Market Overview:

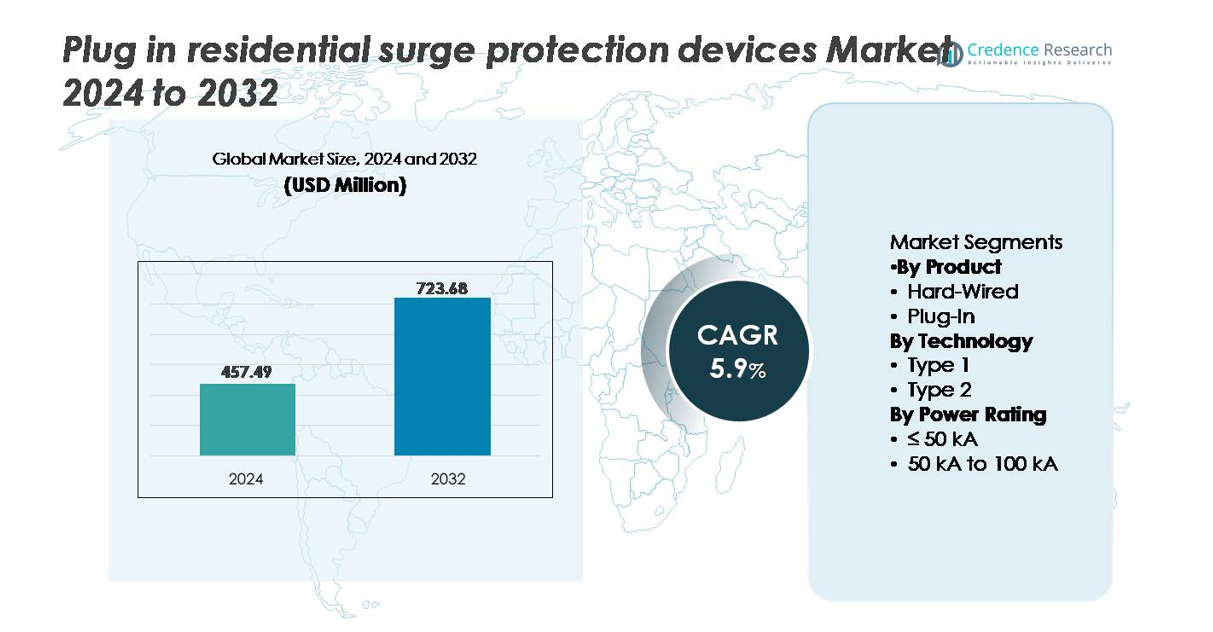

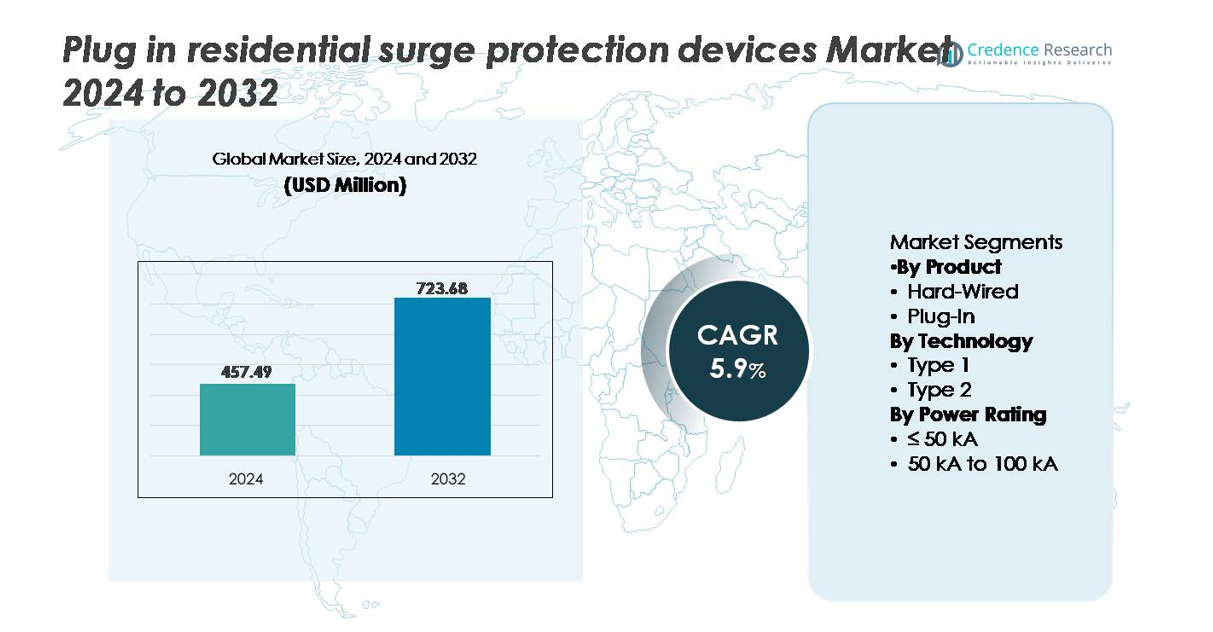

The plug-in residential surge protection devices market was valued at USD 457.49 million in 2024 and is projected to reach USD 723.68 million by 2032, registering a CAGR of 5.9% during the forecast period (2025-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plug-In Residential Surge Protection Devices Market Size 2024 |

USD 457.49 million |

| Plug-In Residential Surge Protection Devices Market, CAGR |

5.9% |

| Plug-In Residential Surge Protection Devices Market Size 2032 |

USD 723.68 million |

The plug-in residential surge protection devices market is influenced by key players including Honeywell International, Eaton, Hubbell, Belkin, Legrand, ABB, and Havells, each competing on product safety certifications, outlet configurations, smart monitoring features, and distribution strength. North America leads the global market with approximately 32% share, driven by high household electronics adoption and strong regulatory compliance standards. Europe and Asia Pacific closely follow, supported by rising residential electrification and expanding smart appliance usage. Leading companies increasingly focus on compact, multi-device protection solutions integrated with visual fault indicators and component-level thermal protection to address evolving residential power continuity requirements.

Market Insights:

- The plug-in residential surge protection devices market was valued at USD 457.49 million in 2024 and is expected to reach USD 723.68 million by 2032, registering a 5.9% CAGR during the forecast period.

- Market growth is driven by rising adoption of smart home appliances, increased grid disturbances, and the need to protect high-value electronics from voltage fluctuations and transient surges.

- Key trends include the shift toward compact multi-socket designs, IoT-enabled monitoring features, and growing online retail penetration accelerating purchasing decisions.

- Competition intensifies as global players innovate on safety certifications, thermal disconnect technologies, and lifecycle indicators, while low-cost uncertified imports create pricing pressure.

- North America leads with ~32% share, followed by Asia Pacific (~29%) and Europe (~27%), while the plug-in segment dominates product adoption, and ≤50 kA power rating holds the largest segment share due to affordability and suitability for standard residential requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The plug-in segment holds the dominant market share in plug-in residential surge protection devices, driven by its retrofit-friendly installation and lower dependency on infrastructure modifications. Homeowners increasingly prefer plug-in solutions for ease of replacement, portability, and compatibility with consumer electronics and smart home appliances. Conversely, hard-wired systems remain essential for whole-home electrical protection but require professional installation, limiting adoption among rental and multi-dwelling residences. Rising global urban tenancy and demand for device-level protection further strengthen the plug-in segment as the leading adoption category in residential surge protection markets.

- For instance, Belkin’s 12-Outlet Surge Protector (model BE112230-08) provides a certified energy absorption rating of 3,940 joules and supports a maximum spike current of 75,000 A (amperes), enabling protection for home office systems, entertainment hubs, and connected appliances without panel-level intervention.

By Technology

Type 2 surge protection devices represent the dominant sub-segment, primarily due to their suitability for point-of-use protection and integration with interior distribution panels. Their capability to safeguard against residual lightning energy, switching surges, and grid instability events positions them as the preferred solution in modern households using sensitive electronic equipment. Type 1 devices are vital for external surge defense at service entrances but lack the flexibility and targeted appliance-level protection increasingly sought by homeowners. The rise of home automation and connected electronics accelerates demand for Type 2 SPDs.

By Power Rating

The ≤ 50 kA segment holds the largest market share, supported by widespread deployment in standard residential environments with moderate surge risk and lower power infrastructure complexity. This rating class meets the needs of most households while providing cost-efficiency and compact form factors suitable for plug-in and modular designs. The 50 kA to 100 kA segment caters to residences requiring higher capacity protection, including large smart homes and properties in lightning-prone regions. However, premium costs and limited installer awareness maintain ≤ 50 kA as the dominant adoption category in residential surge protection.

- For instance, the Eaton CHSPT2SURGE Type 2 device offers a maximum surge current rating of 36,000 A (36 kA) per phase. It features MOV-based suppression with thermal disconnect technology, enabling robust protection for smart appliances and HVAC systems.

Key Growth Drivers:

Rapid Expansion of Smart Home Ecosystems and Rising Electronic Device Density

The proliferation of smart homes and connected appliances serves as a major growth driver for plug-in residential surge protection devices. Increased adoption of smart TVs, home automation hubs, gaming consoles, security networks, EV chargers, and IoT-based lighting systems raises the sensitivity of household electrical infrastructure to transient voltage events. Higher device density per household increases the financial and operational risk associated with surge-induced failures, particularly as semiconductor-rich components possess lower voltage tolerance. Consumers are becoming more aware of preventing costly downtime, data loss, and equipment repairs through point-of-use surge protection rather than solely relying on whole-home systems. Additionally, subscription-based digital homes and cloud-integrated appliances amplify the need for uninterrupted power continuity and protection. As residential electrification and smart home adoption accelerate, plug-in SPDs offer a cost-efficient, user-installable solution that aligns with modern electronic living environments.

- For instance, Samsung’s SmartThings platform had grown to over 350 million users globally by August 2024, and connects with over 1 billion Samsung Galaxy devices and appliances, intensifying the general need for device-level surge protection as homes evolve into digital service environments.

Growing Frequency of Grid Disruptions and Climate-Induced Electrical Instability

Unpredictable weather patterns, intensified lightning activity, and aging electrical infrastructure contribute to rising grid disturbances, creating favorable conditions for surge protection device adoption. Voltage fluctuations resulting from storm-related outages, grid overloads, and switching surges significantly impact household electronics and safety systems. Plug-in SPDs mitigate exposure to unpredictable voltage transients that increasingly accompany extreme climate events, including heatwave-driven power demand spikes, winter storm disruptions, and seasonal grid instability. In regions with legacy transmission networks, electrical surges occur more frequently due to fluctuating loads and outdated circuit protections. Governments and utilities are investing in modernization, but prolonged replacement timelines sustain demand for plug-in surge solutions as an immediate protective measure. The urgency to safeguard home appliances, reduce insurance claims, and ensure operational resilience underpins sustained SPD uptake across residential markets.

- For instance, Vaisala recorded over 242 million lightning events across the United States in 2023, intensifying demand for device-level surge mitigation in residential environments.

Growing Consumer Preference for Retrofit-Friendly and Affordable Protection Solutions

The shift toward flexible, scalable, and cost-efficient electrical protection solutions drives demand for plug-in surge protection devices. Unlike traditional hardwired systems requiring electrician support, plug-in SPDs enable immediate installation, safe replacement, and portability across devices appealing to homeowners, tenants, and multi-family units. Their price competitiveness relative to whole-home surge panels makes them attractive for budget-conscious consumers seeking appliance-specific protection. Additionally, rising home renovation activity and aftermarket digital device purchases extend DP replacement cycles, further supporting SPD growth. Increased awareness through retail channels, e-commerce platforms, and bundled sales with electronics boosts adoption rates. As consumers prioritize hassle-free protection without infrastructure changes, plug-in SPDs continue to benefit from favorable positioning as the most accessible surge mitigation solution in residential environments.

Key Trends & Opportunities:

Integration of IoT Monitoring and Predictive Maintenance Capability

The transition toward smart plug-in surge protection devices presents a transformative opportunity for manufacturers. Embedding sensors, real-time diagnostics, and mobile notification capabilities enables predictive maintenance and risk mitigation before device failure occurs. IoT-enabled SPDs can record surge events, track degradation of components, and alert users when replacement thresholds are reached, improving safety outcomes and reducing appliance downtime. As homeowners adopt energy dashboards and home management apps, plug-in SPDs that integrate via Wi-Fi or Bluetooth generate added value. Data-driven surge analytics also enable service subscription models for monitoring and warranty services. This trend shifts manufacturers from hardware-only sales toward lifecycle engagement platforms, unlocking recurring revenue streams in residential power safety markets.

- For instance, Schneider Electric’s Wiser Energy system can monitor power consumption in real-time and detect anomalies through AI and machine learning-based load signatures (often utilizing the integrated Square D version of the Sense app), offering users proactive alerts to help protect sensitive equipment and optimize energy use.

Rising Adoption Through Retail Expansion and E-Commerce Distribution

The increasing availability of plug-in SPDs across both offline and online retail platforms creates a strong opportunity for wider market penetration. E-commerce enables direct-to-consumer education, faster buying decisions, and comparison-based product selection essential for a category that benefits from awareness-based adoption. Retail expansion also aligns with last-minute consumer purchases made during appliance upgrades or replacements. Manufacturers capitalizing on brand visibility through consumer electronics stores, DIY hardware chains, and digital storefronts achieve enhanced market scalability, especially among younger, tech-focused buyers. The bundling of plug-in SPDs with appliances, gaming consoles, and home office equipment also enhances cross-sale opportunities, driving device-specific protection adoption.

- For instance, surge protectors are a high-demand and essential product category within Amazon’s U.S. marketplace, demonstrating the significant scale at which digital channels influence the adoption and purchase of consumer electronics and safety accessories.

Key Challenges

Low Consumer Awareness and Misconceptions About Surge Risks

A significant challenge for the plug-in residential surge protection devices market lies in low awareness of surge-related damage and misconceptions that basic power strips provide adequate protection. Many homeowners underestimate the repetitive minor surges that gradually degrade electronics overtime rather than causing immediate failure. Perceived complexity surrounding electrical protection further deters adoption, as consumers may not clearly distinguish between surge protectors, voltage stabilizers, and UPS systems. Lack of standardized labeling and performance rating clarity contributes to purchasing hesitation. Overcoming these barriers requires stronger education campaigns, improved packaging communication, and retailer-driven advisory support to convert awareness into demand.

Price Sensitivity and Competition From Low-Cost Uncertified Imports

Price sensitivity in emerging markets and the presence of low-cost, non-certified surge protectors create a challenge for premium and safety-certified plug-in SPDs. Unregulated imports often lack compliance with safety and performance standards but attract buyers due to lower pricing. This undermines value perception for certified products equipped with higher-rated components, thermal protection, and advanced suppression technology. Manufacturers face added cost pressures due to material, semiconductor, and regulatory compliance requirements. Strengthening enforcement, promoting quality certifications, and differentiating on durability and lifecycle assurance remain critical to overcoming pricing-driven competition and sustaining confidence in premium surge protection solutions.

Regional Analysis:

North America

North America holds approximately 32% market share, driven by high household electronics penetration, advanced electrical infrastructure, and early adoption of smart home technologies. Frequent grid disturbances caused by storms, aging transmission networks, and expanding EV charging installation rates increase demand for plug-in residential surge protection devices. The U.S. leads consumption due to strong retail distribution, insurance incentives, and consumer awareness related to surge risks. Increasing deployment of remote workstations and home offices continues to boost point-of-use protection requirements. Regulatory emphasis on device safety standards and certified protection solutions further strengthens market growth in the region.

Europe

Europe accounts for nearly 27% market share, supported by energy transition reforms, electrification of residential buildings, and rising deployment of heat pumps, solar inverters, and electric vehicle chargers in households. The shift toward Net-Zero infrastructure and adoption of digital appliances in Germany, the UK, and Nordic countries increases exposure to electrical surges and harmonics. EU safety directives and the widespread use of CE-certified products reinforce structured market adoption. Additionally, consumer emphasis on sustainability favors compact, energy-efficient plug-in SPDs. The replacement of legacy housing stock in Western Europe accelerates retrofit-based surge protection installations, creating sustained market opportunity.

Asia Pacific

Asia Pacific represents around 29% market share, emerging as a rapidly expanding region due to urbanization, population growth, and rising ownership of consumer electronics. Expanding middle-class households, digital learning devices, and home appliance upgrades fuel demand for surge protection solutions. Countries such as China, Japan, South Korea, and India experience increasing power instability from rapid industrialization and extreme climate events, prompting adoption of plug-in SPDs as preventive protection. E-commerce penetration significantly accelerates product visibility and competitive pricing. Government-led smart city programs further support long-term growth, positioning Asia Pacific as a key destination for manufacturers targeting scale-driven demand.

Latin America

Latin America accounts for approximately 6% market share, driven by incremental modernization of residential electrical systems in Brazil, Mexico, and Argentina. The region faces persistent challenges related to fluctuating grid reliability, voltage instability, and frequent outage events that heighten consumer need for appliance-level surge protection. Cost competitiveness remains a critical purchase factor, with plug-in SPDs preferred over whole-home solutions due to affordability and ease of installation. Growth is further supported by rising adoption of home electronics and small office setups. However, limited consumer awareness and presence of low-cost imports moderately impact premium product penetration.

Middle East & Africa

The Middle East & Africa region holds close to 6% market share, shaped by expanding residential construction, rising electrification rates, and the increasing presence of digitally connected households. Gulf nations invest heavily in smart infrastructure, elevating demand for plug-in surge devices to safeguard home automation systems and sensitive appliances. Africa demonstrates emerging potential as grid expansion projects advance electrification, though price sensitivity influences adoption. Extreme heatwaves and grid load fluctuations intensify surge occurrences, driving awareness of protection needs. Market growth remains gradual but steady, supported by retail expansion and replacement of unregulated electrical accessories with certified protection devices.

Market Segmentations:

By Product

By Technology

By Power Rating

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the plug-in residential surge protection devices market is characterized by the presence of global electrical equipment manufacturers, regional brands, and specialized consumer electronics accessory providers. Companies compete through innovation in compact form factors, multi-outlet configurations, thermal disconnect safety mechanisms, and integrated indicators for end-of-life status and surge event notification. Retail channel dominance and e-commerce penetration significantly influence brand positioning, as consumers increasingly rely on digital product comparisons and ratings to guide purchasing decisions. Strategic partnerships with appliance manufacturers and bundled offerings enhance market visibility, while regulatory compliance and certification such as UL, RoHS, and CE remain critical differentiators. Continuous advancements in semiconductor-based protection components and IoT-enabled monitoring create opportunities for premium product segmentation. However, competition from low-cost, non-certified imports challenges pricing and quality perception, prompting established players to focus on durability, warranty assurance, and educational campaigns to reinforce value propositions in residential safety and power continuity solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In October 2025, Delta unveiled an 800 V HVDC architecture for AI data centers that boosts efficiency by more than 4% and integrates high-capacity SPDs for rack-level protection.

- In May 2024, Phoenix Contact expanded its production network to the North American market by establishing Phoenix Contact Production S.A. de C.V. in Mexico. The new 20,000 m² facility in Querétaro, with aimed to begin production by the end of 2025, employing approximately 700 people by 2032.

- In February 2024, ABB announced that they have acquired SEAM Group. This strategic acquisition is poised to enhance ABB’s Electrification portfolio in electrical safety, renewables, and asset management advisory services. With the acquisition, ABB aims to meet the escalating demand for modernizing and optimizing assets for safer, smarter, and more sustainable operations

Report Coverage:

The research report offers an in-depth analysis based on Product, Technology, Power rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for plug-in residential surge protection devices will rise as households continue integrating smart appliances and automation systems.

- IoT-enabled SPDs with real-time diagnostics and surge event notifications will gain mainstream adoption.

- Manufacturers will introduce compact, multi-device protection designs optimized for home offices and entertainment hubs.

- Retail and e-commerce channels will drive stronger brand competition and faster product replacement cycles.

- Growth in EV home charging installations will create new use cases for plug-in surge protection solutions.

- Safety certification and regulatory compliance will become stronger differentiators in buyer decisions.

- Predictive maintenance features will evolve, enabling end-of-life alerts and data-driven replacement recommendations.

- Consumer awareness campaigns will accelerate adoption in emerging markets with rising electronic ownership.

- Integration with energy management dashboards will enhance visibility of household power quality events.

- Premium SPDs offering longer lifespan and higher surge handling capabilities will expand adoption in high-risk regions.