Market Overview

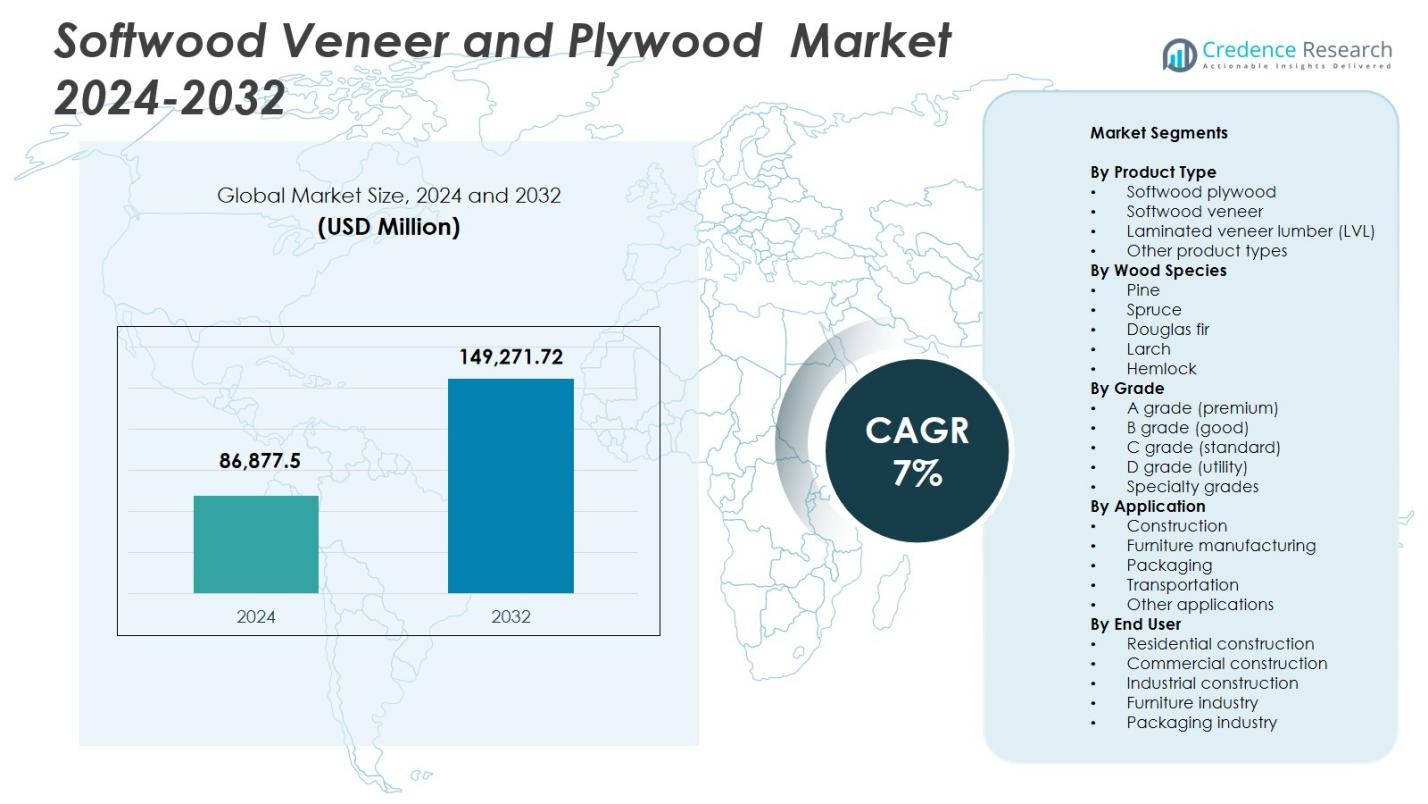

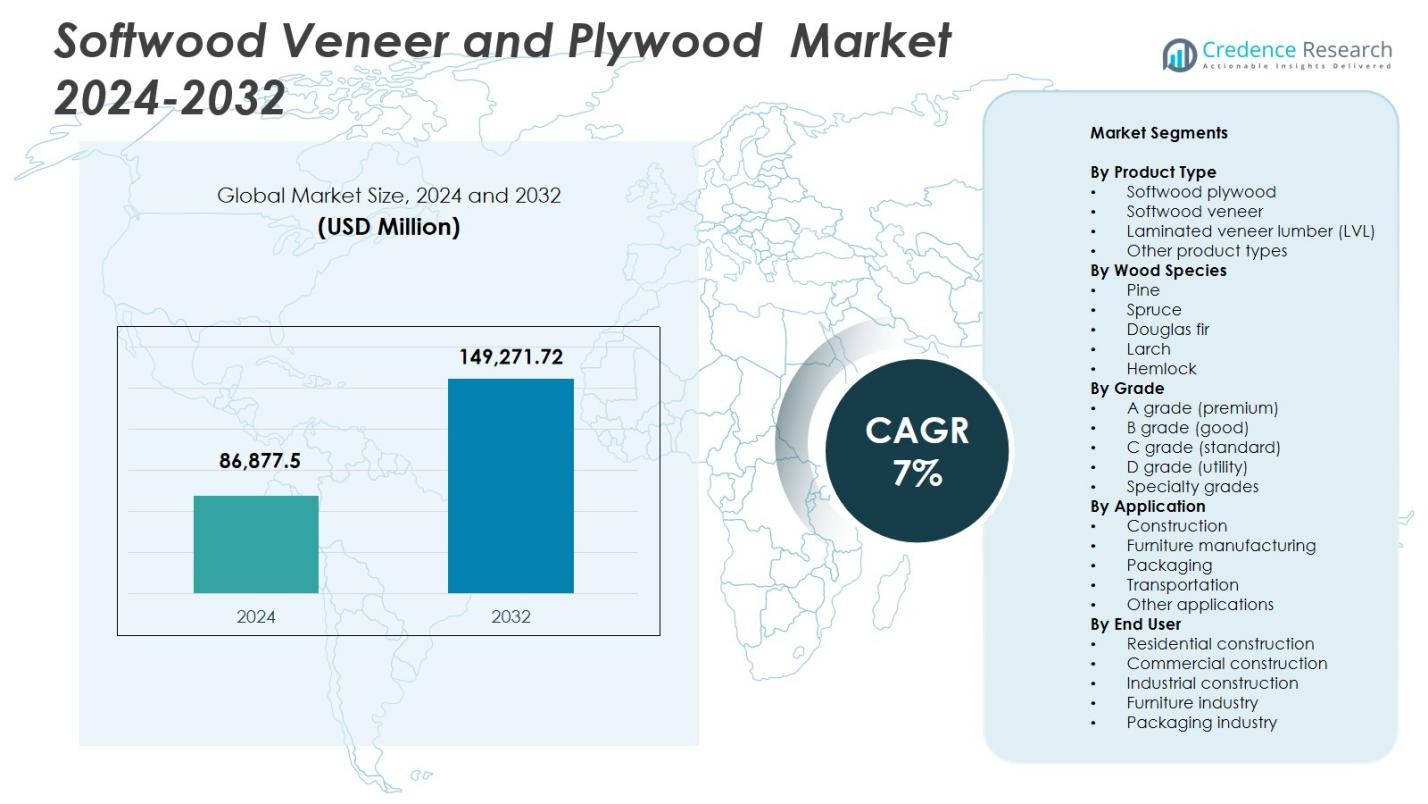

Softwood Veneer and Plywood Market size was valued at USD 86,877.5 Million in 2024 and is anticipated to reach USD 149,271.72 Million by 2032, growing at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Softwood Veneer and Plywood Market Size 2024 |

USD 86,877.5 Million |

| Softwood Veneer and Plywood Market, CAGR |

7% |

| Softwood Veneer and Plywood Market Size 2032 |

USD 149,271.72 Million |

Softwood Veneer and Plywood Market is driven by key players such as Georgia-Pacific, West Fraser Timber Co. Ltd., Weyerhaeuser, Arauco, Dongwha Group, Kronospan, Canfor Plywood, Century Plyboards, Boise Cascade, and Metsä Wood. These companies focus on expanding production capacities, adopting sustainable forestry practices, and offering premium-grade and engineered products like laminated veneer lumber (LVL) to meet growing demand across construction, furniture, and interior design applications. Asia-Pacific leads the market with a 31.2% share in 2024, followed by North America at 28.4% and Europe at 24.7%. High urbanization, infrastructure development, and rising disposable incomes in these regions fuel demand for softwood plywood and veneer. Strategic regional expansions, technological advancements, and sustainable sourcing initiatives by these top players reinforce their market presence while addressing both industrial and consumer needs across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Softwood Veneer and Plywood market size was valued at USD 86,877.5 Million in 2024 and is projected to reach USD 149,271.72 Million by 2032, growing at a CAGR of 7% during the forecast period.

- Rising construction activities, infrastructure development, and increasing demand for furniture and interior design applications are driving market growth. Growth in sustainable and eco-friendly wood products further supports adoption.

- Engineered wood products like laminated veneer lumber (LVL) and multi-layer plywood are gaining traction. Premium-grade plywood and veneer are increasingly preferred for residential, commercial, and industrial applications. Expansion of modular construction and urbanization are key trends.

- Key players include Georgia-Pacific, West Fraser Timber Co. Ltd., Weyerhaeuser, Arauco, Dongwha Group, Kronospan, Canfor Plywood, Century Plyboards, Boise Cascade, and Metsä Wood. Companies focus on sustainable sourcing, capacity expansion, and product innovation to maintain market position.

- Asia-Pacific leads with 31.2% share, followed by North America at 28.4% and Europe at 24.7%. Softwood plywood dominates product type with 42.3% share, while pine leads wood species with 38.7% share.

Market Segmentation Analysis

By Product Type

The Softwood Veneer and Plywood market is primarily segmented by product type into softwood plywood, softwood veneer, laminated veneer lumber (LVL), and other product types. Softwood plywood dominates with a 42.3% market share in 2024, driven by its high structural strength, ease of processing, and wide adoption in construction, furniture, and interior design. Laminated veneer lumber is gaining traction due to its dimensional stability and suitability for large structural applications. Softwood veneer and other product types remain niche segments, primarily used in decorative applications and specialized manufacturing, supported by rising demand for sustainable and lightweight wood products.

- For instance, laminated veneer lumber (LVL) is increasingly adopted in structural applications LVL is engineered by bonding thin veneers under heat and pressure, offering high strength, dimensional stability, and the ability to span long distances, making it ideal for beams, floor joists, rafters, and wall framing in both residential and commercial construction.

By Wood Species

Segmenting by wood species, the market includes pine, spruce, Douglas fir, larch, and hemlock. Pine holds the leading 38.7% share in 2024, attributed to its abundant availability, consistent quality, and cost-effectiveness across industrial and residential applications. Douglas fir and spruce are valued for their superior strength-to-weight ratio, supporting LVL and structural plywood production. Larch and hemlock maintain moderate demand, mainly for exterior and specialty construction applications. Growth in sustainable forestry practices and engineered wood adoption further boosts species-specific utilization in construction and furniture manufacturing.

- For instance, Douglas fir is often selected for structural lumber and engineered wood products thanks to its high strength‑to‑weight ratio, good nail and screw holding, and suitability for beams, trusses, and structural plywood making it a go‑to species for load‑bearing construction.

By Grade

The market is categorized by grade into A (premium), B (good), C (standard), D (utility), and specialty grades. A grade (premium) dominates with a 45.1% share in 2024, driven by high demand in premium furniture, cabinetry, and interior design segments where superior surface finish and durability are critical. B and C grades serve mid-tier construction and industrial applications, offering a balance between cost and quality. D and specialty grades cater to utility and niche decorative purposes. Rising consumer preference for high-quality wood products and stringent quality standards reinforce the dominance of premium-grade softwood plywood and veneer.

Key Growth Drivers

Rising Construction and Infrastructure Activities

The Softwood Veneer and Plywood market is significantly propelled by expanding construction and infrastructure projects globally. Increasing urbanization, population growth, and government investments in residential, commercial, and public infrastructure drive demand for softwood plywood and veneer due to their structural strength, durability, and versatility. The preference for engineered wood products in flooring, paneling, and furniture enhances adoption rates. Softwood plywood, in particular, benefits from large-scale building projects where dimensional stability and ease of installation are crucial. Additionally, the integration of sustainable construction practices and green building certifications encourages the use of certified softwood products, creating sustained growth. Rising renovation and remodeling activities in developed economies further augment demand, ensuring steady consumption across both new construction and refurbishment projects, thereby acting as a major growth catalyst for the market.

- For instance, Ecoply structural plywood from Carter Holt Harvey features in the Monash University Chancellery building, forming stepped balustrades around the central void in a net-zero carbon, Passivhaus-compliant design made from FSC-certified Radiata Pine.

Increasing Demand for Eco-Friendly and Sustainable Wood Products

Sustainability trends are a pivotal growth driver in the Softwood Veneer and Plywood market. Manufacturers and consumers are increasingly shifting toward eco-friendly and responsibly sourced wood products to minimize environmental impact. Softwood veneer and plywood, produced from sustainably managed forests, support circular economy principles and low carbon footprint construction. Rising environmental awareness and regulatory pressures, such as forest certification schemes and emissions reduction mandates, further reinforce adoption. The growing popularity of green building materials in residential, commercial, and institutional applications boosts market growth. Additionally, engineered products like laminated veneer lumber (LVL) optimize wood usage, reducing waste while maintaining structural integrity, making these products attractive to environmentally conscious stakeholders. This focus on sustainability drives product innovation, supports premium pricing, and enhances market expansion globally.

- For instance, AK Apple Plywood in India manufactures eco-friendly plywood using FSC-certified raw materials and energy-efficient processes, recycling wood waste such as sawdust and chips into particle boards to reduce landfill and emissions.

Growth in Furniture and Interior Design Applications

The increasing demand for high-quality furniture, cabinetry, and interior design elements fuels growth in the Softwood Veneer and Plywood market. Softwood plywood and veneer are widely preferred in modular furniture, wall paneling, and decorative applications due to their smooth finish, workability, and aesthetic appeal. Rising disposable incomes, lifestyle upgrades, and urban living trends stimulate consumer demand for stylish, durable, and lightweight wooden furniture. Additionally, the rise of e-commerce platforms and home improvement retail chains facilitates accessibility to premium-grade softwood products, expanding adoption. Interior designers and architects increasingly specify softwood plywood and veneer in modern residential and commercial projects for both functionality and aesthetics. The combined effect of rising demand for furniture, interior décor, and DIY projects strengthens the market’s growth trajectory and underscores the importance of product versatility across applications.

Key Trends & Opportunities

Adoption of Engineered Wood Products and LVL

The Softwood Veneer and Plywood market is witnessing a growing trend toward engineered wood products such as laminated veneer lumber (LVL), cross-laminated timber (CLT), and multi-layer plywood. LVL offers enhanced strength, stability, and dimensional uniformity compared to traditional softwood plywood, making it increasingly preferred in structural applications and high-rise construction. This shift enables manufacturers to cater to modern construction demands requiring lightweight, durable, and eco-friendly materials. Opportunities also arise in prefabricated construction and modular building segments, where engineered wood components reduce construction time and labor costs. Continued research and development in product engineering and performance enhancement present avenues for market expansion and higher adoption across industrial, commercial, and residential applications.

- For instance, LVL is widely acknowledged for its superior structural performance LVL beams offer enhanced strength, stiffness, and dimensional stability compared to traditional lumber, with far less susceptibility to warping or shrinkage, making them ideal for long‑span beams, joists, headers, and load‑bearing frames in both residential and commercial buildings

Expansion in Emerging Economies

Emerging economies in Asia-Pacific, Latin America, and Africa present significant opportunities for the Softwood Veneer and Plywood market. Rapid urbanization, rising disposable incomes, and growing industrialization in these regions drive demand for construction materials, furniture, and interior products. Governments are investing in housing and infrastructure development, supporting the consumption of softwood plywood and veneer. Additionally, increasing awareness of sustainable wood products and access to certified wood enhance market penetration. The presence of cost-competitive local manufacturers and expanding export channels further stimulates growth. These markets also offer opportunities for premium-grade and engineered wood adoption as urban populations seek modern, high-quality, and environmentally responsible building materials, creating long-term growth potential for both domestic and international players.

- For instance, in India, government initiatives such as the Pradhan Mantri Awas Yojana (PMAY) and Smart Cities Mission are stimulating demand for moisture‑resistant and fire‑retardant plywood in affordable housing and urban infrastructure, supporting higher consumption of structural and interior wood panels.

Key Challenges

Fluctuating Raw Material Prices and Supply Constraints

The Softwood Veneer and Plywood market faces challenges from the volatility of raw material prices and limited availability of high-quality softwood. Timber supply shortages, transportation bottlenecks, and environmental restrictions on logging can lead to price fluctuations, impacting manufacturing costs and profit margins. Dependence on sustainably sourced forests and compliance with certification standards adds complexity and operational costs. Sudden geopolitical disruptions or natural calamities affecting forest regions further exacerbate supply instability. These factors can hinder market expansion and create uncertainty in pricing, especially for premium-grade and engineered wood products. Manufacturers must optimize supply chain management, maintain strategic timber reserves, and explore alternative sourcing to mitigate these challenges.

Competition from Alternative Materials

The Softwood Veneer and Plywood market contends with competition from substitute materials such as medium-density fiberboard (MDF), particleboard, metal, plastic laminates, and concrete panels. These alternatives may offer cost advantages, moisture resistance, or higher durability in specific applications, affecting demand for traditional softwood products. Increased adoption of composites and synthetic materials in furniture, construction, and interior design can reduce market share. Additionally, the perception of engineered alternatives as more uniform and low-maintenance products challenges softwood plywood and veneer adoption. To overcome this, manufacturers need to emphasize product quality, sustainability, and value-added features, while innovating designs that leverage the aesthetic and structural benefits of softwood products to retain competitiveness.

Regional Analysis

North America

The North American Softwood Veneer and Plywood market held a 28.4% share in 2024, led by the United States and Canada due to robust construction activities, growing furniture manufacturing, and infrastructure modernization. High adoption of premium-grade softwood plywood and veneer in residential, commercial, and industrial projects drives demand. The region benefits from well-established distribution networks, advanced manufacturing facilities, and sustainable forestry practices. Rising renovation and remodeling activities, coupled with government incentives for green building, further support market growth. Additionally, increasing demand for engineered wood products like LVL enhances adoption across structural and interior applications, strengthening North America’s leadership in the market.

Europe

Europe accounted for a 24.7% market share in 2024, with Germany, France, and the UK driving demand through residential construction, commercial interiors, and furniture manufacturing. Strict environmental regulations and sustainability mandates promote certified softwood products, including premium plywood and veneer. Engineered wood products are increasingly adopted for modular construction and energy-efficient buildings. Growing urbanization and renovation trends, along with technological advancements in processing and finishing, support market expansion. Additionally, rising awareness of eco-friendly materials among consumers and designers encourages the use of softwood veneer and plywood in interior décor, cabinetry, and flooring applications, reinforcing Europe’s steady growth trajectory.

Asia-Pacific

The Asia-Pacific region captured a 31.2% share in 2024, driven by China, India, Japan, and Southeast Asian economies. Rapid urbanization, industrialization, and infrastructure development fuel demand for construction-grade softwood plywood and engineered products like LVL. Rising middle-class populations and increasing disposable incomes stimulate furniture manufacturing and interior design adoption. Government initiatives promoting affordable housing, commercial complexes, and green building practices further accelerate growth. Additionally, local production capacity expansion and cost-competitive exports contribute to market penetration. Asia-Pacific remains a high-growth region due to the combination of large-scale construction projects, rising demand for premium-grade wood products, and increased awareness of sustainable forestry practices.

Latin America

Latin America accounted for a 7.6% market share in 2024, with Brazil, Chile, and Mexico leading consumption. The region benefits from abundant forest resources and expanding furniture and construction industries. Growing urbanization, residential development, and commercial construction projects drive demand for softwood veneer, plywood, and engineered wood products. Sustainable forestry initiatives and certification programs encourage the use of responsibly sourced softwood products. Additionally, exports to North America and Europe support regional manufacturers’ growth. However, fluctuations in raw material prices and logistical challenges can affect market stability. Continued investment in infrastructure and premium-grade product adoption is expected to boost the region’s market potential.

Middle East & Africa

The Middle East & Africa region held a 7.0% share in 2024, driven by construction booms in the UAE, Saudi Arabia, and South Africa. Demand is primarily fueled by residential, commercial, and hospitality projects, along with growing interest in sustainable and engineered wood products. Softwood plywood and veneer are increasingly specified for interiors, modular construction, and furniture applications. Investments in high-end infrastructure and urban development, along with rising disposable incomes, support market growth. Challenges such as raw material sourcing and import dependency exist, but favorable trade policies and ongoing construction projects provide opportunities for expansion. Premium-grade softwood products remain highly preferred in the region.

Market Segmentations

By Product Type

- Softwood plywood

- Softwood veneer

- Laminated veneer lumber (LVL)

- Other product types

By Wood Species

- Pine

- Spruce

- Douglas fir

- Larch

- Hemlock

By Grade

- A grade (premium)

- B grade (good)

- C grade (standard)

- D grade (utility)

- Specialty grades

By Application

- Construction

- Furniture manufacturing

- Packaging

- Transportation

- Other applications

By End User

- Residential construction

- Commercial construction

- Industrial construction

- Furniture industry

- Packaging industry

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Softwood Veneer and Plywood market is characterized by the presence of several established players focusing on product innovation, capacity expansion, and sustainable practices to strengthen their market positions. Key players include Georgia-Pacific, West Fraser Timber Co. Ltd., Weyerhaeuser, Arauco, Dongwha Group, Kronospan, Canfor Plywood, Century Plyboards, Boise Cascade, and Metsä Wood. These companies leverage strong distribution networks, advanced manufacturing technologies, and strategic partnerships to cater to growing demand across construction, furniture, and interior design applications. Emphasis on premium-grade and engineered wood products, including laminated veneer lumber (LVL), supports market differentiation. Sustainability initiatives, such as certified sourcing and low-emission production processes, enhance brand reputation and align with regulatory requirements. Regional expansions, mergers, and acquisitions enable these companies to strengthen supply chains and access emerging markets. Continuous investment in research and development ensures product quality, dimensional stability, and aesthetic appeal, maintaining competitiveness in a dynamic global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Weyerhaeuser

- Century Plyboards / CenturyProwud

- Kronospan / Kronoplus

- Georgia-Pacific

- Dongwha / Dongwha Group

- Canfor / Canfor Plywood

- Arauco

- West Fraser Timber Co. Ltd.

- Boise Cascade

- Metsä Wood

Recent Developments

- In September 2024, Duroply Industries Limited showcased a premium plywood and veneer collection at Matecia 2024 (held at Yashobhoomi, New Delhi) featuring its “Nature’s Signature” veneer collection and sustainable‑practice‑based product offerings.

- In March 2024, Richelieu Hardware acquired Allegheny Plywood Company (U.S.-based) a move that could influence supply and distribution dynamics in plywood and panel markets.

- In January 2024, EGGER Group acquired a 25.1% stake in Panel Plus Co., Ltd. (a Thai wood‑based materials manufacturer), expanding EGGER’s presence in Asia and presumably enhancing its plywood/veneer supply position

Report Coverage

The research report offers an in-depth analysis based on Product Type, Wood Species, Grade, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium-grade softwood plywood and veneer will continue to rise across residential and commercial construction.

- Engineered wood products like laminated veneer lumber (LVL) will see increasing adoption in structural applications.

- Sustainable and eco-friendly wood products will gain greater preference due to environmental regulations and consumer awareness.

- Expansion of modular and prefabricated construction will drive market growth.

- Urbanization and infrastructure development in emerging economies will create significant opportunities.

- Furniture manufacturing and interior design sectors will remain key consumption areas.

- Technological advancements in processing and finishing will enhance product quality and appeal.

- Regional market expansion, especially in Asia-Pacific and North America, will support global growth.

- Companies will focus on strategic partnerships, acquisitions, and capacity expansions to strengthen market presence.

- Rising demand for specialty and engineered grades will encourage product innovation and diversification.