Market Overview

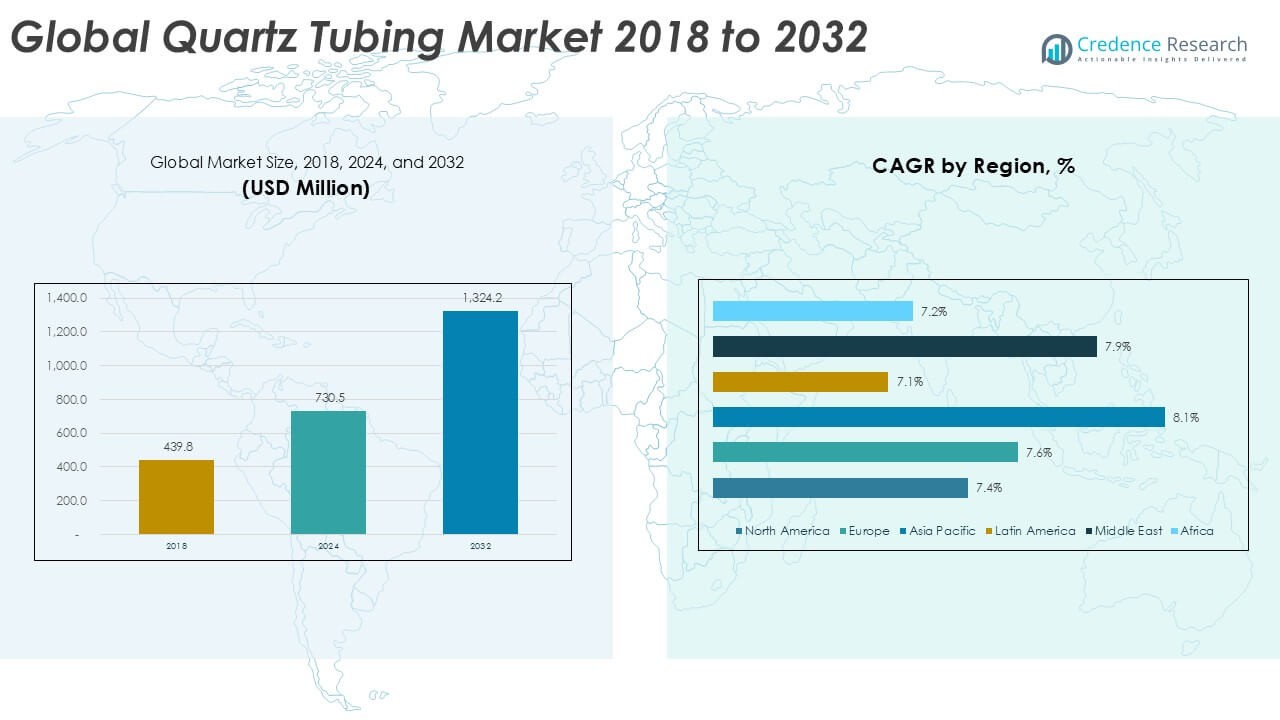

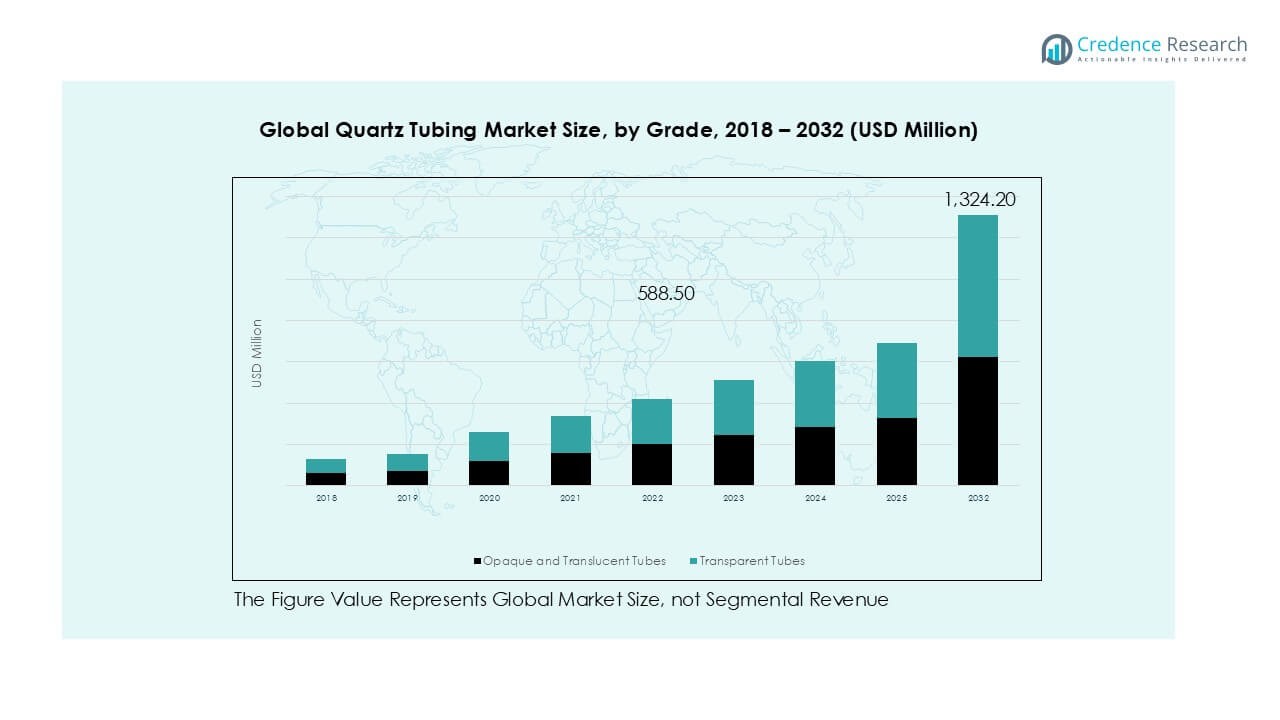

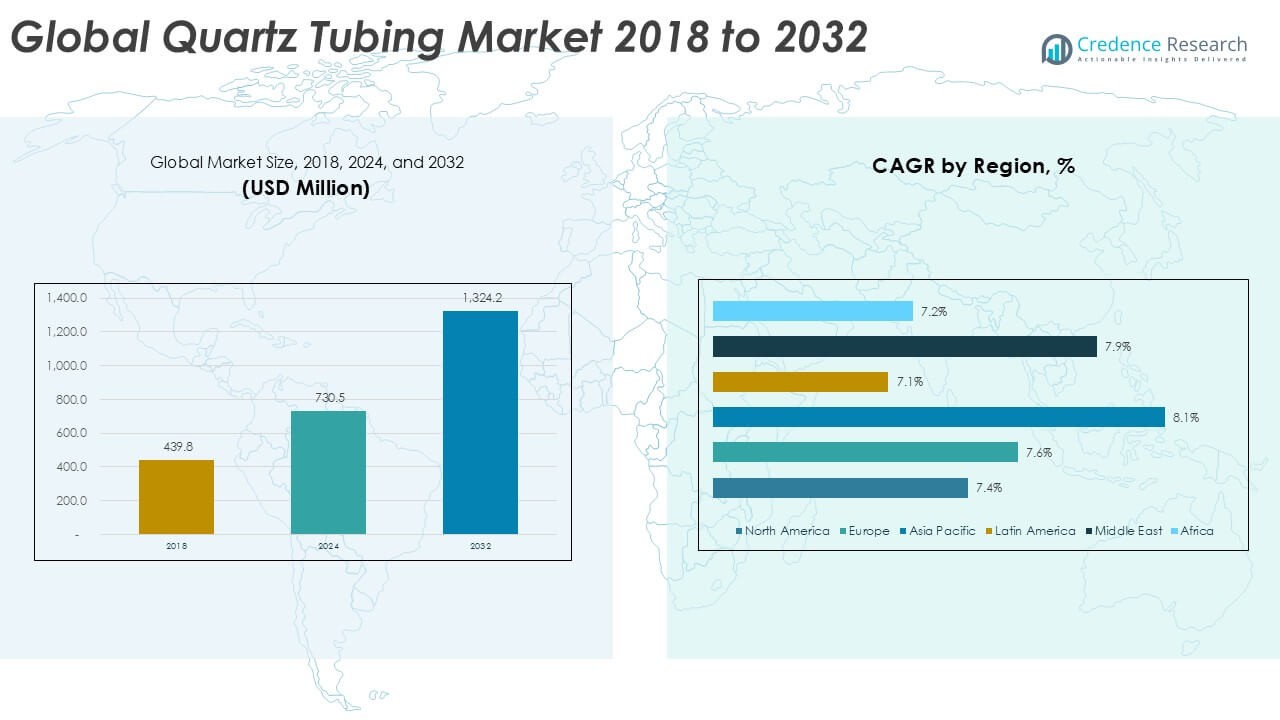

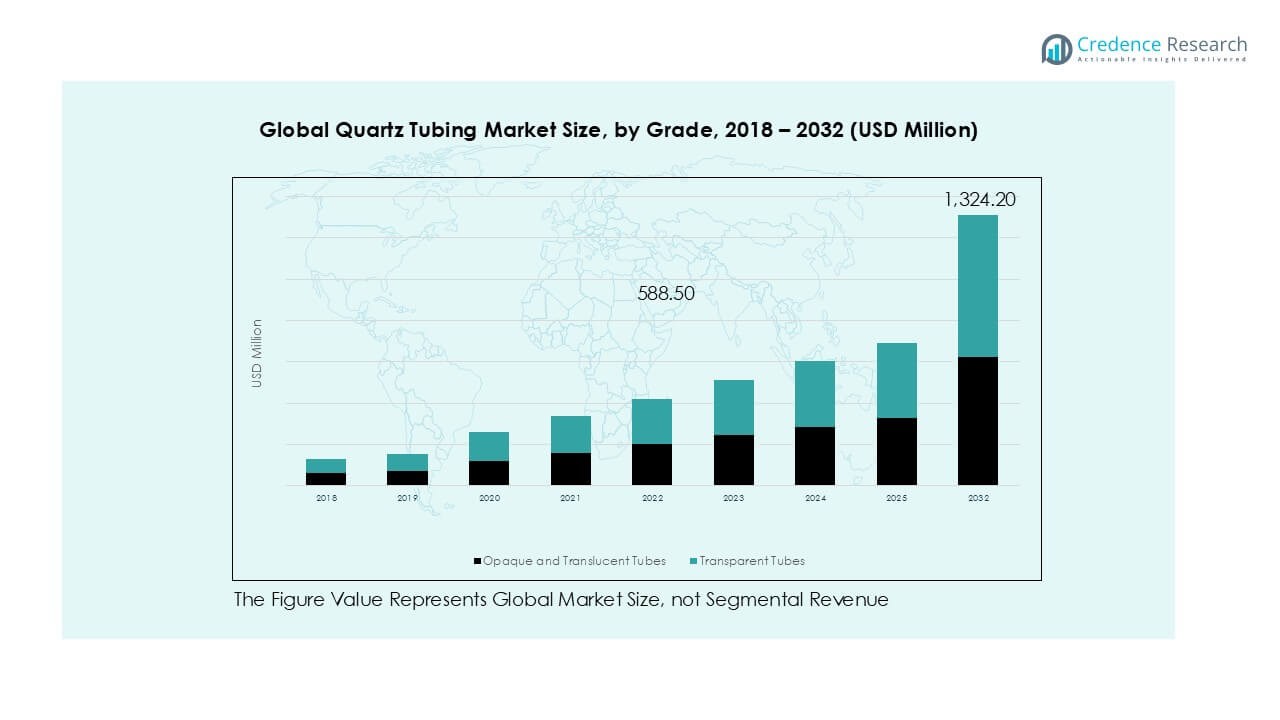

Global Quartz Tubing market size was valued at USD 439.8 million in 2018 and increased to USD 730.5 million in 2024. The market is anticipated to reach USD 1,324.2 million by 2032, at a CAGR of 7.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Quartz Tubing Market Size 2024 |

USD 730.5 Million |

| Quartz Tubing Market, CAGR |

7.69% |

| Quartz Tubing Market Size 2032 |

USD 1,324.2 Million |

The global quartz tubing market is led by major players such as Momentive, Heraeus, QSIL, TOSOH, Fudong Lighting, Ohara, Hongyang Quartz, Ruipu Quartz, Kear Scientific, and Micro Scientific Glass Co., each competing through high-purity products, precise dimensional control, and strong supply capabilities. These companies support key industries such as semiconductor fabrication, industrial heating, and UV-based environmental systems. Asia Pacific stands as the leading regional market with approximately 37% share, driven by its dominant semiconductor manufacturing base and rapid expansion in solar and electronics production. North America and Europe follow as strong contributors, supported by advanced industrial and chip-fabrication activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global quartz tubing market grew from USD 439.8 million in 2018 to USD 730.5 million in 2024. The market is projected to reach USD 1,324.2 million by 2032, expanding at a 7.69% CAGR.

- Semiconductor fabrication drives demand, holding about 45–48% application share. High-purity transparent tubes support diffusion, oxidation, and CVD steps in advanced fabs.

- The market trends toward ultra-high-purity, low-defect quartz with tight tolerances. Demand rises from AI chips, EV electronics, solar cells, and UV systems.

- Competition favors established players with secured quartz feedstock and advanced melting technology. Smaller firms face high entry barriers due to capital-intensive production.

- Asia Pacific leads with around 37% share, followed by North America at 28% and Europe at 24%. Opaque and translucent tubes dominate with nearly 58–60% segment share.

Market Segmentation Analysis:

By Type

Opaque and translucent tubes lead the global quartz tubing market with an estimated 58–60% share due to strong use in high-temperature industrial furnaces, UV systems, and chemical processing. These formats handle thermal shock and aggressive environments, which drives steady demand in manufacturing and energy sectors. Transparent tubes follow with notable growth in semiconductor and photonics use because they offer high purity and optical clarity for wafer processing and specialty lighting. Rising adoption of precision thermal systems and tighter contamination standards continues to strengthen both sub-segments across advanced production lines.

- For instance, Heraeus manufactures translucent and transparent quartz tubes with hydroxyl (OH) content below 10 ppm and thermal expansion near 0.55×10⁻⁶/K, enabling use in high-temperature furnace and UV-system designs.

By Application

Semiconductor applications dominate the market with roughly 45–48% share, supported by dense use of transparent quartz tubes in diffusion, oxidation, and CVD tools. The sub-segment grows as chip nodes shrink and purity standards tighten in 300-mm and advanced wafer fabs. Industrial applications hold steady demand from high-temperature processing, chemical reactors, and UV disinfection systems. Lighting applications show moderate growth as quartz tubes remain essential for high-intensity lamps and UV-C systems. Expansion of semiconductor capacity and rising clean-processing needs act as the primary drivers across all application segments.

- For instance, Momentive supplies semiconductor-grade quartz tubes used in 300-mm LPCVD and oxidation tools, with certified metal impurities such as Fe, Al, and Ti kept below 1 ppm to meet strict fab contamination rules.

Key Growth Drivers

Rising Demand from Semiconductor Fabrication

Growing semiconductor production strongly boosts quartz tubing demand as fabs expand wafer-processing capacity. Advanced nodes require high-purity transparent quartz tubes for diffusion, oxidation, and CVD steps that must maintain strict thermal stability and ultra-low contamination levels. As leading chip producers increase investments in 300-mm and upcoming 450-mm wafer technologies, they adopt higher-quality quartz products to support tighter process tolerance. Rapid growth in logic, memory, and power semiconductor lines further strengthens adoption across global foundries. Governments in the U.S., Europe, South Korea, and Japan also expand incentives for domestic semiconductor manufacturing, which drives new furnace installations and replacement cycles for precision quartzware. Strong growth in AI chips, EV power electronics, and data-center processors continues to raise throughput needs, creating sustained demand for high-performance quartz tubing.

- For instance, QSIL supplies semiconductor-grade quartz tubing with documented metallic impurities below 1 ppm and hydroxyl levels under 5 ppm, which supports oxidation and LPCVD tools that run at temperatures above 1,050 °C in advanced 300-mm fabs.

Expansion of High-Temperature Industrial Processing

Industrial processing sectors adopt quartz tubing because these tubes offer strong thermal shock resistance and stability at temperatures above 1,000°C. Chemical, metallurgical, and glass industries use opaque and translucent quartz tubes in reactors, inspection systems, and furnace components, supporting rising operational reliability. Growth in advanced ceramics, powder metallurgy, and high-purity materials also increases usage where steel or alumina components cannot meet contamination limits. Many industries upgrade legacy equipment toward automation-ready heating systems, which rely on dimensionally stable quartz components for repeatable thermal cycles. The global shift toward energy-efficient heat-treatment technology encourages suppliers to offer longer-life and higher-purity quartz options. Expanding production of specialty materials for EV batteries, LEDs, solar cells, and optical devices strengthens this demand, making industrial applications a key driver.

- For instance, Heraeus industrial-grade fused silica supports continuous operation up to 1,200 °C and maintains thermal expansion near 0.55×10⁻⁶/K, enabling stable tube performance in high-load furnace and reactor environments.

Increasing Use in UV Lighting and Environmental Systems

Demand rises in UV-based purification, disinfection, and environmental systems, strengthening the market for quartz tubing with high UV transmittance. Water-treatment and wastewater-reuse facilities adopt UV-C reactors, which require precision quartz sleeves for lamp protection and high radiation throughput. Growth in HVAC disinfection, municipal water upgrades, and industrial hygiene programs expands large-scale UV installations. Healthcare and food-processing sectors also increase adoption due to stricter microbial control requirements. Quartz tubing supports longer lamp life and stable transmission in high-intensity UV systems, making it preferred over standard glass. Rising demand for advanced UV-LED systems also drives the need for specialized quartz optics. Global investment in public health infrastructure and environmental safety regulations continues to push this trend forward.

Key Trends & Opportunities

Shift Toward High-Purity, Low-Defect Quartz Products

A major trend focuses on the shift toward ultra-high-purity quartz tubing engineered for semiconductor and photonics use. Chip manufacturers require tubes with extremely low OH content, tight dimensional tolerance, and minimal micro-defects to support precise thermal and chemical steps. This trend creates opportunities for suppliers who invest in advanced melting, refining, and inspection technologies that reduce contamination risk. Automation in quartz shaping, CNC machining, and laser measurement systems becomes more common as customers demand consistent batch-to-batch quality. The growing use of transparent quartz in high-end optics, UV-LED housings, and clean-energy research further expands the premium-product segment. Companies that supply traceability-enabled products gain a strong advantage as fabs tighten quality-control requirements.

- For instance, Momentive produces semiconductor-grade quartz tubing, such as Grade GE214, which features OH levels typically under 10 ppm, with some grades (like Type 012 synthetic) at less than 5 ppm. The material is engineered with tight dimensional tolerances that vary by product size and customer specifications, which ensures the necessary precision for defect-free use in demanding high-temperature processes like CVD and oxidation systems.

Rising Adoption in Renewable Energy and Advanced Material Processing

Demand for advanced materials in solar cells, EV batteries, and high-performance ceramics creates new opportunities for quartz tubing suppliers. Quartz components support high-temperature sintering, rapid thermal processing, and controlled-atmosphere steps used in lithium-ion cathode materials and silicon wafer production. As global renewable-energy investments grow, production lines expand and require durable quartzware with long heating-cycle life. The rise of hydrogen technologies, optical sensors, and specialty nanomaterials also increases the need for clean, thermally stable reactor tubing. Suppliers offering customized tube geometries, improved mechanical strength, and cloud-monitored production systems gain access to emerging growth pockets. This trend aligns with broader decarbonization policies and clean-technology investments worldwide.

- For instance, Heraeus provides fused-silica reactor tubes rated for continuous use above 1,200 °C with thermal expansion near 0.55×10⁻⁶/K, supporting rapid thermal processes in solar-grade silicon and battery-material refining.

Key Challenges

Volatility in High-Purity Quartz Feedstock Supply

The market faces supply constraints because high-purity quartz feedstock remains concentrated among a few global producers. Limited mining sites, long extraction timelines, and strict purity requirements restrict supply flexibility. Any disruption in these sources impacts pricing and production cycles for quartz tubing manufacturers. Expansion of semiconductor and advanced-material industries intensifies competition for premium quartz, creating a risk of shortages. Many suppliers look for synthetic alternatives, but production remains costly and technically demanding. This challenge pressures manufacturers to optimize yield, reduce scrap rates, and secure long-term supply contracts with upstream partners.

High Manufacturing Costs and Technical Barriers

Quartz tubing production involves complex high-temperature melting, precision shaping, and defect-control processes that demand specialized equipment and skilled labor. These requirements increase capital and operational costs, especially for large-diameter or high-purity tubes. Meeting semiconductor-level tolerance adds further complexity, as even minor deviations in wall thickness or purity can lead to product rejection. Smaller manufacturers struggle to compete with established suppliers that operate automated systems and maintain strict quality standards. The cost burden limits entry into advanced applications and forces companies to invest heavily in R&D, furnace upgrades, and digital inspection tools to remain competitive.

Regional Analysis

North America

North America holds about 28% of the global quartz tubing market, supported by strong semiconductor expansion and steady industrial demand. The market grew from USD 114.83 million in 2018 to USD 187.57 million in 2024, driven by advanced wafer-processing needs and UV-system adoption. Favorable investments in chip fabrication and clean-processing technologies sustain growth. By 2032, the region is projected to reach USD 332.38 million, advancing at a 7.4% CAGR. Strong adoption of high-purity transparent tubes across oxidation and diffusion tools continues to reinforce regional leadership.

Europe

Europe accounts for roughly 24% of the global market and benefits from strong manufacturing ecosystems and rising environmental technology adoption. Market size increased from USD 97.23 million in 2018 to USD 160.48 million in 2024, driven by growth in industrial heating, UV disinfection, and specialty materials. The region is forecast to reach USD 288.41 million by 2032, expanding at a 7.6% CAGR. Semiconductor initiatives in Germany, France, and the U.K. strengthen demand for high-purity quartz tubing in advanced furnace systems.

Asia Pacific

Asia Pacific remains the dominant region with about 37% market share, supported by the world’s largest semiconductor and electronics manufacturing base. Market revenue grew from USD 152.47 million in 2018 to USD 259.87 million in 2024, driven by rapid foundry expansion and high-temperature industrial processing. The region is expected to reach USD 487.04 million by 2032, recording the fastest 8.1% CAGR. Strong investment in 300-mm fabs, solar production, and UV disinfection systems continues to push demand for both transparent and opaque quartz tubing.

Latin America

Latin America holds nearly 7% market share, supported by moderate industrial growth and rising adoption of UV purification technologies. Market size increased from USD 38.52 million in 2018 to USD 61.93 million in 2024 as manufacturing and environmental systems expanded. The region is projected to reach USD 107.26 million by 2032, growing at a 7.1% CAGR. Demand rises in metallurgy, chemical processing, and water-treatment installations, where quartz tubing offers strong thermal and UV performance.

Middle East

The Middle East captures about 4% of the global market, driven by rising industrial furnace installations and growing UV-based water-treatment programs. Regional revenue increased from USD 21.02 million in 2018 to USD 35.29 million in 2024, supported by energy-sector processing needs. The market is forecast to reach USD 64.89 million by 2032, advancing at a 7.9% CAGR. Investments in high-purity material processing and municipal water infrastructure further increase demand for durable quartz tubing.

Africa

Africa holds close to 4% market share, with demand linked to developing industrial sectors and expanded water-treatment projects. The market grew from USD 15.70 million in 2018 to USD 25.36 million in 2024, reflecting rising adoption of UV disinfection and basic thermal processing equipment. By 2032, Africa is expected to reach USD 44.23 million, progressing at a 7.2% CAGR. Growth remains steady as countries increase spending on public health, mining operations, and small-scale manufacturing systems requiring heat-resistant quartz components.

Market Segmentations:

By Type

- Opaque and Translucent Tubes

- Transparent Tubes

By Application

- Industrial Applications

- Semiconductor

- Lighting

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global quartz tubing market features a mix of multinational producers and specialized regional manufacturers competing on purity levels, dimensional accuracy, and long thermal-cycle durability. Leading companies such as Momentive, Heraeus, QSIL, and TOSOH command strong positions due to advanced melting technologies, automated shaping systems, and large global distribution networks. These players supply high-purity transparent tubes used in semiconductor oxidation and diffusion tools, which strengthens their premium-market presence. Regional manufacturers, including Fudong Lighting, Hongyang Quartz, Ruipu Quartz, Kear Scientific, and Micro Scientific Glass Co., expand capacity to serve lighting, industrial processing, and UV-treatment applications. Many competitors invest in precision inspection systems, low-defect quartz grades, and customized large-diameter tubes to meet rising demand from chip fabrication, solar production, and advanced material processing. Strategic expansions, material innovations, and long-term supply agreements remain key differentiators in this market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Momentive

- Heraeus

- QSIL

- TOSOH

- Fudong Lighting

- Ohara

- Hongyang Quartz

- Ruipu Quartz

- Kear Scientific

- Micro Scientific Glass Co.

Recent Developments

- In Jan 2025, Heraeus combined high-performance materials units into Heraeus Covantics to expand its technology leadership in high-purity quartz and fused silica products.

- In Nov 2024, Momentive Technologies promoted two long-serving executives into global quartz and ceramics leadership roles, strengthening its quartz business focus.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as semiconductor fabs expand advanced-node production and require higher-purity quartz.

- Adoption of large-diameter transparent tubes will grow to support next-generation furnace designs.

- UV-C disinfection systems will boost quartz demand across water, air, and surface-treatment projects.

- Producers will invest in automated forming and laser-based inspection to improve product consistency.

- High-temperature industrial processing will continue to drive steady need for opaque and translucent tubes.

- Solar manufacturing growth will strengthen demand for quartz components used in wafer and cell production.

- Supply chains will shift toward long-term contracts to secure high-purity quartz feedstock.

- Regional players will expand capacity to meet rising local demand for lighting and industrial applications.

- Innovation will focus on reducing defect density and improving dimensional accuracy for semiconductor use.

- Sustainability goals will encourage manufacturers to enhance furnace efficiency and extend quartz lifecycle performance.