Market Overview:

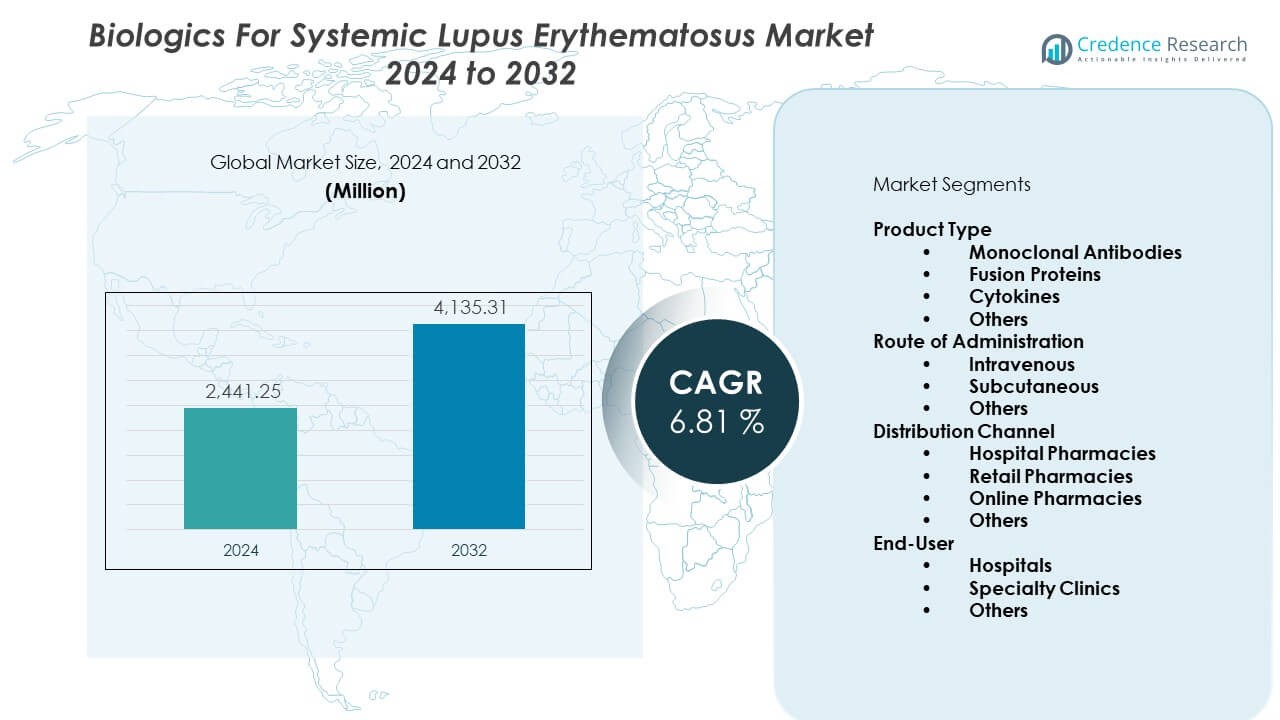

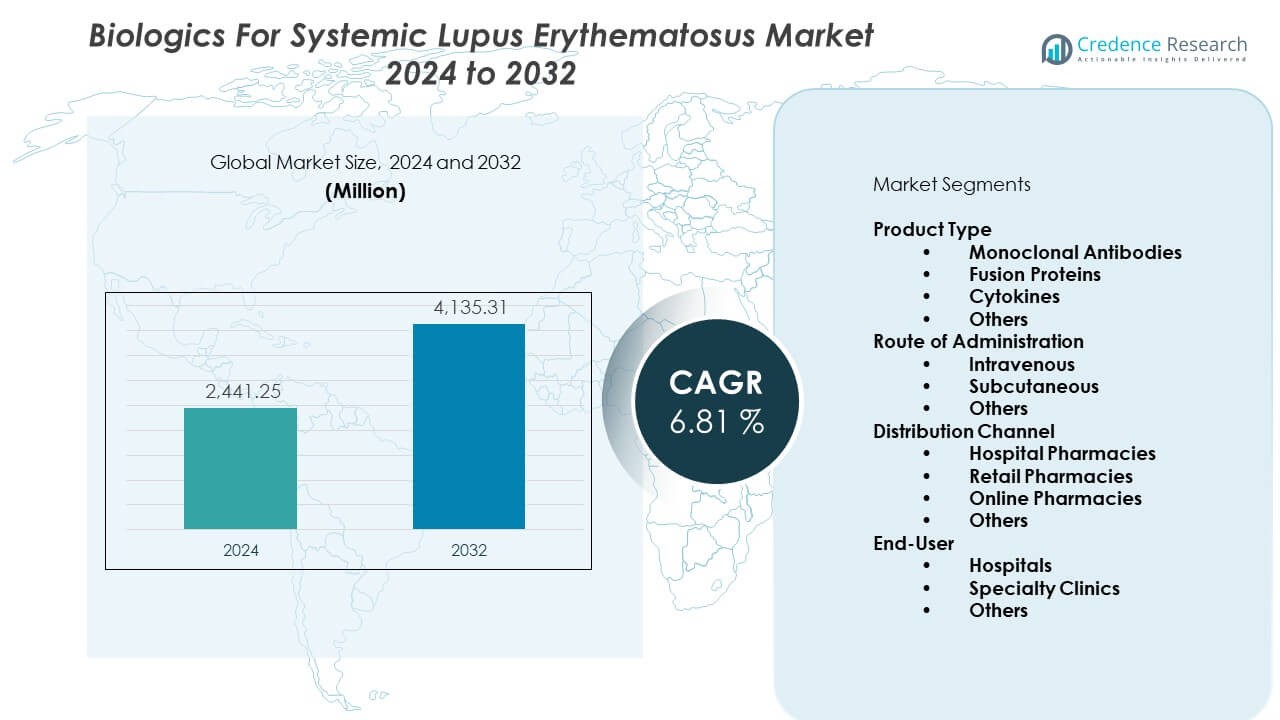

The biologics for systemic lupus erythematosus market is projected to grow from USD 2441.25 million in 2024 to an estimated USD 4135.31 million by 2032, with a CAGR of 6.81% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biologics For Systemic Lupus Erythematosus Market Size 2024 |

USD 2441.25 Million |

| Biologics For Systemic Lupus Erythematosus Market, CAGR |

6.81% |

| Biologics For Systemic Lupus Erythematosus Market Size 2032 |

USD 4135.31 Million |

Growing demand for precise and long-acting therapies drives strong adoption. Healthcare providers choose biologics to manage severe symptoms and reduce flare frequency. Drug makers expand R&D efforts to introduce safer monoclonal antibodies with stronger clinical outcomes. Regulatory bodies speed up approvals for promising candidates, improving treatment access. Rising disease awareness encourages earlier diagnosis and biologic use. Advancements in biomarker research support tailored treatment plans. These combined drivers strengthen the biologics for systemic lupus erythematosus market.

North America leads due to strong biologic adoption, early diagnosis rates, and advanced healthcare networks. Europe follows, supported by expanded clinical guidelines and steady uptake of novel monoclonal therapies. Asia Pacific emerges as the fastest-growing region as patient awareness increases and healthcare spending rises. China, Japan, and India see higher clinical trial activity and wider biologic availability. Latin America and the Middle East show gradual improvement as access to specialty therapies expands and healthcare reforms progress.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The biologics for systemic lupus erythematosus market is projected to grow from USD 2441.25 million in 2024 to USD 4135.31 million by 2032, supported by a 6.81% CAGR driven by rising use of targeted immunology therapies.

- North America holds 38%, Europe holds 30%, and Asia Pacific holds 22%, with these regions leading due to strong specialty care networks, high biologic adoption, and structured clinical guidelines.

- Asia Pacific is the fastest-growing region with a 22% share, driven by improving access to specialty clinics, rising diagnosis rates, and increasing healthcare investment.

- Monoclonal antibodies dominate product type distribution with a 45% share due to strong clinical performance and wide prescriber preference.

- Subcutaneous administration holds a 35% share, supported by its convenience, home-care suitability, and strong adherence rates.

Market Drivers:

Strong Shift Toward Targeted Immunomodulation and High-Efficacy Therapeutic Profiles

The growth path strengthens due to rising demand for targeted therapies that control complex immune activity with higher precision. Clinicians prefer biologics that reduce disease flares and improve long-term symptom stability. Drug makers focus on advanced monoclonal antibodies that deliver stronger efficacy than older systemic options. The biologics for systemic lupus erythematosus market benefits from continuous progress in clinical design that supports better outcomes. New evidence from real-world use guides faster adoption and broader physician confidence. It drives steady switching from broad immunosuppressants to advanced biologics. Patient groups demand better safety profiles and longer remission periods. Healthcare systems support therapies that lower long-term burden and reduce complications.

- For instance, AstraZeneca reported in peer-reviewed Phase 3 TULIP-2 results that anifrolumab achieved a 47.8% BICLA response rate versus 31.5% with placebo, confirming stronger flare reduction and improved clinical stability.

Rapid Growth in R&D Pipelines Supported by Biomarker and Precision-Medicine Innovation

Biomarker research supports development of biologics that match patient-specific immune pathways. Drug developers track new immune signatures that improve treatment decisions and guide therapy selection. Clinical teams use precision tools that identify likely responders and reduce treatment uncertainty. The biologics for systemic lupus erythematosus market gains momentum from wider trial enrollment and improved study designs. It supports stable expansion of next-generation candidates with differentiated mechanisms. Companies expand research alliances with academic centers to enhance discovery. Screening platforms grow stronger and help identify high-potential compounds faster. Regulators support trials that demonstrate strong safety and benefit consistency.

- For instance, GSK confirmed through a post-hoc analysis pooling data from the Phase 3 BLISS-52 and BLISS-76 biomarker analysis that belimumab-treated patients with high disease activity (specifically, low complement and anti-dsDNA positivity) demonstrated a more pronounced response to treatment compared to the overall study population.

Rising Diagnosis Rates and Wider Access to Specialty Care Across Established Healthcare Systems

Higher diagnostic awareness encourages patients to seek earlier treatment interventions. Hospitals train clinicians to detect subtle immune symptoms linked to lupus progression. Improved diagnostic patterns lead to earlier biologic adoption and stronger treatment timelines. Payers support early intervention strategies that reduce long-term organ complications. The biologics for systemic lupus erythematosus market expands with broader inclusion of biologics in treatment pathways. It benefits from structured reimbursement coverage across major healthcare systems. Physician training programs promote familiarity with newer therapies. Support groups and awareness campaigns boost demand for advanced therapeutic support.

Regulatory Acceleration for Novel Biologics Supported by Strong Clinical Evidence

Regulators fast-track approvals when candidates show strong safety and efficacy in diverse patient groups. New frameworks simplify review cycles for advanced immunomodulators. Robust data packages encourage confidence among clinical experts. The biologics for systemic lupus erythematosus market gains from shorter timelines between trial completion and commercial entry. It helps drug makers bring innovative therapies to patients faster. Hospitals integrate approved options into treatment plans without long delays. Global health authorities encourage strong post-approval monitoring to support long-term safety. These regulatory actions support faster therapeutic access worldwide.

Market Trends:

Growing Preference for Multi-Mechanism Biologics Designed for Complex Autoimmune Pathways

Biologic development moves toward therapies that target multiple immune pathways. Researchers design agents that control both acute flare events and chronic inflammation. It helps improve symptom durability and deliver broader disease control. The biologics for systemic lupus erythematosus market shifts to molecules with dual or expanded mechanisms. Developers invest in diversified technology platforms that support complex immune modulation. Patients respond well to therapies that reduce peak flare severity. Clinical studies evaluate new pathway combinations that improve long-term outcomes. This shift supports new market segments for advanced mechanism blends.

- For instance, Biogen and UCB have been developing the dual-pathway antibody dapirolizumab pegol for systemic lupus erythematosus (SLE). While the drug’s initial mid-stage (Phase IIb) trial failed to meet its primary endpoint for a statistically significant dose-response relationship, subsequent Phase III trials (PHOENYCS GO) have demonstrated significant success.

Increased Uptake of Self-Administration and Home-Based Biologic Delivery Platforms

More patients adopt biologics that support at-home administration with easy-to-use formats. Device makers design auto-injectors that improve convenience and reduce clinic visits. It helps strengthen patient adherence to long-term therapy plans. The biologics for systemic lupus erythematosus market observes growing interest in home-care compatible products. Digital monitoring tools track dose patterns and help clinicians manage progress. Remote care platforms expand access for patients in rural or underserved regions. Self-care options reduce healthcare system strain and support timely treatment. This trend influences future product design across the sector.

- For instance, BD confirmed that its Intevia 1-mL disposable autoinjector system is designed to deliver high-viscosity biologics (viscosity up to 40 cP for the 2.25mL version) and supports at-home use, aiming to improve patient adherence for chronic diseases. The device features precise dose control through pre-fillable syringes and provides feedback indicators to ensure the correct dose has been delivered, thus potentially reducing clinic-based administration needs.

Expansion of Combination Therapy Models Supported by Real-World Evidence

Healthcare providers increase use of combination approaches that blend biologics with optimized background treatments. Real-world data shows improved outcomes in patients receiving structured combination plans. Clinical experts track patient segments that respond well to specific therapy pairs. It guides new treatment frameworks across major hospitals. The biologics for systemic lupus erythematosus market grows with interest in combination strategies that stabilize chronic symptoms. Researchers evaluate dosing intervals and treatment cycles with more precision. Trial data supports safer integration of agents with complementary roles. These shifts drive new treatment patterns.

Integration of Digital Health Tools to Improve Monitoring and Early Intervention

Digital platforms support symptom tracking and help clinicians detect flare signals earlier. Patients use mobile tools to record pain patterns and treatment responses. It supports better follow-up and stronger treatment adherence. The biologics for systemic lupus erythematosus market gains value from data-driven monitoring systems. Hospitals use digital dashboards that highlight symptom changes in real time. Early detection reduces severe flare events and improves patient quality of life. Technology vendors expand systems that align with biologic dosing cycles. These tools improve long-term disease control.

Market Challenges Analysis:

High Therapy Costs, Access Gaps, and Limited Affordability Across Key Patient Groups

High treatment costs restrict patient access within many healthcare environments. Insurance plans often impose strict criteria for biologic approval. It limits the number of eligible patients within developing regions. The biologics for systemic lupus erythematosus market faces pressure due to affordability barriers and uneven coverage. Hospitals struggle to provide equitable access when reimbursement systems remain inconsistent. Patients face out-of-pocket burdens that delay timely treatment. Clinical teams identify treatment gaps related to income differences. These financial constraints reduce overall adoption speed.

Complex Immune Diversity, Variable Response Rates, and Limited Long-Term Data for Advanced Biologics

Patients show wide immune variability, which complicates treatment planning. Many biologics deliver strong benefits for some patients but limited response for others. It challenges providers who seek predictable outcomes. The biologics for systemic lupus erythematosus market encounters uncertainty tied to incomplete long-term evidence. Follow-up studies require long timeframes and large patient groups. Researchers struggle to define universal response markers. Treatment resistance develops in some patients due to pathway complexity. These scientific barriers slow progress in clinical optimization.

Market Opportunities:

Development of Next-Generation Biologics Targeting Underexplored Immune Pathways

Drug makers explore new immune targets that offer broader disease control. It opens new spaces for therapies that outperform older agents. The biologics for systemic lupus erythematosus market gains future expansion potential with advanced monoclonal formats. Research groups identify novel pathway triggers linked to severe flare events. Companies invest in new discovery tools that speed early development. Hospitals prepare to adopt therapies that support deeper symptom relief. These innovations expand future candidate pipelines. New biologics enter trials with strong preliminary profiles.

Growth Potential in Emerging Regions Supported by Better Infrastructure and Wider Clinical Access

Emerging regions improve healthcare infrastructure and specialty care networks. It encourages faster adoption of advanced biologics among new patient groups. The biologics for systemic lupus erythematosus market benefits from rising diagnosis rates and stronger clinical capabilities. Governments invest in specialist training programs to expand treatment capacity. Hospitals strengthen biologic administration frameworks. Patient advocacy groups promote early intervention strategies. Clinical trial participation increases across key countries. These changes open long-term expansion opportunities.

Market Segmentation Analysis:

Product Type

Monoclonal antibodies lead the biologics for systemic lupus erythematosus market due to strong clinical outcomes and wider physician preference. These agents deliver targeted immune control and support consistent flare reduction. Fusion proteins gain attention for their ability to influence multiple immune signals. Cytokines hold a smaller share because their clinical use remains limited. Others include emerging biologic formats with early development potential. It reflects steady movement toward advanced immunology platforms that improve disease management. Product diversification strengthens long-term adoption across hospital networks.

- For instance, in a pooled analysis of real-world data, GSK reported that belimumab was associated with a 66% reduction in mean overall flare incidence per patient per year compared to the 12 months prior to treatment initiation.

Route of Administration

Intravenous delivery maintains a strong presence because many biologics require controlled dosing in clinical settings. Hospitals prefer IV formats for patients with severe symptoms and complex flare profiles. Subcutaneous delivery grows due to home-care suitability and improved convenience. It supports better adherence for long-term therapy plans. Others include new formats under evaluation that support flexible administration. The biologics for systemic lupus erythematosus market benefits from wider adoption of patient-friendly delivery models that improve continuity of care.

- For instance, AstraZeneca’s approved subcutaneous formulation of anifrolumab demonstrated equivalent exposure and clinical response compared to the IV dose in controlled studies, supporting broader adoption of SC administration.

Distribution Channel

Hospital pharmacies dominate distribution because most biologics require specialist supervision. These facilities handle advanced cold-chain needs and manage high-value therapies. Retail pharmacies expand involvement for subcutaneous options. Online pharmacies gain traction in regions with structured digital-health networks. It supports refill management for stable patients. Others contribute minimal volume but reflect growing interest in decentralized access. The channel structure strengthens supply reliability across major care environments.

End-User

Hospitals remain leading end-users due to their role in diagnosing complex lupus cases and managing biologic induction phases. Specialty clinics gain share due to rising expertise in autoimmune disorders. It helps expand biologic therapy access for stable and moderate-severity patients. Others include smaller care centers that support follow-up dosing and routine monitoring. The biologics for systemic lupus erythematosus market benefits from stronger referral networks that link primary care and specialty facilities.

Segmentation:

By Product Type

- Monoclonal Antibodies

- Fusion Proteins

- Cytokines

- Others

By Route of Administration

- Intravenous

- Subcutaneous

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

By End-User

- Hospitals

- Specialty Clinics

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the biologics for systemic lupus erythematosus market, accounting for 38%. Strong adoption of advanced monoclonal therapies drives this lead and supports steady treatment expansion. Hospitals across the region maintain strong diagnostic networks that identify complex lupus cases early. It benefits from robust reimbursement frameworks that encourage biologic use across diverse patient groups. Pharmaceutical companies maintain active R&D pipelines that strengthen regional innovation. Specialist clinics expand biologic integration into long-term care pathways. These factors secure North America’s dominant position.

Europe

Europe follows with a 30% share supported by structured clinical guidelines and wide specialist availability. The region maintains strong physician familiarity with targeted immunomodulators and supports broad biologic adoption. It benefits from high regulatory emphasis on therapeutic safety and clinical value. Healthcare systems promote early management strategies that align with advanced treatment models. Demand grows due to rising diagnosis rates across key countries. Investment in autoimmune research strengthens therapeutic development. Europe holds a stable position within the global landscape of the biologics for systemic lupus erythematosus market.

Asia Pacific

Asia Pacific holds 22% and represents the fastest-growing region driven by higher patient awareness and expanding specialty care. It gains momentum from rising healthcare investments and improving biologic accessibility across major markets. Hospitals integrate advanced treatment protocols supported by regional policy initiatives. Clinical trial activity increases in China, Japan, and India, strengthening long-term development pipelines. Specialist availability improves as training programs expand across urban centers. Patient demand grows due to wider recognition of early treatment benefits. This growth pattern positions Asia Pacific as a key future pillar of the biologics for systemic lupus erythematosus market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- GlaxoSmithKline plc (Benlysta)

- AstraZeneca plc (Saphnelo)

- Roche / F. Hoffmann-La Roche Ltd.

- Pfizer Inc.

- Biogen Inc.

- Bristol-Myers Squibb Company

- Sanofi S.A.

- Novartis AG

- Eli Lilly and Company

- Aurinia Pharmaceuticals Inc.

- Anthera Pharmaceuticals Inc.

- UCB S.A.

Competitive Analysis:

The biologics for systemic lupus erythematosus market shows strong competition driven by a small group of global companies that invest heavily in targeted immunology. GlaxoSmithKline and AstraZeneca lead with established branded therapies supported by broad physician trust. Roche and Novartis strengthen portfolios with advanced monoclonal antibodies that target specific immune pathways. It gains further intensity through pipeline expansions from Eli Lilly, Bristol-Myers Squibb, and Sanofi. Smaller innovators focus on niche immune targets that support differentiated positioning. Companies rely on strategic collaborations, trial expansions, and real-world evidence to reinforce clinical value.

Recent Developments:

- In November 2025, Roche announced statistically significant and clinically meaningful results from the Phase III ALLEGORY study of Gazyva/Gazyvaro (obinutuzumab) in adults with systemic lupus erythematosus on standard therapy. The study met its primary endpoint showing a higher percentage of people achieved a minimum four-point improvement in SLE Responder Index 4 at one year with Gazyva/Gazyvaro versus standard therapy, with all key secondary endpoints also met including sustained corticosteroid control and reduced flares. If approved, Gazyva/Gazyvaro would be the first anti-CD20 therapy for SLE to directly target B cells, a key driver of inflammation and disease activity, and these results follow the October 2025 U.S. FDA approval for Gazyva/Gazyvaro in lupus nephritis. In October 2025, the FDA approved Gazyva/Gazyvaro for the treatment of adult patients with active lupus nephritis who are receiving standard therapy, based on superiority demonstrated in Phase II NOBILITY and Phase III REGENCY data, making it the only anti-CD20 monoclonal antibody to demonstrate a complete renal response benefit in lupus nephritis in a randomized Phase III study.

- In September 2025, AstraZeneca announced positive interim results from the Phase III TULIP-SC study, demonstrating that subcutaneous administration of Saphnelo (anifrolumab) showed a reduction in disease activity in individuals with moderate to severe systemic lupus erythematosus compared to placebo. The planned interim analysis took place after the first 220 subjects completed 52 weeks of treatment and showed that the safety profile of the subcutaneous administration aligns with the profile observed in intravenous infusions, with disease activity reduction gauged via the British Isles Lupus Assessment Group-based Composite Lupus Assessment at week 52. These interim findings are particularly important because approximately half of systemic lupus erythematosus patients today taking a biologic are already treated with a self-administered subcutaneous option, and AstraZeneca is actively working with regulatory authorities to bring this new administration option to patients as soon as possible. The company acquired global rights to Saphnelo through an exclusive licensing and partnership agreement with Medarex in 2004.

- In June 2025, the U.S. Food and Drug Administration approved GlaxoSmithKline’s Benlysta (belimumab) 200 mg/mL autoinjector for subcutaneous injection in patients five years of age and older with active lupus nephritis who are receiving standard therapy. This approval represents a significant milestone as it provides pediatric lupus nephritis patients and caregivers with a first-of-its-kind subcutaneous option that can be administered at home, expanding treatment choices beyond intravenous infusion. The 200 mg/mL autoinjector was previously approved for pediatric patients with active systemic lupus erythematosus in May 2024, and this latest approval extends its use to the more serious complication of lupus nephritis. This at-home treatment option demonstrates GSK’s ongoing commitment to improving patients’ well-being and easing their treatment journey, particularly for younger patients who may experience more aggressive and severe lupus symptoms compared to adults.

Report Coverage:

The research report offers an in-depth analysis based on Product Type and Route of Administration. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing use of targeted monoclonal antibodies will strengthen treatment outcomes.

- Increased payer support may expand access for patients needing long-term care.

- Rising adoption of subcutaneous delivery models will improve therapy adherence.

- More clinical trials will explore multi-pathway immune modulation for deeper control.

- Digital monitoring tools will support early flare detection and better treatment planning.

- Emerging markets will invest in specialty care networks that enable biologic access.

- Pipeline diversification will introduce biologics with improved safety advantages.

- Strategic partnerships will accelerate discovery of next-generation immune targets.

- Hospitals and specialty clinics will increase biologic integration into care pathways.

- Regulatory incentives will support faster review of innovative biologics.