Market Overview

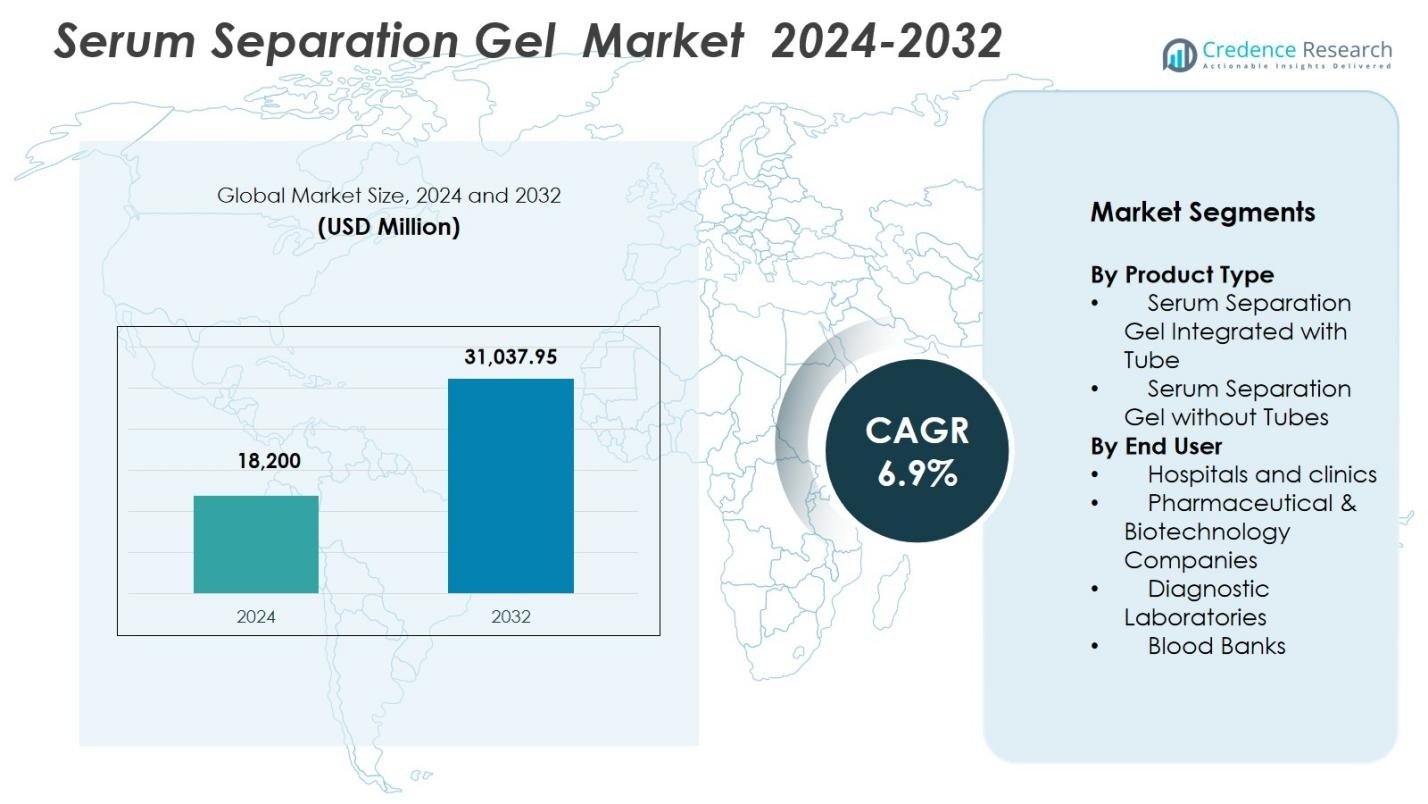

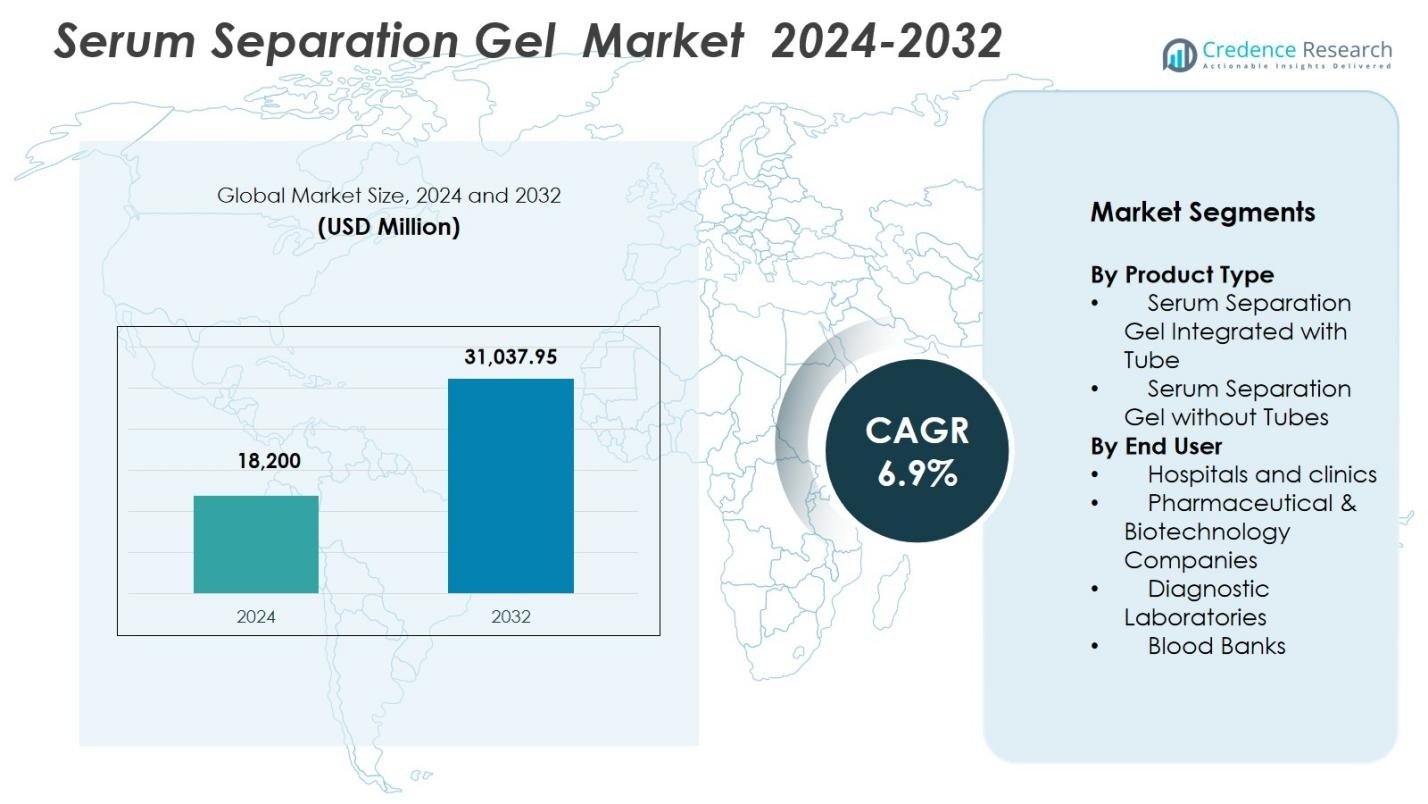

Serum Separation Gel Market size was valued at USD 18,200 Million in 2024 and is anticipated to reach USD 31,037.95 Million by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Serum Separation Gel Market Size 2024 |

USD 18,200 Million |

| Serum Separation Gel Market , CAGR |

6.9% |

| Serum Separation Gel Market Size 2032 |

USD 31,037.95 Million |

Serum Separation Gel Market is driven by leading players such as Qiagen N.V., Cardinal Health Inc., Medtronic PLC, Merck KGaA, Danaher Corporation, Bio-Rad Laboratories, Becton Dickinson & Company, and F. Hoffmann-La Roche Ltd., all of which focus on enhancing gel purity, stability, and compatibility with automated diagnostic systems. These companies strengthen global supply capabilities through product innovation and expanded distribution networks. Regionally, North America led the Serum Separation Gel Market with a 36.7% share in 2024, supported by advanced healthcare infrastructure, high diagnostic testing volumes, and strong adoption of integrated serum separation gel tubes across hospitals, laboratories, and research institutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Serum Separation Gel Market reached USD 18,200 Million in 2024 and is expected to reach USD 31,037.95 Million by 2032, growing at a CAGR of 6.9%.

- Market growth is driven by rising diagnostic testing volumes, increasing automation in clinical laboratories, and strong demand for high-quality sample separation technologies.

- Key trends include the shift toward automation-ready gel tubes, innovations in gel formulations with higher stability, and expanding adoption in biopharmaceutical research workflows.

- Leading players focus on product enhancements, improved assay compatibility, and wider distribution, with Serum Separation Gel Integrated with Tube holding a 64.3% share and Hospitals & Clinics leading end users with 41.8%.

- North America dominated with a 36.7% share in 2024, followed by Europe at 29.4% and Asia-Pacific at 22.6%, supported by advanced healthcare systems, rising diagnostic investment, and rapid laboratory modernization.

Market Segmentation Analysis:

By Product Type

The Serum Separation Gel Market by product type was led by Serum Separation Gel Integrated with Tube, accounting for 64.3% share in 2024. This dominance stems from its high adoption in clinical diagnostics due to convenience, reduced contamination risks, and improved sample integrity during centrifugation. Integrated tubes streamline workflow efficiency by eliminating manual gel handling, which accelerates processing in high-volume laboratories. Growing automation in healthcare settings and the rising demand for standardized blood collection systems further strengthen the adoption of integrated serum separation gel tubes across hospitals, diagnostic centers, and blood banks.

- For instance, Greiner Bio-One’s VACUETTE CAT Serum Separator Clot Activator tubes use micronized silica particles and a barrier gel that forms a stable separation between serum and cells post-centrifugation.

By End User

Among end users, Hospitals and Clinics dominated the Serum Separation Gel Market with a 41.8% share in 2024. Their leadership is driven by the large volume of routine blood tests, emergency diagnostics, and chronic disease monitoring performed across healthcare facilities. The increasing emphasis on accuracy and faster turnaround times supports the rising use of high-performance serum separation gels. Expansion of hospital laboratories, growing patient inflow, and advancements in phlebotomy practices further elevate demand. Additionally, hospitals increasingly adopt integrated gel-based tubes to enhance workflow efficiency and minimize pre-analytical errors.

- For instance, KS Medical’s Serum Separator Tube (SST) uses separation gel with density between serum and blood cells to form a barrier post-centrifugation, aiding rapid serum isolation for biochemical and immune analyses in clinics while preventing hemolysis.

Key Growth Drivers

Rising Demand for High-Quality Diagnostic Testing

The Serum Separation Gel Market grows strongly as healthcare systems increasingly prioritize accurate and reliable diagnostic outcomes. The rising global burden of chronic diseases, including cardiovascular, metabolic, and infectious conditions, drives higher dependence on blood-based diagnostics. Serum separation gels improve sample stability, minimize hemolysis, and support high-throughput processing, making them essential in modern laboratories. As hospitals and diagnostic centers expand test volumes and adopt advanced analyzers, demand for gels ensuring consistent separation performance continues to accelerate across developed and emerging markets.

- For instance, BD Vacutainer SST™ Tubes use micronized silica particles to accelerate clotting combined with a polymer gel barrier that forms between the serum and clot after centrifugation at typical lab speeds, enabling direct serum aspiration without transfer and supporting chemistry testing workflows.

Expansion of Clinical Laboratories and Automation Adoption

Clinical laboratories worldwide are scaling their testing capacity due to rising patient inflow and growing emphasis on rapid diagnostics. Automated blood collection and processing solutions are widely adopted to improve operational efficiency and reduce manual errors. Serum separation gels play a central role in automated workflows by enabling uniform serum partitioning and compatibility with modern centrifugation systems. Investments in laboratory modernization, increased accreditation requirements, and the shift toward high-volume automated analyzers collectively strengthen the uptake of serum separation gel tubes across healthcare ecosystems.

- For instance, Roche’s cobas 8000 modular analyzer series is designed for high‑volume chemistry and immunochemistry testing and is routinely used with serum separator tubes to support consolidated, fully automated sample processing in large hospital laboratories.

Growth in Biopharmaceutical and Research Applications

The expanding biopharmaceutical sector significantly contributes to market growth as R&D activities intensify in drug discovery, vaccine development, and biomarker research. Serum separation gels support standardized sample preparation, which enhances reproducibility and accuracy in analytical testing. As biotech companies and CROs increase their focus on precision therapeutics and cell-based studies, the need for high-quality serum samples grows. Additionally, rising investment in life science research infrastructure, coupled with increasing clinical trial activities, further elevates the demand for advanced serum separation gel formats.

Key Trends & Opportunities

Integration of Advanced Tube Designs and Material Innovations

A key trend shaping the Serum Separation Gel Market is the development of enhanced gel formulations and tube designs that offer superior thermal stability, faster clotting, and improved phase separation. Manufacturers are incorporating polymer blends and inert additives to strengthen gel consistency and diagnostic assay compatibility. These innovations reduce pre-analytical variability and enable laboratories to support complex biochemical and molecular tests. As healthcare providers shift toward precision diagnostics, opportunities emerge for companies offering customizable gel solutions tailored to specialized clinical and research applications.

- For instance, BD Vacutainer Rapid Serum Tube (RST) uses thrombin-based clot activator with separating gel to achieve a clotting time of 5 minutes, forming clear, fibrin-free serum for rapid processing.

Rising Adoption of Automation-Compatible Collection Systems

Automation-ready blood collection solutions are gaining traction as laboratories pursue faster turnaround times and reduced manual intervention. Serum separation gels optimized for robotic sample handling, automated centrifugation, and barcode-integrated tracking systems create new growth avenues. This trend is further supported by digital laboratory ecosystems that demand standardized, reproducible samples for seamless workflow integration. Manufacturers offering automation-compatible tubes with enhanced durability and consistent gel performance stand to benefit significantly as diagnostic laboratories continue their transition toward fully automated processing environments.

- For instance, BD Vacutainer SST Tubes employ a polymer gel barrier that forms a stable separation between serum and cells post-centrifugation, enabling efficient handling in automated lab workflows without additional transfers.

Key Challenges

Variability in Gel Formulation and Assay Interference Risks

Despite advancements, inconsistencies in gel composition across manufacturers can lead to assay interference, poor separation quality, or contamination risks. Certain gel additives may interact with sensitive analytes, impacting test accuracy in immunoassays or therapeutic drug monitoring. Laboratories must carefully validate tube compatibility with specific testing protocols, increasing operational complexity. Ensuring formulation stability across temperature extremes and storage conditions remains a challenge, pushing manufacturers to adopt stricter quality control and more transparent performance specifications to maintain reliability.

Pricing Pressure and Limited Awareness in Emerging Markets

The Serum Separation Gel Market faces pricing constraints due to cost-sensitive healthcare environments, particularly in emerging regions where laboratories often rely on low-cost alternatives. Limited awareness of the clinical benefits of high-quality gels such as reduced hemolysis and improved sample integrity hinders premium product adoption. Budget-constrained facilities may prioritize upfront savings over long-term diagnostic accuracy. Additionally, inconsistent procurement systems and restricted access to advanced collection tubes slow market penetration, requiring manufacturers to emphasize education, training, and competitive pricing strategies.

Regional Analysis

North America

North America held a 36.7% share of the Serum Separation Gel Market in 2024, driven by its advanced healthcare infrastructure and high diagnostic testing volumes. The region benefits from widespread adoption of integrated gel-based tubes across hospitals, clinical laboratories, and biopharmaceutical research centers. Increased prevalence of chronic diseases and strong investment in laboratory automation further accelerate demand. The presence of leading manufacturers and strict quality standards supports rapid deployment of high-performance separation gels. Continuous innovation in diagnostic technologies and growing R&D funding help sustain North America’s leadership in the global market.

Europe

Europe accounted for a 29.4% share of the Serum Separation Gel Market in 2024, supported by well-established clinical laboratories and stringent regulatory frameworks ensuring high-quality diagnostic practices. Rising demand for serum-based analysis in chronic disease management and expanding biotechnology research stimulate product adoption. Countries such as Germany, the U.K., and France lead the region due to strong healthcare spending and widespread use of automated blood collection systems. Increasing emphasis on standardization, laboratory accreditation, and improved sample handling procedures continues to enhance Europe’s market position, fostering consistent growth across both Western and Eastern regions.

Asia-Pacific

Asia-Pacific captured a 22.6% share of the Serum Separation Gel Market in 2024, reflecting rapid healthcare expansion and rising diagnostic testing volumes in China, India, Japan, and Southeast Asia. Growing investments in hospital infrastructure, modernization of clinical laboratories, and an increasing focus on early disease detection significantly drive demand. The region’s flourishing biotechnology and pharmaceutical sectors further enhance adoption of high-quality separation gels for research and clinical applications. As awareness of sample integrity and standardized blood collection increases, Asia-Pacific emerges as one of the fastest-growing markets with strong long-term potential.

Latin America

Latin America held a 6.8% share of the Serum Separation Gel Market in 2024, supported by growing diagnostic needs and expanding healthcare access across Brazil, Mexico, Argentina, and Chile. Rising incidence of infectious and chronic diseases is increasing the use of blood-based testing, prompting laboratories to adopt better serum preparation solutions. Although resource constraints persist, gradual improvements in hospital infrastructure and wider availability of automated analyzers drive market adoption. Government initiatives promoting healthcare modernization and strengthened laboratory networks continue to support demand for reliable serum separation gels across the region.

Middle East & Africa

The Middle East & Africa region accounted for a 4.5% share of the Serum Separation Gel Market in 2024, driven by expanding diagnostic infrastructure and increasing investment in hospital and laboratory modernization. Growth is most prominent in GCC countries, where strong healthcare spending supports adoption of advanced blood collection technologies. Rising awareness of accurate diagnostic practices and growing private healthcare facilities contribute to higher demand. However, limited access to high-quality consumables and price-sensitive markets in parts of Africa present challenges. Ongoing efforts to improve laboratory capabilities are expected to enhance the region’s future market potential.

Market Segmentations

By Product Type

- Serum Separation Gel Integrated with Tube

- Serum Separation Gel without Tubes

By End User

- Hospitals and clinics

- Pharmaceutical & Biotechnology Companies

- Diagnostic Laboratories

- Blood Banks

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Serum Separation Gel Market features leading players such as Qiagen N.V., Cardinal Health Inc., Medtronic PLC, Bio-Rad Laboratories, Microfluidics International Corporation, BioVision Inc., Danaher Corporation, Becton Dickinson & Company, F. Hoffmann-La Roche Ltd., and Merck KGaA driving innovation and product enhancements. These companies focus on developing high-purity gel formulations, automation-ready collection tubes, and solutions that ensure superior sample integrity for high-throughput diagnostics. Many players invest heavily in R&D to improve gel stability, temperature resistance, and assay compatibility, supporting advanced clinical and molecular testing needs. Strategic initiatives, including capacity expansion, quality certifications, and regional distribution partnerships, enable manufacturers to strengthen their global presence. Increasing collaboration with hospitals, diagnostic laboratories, and biopharmaceutical companies further enhances product uptake. With rising demand for standardized and reliable blood separation systems, major players continue to prioritize innovation, regulatory compliance, and automation integration as key differentiators in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BioVision, Inc.

- Merck KGaA

- Becton Dickinson & Company

- Microfluidics International Corporation

- Cardinal Health Inc.

- Danaher Corporation

- Medtronic PLC

- Qiagen N.V.

- Bio-Rad Laboratories

- F. Hoffmann-La Roche Ltd.

Recent Developments

- In February 2025 Becton, Dickinson and Company (BD) announced plans to separate its Biosciences and Diagnostic Solutions business to more sharply focus on diagnostics growth and innovation.

- In May 2024, Greiner Bio-One International GmbH introduced an enhanced version of its VACUETTE serum separation tubes with advanced polymer gel formulation to improve serum clarity and reduce processing times for high-throughput diagnostic testing.

- In March 2024, Improve Medical announced a new range of serum separation gel tubes compliant with EU MDR regulations, targeting hospitals and labs for cost-effective clinical diagnostics.

- In July 2023 Bio-Rad Laboratories and QIAGEN N.V. signed a cross-licensing agreement resolving a patent dispute, enabling mutual access to digital PCR technologies that can support advanced diagnostic workflows.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising global diagnostic testing volumes.

- Adoption of automation-ready separation gel tubes will increase across high-throughput laboratories.

- Innovations in gel formulations will enhance stability, sample purity, and assay compatibility.

- Healthcare digitization will expand demand for standardized blood collection solutions.

- Biopharmaceutical R&D growth will boost the need for high-quality serum preparation materials.

- Emerging markets will show rapid adoption as healthcare infrastructure modernizes.

- Manufacturers will focus on sustainable, high-performance materials to meet regulatory expectations.

- Partnerships between producers and diagnostic laboratories will strengthen product optimization.

- Expansion of clinical research and clinical trials will elevate demand for consistent serum samples.

- Quality assurance and compliance requirements will drive further improvements in gel manufacturing standards.