Market Overviews

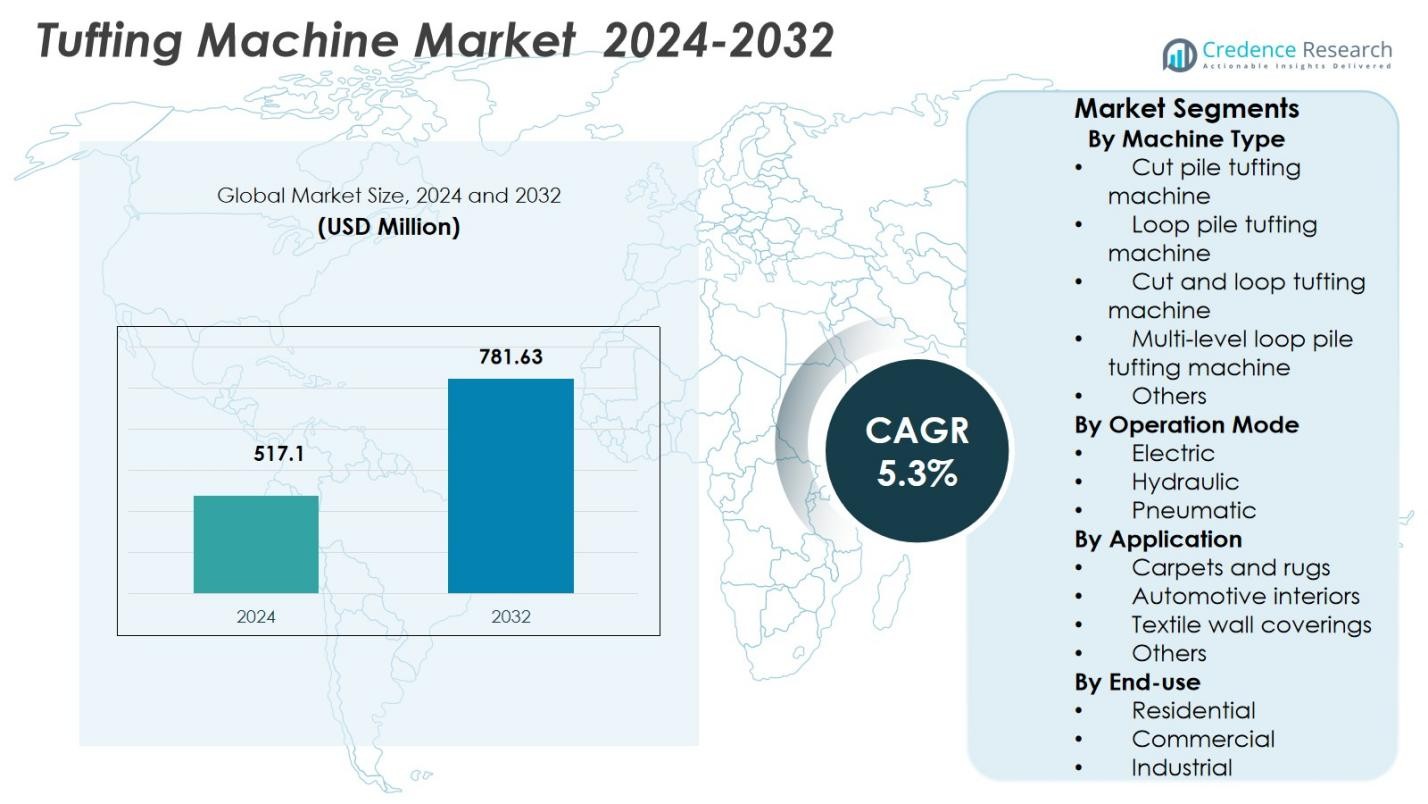

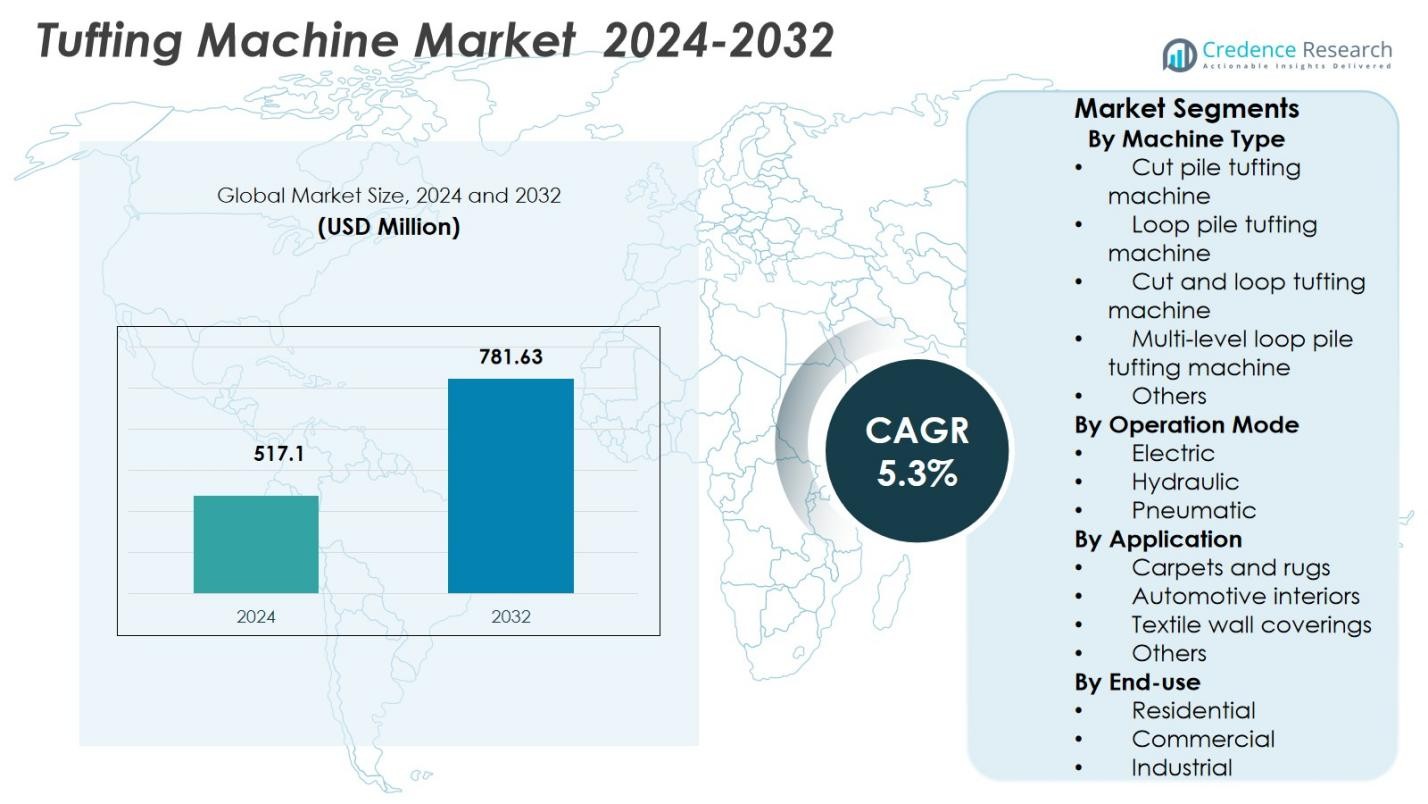

Tufting Machine Market size was valued at USD 517.1 million in 2024 and is anticipated to reach USD 781.63 million by 2032, growing at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tufting Machine Market Size 2024 |

USD 517.1 Million |

| Tufting Machine Market, CAGR |

5.3% |

| Tufting Machine Market Size 2032 |

USD 781.63 Million |

Tufting Machine Market is characterized by the presence of established global and regional manufacturers such as Groz-Beckert, Staubli, Tuftco, Card Monroe, Bonas, Sahinler, Suntech, Becker, Siemonsma, and Textile Machinery Associates, which focus on precision engineering, automation, and high-speed production capabilities. These players emphasize product innovation, digital control integration, and customized machine configurations to address diverse carpet, automotive, and interior textile requirements. From a regional perspective, Asia-Pacific led the Tufting Machine Market with a 34.9% market share in 2024, driven by large-scale textile manufacturing, cost-efficient production, and strong demand for carpets and rugs. Europe and North America follow, supported by advanced manufacturing infrastructure and steady demand for premium flooring and automotive interior textiles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Tufting Machine Market was valued at USD 517.1 million in 2024 and is projected to grow at a CAGR of 5.3% during the forecast period, driven by steady demand from flooring, automotive, and interior textile applications.

- Market growth is supported by rising carpet and rug manufacturing, increased construction activity, and expanding use of tufted textiles in automotive interiors, where manufacturers prioritize durability, design flexibility, and production efficiency.

- A key trend in the market is the increasing adoption of automated and digitally controlled tufting machines, with electric operation modes gaining wider preference due to higher precision, lower maintenance, and better energy efficiency.

- Cut pile tufting machines lead the market by machine type with a 41.6% share, while carpets and rugs dominate the application segment with a 58.3% share, reflecting strong demand from residential and commercial flooring industries.

- Asia-Pacific leads the market with a 34.9% share, followed by North America at 26.8% and Europe at 24.3%, while Latin America and the Middle East & Africa together account for the remaining share, supported by construction and hospitality growth.

Market Segmentation Analysis:

By Machine Type:

The Tufting Machine Market by machine type is led by cut pile tufting machines, which accounted for 41.6% market share in 2024. Their dominance is driven by strong demand from residential and commercial carpet manufacturing, where cut pile structures offer superior softness, durability, and aesthetic appeal. These machines support high production speeds, consistent pile height, and compatibility with a wide range of yarns, making them the preferred choice for large-scale carpet producers. Growing investments in premium flooring, hospitality projects, and home renovation activities continue to reinforce the leadership of cut pile tufting machines.

- For instancce, Card-Monroe’s Concept 2023 achieves straight sew speeds up to 1800 RPM at pile heights of 3/8″ and 5/8″, enabling efficient production for residential and automotive carpets.

By Operation Mode:

By operation mode, electric tufting machines dominated the Tufting Machine Market with a 47.9% share in 2024. Electric systems offer higher precision, lower energy losses, reduced maintenance requirements, and better integration with automated and digital control systems compared to hydraulic and pneumatic alternatives. Manufacturers increasingly adopt electric machines to improve operational efficiency, minimize downtime, and comply with energy-efficiency standards. The shift toward smart manufacturing and Industry 4.0–enabled textile plants further accelerates demand for electrically operated tufting machines across both developed and emerging textile markets.

- For instance, EFAB’s eTuft robotic machine delivers tufting speeds up to 2000 stitches per minute with cut pile heights of 12-75 mm, featuring wireless remote control and seamless integration with eDesigner software for precise positioning in modern carpet production.

By Application:

In terms of application, carpets and rugs emerged as the leading segment, capturing 58.3% market share in 2024. This dominance is supported by sustained global demand for residential flooring, commercial interiors, and hospitality infrastructure. Tufting machines are widely used in carpet and rug production due to their high output capacity, design flexibility, and cost efficiency. Urbanization, rising disposable income, and increasing preference for customized and patterned carpets drive continuous investment in tufting technologies, reinforcing the segment’s strong position within the overall Tufting Machine Market.

Key Growth Drivers

Expansion of Global Carpet and Flooring Manufacturing

The Tufting Machine Market benefits strongly from the expansion of global carpet and flooring manufacturing, driven by residential construction, commercial real estate development, and hospitality infrastructure growth. Rising urbanization and renovation activities increase demand for carpets, rugs, and textile floor coverings, particularly in Asia-Pacific and the Middle East. Tufting machines enable high-speed, large-volume carpet production with consistent quality and design flexibility, making them essential for manufacturers scaling operations. Growing preference for customized patterns and premium finishes further stimulates investment in advanced tufting equipment.

- For instance, A.T.E. India’s eTuft Robotic Tufting Machine integrates with design software for tufted carpets and artificial grass, handling pile heights from 13 to 75 mm in cut pile. It delivers production throughput of 1-6.5 sq m/hr at up to 2000 stitches/minute.

Increasing Adoption of Automated and High-Precision Machinery

Automation adoption significantly drives the Tufting Machine Market as manufacturers seek higher productivity, improved accuracy, and reduced labor dependency. Modern tufting machines integrate computerized controls, servo-driven systems, and digital patterning to deliver precise stitch density and uniform pile height. These capabilities reduce material wastage and rework while supporting complex designs. Textile producers increasingly invest in automated tufting solutions to enhance operational efficiency, meet tight production timelines, and maintain consistent quality standards across high-volume manufacturing environments.

- For instance, Tuftco’s iBalance software, patented under US 9,915,017, loads patterns and uses algorithms to balance yarn usage within repeats, minimizing waste while preserving design intent.

Growth in Automotive and Interior Textile Applications

Rising demand for automotive interiors and interior textile applications acts as a key growth driver for the Tufting Machine Market. Tufting technology is widely used in automotive carpets, trunk liners, and floor mats due to its durability and design versatility. Growth in vehicle production, especially in emerging economies, increases demand for high-performance interior textiles. Additionally, expanding use of tufted textiles in wall coverings and commercial interiors supports machine adoption, as manufacturers prioritize efficient production of specialized, application-specific textile products.

Key Trends & Opportunities

Integration of Digital Controls and Smart Manufacturing

A major trend shaping the Tufting Machine Market is the integration of digital controls and smart manufacturing technologies. Advanced machines feature real-time monitoring, programmable pattern control, and data-driven performance optimization. These capabilities enable manufacturers to improve process visibility, reduce downtime, and enhance product consistency. The growing focus on Industry 4.0 adoption creates opportunities for suppliers offering digitally enabled tufting machines that support predictive maintenance, remote diagnostics, and seamless integration with automated textile production lines.

- For instance, EFAB’s eTuft robotic tufting machine integrates eHMI software with a synchronized laser pointer and camera on the tufting head for precise positioning and automated repairing. The system supports nonstop cut/loop pile changeover and variable pile height effects from 4mm to 18mm, allowing quick parameter adjustments like stitch rate without mechanical downtime.

Rising Demand for Customized and Design-Focused Textiles

Increasing demand for customized and design-intensive textiles presents strong opportunities in the Tufting Machine Market. Consumers and commercial buyers seek unique textures, patterns, and multi-level pile structures in carpets and interior textiles. This trend drives demand for versatile tufting machines capable of producing cut, loop, and multi-level designs within a single platform. Manufacturers offering flexible and multi-function machines benefit from this shift, as textile producers invest in equipment that supports rapid design changes and short production runs.

- For instance, Wuding (WDCM) offers a multi‑level loop pile tufting machine with a double sliding needle bar that can produce carpets with 64 different loop heights at each needle, enabling complex, textured graphic patterns.

Key Challenges

High Capital Investment and Equipment Costs

High capital investment remains a significant challenge in the Tufting Machine Market, particularly for small and mid-sized textile manufacturers. Advanced tufting machines equipped with automation, digital controls, and energy-efficient systems require substantial upfront expenditure. In addition to purchase costs, installation, operator training, and maintenance further increase total ownership costs. These financial barriers can limit adoption in cost-sensitive markets and slow modernization efforts among manufacturers operating with constrained capital budgets.

Technical Complexity and Skilled Workforce Requirements

The increasing technical complexity of modern tufting machines poses another key challenge for the Tufting Machine Market. Advanced systems require skilled operators and technicians capable of managing computerized controls, software interfaces, and precision components. Limited availability of trained personnel in certain regions can lead to underutilization of machine capabilities and higher downtime risks. Manufacturers must invest in workforce training and technical support, which adds operational costs and may delay full-scale adoption of advanced tufting technologies.

Regional Analysis

North America

North America accounted for 26.8% market share in 2024 in the Tufting Machine Market, supported by strong demand from residential and commercial flooring industries. The region benefits from advanced manufacturing infrastructure, high automation adoption, and steady replacement demand for modern tufting equipment. Growth in renovation activities, hospitality projects, and commercial interiors sustains carpet and rug production. Additionally, automotive interior manufacturing in the United States drives demand for precision tufting machines. Manufacturers in the region emphasize high-speed, digitally controlled machines to improve productivity and meet strict quality standards.

Europe

Europe held a 24.3% market share in 2024 in the Tufting Machine Market, driven by established textile industries and strong demand for premium carpets and interior textiles. Countries such as Germany, the United Kingdom, Belgium, and Turkey remain key manufacturing hubs. The region emphasizes energy-efficient and automated tufting solutions aligned with sustainability regulations and advanced manufacturing practices. Demand from automotive interiors, commercial flooring, and textile wall coverings supports steady equipment upgrades. European manufacturers prioritize design flexibility and precision, reinforcing consistent investment in technologically advanced tufting machinery.

Asia-Pacific

Asia-Pacific dominated the Tufting Machine Market with a 34.9% market share in 2024, driven by large-scale textile manufacturing in China, India, and Southeast Asia. Rapid urbanization, infrastructure development, and rising disposable income fuel demand for carpets and rugs across residential and commercial sectors. The region benefits from cost-effective manufacturing, expanding automotive production, and increasing export-oriented carpet manufacturing. Local producers invest in high-capacity tufting machines to support mass production, while growing adoption of automation improves efficiency and product consistency across competitive textile markets.

Latin America

Latin America accounted for 7.2% market share in 2024 in the Tufting Machine Market, supported by expanding construction activity and growing demand for residential flooring. Countries such as Brazil and Mexico drive regional consumption through housing development and commercial infrastructure projects. The automotive sector also contributes to demand for tufted interior components. Manufacturers increasingly adopt modern tufting machines to improve productivity and reduce operational costs. Gradual industrial modernization and rising investment in local textile production support steady growth across the region.

Middle East & Africa

The Middle East & Africa region held a 6.8% market share in 2024 in the Tufting Machine Market, driven by hospitality, commercial construction, and infrastructure expansion. Demand for carpets and textile floor coverings is supported by hotel projects, offices, and residential developments, particularly in the Gulf countries. Local carpet manufacturing is expanding to reduce import dependence, driving investment in tufting equipment. In Africa, growing urban populations and rising consumer spending on home furnishings further support gradual adoption of tufting machines across the region.

Market Segmentations:

By Machine Type

- Cut pile tufting machine

- Loop pile tufting machine

- Cut and loop tufting machine

- Multi-level loop pile tufting machine

- Others

By Operation Mode

- Electric

- Hydraulic

- Pneumatic

By Application

- Carpets and rugs

- Automotive interiors

- Textile wall coverings

- Others

By End-use

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Tufting Machine Market is shaped by the presence of established manufacturers such as Groz-Beckert, Staubli, Tuftco, Card Monroe, Bonas, Sahinler, Suntech, Becker, and Textile Machinery Associates. The market features a mix of global leaders and specialized regional players competing on technology innovation, machine precision, and production efficiency. Companies focus on developing high-speed tufting machines with advanced automation, digital pattern control, and energy-efficient operation to meet evolving textile manufacturing requirements. Strategic investments in research and development enable suppliers to offer machines capable of handling complex designs and multiple pile structures. After-sales service, technical support, and customization capabilities play a critical role in supplier selection, particularly among large carpet and automotive textile manufacturers. Continuous upgrades, product differentiation, and expansion into emerging textile markets remain central to sustaining competitive positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Suntech

- Groz-Beckert

- Tuftco

- Siemonsma

- Becker

- Staubli

- Textile Machinery Associates

- Sahinler

- Bonas

- Card Monroe

Recent Developments

- In June 2025, Card-Monroe Corporation (CMC) announced a strategic OEM partnership with Appalachian Electronic Instruments (AEI) to integrate the TuftX single-end defect detection system into all new tufting machine sales worldwide.

- In September 2025, Vandewiele partnered with Shaj Corporation to showcase tufting innovations at DTG 2025 in Dhaka, highlighting high-speed platforms like HST Tufting.

- In October 2025, Stäubli unveiled the SAFIR PRO S37 automatic drawing-in machine at ITMA Asia 2025, reflecting advanced automation and precision solutions in textile machinery.

Report Coverage

The research report offers an in-depth analysis based on Machine Type, Operation Mode, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Tufting Machine Market will continue to benefit from sustained demand for carpets, rugs, and interior textiles across residential and commercial sectors.

- Manufacturers will increasingly adopt automated and digitally controlled tufting machines to improve productivity and quality consistency.

- Integration of smart monitoring and data-driven maintenance will become more common to reduce downtime and operational costs.

- Demand for multi-functional machines capable of producing cut, loop, and multi-level pile designs will strengthen.

- Electric operation modes will gain wider acceptance due to energy efficiency and lower maintenance requirements.

- Growth in automotive interior textiles will support steady demand for precision tufting equipment.

- Emerging economies will drive new installations as local textile manufacturing capacities expand.

- Sustainability requirements will encourage development of energy-efficient and low-waste tufting technologies.

- Customization and short production runs will increase demand for flexible and adaptable machine configurations.

- Strategic partnerships and technology upgrades will remain critical for suppliers to strengthen market positioning.