Market Overview

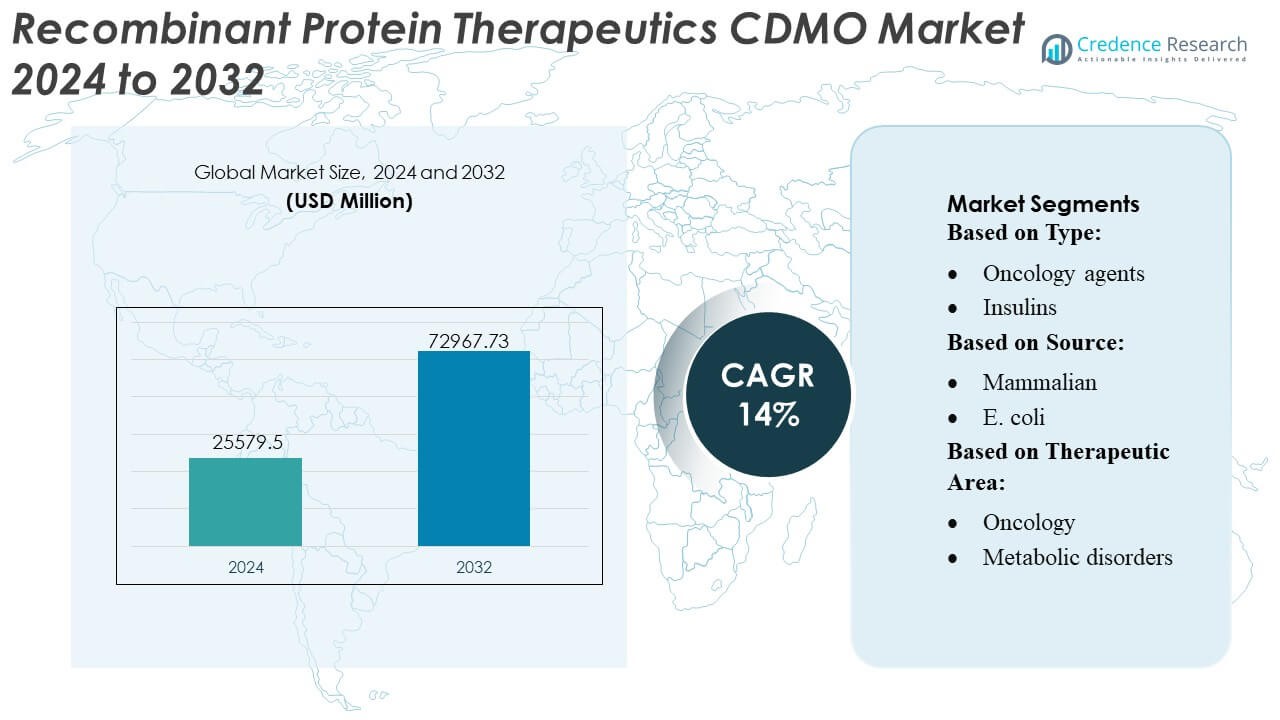

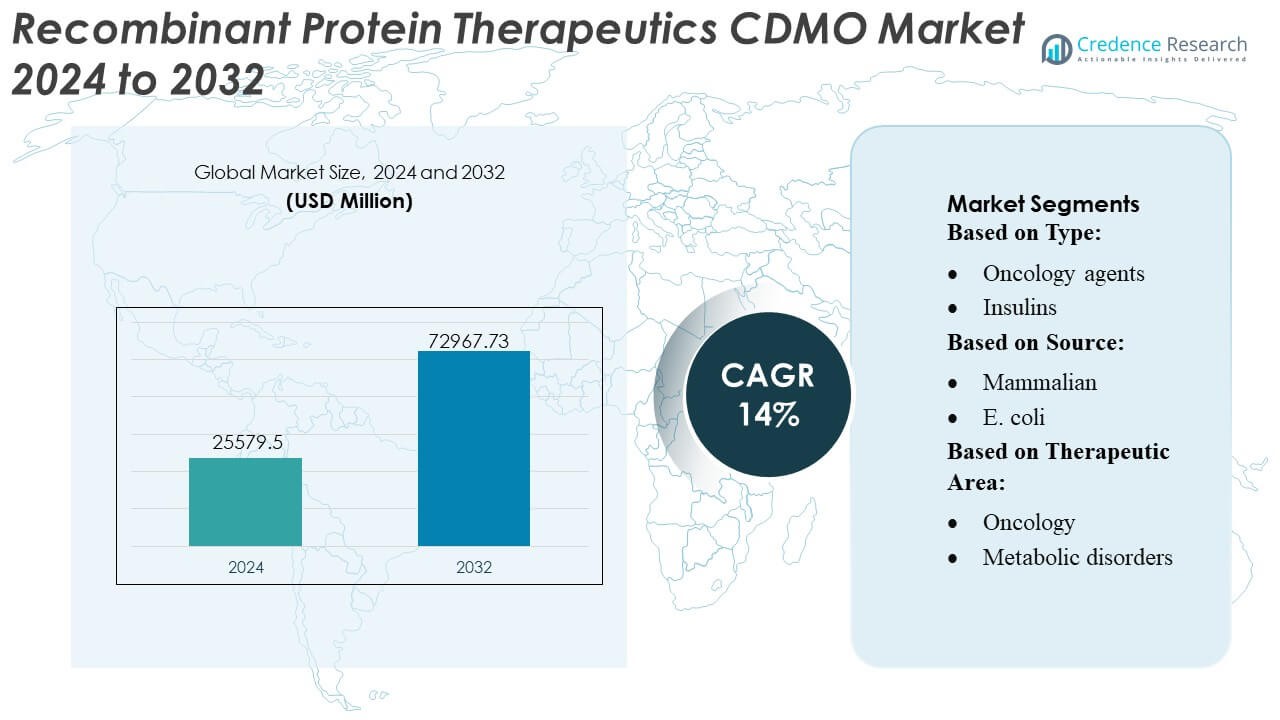

Recombinant Protein Therapeutics CDMO Market size was valued USD 25579.5 million in 2024 and is anticipated to reach USD 72967.73 million by 2032, at a CAGR of 14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Recombinant Protein Therapeutics CDMO Market Size 2024 |

USD 25579.5 Million |

| Recombinant Protein Therapeutics CDMO Market, CAGR |

14% |

| Recombinant Protein Therapeutics CDMO Market Size 2032 |

USD 72967.73 Million |

The Recombinant Protein Therapeutics CDMO Market is shaped by globally established service providers that invest in advanced expression engineering, scalable biomanufacturing platforms, and integrated development-to-commercialization capabilities. These companies strengthen competitiveness through high-yield mammalian and microbial systems, single-use bioreactors, intensified upstream processes, and robust purification technologies tailored for complex recombinant proteins. Strategic partnerships with biotech innovators and expanded analytical infrastructure further enhance reliability and regulatory readiness. North America remains the leading region with a 38% market share, supported by strong biopharma concentration, mature CDMO capacity, and steady demand for outsourced development and GMP manufacturing services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Recombinant Protein Therapeutics CDMO Market reached USD 25,579.5 million in 2024 and is projected to hit USD 72,967.73 million by 2032 at a 14% CAGR, reflecting rapid expansion driven by rising biologics development and outsourced manufacturing demand.

- Growing pipelines in oncology, immunology, and rare diseases fuel strong market drivers, supported by high adoption of mammalian expression systems and continuous bioprocessing technologies.

- Market trends highlight investment in single-use bioreactors, AI-enabled process optimization, and intensified upstream systems that boost yield and reduce timelines.

- Competitive dynamics strengthen as global CDMOs expand multi-site capacity, enhance analytical capabilities, and form partnerships to support complex recombinant protein platforms.

- Regional analysis shows North America leading with a 38% share, while the mammalian expression segment dominates with over 55% share, supported by demand for high-quality therapeutic proteins.

Market Segmentation Analysis:

By Type

Oncology agents hold the dominant position with an estimated 32–34% market share, driven by rising demand for targeted biologics, antibody–drug conjugates, and next-generation immunotherapies that require high-precision expression, purification, and scale-up capabilities. CDMOs benefit from growing outsourcing volumes as biopharma companies accelerate pipelines for solid tumors, blood cancers, and rare oncology indications. Immunostimulating and immunosuppressive agents also show strong momentum as developers expand cytokine, checkpoint, and fusion-protein portfolios. Increasing regulatory approvals for biosimilar insulins and optimization of growth hormones and coagulation factors further support segment expansion across global CDMO networks.

- For instance, Merck offers a portfolio of Mobius single-use bioreactors ranging in size, including a 2000 L capacity, designed to provide flexibility and scalability in biomanufacturing.

By Source

Mammalian expression systems lead with a 58–60% market share, fueled by their ability to produce complex glycosylated recombinant proteins with high bioactivity and clinical comparability. CDMOs invest heavily in CHO cell line development, intensified bioreactors, and high-throughput process optimization to meet demand for oncology, autoimmune, and metabolic therapies. E. coli systems continue gaining traction for non-glycosylated proteins and cost-efficient bulk production. S. cerevisiae supports vaccine antigens and select enzymes, while emerging microbial and hybrid systems enable high-yield, rapid-turnaround development for early-stage programs seeking accelerated timelines.

- For instance, Curia Global, Inc. reported that its proprietary CHO-based platform supports fed-batch runs reaching antibody titers of 7 g/L, and its microbial fermentation facilities operate stainless-steel reactors up to 3,000 L, delivering recombinant protein expression levels exceeding 20 g/L in optimized E. coli systems capabilities validated in Curia’s biologics manufacturing expansion announced through its technical documentation.

By Therapeutic Area

Oncology remains the dominant therapeutic area with 35–37% market share, supported by a strong pipeline of monoclonal antibodies, bispecifics, and recombinant fusion proteins that require advanced platform technologies and flexible commercial-scale capacity. CDMOs enable rapid clinical material supply, robust cell-line engineering, and scalable upstream–downstream integration that aligns with accelerated regulatory pathways. Immunological disorders represent a fast-growing segment due to rising demand for cytokine-modulating and immune-rebalancing biologics. Infectious diseases and metabolic disorders maintain stable outsourcing needs, while hematology and women’s health programs benefit from improved expression technologies and niche therapeutic innovation.

Key Growth Drivers

- Expanding Biologics Pipeline and Rising Complexity of Recombinant Proteins

Growth accelerates as pharmaceutical companies expand biologics pipelines, focusing on monoclonal antibodies, fusion proteins, cytokines, and engineered therapeutic proteins that demand specialized development expertise. Increasing molecular complexity drives reliance on CDMOs equipped with high-throughput screening, advanced expression engineering, and scalable upstream technologies. Small and mid-size biotech firms outsource early development through commercial manufacturing to reduce capital burden. This shift positions CDMOs as strategic partners supporting accelerated timelines, improved yield optimization, and flexible capacity required for next-generation recombinant protein therapies.

- For instance, Ajinomoto’s global manufacturing footprint includes reactor and production capacities spanning from 50 L up to 10,000 L, with total reactor capacity at its Belgian sites reaching 590 m³, enabling scale-up from lab through commercial quantities across small molecules, intermediates and biopharma APIs.

- Increased Adoption of Mammalian Expression Systems for High-Value Therapeutics

Market expansion strengthens with growing demand for mammalian cell lines especially CHO cells due to their superior product quality, authentic post-translational modifications, and proven regulatory acceptance. Biopharma companies increasingly prefer mammalian systems for oncology agents, autoimmune therapies, and immunomodulators, encouraging CDMOs to invest in high-efficiency bioreactors, intensified perfusion processes, and automated culture systems. Enhanced productivity, stable glycosylation patterns, and reduced process variability enable faster commercialization of complex biologics, increasing outsourcing of development and GMP manufacturing activities to specialized CDMOs with deep mammalian expertise.

- For instance, WuXi AppTec’s biologics arm reported that its WuXiUP™ continuous processing platform achieved volumetric productivities above 4 g/L/day in perfusion mode, and its global mammalian network now operates bioreactors ranging from 50 L to 20,000 L including more than 50 single-use units validated for GMP runs supporting drug substance manufacturing at commercial scale.

- Rising Outsourcing of End-to-End Bioprocessing to Reduce Cost and Time-to-Market

Pharma and biotech companies accelerate outsourcing to reduce operational risk, manufacturing costs, and regulatory burden associated with recombinant protein production. CDMOs offering integrated services cell line development, formulation, analytical characterization, and fill-finish gain strong traction as sponsors seek single-partner models that simplify supply chains. Demand for flexible, modular manufacturing capacity grows alongside rapid development programs in oncology and rare diseases. CDMOs with digitalized facilities, standardized platform processes, and tech-transfer efficiency benefit significantly from shorter development cycles and increasing volume of outsourced therapeutic programs.

Key Trends & Opportunities

- Growing Adoption of Single-Use Bioprocessing and High-Intensity Manufacturing Platforms

A key trend is rapid migration toward single-use bioreactors, disposable filtration systems, and continuous perfusion culture that improve operational flexibility and reduce cleaning validation time. CDMOs utilize these platforms to enable faster scale-up, minimize contamination risks, and support multi-product environments essential for recombinant protein programs. High-intensity upstream systems boost protein yields and shorten production cycles, creating opportunities for CDMOs to offer cost-competitive manufacturing packages that appeal to emerging biotech firms operating under accelerated development frameworks.

- For instance, LGC Limited, company has continually invested in expanding its capacity, including adding significant lab space in Petaluma focused on large-scale oligo manufacturing. The total manufacturing space across their sites exceeds 14,000 m².

- Expansion of Modular and Multi-Regional Manufacturing Capacity

CDMOs increasingly deploy modular cleanrooms, adaptive biomanufacturing suites, and multi-regional production hubs to address global therapeutic demand and mitigate supply disruptions. This trend opens opportunities for clients seeking redundancy, proximity to clinical markets, and compliance with region-specific regulatory frameworks. Investments in advanced downstream purification, cryogenic storage, and automated quality testing strengthen global service capabilities. Multi-site harmonization also enables smoother tech transfer and consistent product quality, making CDMOs more attractive partners for large-scale recombinant protein commercialization.

- For instance, Univercells the company has extended the platform with the scale‑X™ nitro controller, capable of operating up to 600 m² fixed-bed bioreactors enabling large-scale manufacturing of viral vectors, vaccines, or oncolytic viruses with a minimal footprint.

- Integration of Digital, AI-Driven, and Automation Technologies Across Bioprocesses

Data-driven biomanufacturing emerges as a significant opportunity, with CDMOs adopting AI-enabled predictive modeling, digital twins, advanced PAT tools, and automated workflows. These technologies enhance upstream productivity, optimize purification parameters, and reduce batch failures through real-time analytics. Sponsors benefit from shorter development cycles, higher batch consistency, and transparent quality oversight. CDMOs leveraging robotics, electronic batch records, and cloud-integrated process monitoring differentiate themselves through efficiency and regulatory readiness, improving competitiveness in the fast-growing recombinant protein outsourcing market.

Key Challenges

- Capacity Limitations and Production Bottlenecks for Complex Proteins

The market faces constraints due to limited availability of high-capacity mammalian and microbial manufacturing suites, especially for complex or low-yield recombinant proteins. Sudden demand surges from oncology and immunology pipelines intensify competition for bioreactor slots, leading to extended wait times and constrained project initiation. Scale-up inconsistencies, purification bottlenecks, and batch variability further challenge timelines. CDMOs must balance capacity utilization with flexibility while investing in advanced equipment and process intensification to overcome these production limitations.

- Increasing Regulatory and Quality Compliance Burden Across Global Markets

CDMOs operate under stringent regulatory frameworks requiring strict adherence to GMP, process validation, biosafety, and data integrity standards. Frequent updates in regulatory guidelines for biologics especially regarding cell line characterization, viral safety, and impurity profiling elevate compliance complexity. Ensuring global harmonization across FDA, EMA, PMDA, and emerging markets increases operational risk and resource intensity. CDMOs must maintain robust quality systems, highly trained staff, and digital traceability tools to avoid audit findings and ensure uninterrupted supply for recombinant protein therapeutics.

Regional Analysis

North America

North America holds the leading 38% market share, supported by a strong concentration of biopharmaceutical companies, advanced CDMO infrastructure, and high adoption of mammalian and microbial expression systems. Extensive investment in oncology, immunology, and rare disease biologics boosts outsourcing demand for recombinant protein development and GMP manufacturing. The region benefits from regulatory clarity provided by the FDA, strong venture capital funding for biotech start-ups, and established large-scale bioreactor capacity. Growing integration of digitalized facilities, high-throughput screening, and automated downstream processing further reinforces North America’s leadership in CDMO-based recombinant protein production.

Europe

Europe accounts for roughly 30% of the market, driven by significant biologics research activity, strong regulatory frameworks, and expanding investments in advanced biomanufacturing capabilities. CDMOs in Germany, Switzerland, and the U.K. benefit from expertise in cell line development, continuous bioprocessing, and multi-modal analytical testing. Demand rises as regional pharma companies outsource complex recombinant protein projects to optimize cost and accelerate development timelines. Strategic collaborations between CDMOs and academic biotechnology clusters strengthen innovation pipelines. The region’s growing adoption of single-use systems and modular cleanroom technologies supports steady expansion across both early-stage and commercial biologics programs.

Asia-Pacific

Asia-Pacific holds an estimated 24% market share and demonstrates the fastest expansion due to increasing biologics manufacturing investments, cost-efficient production capabilities, and government-backed biopharma development initiatives. China, South Korea, India, and Singapore emerge as key outsourcing destinations offering competitive capacity for recombinant protein expression, large-scale fermentation, and downstream purification. Regional CDMOs attract global clients seeking flexible capacity and accelerated tech transfer. Strong growth in oncology and metabolic disorder therapeutics fuels demand for CHO- and E. coli-based production. Expanding GMP facilities, talent development programs, and supportive regulatory reforms position Asia-Pacific as a high-growth CDMO hub.

Latin America

Latin America captures around 5% of the market, supported by growing healthcare expenditure, regional biologics research programs, and expanding partnerships with global CDMOs. Brazil and Mexico lead demand through rising clinical trial activity and increased focus on biosimilars, prompting interest in recombinant protein development services. Although manufacturing infrastructure remains limited, investments in GMP facilities, quality systems, and regulatory modernization improve the region’s outsourcing appeal. Market growth strengthens as regional pharmaceutical companies seek cost-effective development pathways and collaborate with international CDMOs for complex protein expression and scale-up requirements.

Middle East & Africa

The Middle East & Africa region holds nearly 3% of the market, characterized by emerging interest in biologics manufacturing, rising incidence of chronic diseases, and increasing adoption of advanced therapeutics. Growth is concentrated in the Gulf Cooperation Council countries, where investments in biotechnology parks, research centers, and pharmaceutical innovation hubs accelerate market development. Limited local CDMO capacity drives reliance on global partners for recombinant protein research, formulation, and manufacturing. Improvements in regulatory frameworks and growing collaborations with European and Asian CDMOs gradually strengthen the region’s position in the global outsourcing landscape.

Market Segmentations:

By Type:

By Source:

By Therapeutic Area:

- Oncology

- Metabolic disorders

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Recombinant Protein Therapeutics CDMO Market features a diversified group of global and specialized players, including Merck KGaA, Curia Global, Inc., BIOSPRING, Ajinomoto Co., Inc., WuXi AppTec, LGC Limited, KNC Laboratories Co., Ltd., Univercells Inc., Danaher (Aldevron), and Agilent Technologies, Inc. the Recombinant Protein Therapeutics CDMO Market reflects increasing specialization, capacity expansion, and strong emphasis on integrated bioprocessing solutions. CDMOs differentiate through advanced expression platforms, high-yield cell line development, and robust GMP-compliant manufacturing systems that support complex recombinant proteins across oncology, immunology, and metabolic disorder pipelines. Companies strengthen their competitive position by investing in single-use bioreactors, continuous perfusion systems, and automated downstream purification workflows that enhance productivity and reduce batch variability. Growing demand for accelerated development timelines encourages CDMOs to expand analytical capabilities, digitalize operations, and establish multi-regional manufacturing hubs. The market becomes more dynamic as strategic partnerships, technology licensing, and innovation-driven service models enable broader support for both early-stage biotech firms and established pharmaceutical developers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Merck KGaA

- Curia Global, Inc.

- BIOSPRING

- Ajinomoto Co., Inc.

- WuXi AppTec

- LGC Limited

- KNC Laboratories Co., Ltd.

- Univercells Inc.

- Danaher (Aldevron)

- Agilent Technologies, Inc.

Recent Developments

- In March 2025, ICON plc, a major clinical research organization, partnered with Mural Health Technologies, a patient-focused tech company, to integrate Mural Health’s Mural Link platform for managing participant engagement and payments in ICON’s upcoming clinical trials, aiming to improve patient experience and site efficiency.

- In March 2025, Shilpa Medicare launched a unique “hybrid CDMO” model at DCAT, integrating traditional development/manufacturing (small/large molecules, peptides) with pre-developed, ready-to-license products, offering pharma partners flexible routes to market, reducing risk, and accelerating launches, while maintaining strict B2B focus.

- In March 2025, ATA Action acquired the Digital Therapeutics Alliance (DTA), a global provider promoting digital therapeutics access. This merger strengthens advocacy efforts to support innovative technologies reshaping healthcare and enhancing patient outcomes.

- In October 2024, Click Therapeutics, Inc. launched Software-Enhanced Drug therapies under its new Click SE offering, introducing a novel category of prescription digital therapeutics aligned with growing FDA interest in Prescription Drug-Use Related Software (PDURS) guidance.

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Therapeutic Area and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for recombinant protein outsourcing will rise as biotech pipelines expand across oncology, immunology, and rare diseases.

- CDMOs will increase investment in high-capacity single-use and continuous bioprocessing systems to improve productivity.

- Adoption of AI-driven process optimization will strengthen yield enhancement and reduce development timelines.

- Mammalian expression platforms will gain further dominance as complexity and quality requirements for therapeutic proteins increase.

- Modular and multi-regional GMP facilities will expand to ensure supply-chain resilience and faster global delivery.

- CDMOs will deepen analytical and characterization capabilities to meet evolving regulatory expectations.

- Partnerships between biotech innovators and CDMOs will accelerate commercialization of next-generation recombinant proteins.

- Microbial expression systems will evolve with enhanced strain engineering to support cost-efficient production.

- Quality-by-design frameworks and digital batch records will become standard to ensure regulatory compliance and transparency.

- Integrated end-to-end service models will strengthen as sponsors prefer single-provider solutions for development to fill-finish manufacturing.