Market Overview

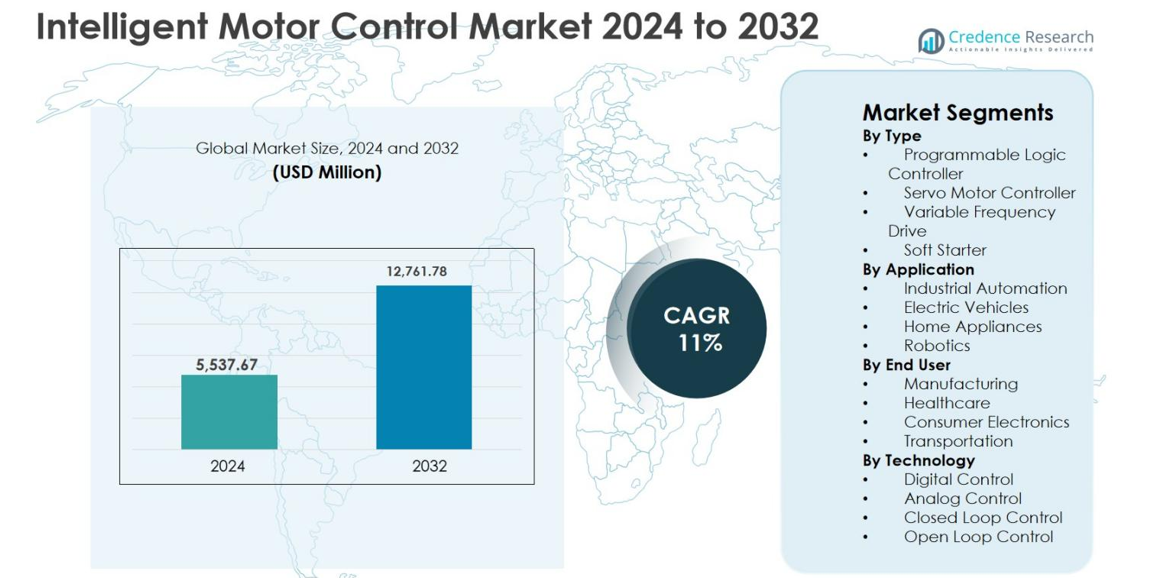

The Intelligent Motor Control Market size was valued at USD 5,537.67 million in 2024 and is anticipated to reach USD 12,761.78 million by 2032, expanding at a CAGR of 11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intelligent Motor Control Market Size 2024 |

USD 5,537.67 million |

| Intelligent Motor Control Market, CAGR |

11% |

| Intelligent Motor Control Market Size 2032 |

USD 12,761.78 million |

The Intelligent Motor Control market is driven by the strong presence of established global players such as ABB Group, General Electric Company, Rockwell Automation, Inc., Mitsubishi Electric Corporation, Larsen & Toubro Ltd., LSIS Co., Ltd., NXP Semiconductors NV, Nanotec Electronic GmbH & Co. KG, Roboteq Inc, and Fairford Electronics Ltd., which focus on advanced automation, energy efficiency, and digital motor control solutions. These companies invest heavily in smart motor technologies, integrated drives, and IoT-enabled controllers to strengthen their market position across industrial and commercial applications. Regionally, North America leads the Intelligent Motor Control market with a 34.2% share in 2024, supported by early adoption of industrial automation, smart manufacturing, and electric mobility, followed by Asia Pacific and Europe with strong growth momentum.

Market Insights

- Intelligent Motor Control market size was valued at USD 5,537.67 million in 2024 and is projected to reach USD 12,761.78 million by 2032, growing at a CAGR of 11% during the forecast period.

- Market growth is driven by rising industrial automation, increasing demand for energy-efficient motor systems, and strong adoption of smart manufacturing solutions across manufacturing, transportation, and utilities, with Manufacturing end users holding a dominant 49.3% segment share in 2024.

- Technology trends include rapid adoption of Variable Frequency Drives, which dominated the type segment with a 42.6% share, along with growing integration of IoT, AI-based monitoring, and predictive maintenance capabilities in intelligent motor controllers.

- Market participants focus on product innovation, digital motor platforms, and system integration, while high initial investment costs and integration complexity remain key restraints for small and mid-scale industries.

- North America led the market with a 34.2% regional share in 2024, followed by Asia Pacific at 29.8% and Europe at 28.6%, while Latin America and Middle East & Africa together accounted for the remaining share, supported by gradual industrial modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Intelligent Motor Control market by type is led by Variable Frequency Drives (VFDs), which accounted for 42.6% market share in 2024, driven by their widespread adoption in energy optimization and precise speed control applications. VFDs enable significant energy savings, reduce mechanical stress, and improve motor lifespan, making them the preferred choice across industrial and commercial settings. Programmable Logic Controllers and Servo Motor Controllers follow due to their role in complex automation and motion control, while Soft Starters gain traction in cost-sensitive applications requiring controlled motor startup and reduced inrush current.

- For instance, Siemens reports that applying its SINAMICS VFDs to pump and fan systems can cut energy use by up to 60% in variable-torque applications.

By Application

By application, Industrial Automation dominated the Intelligent Motor Control market with a 46.8% share in 2024, supported by rising automation across manufacturing plants, process industries, and smart factories. The need for high efficiency, predictive maintenance, and real-time motor monitoring strongly drives adoption. Robotics is emerging rapidly due to precision control requirements, while Electric Vehicles witness steady growth fueled by electrification trends and government incentives. Home Appliances contribute through demand for energy-efficient motors in HVAC systems, washing machines, and smart household devices.

- For instance, Rockwell Automation’s Allen‑Bradley intelligent motor control centers integrate drives, overload relays, and PLCs to provide real-time diagnostics and predictive maintenance in process plants.

By End User

The Manufacturing segment held the largest share of 49.3% in the Intelligent Motor Control market in 2024, driven by extensive use of automated machinery, conveyor systems, and production lines. Manufacturers increasingly deploy intelligent motor control solutions to improve operational efficiency, reduce downtime, and support Industry 4.0 initiatives. Transportation follows due to rising investments in railways and electric mobility, while Healthcare adoption grows steadily with advanced medical equipment. Consumer Electronics contributes through compact motor controllers used in smart devices and appliances.

Key Growth Drivers

Rising Industrial Automation and Smart Manufacturing Adoption

The rapid expansion of industrial automation is a primary growth driver for the Intelligent Motor Control market. Manufacturing facilities increasingly deploy intelligent motor control systems to enhance operational efficiency, reduce downtime, and enable predictive maintenance. These solutions provide real-time monitoring, adaptive speed control, and fault diagnostics, which are essential for Industry 4.0 and smart factory environments. Growing investments in automated production lines across automotive, electronics, food processing, and pharmaceuticals further accelerate demand. Additionally, the integration of IoT and advanced analytics with motor controllers allows manufacturers to optimize energy usage and improve asset utilization, strengthening the adoption of intelligent motor control technologies across both discrete and process industries.

- For instance, ABB’s Ability Digital Powertrain platform connects motors, drives, and bearings with cloud-based analytics to optimize energy usage and improve asset utilization in both discrete and process industries.

Increasing Focus on Energy Efficiency and Sustainability

Energy efficiency regulations and sustainability initiatives strongly drive the Intelligent Motor Control market. Industries and commercial facilities seek to minimize energy consumption and carbon emissions by deploying advanced motor control solutions such as variable frequency drives and smart controllers. Intelligent motor control systems optimize motor speed and torque based on load conditions, significantly reducing power losses and operational costs. Governments worldwide enforce stringent energy performance standards for industrial equipment, HVAC systems, and electric motors, encouraging replacement of conventional motor controls with intelligent alternatives. Rising electricity prices further motivate end users to invest in energy-efficient motor solutions, making intelligent motor control a critical component of long-term sustainability strategies.

- For instance, Schneider Electric notes that its Altivar Process drives help industrial users reduce energy consumption by up to 30% through optimized speed control and embedded energy-measurement functions.

Growth of Electric Vehicles and Electrified Transportation

The rapid growth of electric vehicles and electrified transportation systems significantly boosts demand for intelligent motor control solutions. EV powertrains, charging infrastructure, and auxiliary systems rely on advanced motor controllers for precise speed, torque, and thermal management. Governments promoting electric mobility through incentives and emission reduction targets accelerate adoption across passenger vehicles, commercial fleets, and public transportation. Intelligent motor control systems enhance vehicle efficiency, extend driving range, and improve overall performance. Additionally, expanding investments in electric railways, metros, and smart transportation infrastructure further support market growth, positioning intelligent motor control as a core technology in the global electrification ecosystem.

Key Trends & Opportunities

Integration of IoT, AI, and Predictive Maintenance Technologies

The integration of IoT and artificial intelligence presents a major trend and opportunity in the Intelligent Motor Control market. Connected motor controllers enable continuous data collection on performance, temperature, vibration, and energy consumption. AI-driven analytics transform this data into actionable insights, supporting predictive maintenance and minimizing unplanned downtime. Industries increasingly adopt cloud-based monitoring platforms to remotely manage motor systems across multiple facilities. This trend enhances asset reliability, extends equipment lifespan, and reduces maintenance costs. Vendors offering smart, connected motor control solutions with advanced analytics gain competitive advantage, creating new revenue opportunities through software, services, and lifecycle management offerings.

- For instance, Rockwell Automation’s FactoryTalk Analytics and GuardianAI software use data from PowerFlex drives as virtual sensors to detect anomalies and enable condition-based monitoring for pumps, fans, and blowers without extra hardware.

Expansion of Intelligent Motor Control in Consumer and Residential Applications

Intelligent motor control is rapidly expanding beyond industrial settings into consumer and residential applications. Smart home appliances, HVAC systems, and building automation increasingly incorporate intelligent motor controllers to improve energy efficiency and user comfort. Growing adoption of smart homes, coupled with rising consumer awareness of energy savings, drives demand for compact and cost-effective motor control solutions. Technological advancements enable manufacturers to integrate intelligent features into smaller motors used in appliances and consumer electronics. This shift opens new growth avenues for market players, particularly in emerging economies experiencing urbanization and increasing disposable income.

- For instance, Samsung’s AI Energy-enabled appliances use digital inverter motors and connected control to optimize energy consumption in washing machines and other devices, with internal tests showing large reductions in power use when AI modes are activated.

Key Challenges

High Initial Investment and Integration Complexity

High upfront costs associated with intelligent motor control systems pose a significant challenge to market growth. Advanced motor controllers, sensors, and software platforms require substantial capital investment, particularly for small and medium-sized enterprises. Integration with existing legacy systems can be complex and time-consuming, requiring skilled personnel and system upgrades. In cost-sensitive industries, these factors delay adoption despite long-term operational benefits. Additionally, concerns over return on investment and extended payback periods restrict deployment in price-driven markets, limiting penetration in developing regions and smaller industrial facilities.

Cybersecurity Risks and Technical Skill Gaps

The increasing connectivity of intelligent motor control systems introduces cybersecurity risks and operational challenges. Connected motor controllers and cloud-based platforms are vulnerable to cyber threats, data breaches, and system disruptions. Ensuring secure communication, data integrity, and system resilience requires continuous investment in cybersecurity measures. Furthermore, the market faces a shortage of skilled professionals capable of managing advanced motor control systems, AI analytics, and IoT platforms. This technical skill gap increases training costs and slows adoption, particularly in regions with limited access to advanced automation expertise.

Regional Analysis

North America

North America accounted for 34.2% of the Intelligent Motor Control market share in 2024, driven by strong adoption of industrial automation, smart manufacturing, and energy-efficient motor systems. The presence of advanced manufacturing facilities, high penetration of Industry 4.0 technologies, and early adoption of predictive maintenance solutions support regional growth. Rising investments in electric vehicles, renewable energy integration, and modernized HVAC systems further boost demand. The United States leads the region due to large-scale industrial operations, while Canada contributes through growing investments in smart infrastructure and energy-efficient industrial equipment.

Europe

Europe held a 28.6% share of the Intelligent Motor Control market in 2024, supported by stringent energy-efficiency regulations and strong emphasis on sustainability. The region benefits from widespread adoption of intelligent motor solutions across automotive manufacturing, industrial machinery, and building automation. Countries such as Germany, France, and the United Kingdom drive demand through advanced automation, robotics, and electric mobility initiatives. The region’s focus on reducing carbon emissions and improving industrial energy performance encourages replacement of conventional motor systems with intelligent motor control technologies across both industrial and commercial sectors.

Asia Pacific

Asia Pacific dominated the Intelligent Motor Control market with a 29.8% share in 2024, driven by rapid industrialization, expanding manufacturing capacity, and increasing automation across China, Japan, South Korea, and India. The region benefits from strong growth in automotive production, electronics manufacturing, and electric vehicle adoption. Government initiatives supporting smart manufacturing and energy efficiency further accelerate demand. China leads due to large-scale industrial automation, while India and Southeast Asia show high growth potential supported by infrastructure development and rising investments in smart factories.

Latin America

Latin America accounted for 4.5% of the Intelligent Motor Control market share in 2024, supported by gradual modernization of industrial infrastructure and growing focus on energy efficiency. Countries such as Brazil and Mexico lead regional demand through investments in manufacturing, mining, and oil & gas sectors. Increasing adoption of automation technologies in food processing and packaging industries further supports growth. Although price sensitivity remains a challenge, rising awareness of energy savings and operational efficiency encourages adoption of intelligent motor control solutions across industrial and commercial applications.

Middle East & Africa

The Middle East & Africa region held 2.9% of the Intelligent Motor Control market share in 2024, driven by investments in industrial diversification, infrastructure development, and energy optimization. Demand is supported by growing automation in oil & gas, water treatment, and power generation sectors. Countries such as Saudi Arabia and the UAE invest in smart industrial facilities aligned with national vision programs. In Africa, gradual industrial development and electrification projects create emerging opportunities, though adoption remains moderate due to high initial investment costs.

Market Segmentations:

By Type

- Programmable Logic Controller

- Servo Motor Controller

- Variable Frequency Drive

- Soft Starter

By Application

- Industrial Automation

- Electric Vehicles

- Home Appliances

- Robotics

By End User

- Manufacturing

- Healthcare

- Consumer Electronics

- Transportation

By Technology

- Digital Control

- Analog Control

- Closed Loop Control

- Open Loop Control

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Intelligent Motor Control market features a dynamic landscape characterized by the presence of several global and regional players focused on innovation, product differentiation, and strategic expansion. Leading companies such as ABB Group, Siemens AG, Rockwell Automation, Inc., Mitsubishi Electric Corporation, and Schneider Electric SE maintain strong market positions through broad product portfolios, advanced automation capabilities, and global distribution networks. These players emphasize the integration of IoT, digital monitoring, and energy-efficient technologies into motor control solutions to address evolving industrial requirements. Companies including General Electric Company, Larsen & Toubro Ltd., LSIS Co., Ltd., and NXP Semiconductors NV strengthen the market through application-specific solutions and regional expansion. Smaller technology-focused firms such as Nanotec Electronic GmbH & Co. KG and Roboteq Inc contribute through specialized motion control and compact motor controller offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2025, Mikroe launched the BLDC FOC 2 Click board, a compact motor control solution designed to deliver smooth, efficient performance for BLDC motors in robotics and industrial automation applications.

- In September 2025, CTS Corporation launched the COBROS™ platform, a next-generation electric motor control technology that uses real-time, in-situ magnetic field sensing to improve accuracy and reduce system complexity for industrial and automotive motor applications.

- In March 2025, Rockwell Automation introduced the M100 Electronic Motor Starter, expanding its intelligent motor control portfolio with a starter that simplifies panel wiring, integrates advanced functional safety features, and enhances motor start/stop performance in automated systems

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Intelligent motor control adoption will accelerate with the continued expansion of industrial automation and smart factory initiatives.

- Integration of IoT, cloud platforms, and advanced analytics will enhance real-time monitoring and predictive maintenance capabilities.

- Demand for energy-efficient motor solutions will increase due to stricter energy regulations and sustainability targets.

- Electric vehicle growth will drive wider use of intelligent motor controllers in powertrains, charging systems, and auxiliary functions.

- Compact and cost-optimized motor control solutions will gain traction in consumer electronics and home appliance applications.

- Adoption of AI-enabled motor control algorithms will improve performance optimization and fault detection accuracy.

- Emerging economies will witness higher deployment supported by infrastructure development and manufacturing expansion.

- Manufacturers will focus on modular and scalable motor control systems to address diverse industrial requirements.

- Cybersecurity features will become increasingly important as motor control systems become more connected.

- Strategic partnerships and technology collaborations will strengthen product innovation and global market presence.