Market Overview

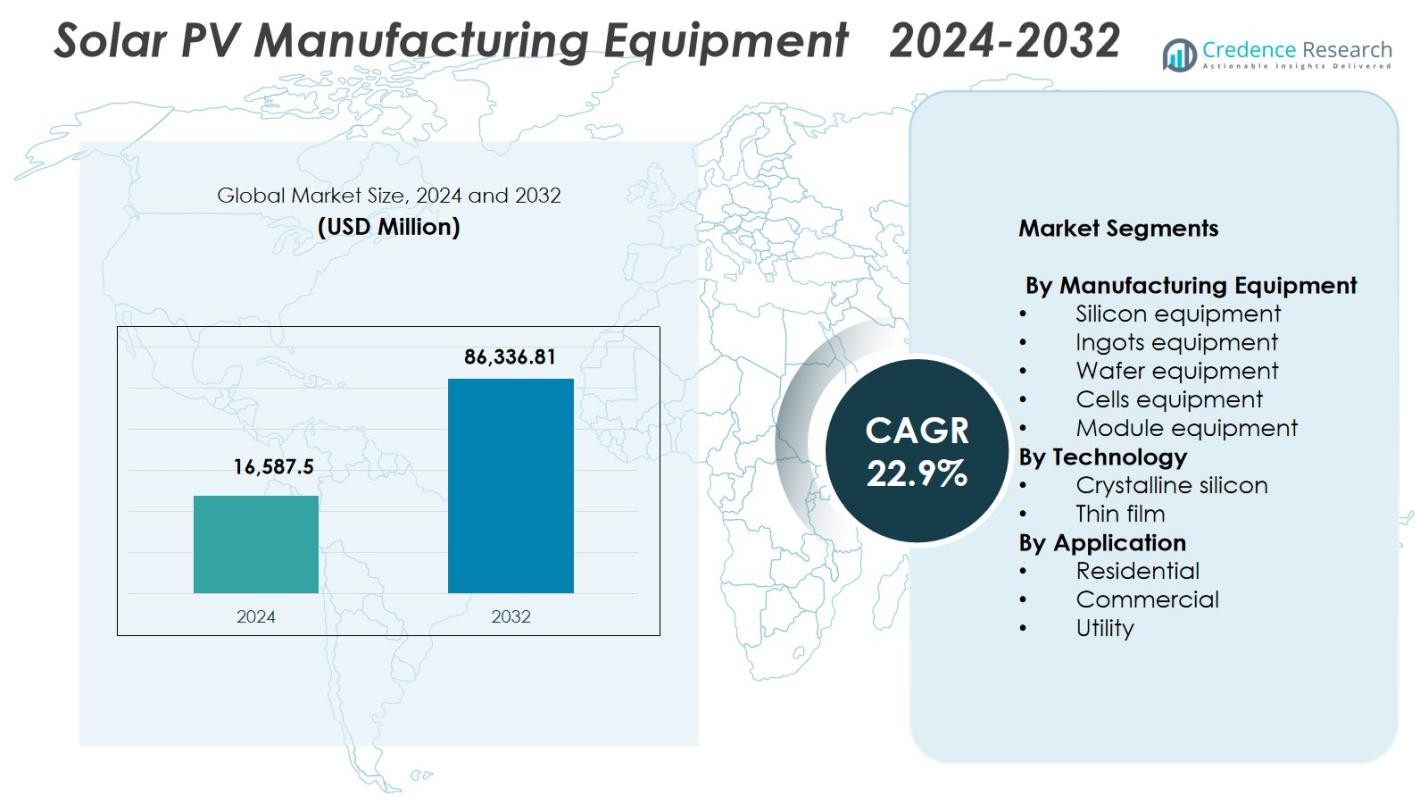

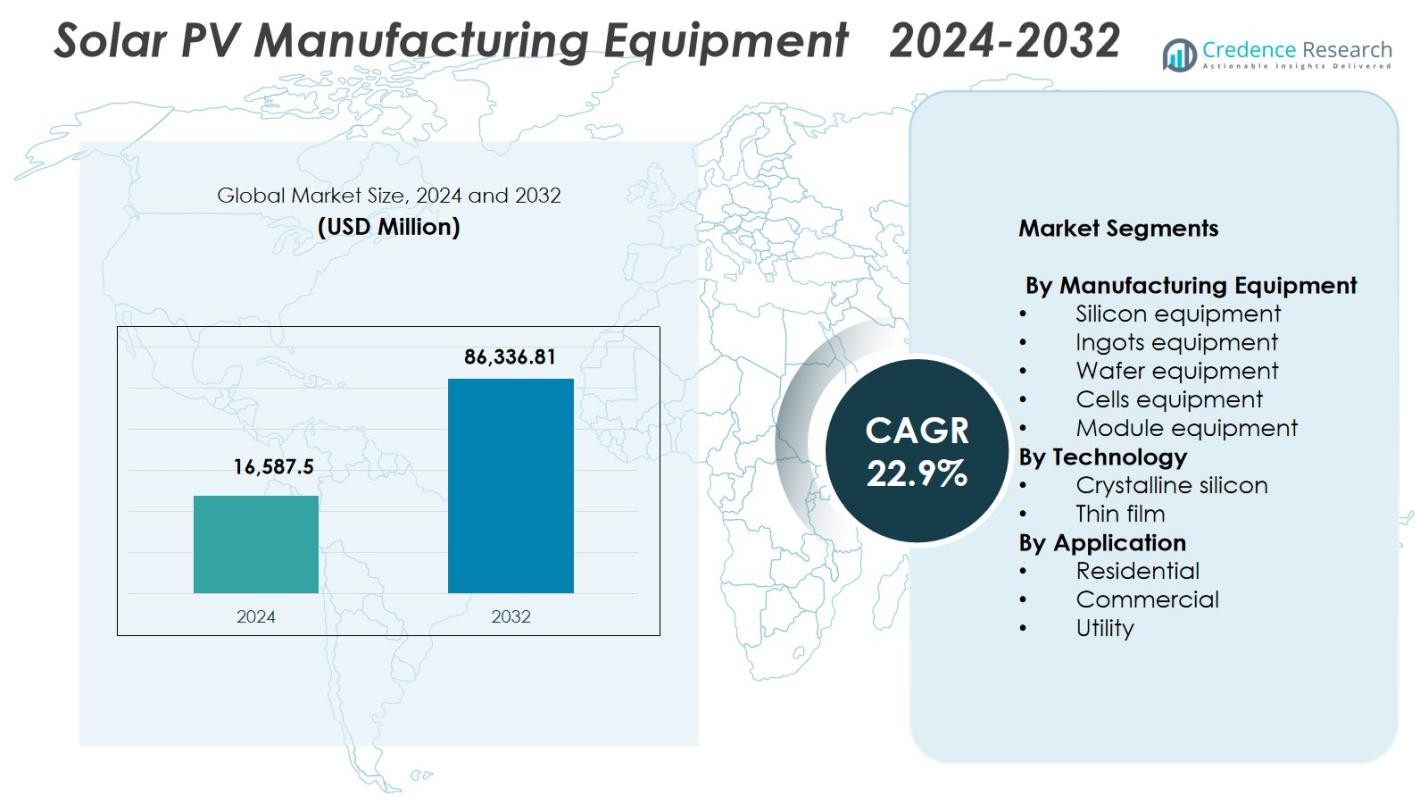

Solar PV Manufacturing Equipment Market size was valued at USD 16,587.5 Million in 2024 and is anticipated to reach USD 86,336.81 Million by 2032, at a CAGR of 22.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar PV Manufacturing Equipment Market Size 2024 |

USD 16,587.5 Million |

| Solar PV Manufacturing Equipment Market, CAGR |

22.9% |

| Solar PV Manufacturing Equipment Market Size 2032 |

USD 86,336.81 Million |

Solar PV Manufacturing Equipment Market features leading players such as Applied Materials, Meyer Burger, Horiba, Centrotherm, Tempress Systems, Singulus Technologies, CETC Solar, and Jinchen Machinery, each advancing high-precision tools for ingot, wafer, cell, and module production. These companies focus on high-throughput automation, digitalized manufacturing, and equipment tailored for technologies like TOPCon, HJT, and bifacial modules. Asia-Pacific emerges as the dominant region with a 41.6% market share, driven by large-scale manufacturing capacity, strong policy support, and extensive investments in next-generation PV technologies. Europe and North America also expand steadily as governments strengthen solar manufacturing ecosystems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Solar PV Manufacturing Equipment Market reached USD 16,587.5 Million in 2024 and is projected to grow at a CAGR of 22.9% through 2032.

- Market growth is driven by rising global solar installations and strong demand for high-efficiency cell technologies such as TOPCon, HJT, and IBC, which require advanced production equipment.

- A key trend is the rapid shift toward automation, AI-enabled quality control, and digitalized manufacturing lines designed to enhance yield and reduce operational costs.

- Major players focus on expanding high-throughput ingot, wafer, cell, and module equipment portfolios as the cells equipment segment leads with 34.8% market share in 2024.

- Asia-Pacific dominates regional demand with a 41.6% share, supported by large-scale manufacturing ecosystems, while Europe holds 25.7% and North America 22.4%, reflecting strong policy-driven capacity expansion.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Manufacturing Equipment

The Solar PV Manufacturing Equipment Market is dominated by cells equipment, holding 34.8% market share in 2024, driven by rapid advancements in high-efficiency cell architectures such as TOPCon, HJT, and IBC. Demand for precision automation, upgraded metallization lines, and advanced PECVD and PVD tools further accelerates investment in this segment. Module and wafer equipment also witness steady adoption as manufacturers expand capacity to meet global solar installation targets. However, the dominant position of cells equipment is reinforced by continuous innovation focused on boosting conversion efficiency and reducing cost per watt across large-scale production facilities.

- For instance, Reliance Industries has commissioned its first gigawatt-scale heterojunction module line in Jamnagar, designed as part of a planned 10 GW vertically integrated complex from polysilicon to modules, with HJT panels already reaching up to 720 Wp output and BIS certification.

By Technology

Within the Solar PV Manufacturing Equipment Market, crystalline silicon technology leads with a 78.6% market share, supported by its established supply chain, high module efficiency, and strong deployment across residential, commercial, and utility-scale installations. The segment benefits from ongoing technological enhancements including PERC, TOPCon, and bifacial designs, which require sophisticated manufacturing tools for wafer texturing, diffusion, and passivation. Thin-film technology also expands, especially in cadmium telluride and CIGS solutions, but crystalline silicon maintains dominance due to its scalability, cost competitiveness, and widespread industry adoption across global manufacturing clusters.

- For instance, SENTECH’s SENsolar PV system supports PERC and TOPCon manufacturing through quality control measurements of SiO2, Al2O3, and SiNx films for front-side anti-reflection and backside passivation.

By Application

The utility segment holds the leading position in the Solar PV Manufacturing Equipment Market with a 62.4% market share in 2024, driven by large-scale solar farm developments and national renewable energy targets. Utility developers prioritize high-efficiency modules and advanced manufacturing lines that support gigawatt-scale production, strengthening demand for automated cell, wafer, and module equipment. Commercial and residential applications continue to grow, supported by rooftop solar incentives and declining module costs. However, the utility segment remains dominant as governments and IPPs expand ultra-large solar parks to accelerate grid decarbonization and meet long-term capacity addition goals.

Key Growth Drivers

Rising Global Solar Capacity Expansion

The Solar PV Manufacturing Equipment Market grows strongly as nations accelerate solar deployment to meet energy transition goals. Utility-scale solar parks, rooftop programs, and green hydrogen initiatives are driving record additions in photovoltaic capacity. This expansion compels manufacturers to invest in advanced ingot, wafer, cell, and module production lines to support multi-gigawatt output. Government incentives, declining LCOE, and supportive industrial policies in China, India, the U.S., and Europe further enhance equipment demand. As production scales rapidly, manufacturers prioritize high-precision, automated systems to ensure efficiency, yield improvement, and cost competitiveness.

- For instance, Adani Solar is constructing a fully integrated 10 GW solar PV manufacturing ecosystem in Mundra, India, incorporating advanced machinery for ingot, wafer, cell, and module production sourced from leading vendors to achieve global benchmarks in scale and reliability.

Advancement of High-Efficiency PV Technologies

Rapid adoption of high-efficiency technologies such as TOPCon, HJT, and IBC significantly boosts demand for cutting-edge manufacturing equipment. These technologies require sophisticated tools for passivation, metallization, laser processing, and cell interconnection, prompting manufacturers to upgrade production lines. Growing interest in bifacial and tandem-junction modules further accelerates equipment modernization. As industry stakeholders compete to increase module efficiency and reduce cost per watt, innovative manufacturing systems offering tighter process control, higher throughput, and improved material utilization become critical growth catalysts across the global PV equipment supply chain.

- For instance, Premier Energies commissioned a 1.2 GW TOPCon cell manufacturing line in Hyderabad using advanced 16-busbar architecture for efficiencies exceeding 25%, expanding total cell capacity from 2 GW to 3.2 GW.

Government Policies and Domestic Manufacturing Push

Supportive government policies including subsidies, tax credits, import barriers, and PLI-type incentives are driving strong investment in domestic PV manufacturing. Countries aim to reduce dependence on imports, strengthen energy security, and create vertically integrated solar production ecosystems. This policy environment boosts demand for equipment across silicon, ingots, wafers, cells, and modules. Strategic funding for clean energy manufacturing and reshoring initiatives encourages companies to establish new production lines and upgrade legacy infrastructure. These manufacturing expansion programs significantly enhance equipment procurement, benefiting global suppliers of advanced solar production machinery.

Key Trends & Opportunities

Shift Toward Fully Automated and Smart Manufacturing

A major trend reshaping the Solar PV Manufacturing Equipment Market is the transition toward fully automated, AI-enabled production environments. Manufacturers adopt robotics, real-time monitoring systems, digital twins, and predictive maintenance tools to enhance yield, reduce downtime, and optimize material flow. Smart manufacturing platforms also support tighter process control for advanced PV technologies. This shift creates significant opportunities for equipment suppliers delivering integrated automation, AI-driven analytics, and factory-level digitalization solutions that allow solar manufacturers to improve efficiency, scalability, and cost-effectiveness across high-volume production lines.

- For instance, POWERCHINA Hubei Electric Engineering used digital twins in MicroStation and OpenBuildings to automate placement and angling of 14,080 solar panels on hilly terrain for an 80-megawatt PV station.

Opportunities in Next-Generation PV Materials and Technologies

Emerging PV solutions including perovskite-silicon tandem cells, thin-film technologies, and advanced coating materials create new opportunities for specialized manufacturing equipment. The industry is investing heavily in R&D to commercialize these high-efficiency, low-cost alternatives, which require unique deposition, printing, encapsulation, and material-handling tools. Equipment providers that develop scalable, high-throughput systems tailored for next-generation materials stand to gain significant market share. As global demand shifts toward higher-performance and more durable modules, suppliers who innovate early in this space will capture long-term commercial advantages.

- For instance, First Solar’s Series 7 thin-film CdTe modules, rated up to around 550 W with module efficiencies near 18%-19% and generating up to 8% more energy per watt than conventional crystalline silicon modules in hot climates, rely on large-area vapor deposition and glass-handling systems that exemplify the need for specialized high-throughput equipment.

Key Challenges

High Capital Investment Requirements

One of the major challenges in the Solar PV Manufacturing Equipment Market is the substantial capital investment required to establish or expand production facilities. Setting up ingot, wafer, cell, and module lines involves complex, high-precision equipment that demands significant upfront expenditure. Smaller manufacturers often struggle to secure financing, especially in volatile policy or pricing environments. Rapid technological evolution also increases the risk of equipment becoming obsolete, compelling companies to frequently reinvest. These financial pressures limit market participation and create barriers for new entrants attempting to scale production.

Technological Complexity and Rapid Innovation Cycles

The fast-paced evolution of solar cell technologies presents an ongoing challenge for equipment suppliers and manufacturers. Transitioning from PERC to TOPCon, HJT, or tandem cells requires entirely new production tools, advanced process expertise, and continuous workforce training. This rapid innovation cycle increases operational complexity and creates integration difficulties for legacy manufacturing lines. Companies that fail to adapt quickly risk losing competitiveness. Additionally, ensuring consistent product quality across increasingly sophisticated PV designs demands rigorous calibration, testing, and precision engineering, further intensifying technical and operational challenges.

Regional Analysis

North America

North America secures a strong presence in the Solar PV Manufacturing Equipment Market, supported by large-scale investments in domestic solar manufacturing and favorable policy frameworks such as the Inflation Reduction Act. The region accounts for 22.4% market share in 2024, driven by expanding cell and module production capacity in the U.S. and the growing push to reduce reliance on Asian imports. Technological advancements, automation upgrades, and rising utility-scale solar installations further stimulate equipment demand. Strategic partnerships between equipment suppliers and emerging manufacturers continue to strengthen the region’s long-term manufacturing ecosystem.

Europe

Europe commands 25.7% market share in the Solar PV Manufacturing Equipment Market, driven by strong regulatory backing, energy security priorities, and large-scale initiatives to revitalize regional solar manufacturing. The EU’s emphasis on creating a resilient PV supply chain, combined with incentives for sustainable and high-efficiency technologies, boosts demand for advanced ingot, wafer, cell, and module production equipment. Increasing adoption of high-efficiency architectures such as TOPCon and HJT also accelerates equipment upgrades. Europe’s commitment to decarbonization and circular manufacturing continues to position the region as a key growth hub for specialized PV technologies.

Asia-Pacific

Asia-Pacific leads the Solar PV Manufacturing Equipment Market with a dominant 41.6% market share, driven by its highly integrated solar manufacturing ecosystem and world-leading production capacities in China, India, South Korea, and Southeast Asia. Massive investments in gigawatt-scale production lines for wafers, cells, and modules continue to elevate equipment demand. The region benefits from strong government support, competitive manufacturing costs, and rapid adoption of next-generation technologies. As countries expand renewable energy targets and strengthen export capabilities, Asia-Pacific remains the global epicenter for PV equipment deployment, innovation, and large-volume manufacturing growth.

Latin America

Latin America captures 5.3% market share in the Solar PV Manufacturing Equipment Market, supported by emerging investments in localized module assembly and increasing solar deployment across Brazil, Mexico, and Chile. Growing interest in reducing import dependence and supporting domestic renewable manufacturing encourages regional procurement of module and balance-of-line equipment. Expanding utility-scale solar tenders and improving financing frameworks further contribute to equipment demand. Although still developing, the region’s manufacturing landscape presents significant long-term potential as nations pursue energy diversification, cost-competitive solar power, and industrialization of clean energy technologies.

Middle East & Africa

The Middle East & Africa region holds 5.0% market share in the Solar PV Manufacturing Equipment Market, driven by ambitious solar deployment plans and national programs promoting local manufacturing. Countries like the UAE, Saudi Arabia, Egypt, and South Africa increasingly invest in module assembly lines and early-stage cell production capacity to support large-scale solar projects. Strong demand from utility-scale installations, combined with favorable industrial policies and economic diversification goals, enhances equipment investments. While the region’s manufacturing base is still expanding, long-term opportunities remain substantial as solar becomes a central pillar of regional energy strategies.

Market Segmentations:

By Manufacturing Equipment

- Silicon equipment

- Ingots equipment

- Wafer equipment

- Cells equipment

- Module equipment

By Technology

- Crystalline silicon

- Thin film

By Application

- Residential

- Commercial

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis in the Solar PV Manufacturing Equipment Market highlights leading players such as Applied Materials, Meyer Burger, Horiba, Centrotherm, Tempress Systems, Singulus Technologies, CETC Solar, and Jinchen Machinery, which collectively shape the industry’s technological and manufacturing capabilities. These companies compete by advancing high-precision tools for ingot casting, wafer slicing, cell processing, and module assembly, addressing the growing demand for TOPCon, HJT, IBC, and bifacial technologies. The market is characterized by rapid innovation cycles, with suppliers investing in automation, digitalization, and high-throughput platforms to enhance yield and lower production costs. Strategic partnerships, capacity expansion projects, and global manufacturing alliances further intensify competition as manufacturers seek vertically integrated production models. With increasing government incentives encouraging domestic solar manufacturing across major regions, equipment providers that deliver scalable, energy-efficient, and cost-effective solutions are well positioned to secure long-term growth and reinforce their market presence.

Key Player Analysis

- LDK Solar

- Goldi Solar

- Servotech Renewable Power System

- Adani Solar

- Premier Energies

- JA Solar

- RenewSys

- First Solar

- Grew Solar

- Emmvee

Recent Developments

- In October 2025, Waaree Solar acquired a 1-gigawatt module manufacturing line from Meyer Burger to expand its U.S. production capacity.

- In September 2025, Meyer Burger secured court approval to sell its U.S. solar module and cell manufacturing equipment to Waaree Solar Americas and Babacomari Solar North.

- In February 2025, Veda Solar signed a memorandum of understanding with solar module manufacturing equipment supplier Cliantech Solutions to set up a 1.5 GW TOPCon solar module manufacturing line, strengthening its module production capabilities with advanced equipment.

- In October 2024, Singulus Technologies and Yingkou Jinchen Machinery strengthened their partnership and showcased advanced solar cell and module equipment at the Renewable Energy India Expo 2024.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Manufacturing Equipment, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as global solar manufacturing capacity expands across wafers, cells, and modules.

- Adoption of high-efficiency technologies such as TOPCon, HJT, and tandem cells will drive continuous upgrades in manufacturing equipment.

- Automation, AI-enabled quality control, and smart factory systems will play a central role in boosting production efficiency.

- Governments will increasingly support domestic solar manufacturing through incentives, reshoring policies, and supply chain localization.

- Equipment suppliers will focus on high-throughput, energy-efficient tools to reduce production costs and enhance yield.

- Investments in next-generation perovskite and hybrid module technologies will open significant opportunities for new equipment platforms.

- Manufacturers will expand vertically integrated production lines to strengthen cost competitiveness and supply chain control.

- The shift toward sustainable and low-carbon manufacturing will encourage development of eco-optimized equipment solutions.

- Global competition will intensify as emerging markets scale up manufacturing infrastructure.

- Long-term demand will remain robust as solar energy becomes a dominant pillar of global decarbonization strategies.

Market Segmentation Analysis:

Market Segmentation Analysis: