Market Overview

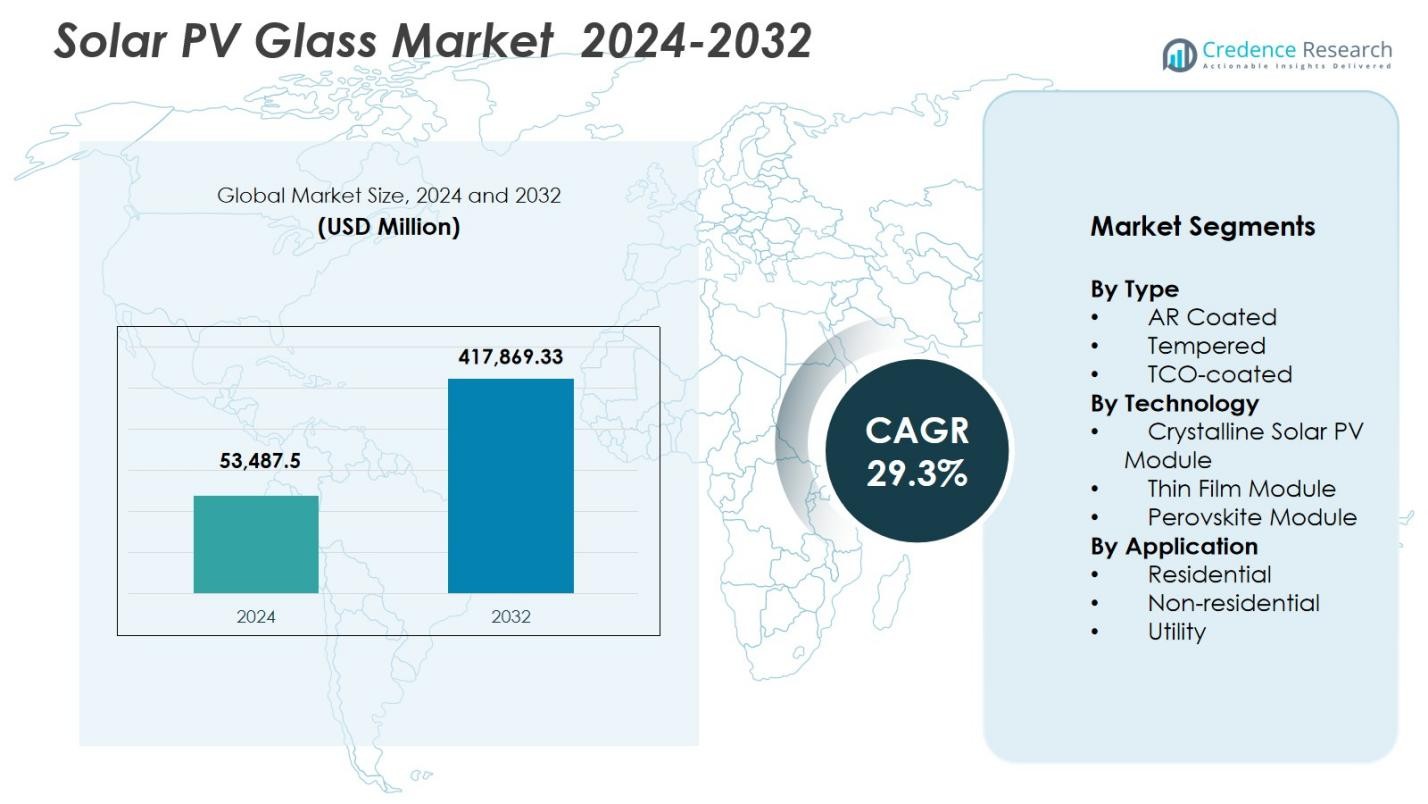

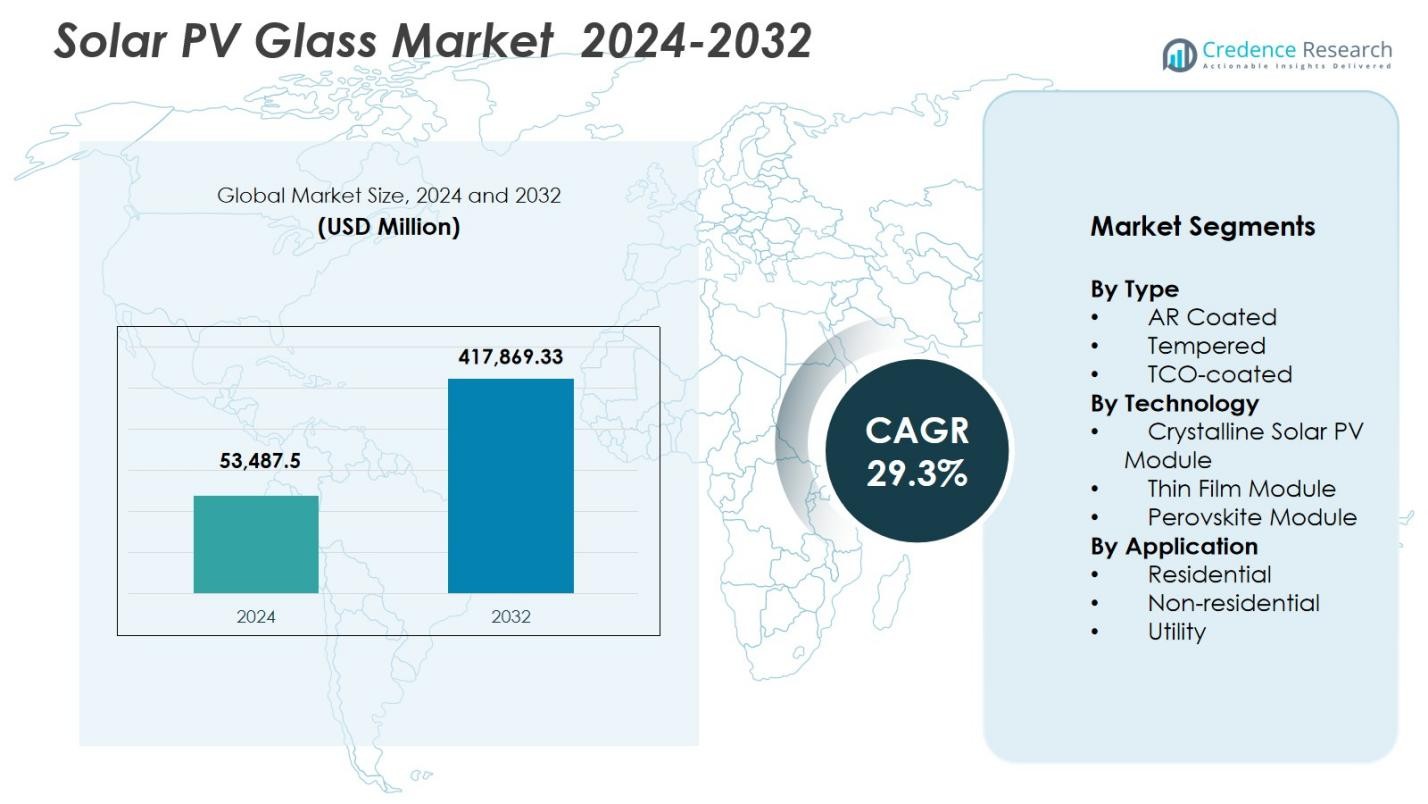

Solar PV Glass Market size was valued at USD 53,487.5 Million in 2024 and is anticipated to reach USD 417,869.33 Million by 2032, at a CAGR of 29.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar PV Glass Market Size 2024 |

USD 53,487.5 Million |

| Solar PV Glass Market, CAGR |

29.3% |

| Solar PV Glass Market Size 2032 |

USD 417,869.33 Million |

The Solar PV Glass Market is driven by strong participation from leading manufacturers such as Xinyi Solar Holding Ltd., First Solar Inc., Saint-Gobain S.A., Nippon Sheet Glass Co. Ltd., Guardian Industries, and Borosil Renewables, all of which continue to expand capacity and advance coating technologies to meet rising global demand. These companies focus on high-transmittance, low-iron, and anti-reflective glass solutions that support high-efficiency and bifacial module production. Asia-Pacific remains the dominant regional market, accounting for 41.6% of global share, supported by extensive solar manufacturing ecosystems and large-scale installation pipelines, while Europe and North America follow with steady growth driven by clean energy policies and technological adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Solar PV Glass Market was valued at USD 53,487.5 million in 2024 and is projected to reach USD 417,869.33 million by 2032, registering a CAGR of 29.3%.

- Market growth is driven by rising global solar installations, strong demand for high-efficiency modules, and increasing adoption of double-glass and bifacial technologies that require advanced PV glass solutions.

- Key trends include rapid expansion of building-integrated photovoltaics (BIPV), improvements in anti-reflective and low-iron glass technologies, and a shift toward ultra-thin, lightweight designs for next-generation modules.

- Leading players such as Xinyi Solar, First Solar, Saint-Gobain, Borosil Renewables, Guardian Industries, and Nippon Sheet Glass strengthen competition through capacity expansions and technology upgrades across major markets.

- Asia-Pacific holds the largest regional share at 41.6%, while Europe captures 25.7% and North America holds 21.4%; AR-coated glass leads the type segment with 46.8% share, and crystalline modules dominate technology adoption with 72.4% share.

Market Segmentation Analysis

Market Segmentation Analysis

By Type

The Solar PV Glass Market demonstrates strong momentum across type categories, with AR-coated glass leading the segment with a dominant 46.8% market share in 2024. Its ability to enhance light transmission by 2–4%, reduce reflection losses, and improve overall module efficiency keeps it the preferred choice for high-performance solar installations. Tempered glass follows due to its structural durability, thermal resistance, and suitability for harsh environments. Meanwhile, TCO-coated glass is gaining traction in thin-film technologies. Increasing demand for high-efficiency modules and utility-scale solar farm expansion continues to drive adoption of advanced AR-coated solutions.

- For instance, laboratory measurements of AR-coated PV modules demonstrated increases in DC power output by about 6.4% (or +5.5% by modified performance ratio) relative to equivalent modules with uncoated glass illustrating how AR coatings translate directly into higher module output.

By Technology

Crystalline solar PV modules account for the largest share of 72.4% in the Solar PV Glass Market, supported by their high conversion efficiency, durability, and widespread global deployment. These modules rely heavily on high-transmittance, low-iron glass, strengthening demand for premium PV glass solutions. Thin-film modules contribute steady growth due to their lightweight structure and suitability for large-area installations, while perovskite modules show rapid innovation and early-stage commercialization potential. The dominance of crystalline technology is driven by declining production costs, strong rooftop adoption, and expansive utility-scale solar projects worldwide.

- For instance, First Solar’s thin-film Series 7 modules, launched in 2023-2024, use proprietary tempered front glass optimized for CdTe technology, demonstrating how thin-film advancements continue to stimulate specialized glass requirements.

By Application

The utility segment dominates the Solar PV Glass Market with a 54.2% market share, driven by large-scale solar parks requiring durable, high-efficiency PV glass for sustained energy output. Rapid investments in renewable energy infrastructure, government-backed solar tenders, and declining levelized cost of electricity (LCOE) support strong demand from this application cluster. The non-residential segment follows, fueled by commercial rooftop installations and industrial decarbonization initiatives. The residential segment is expanding steadily as distributed solar systems gain traction. Utility-scale capacity additions remain the primary driver for high-volume, performance-optimized solar PV glass consumption.

Key Growth Drivers

Expanding Global Solar Capacity and Utility-Scale Installations

Rapid expansion of global solar capacity stands as a primary growth driver for the Solar PV Glass Market, especially as nations intensify renewable energy targets to reduce carbon emissions. Utility-scale solar farms require high volumes of durable, high-transmittance PV glass to maximize output, making this segment the largest consumer. Government incentives, declining levelized cost of electricity (LCOE), and large-scale solar tenders across China, India, the U.S., and Europe continue to accelerate adoption. Advanced PV glass technologies, such as anti-reflective and bifacial-compatible structures, further enhance energy generation and operational efficiency. The integration of solar into industrial power procurement and grid modernization efforts strengthens long-term demand. As developers aim for higher yield and stable performance in harsh climatic environments, the need for robust PV glass solutions increases. These combined factors position utility installations as a sustained engine for market expansion globally.

- For instance, China added 216 GW of new solar capacity in 2023, the highest annual addition ever recorded, driving unprecedented demand for high-transmittance PV glass in utility-scale deployments.

Advancements in High-Efficiency Module Technologies

Technological advancements in solar modules significantly drive the need for specialized PV glass with enhanced optical and mechanical properties. The shift toward high-efficiency architectures such as PERC, TOPCon, heterojunction, and bifacial modules requires glass that delivers superior light transmittance, low reflectivity, and strong durability. These next-generation modules depend on anti-reflective coatings, low-iron composition, and textured surfaces to optimize photon absorption. As manufacturers push module efficiency beyond 22–24%, PV glass becomes a critical performance determinant. Additionally, the rising deployment of bifacial modules accelerates demand for double-glass designs that provide long-term stability and enhanced energy yield. Innovations in perovskite and tandem cells also boost the need for ultra-thin, flexible, and high-clarity glass solutions. With solar module manufacturers racing to differentiate performance, the role of advanced PV glass continues to strengthen as a core enabler of high-output systems.

- For instance, REC’s heterojunction Alpha Pure-R modules achieve efficiencies above 22.3%, enabled by double-glass construction and specialized AR-coated surfaces that enhance bifacial response.

Rising Adoption of Rooftop Solar Across Residential and Commercial Sectors

Growing adoption of rooftop solar systems in residential, commercial, and industrial sectors serves as a major growth catalyst, driven by rising electricity prices, net metering policies, and increasing consumer preference for self-sustaining energy solutions. Rooftop installations require lightweight, durable PV glass engineered for long-term exposure to varying weather conditions. Enhanced safety norms and urban building-integrated photovoltaics (BIPV) are further accelerating the use of specialized PV glazing. Commercial properties including retail chains, warehouses, hotels, and office complexes are increasingly integrating solar to reduce operational costs and meet ESG commitments. Demand for aesthetically appealing glass solutions, such as colored, textured, or semi-transparent PV glass, is also expanding as architectural solar gains traction. With rooftop solar becoming a central component of distributed energy strategies worldwide, the need for versatile and high-performance PV glass continues to rise sharply.

Key Trends & Opportunities

Growth of Bifacial Modules and Double-Glass Technologies

The rapid global shift toward bifacial solar modules is reshaping demand patterns for Solar PV Glass, creating new opportunities for manufacturers specializing in double-glass technologies. Bifacial modules generate power from both sides, requiring high-transmittance, low-iron glass on the front and durable, transparent glass or coatings on the rear. As these modules offer 5–20% higher energy yield, their adoption is increasing across utility-scale and commercial installations, particularly in regions with high ground reflectivity or snowy climates. This trend creates a strong market pull for robust, tempered double-glass structures that replace traditional polymer backsheets. The enhanced lifespan, improved fire resistance, and reduced degradation rates of double-glass modules further reinforce their appeal. With global manufacturers expanding bifacial production lines, PV glass suppliers are positioned to benefit from long-term volume growth and premium product demand.

- For instance, LONGi reported that its bifacial PERC modules achieved 10–25% higher energy yield in high-albedo field tests, accelerating demand for durable double-glass constructions in utility projects.

Emergence of Building-Integrated Photovoltaics (BIPV)

Building-integrated photovoltaics are rapidly emerging as a transformative opportunity for the Solar PV Glass Market, driven by the architectural demand for energy-generating building materials. BIPV systems incorporate solar glass into facades, windows, skylights, and roofing, creating dual functionality structural aesthetics and power generation. The trend aligns with global green building certifications, net-zero construction mandates, and urban sustainability goals. Manufacturers have begun producing customizable solar glass options, including colored, semi-transparent, and patterned variants that meet design and energy requirements. Advancements in thin-film and perovskite technologies further enhance BIPV performance under low-light conditions, broadening installation potential in dense city environments. With construction industries prioritizing integrated renewable solutions, BIPV represents one of the strongest long-term growth opportunities for PV glass producers.

- For instance, Onyx Solar installed semi-transparent photovoltaic glass at the Dubai Frame and Copenhagen International School, where façade-integrated PV glass generates onsite electricity while providing daylighting.

Key Challenges

High Production Costs and Raw Material Price Volatility

One of the primary challenges for the Solar PV Glass Market is the high cost of production, driven by energy-intensive manufacturing processes and volatile prices of key raw materials such as silica sand, soda ash, and specialized coatings. The transition toward advanced, low-iron, AR-coated, and tempered PV glass further elevates production complexity and cost pressure. Manufacturers also face rising furnace operating expenses due to decarbonization mandates and global energy price fluctuations. These cost burdens often transfer downstream to module producers, affecting overall solar system pricing and project economics. Smaller manufacturers struggle to compete with large, vertically integrated players who benefit from economies of scale. Without consistent cost optimization and supply stability, profitability remains a significant concern for the industry.

Supply Chain Constraints and Limited Manufacturing Capacity

Rapid global expansion in solar installations has exposed supply chain limitations, with PV glass production capacity struggling to match module manufacturing growth. Long lead times, regional production imbalances, and logistic bottlenecks have created periodic shortages, affecting module delivery schedules and project execution timelines. Concentration of PV glass manufacturing in specific countries intensifies dependency risks, especially during geopolitical disruptions or trade restrictions. Transporting heavy glass adds further logistical complexity and cost, limiting cross-border flexibility. These constraints also make it difficult for emerging solar technologies such as bifacial and BIPV systems to scale efficiently. Addressing capacity gaps and expanding localized production remain critical for ensuring reliable supply and supporting the accelerating pace of global solar deployment.

Regional Analysis

North America

North America holds a significant position in the Solar PV Glass Market, accounting for 21.4% of global share in 2024, supported by strong renewable energy commitments, expanding utility-scale solar farms, and rising installations across commercial rooftops. The U.S. drives most of the demand due to federal tax incentives, state-level clean energy mandates, and accelerating adoption of bifacial and high-efficiency modules. Growth in distributed solar, corporate power purchase agreements (PPAs), and rapid expansion of solar manufacturing capacity under the Inflation Reduction Act further strengthen demand for advanced PV glass. Canada contributes steadily with increasing solar participation in provincial energy transitions.

Europe

Europe captures 25.7% of the Solar PV Glass Market in 2024, driven by stringent carbon neutrality goals, modernization of grid infrastructure, and aggressive adoption of rooftop and ground-mounted solar systems. Germany, Spain, Italy, and the Netherlands lead installations due to favorable tariffs and declining LCOE for solar projects. The region’s strong tilt toward bifacial modules and rising adoption of building-integrated photovoltaics (BIPV) boosts demand for specialized solar glass. EU energy security initiatives and large-scale investments in local manufacturing are accelerating capacity expansions. Sustainability regulations also support increased uptake of low-iron and AR-coated glass technologies.

Asia-Pacific

Asia-Pacific dominates the Solar PV Glass Market with 41.6% global share, fueled by massive solar deployment across China, India, Japan, and South Korea. China remains the world’s largest producer and consumer of PV glass, driven by extensive manufacturing capacity, export momentum, and utility-scale solar expansion. India’s accelerating solar tenders, rooftop solar incentives, and domestic manufacturing push under PLI schemes further elevate demand. The region benefits from favorable government policies, declining production costs, and widespread adoption of high-efficiency modules. Rapid growth in bifacial, double-glass, and thin-film technologies strengthens Asia-Pacific’s leadership in PV glass consumption and supply.

Latin America

Latin America accounts for 6.3% of the global Solar PV Glass Market in 2024, supported by increasing solar installations across Brazil, Mexico, Chile, and Argentina. Large-scale solar farms dominate demand due to favorable climatic conditions, competitive project auctions, and rising energy diversification initiatives. Brazil leads regional growth with strong investment in utility-scale PV, while Chile leverages high solar irradiance for industrial power generation. Adoption of distributed solar in commercial applications is also increasing. Government-backed renewable energy programs, combined with declining module prices and corporate clean energy commitments, continue to stimulate demand for durable, high-performance PV glass across the region.

Middle East & Africa

The Middle East & Africa region holds 5.0% of the Solar PV Glass Market, driven by rapid expansion of large-scale solar parks and ambitious renewable energy targets across the UAE, Saudi Arabia, South Africa, and Egypt. High solar irradiance levels create ideal conditions for PV deployment, boosting demand for robust, high-transmittance solar glass capable of withstanding harsh desert environments. Mega-projects such as NEOM, Mohammed bin Rashid Solar Park, and Benban Solar Park fuel significant consumption volumes. Ongoing investment in grid modernization, industrial decarbonization, and utility-scale tenders further strengthen regional growth prospects for advanced solar PV glass solutions.

Market Segmentations

By Type

- AR Coated

- Tempered

- TCO-coated

By Technology

- Crystalline Solar PV Module

- Thin Film Module

- Perovskite Module

By Application

- Residential

- Non-residential

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Solar PV Glass Market is shaped by a mix of global manufacturers and vertically integrated solar companies that continue to expand production capacity, enhance technological capabilities, and strengthen supply chain resilience. Leading players such as Xinyi Solar Holding Ltd., First Solar Inc., Saint-Gobain S.A., Nippon Sheet Glass Co. Ltd., Guardian Industries, and Borosil Renewables dominate the market through large-scale manufacturing, advanced coating technologies, and extensive distribution networks. Companies are increasingly investing in high-transmittance, low-iron, anti-reflective, and double-glass solutions to meet the growing demand for high-efficiency modules, bifacial panels, and emerging BIPV applications. Strategic initiatives including capacity expansions in Asia-Pacific, backward integration into raw materials, and partnerships with solar module manufacturers are enhancing competitive positioning. As global solar installations surge, competition intensifies around product durability, optical performance, and cost optimization, driving continuous innovation across the PV glass value chain.

Key Player Analysis

- Guardian Industries

- ReneSola Ltd.

- Hanwha Q CELLS Co.

- Sun Power Corporation

- Borosil Glass Works Limited

- Saint-Gobain S.A

- First Solar Inc.

- Yingli Green Energy Holding Company Ltd.

- Xinyi Solar Holding Ltd.

- Nippon Sheet Glass Co. Ltd.

Recent Developments

- In November 2024, Onyx Solar unveiled its next-generation walkable solar PV glass tiles designed for decks, patios, and pedestrian pathways. Each 8 mm anti-slip safety glass tile delivers 75 W output and withstands loads up to 400 kg/m², enhancing durability and functional aesthetics for integrated solar surfaces.

- In August 2024, Ankara Solar Energy rolled out a new line of walkable PV flooring tailored for both commercial and residential installations. Now available across Europe and the U.S., the product range includes 30 W and 120 W square panels featuring anti-slip glass and a pedestal-supported installation system.

- In April 2024, Bluebird Solar introduced its n-type TOPCon dual-glass bifacial PV module at RenewX 2024 in Hyderabad. The module delivers 600 Wp output, 23.25% efficiency, and incorporates a 16-busbar architecture to reduce resistive losses.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness accelerated adoption of high-efficiency PV glass as global solar capacity continues to expand across utility and rooftop segments.

- Growth in bifacial module installations will drive stronger demand for double-glass structures with enhanced durability and optical performance.

- Manufacturers will increasingly shift toward low-carbon and sustainable PV glass production to meet tightening environmental regulations.

- Building-integrated photovoltaics will emerge as a major long-term opportunity, boosting demand for customizable solar glass solutions.

- Technological advancements in perovskite and tandem cells will create new requirements for ultra-thin and high-transmittance PV glass.

- Increased localization of solar manufacturing in Asia, Europe, and the U.S. will enhance supply chain stability and regional competitiveness.

- Automation and digital quality control will improve glass processing efficiency and reduce production costs.

- Strategic partnerships between PV glass manufacturers and module producers will streamline innovation and product alignment.

- Market players will expand coating technologies to improve light absorption, anti-soiling, and weather resistance.

- Rising corporate sustainability commitments and clean energy policies will support strong long-term demand for advanced solar PV glass worldwide.

Market Segmentation Analysis

Market Segmentation Analysis