Market Overview

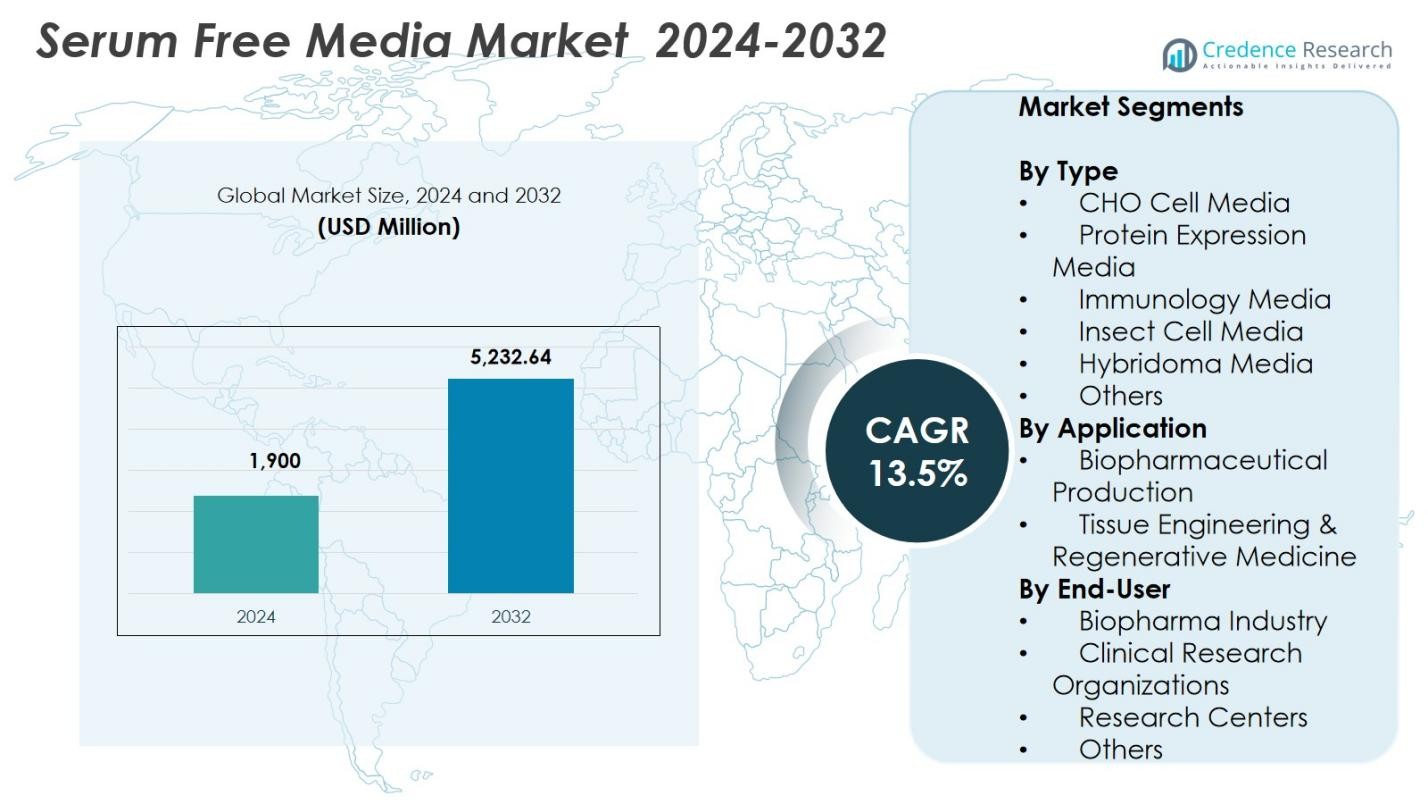

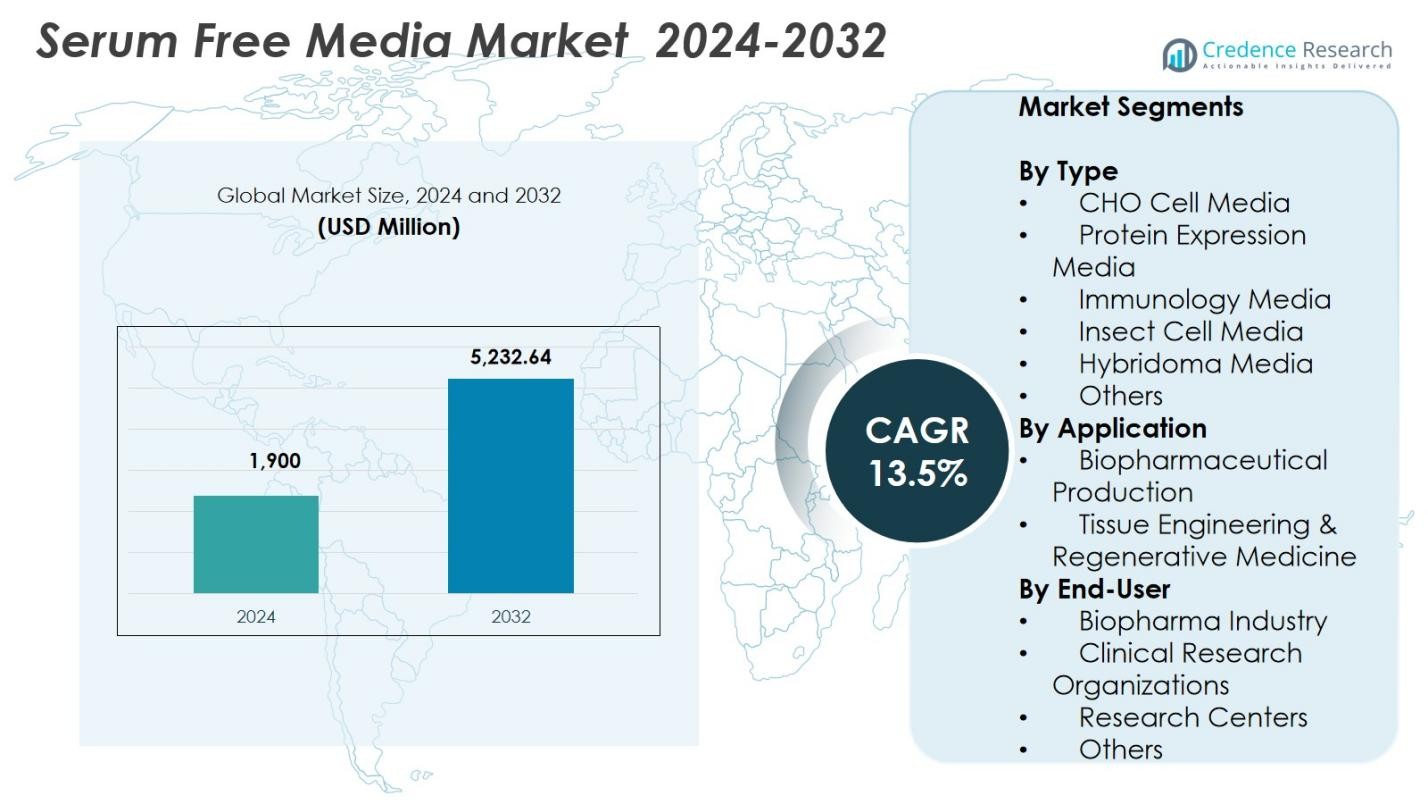

Serum Free Media Market size was valued at USD 1,900 Million in 2024 and is anticipated to reach USD 5,232.64 Million by 2032, at a CAGR of 13.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Serum Free Media Market Size 2024 |

USD 1,900 Million |

| Serum Free Media Market, CAGR |

13.5% |

| Serum Free Media Market Size 2032 |

USD 5,232.64 Million |

Serum Free Media Market features leading players such as STEMCELL Technologies, GE Healthcare, Merck KGaA, Lonza, Thermo Fisher Scientific Inc., Corning Incorporated, PAN Biotech, Irvine Scientific, MP Biomedicals, and PromoCell GmbH, all of which focus on advancing chemically defined and high-performance media for biologics and cell therapy production. North America led the Serum Free Media Market with 41.6% share in 2024, supported by strong biomanufacturing infrastructure and high adoption of serum-free systems. Europe followed with 28.3% share, driven by expanding stem-cell research and stringent quality standards, while Asia-Pacific accounted for 22.7% share, reflecting rapid growth in biopharma manufacturing and increased investment in cell and gene therapy development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Serum Free Media Market reached USD 1,900 Million in 2024 and will grow at a CAGR of 13.5% through 2032, driven by rising biologics demand and advanced cell culture applications.

- Strong market growth is fueled by expanding monoclonal antibody production, increasing adoption of serum-free formulations for consistent bioprocessing, and the dominance of CHO Cell Media with 37.4% share in 2024.

- Automation, single-use bioreactors, and expanding cell and gene therapy pipelines are shaping market trends, encouraging development of chemically defined and high-performance media.

- Key players such as STEMCELL Technologies, GE Healthcare, Merck KGaA, Lonza, Thermo Fisher Scientific Inc., and Corning Incorporated strengthen market presence through product innovation and global expansion.

- North America led the market with 41.6% share in 2024, followed by Europe at 28.3% and Asia-Pacific at 22.7%, supported by strong biopharma manufacturing and rising investment in regenerative medicine.

Market Segmentation Analysis:

By Type

The CHO Cell Media segment dominated the Serum Free Media Market with 37.4% share in 2024, driven by its extensive use in monoclonal antibody manufacturing, recombinant protein production, and large-scale biologics development. Biopharma companies increasingly prefer CHO-based platforms because they provide high productivity, scalability, and stable expression systems for therapeutic proteins. Rising approvals of biologics and biosimilars, coupled with expanding biomanufacturing capacities, continue to strengthen demand for optimized CHO media formulations. Other segments including protein expression, immunology, insect, hybridoma, and specialty media are also growing, supported by diversified research applications and cell-specific performance enhancements.

- For instance, Roche manufactures Trastuzumab (Herceptin) for breast cancer via recombinant DNA technology in CHO cells, ensuring consistent quality through controlled cell culture and purification.

By Application

Biopharmaceutical Production led the Serum Free Media Market with 66.1% share in 2024, supported by rising biologics demand, vaccine development, and adoption of serum-free systems to ensure lot-to-lot consistency and regulatory compliance. The shift toward scalable bioprocessing, including upstream cell culture optimization and high-yield recombinant protein expression, further accelerates segment growth. Serum-free media offers enhanced reproducibility, reduced contamination risk, and improved downstream purification efficiency, making it the preferred choice for commercial manufacturing. Tissue Engineering & Regenerative Medicine accounted for the remaining share, driven by advancements in stem-cell therapies and scaffold-based research.

- For instance, Pluristem Therapeutics developed a proprietary serum-free media formulation in 2019 for large-scale production of its PLX-R18 cell therapy product.

By End-User

The Biopharma Industry dominated the Serum Free Media Market with 54.8% share in 2024, driven by expanding biologics pipelines, large-scale commercial manufacturing, and increasing use of serum-free formulations to meet GMP and regulatory requirements. Biopharma companies prioritize serum-free media due to improved batch uniformity, reduced contamination risks, and enhanced scalability for continuous and fed-batch bioprocessing. Clinical Research Organizations, Research Centers, and Others collectively contribute to the remaining share, benefiting from rising adoption of serum-free systems in preclinical studies, vaccine development, cell-line engineering, and emerging applications in regenerative medicine.

Key Growth Drivers

Rising Demand for Biologics and Cell-Based Therapeutics

The rapid expansion of biologics, including monoclonal antibodies, vaccines, cell therapies, and recombinant proteins, is a primary driver of the Serum Free Media Market. Manufacturers increasingly adopt serum-free formulations to achieve greater batch consistency, reduce contamination risks, and comply with stringent regulatory expectations for biopharmaceutical production. The scalability of serum-free platforms supports high-density cell cultures and optimized upstream processing, enabling higher productivity. As global approvals of biologics increase and pipeline candidates progress across clinical stages, demand for advanced serum-free media continues to accelerate across commercial and research settings.

- For instance, Thermo Fisher Scientific’s Gibco ExpiCHO Expression Medium, a chemically defined serum-free option, supports high-density suspension cultures of CHO cells for recombinant protein production, facilitating higher yields without animal-derived components.

Shift Toward Chemically Defined and GMP-Compliant Media

A growing emphasis on reproducible, contamination-free bioprocessing is driving the transition from serum-supplemented media to chemically defined serum-free solutions. Biopharma manufacturers prefer serum-free media because it eliminates batch variability, improves downstream purification efficiency, and strengthens regulatory compliance for GMP operations. The rise of continuous bioprocessing and single-use technologies further boosts adoption, as serum-free formulations integrate more efficiently with automated, closed-loop manufacturing systems. These benefits support consistent product quality, reduced operational risks, and faster scale-up, making serum-free media essential for modern biomanufacturing.

- For instance, Lonza introduced its TheraPEAK T‑VIVO Cell Culture Medium in May 2023, a chemically defined, non‑animal origin serum‑free medium designed to improve consistency in CAR T‑cell manufacturing by reducing variability in T‑cell expansion and function.

Advancements in Cell Line Engineering and Regenerative Medicine

Enhanced cell engineering tools such as CRISPR, high-throughput screening, and optimized expression systems significantly increase the demand for specialized serum-free media tailored to specific cell types. Regenerative medicine applications, including stem-cell expansion, induced pluripotent stem cells, and tissue engineering models, require highly controlled media environments that serum-free solutions provide. These formulations support improved cell viability, lineage-specific differentiation, and long-term stability. As global investment in advanced therapies rises, the need for customizable, high-performance serum-free media strengthens, expanding adoption across research laboratories, clinical trial manufacturing, and therapeutic development.

Key Trends & Opportunities

Expansion of Single-Use Bioprocessing and Automation

The adoption of single-use bioreactors, automated culture systems, and modular bioprocessing equipment is reshaping serum-free media demand. These systems require contamination-free, standardized media to maintain reproducibility across batches and support flexible manufacturing. Serum-free formulations align well with digitalized workflows, enabling real-time monitoring, automated feeding strategies, and enhanced process scalability. Opportunities emerge as biopharma companies increasingly integrate robotics, AI-driven optimization, and perfusion systems, driving demand for media tailored to continuous and semi-continuous processes. This trend accelerates efficiency while reducing operational costs and manufacturing complexity.

- For instance, Cytiva’s iCELLis Nano fixed-bed bioreactor, equipped with a 1.07 m² single-use unit, supports serum-free cultivation of adherent Vero cells for Japanese encephalitis virus production, using 850 mL working volume for carrier conditioning and process optimization.

Growing Investment in Cell and Gene Therapy Platforms

Rising investments in CAR-T therapies, stem-cell treatments, and viral vector manufacturing are creating substantial opportunities for serum-free media suppliers. Advanced therapy manufacturers require highly controlled media formulations that support rapid cell expansion, improved viability, and consistent phenotypic expression. Serum-free media offers a safer and more regulatory-aligned alternative to FBS-based systems, making it the preferred choice for clinical-grade production. As global approvals for cell and gene therapies increase, demand grows for specialized, chemically defined serum-free media optimized for T cells, stem cells, and vector-producing cell lines.

- For instance, Gibco’s CTS™ OpTmizer™ T Cell Expansion SFM supports high-density culture of human T cells at over 4 x 10^6 CD3+ T-cells/mL and is widely used in CAR T-cell research for activation with Dynabeads or antibodies.

Key Challenges

High Cost of Development and Production

Serum-free media development requires complex formulation processes, extensive validation, and ongoing optimization, leading to significantly higher production costs compared to serum-based alternatives. Manufacturers need to invest in advanced purification, quality testing, and cell-specific optimization, increasing overall expenditure. These costs can create adoption barriers for small and mid-sized research facilities with limited budgets. Additionally, the premium pricing of chemically defined and GMP-compliant formulations often limits broader uptake, challenging market penetration in cost-sensitive regions and slowing transition from conventional serum-supplemented media.

Cell Line Adaptation and Performance Limitations

Adapting existing cell lines from serum-supplemented environments to serum-free conditions remains a major challenge. Many cell types experience reduced viability, slower growth, or altered protein expression during transition, requiring extensive optimization and long adaptation timelines. Variability in how different lines respond to serum-free formulations complicates standardization and may introduce risks during scale-up. These performance limitations can delay development cycles, increase operational complexity, and limit adoption among laboratories working with diverse or sensitive cell models, thereby impacting overall market growth.

Regional Analysis

North America

North America dominated the Serum Free Media Market with 41.6% share in 2024, driven by strong biopharmaceutical manufacturing capacity, high biologics approval rates, and extensive adoption of advanced cell culture technologies. The United States leads regional growth due to significant investments in cell and gene therapy development, robust CRO activity, and widespread transition to chemically defined serum-free systems. The presence of major biopharma companies, well-established GMP infrastructure, and supportive regulatory pathways further accelerate demand. Canada contributes additional growth through rising research funding and expanding academic–industry collaborations in regenerative medicine and immunotherapy.

Europe

Europe held 28.3% share in 2024, supported by a well-developed bioprocessing sector and strong emphasis on high-quality, compliant manufacturing. Countries such as Germany, the U.K., and France lead adoption due to expanding biologics pipelines, rising stem-cell research activity, and rapid technological integration across biomanufacturing facilities. The region’s stringent regulatory standards encourage the use of serum-free and chemically defined media to ensure consistency and reduce contamination risks. Growth is further strengthened by EU-funded initiatives advancing cell therapy, vaccine development, and precision medicine, which continue to drive procurement of high-performance serum-free media formulations.

Asia-Pacific

Asia-Pacific accounted for 22.7% share in 2024, emerging as the fastest-growing region due to expanding biopharma manufacturing clusters, rising R&D spending, and government-backed investment in biologics and vaccine production. China, India, South Korea, and Japan are key contributors, supported by increasing establishment of GMP-compliant facilities and rapid adoption of serum-free systems to enhance process consistency. The region benefits from a growing talent pool, strategic partnerships with global manufacturers, and rising demand for affordable biologics. Expansion of cell therapy research institutes and biotechnology parks continues to fuel significant opportunities for serum-free media suppliers.

Latin America

Latin America held 4.2% share in 2024, with growth driven by increasing investments in biopharmaceutical research, vaccine manufacturing, and academic–industry collaborations. Brazil and Mexico lead regional adoption due to expanding biotechnology capabilities and government programs focused on strengthening domestic bioprocessing infrastructure. The shift toward serum-free systems is encouraged by the need for enhanced product consistency and reduced contamination risk in clinical and preclinical research. Although adoption remains moderate, rising interest in biosimilars manufacturing and public health initiatives continues to create opportunities for serum-free media expansion across research laboratories and emerging biopharma companies.

Middle East & Africa

The Middle East & Africa region represented 3.2% share in 2024, supported by growing investment in healthcare modernization, biotechnology development, and clinical research infrastructure. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are strengthening their life sciences ecosystems, increasing demand for high-quality serum-free media in diagnostics, vaccine research, and early-stage bioprocessing. International partnerships and rising establishment of research centers contribute to improved adoption. While market penetration remains lower than other regions, the region’s expanding focus on biologics, academic research, and translational medicine supports steady long-term growth prospects.

Market Segmentations

By Type

- CHO Cell Media

- Protein Expression Media

- Immunology Media

- Insect Cell Media

- Hybridoma Media

- Others

By Application

- Biopharmaceutical Production

- Tissue Engineering & Regenerative Medicine

By End-User

- Biopharma Industry

- Clinical Research Organizations

- Research Centers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Serum Free Media Market analysis reveals a strong presence of major players including STEMCELL Technologies, GE Healthcare, MP Biomedicals, Merck KGaA, PAN Biotech, Lonza, Corning Incorporated, Thermo Fisher Scientific Inc., Irvine Scientific, and PromoCell GmbH. These companies focus on expanding their product portfolios, investing in advanced cell culture technologies, and developing chemically defined, GMP-compliant media to meet rising biopharmaceutical standards. Strategic initiatives such as acquisitions, global manufacturing expansion, and collaborations with research institutes strengthen their market positioning. Leading players emphasize innovation in CHO media, stem-cell culture platforms, and high-performance recombinant protein expression systems to support next-generation therapeutics. Continuous advancements in cell engineering, automation-ready formulations, and scalable upstream processes further drive competition, encouraging companies to enhance customization, improve reproducibility, and deliver cost-effective solutions for both research and commercial bioproduction environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PAN Biotech

- GE Healthcare

- PromoCell GmbH

- Corning Incorporated

- MP Biomedicals, LLC

- STEMCELL Technologies

- Irvine Scientific

- Merck KGaA

- Lonza

- Thermo Fisher Scientific Inc.

Recent Developments

- In December 2024, Merck KGaA signed a definitive agreement to acquire HUB Organoids Holding B.V. (HUB), a company pioneering organoid-based cell culture models, strengthening its capabilities in advanced cell-based systems.

- In August 2024, Nucleus Biologics launched its QuickStart Media platform, incorporating NB-ROC, a serum-free T-cell medium, to streamline custom and off-the-shelf media selection for cell therapy developers.

- In April 2023, Multus Biotechnology partnered with Appleton Woods to roll out Proliferum LSR, a serum-free cell culture medium for cultivated meat producers across the UK market.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Serum Free Media Market will expand rapidly as biologics, vaccines, and cell-based therapies gain wider global adoption.

- Demand for chemically defined and GMP-compliant formulations will strengthen to support consistent and contamination-free bioprocessing.

- Adoption of single-use bioreactors and automated culture systems will drive the need for optimized serum-free media.

- Cell and gene therapy advancements will accelerate development of specialized media for T cells, stem cells, and viral vector production.

- Expansion of regenerative medicine will increase demand for high-performance media supporting differentiation and long-term cell stability.

- Biopharma companies will invest more in scalable upstream processes, boosting usage of serum-free formulations.

- AI-driven process optimization and digital biomanufacturing will create opportunities for media tailored to continuous workflows.

- Emerging biotech clusters in Asia-Pacific will drive significant regional demand for commercial-scale serum-free media.

- Collaborations between manufacturers and research institutes will foster innovation in cell-specific media solutions.

- Competitive focus will shift toward cost-efficient, high-yield, customizable media systems for next-generation bioprocessing.