Market Overview

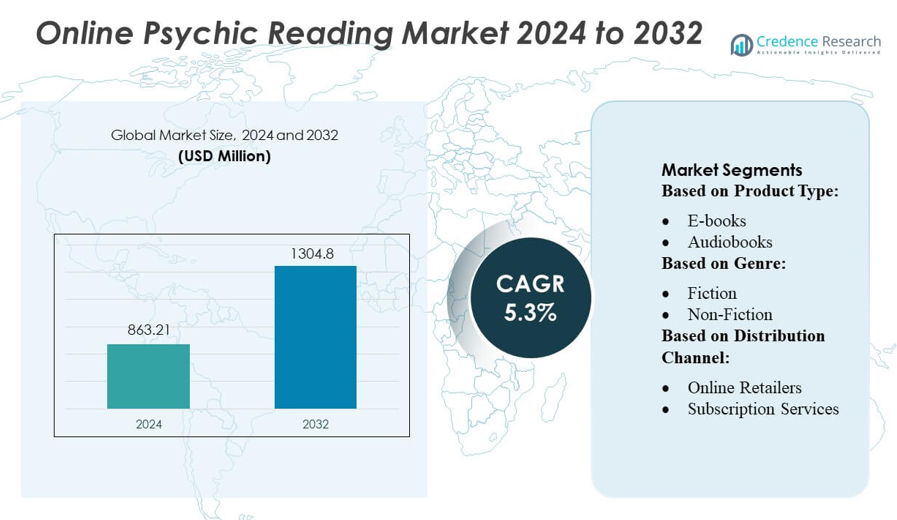

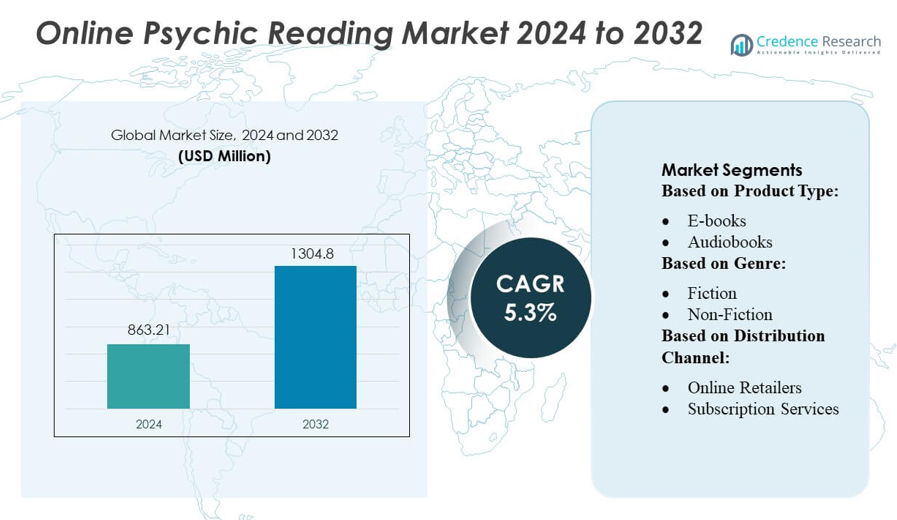

Online Psychic Reading Market size was valued USD 863.21 million in 2024 and is anticipated to reach USD 1304.8 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Online Psychic Reading Market Size 2024 |

USD 863.21 million |

| Online Psychic Reading Market, CAGR |

5.3% |

| Online Psychic Reading Market Size 2032 |

USD 1304.8 million |

The Online Psychic Reading Market is led by prominent players such as Lulu Press, Inc., Google, Barnes & Noble Booksellers, Inc., Rakuten Kobo Inc., Scribd Inc., Hachette Book Group, Apple Inc., Amazon.com, Inc., Smashwords, Inc., and HarperCollins Publishers. These companies focus on leveraging technology, personalized services, and mobile platforms to enhance user engagement and expand their digital presence. Strategic initiatives include subscription-based models, AI-assisted readings, live video consultations, and collaborations with wellness and lifestyle platforms. North America emerges as the leading region, capturing approximately 35% of the global market share, driven by high internet penetration, widespread smartphone adoption, and strong consumer acceptance of online spiritual and wellness services. The region’s mature digital ecosystem and demand for personalized guidance position it as a key growth hub, while innovation and service differentiation remain critical for maintaining competitive advantage across global markets.

Market Insights

- The Online Psychic Reading Market was valued at USD 863.21 million in 2024 and is expected to reach USD 1304.8 million by 2032, growing at a CAGR of 5.3% during the forecast period.

- Growth is driven by rising demand for personalized spiritual guidance, increasing adoption of mobile platforms, and integration of AI-assisted readings and live video consultations.

- Key trends include subscription-based models, partnerships with wellness and lifestyle platforms, and immersive user experiences through digital tools, enhancing engagement and retention.

- The market is competitive, with players focusing on technology, personalized services, and differentiated offerings; challenges include ensuring service credibility, regulatory compliance, and quality control.

- North America leads with a 35% market share, followed by Europe and Asia Pacific; segment-wise, chat-based readings, video consultations, and AI-driven services dominate due to convenience and accessibility, while emerging regions present high growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

In the Online Psychic Reading Market, e-books dominate the product type segment, capturing approximately 45% of the market share. Their popularity is driven by convenience, affordability, and the ability to offer instant access to diverse psychic reading content. Audiobooks follow closely, favored for their hands-free engagement and immersive experience, particularly among commuters and multitaskers. Interactive books are gaining traction by providing personalized features such as decision-based pathways and user inputs that enhance engagement. Market growth is further supported by advancements in digital publishing technology and increasing consumer preference for on-demand learning formats.

- For instance, Google Books currently hosts over 40 million books in more than 500 languages, making a broad digital repository accessible worldwide.

By Genre

Within the genre segment, non-fiction books lead with nearly 50% market share, largely due to strong consumer interest in practical psychic guidance, self-help strategies, and spiritual development. Fictional psychic content appeals to readers seeking entertainment with mystical narratives, while educational books are valued for structured learning about psychic practices. Children’s books are an emerging niche, focusing on age-appropriate spiritual awareness and imagination. Market growth is propelled by increasing awareness of mindfulness, self-discovery, and cultural acceptance of metaphysical practices, driving consistent demand across all age groups and genres.

- For instance, Barnes & Noble Booksellers, Inc. operates a digital storefront through NOOK that offers over 4.5 million eBooks for sale, demonstrating the company’s capacity to support a broad range of genres and formats.

By Distribution Channel

Online retailers are the dominant distribution channel, commanding roughly 55% of the market share, thanks to their broad reach, user-friendly platforms, and competitive pricing strategies. Subscription services are increasingly popular, offering bundled access to multiple books and exclusive psychic content, appealing to loyal audiences. Direct sales from authors or psychic experts provide a personalized experience, while other channels, including mobile apps and social media platforms, are emerging rapidly. The segment benefits from growing e-commerce adoption, convenience of digital delivery, and marketing strategies that target niche audiences through online promotions and influencer partnerships.

Key Growth Drivers

Rising Consumer Demand for Personalized Experiences

The growing preference for individualized guidance and emotional support is driving the online psychic reading market. Consumers increasingly seek tailored solutions for personal, professional, and relationship concerns. Digital platforms offer convenient, real-time access to certified psychics, enhancing engagement. For instance, mobile applications and chat-based services allow users to receive personalized insights on demand. This ease of access, combined with anonymity and privacy, encourages repeated usage, thereby fueling market expansion and attracting a diverse consumer base seeking spiritual and psychological guidance.

For instance, Kobo Libra 2 offers 32 GB of storage—enough to store up to 24,000 eBooks or 150 audiobooks—and features a 7″ HD E Ink Carta 1200 touchscreen with 1264×1680 resolution (300 ppi), delivering a clear and comfortable reading experience.

Technological Advancements in Digital Platforms

Advances in AI, video conferencing, and secure payment systems have streamlined online psychic services. Interactive apps and websites now support live video, chat, and AI-assisted compatibility analysis, improving user experience. Integration of AR and VR technologies is also enabling immersive consultations. For example, platforms leveraging AI-driven personality profiling help psychics provide more accurate readings. These technological innovations reduce barriers to entry, increase accessibility, and build trust, positioning online psychic reading services as a convenient and credible alternative to traditional in-person sessions.

For instance, Scribd launched a new generative‑AI feature called “Ask AI”, which enables users to query and extract key insights from documents up to 1,000 pages in a matter of seconds — significantly simplifying content discovery and research across Scribd’s extensive library.

Global Acceptance of Spiritual and Holistic Practices

Growing awareness and cultural acceptance of spiritual wellness and alternative therapies are expanding the market. Consumers increasingly integrate psychic readings into lifestyle choices for stress management and self-discovery. For instance, influencers and social media campaigns promoting tarot, astrology, and energy healing have heightened interest among younger demographics. This shift toward holistic approaches complements mainstream wellness trends, creating opportunities for service providers to diversify offerings, enhance engagement, and capture a broader global audience seeking non-conventional guidance and personal growth tools.

Key Trends & Opportunities

Integration of AI and Data Analytics

The use of AI algorithms and big data in online psychic platforms is enabling more personalized predictions. Psychics can leverage behavioral analytics to deliver tailored insights, improving accuracy and customer satisfaction. For instance, AI-driven compatibility and trend analysis help practitioners refine recommendations in real time. This trend not only enhances user trust but also provides platforms with actionable data for retention strategies, representing a significant opportunity to differentiate services in a competitive market by offering highly customized, predictive experiences.

For instance, Kindle Unlimited, allows users to borrow up to 20 titles at a time from a catalog exceeding 5 million titles spanning e‑books, audiobooks, comics and magazines.

Expansion through Mobile and On-Demand Services

Mobile applications and on-demand psychic reading services are driving market growth. Users increasingly prefer instant access to readings via smartphones and tablets, reflecting broader digital consumption habits. For example, apps offering chat-based tarot sessions or real-time astrology consultations enable global reach and convenience. This trend allows platforms to scale rapidly, attract younger audiences, and increase engagement through push notifications, subscription models, and loyalty programs, creating a continuous revenue stream and new monetization opportunities for service providers.

For instance, Smashwords operates a robust on‑demand self‑publishing and distribution platform that, as of late 2022, listed 731,100 e‑books, up from 590,200 at the end of 2021, reflecting a 24% increase in its catalog.

Strategic Collaborations and Partnerships

Collaborations with wellness brands, lifestyle apps, and social media platforms are emerging as key opportunities. Such partnerships extend market visibility and provide integrated services to a broader audience. For instance, psychic platforms partnering with meditation or mental health apps can offer bundled experiences, enhancing value for users. These collaborations also facilitate cross-marketing, customer acquisition, and brand credibility, positioning platforms to capitalize on lifestyle-driven trends and expand beyond traditional user bases into adjacent wellness and spiritual markets.

Key Challenges

Regulatory and Legal Compliance Issues

The online psychic reading market faces challenges related to consumer protection, fraud prevention, and varying legal frameworks across regions. Licensing requirements and guidelines for online spiritual services are often inconsistent, creating operational risks. For instance, disputes over inaccurate readings or payment issues can lead to reputational damage and legal scrutiny. Platforms must implement robust verification, transparency, and dispute resolution mechanisms to maintain credibility and navigate regulatory complexities while ensuring user trust in a largely unregulated digital environment.

Maintaining Service Quality and Credibility

Ensuring consistent accuracy, ethical practices, and practitioner authenticity remains a critical challenge. The presence of unverified or inexperienced psychics can undermine consumer confidence. For example, platforms must invest in certification, training, and monitoring to validate practitioners’ credentials. Additionally, delivering a high-quality digital experience that replicates the trust and rapport of in-person sessions is essential. Maintaining credibility while scaling globally requires rigorous quality control, robust user feedback systems, and continuous professional development for service providers.

Regional Analysis

North America

North America leads the online psychic reading market, accounting for approximately 35% of the global share. High internet penetration, growing smartphone adoption, and a strong preference for digital wellness solutions drive regional growth. The U.S. dominates the market, fueled by tech-savvy consumers seeking personalized spiritual and mental wellness services. Platforms offering AI-assisted readings and video consultations have gained traction, while social media influencers further boost adoption. The presence of established service providers and early adoption of mobile apps enhances accessibility. Consumer openness to alternative therapies and holistic wellness continues to support sustained expansion in the region.

Europe

Europe holds around 25% of the global market, driven by increasing awareness of holistic wellness and spiritual guidance. Countries like the UK, Germany, and France exhibit high adoption of digital psychic services, facilitated by advanced internet infrastructure and growing online payment acceptance. Platforms offering multilingual consultations and astrology-based personalized readings are gaining popularity. The region benefits from a culturally diverse consumer base receptive to tarot, numerology, and energy healing. Collaborations with lifestyle apps and wellness platforms further expand reach. Regulatory frameworks, although varied, encourage transparent and secure online services, ensuring steady market growth across Western and Northern Europe.

Asia Pacific

The Asia Pacific region represents approximately 20% of the global online psychic reading market, driven by increasing smartphone penetration, rising disposable incomes, and cultural affinity toward astrology and spiritual guidance. India, China, and Japan are key markets, where digital platforms offering real-time video and chat consultations have surged. Integration with mobile wallets and social apps facilitates seamless access for younger demographics. Rising interest in personalized and mental wellness services, coupled with regional festivals and traditional practices, fuels engagement. Localized content and culturally tailored offerings enable platforms to capture a large user base and expand market presence across urban centers.

Latin America

Latin America contributes about 12% of the global market, supported by growing internet accessibility and mobile adoption in countries like Brazil and Mexico. Consumers increasingly explore digital psychic services for guidance in relationships, career, and personal wellness. Platforms offering affordable subscriptions, chat-based consultations, and culturally relevant astrology readings are gaining popularity. Social media campaigns and influencer promotions further enhance adoption among younger users. Despite infrastructural challenges in rural areas, urban centers exhibit robust growth. Platforms focusing on secure payment methods and regional languages are well-positioned to expand their footprint and capture a larger share of this emerging market.

Middle East & Africa

The Middle East & Africa region accounts for roughly 8% of the global online psychic reading market. Growth is driven by increasing digital literacy, smartphone penetration, and urbanization in countries like the UAE, Saudi Arabia, and South Africa. Consumers are exploring astrology, tarot, and numerology services through mobile apps and online platforms. Cultural openness to spiritual guidance, coupled with growing disposable incomes, supports adoption. However, regulatory and payment infrastructure challenges persist. Providers focusing on localized content, Arabic and regional language support, and secure, convenient digital payment solutions are positioned to capture the expanding user base and increase market penetration across urban markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type:

By Genre:

By Distribution Channel:

- Online Retailers

- Subscription Services

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Online Psychic Reading Market is highly competitive, with key players including Lulu Press, Inc., Google, Barnes & Noble Booksellers, Inc., Rakuten Kobo Inc., Scribd Inc., Hachette Book Group, Apple Inc., Amazon.com, Inc., Smashwords, Inc., and HarperCollins Publishers. The Online Psychic Reading Market is highly competitive, driven by innovation, platform accessibility, and service differentiation. Companies focus on delivering personalized experiences through AI-assisted insights, live video consultations, and mobile applications to enhance user engagement. Strategies such as subscription models, loyalty programs, and integrated wellness services help retain customers and expand market reach. Differentiation is also achieved through niche offerings like astrology, tarot, and numerology, catering to specific consumer preferences. Additionally, investments in digital marketing, user-friendly interfaces, and secure payment systems strengthen credibility and trust. Sustaining a competitive edge requires continuous innovation, high service quality, and adaptability to evolving consumer expectations in a rapidly growing digital environment.

Key Player Analysis

Recent Developments

- In November 2024, HarperCollins Germany announced the acquisition of GRÄFE UND UNZER, a German-based guidebook publisher. The addition of this publishing brand enables HarperCollins Germany to expand its portfolio to offer books on topics such as healthy eating, cooking and enjoyment, partnership and family, life advice, gardening, nature, health, pets, and travel.

- In September 2024, Magellan Health introduced the “Teen Mental Wellbeing” app which is powered by the BeMe app, to support the emotional and mental health of individuals aged 13-22. The app is available to existing and new Magellan employer customers and provides tools for proactive well-being management, including access to live human connection.

- In August 2024, Scribd, Inc. introduced a beta version of its AI-powered tool, ‘Ask AI,’ which has been developed to elevate customer experience for its Scribd and Everand brands. This feature enables users to rapidly gather vital information from documents on Scribd, avoiding spending excessive time on research.

- In September 2023, Headspace and One Medical focused on devising solutions to reduce anxiety concerning medical appointments and to spread awareness towards preventive health screenings.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Genre, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital adoption will continue to drive growth in online psychic services globally.

- Mobile applications and on-demand consultations will expand consumer accessibility.

- Integration of AI and analytics will enhance personalization and predictive accuracy.

- Interest in holistic wellness and spiritual guidance will increase market demand.

- Subscription models and loyalty programs will strengthen customer retention.

- Partnerships with lifestyle and wellness platforms will create new growth opportunities.

- Social media and influencer-driven marketing will boost brand visibility.

- Regional markets in Asia Pacific and Latin America will see accelerated adoption.

- Service quality and practitioner credibility will remain critical for sustained growth.

- Emerging technologies like AR and VR will offer immersive user experiences and engagement.