Market Overview

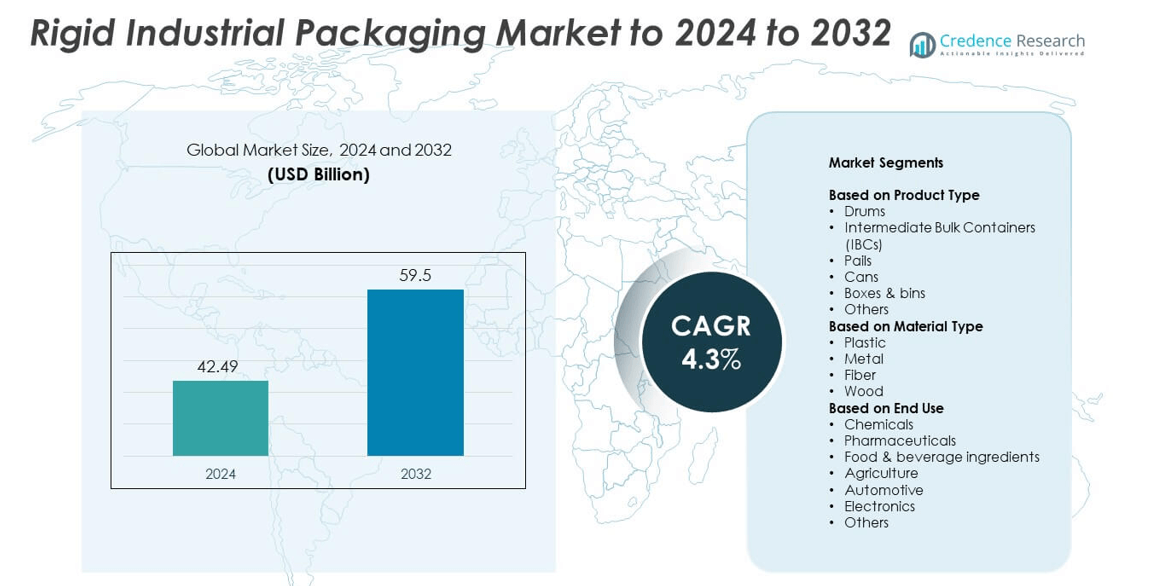

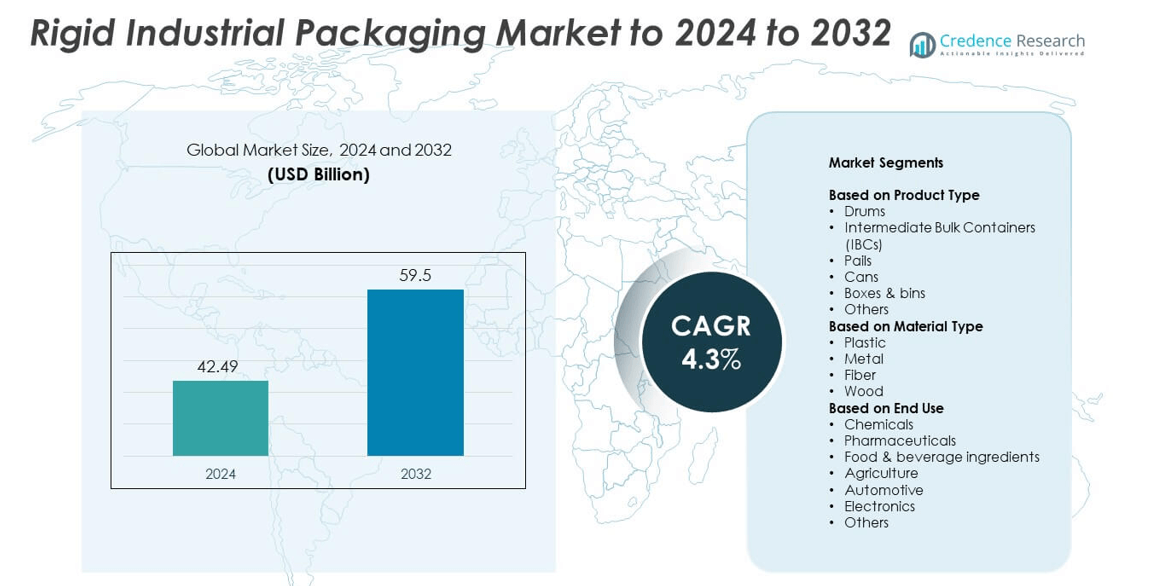

Rigid Industrial Packaging Market size was valued USD 42.49 Billion in 2024 and is anticipated to reach USD 59.5 Billion by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rigid Industrial Packaging Market Size 2024 |

USD 42.49 Billion |

| Rigid Industrial Packaging Market, CAGR |

4.3% |

| Rigid Industrial Packaging Market Size 2032 |

USD 59.5 Billion |

The rigid industrial packaging market is highly competitive, with leading companies such as Amcor Rigid, Greif Packaging LLC, Sonoco Products Company, Greiner Packaging, LyondellBasell, Rieke Packaging Systems, Nefab Group, Balmer Lawrie & Co. Ltd., and Avantium driving innovation and global expansion. These players focus on sustainable materials, product customization, and smart packaging technologies to enhance supply chain efficiency. North America led the global market in 2024 with a 33% share, supported by strong industrial output, advanced logistics infrastructure, and rising adoption of recyclable containers across chemical, pharmaceutical, and food sectors.

Market Insights

- The rigid industrial packaging market was valued at USD 42.49 billion in 2024 and is projected to reach USD 59.5 billion by 2032, growing at a CAGR of 4.3%.

- Growing demand from the chemical and pharmaceutical industries is driving market expansion, supported by rising global trade and the need for durable and reusable packaging solutions.

- Key trends include increased use of sustainable materials, adoption of smart IoT-enabled containers, and greater focus on returnable and recyclable packaging systems.

- The market remains competitive with players focusing on material innovation, cost efficiency, and regulatory compliance to strengthen global presence.

- North America led with a 33% share in 2024, followed by Europe at 29% and Asia-Pacific at 27%, while the drums segment held the largest product share of 39% due to widespread industrial adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Drums dominated the rigid industrial packaging market with a 39% share in 2024. Their widespread use in transporting chemicals, oils, and lubricants stems from durability, reusability, and leak resistance. Steel and plastic drums remain key for hazardous and non-hazardous materials due to compliance with international safety standards. Rising demand for efficient bulk liquid transport in chemical and food industries continues to drive adoption. The development of corrosion-resistant coatings and UN-certified drum models strengthens their dominance across global logistics networks.

- For instance, North Coast Container supplies UN-rated steel drums in 10–85 gallon sizes, with body steel thickness from 0.5–1.4 mm and DOT 7A Type A compliance.

By Material Type

Plastic led the market with a 47% share in 2024, driven by cost efficiency and versatility. High-density polyethylene (HDPE) and polypropylene (PP) are preferred for their chemical resistance, lightweight nature, and recyclability. Plastic containers are used extensively in chemical, agricultural, and food applications. The shift toward sustainable packaging and the introduction of bio-based plastics further enhance demand. Continuous improvements in molding technologies and durability make plastic a preferred choice for high-volume industrial packaging solutions.

- For instance, according to its 2024 Sustainability Report, Berry Global achieved significant progress towards its Impact 2025 goals, including ensuring that 93% of its fast-moving consumer goods packaging is either recyclable or has a validated alternative.

By End Use

The chemicals segment accounted for the largest share of 36% in 2024. Chemical manufacturers rely heavily on rigid packaging for safe storage and transport of acids, solvents, and hazardous compounds. Metal drums, IBCs, and HDPE containers ensure product integrity and meet strict international transport regulations. Growing chemical exports and expansion of specialty chemical production continue to drive packaging demand. The sector’s need for durable, tamper-proof, and reusable containers reinforces steady adoption across both bulk and specialty chemical applications.

Key Growth Drivers

Rising Demand from Chemical and Pharmaceutical Industries

The chemical and pharmaceutical industries are major contributors to rigid industrial packaging growth. These sectors require durable, leak-proof, and compliant containers to safely transport hazardous and high-value products. Increased production of specialty chemicals and active pharmaceutical ingredients is boosting demand for steel drums and intermediate bulk containers. Regulatory standards emphasizing secure material handling and waste reduction further support adoption. The trend toward global export expansion continues to strengthen the market’s reliance on robust and reusable rigid packaging solutions.

- For instance, Greif’s circular network collected 3.6 million containers in 2024, of which it reconditioned or remanufactured more than 2.6 million and recycled the remaining.

Growing Focus on Sustainable and Recyclable Materials

Sustainability is becoming a central growth factor as manufacturers adopt recyclable materials such as high-density polyethylene (HDPE) and metal alloys. Companies are investing in closed-loop systems that reduce waste and promote reuse of packaging products. Consumer and regulatory pressures for eco-friendly solutions are accelerating the development of bio-based and lightweight rigid containers. This shift supports both cost efficiency and environmental goals, driving innovation in materials and production processes across industrial packaging operations worldwide.

- For instance, PureCycle’s Ironton facility is designed for a nameplate capacity of 107 million pounds (approximately 48,500 metric tons) per year of polypropylene recycling.

Expansion of Industrial Manufacturing and Global Trade

Rapid growth in manufacturing and cross-border trade continues to elevate packaging requirements. Industrial exporters demand durable and standardized packaging formats to ensure product safety during transportation. Expanding industrial infrastructure, especially in emerging economies, drives consumption of rigid containers for bulk materials, chemicals, and food ingredients. The focus on efficient logistics, storage optimization, and longer product life cycles strengthens the role of rigid packaging across global supply chains.

Key Trends and Opportunities

Adoption of Smart and IoT-Enabled Packaging

Smart packaging technologies are emerging as a major trend, enhancing product traceability and safety. RFID tags and IoT sensors integrated into rigid containers allow real-time monitoring of temperature, pressure, and shipment location. This innovation improves supply chain visibility and reduces product losses during transit. Industries handling hazardous chemicals and sensitive pharmaceuticals are increasingly adopting digital monitoring systems to comply with safety regulations. The growing use of connected packaging solutions creates significant opportunities for advanced technology integration.

- For instance, multiple market research reports for 2024 show the Intermediate Bulk Container (IBC) market valued in U.S. dollars, with figures ranging from approximately $9.93 billion to $24.38 billion.

Increased Use of Returnable and Reusable Containers

The market is witnessing strong growth in reusable and returnable rigid packaging systems. Companies are shifting toward container pooling programs that reduce single-use waste and overall cost. Returnable packaging improves lifecycle efficiency and aligns with sustainability targets set by global corporations. Logistics service providers are adopting standardized designs for easier handling and reconditioning. This transition supports circular economy initiatives, encouraging long-term adoption of durable industrial containers in global supply chains.

- For instance, ORBIS Europe reports saving 60–70 kg CO₂ per large load carrier when using up to 90% recycled material, with 1.2 million tons CO₂ saved through recycling systems.

Key Challenges

Fluctuating Raw Material Costs

Volatility in raw material prices, especially plastics and metals, remains a key challenge. Rising resin and steel prices directly impact manufacturing costs and profit margins. Packaging producers struggle to balance cost management with product quality and sustainability commitments. Currency fluctuations and geopolitical tensions further affect material availability. To mitigate these issues, manufacturers are focusing on material substitution, long-term supplier agreements, and recycling-based production processes to maintain competitiveness in global markets.

Stringent Environmental Regulations

Environmental policies targeting plastic waste and emissions are tightening globally, posing challenges for packaging producers. Compliance with extended producer responsibility (EPR) laws and waste management standards requires costly process adjustments. Companies must invest in cleaner production technologies and recycling infrastructure to meet sustainability benchmarks. Smaller manufacturers face difficulty adapting due to limited resources. Despite driving eco-friendly innovation, these regulations increase operational complexity and may constrain profit margins in the short term.

Regional Analysis

North America

North America held the largest share of 33% in the rigid industrial packaging market in 2024. The region’s strong chemical, pharmaceutical, and food processing sectors drive high demand for durable packaging solutions. The United States leads with widespread adoption of steel drums, intermediate bulk containers, and HDPE-based packaging. Regulatory standards promoting product safety and sustainability encourage use of recyclable materials. Growing investments in industrial automation and logistics infrastructure further support market expansion. Continuous innovation in lightweight and returnable packaging formats enhances efficiency and reduces overall operational costs across industries.

Europe

Europe accounted for a 29% share of the rigid industrial packaging market in 2024. Demand is primarily driven by the region’s well-established chemical, automotive, and food manufacturing sectors. Countries such as Germany, France, and the United Kingdom lead in adopting sustainable packaging practices aligned with EU waste reduction policies. The transition toward circular economy models supports the use of reusable metal and plastic containers. Rising export activities and stringent safety standards strengthen packaging demand. Increasing preference for eco-friendly materials and advanced manufacturing technologies continues to shape market dynamics across Europe.

Asia-Pacific

Asia-Pacific captured a 27% market share in 2024, driven by rapid industrialization and expanding manufacturing bases in China, India, and Japan. The growing production of chemicals, pharmaceuticals, and food ingredients has created strong demand for rigid packaging solutions. Regional governments supporting industrial and export growth further accelerate adoption. Rising investment in logistics infrastructure and warehousing enhances packaging utilization. Manufacturers are increasingly adopting cost-effective and high-capacity containers for bulk materials. Strong focus on sustainability and recyclability, particularly in China and South Korea, continues to influence regional packaging innovations.

Latin America

Latin America accounted for an 8% share of the rigid industrial packaging market in 2024. Brazil and Mexico dominate the regional landscape due to robust chemical and food processing industries. The region’s expanding agricultural exports also boost demand for rigid containers, especially drums and pails. Manufacturers are focusing on durable and recyclable materials to meet environmental standards. Growth in local manufacturing and trade activities supports packaging innovations. However, fluctuating raw material prices and limited recycling infrastructure remain key constraints affecting the overall regional market expansion.

Middle East & Africa

The Middle East & Africa held a 6% share of the rigid industrial packaging market in 2024. The market benefits from rising investments in oil, gas, and chemical industries, particularly in Saudi Arabia, the UAE, and South Africa. Demand for metal drums and intermediate bulk containers remains strong due to bulk transport needs in energy sectors. Ongoing infrastructure development and industrial diversification initiatives further drive growth. Increasing emphasis on export packaging standards and the gradual adoption of sustainable materials contribute to the region’s evolving packaging landscape.

Market Segmentations:

By Product Type

- Drums

- Intermediate Bulk Containers (IBCs)

- Pails

- Cans

- Boxes & bins

- Others

By Material Type

By End Use

- Chemicals

- Pharmaceuticals

- Food & beverage ingredients

- Agriculture

- Automotive

- Electronics

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The rigid industrial packaging market features a competitive landscape led by key players such as Amcor Rigid, Greif Packaging LLC, Sonoco Products Company, Greiner Packaging, LyondellBasell, Rieke Packaging Systems, Nefab Group, Balmer Lawrie & Co. Ltd., and Avantium. These companies focus on product innovation, sustainable material development, and expanding their global manufacturing footprints to strengthen market positions. Strategic collaborations and acquisitions enhance their portfolio diversification and supply chain capabilities. Market participants are investing in recyclable polymers, lightweight designs, and smart tracking technologies to meet rising sustainability and logistics efficiency demands. Continuous research in bio-based plastics and returnable packaging models supports compliance with global environmental standards. The industry also witnesses strong regional competition driven by advancements in material science, automation in packaging lines, and digitalized logistics. Long-term growth strategies emphasize balancing cost efficiency, durability, and regulatory compliance while addressing increasing customer preference for eco-friendly industrial packaging solutions.\

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor Rigid

- Greif Packaging LLC

- Sonoco Products Company

- Greiner Packaging

- LyondellBasell

- Rieke Packaging Systems

- Nefab Group

- Balmer Lawrie & Co. Ltd.

- Avantium

Recent Developments

- In 2025, Avantium and Amcor Rigid Packaging partnered to develop sustainable packaging using Avantium’s plant-based polymer, Releaf.

- In 2025, LyondellBasell launched Pro-fax EP649U, a polypropylene impact copolymer designed for thin-walled injection molding in the rigid packaging market.

- In 2024, Sonoco Products Company Acquired Eviosys, the largest metal packaging manufacturer in Europe, the Middle East, and Africa.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for recyclable and reusable packaging solutions will continue to rise globally.

- Adoption of smart packaging technologies such as RFID and IoT tracking will expand.

- Growth in global manufacturing and trade activities will drive large-scale packaging requirements.

- Chemical and pharmaceutical sectors will remain key consumers of rigid industrial containers.

- Development of lightweight and durable plastic materials will improve cost efficiency.

- Circular economy initiatives will promote container return and reuse programs.

- Automation in filling, handling, and logistics will enhance operational productivity.

- Stringent environmental regulations will accelerate the shift toward sustainable materials.

- Emerging economies in Asia and Latin America will experience faster market expansion.

- Continuous innovation in design and coating technologies will enhance product safety and lifespan.