Market Overview:

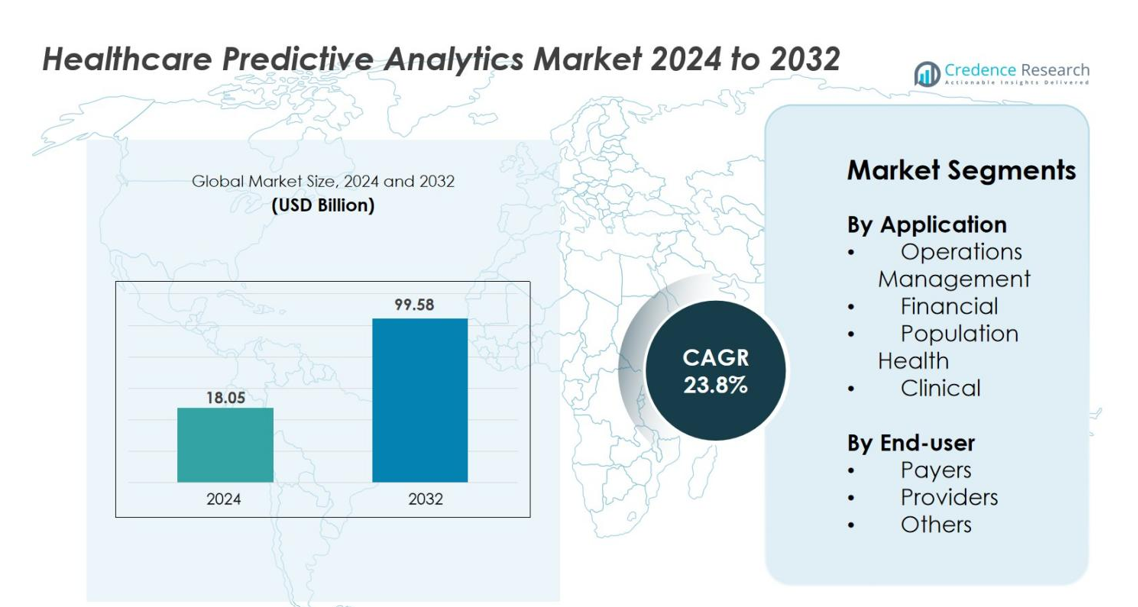

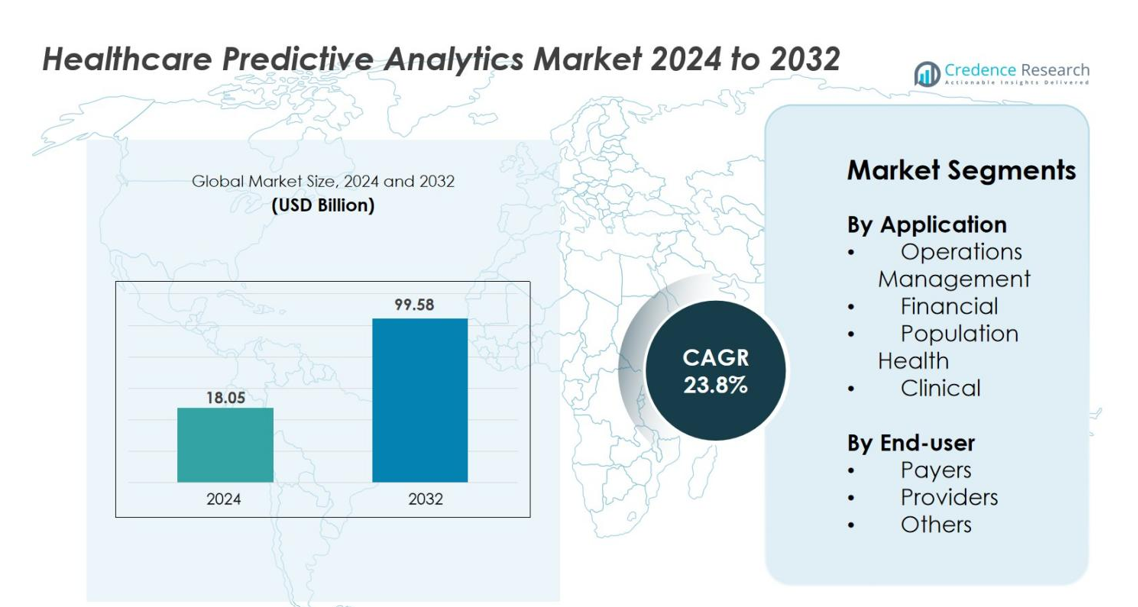

Healthcare Predictive Analytics Market size was valued at USD 18.05 Billion in 2024 and is anticipated to reach USD 99.58 Billion by 2032, at a CAGR of 23.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Predictive Analytics Market Size 2024 |

USD 18.05 Billion |

| Healthcare Predictive Analytics Market, CAGR |

23.8% |

| Healthcare Predictive Analytics Market Size 2032 |

USD 99.58 Billion |

Healthcare Predictive Analytics Market is shaped by leading players such as IBM, Oracle, Optum, SAS, Verisk Analytics, McKesson Corp., Veradigm, Cloudera, INFRAGISTICS, and MedeAnalytics, all of whom continue to expand their capabilities in AI-driven modeling, real-time clinical insights, and cloud-based analytics platforms. These companies strengthen their market presence through product innovation, interoperability enhancements, and strategic partnerships with healthcare providers and payers. Regionally, North America dominates the market with a 41.8% share in 2024, supported by strong digital health infrastructure and rapid adoption of predictive tools. Europe follows with 27.4%, while Asia-Pacific holds 22.6%, reflecting accelerating digitization and healthcare modernization across emerging economies.

Market Insights

- Healthcare Predictive Analytics Market was valued at USD 18.05 Billion in 2024 and is projected to reach USD 99.58 Billion by 2032, growing at a CAGR of 23.8%.

- Growing need for early disease detection, workflow optimization, and rising adoption of value-based care models strongly drives demand for predictive analytics across providers and payers.

- AI-driven clinical decision support, real-time monitoring, and expansion of personalized medicine accelerate market trends, supported by increasing integration of cloud and big data platforms.

- Key players including IBM, Oracle, Optum, SAS, Verisk Analytics, McKesson Corp., Veradigm, and Cloudera strengthen the landscape through advanced analytics solutions and strategic partnerships.

- North America leads with a 41.8% regional share, followed by Europe at 27.4% and Asia-Pacific at 22.6%, while the Clinical segment dominates applications with a 42.6% share, reflecting strong adoption in diagnosis, risk assessment, and treatment planning.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Application

The Healthcare Predictive Analytics market is dominated by the Clinical segment, holding 42.6% share in 2024, driven by rising demand for early disease detection, precision diagnostics, and risk-stratification tools across care settings. Providers increasingly use predictive models to reduce hospital readmissions, optimize treatment pathways, and improve patient safety. Population Health analytics follows, supported by growing value-based care adoption and chronic disease management initiatives. Financial analytics continues to gain relevance as hospitals aim to reduce claim denials and fraud, while Operations Management benefits from the shift toward data-driven workflow and resource optimization.

- For instance, Mayo Clinic’s AI-enabled cardiac prediction model demonstrated the ability to detect asymptomatic left-ventricular dysfunction using ECG data from more than 44,000 patients, improving early detection accuracy.

By End-user

Providers lead the Healthcare Predictive Analytics market with a 54.3% share in 2024, anchored by accelerating digital transformation across hospitals, clinics, and integrated health systems. Adoption is fueled by the need to enhance diagnostic accuracy, improve care coordination, and reduce operational inefficiencies. Payers represent the second-largest segment as insurance firms deploy predictive tools for fraud detection, premium modeling, and high-risk member identification. The Others category, including research institutions and public health agencies, is expanding steadily as organizations increasingly utilize predictive tools for disease surveillance and health program planning.

- For instance, Cleveland Clinic uses its predictive analytics platform to analyze more than 2 million annual patient encounters, enabling early identification of clinical deterioration, while HCA Healthcare applies machine-learning models across over 180 hospitals to improve sepsis detection by processing millions of vital-sign data points daily

Key Growth Drivers

Rising Need for Early Disease Detection and Proactive Care

The growing emphasis on early disease detection stands as a major driver for the Healthcare Predictive Analytics market. Healthcare systems worldwide are shifting from reactive treatment models to proactive care frameworks aimed at identifying health risks before conditions worsen. Predictive analytics enables clinicians to analyse historical medical records, lab results, and real-time patient data to forecast the likelihood of chronic diseases such as diabetes, heart failure, and cancer. This proactive approach significantly improves clinical decision-making, enhances patient outcomes, and reduces hospital readmissions. Increasing prevalence of lifestyle disorders and aging populations further fuel demand for risk-stratification tools that help prioritize high-risk patients. The integration of predictive models within EHR platforms, remote monitoring devices, and AI-powered clinical decision support systems amplifies efficiency, enabling providers to make accurate, data-driven treatment plans. As healthcare organizations seek to improve population health outcomes and minimize costs, demand for predictive analytics continues to accelerate.

- For instance, Mayo Clinic’s AI-enabled ECG model was trained on more than 700,000 patient ECGs to detect asymptomatic left-ventricular dysfunction, demonstrating significantly improved early-diagnosis capability, while Mount Sinai’s deep-learning model analyzed over 1.6 million EHR records to predict heart-failure events with clinically validated accuracy.

Growing Adoption of Value-Based Care and Cost Optimization

The rapid transition from fee-for-service to value-based care models significantly accelerates the adoption of predictive analytics. Hospitals, integrated delivery networks, and payers are increasingly measured on outcome-based performance metrics such as reduced readmissions, improved treatment adherence, and enhanced patient satisfaction. Predictive analytics supports these goals by identifying clinical and operational inefficiencies and enabling early intervention strategies. Health insurers benefit through risk scoring, fraud detection, and claims optimization tools that reduce financial leakages. For providers, the ability to forecast patient volumes, resource needs, and care utilization helps improve workflow efficiency and cost management. Governments and regulatory bodies are also incentivizing value-based initiatives, increasing the urgency for predictive tools that can evaluate care quality and performance metrics. As healthcare costs rise globally, predictive analytics offers a critical means for optimizing financial sustainability while improving clinical outcomes, thereby strengthening its relevance across the healthcare ecosystem.

- For instance, HCA Healthcare applies machine-learning algorithms across more than 180 hospitals, analyzing millions of clinical data points daily to identify early signs of sepsis and other deterioration events, leading to measurable improvements in outcome-based performance indicators.

Increasing Digitization, EHR Integration, and Big Data Growth

The exponential rise in healthcare data—generated from EHRs, medical imaging, IoT devices, genomics, and insurance records—has become a powerful catalyst for predictive analytics adoption. Digitized patient information offers unprecedented insights when combined with machine learning algorithms capable of identifying complex clinical patterns. Healthcare organizations now rely on integrated data ecosystems to drive personalized treatment recommendations, automate administrative tasks, and improve diagnostic accuracy. Cloud adoption is expanding, making analytics platforms more scalable and accessible for both small and large healthcare institutions. Government mandates for EHR adoption and interoperability standards also play a crucial role in creating unified datasets suitable for predictive modelling. As digital transformation accelerates, predictive analytics becomes essential for converting raw healthcare data into actionable intelligence. The ability to process large datasets in real time empowers stakeholders to improve patient outcomes, reduce operational inefficiencies, and strengthen long-term healthcare planning.

Key Trends & Opportunities

AI-Driven Clinical Decision Support and Real-Time Analytics

AI-powered clinical decision support systems represent one of the most significant trends in the Healthcare Predictive Analytics market. These systems use machine learning algorithms to analyse patient histories, vitals, diagnostic reports, and real-time monitoring data to predict potential complications and recommend intervention strategies. The growing adoption of wearable devices and remote monitoring tools generates continuous streams of patient information that enhance the accuracy of predictive insights. Hospitals use real-time analytics for sepsis alerts, ICU deterioration prediction, and emergency triage optimization. AI-driven insights help reduce diagnostic errors, minimize treatment delays, and improve patient safety. As providers increasingly prioritise intelligent automation and clinical efficiency, AI-augmented predictive analytics opens new opportunities for smarter decision-making. This trend continues to expand as health systems adopt more advanced predictive engines integrated into EHRs, telehealth platforms, and connected care ecosystems.

- For instance, Apple’s Heart Study evaluated ECG data from over 419,000 Apple Watch users to detect irregular rhythms linked to atrial fibrillation, demonstrating how continuous wearable streams can feed predictive algorithms with clinically relevant signals for early intervention.

Expansion of Personalized and Precision Medicine Applications

Personalized and precision medicine is emerging as a transformative opportunity area for predictive analytics. By combining genetic data, biomarker profiles, lifestyle information, and clinical histories, predictive models help forecast disease risks and treatment responses unique to each patient. This enables clinicians to design more accurate and individualized therapies, particularly in oncology, cardiology, and rare disease management. Advancements in genomic sequencing, bioinformatics, and pharmacogenomics further accelerate adoption, enabling early identification of susceptibility patterns and optimizing drug selection. Predictive analytics also supports adverse event prediction, personalized drug dosing, and targeted treatment planning, reducing complications and improving therapeutic outcomes. Pharmaceutical companies leverage predictive tools to enhance clinical trial design, patient selection, and drug development processes. As the healthcare industry shifts toward outcome-driven and personalized treatment pathways, predictive analytics plays a critical enabling role, creating wide opportunities across biopharma, diagnostics, and clinical care.

- For instance, Illumina’s NovaSeq systems generate up to 20 billion reads per run, enabling large-scale genomic datasets used in predictive risk modeling, and 23andMe’s research database includes genetic information from more than 14 million individuals, supporting AI-driven disease susceptibility predictions.

Key Challenges

Data Privacy, Regulatory Compliance, and Security Risks

Data privacy and security remain major obstacles to widespread adoption of predictive analytics in healthcare. Organizations must comply with strict regulatory frameworks such as HIPAA, GDPR, and national patient data protection laws, which govern how sensitive health data can be collected, processed, and shared. As predictive models require large, diverse datasets, risks related to cyberattacks, unauthorized access, and data breaches increase significantly. Integrating data from multiple sources—EHRs, labs, imaging systems, and wearables—creates inconsistencies in data governance and raises concerns about accuracy and transparency of AI algorithms. Ensuring fairness, avoiding bias, and maintaining explainability in predictive outputs remain ongoing challenges. Healthcare providers must invest heavily in cybersecurity, encryption, secure cloud environments, and continuous monitoring. Although necessary, these compliance requirements create operational burdens and may slow integration of predictive analytics into clinical workflows.

Integration Complexities and High Implementation Costs

Implementing predictive analytics requires complex integration with existing hospital IT systems, EHRs, diagnostic platforms, and administrative tools. Many healthcare institutions still operate on outdated or siloed systems, making interoperability a persistent challenge. Customizing predictive models to fit clinical workflows demands skilled data scientists, strong IT teams, and substantial configuration time. High upfront investments—including software licensing, data migration, cloud infrastructure, and workforce training—pose challenges for smaller healthcare providers. Data fragmentation, inconsistent records, and missing data reduce predictive accuracy, requiring additional data cleansing efforts. Clinician adoption can be slow due to unfamiliarity with algorithmic insights or concerns about workflow disruption. Continuous updates, model validation, and performance monitoring create long-term operational costs. These complexities collectively limit the ease of adoption and delay full-scale implementation of predictive analytics across healthcare environments.

Regional Analysis

North America

North America leads the Healthcare Predictive Analytics market with a 41.8% share in 2024, driven by advanced healthcare IT infrastructure, extensive EHR adoption, and strong investments in AI-powered clinical systems. The U.S. dominates the region due to high patient data availability, strong payer-provider alignment, and rapid adoption of value-based care models. Leading technology companies and healthcare networks increasingly implement predictive models for risk scoring, clinical decision support, and operational optimization. Supportive federal policies promoting interoperability and digital health innovation further accelerate adoption across hospitals, insurers, and research institutions.

Europe

Europe holds a 27.4% share in 2024, supported by accelerated adoption of digital health frameworks, expanding AI integration in clinical workflows, and increasing focus on cost-efficient healthcare delivery. Western European countries—such as Germany, the U.K., France, and the Netherlands—drive demand due to strong regulatory support for digital transformation and population health management. Hospitals increasingly use predictive analytics to reduce wait times, enhance diagnostics, and optimize chronic disease programs. The region’s shift toward standardized EHR systems and cross-border health data exchange strengthens market growth, while research institutions continue advancing AI-powered medical analytics.

Asia-Pacific

Asia-Pacific accounts for a 22.6% share in 2024, emerging as the fastest-growing region due to expanding healthcare digitization, rising chronic disease prevalence, and increasing investments in smart hospital infrastructure. China, India, Japan, and South Korea lead adoption as governments push national digital health initiatives and AI-driven healthcare modernization. Rapid urbanization, a growing aging population, and expanding insurance coverage create strong demand for predictive tools in clinical risk management and operational efficiency. The region’s large patient pool and rising use of mobile health platforms further accelerate real-time predictive analytics integration across care settings.

Latin America

Latin America captures a 4.8% share in 2024, supported by improving healthcare IT infrastructure, growing telehealth adoption, and rising demand for cost-effective analytics solutions across hospitals and insurance providers. Brazil and Mexico lead the region as healthcare systems modernize and focus on reducing treatment delays, fraud, and preventable hospitalizations. Predictive analytics adoption is gaining traction in public health programs, particularly for infectious disease monitoring and chronic care management. Limited interoperability and budget constraints remain challenges, yet ongoing digital transformation efforts and increasing cloud-based deployments continue to strengthen market penetration.

Middle East & Africa

The Middle East & Africa region holds a 3.4% share in 2024, with growth led by expanding smart healthcare investments in the UAE, Saudi Arabia, and South Africa. Regional health systems are increasingly integrating predictive tools to enhance early diagnosis, manage high-risk populations, and improve resource planning. National digital health strategies, especially in GCC countries, support AI adoption in hospitals and public health surveillance. However, limited data availability and uneven digital infrastructure slow broader adoption across parts of Africa. Despite these challenges, growing clinical modernization initiatives continue to create strong long-term opportunities.

Market Segmentations

By Application

- Operations Management

- Financial

- Population Health

- Clinical

By End-user

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Healthcare Predictive Analytics market features a diverse and expanding competitive landscape shaped by technology leaders, healthcare IT providers, analytics specialists, and integrated healthcare solution companies. Key players such as IBM, Oracle, Optum, SAS, Verisk Analytics, McKesson Corp., Allscripts (now Veradigm), Cloudera, INFRAGISTICS, and MedeAnalytics are strengthening their presence through advanced AI-driven platforms, cloud-based predictive engines, and real-time clinical decision support tools. These companies focus on enhancing interoperability, improving data integration, and offering scalable analytics solutions tailored to hospitals, payers, and population health programs. Strategic initiatives including product innovations, AI model development, cross-industry partnerships, and healthcare data collaborations enable vendors to expand capabilities across clinical, operational, and financial analytics. Many leading firms also invest heavily in big data infrastructure, machine learning algorithms, and precision medicine analytics, positioning themselves to support healthcare providers as they transition toward proactive, data-driven care models.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Oracle

- Optum, Inc.

- Cloudera

- Verisk Analytics, Inc.

- IBM

- INFRAGISTICS

- McKesson Corp.

- SAS

- Allscripts (now Veradigm)

- MedeAnalytics, Inc.

Recent Developments

- In October 2025, Qualtrics announced the planned acquisition of healthcare-tech company Press Ganey Forsta for USD 6.75 billion, enabling expansion of AI analytics capabilities in healthcare feedback and outcomes.

- In August 2025, Komodo Health launched “Marmot,” its new healthcare-native AI engine delivering transparent, verifiable analytics in minutes and already deployed with pharmaceutical partner Alnylam Pharmaceuticals.

- In July 2025, Arcadia Solutions entered into a strategic partnership with Nordic Capital (Nordic becoming the majority owner) to accelerate its AI-powered analytics platform and drive value-based care transformation

Report Coverage

The research report offers an in-depth analysis based on Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly as healthcare systems shift toward proactive and preventive care models supported by AI-driven predictions.

- Adoption of real-time analytics will increase as hospitals integrate IoT devices, wearables, and remote monitoring tools into clinical workflows.

- Precision medicine will gain stronger momentum with predictive models enhancing personalized treatment planning and genomic insights.

- Integration of predictive analytics into telehealth platforms will improve virtual care efficiency and patient monitoring accuracy.

- Cloud-based analytics solutions will see higher uptake due to scalability, lower costs, and improved interoperability across healthcare networks.

- Providers will rely more on predictive tools to reduce hospital readmissions, manage high-risk patients, and optimize clinical outcomes.

- Payers will increasingly use predictive models to detect fraud, streamline claims, and manage population-level health risks.

- Investments in AI governance and ethical frameworks will rise to ensure transparency, fairness, and reduced bias in algorithmic outputs.

- Healthcare organizations will prioritize unified data platforms to eliminate silos and strengthen predictive accuracy across care settings.

- Emerging markets will accelerate adoption as governments push digital health initiatives and expand smart hospital infrastructure.