Market Overview

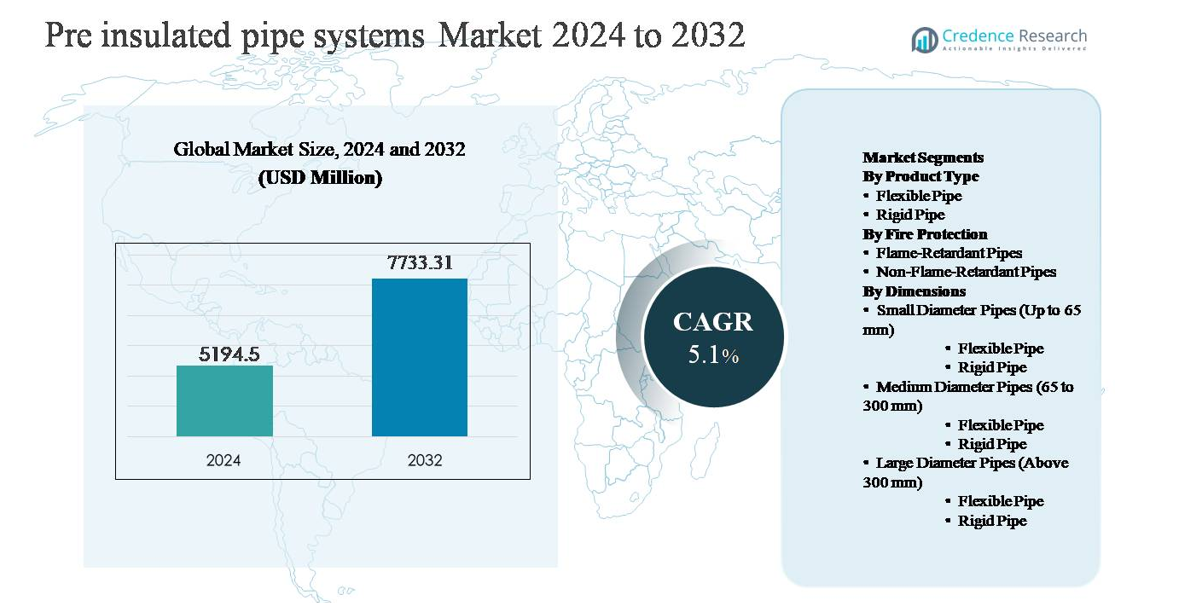

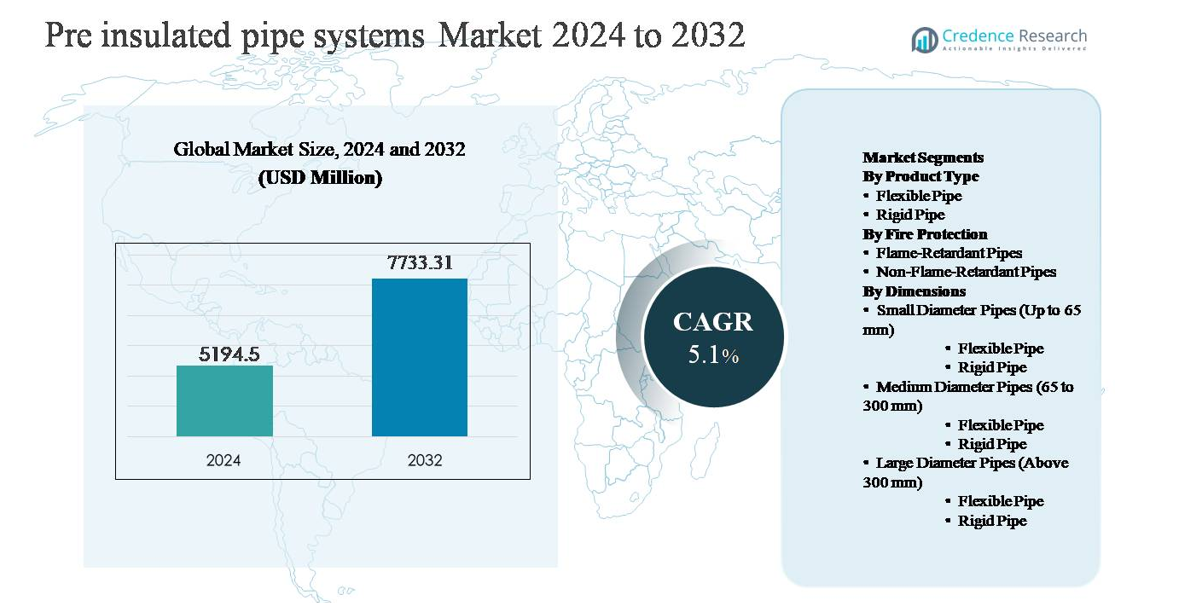

The pre-insulated pipe systems market was valued at USD 5,194.5 million in 2024 and is anticipated to reach USD 7,733.31 million by 2032, expanding at a compound annual growth rate (CAGR) of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pre-Insulated Pipe Systems Market Size 2024 |

USD 5,194.5 million |

| Pre-Insulated Pipe Systems Market, CAGR |

5.1% |

| Pre-Insulated Pipe Systems Market Size 2032 |

USD 7,733.31 million |

The pre-insulated pipe systems market is led by a group of globally established manufacturers and strong regional suppliers that compete on system durability, thermal efficiency, and large-scale project execution. These players maintain robust portfolios serving district heating, district cooling, and industrial energy distribution networks, with a strong focus on long-life insulation performance and integrated monitoring solutions. Europe dominates the competitive landscape, accounting for approximately 38% of the global market share, supported by mature district heating infrastructure and continuous network modernization. North America follows with about 25% share, driven by infrastructure upgrades and institutional heating systems, while Asia-Pacific holds around 24% and represents the fastest-growing region. Market leaders strengthen their positions through long-term utility contracts, regional manufacturing presence, and technologically differentiated insulation systems.

Market Insights

- The pre-insulated pipe systems market was valued at USD 5,194.5 million in 2024 and is projected to reach USD 7,733.31 million by 2032, growing at a CAGR of 5.1% during the forecast period, supported by steady demand from district heating, cooling, and industrial energy transport applications.

- Market growth is primarily driven by expanding district heating and cooling infrastructure and rising focus on energy efficiency, with rigid pipes dominating product type segments at around 65% share due to superior mechanical strength and long service life in underground installations.

- Key trends include increasing integration with renewable energy and waste heat recovery systems, along with rising adoption in retrofit projects; medium diameter pipes (65–300 mm) lead the dimension segment with about 45% share, reflecting extensive use in municipal networks.

- The competitive landscape is moderately consolidated, with global and regional players competing on insulation efficiency, system reliability, and turnkey project capabilities, while long-term utility contracts and retrofit expertise remain critical differentiators.

- Regionally, Europe leads with approximately 38% market share, followed by North America at 25% and Asia-Pacific at 24%, while Latin America and the Middle East & Africa collectively account for the remaining share, driven mainly by industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

The product type segment of the pre-insulated pipe systems market is dominated by rigid pipes, which account for an estimated around 65% market share in 2024. Rigid pipes are widely preferred in district heating, district cooling, and industrial energy networks due to their high mechanical strength, long service life exceeding 30 years, and superior thermal insulation efficiency. Their ability to withstand high operating temperatures and pressures makes them suitable for large-scale underground installations. Flexible pipes, while gaining traction in small-scale and retrofit applications, remain secondary due to limited pressure-handling capacity and shorter installation lengths.

- For instance, LOGSTOR’s steel-based pre-insulated district heating pipes are designed for continuous operating temperatures up to 140 °C and pressures of 16 bar, with factory-applied polyurethane insulation achieving thermal conductivity values as low as 0.027 W/m·K, enabling long-term heat retention over transmission distances exceeding 20 km in municipal networks.

By Fire Protection:

Within the fire protection segment, non-flame-retardant pipes hold the dominant position with approximately 60% market share, driven by extensive deployment in district heating, cooling, and water distribution systems where fire exposure risk is relatively low. These pipes offer cost advantages, lower material complexity, and proven thermal performance, making them the preferred choice for municipal and utility-scale projects. Flame-retardant pipes are increasingly adopted in high-risk environments such as tunnels, industrial plants, and commercial buildings; however, higher material costs and regulatory-driven use restrict their broader penetration.

- For instance, KE KELIT’s KELIT PEX FF (FibreFlex Pro) district heating pipe systems utilize cross-linked polyethylene (PE-Xa) carrier pipes (reinforced with aramid fibers) with polyurethane (PUR) insulation designed for a maximum continuous operating temperature of 80 °C (or up to 95 °C max operating/floating temperature, depending on specific application class requirements) and short-term peaks up to 115 °C.

By Dimensions:

The market by dimensions is led by medium diameter pipes (65–300 mm), representing about 45% of total demand, primarily due to their extensive use in district heating and cooling networks. Within this range, rigid pipes dominate because they efficiently handle high flow rates and thermal loads over long distances. Small diameter pipes are mainly used for building-level distribution and service connections, while large diameter pipes serve backbone transmission lines but face slower growth due to higher installation costs, complex civil works, and limited project volumes compared to medium-sized networks.

Key Growth Drivers

Expansion of District Heating and Cooling Infrastructure

The rapid expansion of district heating and district cooling networks is a primary growth driver for the pre-insulated pipe systems market. Governments and municipalities are increasingly investing in centralized thermal energy networks to improve energy efficiency, reduce fuel consumption, and lower urban carbon emissions. Pre-insulated pipes play a critical role in these systems by minimizing heat loss during transmission and ensuring long-term operational reliability. Their factory-applied insulation and protective casing significantly reduce installation time and lifecycle maintenance costs compared to conventional piping. Growing urbanization, combined with large-scale residential and commercial construction projects, is further accelerating network extensions and retrofitting of aging pipelines. In colder regions and dense urban centers, district heating projects continue to expand, directly supporting sustained demand for high-performance pre-insulated pipe systems.

- For instance, BRUGG Pipes supported multiple European district heating expansions using its FLEXWELL® and CALPEX® systems, enabling trench lengths of up to 1,000 m per delivery reel and reducing joint counts by several hundred connections per project, directly lowering leak risk and installation time.

Rising Focus on Energy Efficiency and Emission Reduction

Increasing emphasis on energy efficiency across industrial and municipal sectors is strongly driving adoption of pre-insulated pipe systems. Energy losses during fluid transport represent a significant cost burden for utilities and industrial operators, prompting a shift toward thermally efficient piping solutions. Pre-insulated pipes help maintain stable operating temperatures and reduce fuel consumption in heating and cooling processes. Regulatory frameworks promoting energy conservation, waste heat utilization, and lower greenhouse gas emissions further reinforce this trend. Industries such as oil & gas, chemicals, food processing, and power generation are upgrading thermal distribution networks to comply with efficiency mandates. As organizations prioritize operational optimization and sustainability targets, demand for advanced insulation systems continues to rise steadily.

- For instance, Georg Fischer’s COOL-FIT 4.0 pre-insulated plastic piping system integrates PE100 carrier pipes with low-conductivity foam insulation rated at 0.023 W/m·K, enabling chilled water transport at temperatures down to –50 °C while reducing energy demand on cooling equipment.

Growth in Industrial Process Applications

Industrial process expansion is another major driver fueling the pre-insulated pipe systems market. Sectors such as chemicals, petrochemicals, refineries, and manufacturing require reliable thermal pipelines to transport steam, hot water, and process fluids over long distances. Pre-insulated pipes offer superior resistance to temperature fluctuations, corrosion, and mechanical stress, making them suitable for harsh operating environments. Increasing industrial capacity additions, plant modernization initiatives, and replacement of aging infrastructure are accelerating adoption. Additionally, industries focused on continuous operations value the reduced downtime and predictable performance offered by factory-insulated solutions. As industrial energy management becomes more sophisticated, pre-insulated pipe systems are increasingly specified as standard components in new and upgraded facilities.

Key Trends & Opportunities

Integration with Renewable and Waste Heat Recovery Systems

A key trend shaping the market is the integration of pre-insulated pipe systems with renewable energy and waste heat recovery projects. District heating networks are increasingly connected to biomass plants, geothermal sources, solar thermal installations, and industrial waste heat streams. Pre-insulated pipes enable efficient long-distance heat transport from decentralized and low-temperature energy sources to end users. This trend creates strong opportunities for suppliers to develop pipes optimized for varying temperature ranges and hybrid energy systems. As cities transition toward low-carbon heating solutions, the role of advanced insulation technologies becomes increasingly critical, opening new avenues for product innovation and customized system designs.

- For instance, Perma-Pipe International delivered pre-insulated pipeline systems for waste heat recovery from combined heat and power (CHP) and industrial facilities, engineered to handle operating temperatures up to 180 °C and pressures of 16 bar, allowing recovered heat from process exhaust streams to be transferred into municipal district heating loops.

Growing Adoption in Retrofit and Infrastructure Modernization Projects

Infrastructure modernization and retrofit projects represent a significant opportunity for the pre-insulated pipe systems market. Many existing heating and cooling networks suffer from high heat losses, corrosion, and frequent maintenance issues. Utilities are increasingly replacing legacy piping with pre-insulated systems to improve efficiency and extend service life. Flexible pre-insulated pipes are gaining attention in retrofit scenarios due to ease of installation in constrained urban environments. This trend is particularly strong in Europe and mature urban markets, where upgrading existing networks is often more viable than building new ones. The steady flow of refurbishment projects provides a stable, long-term demand base for manufacturers.

- For instance, Aquatherm’s pre-insulated polypropylene (PP-R) piping systems are engineered for continuous operating temperatures up to 70 °C and short-term peaks of 95 °C, with fusion-welded joints that create homogenous pipe connections capable of maintaining pressure ratings up to 20 bar, making them suitable for refurbishment of municipal heating loops without extensive excavation.

Technological Advancements in Insulation and Monitoring

Ongoing technological advancements present another key opportunity. Improvements in insulation materials, such as enhanced polyurethane foams and advanced casing materials, are delivering lower thermal conductivity and higher durability. In parallel, smart monitoring solutions, including leak detection wires and temperature sensors embedded within pre-insulated pipes, are gaining traction. These technologies allow operators to detect failures early, reduce unplanned outages, and optimize maintenance planning. As digitalization spreads across utility and industrial infrastructure, demand for intelligent pre-insulated pipe systems with integrated monitoring capabilities is expected to increase, supporting premium product adoption.

Key Challenges

High Initial Installation and Capital Costs

High upfront installation costs remain a key challenge for the pre-insulated pipe systems market. Compared to conventional piping, pre-insulated systems involve higher material costs and specialized installation requirements. For budget-constrained municipalities and smaller industrial operators, the initial capital investment can be a deterrent despite long-term energy savings. Excavation, civil works, and skilled labor requirements further add to project costs, particularly in urban areas. Although lifecycle benefits are well established, decision-makers often prioritize short-term budget considerations, slowing adoption in cost-sensitive markets. This challenge is more pronounced in developing regions where infrastructure funding remains limited.

Installation Complexity and Skilled Labor Dependency

The installation of pre-insulated pipe systems requires skilled labor and strict adherence to technical standards, which poses another challenge. Improper jointing, insulation damage, or casing defects can compromise system performance and lead to premature failures. Availability of trained installers varies by region, creating execution risks for large-scale projects. In addition, repair and modification of buried pre-insulated pipelines can be complex and time-consuming. These factors increase project risk for end users and contractors. Addressing this challenge requires continuous training, standardized installation practices, and improved system designs that simplify handling and on-site assembly.

Regional Analysis

North America:

North America accounts for approximately 25% of the global pre-insulated pipe systems market, supported by steady investments in district heating, district cooling, and industrial energy infrastructure. The region benefits from strong adoption in the United States and Canada, where utilities focus on reducing transmission losses and upgrading aging thermal networks. Growth is driven by campus heating systems, industrial retrofits, and expanding commercial developments. Increasing emphasis on energy efficiency standards and decarbonization strategies further supports demand. While new installations grow at a moderate pace, replacement of legacy piping and modernization of municipal infrastructure remain key contributors to regional market stability.

Europe:

Europe represents the largest regional market with about 38% market share, driven by the widespread deployment of district heating networks across Northern and Western Europe. Countries such as Germany, Denmark, Sweden, and Poland have mature thermal infrastructure that relies heavily on pre-insulated pipes for heat distribution. Strong regulatory support for energy efficiency, low-carbon heating, and waste heat utilization continues to drive demand. Large-scale network expansions, combined with ongoing refurbishment of older systems, sustain high adoption rates. Europe’s leadership in renewable-integrated district heating further reinforces the dominance of pre-insulated pipe systems in the region.

Asia-Pacific:

Asia-Pacific holds around 24% of the global market share and is the fastest-growing regional market for pre-insulated pipe systems. Rapid urbanization, industrial expansion, and large-scale infrastructure projects in China, South Korea, and parts of Southeast Asia are driving demand. District heating expansion in northern China and growing adoption in industrial process applications significantly support market growth. Government investments in smart cities, energy-efficient infrastructure, and urban heating networks further accelerate adoption. While district heating penetration remains uneven across the region, rising construction activity and industrial energy demand position Asia-Pacific as a key growth engine.

Latin America:

Latin America accounts for approximately 7% of the global pre-insulated pipe systems market, with demand primarily driven by industrial applications and commercial developments. Countries such as Brazil, Mexico, and Chile are witnessing increasing use of pre-insulated pipes in food processing, chemicals, and energy-related projects. District heating adoption remains limited; however, growing focus on energy efficiency and infrastructure modernization is gradually improving market penetration. Industrial retrofits and replacement of conventional piping systems contribute to steady demand. Although growth is slower compared to developed regions, ongoing urban development projects provide incremental expansion opportunities.

Middle East & Africa:

The Middle East & Africa region holds around 6% market share, supported by industrial expansion and infrastructure development in Gulf Cooperation Council countries. Pre-insulated pipe systems are increasingly used in district cooling, oil & gas facilities, and large commercial complexes where thermal efficiency is critical. Harsh climatic conditions and long-distance fluid transport requirements favor insulated piping solutions. In Africa, adoption remains limited but is gradually increasing in urban infrastructure and industrial projects. While overall penetration is lower than other regions, ongoing investments in energy and utility infrastructure support long-term growth potential.

Market Segmentations:

By Product Type

By Fire Protection

- Flame-Retardant Pipes

- Non-Flame-Retardant Pipes

By Dimensions

- Small Diameter Pipes (Up to 65 mm)

- Medium Diameter Pipes (65 to 300 mm)

- Large Diameter Pipes (Above 300 mm)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the pre-insulated pipe systems market is characterized by the presence of established international manufacturers and strong regional players competing on product performance, system reliability, and project execution capabilities. Leading companies focus on delivering complete piping solutions, including pipes, insulation, casing, and integrated leak detection systems, to support district heating, district cooling, and industrial applications. Competition is driven by technological differentiation in insulation efficiency, corrosion resistance, and service life. Major players leverage long-term relationships with utilities and EPC contractors to secure large infrastructure projects, while regional manufacturers compete on cost and localized supply. Strategic priorities include capacity expansion, development of advanced insulation materials, and increased focus on retrofit projects. Additionally, companies are strengthening aftersales services and technical support to enhance customer retention and maintain competitive positioning in large-scale and long-duration infrastructure projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 8, 2025, BRUGG Pipes supplied pre-insulated district heating pipes for the WWZ pipe bridge over the A4 motorway between Holzhäusern and Rotkreuz in Switzerland, demonstrating expanded project execution capability for infrastructure crossings and complex installations.

- In December 3, 2025, Perma-Pipe International The company secured 52 million USD in project awards during Q3 2025, including contracts tied to data center infrastructure and Saudi Aramco-related projects, with new work to be executed from its expanded Dammam facility.

- In August 29, 2025 Aquatherm introduced the aquatherm energy twin pre-insulated twin pipe system, designed for modern district heating networks, available in diameters from 32 mm to 125 mm with integrated flow and return lines within a single casing. This system incorporates PUR foam insulation compliant with DIN EN 253 and a robust PE casing, and when paired with a socket welder developed with Ritmo SPA, enables simultaneous welding of both medium pipes in a single step, reducing connection time by up to 50 % compared to traditional methods and improving installation reliability.

Report Coverage

The research report offers an in-depth analysis based on Product type, Fire protection, Dimensions and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of pre-insulated pipe systems will continue to rise as utilities prioritize long-term energy efficiency and reduction of thermal losses.

- District heating and district cooling network expansions will remain the primary demand drivers, especially in urban and high-density regions.

- Retrofit and replacement of aging thermal pipelines will generate steady demand across developed markets.

- Integration of pre-insulated pipes with renewable energy and waste heat recovery systems will increase significantly.

- Technological advancements in insulation materials will improve thermal performance and service life.

- Smart monitoring and leak detection integration will become more common in new installations.

- Industrial applications will increasingly specify pre-insulated systems as standard infrastructure components.

- Flexible pre-insulated pipes will see higher adoption in constrained urban and retrofit environments.

- Emerging economies will gradually expand usage as infrastructure investments and energy efficiency regulations strengthen.

- Competition will intensify around product reliability, installation efficiency, and lifecycle cost optimization.