Market Overview

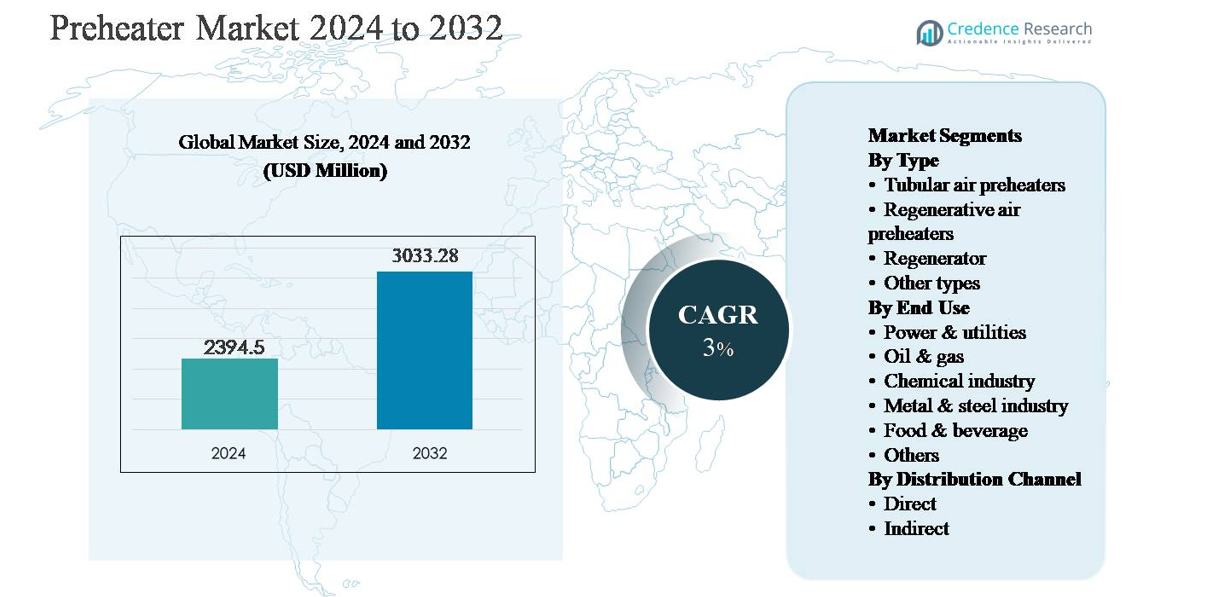

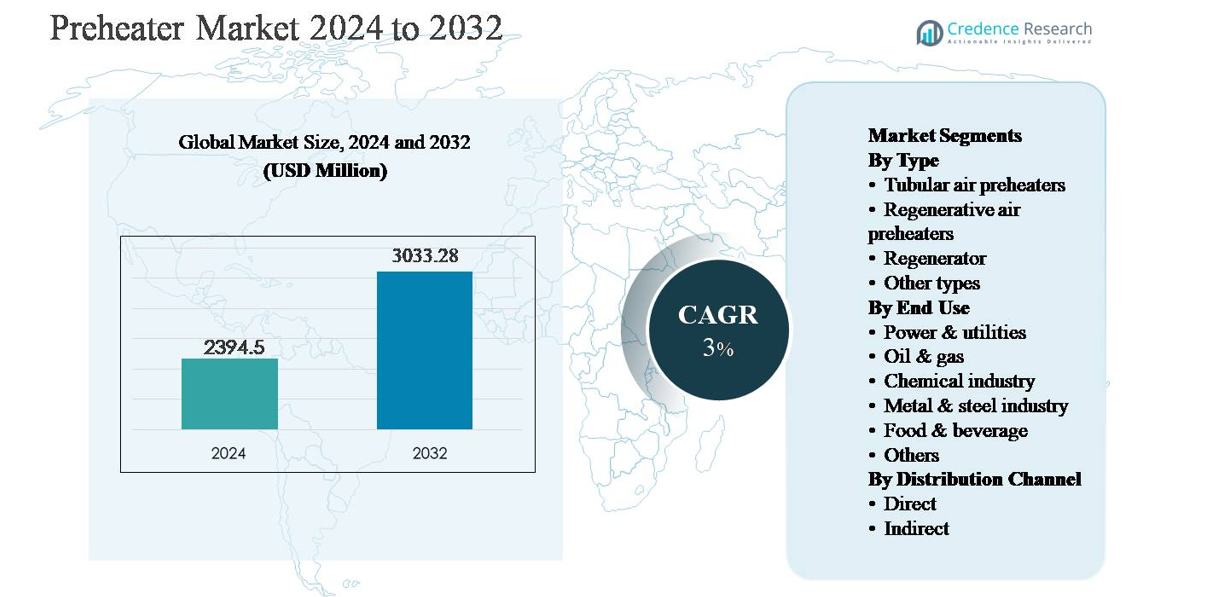

The preheater market was valued at USD 2,394.5 million in 2024 and is projected to reach USD 3,033.28 million by 2032, growing at a compound annual growth rate (CAGR) of 3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Preheater Market Size 2024 |

USD 2,394.5 million |

| Preheater Market, CAGR |

3% |

| Preheater Market Size 2032 |

USD 3,033.28 million |

The preheater market is led by a mix of global engineering majors and regionally strong manufacturers competing on efficiency, scale, and project execution. Key players include Alstom Power, Andritz, Aalborg Engineering, Babcock & Wilcox, Bharat Heavy Electricals, Dongfang Electric, Doosan Heavy Industries, Eisenmann, Five Group, and Jiangsu Jinfeng Air Preheater, with strong penetration in power generation and heavy industrial applications. These companies benefit from long-standing EPC relationships, proprietary thermal designs, and large installed bases that support retrofit demand. Asia-Pacific is the leading region, holding approximately 34% of the global market, driven by extensive power plant capacity and rapid industrialization in China and India. North America follows with around 26% market share, supported by efficiency-driven upgrades and retrofit projects.

Market Insights

- The preheater market was valued at USD 2,394.5 million in 2024 and is projected to reach USD 3,033.28 million by 2032, expanding at a CAGR of 3% during the forecast period, supported by steady demand from power generation and energy-intensive industries.

- Market growth is primarily driven by rising focus on energy efficiency and waste heat recovery, as preheaters reduce fuel consumption and enhance thermal performance in boilers, furnaces, and kilns across power, metals, chemicals, and oil & gas sectors.

- Key trends include growing adoption of regenerative air preheaters, which dominate with around 42% segment share, increasing retrofit projects in aging plants, and integration of advanced materials and monitoring systems to improve durability and lifecycle efficiency.

- The competitive landscape features global engineering players and regional manufacturers competing on efficiency, customization, and aftersales services, with strong presence in large EPC-driven power and industrial projects.

- Regionally, Asia-Pacific leads with ~34% market share, followed by North America at ~26% and Europe at ~24%, while power & utilities remain the dominant end-use segment with about 38% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The preheater market by type is led by regenerative air preheaters, which account for an estimated around 42% market share, driven by their superior thermal efficiency and ability to recover waste heat in large-scale industrial operations. These systems are widely adopted in power plants and heavy industries due to their compact design and reduced fuel consumption. Tubular air preheaters follow, supported by simpler construction and lower maintenance requirements, particularly in smaller installations. Regenerators find niche applications in high-temperature processes, while other types serve specialized industrial heating needs.

- For instance, the Ljungström regenerative air preheater used in a 500 MW utility boiler incorporates dual rotor elements each with a rotor diameter of ~11.4 meters and handles gas flow rates of ~610,000 Nm³/hour on both the flue gas and combustion air sides, preheating incoming air from ~50 °C to ~324 °C before combustion a configuration widely applied in global coal-fired power plants to maximize heat recovery in high-capacity service.

By End Use:

The power & utilities segment dominates, holding approximately 38% of the total market, supported by extensive deployment of preheaters in coal-, gas-, and biomass-fired power plants to improve boiler efficiency and reduce emissions. Stringent energy-efficiency regulations and the need to optimize fuel utilization continue to drive adoption. The oil & gas and chemical industry segments represent strong secondary demand, supported by process heat recovery requirements. The metal & steel industry relies on preheaters for furnaces and kilns, while food & beverage and other industries adopt compact systems for controlled thermal processes.

- For instance, Babcock & Wilcox has supplied regenerative air preheaters for large pulverized-coal boilers where a single unit services boilers rated above 600 MW, with air preheaters handling flue-gas flow rates exceeding 500,000 Nm³/h and increasing combustion air temperatures from below 60 °C to above 300 °C before the burners, directly supporting higher boiler heat utilization.

By Distribution Channel:

The direct distribution channel is the dominant sub-segment, capturing nearly 65% of market share, driven by large industrial buyers preferring direct engagement with manufacturers for customized designs, technical integration, and aftersales service. Direct sales also enable suppliers to participate early in plant design and retrofit projects, strengthening long-term contracts. The indirect channel, including distributors and system integrators, supports small- and mid-scale end users by offering standardized products with shorter lead times. Growth in indirect sales is supported by industrial expansion in emerging markets and decentralized manufacturing facilities.

Key Growth Drivers

Rising Demand for Energy Efficiency and Waste Heat Recovery

Growing emphasis on energy efficiency across industrial operations is a primary driver of the preheater market. Industries such as power generation, metals, chemicals, and oil & gas increasingly deploy preheaters to recover waste heat from flue gases and process exhaust streams, thereby reducing fuel consumption and operating costs. Preheaters improve overall thermal efficiency of boilers, furnaces, and kilns, enabling plants to achieve higher output with lower energy input. This efficiency-driven adoption is further supported by corporate decarbonization targets, where optimizing heat utilization is often one of the most cost-effective pathways to emissions reduction. As fuel prices remain volatile, end users prioritize technologies that deliver predictable energy savings, making preheaters a critical component of modern industrial heat management systems.

- “For instance, Siemens Energy integrates Heat Recovery Steam Generators (HRSGs) within combined-cycle power plants where heat recovery steam generators handle exhaust gas temperatures of up to 620 °C (or higher) from gas turbines rated above 300 MW, transferring sensible heat to downstream steam systems to generate additional electricity via a steam turbine and improve overall plant heat utilization.”

Expansion of Power Generation and Heavy Industrial Infrastructure

Continued expansion and modernization of power generation capacity significantly drive preheater demand. Thermal power plants, including coal-, gas-, and biomass-based facilities, rely on air preheaters to enhance boiler performance and reduce specific fuel consumption. In parallel, growth in heavy industries such as steel, cement, petrochemicals, and refining sustains demand for high-capacity preheating systems used in furnaces and reactors. Emerging economies investing in industrial infrastructure and capacity additions further accelerate installations, particularly for regenerative and tubular air preheaters. Retrofit projects in aging plants also contribute to steady demand, as operators upgrade legacy systems to improve efficiency, reliability, and compliance with newer operational standards.

- For instance, Doosan Enerbility has delivered tubular air preheaters for ultra-supercritical coal plants designed for main steam temperatures of around 600 °C and boiler steam flow rates above 2,000 t/h, supporting large-scale baseload power generation projects.

Stringent Environmental and Emissions Regulations

Environmental regulations targeting emissions reduction and energy conservation strongly support preheater adoption. Governments and regulatory bodies increasingly mandate lower carbon intensity and improved efficiency in industrial operations, especially in power and heavy manufacturing sectors. Preheaters help reduce greenhouse gas emissions indirectly by lowering fuel requirements and improving combustion efficiency. In many regions, compliance with emissions norms requires integrated heat recovery solutions, positioning preheaters as enabling technologies rather than optional upgrades. As regulatory scrutiny intensifies, industries prioritize proven, scalable solutions that deliver measurable efficiency gains, reinforcing sustained demand for advanced preheater systems.

Key Trends & Opportunities

Technological Advancements and Design Optimization

Ongoing advancements in preheater design present significant growth opportunities. Manufacturers are focusing on compact configurations, improved heat transfer materials, corrosion-resistant coatings, and optimized flow geometries to enhance durability and efficiency. Digital monitoring and condition-based maintenance features are increasingly integrated, enabling operators to track performance, predict fouling, and reduce downtime. These innovations expand the addressable market by making preheaters suitable for a broader range of operating conditions, including high-temperature and corrosive environments. Technology-led differentiation also allows suppliers to offer value-added solutions beyond standard equipment supply.

- For instance, Howden has engineered compact regenerative air preheaters using high-density heat-transfer baskets manufactured from corten and enamel-coated steel alloys, enabling continuous operation at flue-gas inlet temperatures of up to 400 °C while reducing overall equipment footprint in retrofit boiler installations where duct space is constrained.

Growth in Retrofit and Aftermarket Services

Retrofitting existing industrial facilities with modern preheater systems is a key opportunity, particularly in mature markets with aging infrastructure. Many plants operate with outdated or inefficient heat recovery equipment, creating strong demand for upgrades that deliver quick efficiency gains without major process redesign. Alongside retrofits, aftermarket services such as maintenance, performance optimization, and component replacement are gaining importance. This shift supports recurring revenue models for suppliers and strengthens long-term customer relationships, especially in energy-intensive industries.

- For instance, Bharat Heavy Electricals Limited (BHEL) undertakes life-extension and modernization programs for air preheaters installed in Indian thermal power stations, where tubular and regenerative units are refurbished to handle flue-gas inlet temperatures of up to 400 °C under continuous baseload operation.

Key Challenges

High Initial Capital Cost and Installation Complexity

Despite long-term efficiency benefits, high upfront costs remain a significant challenge for preheater adoption. Large-scale regenerative and customized preheater systems require substantial capital investment, specialized engineering, and complex installation procedures. For small and mid-sized industrial operators, these costs can delay investment decisions, particularly in price-sensitive markets. Installation often requires planned shutdowns, which may disrupt production schedules and add indirect costs. These factors can limit short-term adoption, especially where energy prices are subsidized or efficiency incentives are weak.

Operational Issues Related to Fouling and Maintenance

Preheaters operating in harsh industrial environments face challenges related to fouling, corrosion, and thermal stress. Accumulation of ash, dust, or corrosive compounds can degrade heat transfer efficiency and increase pressure drops, leading to higher maintenance requirements. Inadequate maintenance can result in unplanned downtime and reduced system lifespan. Managing these operational risks requires skilled personnel and regular servicing, which can increase total cost of ownership. Addressing reliability concerns remains critical for wider adoption, particularly in continuous-process industries.

Regional Analysis

North America:

North America accounts for approximately 26% of the global preheater market, supported by a strong installed base of power generation assets and energy-intensive industries. The region benefits from continuous retrofit and efficiency-upgrade projects across thermal power plants, refineries, and chemical facilities. Stringent environmental regulations and corporate decarbonization goals drive adoption of advanced air preheaters and waste heat recovery systems. The United States leads regional demand due to large-scale industrial operations and ongoing investments in boiler efficiency improvements, while Canada contributes through upgrades in oil sands processing and utility infrastructure.

Europe:

Europe holds nearly 24% of the global preheater market, driven by strict energy-efficiency directives and emissions regulations. Industrial operators across power generation, metals, cement, and chemicals increasingly deploy preheaters to comply with carbon-reduction targets and rising energy costs. Countries such as Germany, the UK, France, and Italy emphasize modernization of existing plants rather than greenfield projects, supporting steady retrofit demand. Advanced regenerative air preheaters are widely adopted due to their higher efficiency and compact footprint. The region’s strong focus on sustainability and circular energy use continues to reinforce long-term market growth.

Asia-Pacific:

Asia-Pacific dominates the global preheater market with an estimated 34% market share, driven by rapid industrialization and expanding power generation capacity. China and India lead demand due to large numbers of coal- and gas-based power plants, steel mills, and chemical complexes. Ongoing investments in industrial infrastructure and capacity expansion support strong uptake of tubular and regenerative air preheaters. Southeast Asian countries also contribute through new manufacturing facilities and energy projects. Although environmental regulations vary across countries, rising fuel costs and efficiency awareness are accelerating adoption of heat recovery technologies across the region.

Latin America:

Latin America represents around 9% of the global preheater market, supported by growth in power generation, oil & gas refining, and metals processing. Brazil and Mexico are the primary contributors, driven by thermal power plants, petrochemical operations, and industrial modernization initiatives. Demand is largely project-based, with emphasis on cost-effective tubular air preheaters and selective regenerative systems for large installations. While regulatory pressure is lower compared to Europe and North America, improving energy efficiency and reducing operational costs remain key adoption drivers. Gradual industrial recovery is expected to sustain moderate market growth.

Middle East & Africa:

The Middle East & Africa region accounts for approximately 7% of the global preheater market, led by demand from oil & gas processing, petrochemicals, and power generation. Gulf countries drive regional growth through large-scale refinery expansions and gas-fired power plants, where preheaters enhance fuel efficiency and process reliability. In Africa, adoption is more limited but growing steadily with investments in power infrastructure and mining operations. The market favors robust, low-maintenance designs suited to harsh operating environments. Long-term growth is supported by industrial diversification and energy optimization initiatives.

Market Segmentations:

By Type

- Tubular air preheaters

- Regenerative air preheaters

- Regenerator

- Other types

By End Use

- Power & utilities

- Oil & gas

- Chemical industry

- Metal & steel industry

- Food & beverage

- Others

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the preheater market is characterized by the presence of established industrial equipment manufacturers and specialized thermal engineering companies competing on efficiency, reliability, and customization capabilities. Leading players focus on regenerative and tubular air preheaters designed for power generation, oil & gas, and heavy industrial applications. Competition is driven by technological differentiation, including enhanced heat transfer designs, corrosion-resistant materials, and systems engineered for high-temperature and particulate-laden environments. Companies strengthen their positions through long-term supply contracts, retrofit solutions, and comprehensive aftersales services covering maintenance and performance optimization. Strategic collaborations with EPC contractors and power plant developers enable early involvement in large-scale projects. Additionally, manufacturers increasingly emphasize digital monitoring, predictive maintenance, and lifecycle cost reduction to differentiate offerings. Regional players compete on cost and localized service support, particularly in emerging markets, intensifying price competition while expanding overall market reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Alstom Power

- Andritz

- Aalborg Engineering

- Dongfang Electric

- Babcock & Wilcox

- Jiangsu Jinfeng Air Preheater

- Bharat Heavy Electricals

- Eisenmann

- Doosan Heavy Industries

- Five Group

Recent Developments

- In September 2025, ANDRITZ secured an order to supply a chemical recovery and steam generation system for Nippon Paper Industries in Ishinomaki, Japan. This project includes a new recovery boiler designed for 2,200 tds/day steam production at steam conditions of 8.3 MPa and 505 °C, integrating advanced automation and digital solutions (instrumentation and control for optimized thermal efficiency).

- In July 2025, ANDRITZ received an order from Chung Hwa Pulp Corporation (Taiwan) including an 1,400 tds/day recovery boiler with advanced digitalization and low-NOx recovery solutions, plus an ash leaching plant with 108 t/d capacity improving heat recovery surfaces and controls.

- In April 2025, Dongfang Electric (related power equipment parent market context) successfully commissioned a 700 MW ultra-supercritical boiler unit at Yunneng Honghe Power Plant that integrates advanced high-efficiency steam generation technology a key enabling system for enhanced heat recovery and preheater integration in large thermal plants. The boiler completed 168 hours of continuous trial operation demonstrating high operational reliability and combustion uniformity under ultra-supercritical conditions.

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Preheater demand will continue to grow steadily as industries prioritize energy efficiency and fuel optimization.

- Regenerative air preheaters will gain wider adoption due to higher thermal efficiency and compact design.

- Retrofit and replacement of aging heat recovery systems will remain a major source of future demand.

- Power generation will remain the largest end-use sector, supported by efficiency upgrades and plant modernization.

- Expansion of industrial capacity in emerging economies will strengthen long-term market growth.

- Advanced materials and corrosion-resistant designs will improve operational reliability and system lifespan.

- Integration of digital monitoring and predictive maintenance will enhance performance management.

- Demand for customized preheaters will increase in complex industrial processes.

- Environmental regulations will reinforce adoption of waste heat recovery solutions.

- Competition will intensify as regional manufacturers expand capabilities and global players focus on lifecycle services.