and replacement projects will support demand in developed regions.

- Compact and modular designs will improve installation flexibility.

- Competition will intensify through innovation, pricing, and service quality.