Market Overview

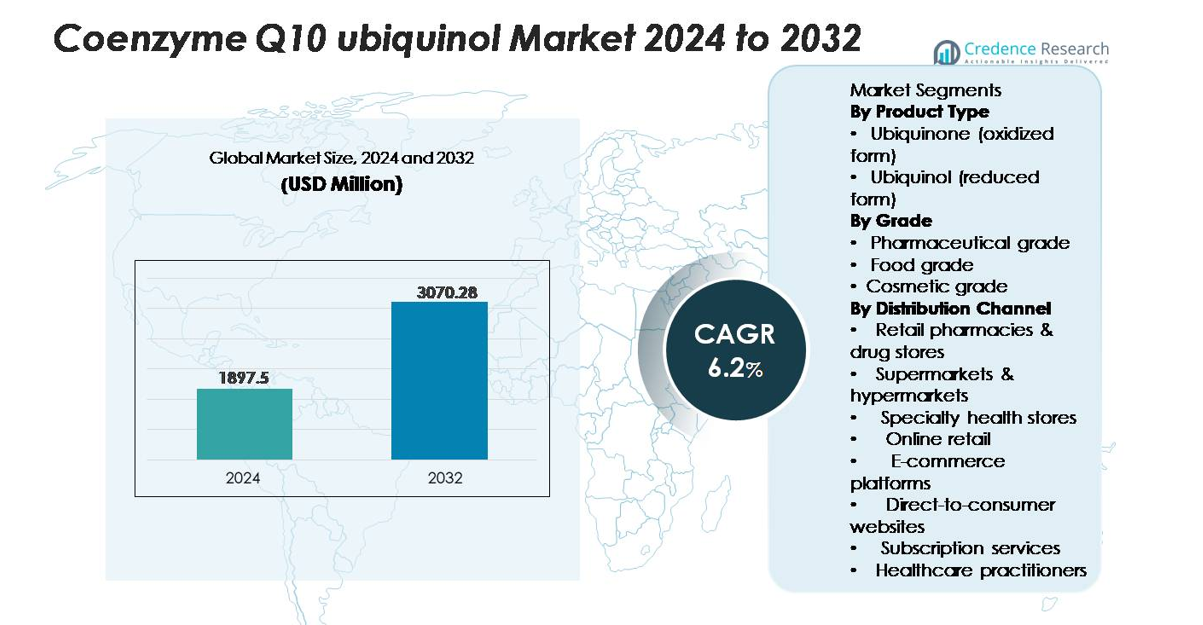

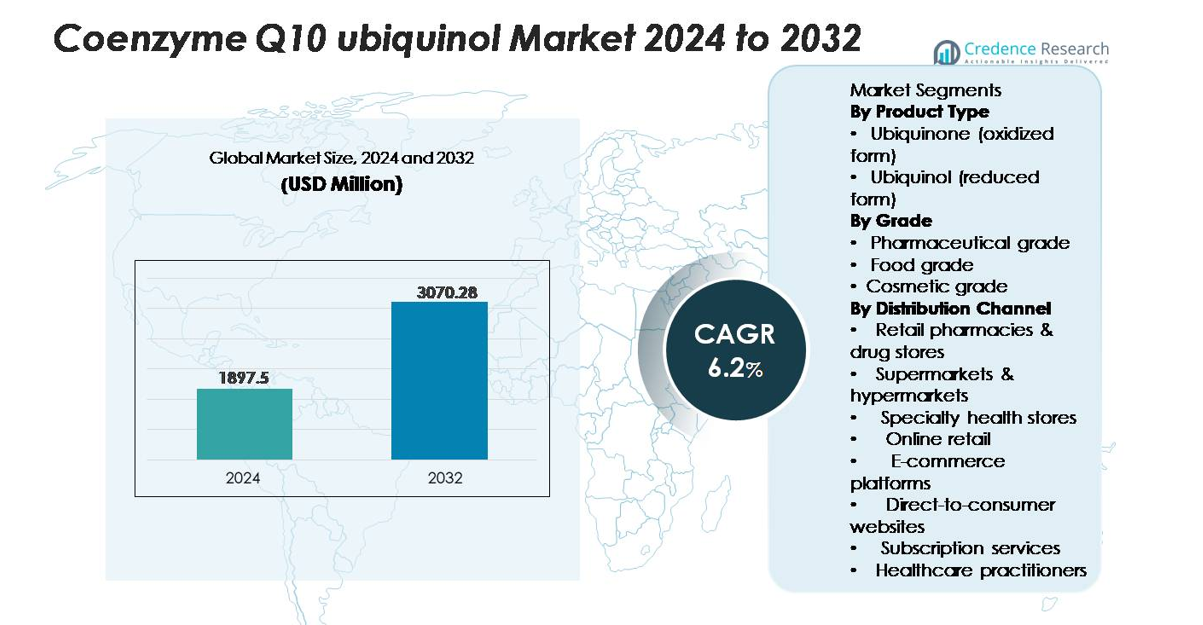

The global Coenzyme Q10 (Ubiquinol) market was valued at USD 1,897.5 million in 2024 and is projected to reach USD 3,070.28 million by 2032, expanding at a CAGR of 6.2% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coenzyme Q10 Ubiquinol Market Size 2024 |

USD 1,897.5 million |

| Coenzyme Q10 Ubiquinol Market, CAGR |

6.2% |

| Coenzyme Q10 Ubiquinol Market Size 2032 |

USD 3,070.28 million |

The Coenzyme Q10 market is shaped by a strong group of global manufacturers, including ZMC-USA LLC, PharmaEssentia Corporation, Gnosis, Nisshin Seifun Group Inc., DSM Nutritional Products AG, Hwail Pharmaceutical Co., Ltd., Mitsubishi Gas Chemical Company, Inc., KANEKA Corporation, and KYOWA HAKKO U.S.A., Inc. These companies lead through advanced fermentation technologies, pharmaceutical-grade purity, and proprietary ubiquinol manufacturing capabilities. KANEKA, a pioneer in ubiquinol production, remains a key innovation driver, while DSM and Gnosis maintain strong positions in premium nutraceutical supply chains. Regionally, North America accounts for about 32% of global market share, supported by high supplement adoption and strong clinical usage, making it the leading market for CoQ10 and ubiquinol formulations.

Market Insights

- The global Coenzyme Q10 (Ubiquinone & Ubiquinol) market was valued at USD 1,897.5 million in 2024 and is projected to reach USD 3,070.28 million by 2032, expanding at a CAGR of 6.2% during the forecast period.

- Market growth is driven by rising demand for high-bioavailability ubiquinol, increasing statin-associated supplementation, and expanding adoption across preventive health, active aging, and cardiovascular wellness categories, with ubiquinol holding the dominant product share.

- Key trends include the shift toward clean-label fermentation-derived CoQ10, rapid expansion of functional food and ready-to-consume delivery formats, and strong online retail penetration supported by subscription-based nutraceutical models.

- Competition intensifies as players like KANEKA Corporation, DSM Nutritional Products AG, Gnosis, and ZMC-USA LLC invest in purity enhancement, patented fermentation processes, and improved absorption technologies, while smaller regional firms leverage e-commerce-driven pricing strategies.

- Regionally, North America leads with ~32% share, followed by Asia-Pacific at ~30% and Europe at ~28%, while Latin America and the Middle East & Africa collectively account for the remaining share, supported by growing supplement adoption and pharmacy-led distribution

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type (Ubiquinone & Ubiquinol)

Ubiquinol (reduced form) holds the dominant share within the product type segment, driven by its superior bioavailability and faster cellular absorption compared to oxidized ubiquinone. Consumers increasingly prefer reduced CoQ10 in dietary supplements, particularly in regions with aging populations where mitochondrial support and cardiovascular health benefits are prioritized. Clinical studies demonstrating higher plasma CoQ10 levels after ubiquinol supplementation further reinforce its adoption. Meanwhile, ubiquinone continues to maintain demand in cost-sensitive markets and pharmaceutical formulations where oxidative stability and compatibility with tablet manufacturing processes remain important.

- For instance, KANEKA the originator of the patented Ubiquinol® ingredient produces material with a verified purity of ≥99% and has demonstrated in controlled human studies that Ubiquinol achieves up to four times higher plasma concentrations compared to conventional ubiquinone, supporting faster and more efficient physiological uptake.

By Grade (Pharmaceutical, Food & Cosmetic)

Pharmaceutical-grade CoQ10 represents the dominant sub-segment, capturing the highest share due to its stringent purity specifications, validated clinical efficacy, and established use in cardiology, neurology, and metabolic health supplements. Manufacturers focus on GMP-certified fermentation processes and solvent-free purification to achieve elevated purity levels suited for therapeutic and high-dose formulations. Food-grade CoQ10 sees rising adoption in fortified functional foods and beverages, while cosmetic-grade CoQ10 grows steadily in anti-aging and dermal repair applications, supported by its antioxidant potency and compatibility with emulsified skincare systems.

- For instance, Gnosis by Lesaffre produces pharmaceutical-grade CoQ10 through a controlled yeast-fermentation process followed by multi-step purification to meet pharmacopeial standards such as USP and EP. The company’s CoQ10 ingredients consistently achieve high purity levels above 98% and are validated through strict batch-to-batch quality testing to support use in clinical and regulated nutraceutical applications.

By Distribution Channel

Retail pharmacies and drug stores dominate the distribution landscape, securing the largest market share due to strong consumer trust, pharmacist recommendations, and higher visibility of clinically positioned CoQ10 brands. The segment benefits from growing adoption among aging consumers seeking heart-health and energy-support supplements. Online retail and e-commerce platforms, however, are expanding rapidly as digital penetration accelerates and subscription-based replenishment models gain traction. Specialty health stores contribute a stable premium-product market, while healthcare practitioners increasingly influence purchases through prescribed nutraceutical regimens for chronic fatigue, cardiovascular support, and mitochondrial health.

KEY GROWTH DRIVERS

Rising Global Focus on Cardiovascular and Metabolic Health

Growing prevalence of cardiovascular disorders, hypertension, and metabolic syndromes continues to strengthen demand for Coenzyme Q10, particularly ubiquinol, due to its established role in supporting myocardial function and improving cellular energy synthesis. Physicians increasingly recommend CoQ10 supplementation for patients on statins, as the drug-induced suppression of HMG-CoA reductase reduces endogenous CoQ10 synthesis and contributes to muscle fatigue. This clinical linkage boosts long-term supplementation rates across middle-aged and elderly populations. Additionally, expanding preventive healthcare adoption, rising awareness of mitochondrial health, and higher supplement uptake in at-risk groups reinforce market momentum. With aging demographics and shifting lifestyles increasing oxidative stress and energy deficiency concerns, ubiquinol-based formulations gain preferential traction for their superior absorption profile, further supporting sustained market expansion globally.

- For instance, Kaneka’s Ubiquinol® has demonstrated up to four-times higher bioavailability than conventional ubiquinone in controlled human studies, with multiple trials confirming significantly greater rises in plasma CoQ10 levels after oral supplementation. These findings support its strong use in cardiovascular, metabolic, and healthy-aging regimens.

Increasing Consumer Shift Toward High-Purity and Bioavailable Nutraceuticals

The market benefits from rising consumer preference for high-potency, clinically validated nutraceutical ingredients that offer enhanced bioavailability and measurable health outcomes. Ubiquinol, recognized for delivering higher plasma concentrations than traditional ubiquinone, aligns with this demand shift as consumers seek premium, fast-acting antioxidant solutions. Brands emphasize purity, patented fermentation processes, and pharmaceutical-grade quality to differentiate products in competitive retail channels. In regions with mature supplement markets such as North America, Europe, and Japan consumers show strong willingness to pay for advanced formulas with enhanced absorption technologies, such as lipid-based carriers, microencapsulation, and crystal dispersion systems. These innovations improve solubility and gastrointestinal uptake while allowing lower dosages to achieve therapeutic equivalence. As supplement users increasingly evaluate ingredient science and formulation transparency, demand for high-bioavailability ubiquinol continues to rise, positioning it as a core growth driver in the global market.

- For instance, DSM’s ALL-Q® is an aqueous-dispersion CoQ10 ingredient designed to improve solubility and functional stability in beverages and fortified foods. The formulation enhances dispersibility compared to crystalline CoQ10 and meets DSM’s quality standards for use in nutritional and functional applications.

Expansion of Preventive Wellness and Active Aging Lifestyles

Preventive wellness trends and aging populations significantly accelerate the uptake of CoQ10 supplements as consumers prioritize longevity, cognitive vitality, and energy maintenance. Ubiquinol’s role in supporting mitochondrial ATP production and reducing oxidative stress aligns with the needs of older adults experiencing natural declines in endogenous CoQ10 levels. Wellness programs, functional medicine practices, and long-term health maintenance regimens increasingly integrate CoQ10 for fatigue reduction, immune resilience, and improved metabolic efficiency. Fitness-conscious consumers also adopt CoQ10 to enhance endurance and muscle recovery. The rapid expansion of lifestyle-driven supplementation is supported by growing acceptance of nutraceuticals as part of daily routines, reinforced by digital health platforms, influencer-driven education, and personalized nutrition apps. Together, these factors create an expanding consumer base that views ubiquinol not merely as a therapeutic supplement but as a core component of proactive wellness, thereby accelerating global demand.

KEY TRENDS & OPPORTUNITIES

Rising Adoption of Clean-Label, Fermentation-Derived CoQ10

A major trend reshaping the market is the growing preference for clean-label, naturally derived CoQ10 produced through advanced microbial fermentation rather than synthetic chemical pathways. Consumers increasingly seek non-GMO, solvent-free, allergen-free formulations that align with holistic wellness values and regulatory expectations. Manufacturers respond by investing in yeast and bacterial fermentation technologies that yield high-purity CoQ10 with consistent crystallinity and improved stability. This trend also strengthens opportunities in premium nutraceuticals and functional foods, where natural origin and traceability influence purchasing decisions. Brands highlight transparent sourcing, eco-friendly production, and purity certifications to strengthen market differentiation. As sustainability becomes a decisive consumer criterion, fermentation-based ubiquinol and ubiquinone products gain stronger market acceptance and pricing power, stimulating long-term category growth.

- For instance, Gnosis by Lesaffre manufactures its Ubisolv®-grade CoQ10 through controlled aerobic fermentation that meets both USP and EP pharmacopeial purity requirements above 98%.

Expansion of Functional Foods, Beverages, and Novel Delivery Formats

The integration of CoQ10 into functional foods, energy beverages, softgels, chewables, and effervescent formats creates new opportunities for market penetration across diverse demographic groups. Innovations in nanoemulsions, water-dispersible CoQ10 powders, and lipid-soluble microspheres improve compatibility with beverage and nutrition bar matrices, enabling broader use in sports nutrition and anti-aging formulations. Brands increasingly offer ready-to-consume formats that deliver convenience and enhanced absorption, appealing to younger consumers, athletes, and lifestyle-driven buyers. This trend also supports cross-industry expansion into beauty-from-within products, where CoQ10 blends with collagen, hyaluronic acid, and antioxidants to target skin health. As delivery-tech innovation accelerates, ubiquinol-enriched product lines are expected to expand significantly acrossretail and e-commerce channels.

- For instance, Nisshin Pharma’s PureSorb® CoQ10 applies a proprietary nanodispersion process that converts fat-soluble CoQ10 into a stable, water-dispersible form suitable for beverages and liquid supplements. This technology improves solubility and dispersion uniformity compared to conventional crystalline CoQ10, supporting its use in functional food applications.

Rapid Digitalization and Growth of Subscription-Based Supplement Models

E-commerce platforms, personalized nutrition programs, and AI-based supplement recommendations are transforming how consumers engage with CoQ10 products. Subscription services offering automated monthly deliveries of ubiquinol supplements gain traction due to convenience and adherence benefits. Digital platforms also enable transparent comparison of purity, dosage, and clinical backing, supporting premium product uptake. Direct-to-consumer brands leverage data-driven marketing, microbiome analysis, and personalized wellness assessments to position CoQ10 within customized regimens. This digital ecosystem reduces reliance on traditional retail while opening higher-margin opportunities for brands focused on chronic users, elderly consumers, and individuals on statin therapies. The shift enhances long-term consumption patterns, reinforcing continuous demand growth.

KEY CHALLENGES

High Production Costs and Price Sensitivity in Competitive Markets

CoQ10 production particularly high-purity ubiquinol requires sophisticated fermentation, multi-stage purification, and stabilization processes, resulting in elevated manufacturing costs. These costs translate into higher retail prices, which can limit adoption in price-sensitive regions and among first-time supplement users. Market competition from generic antioxidant supplements such as vitamin E, alpha-lipoic acid, and resveratrol further challenges pricing power. Additionally, the differentiation between ubiquinone and ubiquinol is not fully understood by general consumers, reducing the perceived value of premium formulations. Manufacturers must balance cost-management strategies with investments in R&D, purity improvements, and consumer education to sustain profitability while expanding market reach.

Regulatory Complexities and Inconsistent Global Standards

CoQ10 products face varying regulatory requirements across regions, creating challenges for standardized labeling, dosage approvals, and health claims. Differences between dietary supplement legislation in the U.S., novel food regulations in Europe, and functional food approvals in Asia complicate global distribution strategies. Restrictions on therapeutic claims, purity certifications, and allowable excipients require companies to navigate extensive compliance documentation. Additionally, heightened scrutiny of nutraceutical imports and quality-control failures in lower-cost markets increase the risk of supply disruptions and brand reputation impacts. As regulatory frameworks evolve to tighten safety and efficacy oversight, manufacturers must continuously adapt product formulations and documentation practices, increasing operational complexity.

Regional Analysis

North America

North America holds the largest share at approximately 32%, driven by strong consumer adoption of high-purity nutraceuticals, widespread preventive health awareness, and high prevalence of cardiovascular disorders. The region benefits from robust retail pharmacy penetration, mature e-commerce channels, and strong clinical recommendations for CoQ10 among statin users. Ubiquinol-based formulations gain rapid acceptance due to superior absorption, while product innovation in softgels and functional beverages strengthens premium segment growth. The U.S. leads demand, supported by high spending on dietary supplements and active aging trends that reinforce sustained CoQ10 consumption across adult and elderly populations.

Europe

Europe accounts for roughly 28% of the global market, supported by high demand for pharmaceutical-grade CoQ10 in Germany, Italy, France, and the Nordics. Strong regulatory emphasis on product purity and clinically validated nutraceuticals encourages adoption of ubiquinol among aging populations and individuals managing cholesterol levels. The region’s expanding functional food sector also integrates CoQ10 into fortified beverages and anti-aging nutritional products. Pharmacies dominate distribution, but online channels grow steadily due to subscription-based supplement models. Increasing prevalence of cardiovascular and metabolic disorders strengthens long-term demand, positioning Europe as one of the most stable and regulated CoQ10 markets globally.

Asia-Pacific

Asia-Pacific holds about 30% market share, making it one of the most dynamic regions, with Japan, China, and South Korea driving strong uptake of high-absorption ubiquinol supplements. Japan remains a global leader in CoQ10 innovation, leveraging advanced fermentation technologies and a mature functional food industry. China’s rapid expansion in e-commerce nutraceutical sales significantly boosts volume growth. Rising middle-class incomes, lifestyle diseases, and interest in anti-aging wellness trends accelerate adoption. Local manufacturers increasingly scale production capacities to meet domestic and export demand, reinforcing Asia-Pacific’s position as both a major consumption and manufacturing hub for CoQ10.

Latin America

Latin America captures around 6% of global share, supported by growing awareness of cardiovascular health and increasing nutraceutical penetration in Brazil, Mexico, and Chile. The region sees expanding demand for ubiquinone-based supplements due to affordability, while premium ubiquinol gains traction among urban, health-conscious consumers. Pharmacy-led distribution remains dominant, but online channels grow as digital retail infrastructure improves. Economic fluctuations and pricing sensitivity moderate adoption rates; however, rising incidence of metabolic disorders and strengthening preventive healthcare initiatives provide continued momentum. Manufacturers targeting value-based pricing and localized marketing benefit from long-term growth potential.

Middle East & Africa

The Middle East & Africa region accounts for approximately 4% of total market share, with demand concentrated in the Gulf Cooperation Council countries, driven by rising chronic disease burdens and increasing adoption of premium dietary supplements. Pharmacies dominate sales, supported by strong clinician recommendations for CoQ10 among patients with cardiovascular and metabolic conditions. Growing wellness tourism in the UAE and broader nutritional awareness campaigns support gradual expansion. However, limited local manufacturing and higher import costs constrain broader penetration. As digital retail channels develop and healthcare spending increases, the region is expected to experience steady, incremental growth in ubiquinol and ubiquinone supplements.

Market Segmentations:

By Product Type

- Ubiquinone (oxidized form)

- Ubiquinol (reduced form)

By Grade

- Pharmaceutical grade

- Food grade

- Cosmetic grade

By Distribution Channel

- Retail pharmacies & drug stores

- Supermarkets & hypermarkets

- Specialty health stores

- Online retail

- E-commerce platforms

- Direct-to-consumer websites

- Subscription services

- Healthcare practitioners

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Coenzyme Q10 market is characterized by a mix of established nutraceutical manufacturers, specialized fermentation producers, and premium formulators focused on high-bioavailability ubiquinol. Leading players emphasize patented production technologies, solvent-free purification methods, and pharmaceutical-grade quality to differentiate in a highly regulated and science-driven market. Companies with advanced fermentation capabilities maintain a competitive advantage due to consistent high-purity yields and stable crystalline structures. Global brands also compete through innovation in delivery formats, including nanoemulsions, softgels, and water-dispersible CoQ10 powders targeting improved absorption and consumer convenience. Strategic partnerships with contract manufacturers, expansion into functional foods, and increased investment in clinical validation further strengthen market positioning. Meanwhile, regional supplement brands leverage e-commerce, subscription models, and personalized nutrition platforms to capture growing demand, resulting in a competitive yet rapidly expanding global market for ubiquinone and ubiquinol formulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ZMC-USA LLC

- Gnosis

- Nisshin Seifun Group Inc.

- DSM Nutritional Products AG

- HWAIL Pharmaceutical Co., Ltd.

- Mitsubishi Gas Chemical Company, Inc.

- KANEKA Corporation

Recent Developments

- In September 2025, Kaneka Corporation launched the “Ubiquinol Verified Program” in partnership with Eurofins QKEN K.K. to independently verify potency and authenticity of Kaneka Ubiquinol® in consumer supplements worldwide.

- In September 2025, Kaneka released a new consumer-facing product Watashi no Chikara My Energy Q10 Drink Sukoyaka Rhythm containing 100 mg of active CoQ10 per serving, using a proprietary emulsification for beverage compatibility

Report Coverage

The research report offers an in-depth analysis based on Product type, Grade, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ubiquinol will continue rising as aging populations prioritize mitochondrial health and high-absorption antioxidant supplements.

- Clinical research advancements will strengthen CoQ10’s positioning in cardiovascular, metabolic, and neurological wellness applications.

- Fermentation-derived, clean-label CoQ10 will gain broader adoption as consumers favor natural, non-synthetic ingredients.

- Advanced delivery formats such as nanoemulsions, chewables, and water-dispersible powders will expand market penetration across diverse demographics.

- Personalized nutrition platforms and subscription models will increase long-term consumer adherence to daily CoQ10 supplementation.

- Pharmaceutical-grade ubiquinol will see stronger integration into clinician-recommended regimens, particularly for statin-associated deficiency.

- Functional food and beverage companies will increasingly incorporate CoQ10 into fortified products targeting energy and anti-aging benefits.

- Manufacturers will expand capacity and enhance purification technologies to meet demand for high-purity and stable ubiquinol.

- E-commerce dominance will intensify, with digital retail shaping brand competition and global accessibility.

- Regional growth will accelerate in Asia-Pacific and Latin America as awareness rises and distribution infrastructure improves.