Market Overview

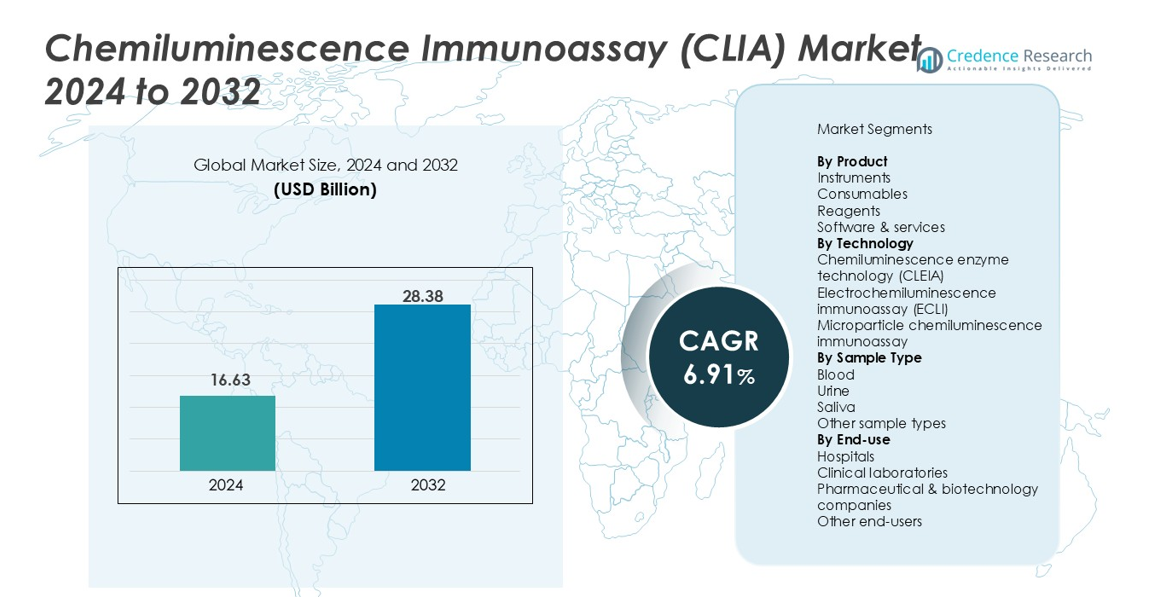

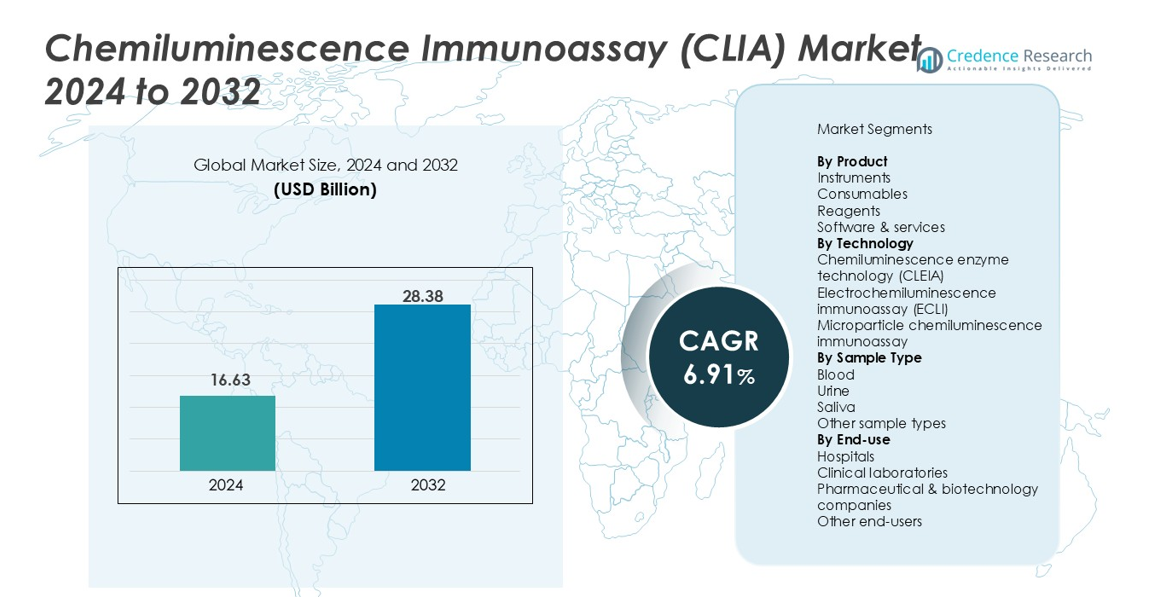

Chemiluminescence Immunoassay (CLIA) Market size was valued at USD 16.63 Billion in 2024 and is projected to reach USD 28.38 Billion by 2032, expanding at a CAGR of 6.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chemiluminescence Immunoassay (CLIA) Market Size 2024 |

USD 16.63 Billion |

| Chemiluminescence Immunoassay (CLIA) Market, CAGR |

6.91% |

| Chemiluminescence Immunoassay (CLIA) Market Size 2032 |

USD 28.38 Billion |

Chemiluminescence Immunoassay (CLIA) Market is shaped by major players such as Abbott Laboratories, Danaher Corporation, F. Hoffmann-La Roche Ltd, DiaSorin S.p.A, Bio-Rad Laboratories Inc., Revvity Inc., Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Eurofins Scientific SE, Maccura Biotechnology Co. Ltd., and H.U. Group Holdings Inc., who strengthen their presence through advanced analyzer platforms and expanded reagent portfolios. North America led the Chemiluminescence Immunoassay (CLIA) Market with a 39.4% share in 2024, driven by strong diagnostic infrastructure and adoption of high-sensitivity testing technologies. Europe followed with 28.1%, supported by automation growth and rising demand for precision disease screening across clinical laboratories.

Market Insights

- Chemiluminescence Immunoassay (CLIA) Market size was USD 16.63 Billion in 2024 and will reach USD 28.38 Billion by 2032, registering a CAGR of 6.91%.

- Market expansion is driven by rising test volumes for oncology, infectious diseases, and endocrine disorders, with Reagents holding a 48.6% share as the dominant product category due to recurring consumption in automated systems.

- A key trend includes the shift toward high-sensitivity multiplex assays and wider adoption of electrochemiluminescence technology, which led the segment with a 52.3% share.

- Industry players strengthen their position through advanced analyzer launches, expanded assay menus, and strategic collaborations across hospitals, laboratories, and biotechnology firms.

- Regionally, North America held 39.4% of the market in 2024, followed by Europe at 28.1%, while Asia-Pacific accounted for 22.7% and remains the fastest-growing region due to increasing diagnostic modernization and expanding laboratory networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

In the Chemiluminescence Immunoassay (CLIA) Market, Reagents dominated the product segment with a 48.6% share in 2024, driven by their recurring utilization in high-throughput diagnostics and expanding test menu availability across infectious diseases, oncology, and endocrinology. The rising adoption of fully automated analyzers increases reagent consumption, strengthening long-term revenue streams for manufacturers. Consumables accounted for 27.4%, supported by increased laboratory workflow automation, while Instruments held a 17.9% share due to upgraded analyzer installations. Software & services captured the remaining 6.1% as demand for digital diagnostic platforms and remote instrument management grew steadily.

- For instance, Siemens Healthineers introduced the Atellica CI Analyzer with enhanced chemiluminescence assay throughput, which increased reagent pull-through in mid-volume laboratories.

By Technology

The market was led by Electrochemiluminescence Immunoassay (ECLI), holding a 52.3% share in 2024, supported by superior analytical sensitivity, wide dynamic range, and enhanced precision in complex disease testing. Its strong adoption in oncology biomarkers, cardiac markers, and autoimmune diagnostics accelerated segment expansion. Chemiluminescence enzyme technology (CLEIA) held a 31.5% share due to its established use in routine assays and compatibility with mid-volume analyzers. Microparticle chemiluminescence immunoassay accounted for 16.2%, strengthened by rapid assay throughput and increasing integration into automated laboratory systems.

- For instance, Roche received FDA clearance for its Elecsys β-Amyloid (42/40) CSF ratio test, which leverages ECLIA technology, boosting adoption across neurodegenerative diagnostic workflows.

By Sample Type

Blood samples led the segment with a 64.7% share in 2024, driven by their clinical relevance across nearly all immunoassay test categories, including hormone profiling, tumor markers, and infectious disease diagnostics. The reliability and high biomarker concentration in serum and plasma enhance assay accuracy, supporting widespread use in hospitals and diagnostic laboratories. Urine samples captured a 19.3% share owing to non-invasive collection benefits, particularly in drug screening and renal biomarkers. Saliva accounted for 9.1% as interest in home-based diagnostics grew, while other sample types comprised 6.9% due to niche testing applications.

Market Overview

Growing Burden of Chronic and Infectious Diseases

Rising global prevalence of chronic and infectious diseases strongly accelerates adoption of CLIA systems due to their superior sensitivity, rapid turnaround time, and broad assay menu. Hospitals and diagnostic laboratories increasingly rely on CLIA for accurate detection of oncology markers, cardiac biomarkers, hormonal disorders, and infectious pathogens. The need for early diagnosis and continuous monitoring of long-term conditions expands test volumes significantly. This driver is further supported by increasing healthcare expenditure and government-led screening programs that promote high-performance immunoassay technologies.

- For instance, Brazil’s Ministry of Health scaled up infectious-disease screening programs using CLIA assays for HIV, hepatitis B/C, and syphilis, expanding test volumes in public laboratories.

Advancements in Automated Analyzer Platforms

Technological enhancements in fully automated CLIA analyzers strengthen market expansion by improving throughput, reducing manual intervention, and enabling multi-parameter testing. Modern systems offer improved assay precision, advanced chemiluminescence detection, and greater integration with laboratory information systems, supporting streamlined workflows. Manufacturers continue to introduce compact, high-throughput analyzers suitable for centralized laboratories and decentralized diagnostic centers. These innovations attract healthcare providers seeking operational efficiency and reliable clinical outcomes, reinforcing adoption across developed and emerging markets.

- For instance, SNIBE’s MAGLUMI X6 delivers high throughput of 450 tests per hour from a single module, featuring up to 412 sample positions, 30 refrigerated reagent positions, and up to 2000 walk-away tests with no-pause loading.

Growing Use of CLIA in Specialized Diagnostic Applications

CLIA adoption rises as clinical testing shifts toward specialized diagnostics in oncology, autoimmune disorders, reproductive health, and cardiovascular diseases. The assay’s ability to detect low-abundance biomarkers with high reproducibility makes it indispensable for precision medicine and personalized treatment strategies. Increasing demand for high-sensitivity assays in research institutions, specialty clinics, and reference laboratories further drives growth. Expansion of test panels and continuous R&D investments by diagnostic companies broaden application scope, strengthening CLIA’s role in advanced disease detection and monitoring.

Key Trends & Opportunities

Expansion of High-Sensitivity Multiplex Assays

A major trend shaping the CLIA market is the shift toward high-sensitivity multiplex assays that allow simultaneous detection of multiple biomarkers from a single sample. This enhances diagnostic efficiency and supports the growing need for comprehensive disease profiling, particularly in oncology and infectious diseases. Manufacturers are investing in assay miniaturization, improved detection chemistries, and microfluidic integration, enabling faster and more accurate results. This trend creates opportunities for laboratories to reduce testing costs while improving clinical decision-making and patient outcomes.

- For instance, Siemens Healthineers expanded its Atellica® IM menu with a high-sensitivity cardiac troponin I assay designed for rapid myocardial injury detection.

Rise of Digital Diagnostics and Remote Laboratory Connectivity

Growing digital transformation in healthcare creates new opportunities for CLIA systems integrated with cloud-based platforms, AI-driven analytics, and remote monitoring capabilities. Laboratories increasingly adopt digital solutions to manage assay workflows, automate quality control, and improve data accuracy. Remote instrument connectivity supports preventive maintenance and uninterrupted operations. These advancements strengthen decentralized testing models and enable efficient sample management across multisite networks. As digital diagnostics expand, vendors offering interoperable, software-enabled CLIA solutions gain a significant competitive edge.

- For instance, Roche Diagnostics enhanced its cobas® pro integrated solutions with cloud-connected middleware enabling real-time performance monitoring and automated QC management.

Key Challenges

High Initial Investment and Operational Costs

Despite strong demand, high acquisition costs of automated CLIA analyzers and recurring expenses for reagents and consumables present major challenges for smaller laboratories and healthcare facilities. Budget constraints limit adoption, particularly in low- and middle-income countries. Additionally, maintaining instrument uptime, training specialized operators, and ensuring compliance with regulatory standards increase operational burdens. These cost-related barriers slow market penetration, compelling manufacturers to explore affordable system models and reagent rental programs.

Regulatory Complexities and Quality Compliance Requirements

Stringent regulatory frameworks governing immunoassay development, validation, and manufacturing pose challenges for industry participants. Achieving consistent assay performance, meeting global quality certifications, and undergoing periodic audits increase time-to-market and operational complexity. Variations in diagnostic approval pathways across regions further complicate global commercialization strategies. Ensuring reagent standardization, maintaining batch-to-batch consistency, and adhering to evolving laboratory safety norms remain critical hurdles that companies must address to sustain product reliability and market trust.

Regional Analysis

North America

North America dominated the Chemiluminescence Immunoassay (CLIA) Market with a 39.4% share in 2024, driven by strong adoption of advanced diagnostic technologies, well-established healthcare infrastructure, and high testing volumes across infectious diseases, oncology, and endocrine disorders. The region benefits from the presence of leading diagnostic manufacturers and continuous technological upgrades in automated analyzers. Rising demand for high-sensitivity biomarker testing and increasing emphasis on early detection programs further support market expansion. Growth is also reinforced by expanding reimbursement coverage and investments in precision medicine initiatives across the U.S. and Canada.

Europe

Europe accounted for a 28.1% share in 2024, supported by a mature clinical diagnostics ecosystem, growing burden of chronic illnesses, and extensive use of CLIA systems in hospitals and reference laboratories. Regulatory focus on high-accuracy immunoassays strengthens adoption of advanced platforms, especially in Germany, the U.K., France, and Italy. Increasing investments in laboratory automation and integration of digital diagnostics accelerate market penetration. Rising demand for high-throughput analyzers in public health facilities and expanding oncology testing further contribute to Europe’s consistent market growth within the CLIA segment.

Asia-Pacific

Asia-Pacific held a 22.7% share in 2024 and represents the fastest-expanding region, driven by rising healthcare expenditure, widespread diagnostic modernization, and increasing prevalence of infectious diseases and metabolic disorders. China, India, Japan, and South Korea lead adoption due to expanding laboratory networks and rapid integration of automated immunoassay systems. Growing emphasis on early disease screening, government-supported healthcare reforms, and higher test affordability are accelerating market penetration. Strong presence of regional diagnostic manufacturers and rising investments in localized CLIA reagent production further strengthen Asia-Pacific’s long-term growth outlook.

Latin America

Latin America captured a 5.6% share in 2024, driven by expanding diagnostic capabilities across Brazil, Mexico, Argentina, and Colombia. Growth is supported by increasing test volumes for infectious diseases, broader access to automated analyzers, and rising demand for cost-effective immunoassay solutions. Private healthcare expansion and modernization of clinical laboratories contribute to greater adoption of CLIA systems. However, budget constraints and uneven reimbursement structures influence market performance. Ongoing investments in public health programs and rising awareness of early diagnostic screening continue to create favorable opportunities for market development.

Middle East & Africa

The Middle East & Africa region held a 4.2% share in 2024, driven by gradual improvements in healthcare infrastructure and increasing adoption of modern diagnostic platforms across the UAE, Saudi Arabia, South Africa, and Egypt. Demand for CLIA systems grows as hospitals enhance disease surveillance and expand screening programs for chronic and infectious conditions. Private-sector investments, coupled with rising laboratory automation, support market expansion. Despite growth potential, challenges such as limited skilled workforce and budget restrictions persist. Nonetheless, expanding healthcare modernization initiatives continue to strengthen the region’s long-term CLIA adoption.

Market Segmentations

By Product

- Instruments

- Consumables

- Reagents

- Software & services

By Technology

- Chemiluminescence enzyme technology (CLEIA)

- Electrochemiluminescence immunoassay (ECLI)

- Microparticle chemiluminescence immunoassay

By Sample Type

- Blood

- Urine

- Saliva

- Other sample types

By End-use

- Hospitals

- Clinical laboratories

- Pharmaceutical & biotechnology companies

- Other end-users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Chemiluminescence Immunoassay (CLIA) Market is shaped by leading players such as Abbott Laboratories, Bio-Rad Laboratories Inc., Danaher Corporation, DiaSorin S.p.A, Eurofins Scientific SE, F. Hoffmann-La Roche Ltd, H.U. Group Holdings Inc., Maccura Biotechnology Co. Ltd., Revvity Inc., and Shenzhen Mindray Bio-Medical Electronics Co. Ltd. These companies strengthen their market position through continuous product innovation, expansion of automated analyzer platforms, and development of high-sensitivity reagent portfolios. Strategic initiatives including technology upgrades, regulatory approvals, partnerships with clinical laboratories, and expansion into emerging markets enhance their global reach. Manufacturers increasingly invest in digital diagnostics, remote connectivity solutions, and broader assay menus to address rising testing demand in oncology, infectious diseases, and chronic disorder management. Growing emphasis on precision diagnostics and laboratory automation further intensifies market activity, enabling key players to differentiate through performance reliability, scalability, and robust service networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2024, Mindray introduced the CLIA analyzer CL-2600i a compact, mid-volume instrument capable of ~240 tests/hour.

- In March 2024, Zybio launched its fully-automated chemiluminescence immunoassay analyzer EXI 8000 at the CACLP 2024 exhibition.

- In July 2023, Fapon unveiled its high-throughput CLIA system Shine i8000/9000 during the AACC 2023 Clinical Lab Expo. The analyzer supports up to 900 tests/hour.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Sample Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as healthcare providers adopt high-sensitivity diagnostic assays for early disease detection.

- Automation in clinical laboratories will increase demand for advanced CLIA analyzers with higher throughput.

- Growth in oncology, cardiology, and infectious disease testing will strengthen the relevance of specialized CLIA panels.

- Digital diagnostics and AI-driven workflow optimization will enhance assay precision and operational efficiency.

- Point-of-care and decentralized testing models will gradually incorporate compact CLIA systems.

- Manufacturers will invest in expanding reagent portfolios to support broader clinical applications.

- Emerging markets will gain traction due to improved healthcare infrastructure and enhanced screening programs.

- Integration of cloud connectivity and remote monitoring will become standard across next-generation analyzers.

- Personalized medicine and biomarker-focused research will drive development of ultra-sensitive CLIA platforms.

- Regulatory harmonization and quality compliance advancements will support global market penetration and product reliability.