Market Overview

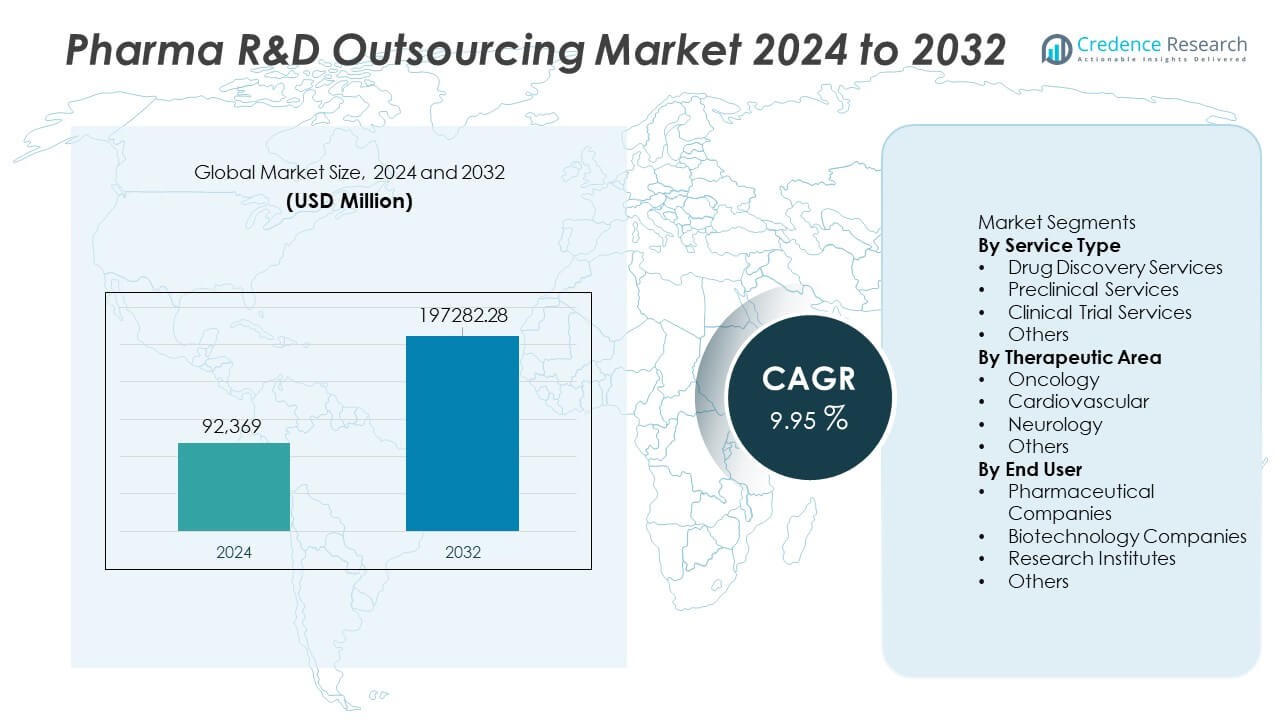

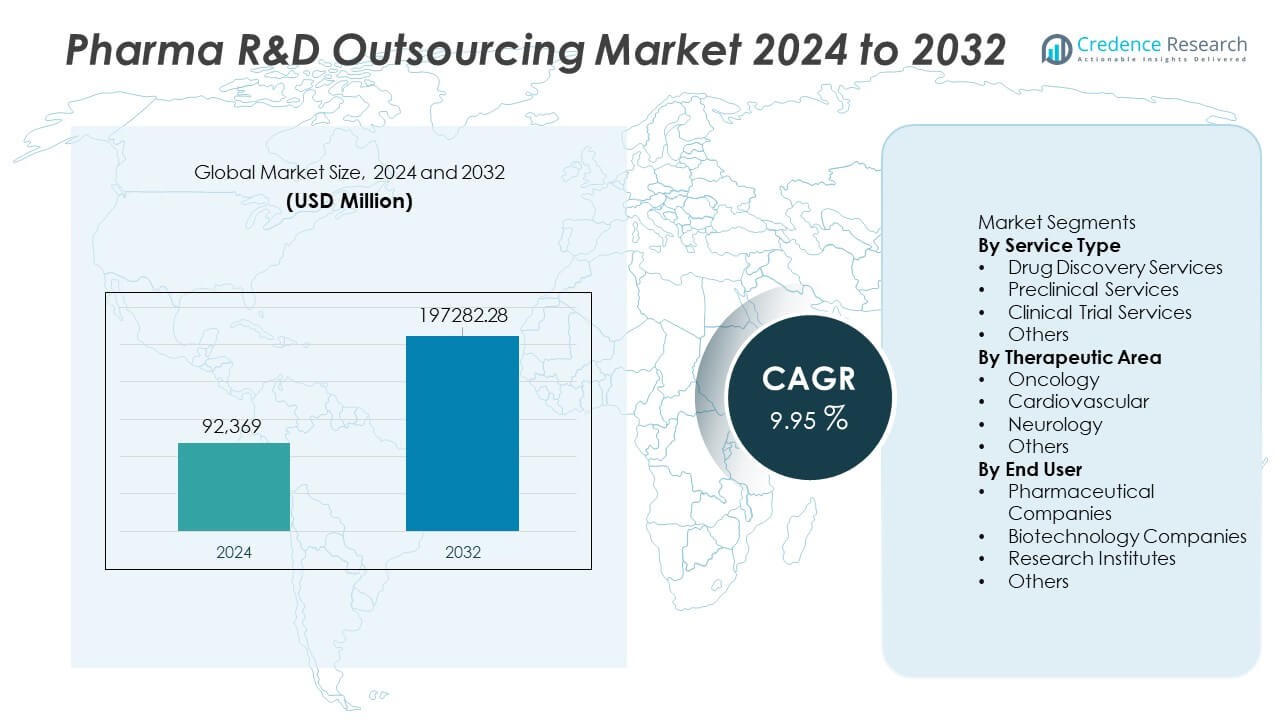

The Pharma R&D Outsourcing Market was valued at USD 92,369 million in 2024 and is projected to reach USD 197,282.28 million by 2032, expanding at a CAGR of 9.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pharma R&D Outsourcing Market Size 2024 |

USD 92,369 Million |

| Pharma R&D Outsourcing Market, CAGR |

9.95% |

| Pharma R&D Outsourcing Market Size 2032 |

USD 197,282.28 Million |

The Pharma R&D Outsourcing market is led by major companies such as IQVIA, Labcorp Drug Development, Syneos Health, Charles River Laboratories, ICON plc, WuXi AppTec, Parexel International, Lonza, Thermo Fisher Scientific (PPD), and Eurofins Scientific. These firms shape global outsourcing through advanced discovery platforms, large clinical trial networks, and strong regulatory expertise. North America leads the market with 42% share due to mature CRO infrastructure and high R&D spending. Europe follows with 30% share, supported by strong biopharma research activity, while Asia Pacific holds 23% share, driven by rapid expansion of cost-efficient outsourcing hubs and rising investment in clinical development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Pharma R&D Outsourcing market reached USD 92,369 million in 2024 and will grow at a CAGR of 9.95% through 2032.

- Demand rises as drug developers seek faster pipelines, with clinical trial services holding 46% share due to growing complexity and global study expansion.

- Trends strengthen around AI-enabled discovery, real-world evidence, and decentralized trials that improve efficiency and reduce development delays.

- Competition intensifies as leading CROs expand global sites, enhance regulatory capabilities, and invest in integrated platforms while smaller firms face cost and scalability restraints.

- North America leads with 42% share, Europe follows with 30%, and Asia Pacific holds 23%, supported by strong clinical trial activity, cost advantages, and rising oncology research demand across outsourced programs.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Service Type

Clinical trial services lead this segment with 46% share, driven by rising demand for large-scale study management, patient recruitment support, and global trial execution capabilities. Pharmaceutical companies increasingly outsource Phase I–III trials to reduce timelines, improve data quality, and access specialized expertise. CROs strengthen their position by expanding decentralized trial capabilities, advanced analytics, and real-world evidence integration. Preclinical services grow as companies accelerate early-stage development using outsourced toxicology, pharmacology, and formulation studies. Drug discovery services also expand with increased use of AI-driven screening and target identification. Clinical trial dominance reflects the high cost and complexity of late-stage programs.

- For instance, IQVIA expanded its decentralised trial network to support many active DCT programs using its Orchestrated Clinical Trials platform with extensive remote patient connections worldwide.

By Therapeutic Area

Oncology dominates this segment with 39% share, supported by rising cancer prevalence and intensive investment in precision therapies, immuno-oncology, and combination treatment research. Cancer drug development requires complex trials, biomarker-guided studies, and advanced imaging, driving strong outsourcing demand. CROs provide specialized oncology networks, global patient pools, and expertise in rare tumor research. Cardiovascular research follows as companies pursue new therapies for heart failure and metabolic disorders. Neurology grows steadily due to increased focus on Alzheimer’s, Parkinson’s, and rare neurological conditions. Oncology leadership continues as pipelines increasingly shift toward targeted and personalized cancer treatments.

- For instance, ICON plc supported a large number of active oncology trials and expanded its global oncology site network to a vast number of certified cancer research centers.

By End User

Pharmaceutical companies hold the leading 58% share, driven by extensive outsourcing of discovery, preclinical work, and large-scale clinical trials to reduce operational costs and enhance development speed. Large firms rely on CROs for global study execution, regulatory navigation, and advanced research technologies. Biotechnology companies follow, benefiting from outsourced capabilities that support small internal teams and accelerate innovative therapy development. Research institutes contribute steady demand through collaborative studies and government-funded programs. The dominance of pharmaceutical companies remains strong as they continue shifting toward flexible outsourcing models to optimize R&D productivity and manage complex therapeutic pipelines.

Key Growth Drivers

Rising Complexity of Drug Development and Higher R&D Costs

The increasing scientific and regulatory complexity of drug development drives greater reliance on outsourcing partners. Pharmaceutical companies face longer development timelines, higher clinical trial failure rates, and rising operational expenses, making outsourcing a cost-efficient alternative. CROs offer advanced technologies, global patient access, and specialized expertise that streamline each stage of development. This support helps companies reduce overhead, accelerate milestones, and improve trial efficiency. As innovation shifts toward biologics, gene therapies, and precision medicines, outsourcing becomes essential for managing sophisticated research and ensuring faster market entry.

- For instance, Labcorp Drug Development expanded its central laboratory network by adding automation systems, which improved biomarker turnaround time for complex biologics programs.

Growing Demand for Clinical Trials Across Emerging Markets

The expansion of clinical research in Asia, Latin America, and Eastern Europe accelerates outsourcing demand due to larger patient pools, faster recruitment, and lower operational costs. Pharmaceutical companies increasingly partner with CROs that have strong regional networks and regulatory knowledge. Emerging markets offer diverse demographics that support broader therapeutic studies and real-world data generation. This trend strengthens global trial feasibility and reduces development timelines. As healthcare infrastructure improves and governments support clinical research, outsourcing opportunities in these regions continue to rise, boosting overall market growth.

- For instance, Parexel strengthened its Asia-Pacific footprint by adding new clinical trial sites in India and China, enabling enrollment support for trials with a significant number of patients. The company operates many trial locations across various states in India and engages with hundreds of sites across Greater China.

Increased Adoption of AI, Analytics, and Digital Research Technologies

Advancements in AI, big data analytics, and digital platforms transform R&D efficiency and accuracy. CROs adopt predictive modeling, automated data capture, and virtual trial technologies to improve study design, patient monitoring, and decision-making. Digital tools reduce manual processes, enhance data quality, and support risk-based monitoring. This technological shift helps pharmaceutical companies accelerate drug discovery and reduce trial delays. The integration of digital ecosystems enhances collaboration, improves transparency, and strengthens regulatory readiness. As innovation intensifies, outsourcing providers with strong technological capabilities gain significant competitive advantage.

Key Trends & Opportunities

Expansion of Decentralized and Hybrid Clinical Trial Models

The shift toward decentralized trials creates major opportunities for outsourcing providers offering remote monitoring, digital recruitment, and patient-centric technology platforms. These models improve trial accessibility, reduce dropout rates, and minimize site burden. Wearables, telehealth tools, and electronic data capture systems enable continuous monitoring and real-time analysis. Pharmaceutical companies adopt decentralized approaches to reach diverse populations and enhance trial efficiency. As patient expectations evolve toward convenience and remote participation, decentralized trials become a long-term opportunity for CROs driving innovation in clinical research.

- For instance, Syneos Health leverages its patient engagement capabilities to support hybrid trials globally, processing large amounts of digital data through its eClinical platform.

Growth of Specialized R&D Outsourcing for Biologics and Advanced Therapies

Biologics, cell therapies, and gene therapies require specialized research expertise, advanced labs, and sophisticated handling capabilities, driving strong outsourcing demand. CROs expand service portfolios to support complex assays, biomarker development, and high-potency biologic testing. Pharmaceutical and biotech companies rely on outsourcing partners for scalable infrastructure and regulatory compliance. This trend opens significant opportunities as pipelines continue shifting toward personalized and targeted therapies. Specialized outsourcing helps accelerate development while ensuring technical precision and safety.

- For instance, Charles River Laboratories increased its testing capacity, enabling comprehensive testing services including vector potency and residual impurity testing.

Key Challenges

Regulatory Complexity and Evolving Compliance Requirements

Pharma R&D outsourcing faces strict global regulatory frameworks that require extensive documentation, quality control, and data transparency. Frequent updates in clinical trial guidance, safety reporting, and data protection rules create operational burdens for providers. CROs must maintain harmonized processes across regions, increasing complexity in global studies. Failure to meet regulatory expectations can delay approvals or compromise study integrity. Managing multi-country compliance and establishing standardized workflows remain major challenges.

Data Security Risks and Integration Barriers Across Digital Platforms

As digital technologies expand, data security becomes a critical concern for outsourced R&D operations. Clinical studies generate sensitive patient and molecular data, heightening risks of breaches, cyberattacks, and data loss. CROs and sponsors must invest in advanced cybersecurity, encryption, and secure cloud systems to protect confidential information. Integration barriers between legacy systems and modern digital platforms create additional challenges in ensuring seamless data flow. These issues can slow research timelines and impact collaboration across global teams.

Regional Analysis

North America

North America holds 41% share of the Pharma R&D Outsourcing market, driven by strong clinical research infrastructure, high biotech activity, and significant investment in advanced therapies. The region benefits from a large presence of global CROs, robust regulatory frameworks, and high adoption of digital trial technologies. Pharmaceutical companies outsource discovery, preclinical, and clinical services to reduce development time and address rising R&D costs. Growth is supported by expanding biologics pipelines and strong demand for decentralized trial models. Strategic partnerships between CROs and pharma companies further enhance North America’s leadership in outsourced R&D operations.

Europe

Europe accounts for 29% share, supported by well-established research institutions, strong regulatory compliance, and high adoption of outsourcing for complex clinical and preclinical studies. Countries such as Germany, the U.K., and France lead market activity due to strong biotech ecosystems and advanced therapeutic development. Outsourcing demand rises as companies focus on cost efficiency and access to specialized expertise. Growth in personalized medicine, rare-disease research, and biologics strengthens the region’s outsourcing requirements. Collaboration across EU member states and increased cross-border clinical trial harmonization further enhance Europe’s competitive position in the global market.

Asia Pacific

Asia Pacific holds 23% share and remains the fastest-growing region driven by large patient pools, cost-effective research environments, and expanding clinical trial capacity across China, India, Japan, and South Korea. Pharmaceutical companies increasingly outsource to access faster recruitment, diverse populations, and strong government support for clinical research. Regional CROs advance capabilities in biologics, biosimilars, and digital trial technologies. The rise of domestic biotech firms boosts demand for discovery and preclinical outsourcing. As infrastructure modernizes and regulatory frameworks improve, Asia Pacific strengthens its position as a major global hub for outsourced pharma R&D.

Latin America

Latin America captures 4% share, supported by growing clinical trial activity in Brazil, Mexico, and Argentina. The region offers diverse patient populations and competitive costs, attracting pharmaceutical companies seeking accelerated recruitment. Outsourcing demand increases as healthcare systems modernize and regulatory agencies strengthen approval processes. However, variability in regulations and slower infrastructure development pose challenges. CROs expand their regional presence to support multi-country trials and improve operational consistency. Despite barriers, Latin America continues to build its role in global R&D outsourcing through rising investment and increased participation in late-phase clinical studies.

Middle East & Africa

Middle East & Africa hold 3% share, driven by emerging research investments in Gulf countries and rising interest in hosting early-stage and observational studies. The UAE and Saudi Arabia lead adoption due to advanced healthcare infrastructure and strong regulatory modernization. African nations experience gradual growth as clinical trial participation increases and pharmaceutical companies explore new patient pools. Infrastructure limitations and lower digital adoption slow expansion, but government initiatives continue to strengthen research ecosystems. As regional capabilities improve, Middle East & Africa offer long-term opportunities for outsourced R&D, especially in public health and chronic disease studies.

Market Segmentations:

By Service Type

- Drug Discovery Services

- Preclinical Services

- Clinical Trial Services

- Others

By Therapeutic Area

- Oncology

- Cardiovascular

- Neurology

- Others

By End User

- Pharmaceutical Companies

- Biotechnology Companies

- Research Institutes

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Pharma R&D Outsourcing market is shaped by leading companies such as IQVIA, Labcorp Drug Development, Syneos Health, Charles River Laboratories, ICON plc, WuXi AppTec, Parexel International, Thermo Fisher Scientific (PPD), Lonza, and Eurofins Scientific. These firms expand their global reach, enhance service depth, and invest in advanced technologies to support end-to-end drug development. Competition intensifies as players strengthen capabilities in AI-enabled discovery, biomarker development, decentralized clinical trials, and integrated data platforms. CROs focus on expanding therapeutic expertise, enhancing regulatory support, and improving trial efficiency through automation and real-world evidence analytics. Strategic partnerships with pharmaceutical and biotechnology companies remain central, enabling faster study execution and scalable development models. Continuous investments in specialized facilities, high-throughput screening, biologics development, and large global trial networks reinforce the competitive advantage of full-service providers in this rapidly growing market.

Key Player Analysis

- IQVIA

- Labcorp Drug Development

- Syneos Health

- Charles River Laboratories

- ICON plc

- WuXi AppTec

- Parexel International

- Thermo Fisher Scientific (PPD)

- Lonza

- Eurofins Scientific

Recent Developments

- In March 2025, IQVIA launched a new platform called Site Lab Navigator to automate and streamline lab workflows for clinical trials.

- In 2025, Charles River Laboratories maintained its position as a top global Contract Research Organization (CRO) in both preclinical and clinical outsourcing markets.

- In 2025, Thermo Fisher Scientific (via PPD) was listed among major contract-research providers dominating the global clinical-trial outsourcing space.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service Type, Therapeutic Area, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Pharma companies will expand outsourcing to reduce development time and improve efficiency.

- CROs will adopt AI and automation to accelerate discovery and trial execution.

- Oncology research will grow as targeted and precision therapies gain stronger focus.

- Decentralized and hybrid clinical trials will become a standard model worldwide.

- Demand for real-world evidence will rise to support faster regulatory decisions.

- Outsourcing in emerging markets will increase as cost advantages and talent pools expand.

- CRO partnerships will strengthen as companies seek integrated end-to-end development support.

- Biotech firms will rely more on external R&D capabilities to manage limited internal resources.

- Investments in data security and compliance will rise due to stricter global regulations.

- Advanced analytical platforms will boost predictive modeling and improve trial success rates.

Market Segmentation Analysis:

Market Segmentation Analysis: