Market Overview

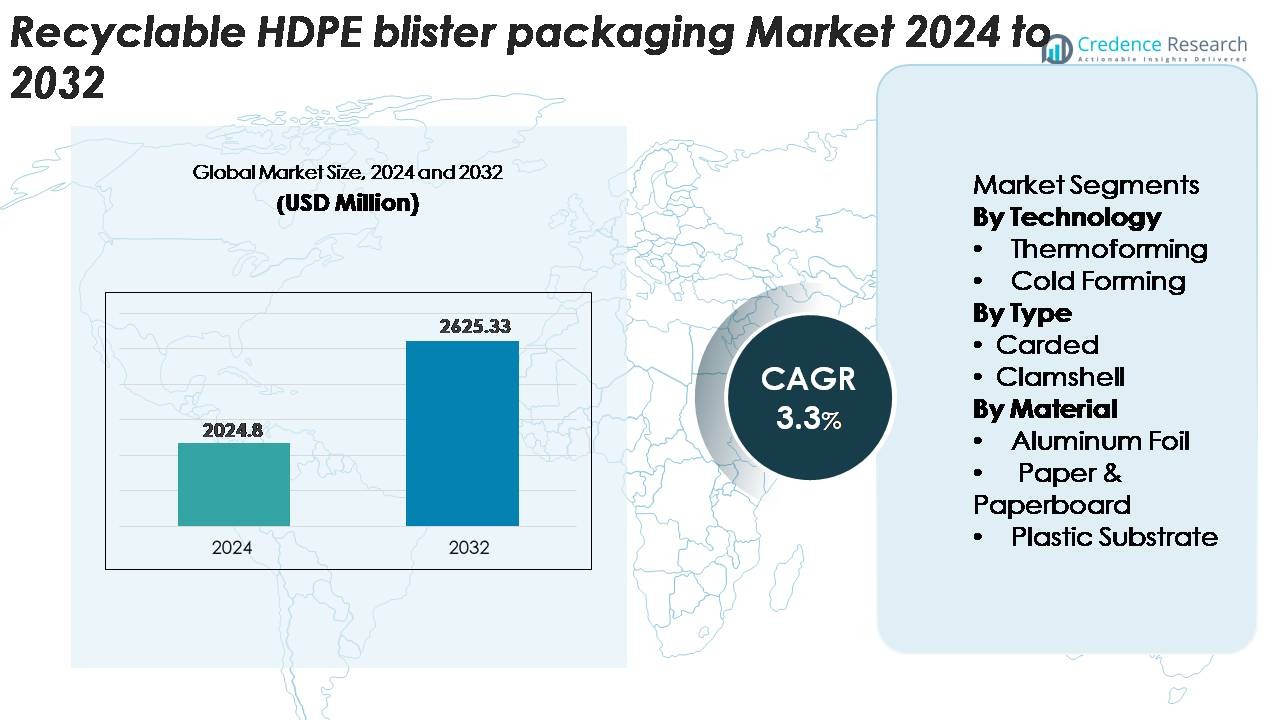

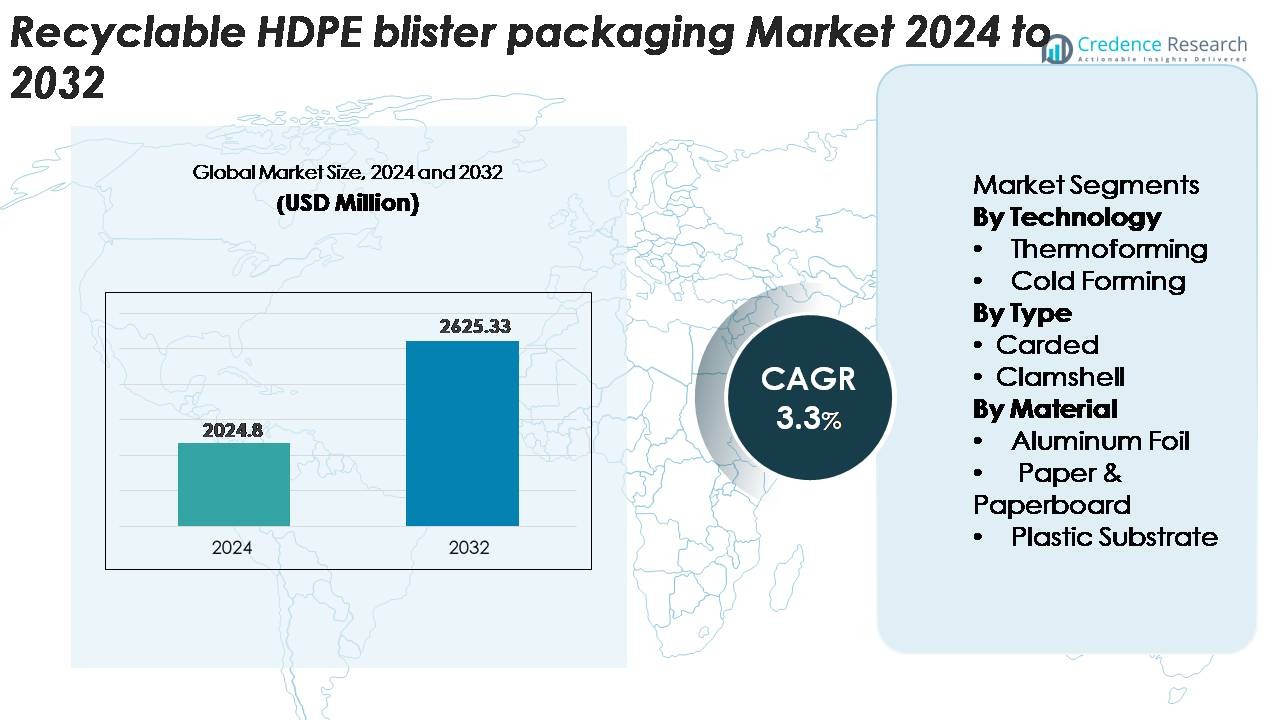

The Recyclable HDPE Blister Packaging Market was valued at USD 2,024.8 million in 2024 and is projected to reach USD 2,625.33 million by 2032, expanding at a CAGR of 3.3% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Recyclable HDPE Blister Packaging Market Size 2024 |

USD 2,024.8 Million |

| Recyclable HDPE Blister Packaging Market, CAGR |

3.3% |

| Recyclable HDPE Blister Packaging Market Size 2032 |

USD 2,625.33 Million |

Leading players in the recyclable HDPE blister packaging market include Amcor plc, Sonoco Products Company, Constantia Flexibles, Klöckner Pentaplast (KP), Huhtamaki, and Blisterpak, Inc., all of which are expanding mono-material HDPE blister solutions to meet brand sustainability targets and regulatory requirements. These companies focus on advanced thermoforming lines, high-purity HDPE substrates, and improved barrier coatings that enhance recyclability without compromising product protection. North America leads the global market with approximately 32% share, supported by strong pharmaceutical demand and mature recycling infrastructure, followed by Europe at around 28%, driven by stringent packaging circularity mandates and rapid adoption of mono-material formats.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The recyclable HDPE blister packaging market reached USD 2,024.8 million in 2024 andis projected to hit USD 2,625.33 million by 2032, reflecting a CAGR of 3.3% driven by rising global demand for mono-material, fully recyclable blister formats.

- Strong market drivers include regulatory pressure for sustainable packaging, rapid adoption in pharmaceuticals and personal care, and improved thermoforming efficiency that strengthens HDPE’s position as the preferred recyclable alternative to PVC-based structures.

- Key trends highlight accelerated use of mono-material HDPE blisters, growing integration of rHDPE, and increased adoption across OTC healthcare, small electronics, and retail-ready packaging, with thermoforming holding the dominant technology share.

- Competitive activity intensifies as major players invest in recyclable barrier coatings, high-clarity HDPE substrates, and circular packaging programs, while restraints emerge due to barrier limitations compared to multilayer laminates and inconsistent global recycling infrastructure.

- Regionally, North America leads with ~32%, followed by Europe at ~28% and Asia-Pacific at ~26%, while carded blisters and HDPE plastic substrates maintain the highest segment shares globally.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Technology

Thermoforming represents the dominant technology in recyclable HDPE blister packaging, accounting for the largest share of the market due to its precision forming capabilities, high throughput, and compatibility with lightweight mono-material designs. Its ability to create consistent cavity structures with reduced material wastage positions it as the preferred solution for pharmaceutical, personal care, and consumer goods applications. Cold forming, while used for higher barrier requirements, holds a smaller share as its slower production cycles and higher material costs limit widespread adoption compared to the efficiency and scalability of thermoforming lines.

· For instance, Amcor’s AmSky™ HDPE blister system runs on standard high-speed pharmaceutical blister lines and replaces PVC with a fully recyclable structure. The company’s HDPE-based Optym™ forming films also offer stable forming depth and reliable puncture resistance during rapid medical packaging production.

By Type

Carded blister packaging holds the dominant share in the recyclable HDPE segment, driven by its strong shelf visibility, lightweight structure, and compatibility with mono-material sealing layers that support circularity goals. The format’s cost-efficiency and ability to integrate tamper-evident features make it highly suitable for OTC healthcare products, small electronics, and household goods. Clamshells maintain a secondary share due to their durability and protective strength, but rising sustainability regulations and retailer pressure for reduced plastic mass are shifting demand increasingly toward streamlined, recyclable carded formats with optimized HDPE content.

· For instance, Sonoco’s EnviroSense® PaperBlister™ platform removes the plastic front card entirely and cuts overall plastic use by as much as 80% compared with PVC–PET blister formats. The design keeps seal strength stable and runs on standard heat-seal equipment used in retail and healthcare packaging.

By Material

Plastic substrates, particularly recyclable HDPE sheets, dominate the material segment as they offer the best balance of formability, rigidity, and recycling stream compatibility. Their higher share is supported by advancements in mono-material blister structures and improved barrier coatings that eliminate the need for multi-material laminates. Paper & paperboard components are gaining traction as backing materials in hybrid eco-pack formats, while aluminum foil retains a limited role where moisture and light protection are critical. However, the market continues moving toward HDPE-centered structures to meet recyclability benchmarks and reduce composite packaging complexity.

Key Growth Drivers

Expansion of Sustainable Packaging Regulations

Increasingly stringent global regulations promoting recyclable and mono-material packaging solutions are accelerating demand for recyclable HDPE blister formats. Governments across North America, Europe, and parts of Asia now mandate reduced plastic waste, extended producer responsibility, and clearer recyclability labeling driving manufacturers to shift away from multi-layer PVC or PET structures that are difficult to process in recycling streams. HDPE’s compatibility with existing high-density polyethylene recovery systems positions it as a preferred alternative, enabling brands to meet compliance and sustainability targets. Consumer expectations for low-carbon packaging and retailer-led environmental scorecards further reinforce this shift, prompting accelerated investments in recycling-compatible blister lines. This regulatory momentum continues to expand the market for HDPE-based formats that offer high recyclability without compromising product protection or visual appeal.

· For instance, Amcor’s AmSky™ recyclable blister system replaces PVC/PVDC with a full-HDPE structure that fits established HDPE recycling streams. The lidding film uses a single-material seal layer in the 18–22-micron range to support reliable sealing on standard pharmaceutical blister lines.

Rising Adoption in Pharmaceuticals and Personal Care

Growth in the pharmaceutical and OTC healthcare sectors is a major catalyst for recyclable HDPE blister packaging due to the material’s durability, barrier versatility, and suitability for high-volume thermoforming lines. As global drug demand increases, especially in solid-dose formulations, manufacturers seek packaging that balances product integrity with environmental responsibility. HDPE’s strength, moisture stability, and design flexibility allow it to replace traditional multi-material blisters while maintaining regulatory compliance and tamper-evidence standards. Personal care brands are also expanding adoption as they transition to recyclable mono-material packaging to improve brand perception and reduce environmental footprint. The combined momentum from these industries drives large-scale procurement of HDPE substrates and accelerates packaging redesign projects integrating recyclable blister formats.

· For instance, Honeywell’s Aclar® UltRx 6000 PCTFE film delivers ultra-low moisture vapor transmission rates near 0.038 g/m²/day at 38°C/100% RH, offering one of the highest moisture barriers for pharmaceutical blisters. The film is usually laminated to PVC or PET structures to support high-barrier stability for sensitive solid-dose drugs.

Advancements in Mono-Material Blister Engineering

Technological progress in mono-material design is creating new opportunities for HDPE blister packaging by improving formability, clarity, and mechanical performance. Innovations in barrier coatings, heat-seal layers, and surface enhancements now allow HDPE to achieve protection levels traditionally delivered by laminated PVC–foil structures. Equipment manufacturers have upgraded thermoforming tools, enabling sharper cavity details and reduced gauge variation while maintaining high line speeds. These advancements help converters reduce material usage and enhance recyclability by eliminating adhesives, multilayer laminates, and incompatible substrates. As brands prioritize circular packaging models, HDPE’s compatibility with closed-loop systems and the growing availability of post-consumer recycled (PCR) content reinforce its position as a future-ready blister packaging material.

Key Trends & Opportunities

Growth of Mono-Material and Circular Packaging Systems

A major trend shaping the market is the shift toward circular packaging frameworks built around mono-material HDPE formats. Companies are increasingly adopting blister structures that integrate HDPE fronts with HDPE- or paper-based backing, enabling simplified recycling in mechanical systems. Packaging developers are also exploring detachable components, easy-peel designs, and clear recycling instructions to improve consumer participation. This trend opens opportunities for brands to elevate environmental performance scores, reduce waste disposal fees, and align with retailer sustainability benchmarks. The rapid expansion of circular economy initiatives worldwide strengthens demand for blister packaging that is both functional and fully recyclable.

· For instance, Amcor’s AmSky™ Blister System uses mono-material HDPE for both the thermoformed base and lidding, achieving an 87% recyclability rating in rigid polyethylene streams verified by Cyclos-HTP and earning Critical Guidance Recognition from the Association of Plastic Recyclers.

Increasing Use of Recycled HDPE (rHDPE) in Blister Structures

Emerging opportunities stem from the integration of recycled HDPE (rHDPE) into blister components to support corporate climate targets and reduce virgin resin dependency. Advances in high-purity rHDPE processing technologies now allow for improved color stability, odor reduction, and mechanical strength suitable for non-sterile consumer goods and select healthcare products. As more brand owners commit to minimum recycled content requirements, demand for rHDPE-compatible blister forming formulations is expanding. Packaging manufacturers that can deliver cost-efficient, high-grade rHDPE blister sheets stand to gain long-term supply agreements with sustainability-focused consumer goods companies.

Expansion of Eco-Designed Retail and E-Commerce Packaging

Retailers and e-commerce platforms increasingly require packaging that minimizes waste, improves recyclability, and withstands shipping stress driving new opportunities for recyclable HDPE blister designs. The rise of ship-in-own-container formats and eco-designed secondary packaging supports the adoption of durable yet lightweight HDPE blisters. Brands are also redesigning packaging to reduce overall plastic mass, incorporate tamper-evidence features, and enhance visual merchandising. As online sales of pharmaceuticals, personal care, and consumer goods grow, manufacturers can capitalize on demand for HDPE blister formats optimized for logistics and shelf-ready presentation.

- For instance, Jones Healthcare Group launched FlexRx One, a sustainable blister pack solution designed for pharmacies with enhanced recyclability features for retail and e-commerce distribution.

Key Challenges

Barrier Limitations Compared to Multi-Material Laminates

A major challenge for recyclable HDPE blister packaging is matching the high barrier performance of traditional PVC/foil or Aclar laminates used in pharmaceuticals and moisture-sensitive products. Although advancements in coatings and HDPE formulations have improveprotection levels, certain applications requiring ultra-low moisture vapor transmission rates still rely on non-recyclable multi-layer structures. Converters must balance sustainability with product stability, often leading to trade-offs in shelf life or sealing performance. Overcoming these limitations requires continued innovation in barrier engineering, functional coatings, and high-clarity HDPE substrates that can meet strict regulatory standards without compromising recyclability.

Limited Recycling Infrastructure and Material Sorting Efficiency

Despite HDPE’s recyclability, global recycling infrastructure remains inconsistent, particularly in emerging markets where collection, sorting, and processing capabilities are underdeveloped. Many sorting facilities prioritize larger HDPE items such as bottles, making thin-gauge blister components more difficult to detect and separate. Adhesive residues, paper backings, and multi-material contamination further complicate recovery and reduce processing yields. These limitations restrict the volume of HDPE blister waste that successfully re-enters the recycling stream. Addressing this challenge requires collaborative efforts among packaging manufacturers, recyclers, and policymakers to enhance material sorting technologies and establish standardized design guidelines.

Regional Analysis

North America

North America holds approximately 32% of the recyclable HDPE blister packaging market, driven by advanced recycling infrastructure, strong regulatory alignment toward mono-material packaging, and high adoption across pharmaceuticals and personal care sectors. The U.S. leads regional growth due to rapid integration of HDPE-based blister formats in OTC healthcare and retail-driven sustainability mandates. Major packaging converters continue upgrading thermoforming lines to support mono-material HDPE platforms, reinforcing the region’s leadership. Canada’s rising circular economy initiatives further accelerate demand for fully recyclable blister designs that reduce composite packaging and improve recovery efficiency.

Europe

Europe accounts for nearly 28% of the global market, supported by rigorous environmental regulations, extended producer responsibility frameworks, and early adoption of mono-material blister structures. Germany, France, Italy, and the U.K. remain key contributors as pharmaceutical and consumer goods companies transition from PVC-based formats to HDPE solutions to meet recyclability targets. The region’s mature recycling ecosystem and strong retailer sustainability scorecards push brands toward HDPE-centered blister systems. Additionally, EU-wide directives promoting reduced plastic mass and enhanced recyclability continue to shape procurement strategies, reinforcing Europe’s position as a leading adopter of recyclable HDPE blister packaging.

Asia-Pacific

The Asia-Pacific region holds around 26% of the market, propelled by rapid expansion in pharmaceutical production, growing personal care consumption, and increasing adoption of sustainable packaging across China, India, Japan, and Southeast Asia. Government initiatives promoting recyclable plastics and improved waste management are accelerating the shift toward HDPE-based blister formats. China’s investment in high-capacity recycling facilities and India’s tightening EPR compliance requirements contribute to growing demand for mono-material structures. Rising urbanization and expanding retail networks further support HDPE blister uptake, especially in small electronics, healthcare essentials, and FMCG product lines.

Latin America

Latin America represents approximately 8% of the market, driven by growing awareness of recyclable packaging, rising pharmaceutical distribution, and the gradual modernization of retail packaging formats. Brazil and Mexico lead regional demand as manufacturers adopt HDPE blister solutions to comply with emerging sustainability standards and reduce dependence on mixed-material structures. However, limited recycling infrastructure and uneven regulatory enforcement constrain broader market penetration. Despite these challenges, increasing investments in thermoforming capabilities and expanding consumer preference for environmentally responsible packaging support steady adoption across healthcare, personal care, and household goods categories.

Middle East & Africa

The Middle East & Africa account for nearly 6% of the market, characterized by growing implementation of sustainability policies and rising consumer goods manufacturing activity. The UAE, Saudi Arabia, and South Africa are early adopters, supported by investment in recycling technologies and the expansion of local pharmaceutical packaging operations. While overall market penetration remains lower than other regions due to infrastructure limitations, demand for HDPE-based recyclable blister formats is increasing as governments promote waste reduction and multinational brands introduce circular packaging targets. Gradual improvements in collection and sorting systems are expected to support continued regional growth.

Market Segmentations:

By Technology

- Thermoforming

- Cold Forming

By Type

By Material

- Aluminum Foil

- Paper & Paperboard

- Plastic Substrate

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the recyclable HDPE blister packaging market is characterized by strong engagement from global and regional packaging manufacturers accelerating their transition toward mono-material solutions. Leading players such as Amcor plc, Sonoco Products Company, Constantia Flexibles, Klöckner Pentaplast, and Huhtamaki are expanding high-clarity, fully recyclable HDPE blister platforms tailored for pharmaceuticals, personal care, and small consumer goods. Companies are prioritizing advancements in thermoforming efficiency, barrier-enhanced HDPE coatings, and sealing technologies that enable brands to replace PVC-based formats without compromising product protection. Strategic investments in circular packaging programs, post-consumer recycled HDPE integration, and sustainable material sourcing further strengthen competitive positioning. Partnerships with pharmaceutical and FMCG companies, along with upgrades in high-speed forming lines, allow leading suppliers to secure long-term contracts. While innovation is robust, competition also intensifies around cost optimization and compliance with global recyclability standards, compelling manufacturers to enhance performance, reduce material weight, and improve recovery compatibility to maintain market leadership.

Key Player Analysis

Recent Developments

- In June 2025, Honeywell International Inc. announced that its Aclar film technology was selected by Evertis for pharmaceutical blister use, supporting barrier performance and recyclability goals.

- In October 2024, Klöckner Pentaplast (kp) introduced the kpNext® MDR1 sustainable medical-device blister film solution, signifying advancement in high-barrier sustainable blister formats.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Technology, Type, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for mono-material HDPE blister formats will continue to rise as global regulations push brands toward fully recyclable packaging solutions.

- Pharmaceutical and OTC healthcare companies will accelerate conversion from PVC-based structures to recyclable HDPE formats to improve compliance and sustainability scoring.

- Adoption of high-clarity, barrier-enhanced HDPE films will expand as coating technologies advance and enable broader product compatibility.

- Recycled HDPE integration in blister substrates will increase as brands commit to higher recycled content targets and circular packaging programs.

- Thermoforming will retain dominance as manufacturers upgrade high-speed lines to support thinner gauges and improved cavity precision.

- E-commerce growth will drive demand for durable, lightweight, and logistics-friendly HDPE blister designs optimized for protection and recyclability.

- Retailers will intensify sustainability requirements, reinforcing the transition toward HDPE-based blister packs with reduced material mass.

- Investments in regional recycling infrastructure and detection technologies will improve HDPE recovery rates and boost circularity.

- Hybrid HDPE–paper blister designs will gain traction as companies balance sustainability goals with visual merchandising needs.

- Competition will increasingly focus on cost efficiency, material optimization, and partnerships that accelerate large-scale HDPE blister adoption.

Market Segmentation Analysis:

Market Segmentation Analysis: