Market Overview

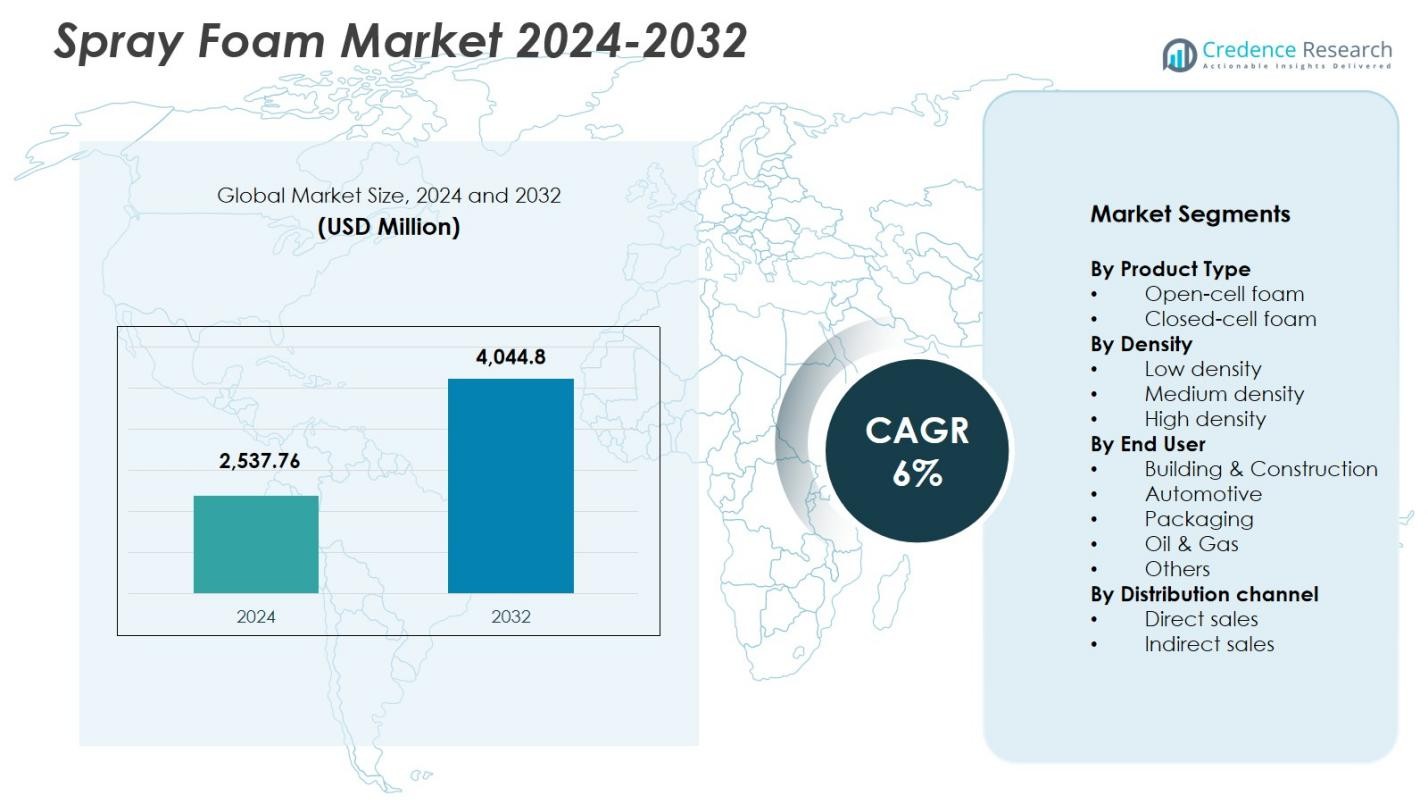

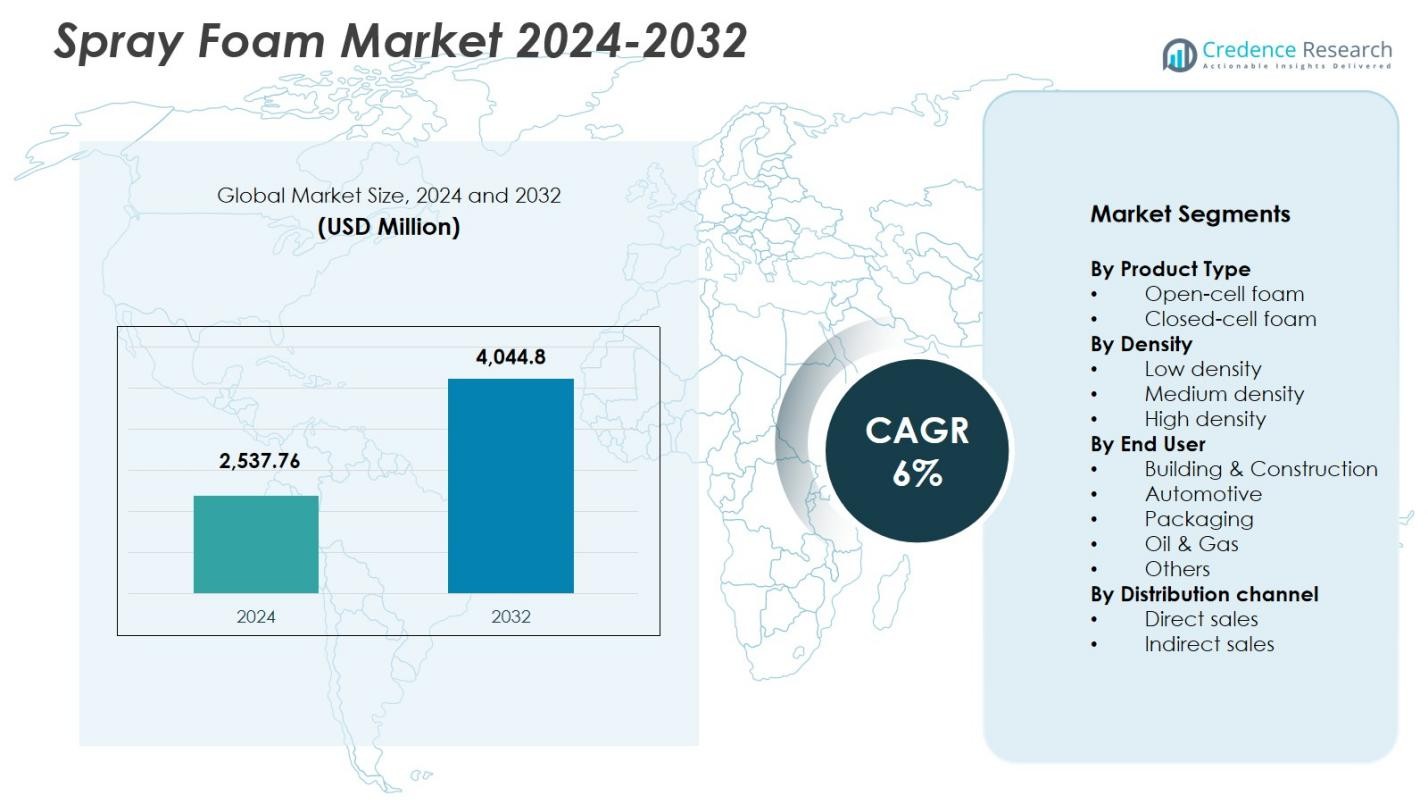

Spray Foam Market size was valued at USD 2,537.76 million in 2024 and is anticipated to reach USD 4,044.8 million by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spray Foam Market Size 2024 |

USD 2,537.76 Million |

| Spray Foam Market, CAGR |

6% |

| Spray Foam Market Size 2032 |

USD 4,044.8 Million |

Spray Foam Market is shaped by prominent players such as BASF SE, Dow Inc., Carlisle Companies Incorporated, CertainTeed LLC, Covestro AG, Saint-Gobain S.A., Demilec (USA) Inc., Gaco Western LLC, Henry Company LLC, and Honeywell International Inc., who strengthen the industry through product innovation and advanced insulation technologies. These companies focus on sustainable, high-performance spray foam solutions that support energy-efficient construction and industrial applications. North America leads the market with a 39.6% share, driven by strict insulation standards, strong retrofitting activity, and widespread adoption of closed-cell foam. Europe follows with a 28.4% share, supported by regulatory emphasis on green-building initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Spray Foam Market was valued at USD 2,537.76 million in 2024 and will grow at a CAGR of 6% through 2032.

- Rising demand for energy-efficient buildings and expanding construction activities drive the Spray Foam Market, with building & construction holding a 71.4% share.

- Key trends include the shift toward low-emission, HFO-based formulations and increased adoption of spray foam across industrial applications such as automotive, oil & gas, and cold storage.

- Major players like BASF SE, Dow Inc., Carlisle Companies, Covestro AG, and Saint-Gobain strengthen the market through product innovation and expanded distribution capabilities.

- North America leads the Spray Foam Market with a 39.6% share, followed by Europe at 28.4%, while Asia-Pacific grows rapidly with a 23.7% share, supported by strong construction and infrastructure development.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type:

The Spray Foam Market by product type is segmented into open-cell foam and closed-cell foam, with closed-cell foam dominating the segment with a 62.3% market share in 2024. Its leadership is driven by superior insulation efficiency, higher R-value, strong moisture resistance, and structural reinforcement capabilities, making it widely preferred in commercial and residential construction. Closed-cell foam also supports energy-efficient building codes and offers enhanced durability across extreme climates, increasing adoption in retrofitting, industrial insulation, and cold-storage applications. Meanwhile, open-cell foam continues to gain traction for cost-effective soundproofing solutions in interior walls.

- For instance, Carlisle Spray Foam Insulation’s SealTite PRO Closed Cell, a medium-density two-component polyurethane foam, applies to wood, masonry, concrete, and metal surfaces in exterior walls, foundations, crawl spaces, and cold storage units for thermal control and air sealing.

By Density:

Based on density, the market includes low-density, medium-density, and high-density spray foams, with medium-density foam holding the dominant share of 48.7% in 2024. Its leadership stems from its balance of thermal performance, structural strength, and versatility in both interior and exterior applications. Medium-density foam is favored in roofing, continuous insulation, and commercial wall assemblies due to its excellent air-sealing ability and moisture barrier properties. Growing demand for durable insulation materials that comply with stringent energy-efficiency regulations continues to expand the usage of medium-density foam across multiple sectors.

- For instance, Johns Manville’s JM Corbond IV, a medium-density closed-cell spray polyurethane foam, uses HFO technology for zero ozone depletion potential while providing high yield and superior moisture performance in commercial and residential buildings.

By End User:

In the end-user segmentation, the market spans building & construction, automotive, packaging, oil & gas, and others, with building & construction leading the segment with a 71.4% market share in 2024. The dominance is supported by rising construction activities, mandatory insulation standards, and increasing demand for energy-efficient building envelopes. Spray foam is extensively used for roofing, wall insulation, crawl spaces, and sealing applications, offering superior air-tightness and long-term performance. The segment’s growth is further propelled by sustainability initiatives, green-building certifications, and the expansion of residential retrofitting programs globally.

Key Growth Drivers

Rising Demand for Energy-Efficient Building Solutions

The Spray Foam Market experiences strong growth as global construction sectors prioritize energy efficiency and stringent building insulation standards. Spray foam’s superior thermal resistance, air-sealing capability, and long-term performance make it a preferred choice for achieving lower energy consumption in residential, commercial, and industrial structures. Government policies promoting green buildings, increasing retrofitting activities, and the rising adoption of high-performance insulation materials significantly strengthen demand. As building owners seek reduced operational costs and enhanced sustainability outcomes, spray foam continues to gain prominence as a premium insulation solution.

- For instance, West Roofing Systems applied at least 1.25 inches of spray foam across 150,000 square feet on six buildings at Jabala Military Base in Iraq, encapsulating aged transite panels and bolts while adding silicone coatings for UV protection.

Expansion of Residential and Commercial Construction Activities

Rapid urbanization, increasing housing investments, and the expansion of commercial infrastructure are key contributors to the market’s growth. Spray foam is widely adopted in roofing, wall insulation, and sealing applications due to its durability and ability to improve structural integrity. Growing construction in emerging economies, along with renovation and remodeling projects in developed regions, further drives market penetration. Enhanced contractor awareness, improved product availability, and advancements in application technology also support widespread use in new-build and reconstruction projects across global markets.

- For instance, BASF applied spray foam insulation in Nigerian projects like hotels and office buildings. This enhanced roof performance with thermal benefits and air sealing in urban commercial settings.

Advancements in Insulation Technology and Product Innovation

Continuous R&D efforts have accelerated the development of next-generation spray foam formulations offering improved performance, lower environmental impact, and enhanced fire resistance. Manufacturers are introducing low-VOC, HFO-based, and environmentally compliant foams that align with global sustainability standards. Innovations in application equipment, faster curing systems, and improved adhesion properties enable more efficient installations across diverse end-user industries. These technological advancements not only strengthen the product’s value proposition but also expand its applicability in industrial environments, packaging solutions, and specialized insulation requirements.

Key Trends & Opportunities

Growing Adoption of Sustainable and Low-Emission Foam Products

A major trend shaping the Spray Foam Market is the rapid shift toward eco-friendly formulations driven by regulatory pressures and rising sustainability expectations. Manufacturers are increasingly adopting HFO blowing agents, bio-based polyols, and low-VOC systems that reduce carbon footprint while maintaining high insulation performance. Green-building certifications and corporate ESG commitments create further opportunities for environmentally compliant spray foam products. As end users prioritize sustainability, companies offering greener formulations stand to gain significant market advantage in both mature and emerging regions.

- For instance, Foam Supplies Inc. (FSI) developed Ecofoam, a VOC-exempt spray polyurethane foam powered by EPA SNAP-approved Ecomate technology, achieving zero global warming potential, zero ozone depletion, and compliance with Montreal and Kyoto Protocols.

Increasing Use of Spray Foam in Industrial and Specialty Applications

Beyond construction, the market sees expanding opportunities in automotive, oil & gas, cold storage, and packaging applications. Spray foam’s lightweight structure, excellent adhesion, and thermal stability enable its use in vehicle insulation, pipeline protection, and vibration absorption solutions. Industrial users also adopt spray foam for equipment housing, temperature-sensitive storage, and structural reinforcement. This diversification broadens revenue potential for manufacturers while reducing reliance on the construction sector. The growing need for high-performance, customizable insulation materials continues to open new avenues across multiple industries.

- For instance, BASF’s water-blown polyurethane spray foam Elastoflex® CE 3651/108 insulates the latest bus model from Suzhou Kinglong, meeting stringent VOC standards verified by PONY Testing International Group.

Key Challenges

Environmental and Regulatory Compliance Concerns

Stricter regulations targeting blowing agents, chemical emissions, and worker safety present a significant challenge for market participants. The transition from HFCs to HFOs increases production costs and demands continuous reformulation efforts. Compliance with environmental guidelines such as VOC limits and fire-safety requirements adds to the complexity of product development and certification. Manufacturers must invest heavily in R&D and regulatory processes to meet evolving standards. These factors can increase pricing pressure and impact smaller players lacking the resources for rapid adaptation.

Fluctuating Raw Material Prices and Supply Chain Constraints

The Spray Foam Market is highly sensitive to volatility in the prices of key raw materials such as isocyanates and polyols, which are derived from petrochemicals. Supply chain disruptions, geopolitical tensions, and fluctuations in crude oil prices directly affect production costs and product availability. Manufacturers often face margin pressures due to unstable input costs and limited supplier diversity. Delays in raw material procurement can also impact project timelines for contractors. Managing supply chain resilience and securing stable raw material sourcing remain critical challenges for industry participants.

Regional Analysis

North America

North America leads the Spray Foam Market with a 39.6% market share in 2024, driven by stringent building insulation standards, widespread adoption of energy-efficient construction practices, and a strong retrofitting industry. The region benefits from high usage of closed-cell spray foam in commercial and residential roofing, wall insulation, and industrial sealing applications. Growth is further supported by favorable green-building incentives, advanced manufacturing capabilities, and the presence of major market players expanding low-emission, high-performance formulations. Rising demand for sustainable insulation materials continues to reinforce North America’s dominant position in the global market.

Europe

Europe holds a significant position in the Spray Foam Market with a 28.4% market share in 2024, supported by strict EU energy-efficiency directives, renovation programs, and increasing adoption of green-building technologies. Countries such as Germany, France, and the U.K. drive demand through large-scale retrofitting initiatives aimed at reducing carbon emissions and improving thermal performance. The market also benefits from rising usage of spray foam in industrial insulation, cold-chain infrastructure, and soundproofing applications. Growing regulatory emphasis on low-VOC, eco-friendly materials continues to shape product innovation and boost spray-foam penetration across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market and accounts for a 23.7% market share in 2024, fueled by rapid urbanization, expanding construction activities, and rising infrastructure investments in China, India, and Southeast Asia. The region’s strong residential and commercial development pipeline drives extensive adoption of spray foam for roofing, wall systems, and HVAC insulation. Industrial applications including cold storage, packaging, and automotive also contribute to rising demand. Government initiatives promoting energy-efficient building standards and fire-safe insulation materials are accelerating market penetration. Increasing manufacturing capacity and cost-effective product availability strengthen Asia-Pacific’s long-term growth trajectory.

Latin America

Latin America captures a 5.2% market share in the Spray Foam Market in 2024, supported by growing construction activity in Brazil, Mexico, and Chile. Demand is driven by rising adoption of high-performance insulation for residential and commercial buildings, supported by an increasing focus on energy efficiency and improved indoor climate control. Expanding industrial applications in cold storage, packaging, and automotive sectors also contribute to regional growth. Despite supply-chain challenges and uneven regulatory frameworks, gradual economic recovery and increased infrastructure spending continue to encourage broader use of spray foam across Latin America.

Middle East & Africa

The Middle East & Africa region accounts for a 3.1% market share in 2024, driven by insulation requirements in hot climatic zones where temperature control is critical for residential, commercial, and industrial buildings. Gulf countries increasingly adopt spray foam to support energy-efficient construction aligned with national sustainability mandates. Industrial applications, including oil & gas pipeline insulation and cold-storage infrastructure, further boost demand. Market growth is tempered by lower awareness levels and limited regional manufacturing, but rising urban development projects and a shift toward high-performance building materials continue to enhance spray-foam usage in the region.

Market Segmentations:

By Product Type

- Open-cell foam

- Closed-cell foam

By Density

- Low density

- Medium density

- High density

By End User

- Building & Construction

- Automotive

- Packaging

- Oil & Gas

- Others

By Distribution channel

- Direct sales

- Indirect sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Spray Foam Market features leading players including BASF SE, Carlisle Companies Incorporated, CertainTeed LLC, Compagnie de Saint-Gobain S.A., Covestro AG, Demilec (USA) Inc., Dow Inc., Gaco Western LLC, Henry Company LLC, and Honeywell International Inc. The market is characterized by strong product innovation, expansion of environmentally compliant formulations, and continuous investment in advanced insulation technologies. Major companies focus on developing HFO-based, low-VOC, and high-performance spray foams to meet evolving regulatory standards and sustainability goals. Strategic partnerships with construction firms, acquisitions to strengthen regional footprints, and expansion of manufacturing capacities remain central competitive strategies. Players are also enhancing contractor training programs and application equipment solutions to improve installation efficiency and product adoption. As demand rises across construction, automotive, industrial, and packaging sectors, key manufacturers compete by broadening product portfolios and offering tailored insulation solutions that deliver superior durability, energy efficiency, and long-term value.

Key Player Analysis

- Dow Inc.

- Gaco Western LLC

- Carlisle Companies Incorporated

- Honeywell International, Inc.

- Demilec (USA) Inc.

- Covestro AG

- Henry Company LLC

- BASF SE

- CertainTeed LLC

- Compagnie de Saint-Gobain S.A.

Recent Developments

- In October 2025, Incline Equity Partners sold Specialty Products and Insulation (SPI), with its spray foam capabilities acquired by TopBuild for expanded insulation distribution.

- In October 2025, TopBuild completed the acquisition of Specialty Products and Insulation (SPI), strengthening its position in the spray foam and insulation sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Density, End User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising global demand for high-performance insulation materials.

- Adoption of environmentally compliant spray foam formulations will accelerate as regulations tighten worldwide.

- Increased penetration of HFO-based and low-emission products will shape next-generation insulation solutions.

- Construction sector expansion and large-scale retrofitting initiatives will continue to boost product usage.

- Technological innovations will enhance curing speed, adhesion, and long-term durability of spray foams.

- Industrial applications such as cold storage, automotive, and oil & gas will offer new revenue opportunities.

- Growing emphasis on energy-efficient buildings will strengthen demand across residential and commercial sectors.

- Manufacturers will expand regional production capabilities to reduce supply chain risks and improve availability.

- Strategic collaborations among insulation suppliers, contractors, and developers will influence market competition.

- Sustainability-driven consumer preferences will encourage broader adoption of bio-based and recyclable formulations.

Market Segmentation Analysis:

Market Segmentation Analysis: