Market Overview:

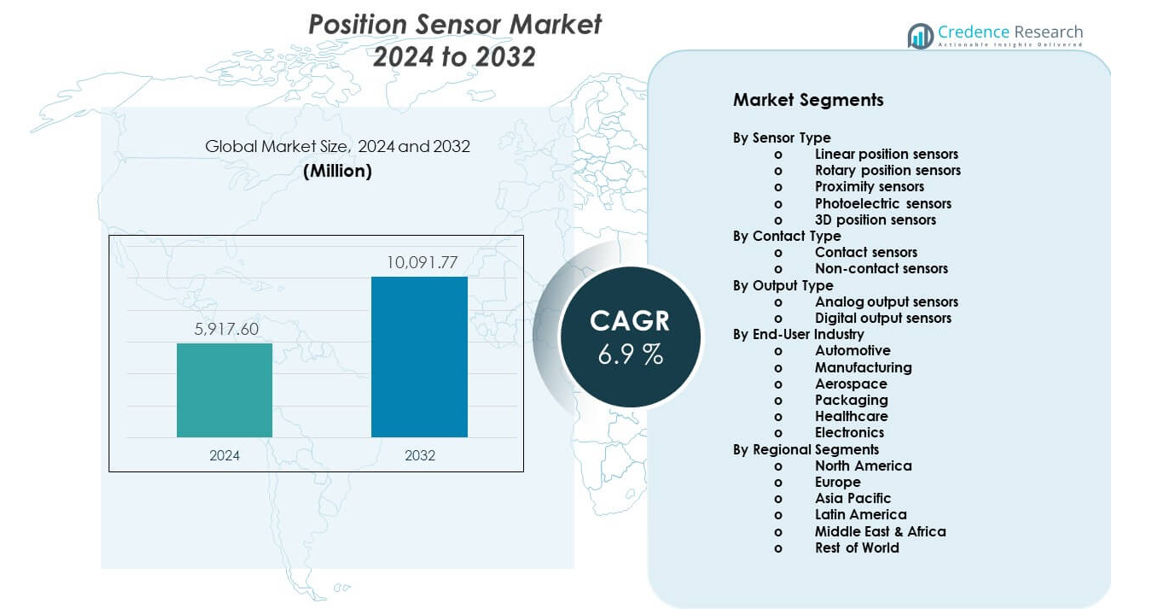

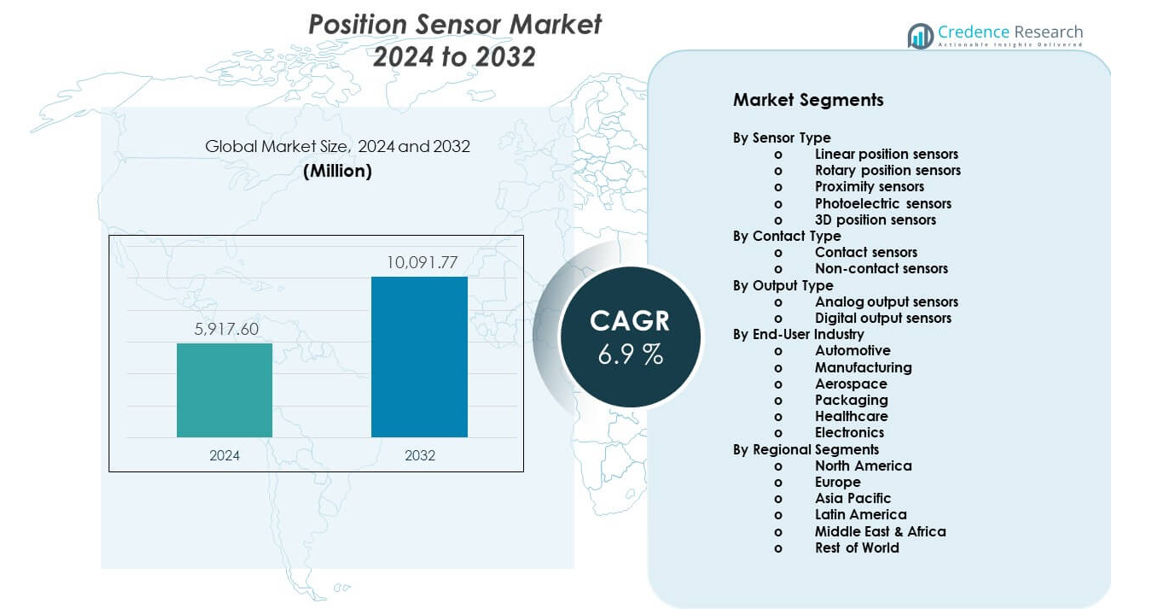

The Position Sensor Market is projected to grow from USD 5,917.6 million in 2024 to an estimated USD 10,091.77 million by 2032. The market is expected to record a CAGR of 6.9% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Position Sensor Market Size 2024 |

USD 5,917.6 million |

| Position Sensor Market, CAGR |

6.9% |

| Position Sensor Market Size 2032 |

USD 10,091.77 million |

Market growth is driven by rising automation across manufacturing and process industries. Position sensors support precise control in robotics, CNC machines, and assembly systems. Automotive demand increases due to electric vehicles, driver assistance systems, and powertrain optimization needs. Consumer electronics rely on compact sensors for touch, motion, and orientation functions. Industrial equipment upgrades also raise replacement demand. Advancements in sensor miniaturization improve accuracy and durability. Integration with digital control systems supports real-time monitoring. These factors together sustain strong adoption across end-use sectors.

Asia Pacific leads the Position Sensor Market due to large manufacturing bases in China, Japan, and South Korea. Strong electronics production and factory automation support regional dominance. Europe follows, driven by automotive innovation and Industry 4.0 adoption in Germany and France. North America shows steady growth from aerospace, robotics, and advanced manufacturing. Emerging markets in Southeast Asia and India expand due to industrial investment and infrastructure development. Local production growth increases sensor integration across machines and vehicles.

Market Insights:

- The market reached USD 5,917.6 million in 2024 and is projected to hit USD 10,091.77 million by 2032, growing at a 9% CAGR, driven by automation and electronics demand.

- Asia Pacific (40%), Europe (28%), and North America (22%) lead due to strong manufacturing bases, automotive production, and advanced automation adoption.

- Asia Pacific is also the fastest-growing region, holding nearly 40% share, supported by factory expansion, electronics output, and rising EV production.

- By end-user industry, automotive accounts for ~34%, while manufacturing holds ~27%, reflecting heavy sensor use in vehicle systems and industrial automation.

- By sensor type, proximity and rotary sensors together represent ~45%, driven by demand for non-contact detection and motor control applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Industrial Automation And Precision Control Requirements

Manufacturers adopt advanced automation to improve output quality and consistency. Position sensors enable accurate motion tracking in automated systems. Robotics and CNC machines depend on reliable position feedback. The Position Sensor Market benefits from wider factory digitization across industries. Sensors support precise alignment, speed control, and fault reduction. Smart factories require stable sensor performance under harsh conditions. Demand rises from automotive, metals, and electronics production lines. This driver strengthens long-term industrial sensor adoption.

- For instance, FANUC reports robot repeatability of ±0.02 mm across several industrial robot models, which depends on high-precision position sensors for closed-loop control.

Expanding Automotive Electronics And Vehicle Electrification Demand

Automotive systems rely on sensors for safety and performance control. Electric vehicles require precise motor and battery position feedback. Advanced driver assistance systems depend on accurate sensor inputs. Position sensors support steering, braking, and transmission control. Vehicle platforms adopt more electronic control units each year. OEMs focus on reliability and compact sensor design. Emission rules push efficient powertrain control. Automotive demand remains a core growth driver.

- For instance, Infineon’s TLE5012B magnetic position sensor operates up to 160 °C junction temperature and supports 15-bit angular resolution, meeting electric power steering requirements.

Growth Of Consumer Electronics And Smart Devices Production

Smartphones and wearables use sensors for motion and orientation detection. Compact design trends increase sensor integration needs. Consumer devices require fast response and low power use. Position sensors enable touch interfaces and camera stabilization. High production volumes support steady demand growth. Device makers prefer durable and cost-effective components. Short product cycles support recurring sensor replacement demand. This driver supports volume-based market expansion.

Rising Use In Industrial Safety And Equipment Monitoring Systems

Safety systems depend on accurate position feedback for machine control. Sensors help prevent overloads and unsafe movements. Industrial equipment upgrades raise demand for modern sensing solutions. Predictive maintenance relies on precise motion data. Sensors reduce downtime through early fault detection. Regulatory safety standards encourage sensor adoption. Operators value reliable performance under continuous operation. Safety-focused applications sustain consistent demand growth.

Market Trends:

Shift Toward Contactless And Non-Mechanical Sensor Technologies

Manufacturers favor contactless sensing for longer service life. Magnetic and optical sensors reduce wear issues. These designs support high-speed and harsh environments. Users prefer stable output over extended cycles. Compact form factors improve system integration. This trend improves reliability across industrial uses. Reduced maintenance lowers total ownership cost. Adoption rises across automation and transport systems.

- For instance, ams-OSRAM’s AS5600 magnetic position sensor provides 12-bit resolution with contactless operation, enabling over 360° rotation without mechanical degradation.

Increasing Integration With Digital Control And IoT Platforms

Sensors connect with digital controllers and monitoring software. Data-driven systems need real-time position feedback. Integration supports remote diagnostics and system optimization. Position data feeds analytics and control dashboards. Smart factories value seamless communication protocols. Edge computing improves response time and accuracy. This trend supports smarter equipment control. Digital integration reshapes sensor system design.

- For instance, Siemens SIMATIC automation systems integrate position sensors via PROFINET with cycle times below 1 ms, enabling real-time motion synchronization.

Miniaturization And High-Accuracy Sensor Design Focus

End users prefer smaller sensors with higher resolution. Space constraints drive compact component development. Precision improves motion control and system efficiency. Advanced materials support stable measurement performance. Manufacturers invest in refined calibration methods. Smaller sensors suit medical and consumer devices. This trend expands application scope. High accuracy becomes a key purchase factor.

Customization And Application-Specific Sensor Solutions Growth

Customers request sensors tailored to specific equipment needs. Custom designs improve fit and performance reliability. Suppliers offer flexible output and housing options. Industry-specific requirements shape product development. OEM partnerships support co-developed sensor platforms. Customization improves long-term customer retention. This trend shifts focus from standard products. Value-added solutions gain importance.

Market Challenges Analysis:

High Cost Pressure And Price Sensitivity Across End Users

Buyers demand cost control in large-volume deployments. Price competition affects supplier margins. Low-cost alternatives create market pressure. Customers compare performance against pricing closely. Manufacturing cost control becomes critical for suppliers. Component sourcing impacts final sensor prices. It challenges premium product positioning. Cost sensitivity remains a key market constraint.

Technical Complexity And Performance Reliability Expectations

Complex applications require precise calibration and stability. Performance failures risk system downtime. Harsh environments test sensor durability. Temperature and vibration affect measurement accuracy. Design errors raise warranty and support costs. Skilled integration expertise is often required. Smaller users face adoption barriers. Reliability demands raise development challenges.

Market Opportunities:

Expansion Of Smart Manufacturing And Industry Digitalization Projects

Industrial digitization creates demand for advanced sensors. Smart plants require continuous position monitoring. Automation upgrades open new installation opportunities. Position Sensor Market suppliers benefit from system retrofits. Digital twins rely on accurate motion data. Governments support smart factory investments. This trend creates long-term demand visibility. Industrial upgrades offer steady opportunity growth.

Rising Adoption In Emerging Economies And New Applications

Emerging markets invest in manufacturing and infrastructure. Local automation adoption increases sensor use. Medical devices and renewable energy systems add demand. Robotics education and research expand usage. Regional production hubs need reliable sensing solutions. Suppliers expand local partnerships and distribution. New applications diversify revenue streams. Emerging regions support future market expansion.

Market Segmentation Analysis:

By Sensor Type

Linear position sensors support precise displacement measurement in industrial machinery and automation systems. Rotary position sensors play a key role in motor control, steering systems, and robotics. Proximity sensors enable reliable object detection without physical contact, supporting safety and automation needs. Photoelectric sensors serve high-speed detection tasks in packaging and material handling. 3D position sensors gain attention in advanced robotics and vision-based systems that require depth and spatial accuracy.

- For instance, SICK’s W4 photoelectric sensors achieve switching frequencies up to 1,200 Hz, supporting high-speed conveyor and packaging lines.

By Contact Type

Contact sensors remain relevant in cost-sensitive applications that require simple and stable measurement. These sensors suit controlled environments with limited wear risk. Non-contact sensors show stronger adoption due to higher durability and reduced maintenance needs. Industries favor these solutions for harsh or high-speed operating conditions. Non-contact designs support long service life and consistent output.

- For instance, Honeywell’s non-contact Hall-effect position sensors are rated for over 10 million operating cycles, far exceeding mechanical potentiometer lifespans.

By Output Type

Analog output sensors deliver continuous signal feedback, which supports fine motion control and calibration tasks. These sensors serve industrial automation and testing environments. Digital output sensors offer clear signal processing and easy system integration. Modern control systems prefer digital formats for accuracy and noise resistance.

By End-User Industry

Automotive demand centers on vehicle control, safety, and electrification systems. Manufacturing relies on sensors for automation, robotics, and quality control. Aerospace uses high-precision sensing for navigation and control systems. Packaging applications focus on speed, alignment, and detection accuracy. Healthcare adopts sensors in medical devices and diagnostics. Electronics manufacturing supports volume demand across compact and precision-driven applications.

Segmentation:

By Sensor Type

- Linear position sensors

- Rotary position sensors

- Proximity sensors

- Photoelectric sensors

- 3D position sensors

By Contact Type

- Contact sensors

- Non-contact sensors

By Output Type

- Analog output sensors

- Digital output sensors

By End-User Industry

- Automotive

- Manufacturing

- Aerospace

- Packaging

- Healthcare

- Electronics

By Regional Segments

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific

Asia Pacific holds the largest share of the global market, accounting for about 40% of total demand. China leads due to large-scale manufacturing, electronics production, and factory automation investments. Japan and South Korea support strong demand through automotive electronics and robotics adoption. India shows rising uptake driven by industrial expansion and infrastructure projects. Regional OEM presence supports local sourcing and cost efficiency. High production volumes sustain steady sensor integration across industries.

Europe

Europe represents nearly 28% of the global market share. Germany leads through advanced automotive engineering and Industry 4.0 deployment. France and the United Kingdom support demand through aerospace, defense, and industrial automation. European manufacturers emphasize precision, safety, and compliance standards. Electric vehicle adoption strengthens sensor use in drivetrains and control systems. Strong R&D focus supports technology upgrades across the region.

North America And Other Regions

North America accounts for around 22% of the global share, driven by the United States. Demand comes from aerospace, robotics, medical devices, and advanced manufacturing. Automation upgrades support steady replacement demand. Latin America holds close to 6%, led by automotive and packaging applications in Brazil and Mexico. Middle East & Africa represent nearly 4%, supported by industrial and infrastructure projects. These regions offer long-term expansion opportunities as automation adoption improves.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Position Sensor Market features strong competition among global electronics and sensing technology providers. Leading companies focus on product accuracy, durability, and system compatibility to strengthen market presence. Firms compete through broad portfolios that serve automotive, industrial automation, electronics, and aerospace applications. Strategic focus centers on compact design, non-contact sensing, and digital output integration. Many players invest in R&D to improve precision and reliability under harsh conditions. Global supply networks and OEM partnerships support scale advantages. It remains moderately consolidated, with innovation and application breadth shaping competitive positioning.

Recent Developments:

- In July 2025, STMicroelectronics announced its planned acquisition of NXP Semiconductors’ MEMS (Microelectromechanical Systems) sensors business for a purchase price of up to $950 million in cash, including $900 million upfront and $50 million subject to the achievement of technical milestones. This acquisition directly addresses the position sensor market by bringing automotive safety products and industrial sensors into ST’s portfolio. The MEMS businesses of ST and NXP are strongly complementary in terms of technology and product portfolio, with the combined offering well-balanced across automotive, industrial, and consumer end markets. NXP’s MEMS sensor business generated approximately $300 million in revenue in 2024 and includes automotive safety sensors for both passive applications such as airbags and active applications such as vehicle dynamics control, along with monitoring sensors for tire pressure, engine management, convenience features, and security applications. The transaction, which is expected to close in the first half of 2026, will complement and expand ST’s leading MEMS sensors technology and product portfolio, unlocking new opportunities for development across these critical market segments.

- Marvell Automotive Ethernet AcquisitionInfineon announced on April 7, 2025, that it would acquire Marvell Technology’s Automotive Ethernet business for $2.5 billion in cash. The transaction, which received all necessary regulatory approvals, was successfully completed on August 14, 2025. This acquisition was strategic for strengthening Infineon’s system capabilities for software-defined vehicles and expanding its market leadership in automotive microcontrollers. The acquired business was projected to generate $225–$250 million in revenue during Marvell’s fiscal year 2026 (which began in February 2025), with a gross margin of around 60%.

- Teradyne PartnershipOn January 31, 2025, Infineon and Teradyne announced a strategic partnership aimed at advancing power semiconductor testing. As part of this collaboration, Teradyne acquired a portion of Infineon’s automated test equipment team in Regensburg, Germany, a move designed to accelerate innovation in technologies like silicon carbide and gallium nitride testing.

Report Coverage:

The research report offers an in-depth analysis based on Sensor Type, Contact Type, Output Type, and End-User Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Automation adoption will sustain long-term sensor demand

- Electric vehicles will increase precision sensing needs

- Non-contact sensors will gain wider industrial preference

- Miniaturization will support compact device integration

- Digital output formats will see higher system adoption

- Smart factories will expand real-time sensing use

- Healthcare devices will adopt precise motion sensing

- Emerging markets will raise manufacturing-led demand

- Custom sensor solutions will gain OEM interest

- Reliability and lifecycle performance will drive selection