Market Overview

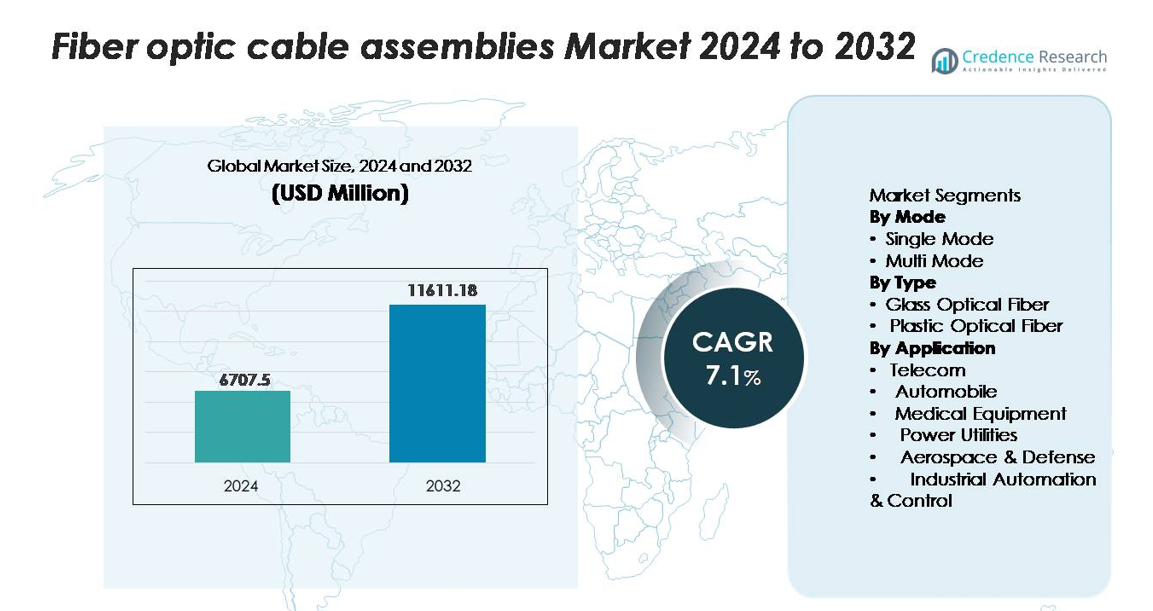

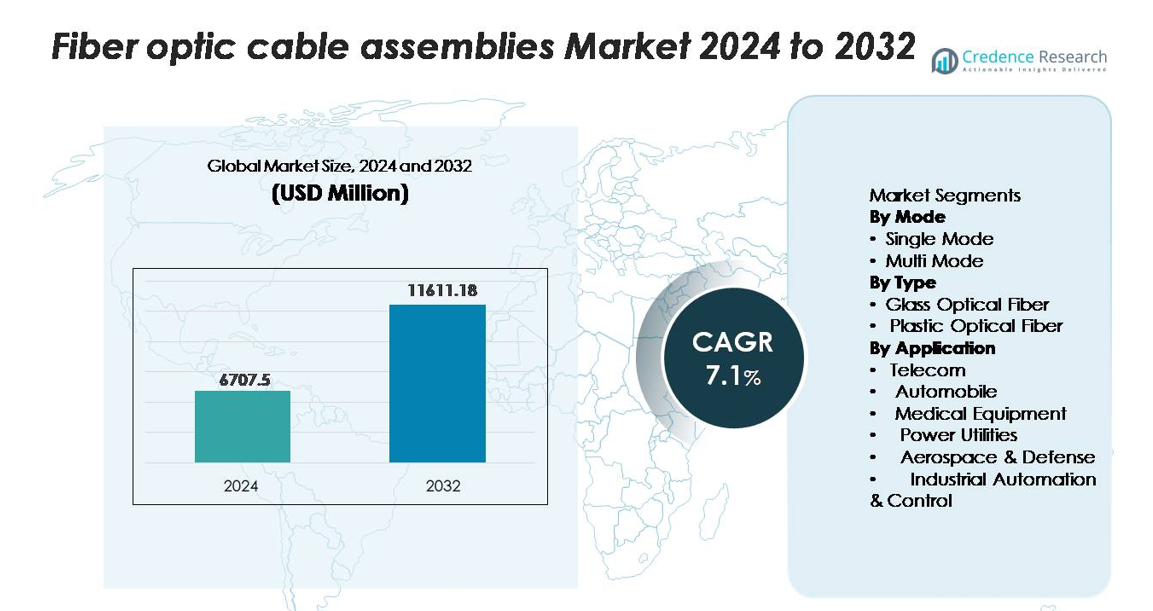

The fiber optic cable assemblies market was valued at USD 6,707.5 million in 2024 and is anticipated to reach USD 11,611.18 million by 2032, expanding at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fiber Optic Cable Assemblies Market Size 2024 |

USD 6,707.5 million |

| Fiber Optic Cable Assemblies Market, CAGR |

7.1% |

| Fiber Optic Cable Assemblies Market Size 2032 |

USD 11,611.18 million |

The fiber optic cable assemblies market is led by major players such as Corning Incorporated, Prysmian Group, Fujikura Ltd., CommScope, Nexans, OFS, and Yangtze Optical Fibre and Cable (YOFC), each leveraging advanced optical technologies and strong global manufacturing capabilities. These companies dominate high-performance segments including single-mode assemblies, MPO/MTP high-density solutions, and ruggedized industrial fiber systems. Asia-Pacific holds the leading regional share at approximately 36%, driven by large-scale telecom upgrades, extensive 5G deployments, and strong domestic production capacity. North America and Europe follow, supported by data center expansion and accelerating FTTH rollouts.

Market Insights

- The fiber optic cable assemblies market reached USD 6,707.5 million in 2024 and is projected to hit USD 11,611.18 million by 2032, expanding at a CAGR of 7.1%.

- Strong demand for high-speed connectivity, 5G backhaul, and FTTH deployments drives rapid adoption, with single-mode fibers holding the dominant segment share due to superior long-distance performance.

- Market trends highlight increasing use of high-density MPO/MTP assemblies and rising adoption in data centers, industrial automation, and automotive electronics, supported by advances in bend-insensitive and low-loss fiber technologies.

- Competition intensifies among leaders such as Corning, Prysmian, Fujikura, CommScope, Nexans, and YOFC, while restraints include high installation costs and the need for skilled fiber technicians.

- Regionally, Asia-Pacific leads with 36% share, followed by North America at 32% and Europe at 27%, driven by telecom expansion, hyperscale data center growth, and accelerated fiber rollout initiatives worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Mode

Single-mode fiber optic cable assemblies dominate the market, holding the largest share due to their ability to support significantly higher bandwidth and longer transmission distances with minimal signal loss. Telecom operators, hyperscale data centers, and 5G infrastructure providers increasingly favor single-mode solutions for high-capacity backbone networks and metro aggregation systems. Multi-mode fibers continue to serve short-distance applications such as enterprise LANs and data centers, but rising demand for ultra-long-reach connectivity and improved spectral efficiency keeps single-mode fibers in a leading position.

- For instance, Corning’s SMF-28® ULL (Ultra-Low-Loss) single-mode fiber delivers attenuation as low as 0.16 dB/km at 1550 nm, enabling ultra-long-haul transmission with lower amplifier spacing.

By Type (Glass Optical Fiber, Plastic Optical Fiber)

Glass optical fiber leads the segment with the highest market share, driven by its superior transmission quality, low attenuation, and ability to handle high-speed data rates essential for telecom, cloud computing, and industrial automation. Its durability and performance in demanding environments make it the preferred choice for critical communication infrastructure. Plastic optical fiber grows steadily in consumer electronics and short-distance automotive applications due to its flexibility, ease of installation, and lower cost, but glass fiber remains dominant because of its unmatched optical performance across long-distance and high-bandwidth networks.

- For instance, Corning’s SMF-28® ULL glass fiber delivers attenuation as low as 0.16 dB/km at 1550 nm and supports coherent transmission using 100–800 Gb/s wavelengths in long-haul and metro networks.

By Application (Telecom, Automobile, Medical Equipment, Power Utilities, Aerospace & Defense, Industrial Automation & Control)

Telecom emerges as the dominant application segment, accounting for the largest share owing to extensive investments in fiber-to-the-home (FTTH), 5G backhaul, and high-capacity

Key Growth Drivers

Rapid Expansion of High-Speed Broadband and 5G Infrastructure

The global rollout of high-speed broadband and 5G networks serves as a primary growth driver for fiber optic cable assemblies. Telecom operators are upgrading legacy copper networks to fiber-rich architectures to support rising bandwidth demand generated by cloud computing, video streaming, and smart home ecosystems. 5G deployment requires dense backhaul and fronthaul networks, where fiber offers low latency and high capacity essential for massive MIMO and network slicing. Government-backed national broadband missions in regions such as North America, Europe, and Asia further accelerate fiber expansion across urban and rural zones. As operators invest heavily in long-haul, metro, and FTTH infrastructure, fiber optic assemblies become indispensable for ensuring connectivity reliability and long-distance signal integrity, reinforcing their strong market momentum.

- For instance, CommScope’s NOVUX™ hardened fiber terminals support up to 12 fiber ports per terminal and are engineered for rapid deployment in 5G small-cell backhaul, reducing installation time by up to 70% through pre-terminated assemblies.

Growing Demand from Data Centers and Cloud Ecosystems

Modern data centers depend heavily on fiber optic cable assemblies to handle ever-increasing workloads associated with AI training, hyperscale cloud platforms, edge computing, and virtualized multi-tenant environments. Fiber’s superior bandwidth and low-loss characteristics support high-density server interconnects, storage area networks, and dynamic workload orchestration. Cloud service providers are expanding global footprints with new hyperscale facilities, driving demand for structured cabling systems, high-fiber-count assemblies, and next-generation connectors such as MPO/MTP. As data volumes surge and latency requirements tighten, operators increasingly rely on single-mode fiber assemblies for long-reach connections across campus architectures and inter-data-center networks. Additionally, the shift toward AI-centric data center designs significantly boosts the adoption of high-performance optical interconnects, ensuring sustained demand across the industry.

- For instance, Coherent Corp. (formerly Finisar) supplies QSFP-DD Active Optical Cables (AOCs) supporting 4 x 100 Gb/s PAM4 or 8 x 50 Gb/s PAM4 transmission with reaches up to 100 meters over multimode fiber, which are widely used for GPU-to-switch connectivity in AI training clusters.

Rising Adoption of Fiber in Industrial, Automotive, and Defense Systems

Industrial automation, automotive electronics, and defense communication systems increasingly adopt fiber optic assemblies due to their immunity to electromagnetic interference, high signal fidelity, and superior durability. Smart factories utilize fiber-based networks to support robotics, process automation, and real-time monitoring in harsh operating environments where copper may fail. The automotive sector integrates fiber for advanced driver-assistance systems, in-vehicle communication networks, and infotainment systems requiring ultra-fast data transfer. In defense and aerospace applications, fiber assemblies enable secure, high-bandwidth communication for radar systems, avionics, and mission-critical surveillance networks. As industries undergo digital transformation and integrate more high-speed communication modules, demand for rugged, miniaturized, and high-temperature-resistant fiber assemblies continues to rise, reinforcing their growing role across diverse applications.

Key Trends & Opportunities

Increasing Shift Toward High-Density and Pre-Terminated Fiber Assemblies

A major trend shaping the market is the rising preference for high-density and pre-terminated fiber assemblies that streamline installation and minimize deployment time. Enterprises and data centers increasingly adopt plug-and-play MPO/MTP assemblies to support rapid scalability, reduced labor requirements, and improved error-free installation. High-density fiber solutions address space constraints in modern racks, cross-connects, and cable management systems. As edge data centers, colocation facilities, and multi-cloud environments expand, demand grows for compact, modular, and fully tested assemblies that guarantee consistent performance. This trend presents significant opportunities for manufacturers offering factory-terminated, low-loss solutions designed for fast deployment in mission-critical networks.

- For instance, CommScope’s Propel™ high-density MPO platform supports up to 3,456 fibers per rack using modular cassettes and offers typical insertion loss of 0.35 dB on low-loss MTP connectors, enabling rapid plug-and-play deployment.

Rising Integration of Fiber in Smart Cities and IoT Ecosystems

Smart city initiatives and IoT deployments create substantial opportunities for fiber optic cable assemblies. Large-scale sensor networks, intelligent transportation systems, utility automation, and public safety monitoring require high-speed, low-latency communication channels that fiber delivers efficiently. Governments and municipalities worldwide invest in fiber-backed infrastructure to support smart lighting, traffic analytics, surveillance, and digital services. As IoT devices proliferate across industrial, commercial, and residential spaces, fiber serves as the backbone enabling massive data transfer and reliable connectivity. This expanding digital ecosystem opens new market avenues for robust outdoor-rated fiber assemblies designed for long-term performance in varied environmental conditions.

- For instance, CommScope’s hardened NOVUX™ Prodigy® fiber terminals deployed in municipal networks support up to 12 hardened ports per unit and operate across a wide temperature range of –40 °C to +65 °C (–40 °F to +149 °F), enabling reliable outdoor connectivity for smart-city cameras and sensors.

Advancements in Fiber Connectivity Technologies

Ongoing innovations such as bend-insensitive fibers, low-loss connectors, and ultra-compact high-fiber-count cables create opportunities for manufacturers to deliver differentiated, performance-enhanced solutions. New connector formats designed for 400G and 800G networks support hyperscale data center upgrades, while ruggedized assemblies enable deployment in harsh industrial and military environments. Continuous R&D in optical materials and production technologies improves assembly quality, flexibility, and thermal resistance. As next-generation communication standards emerge, suppliers offering advanced fiber components gain a competitive advantage in high-growth application areas including photonics, quantum communication, and future AI-optimized networks.

Key Challenges

High Installation Costs and Complex Deployment Processes

Despite strong adoption, the fiber optic cable assemblies market faces challenges related to high installation costs and labor-intensive deployment processes. Fiber networks require skilled technicians, precision handling, and specialized splicing tools, making initial setup expensive compared to copper-based systems. In developing regions, limited technical expertise and inadequate infrastructure slow adoption, especially for large-scale outdoor deployments. The need for careful cable routing, environmental protection, and stringent testing further increases the overall project cost. These factors pose financial constraints for small enterprises and rural operators, creating barriers that providers must address through modular, pre-terminated, and easy-install solutions.

Vulnerability to Physical Damage and Harsh Environmental Conditions

Fiber optic assemblies, though highly efficient, remain susceptible to physical strain, bending, and micro-fractures that can degrade signal quality. Outdoor deployments face added risks from moisture, temperature fluctuations, and rodent damage, requiring costly protective measures such as armored cables and weatherproof enclosures. Industrial environments with high vibration and mechanical stress can accelerate wear unless reinforced assemblies are used. Repairing damaged fiber networks often requires advanced tools and expert intervention, contributing to downtime and operational costs. These vulnerabilities underscore the need for ruggedized designs, improved materials, and continuous investment in robust protective solutions.

Regional Analysis

North America

North America holds a strong position in the fiber optic cable assemblies market, accounting for around 32% of global share, driven primarily by extensive FTTH rollouts, 5G densification, and large-scale data center expansions led by hyperscale operators. The U.S. benefits from significant government-backed broadband investments aimed at bridging rural connectivity gaps, while cloud providers continue to deploy high-fiber-count networks across multi-state data center clusters. Demand also rises from defense modernization programs and industrial automation upgrades. The region maintains consistent growth momentum supported by technological innovation, high digital adoption, and increasing deployment of low-latency communication systems.

Europe

Europe represents approximately 27% of the market, supported by aggressive fiber deployment targets under EU digital transformation initiatives. Countries such as Germany, France, the U.K., and the Nordics are accelerating FTTH penetration and 5G backhaul infrastructure, driving continuous demand for high-performance fiber assemblies. The region’s automotive, industrial automation, and aerospace sectors adopt advanced optical interconnects to enhance communication reliability and operational efficiency. Strong regulatory focus on network modernization, combined with extensive investments by telecom operators and municipal broadband providers, positions Europe as a mature and steadily expanding market for fiber-based communication technologies.

Asia-Pacific

Asia-Pacific dominates the global market with the largest share of around 36%, propelled by massive telecom infrastructure upgrades in China, India, Japan, and South Korea. Rapid urbanization, expanding broadband user bases, and large-scale deployment of 5G, cloud computing, and hyperscale data centers significantly accelerate fiber demand. Manufacturing-driven economies further invest in industrial digitalization, creating additional opportunities for robust optical assemblies. Strong government programs promoting national fiber networks and smart city development reinforce the region’s leadership. Asia-Pacific continues to outpace other regions in both production and consumption, benefiting from mature supply chains and competitive manufacturing capabilities.

Latin America

Latin America contributes about 3–4% of global market share, showing steady growth as countries invest in expanding broadband connectivity and modernizing telecom infrastructure. Brazil, Mexico, Chile, and Colombia lead adoption due to rising demand for high-speed internet, data center development, and 5G preparation. The region’s increasing digital service consumption—driven by e-commerce, fintech, and cloud platforms—supports fiber backbone and metro network expansion. Despite challenges such as inconsistent regulatory frameworks and varying economic stability, investments from global telecom players and regional ISPs continue to accelerate fiber optic deployments across urban and semi-urban areas.

Middle East & Africa

The Middle East & Africa region holds around 2–3% market share, with growth concentrated in Gulf countries such as the UAE, Saudi Arabia, and Qatar, where large-scale smart city projects and 5G rollouts rely heavily on advanced fiber backbones. Africa shows rising adoption as digital transformation initiatives expand fiber connectivity to support enterprise networks, education platforms, and public services. While infrastructural limitations and high deployment costs remain challenges, increasing investments from telecom operators and government programs gradually strengthen regional fiber networks, positioning MEA for long-term growth as digital infrastructure modernizes.

Market Segmentations:

By Mode

By Type

- Glass Optical Fiber

- Plastic Optical Fiber

By Application

- Telecom

- Automobile

- Medical Equipment

- Power Utilities

- Aerospace & Defense

- Industrial Automation & Control

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fiber optic cable assemblies market is characterized by strong participation from leading global manufacturers that continuously invest in advanced optical technologies, high-density interconnect solutions, and large-scale production capabilities. Companies such as Corning, Prysmian Group, Fujikura, CommScope, Nexans, OFS, and YOFC maintain their leadership through extensive product portfolios covering single-mode, multi-mode, MPO/MTP, ruggedized, and specialty fiber assemblies. These players focus on improving insertion loss performance, durability, and interoperability to meet the evolving needs of telecom operators, hyperscale data centers, and industrial automation sectors. Strategic initiatives—such as capacity expansions, fiber design innovations, and collaborations with equipment vendors—strengthen their global footprint. Competitors also leverage regional manufacturing hubs across Asia-Pacific, North America, and Europe to optimize costs and reduce lead times. As demand intensifies from 5G, FTTH, and cloud infrastructure projects, market players increasingly emphasize scalable production, enhanced quality standards, and tailored solutions for emerging high-bandwidth communication applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CommScope

- Finisar

- Leoni

- Coherent

- Nexans

- Rockwell Collins

- Reflex Photonics

- Corning Inc.

- Hitachi Cable

- L. Gore & Associates

Recent Developments

- In July 2025, Leoni AG Sale/closing of its Automotive Cable Solutions division to Time Interconnect Group (Hong Kong), enabling the fibre/cable-solutions division (Leoni Cable Solutions) to grow with new partner.

- In June 2025, Coherent Corp. Launch of a new line of disposable surgical fibre assemblies for laser lithotripsy and advanced medical applications. This is fibre assemblies but for medical/laser-delivery rather than telecom/data-centre cable assemblies.

- In May 2025, Collaboration with Emtelle on a hardened connectivity + blowable fibre-optic micro-cable solution for North America: “CommScope’s Prodigy® solution … combined with Emtelle’s blowable fibre optic micro-cable as the first offering of its kind in North America.”

Report Coverage

The research report offers an in-depth analysis based on Mode, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fiber optic cable assemblies will accelerate as 5G, FTTH, and high-speed broadband networks expand globally.

- Data centers will increasingly adopt high-density MPO/MTP and single-mode solutions to support AI, cloud, and hyperscale workloads.

- Growth in industrial automation will drive adoption of rugged, interference-resistant fiber assemblies for mission-critical operations.

- Automotive applications will expand as vehicles integrate advanced driver-assistance systems and high-bandwidth in-vehicle networks.

- Medical imaging and diagnostic equipment will rely more on precision fiber assemblies for higher data accuracy.

- Smart city and IoT deployments will boost the need for reliable, low-latency fiber backbones.

- Advancements in bend-insensitive and low-loss fibers will enhance performance in dense and complex installations.

- Manufacturers will increase production of pre-terminated assemblies to reduce installation time and improve network scalability.

- Regional manufacturing expansion will continue to lower costs and strengthen global supply chains.

- Competitive pressure will push companies to innovate in miniaturized, high-fiber-count, and thermally resilient assemblies.