Market Overview

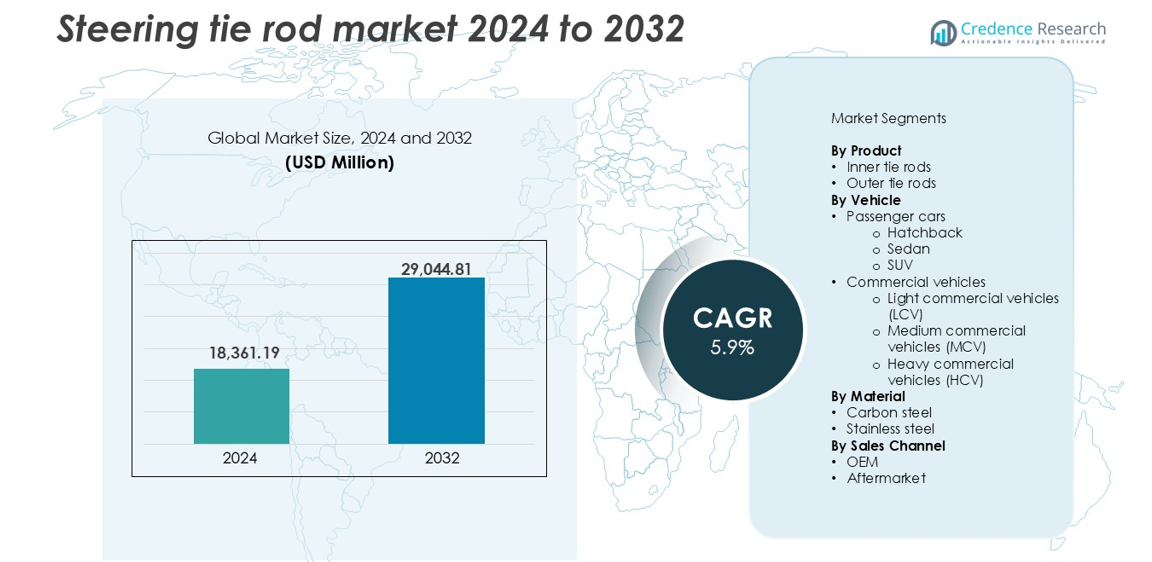

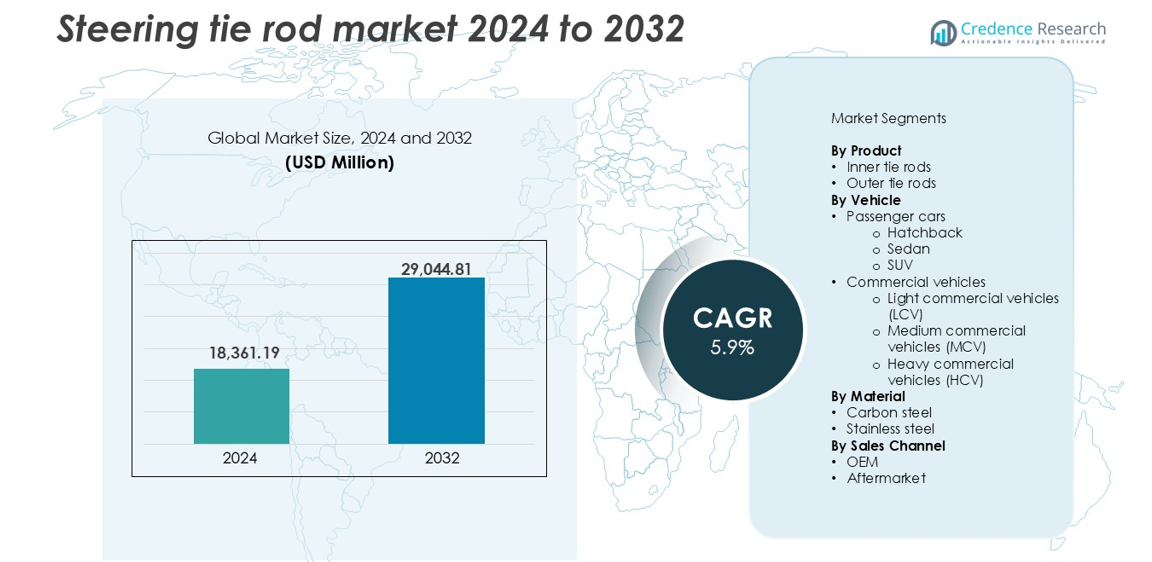

The Steering Tie Rod Market size was valued at USD 18,361.19 million in 2024 and is anticipated to reach USD 29,044.81 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Steering Tie Rod Market Size 2024 |

USD 18,361.19 million |

| Steering Tie Rod Market, CAGR |

5.9% |

| Steering Tie Rod Market Size 2032 |

USD 29,044.81 million |

Top players in the Steering Tie Rod Market include Bosch Group, Nexteer Automotive Group, Delphi Technologies, Mando Corporation, and NSK. These companies lead through strong OEM partnerships, advanced engineering, and global distribution networks. Bosch and Nexteer hold a significant share in North America and Europe due to established automotive supply chains. Mando and NSK maintain a strong presence in Asia-Pacific, supporting high-volume production for regional automakers. Asia-Pacific dominates the global market with a 35% share in 2024, driven by China, India, and Japan. North America and Europe follow with 25% and 22% shares respectively, supported by robust vehicle ownership and aftermarket activity.

Market Insights

- The Steering Tie Rod Market was valued at USD 18,361.19 million in 2024 and is expected to reach USD 29,044.81 million by 2032, growing at a CAGR of 5.9%.

- Increasing global vehicle production and rising SUV and LCV adoption drive strong demand for steering components across OEM and aftermarket channels.

- Lightweight material adoption and rising EV production influence tie rod design, creating demand for compact, high-strength steering systems with improved durability.

- Key players such as Bosch Group, Nexteer Automotive, Mando, and Delphi Technologies lead through OEM partnerships, while regional players expand aftermarket reach.

- Asia-Pacific dominates with a 35% market share due to high vehicle output, followed by North America at 25% and Europe at 22%; outer tie rods hold over 60% of the product segment share, while passenger cars contribute over 70% of total vehicle segment revenue

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The outer tie rods segment holds the dominant share in the Steering Tie Rod Market, accounting for over 60% of total revenue in 2024. These components are critical in linking the steering knuckle to the steering rack, ensuring effective wheel movement and alignment. High replacement frequency due to wear and tear drives segment growth. Demand for enhanced steering stability in modern vehicles further boosts adoption. OEMs and aftermarket suppliers focus on durability and ease of installation, which strengthens outer tie rod preferences across both light and heavy vehicles.

- For instance, ZF Friedrichshafen supplies outer tie rods with a tested fatigue strength of over 1 million load cycles under dynamic conditions, supporting long-life steering systems.

By Vehicle

Passenger cars represent the leading segment, capturing over 70% share in 2024, with SUVs contributing the largest portion within this group. The rapid expansion of the SUV category, driven by rising consumer preference for comfort and multi-terrain capability, supports strong demand. Steering tie rods in passenger vehicles require lightweight yet robust components to meet performance and safety standards. Increased vehicle ownership, especially in developing regions, and the growing middle-class population push up the consumption of steering components across urban centers globally.

- For instance, Hyundai Mobis supplies aluminum-alloy tie rod assemblies for Hyundai and Kia SUVs, reducing weight by over 15% while meeting ISO 9227 corrosion standards.

By Material

Carbon steel dominates the Steering Tie Rod Market by material, holding more than 65% share in 2024. The material’s high tensile strength, cost efficiency, and machinability make it ideal for mass production. Carbon steel tie rods perform well under routine mechanical stress and offer a balanced mix of strength and affordability. Automotive suppliers prefer carbon steel due to its compatibility with varied manufacturing processes and favorable lifecycle cost. While stainless steel offers corrosion resistance, its higher cost limits usage to specialized or premium vehicle applications.

Key Growth Drivers

Rising Global Vehicle Production and Aftermarket Demand

The continuous increase in global vehicle production drives steady growth in the steering tie rod market. Expanding vehicle ownership in emerging economies, along with rising disposable incomes, fuels demand for passenger cars and commercial vehicles. As each vehicle relies on multiple steering components, production volumes directly boost component sales. Additionally, aging vehicle fleets in developed regions contribute to strong aftermarket activity. Tie rods are prone to wear and require regular replacement, especially in poor road conditions. OEM supply contracts and growing distribution networks enhance accessibility for both replacement and repair. Urban infrastructure expansion and logistics sector growth also support commercial vehicle demand, increasing the need for robust steering components. Together, these dynamics form a foundational growth pillar for the market across OEM and aftermarket channels.

- For instance, Toyota produced over 10.3 million vehicles globally in 2023, each using at least two outer and two inner tie rods per unit.

Expanding SUV and Light Commercial Vehicle Sales

The global shift in consumer preference toward SUVs and light commercial vehicles (LCVs) significantly benefits the steering tie rod market. SUVs continue to dominate new passenger vehicle sales due to their perceived safety, cargo space, and road clearance. Each SUV requires a durable and responsive steering system to support weight distribution and handling performance. In parallel, LCVs see rising demand from last-mile delivery and logistics companies amid e-commerce expansion. These vehicle types place higher mechanical stress on steering components, requiring advanced tie rod assemblies for safety and control. OEMs invest in reinforced tie rod designs to handle increased loads, while aftermarket vendors introduce models tailored to popular SUV platforms. The growth of these segments ensures a continuous rise in steering system component consumption across key markets.

- For instance, SUVs accounted for over 46 million global sales in 2023, led by models such as the Toyota RAV4 and Tesla Model Y

Stringent Vehicle Safety and Handling Regulations

Increasing regulatory focus on vehicle safety and handling performance is driving upgrades in steering system design and component quality. Authorities across North America, Europe, and Asia-Pacific enforce stringent standards to reduce accidents and improve maneuverability. Steering tie rods play a key role in vehicle stability, especially during cornering, braking, and evasive actions. As a result, OEMs must meet precise alignment and durability criteria during design and production. Advanced materials, automated assembly techniques, and precision testing are now critical to meeting compliance. Tier-1 suppliers invest in research to enhance tie rod strength, corrosion resistance, and fatigue life. Compliance pressure also affects the aftermarket, as regional rules increasingly mandate certified components. This regulatory landscape pushes innovation and ensures steady demand for reliable, high-performance steering tie rods globally.

Key Trends and Opportunities

Integration of Lightweight and High-Strength Materials

The industry sees a clear trend toward lightweight and high-strength materials to improve fuel efficiency and reduce emissions. Steering tie rods made from advanced carbon steel alloys, aluminum composites, and heat-treated stainless steel offer strength without adding unnecessary weight. This shift aligns with global emissions regulations and automaker targets for lighter vehicles. Material innovation also enhances corrosion resistance and fatigue life, key traits for long-term durability. Suppliers explore hybrid material tie rods that combine metal and polymer components for optimized strength-to-weight ratio. This trend presents strong opportunities for material science companies and OEMs seeking performance upgrades. Vehicles in electric and hybrid categories, in particular, benefit from lighter steering assemblies that support battery efficiency and range optimization.

- For instance, thyssenkrupp supplies forged aluminum steering components weighing under 1.2 kg, offering up to 30% weight reduction over traditional steel parts while maintaining comparable strength.

Increasing Demand for Electric and Autonomous Vehicles

The growth of electric vehicles (EVs) and semi-autonomous driving platforms opens new opportunities in steering technology. EV architectures often require more compact and modular components, including advanced steering assemblies. Tie rods for EVs must meet both space efficiency and dynamic performance needs. In autonomous and driver-assist vehicles, steering precision becomes more critical. This leads to increased demand for zero-tolerance tie rods with integrated sensors or position feedback features. As vehicle control shifts from mechanical to electronic systems, tier-1 suppliers invest in smart steering technologies. Collaborations between steering system manufacturers and automation tech firms support this evolution. These changes redefine the design scope and performance requirements of steering tie rods, creating high-value growth potential.

Key Challenges

Raw Material Cost Fluctuations and Supply Chain Disruptions

Volatility in raw material prices, especially steel and alloy inputs, presents a key challenge for steering tie rod manufacturers. Price hikes in carbon steel or specialty metals increase production costs and compress margins. Manufacturers operating on tight supply contracts or fixed-price OEM agreements face cost management pressures. Global supply chains are still recovering from post-pandemic disruptions, with logistics bottlenecks and geopolitical tensions affecting component flow. Dependence on imported raw materials adds risk exposure. Companies must adapt by sourcing from multiple regions, renegotiating contracts, or investing in vertical integration. Fluctuating costs also affect aftermarket pricing, leading to inconsistent availability for end users. Sustaining profitability amid these variables remains difficult without strong cost-control strategies.

Product Counterfeiting and Substandard Components in Aftermarket

The rise of counterfeit and low-quality steering tie rod products in the aftermarket poses safety and trust concerns. Substandard tie rods may fail under stress, leading to steering instability and road accidents. Counterfeit parts often bypass durability testing and fail to meet regulatory requirements. This undermines customer confidence, especially in developing regions with limited enforcement. OEMs and certified aftermarket players must invest in product traceability, authentication labeling, and dealer education. Regulatory bodies are tightening quality checks, but fragmented distribution channels remain vulnerable. Building awareness among mechanics and fleet operators about the risks of counterfeit steering parts is essential. Poor-quality competition also pressures genuine suppliers on pricing, complicating revenue growth and market integrity.

Regional Analysis

North America

North America holds a market share of over 25% in the global Steering Tie Rod Market in 2024, led by the U.S. and Canada. Strong vehicle ownership, a well-developed aftermarket, and a mature automotive industry support consistent demand. High replacement rates due to aging vehicle fleets and extensive highway networks drive aftermarket growth. The presence of major OEMs and tier-1 suppliers enhances regional competitiveness. SUV and pickup truck sales remain dominant, increasing mechanical load on steering systems. Regulatory standards for vehicle safety also push demand for high-quality components, ensuring steady market momentum across both new vehicle sales and repair channels.

Europe

Europe accounts for approximately 22% share of the Steering Tie Rod Market, driven by Germany, France, and the UK. The region’s well-established automotive sector, strict safety regulations, and preference for high-performance vehicles create a strong environment for steering component upgrades. Demand is supported by premium vehicle production, with OEMs emphasizing responsive and durable steering systems. Electric vehicle adoption is growing, prompting design shifts toward lighter and modular tie rod systems. Aftermarket activity remains high due to longer vehicle lifespans and routine inspection practices. Local suppliers benefit from advanced manufacturing capabilities and stringent quality control, reinforcing Europe’s leadership in high-end components.

Asia-Pacific

Asia-Pacific leads the global Steering Tie Rod Market with a dominant share of over 35% in 2024, fueled by high vehicle production in China, India, Japan, and South Korea. Rapid urbanization, rising disposable incomes, and expanding automotive ownership drive new vehicle sales. China stands out as the largest contributor due to its massive domestic manufacturing capacity. The region also experiences significant demand in both OEM and aftermarket segments. Increasing SUV sales and commercial transport needs raise consumption of heavy-duty steering components. Strong government support for local production, along with robust supplier networks, ensures cost efficiency and scalability in this fast-growing region.

Latin America

Latin America holds around 10% of the global Steering Tie Rod Market, led by Brazil and Mexico. The region’s growth stems from rising automotive assembly operations and increasing vehicle exports. Aftermarket demand remains strong due to older vehicle fleets and widespread use of light commercial vehicles. Economic recovery and infrastructure investments are improving road conditions, which in turn boosts vehicle replacement and servicing activity. Brazil’s industrial base supports local tie rod manufacturing, while Mexico’s proximity to North American supply chains enhances export competitiveness. Market players focus on offering cost-effective yet durable steering solutions to cater to price-sensitive customers.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for nearly 8% share in the Steering Tie Rod Market. Demand is driven by increasing vehicle imports, expanding urban road networks, and a growing need for fleet maintenance. GCC countries, especially Saudi Arabia and the UAE, lead regional growth due to strong construction and logistics sectors. Harsh environmental conditions require durable steering components that can withstand heat and dust. Africa shows growing potential, particularly in aftermarket segments, due to older vehicles and informal service networks. Regional suppliers and distributors focus on reliability and affordability to meet rising mobility needs across developing economies.

Market Segmentations:

By Product

- Inner tie rods

- Outer tie rods

By Vehicle

- Passenger cars

- Commercial vehicles

- Light commercial vehicles (LCV)

- Medium commercial vehicles (MCV)

- Heavy commercial vehicles (HCV)

By Material

- Carbon steel

- Stainless steel

By Sales Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Steering Tie Rod Market features a mix of global OEM suppliers and specialized aftermarket players. Leading companies such as Bosch Group, Nexteer Automotive Group, Delphi Technologies, and Mando Corporation maintain strong OEM relationships through advanced manufacturing capabilities and long-term contracts. These firms invest in R&D to improve product durability, reduce weight, and support electric vehicle integration. Meanwhile, companies like CTR, Sankei Industry, and Ingalls Engineering focus on expanding aftermarket reach with reliable, cost-effective components. Regional players in Asia-Pacific, particularly in China and South Korea, offer competitive pricing and scalable production. Strategic partnerships, acquisitions, and geographic expansions remain common, with firms targeting fast-growing markets in Asia and Latin America. Quality certifications and regulatory compliance also influence competitive positioning, especially in safety-critical components. As vehicle platforms evolve, the market rewards suppliers that combine technical performance with supply chain flexibility and responsive customer support.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Delphi Technologies

- CTR

- NSK

- Bosch Group

- Mando Corporation

- Sankei Industry

- Ingalls Engineering

- ACDelco

- Nexteer Automotive Group

- BorgWarner

Recent Developments

- In June 2024, DRiV Incorporated, a US-based automobile parts supplier, made a major expansion of Monroe Steering and Suspension offerings. It added 750 new part numbers to its range, expanding by 20%. The action was intended to raise product coverage with safety and durability, which met the rising demand for premium steering and suspension parts. The expansion included new components for widely popular late-model vehicles and utilized high-tech materials, anti-corrosion treatments, and demanding tests to meet original equipment requirements.

- In November 2023, Toyota announced its plans to introduce its steer-by-wire technology, named One Motion Grip, into production by the end of 2024. The first models with the technology will be the bZ4X EV SUV and Lexus sibling, the RZ. The steer-by-wire system gets rid of the mechanical link between the steering wheel and wheels, providing a more natural and smooth steering feel. This development is a breakthrough in steering technology, which can shape steering rod design in the future.

- In December 2022, BorgWarner Inc., a U.S.-based automotive and e-mobility supplier, acquired Drivetek AG, a Swiss-based engineering firm specializing in power electronics and electric drive solutions. The acquisition, valued at up to CHF 35 million, was designed to enhance BorgWarner’s auxiliary inverter technologies and support its High Voltage eFan business.

Report Coverage

The research report offers an in-depth analysis based on Product, Vehicle, Material, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow steadily with rising global vehicle production across emerging and developed markets.

- Electric vehicle expansion will drive innovation in lightweight and compact tie rod designs.

- SUV and light commercial vehicle adoption will increase the need for heavy-duty steering components.

- Advanced materials such as aluminum alloys and hybrid composites will gain wider usage.

- OEMs will invest more in precision-engineered tie rods to meet safety and performance standards.

- Aftermarket growth will be driven by aging vehicle fleets and regular replacement needs.

- Asia-Pacific will maintain its lead in production and consumption due to high automotive output.

- Integration of smart steering systems may influence design of next-generation tie rods.

- Regional players will expand reach through cost-effective offerings and partnerships.

- Regulatory pressure will push suppliers to improve quality and product traceability across channels.