Market Overview

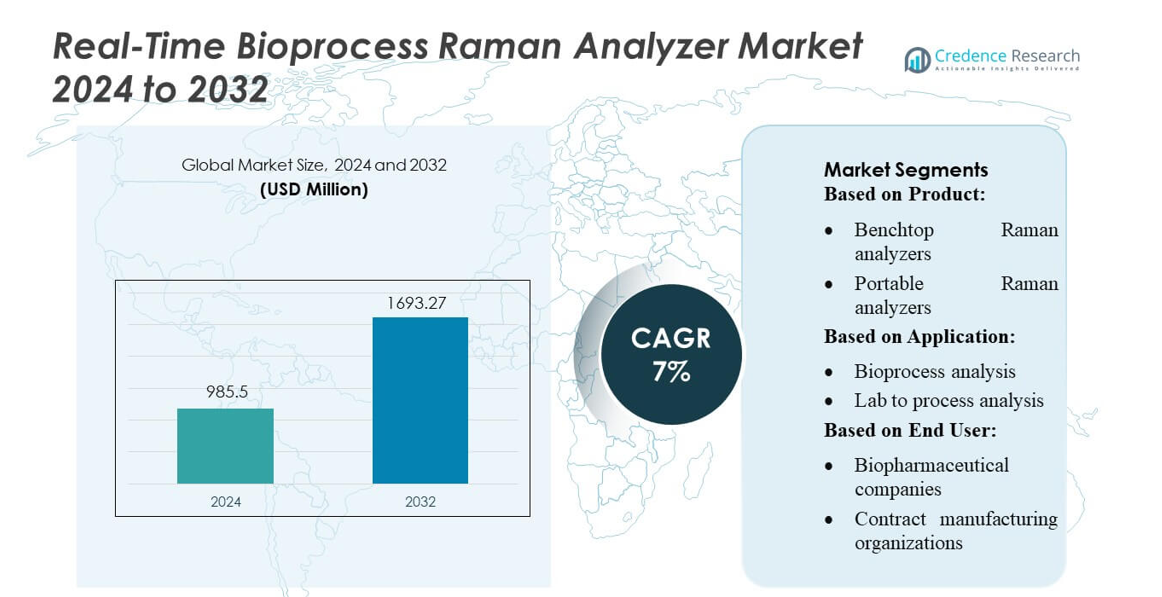

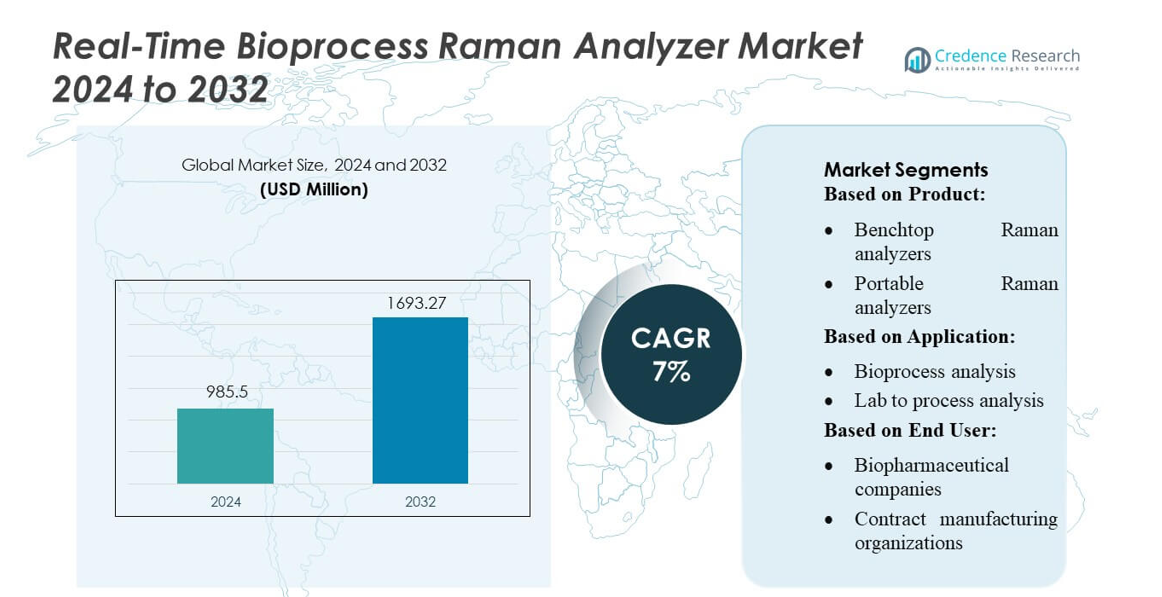

Real-Time Bioprocess Raman Analyzer Market size was valued USD 985.5 million in 2024 and is anticipated to reach USD 1693.27 million by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Real-Time Bioprocess Raman Analyzer Market Size 2024 |

USD 985.5 million |

| Real-Time Bioprocess Raman Analyzer Market, CAGR |

7% |

| Real-Time Bioprocess Raman Analyzer Market Size 2032 |

USD 1693.27 million |

The Real-Time Bioprocess Raman Analyzer market is highly competitive, with leading companies including Sartorius AG, ABB Ltd., HORIBA Group, Shimadzu Corporation, Danaher Corporation, FOSS, Agilent Technologies, Inc., BÜCHI Labortechnik AG, Endress+Hauser Group Services AG, and Bruker Corporation driving innovation and technological advancement. These players focus on developing high-precision analyzers with real-time monitoring capabilities, advanced software integration, and compliance with regulatory standards. They leverage strategic partnerships, R&D investments, and global distribution networks to strengthen market presence and expand into emerging regions. North America emerges as the dominant region, accounting for 42% of the global market share, supported by its strong biopharmaceutical industry, advanced manufacturing infrastructure, and early adoption of process analytical technologies. The region’s focus on quality control, biosimilar production, and process optimization sustains its leadership while encouraging continuous innovation and growth in the global market.

Market Insights

- The Real-Time Bioprocess Raman Analyzer Market size was valued at USD 985.5 million in 2024 and is projected to reach USD 1693.27 million by 2032, growing at a CAGR of 7% during the forecast period.

- Market growth is driven by increasing demand for real-time process monitoring, quality control, and efficiency optimization in biopharmaceutical and biotechnology industries.

- Key trends include integration of Raman analyzers with advanced bioprocess software, automation, miniaturization, and expansion into emerging markets for biosimilar and vaccine production.

- The market is highly competitive, with players focusing on technological innovation, strategic partnerships, and global distribution networks to strengthen their presence and enhance product offerings.

- North America dominates with 42% market share due to strong biopharma infrastructure, while Europe and Asia-Pacific show significant growth potential, with manual and automated Raman analyzers being widely adopted across pharmaceutical, biotechnology, and vaccine manufacturing segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The Real-Time Bioprocess Raman Analyzer market is segmented into Raman analyzers, Raman probes, and software solutions, with further sub-categories including benchtop, portable, on-line, and in-line analyzers. In-line Raman analyzers dominate the market, accounting for approximately 38% share, driven by their ability to provide continuous, real-time monitoring of bioprocesses, enhancing process efficiency and reducing batch failures. Growing demand for automated, non-invasive bioprocess monitoring and rising adoption of advanced biopharmaceutical manufacturing practices are key drivers propelling market growth in this segment.

- For instance, Sartorius’s BioPAT® Spectro integrates with its Ambr® 15 and Ambr® 250 high‑throughput bioreactor systems, enabling automated Raman model building and data consolidation across dozens of parallel mini‑bioreactors.

By Application

Applications of Raman analyzers span bioprocess analysis and lab-to-process analysis, with bioprocess analysis emerging as the dominant sub-segment, representing around 60% of the market. This is driven by the increasing need for real-time monitoring of critical process parameters, ensuring consistent product quality and regulatory compliance. Adoption is further fueled by the push towards Quality by Design (QbD) approaches in biopharmaceutical production, enabling manufacturers to optimize yield, reduce process variability, and accelerate time-to-market.

- For instance, ABB Ltd. offers the MB‑Rx in‑situ reaction monitor — a robust analyzer with a light source designed for approximately 10 years of continuous use, enabling researchers in labs and pilot plants to monitor chemical reaction kinetics, reagent consumption, and by‑product formation in real time.

By End User

The market is primarily served by biopharmaceutical companies, contract manufacturing organizations (CMOs), research organizations, and other end users. Biopharmaceutical companies hold the largest share, approximately 55%, due to their extensive use of Raman analyzers for process development, scale-up, and quality control. Drivers for this sub-segment include the rising complexity of biologics, increasing regulatory scrutiny, and the growing emphasis on process analytical technology (PAT) implementation to enhance production efficiency and ensure compliance across global markets.

Key Growth Drivers

Rising Adoption of Process Analytical Technology (PAT) in Biopharmaceutical Manufacturing

The increasing implementation of PAT frameworks is a primary driver for the Real-Time Bioprocess Raman Analyzer market. Manufacturers are integrating Raman analyzers for real-time monitoring of critical process parameters, ensuring consistent product quality and reducing batch failures. This trend is particularly prominent in biopharmaceutical companies aiming to optimize yields, accelerate development timelines, and comply with stringent regulatory standards, making Raman-based monitoring essential for modern, automated, and quality-focused manufacturing environments.

- For instance, HORIBA Group has installed over 3,000 Raman systems worldwide via its Raman Division — a legacy built over four decades of Raman spectrometer development.

Growth of Biologics and Complex Therapies

The surge in biologics, including monoclonal antibodies, vaccines, and cell and gene therapies, is driving demand for real-time Raman analyzers. These therapies require precise monitoring of complex bioprocesses to maintain efficacy and safety. Real-time Raman analysis enables continuous tracking of critical quality attributes, reducing process variability and enhancing production efficiency. The rapid expansion of the global biologics market, coupled with increasing R&D investments, is fueling adoption of advanced monitoring technologies, positioning Raman analyzers as a critical tool in high-value biomanufacturing.

- For instance, Shimadzu Corporation offers its AIRsight™ Infrared/Raman microscope, which combines Raman and FTIR measurements on the same sample without repositioning, using lasers at 532 nm and 785 nm and objective lenses that allow detection areas as small as 7.5 × 10 µm.

Shift Towards Automation and Digitalization in Bioprocessing

Automation and digitalization in bioprocessing are driving the integration of real-time Raman analyzers. Manufacturers are adopting inline and online analyzers coupled with advanced software for predictive analytics, process control, and reduced human intervention. This transition enhances operational efficiency, minimizes errors, and supports scalability. Additionally, regulatory authorities encourage adoption of digital monitoring solutions to improve process reproducibility and compliance, making Raman analyzers a preferred technology in modern biomanufacturing environments focused on smart, data-driven operations.

Key Trends & Opportunities

Expansion of Portable and Benchtop Raman Analyzers

Portable and benchtop Raman analyzers are witnessing increasing adoption in small-scale labs and pilot production facilities. These compact solutions provide flexibility for lab-to-process analysis, enabling faster process development and troubleshooting. Rising interest from contract manufacturing organizations (CMOs) and research institutions presents opportunities for market players to offer cost-effective, scalable Raman solutions. The trend toward decentralized monitoring and miniaturization is expected to create new growth avenues, particularly in emerging biopharmaceutical hubs in Asia-Pacific and Latin America.

- For instance, Danaher, through its subsidiary Molecular Devices, supplies bioanalytical systems used in early‑stage drug development and life-science research — supporting over 130,000 placements globally across laboratories.

Integration with Advanced Data Analytics and AI

The convergence of Raman spectroscopy with AI and machine learning is a key market opportunity. Advanced data analytics enables predictive monitoring of bioprocesses, identification of deviations, and optimization of critical parameters in real time. Companies leveraging AI-enhanced Raman analyzers can reduce process failures and improve product quality, offering a competitive advantage. This trend aligns with the broader Industry 4.0 movement in biomanufacturing, providing opportunities for solution providers to develop intelligent, software-driven Raman systems that enhance process insights and decision-making capabilities.

- For instance, FOSS A/S — though traditionally focused on NIR/infrared instrumentation — illustrates the potential of analytics‑driven solutions: their network of about 1,700 employees across 32 countries supports global instrument deployment and data‑management infrastructure.

Key Challenges

High Initial Costs and Infrastructure Requirements

The high upfront investment for real-time Raman analyzers, including instrumentation, probes, and integration software, poses a significant challenge. Small-scale biopharmaceutical companies and research labs may face budget constraints, limiting widespread adoption. Additionally, installation requires infrastructure adaptation, calibration, and skilled personnel for operation, increasing operational complexity. These factors slow adoption despite the technology’s clear benefits, making cost optimization and user-friendly solutions crucial for market expansion, particularly in emerging regions with growing biologics manufacturing capacity.

Complexity in Data Interpretation and Standardization

Raman spectroscopy generates complex datasets that require specialized expertise for interpretation. Inconsistent data processing, calibration, and lack of standardized protocols across facilities can hinder adoption and affect decision-making reliability. Companies face challenges in integrating Raman data into existing process control systems, limiting real-time applicability. Addressing these issues through standardized software platforms, training programs, and harmonized analytical guidelines is critical for overcoming adoption barriers and realizing the full potential of Raman analyzers in routine bioprocess monitoring.

Regional Analysis

North America

North America leads the market with a 42% share due to its strong pharmaceutical and biotechnology industries. The region benefits from early adoption of process monitoring technologies, well-established R&D infrastructure, and supportive regulations. Companies focus on improving bioprocess efficiency, biosimilar production, and quality control using Raman analyzers. High investment in process analytical technology and advanced manufacturing facilities drives continued growth, making North America the largest regional market while maintaining steady innovation and demand for real-time monitoring solutions.

Europe

Europe holds around 20% of the market. Countries like Germany, the UK, and France drive adoption through strong pharmaceutical and biotech sectors. Strict regulations and emphasis on quality assurance support the use of Raman analyzers in bioprocess monitoring. Investments in innovation, drug development, and process optimization further increase demand. The region grows steadily as companies adopt advanced analytical tools to enhance manufacturing efficiency and comply with regulatory standards, making Europe a significant contributor to the global market.

Asia-Pacific

Asia-Pacific represents roughly 30% of the market and is the fastest-growing region. Growth is driven by expanding biopharma and biotech industries in China, India, and Japan, along with rising investment in manufacturing infrastructure. Increasing demand for process monitoring, biosimilars, and vaccine production fuels adoption of Raman analyzers. Governments and private companies support technology implementation, making the region a key future market. Rapid industrialization and growing bioprocess capabilities suggest Asia-Pacific will capture an increasingly larger share of global demand.

Latin America

Latin America accounts for about 7% of the market. Growth comes from expanding pharmaceutical manufacturing in Brazil, Mexico, and Argentina, supported by government initiatives in biotechnology. Companies are increasingly adopting Raman analyzers for quality control and process efficiency. While the market is smaller than North America or Europe, steady investments in local biopharma infrastructure indicate continued growth. The region offers emerging opportunities as more manufacturers modernize production processes and integrate advanced process monitoring tools.

Middle East & Africa

The Middle East & Africa hold around 4% of the market. Growth is emerging in countries like the UAE and South Africa, driven by government programs to boost biotechnology and local pharmaceutical manufacturing. Adoption of Raman analyzers is still limited but increasing due to rising demand for vaccines, biosimilars, and regulatory compliance. Investments in bioprocess infrastructure and technology implementation are gradually expanding, suggesting the region will steadily increase its market presence in the coming years.

Market Segmentations:

By Product:

- Benchtop Raman analyzers

- Portable Raman analyzers

By Application:

- Bioprocess analysis

- Lab to process analysis

By End User:

- Biopharmaceutical companies

- Contract manufacturing organizations

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Real-Time Bioprocess Raman Analyzer market include Sartorius AG, ABB Ltd., HORIBA Group, Shimadzu Corporation, Danaher Corporation, FOSS, Agilent Technologies, Inc., BÜCHI Labortechnik AG, Endress+Hauser Group Services AG, and Bruker Corporation. The Real-Time Bioprocess Raman Analyzer market is highly competitive, driven by continuous technological innovation and growing demand for efficient bioprocess monitoring. Companies focus on developing analyzers with enhanced accuracy, real-time data acquisition, and seamless integration with bioprocess software to improve process efficiency and regulatory compliance. Market players invest heavily in research and development to introduce advanced solutions tailored for pharmaceutical, biotechnology, and vaccine manufacturing applications. Strategic initiatives such as mergers, acquisitions, and collaborations are employed to expand global presence and strengthen market positioning. Competitive pricing, comprehensive customer support, and customized service offerings further intensify market rivalry, fostering continuous innovation and ensuring the market remains dynamic and responsive to emerging industry needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sartorius AG

- ABB Ltd.

- HORIBA Group

- Shimadzu Corporation

- Danaher Corporation

- FOSS

- Agilent Technologies, Inc.

- BÜCHI Labortechnik AG

- Endress+Hauser Group Services AG

- Bruker Corporation

Recent Developments

- In February 2025, ABB Ltd. and Sage Geosystems partnered through a Memorandum of Understanding (MoU) to develop geothermal energy and energy storage solutions. The collaboration aims to integrate ABB’s electrification and automation expertise with Sage Geosystems’ innovative Geopressured Geothermal Systems (GGS) technology.

- In January 2025, Yokogawa Electric Corporation introduced the AQ6377E Optical Spectrum Analyzer, which provides fast and accurate mid-wave infrared measurements. This release further emphasizes Yokogawa’s focus on innovative measurement solutions that support diverse industries and applications.

- In February 2024, Unity’s digital twin professional services arm was acquired by Capgemini Services SAS to accelerate enterprises’ digital transformation through real-time 3D technology. This acquisition will enhance Capgemini’s capabilities in helping businesses leverage digital twins, which are virtual representations of physical assets, to improve operations, optimize processes, and create new business models using immersive and interactive experiences.

- In January 2024, Bruker Corporation acquired Tornado Spectral Systems Inc., a Canadian company specializing in process Raman instruments. This acquisition was intended to expand Bruker’s biopharma Process Analytical Technology (PAT) product portfolio.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of real-time monitoring technologies will continue to grow across biopharmaceutical and biotech sectors.

- Increasing demand for process optimization and quality control will drive market expansion.

- Integration of Raman analyzers with advanced bioprocess software will become more widespread.

- Investment in research and development will support the introduction of more accurate and faster analyzers.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will see higher adoption rates.

- Growing production of biosimilars and vaccines will boost demand for process monitoring solutions.

- Regulatory support for process analytical technology will encourage wider deployment of Raman analyzers.

- Technological innovations will focus on miniaturization, automation, and ease of use.

- Strategic collaborations and partnerships will expand global market reach.

- Increasing awareness of cost efficiency and operational productivity will reinforce market growth.