Market Overview

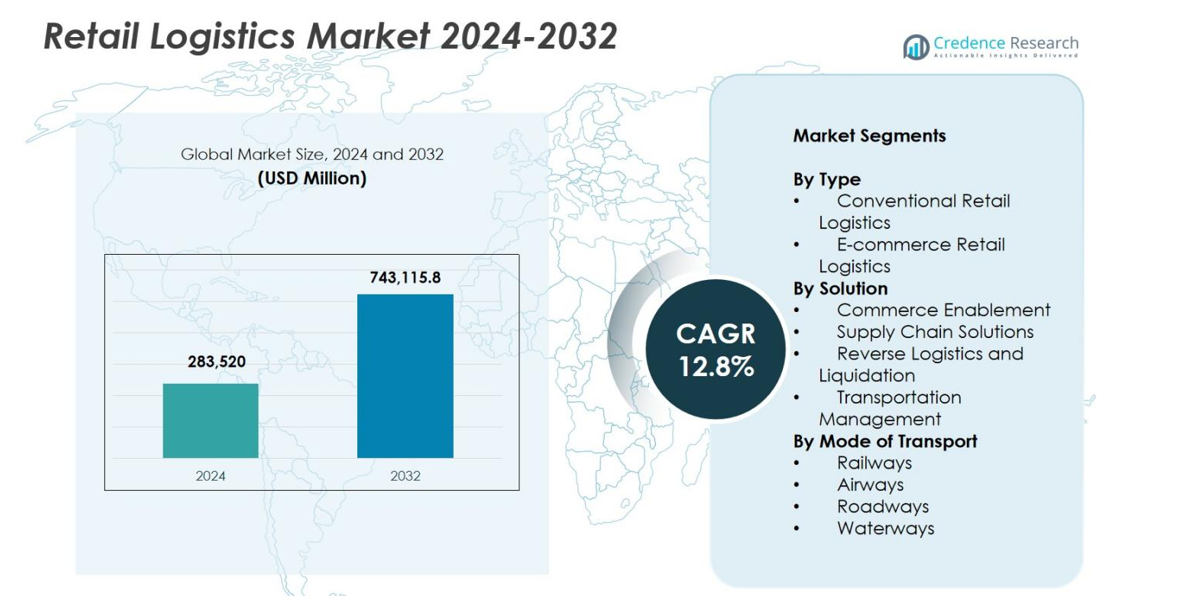

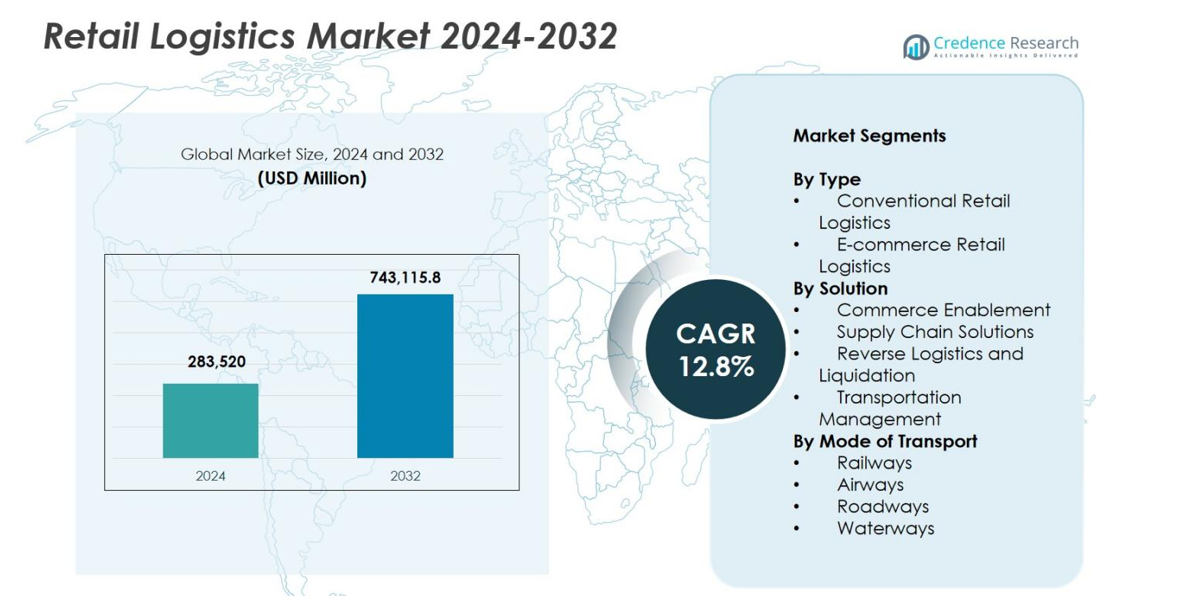

Retail Logistics Market size was valued at USD 283,520 million in 2024 and is anticipated to reach USD 743,115.8 million by 2032, at a CAGR of 12.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Retail Logistics Market Size 2024 |

USD 283,520 million |

| Retail Logistics Market, CAGR |

12.8% |

| Retail Logistics Market Size 2032 |

USD 743,115.8 million |

Retail Logistics Market is shaped by a strong group of global and regional logistics providers that continuously enhance their capabilities to support expanding retail and e-commerce operations. Key players such as DHL International GmbH, United Parcel Service, FedEx, Kuehne + Nagel International, DSV, C.H. Robinson Worldwide, Nippon Express, XPO Logistics, Schneider, and APL Logistics Ltd. are at the forefront, investing in automation, last-mile delivery solutions, and digital logistics platforms to strengthen service efficiency. Regionally, North America led the market with 34.2% share in 2024, supported by advanced infrastructure, high e-commerce penetration, and rapid adoption of technology-driven logistics solutions.

Market Insights

- Retail Logistics Market was valued at USD 283,520 million in 2024 and is projected to grow at a CAGR of 12.8%, reaching USD 743,115.8 million by 2032.

- Strong market drivers include rapid e-commerce expansion, rising last-mile delivery demand, and growing adoption of automation and digital logistics platforms across retail supply chains.

- Key trends include sustainable logistics practices, investments in green fleets, multimodal transport optimization, and increasing reliance on AI-driven fulfillment and reverse logistics solutions.

- Major players such as DHL International GmbH, UPS, FedEx, Kuehne + Nagel, DSV, and XPO Logistics strengthen their presence through technology upgrades and expanded cross-border logistics capabilities.

- Market restraints include high logistics costs, fragmented infrastructure in emerging markets, and supply chain disruptions; regionally, North America held 34.2% share, Europe 28.7%, and Asia-Pacific 26.4%, while e-commerce retail logistics dominated with 58.4% segment share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Retail Logistics Market by type is dominated by e-commerce retail logistics, accounting for 58.4% share in 2024, driven by exponential growth in online shopping, rising demand for rapid fulfillment, and increasing adoption of omnichannel retail models. E-commerce players are investing heavily in automated warehouses, micro-fulfillment centers, and AI-enabled delivery management systems to enhance speed and accuracy. Meanwhile, conventional retail logistics continues to support brick-and-mortar supply chains but grows at a slower pace due to digital commerce expansion. The surge in last-mile delivery demand, return handling, and real-time tracking technologies further strengthens the role of e-commerce logistics.

- For Instance,Walmart deployed AI-based route optimization and dynamic batching across its Spark Driver platform to reduce last-mile delivery times and increase order density.

By Solution

Within the solution category, supply chain solutions led the Retail Logistics Market with 46.7% share in 2024, supported by increasing retailer focus on inventory optimization, warehouse automation, demand forecasting, and integrated order management. These solutions enhance operational visibility, reduce stockouts, and support seamless cross-channel fulfillment. Commerce enablement solutions are rapidly gaining traction as retailers adopt digital platforms for storefront integration, payments, and customer experience optimization. Reverse logistics and liquidation, along with transportation management, are expanding due to higher e-commerce return volumes and growing pressure to reduce delivery costs through route planning and carrier optimization.

- For Instance, Shopify expanded its integrated Commerce Components suite, enabling retailers to unify storefronts, order flows, and payments for end-to-end commerce enablement.

By Mode of Transport

In terms of transportation mode, roadways dominated the Retail Logistics Market with 62.1% share in 2024, attributed to their unmatched flexibility, extensive last-mile reach, and suitability for short- and medium-haul retail distribution. The expansion of e-commerce, rapid urbanization, and growth in parcel deliveries further strengthen roadway logistics demand. Airways are growing steadily due to increasing cross-border e-commerce and demand for expedited shipping, while railways and waterways remain preferred for bulk, long-distance, and cost-efficient cargo movement. The rise of multimodal logistics networks enhances reliability and reduces transit time variability across retail supply chains.

Key Growth Drivers

Rapid Expansion of E-commerce and Omnichannel Retail

The explosive growth of e-commerce remains a major catalyst for the Retail Logistics Market, accelerating investments in automated fulfillment, digital order management, and high-speed delivery networks. As consumers increasingly expect faster shipping, seamless returns, and consistent shopping experiences across channels, retailers rely heavily on logistics partners to optimize inventory flow and enhance fulfillment accuracy. Omnichannel models such as BOPIS, curbside pickup, and ship-from-store further increase the complexity of logistics operations, driving demand for integrated networks that balance online and offline supply chains. Rising parcel volumes, same-day delivery expectations, and cross-border e-commerce expansion continue to strengthen the influence of logistics as a core enabler of modern retail growth.

- For Instance,Target scaled its ship-from-store operations using its Sortation Centers network, improving last-mile delivery speed and reducing per-order fulfillment costs.

Advancements in Automation, AI, and Digital Logistics Platforms

Technological innovation significantly enhances efficiency across the Retail Logistics Market as automation, AI, IoT, and cloud-based systems transform planning, warehousing, and transportation processes. AI-driven analytics improve forecasting and inventory management, while robotics accelerate picking and reduce labor dependency. IoT-enabled tracking ensures real-time visibility of shipments, minimizing delays and disruptions. Cloud-based logistics platforms facilitate seamless coordination between retailers, suppliers, and carriers, improving transparency and decision-making across the supply chain. These advancements reduce operational costs, increase processing speed, and enable retailers to meet heightened consumer expectations for precision and delivery reliability, making digital transformation a central driver of logistics modernization.

- For Instance, Maersk launched its updated IoT-enabled Captain Peter platform, providing real-time temperature, humidity, and location tracking for sensitive retail cargo.

Rising Demand for Last-Mile Delivery Optimization

Last-mile delivery has become one of the most critical components driving growth in the Retail Logistics Market, largely due to its influence on customer experience and overall logistics efficiency. The surge in same-day and next-day delivery demand pushes retailers to invest in route optimization technologies, electric delivery fleets, micro-fulfillment centers, and gig-based delivery networks. Innovative strategies such as parcel lockers, autonomous robots, and drone delivery trials aim to reduce congestion, improve delivery density, and lower last-mile costs. Increasing return volumes from online purchases further elevate the importance of efficient reverse logistics processes. As urban populations expand and e-commerce adoption rises, last-mile optimization remains a key accelerator for market advancement.

Key Trends & Opportunities

Growth of Sustainable and Green Logistics Practices

Sustainability is becoming a defining trend in the Retail Logistics Market as retailers and logistics providers adopt eco-friendly transportation, packaging, and supply chain models. The shift toward electric and hybrid delivery fleets, solar-powered warehouses, biodegradable packaging materials, and carbon-neutral delivery programs aligns with global ESG mandates and consumer expectations for responsible brands. Green warehousing initiatives using energy-efficient systems and automated climate control reduce environmental impact while lowering operational costs. Regulations promoting emissions reduction and waste minimization further accelerate adoption. These sustainability-driven initiatives create opportunities for providers offering low-emission logistics solutions and advanced reverse logistics capabilities that support circular retail models.

- For Instance, Amazon rolled out its recyclable, lightweight packaging initiative across additional markets, reducing packaging material usage by over 30% for eligible shipments.

Expansion of Cross-border E-commerce and Global Supply Chain Integration

Cross-border e-commerce continues to expand rapidly, creating substantial opportunities for retailers and logistics providers to enhance global distribution networks. Consumers increasingly purchase international products, prompting investments in cross-border fulfillment centers, air freight capacity, and automated customs processing tools. Digital documentation systems streamline global compliance, while integrated logistics platforms provide real-time visibility across international routes. Free-trade agreements and improvements in customs automation further reduce friction in cross-border operations. Enhanced global parcel networks, faster shipping solutions, and growing demand for international product availability collectively strengthen the role of global logistics as a strategic growth avenue for retail brands.

- For Instance, FedEx expanded its International Connect Plus service to additional Asia–Pacific markets, providing faster and more affordable cross-border delivery options for e-commerce brands.

Key Challenges

High Logistics Costs and Pressure on Profitability

Rising logistics costs pose a significant challenge for retailers striving to meet consumer expectations for fast and low-cost deliveries. Fuel price fluctuations, labor shortages, warehouse rental inflation, and increasing return volumes add pressure to operational budgets. Last-mile delivery continues to be the costliest segment due to delivery density issues, traffic congestion, and fragmented urban demand. Investments in automation, digital platforms, and green logistics require substantial capital, creating difficulties for smaller providers. Balancing affordability and service quality becomes increasingly complex, pushing retailers to seek innovative ways to optimize transportation routes, warehouse operations, and inventory levels while preserving profitability.

Supply Chain Disruptions and Capacity Constraints

Frequent supply chain disruptions ranging from geopolitical tensions and weather events to port congestion and pandemics create major operational risks for the Retail Logistics Market. These disruptions lead to shipment delays, inventory shortages, and rising logistics costs. Capacity limitations in trucking, warehousing, and air freight further intensify challenges during peak demand periods. Retailers struggle to maintain stable inventory flows while facing unpredictable lead times and fluctuating order volumes. Fragmented global supply chains increase vulnerability, requiring enhanced contingency planning, diversified sourcing, and investment in digital visibility platforms. Building resilient, agile logistics networks is essential but requires significant financial and operational restructuring.

Regional Analysis

North America

North America dominated the Retail Logistics Market with 34.2% share in 2024, driven by mature e-commerce ecosystems, advanced logistics infrastructure, and high adoption of automation and digital fulfillment solutions. Major retailers and third-party logistics providers continue investing in micro-fulfillment centers, AI-enabled delivery routing, and electric last-mile fleets to improve efficiency. Strong consumer demand for fast and flexible delivery services accelerates innovation across warehousing, transportation, and reverse logistics. The U.S. remains the primary growth engine due to its large retail network, robust technological capabilities, and rapid expansion of omnichannel retail operations.

Europe

Europe accounted for 28.7% share in 2024, supported by strong cross-border trade, well-established transport infrastructure, and growing investments in green logistics initiatives. Retailers increasingly adopt omnichannel distribution models, driving demand for integrated warehouse management and sustainable delivery solutions. Strict environmental regulations push logistics providers toward low-emission fleets, optimized packaging, and energy-efficient warehousing. E-commerce growth in Western and Central Europe further strengthens regional demand for advanced last-mile delivery networks. Countries such as Germany, the U.K., and France lead innovation, supported by digital logistics technologies, automated fulfillment systems, and expanding parcel delivery ecosystems.

Asia-Pacific

Asia-Pacific emerged as the fastest-growing region with 26.4% share in 2024, propelled by rapid urbanization, expanding e-commerce penetration, and large-scale investments in logistics infrastructure across China, India, Japan, and Southeast Asia. High-volume online retail transactions fuel the development of smart warehouses, automated sorting centers, and multi-modal transportation networks. Government-led initiatives to enhance port connectivity and cross-border trade corridors further accelerate market growth. Asia-Pacific’s vast population and rising disposable incomes create sustained demand for efficient last-mile delivery services. The region remains a strategic hub for global retail expansion, supported by strong manufacturing capabilities and rapid digitalization of logistics operations.

Latin America

Latin America held 6.1% share in 2024, driven by steady growth in e-commerce adoption and investments in modern warehousing and transportation solutions. Countries such as Brazil, Mexico, and Chile are enhancing logistics networks through digital tracking tools, third-party logistics partnerships, and urban delivery innovations. Despite infrastructure gaps and economic volatility, demand for fast delivery and improved retail distribution continues to rise. Logistics providers increasingly focus on route optimization, reverse logistics, and localized fulfillment strategies to manage high urban congestion and diverse geographic conditions across the region.

Middle East & Africa

The Middle East & Africa region represented 4.6% share in 2024, supported by increasing retail modernization, rising digital commerce activity, and investments in transport and logistics hubs. Gulf countries, particularly the UAE and Saudi Arabia, are expanding smart warehousing facilities, air cargo capabilities, and bonded logistics zones to strengthen regional trade flows. Growing consumer preference for online shopping drives demand for structured last-mile delivery networks and temperature-controlled distribution. In Africa, improvements in road networks and digital payment adoption support market expansion, though logistics fragmentation and infrastructure constraints remain key challenges for scalability.

Market Segmentations

By Type

- Conventional Retail Logistics

- E-commerce Retail Logistics

By Solution

- Commerce Enablement

- Supply Chain Solutions

- Reverse Logistics and Liquidation

- Transportation Management

By Mode of Transport

- Railways

- Airways

- Roadways

- Waterways

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Retail Logistics Market is characterized by the strong presence of global logistics providers, technology-driven delivery platforms, and specialized retail fulfillment companies competing to enhance operational efficiency, delivery speed, and service coverage. Leading players such as DHL International GmbH, United Parcel Service, FedEx, Nippon Express, Kuehne + Nagel International, DSV, C.H. Robinson Worldwide, XPO Logistics, Schneider, and APL Logistics Ltd. continue to expand their capabilities through advanced warehouse automation, AI-enabled transportation management, and integrated omnichannel fulfillment solutions. Companies are investing heavily in last-mile delivery optimization, cross-border e-commerce logistics, and carbon-neutral transportation fleets to address evolving retail demands. Strategic partnerships with retailers and e-commerce platforms, along with acquisitions aimed at strengthening geographic presence and service portfolios, further intensify market competition. As consumer expectations shift toward faster, sustainable, and more transparent deliveries, key players increasingly differentiate themselves through digital innovation, end-to-end visibility platforms, and tailored logistics solutions for diverse retail categories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DHL International GmbH

- Schneider

- APL Logistics Ltd

- C.H. Robinson Worldwide, Inc.

- FedEx

- United Parcel Service

- Nippon Express

- DSV

- Kuehne + Nagel International

- XPO Logistics, Inc.

Recent Developments

- In May 2025, DHL Supply Chain acquired IDS Fulfillment, a U.S.-based e-commerce fulfilment and retail-distribution logistics company

- In April 2025, Delhivery Ltd. announced the acquisition of Ecom Express Ltd. a move to expand its logistics footprint in India’s retail-logistics sector.

- In January 2025, DHL Supply Chain acquired Inmar Supply Chain Solutions a retail- and pharmaceutical-returns logistics provider boosting DHL’s reverse logistics capabilities in North America.

Report Coverage

The research report offers an in-depth analysis based on Type, Solution, Mode of Transport and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as e-commerce adoption accelerates across developed and emerging economies.

- Automation, robotics, and AI-driven fulfillment systems will become standard in warehouses and distribution centers.

- Last-mile delivery networks will expand through micro-fulfillment centers, parcel lockers, and autonomous delivery technologies.

- Sustainability initiatives will drive increased use of electric vehicles, green packaging, and carbon-neutral logistics solutions.

- Cross-border e-commerce will boost demand for integrated global logistics platforms and advanced customs automation.

- Retailers will invest more in real-time visibility tools to improve inventory accuracy and delivery transparency.

- Reverse logistics solutions will gain prominence as return volumes rise due to online shopping growth.

- Strategic partnerships between retailers and logistics providers will strengthen omnichannel fulfillment capabilities.

- Supply chain resilience will become a priority, prompting diversification of suppliers and distribution networks.

- Digital twins and predictive analytics will enhance planning, reduce disruptions, and optimize end-to-end logistics operations.