Market Overview:

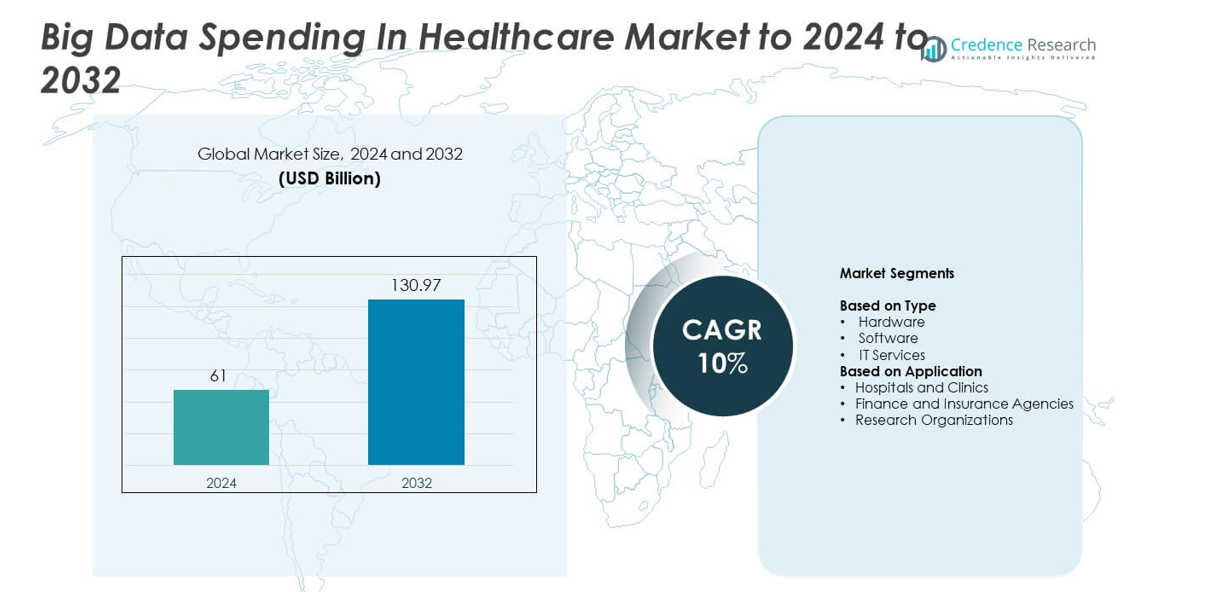

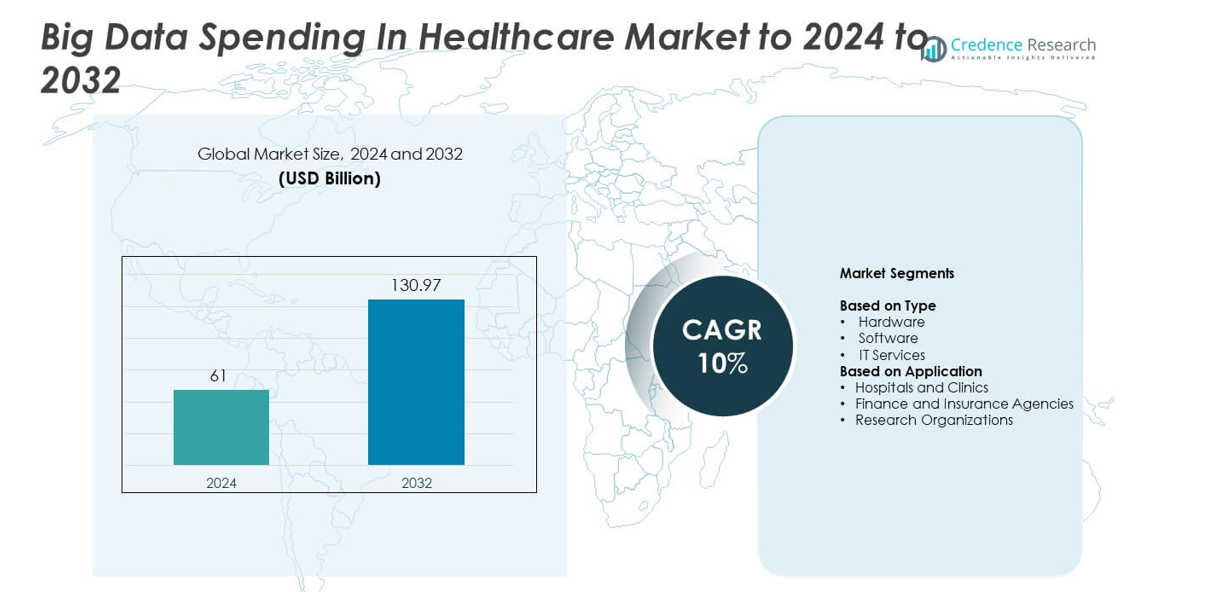

The Big Data Spending in Healthcare Market size was valued at USD 61 billion in 2024 and is anticipated to reach USD 130.97 billion by 2032, at a CAGR of 10 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Big Data Spending in Healthcare Market Size 2024 |

USD 61 billion |

| Big Data Spending in Healthcare Market, CAGR |

10% |

| Big Data Spending in Healthcare Market Size 2032 |

USD 130.97 billion |

The Big Data Spending in Healthcare Market features prominent players including SAS Institute, Huf, Oracle, CI Car International, Microsoft, OMIX, Dorman Products, IBM, SAP, and Guangzhou Yishan Auto Parts. These companies compete by advancing analytics platforms, cloud-based data systems, and AI-enabled healthcare solutions that support hospitals, payers, and research organizations. North America leads the market with a 38% share due to strong digital health adoption and mature IT infrastructure. Europe follows with 27%, supported by strict data standards and growing clinical analytics use, while Asia Pacific holds 23% as rapid digitalization and rising patient volumes drive significant investment in advanced healthcare data platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached 61 billion in 2024 and is projected to hit 130.97 billion by 2032 at a 10% CAGR.

- Rising digital transformation in hospitals and clinics drives demand for analytics, storage, and AI tools, with hardware holding a 42% share and software adoption increasing across healthcare networks.

- Cloud migration, AI-enabled diagnostics, and precision medicine programs shape major trends as providers expand data integration and real-time decision systems.

- Competition grows as global vendors advance secure cloud platforms, predictive analytics tools, and interoperability solutions while facing restraints such as high data security risks and skilled workforce shortages.

- Regional analysis shows North America leading with 38%, followed by Europe at 27% and Asia Pacific at 23%, supported by wider adoption of clinical analytics, EHR systems, and large-scale digital health programs across these regions.

Market Segmentation Analysis:

By Type

Hardware leads the market with a 42% share due to strong demand for high-capacity storage systems, advanced servers, and network equipment that support heavy clinical and operational data loads. Healthcare providers rely on specialized hardware to run analytics platforms, manage imaging archives, and maintain real-time data flows across clinical systems. Software follows as hospitals adopt analytics tools, AI-driven platforms, and EHR-based data engines to support decision-making. IT services grow steadily as healthcare organizations seek integration, maintenance, and cybersecurity support for complex data ecosystems.

- For instance, a fully scaled 252-node PowerScale cluster can deliver up to 15.75 million IOPS and up to 945 GB/s of aggregate throughput.

By Application

Hospitals and clinics dominate the market with a 51% share, driven by rising adoption of electronic health records, diagnostic imaging platforms, and real-time clinical analytics. These healthcare facilities generate high data volumes, which increase demand for strong storage, analytics, and management frameworks. Finance and insurance agencies expand their presence as payers use predictive analytics for fraud detection and claims automation. Research organizations continue to scale investments in high-performance computing and multi-omics data management to support precision medicine and clinical research programs.

- For instance, hospitals globally perform an estimated 9 billionmedical imaging procedures annually (as of late 2024/early 2025), generating large amounts of data, and AI is a key focus for improving efficiency in processing these.

Key Growth Drivers

Rising Digital Transformation in Healthcare

Healthcare providers expand digital systems to manage clinical and operational data. Hospitals adopt electronic health records, imaging systems, and real-time analytics to improve care. Growing dependence on cloud platforms supports faster data access and lower storage costs. Many health networks invest in stronger data pipelines to handle rising patient volumes. This shift encourages higher spending on big data tools that improve decision-making. Digital transformation remains the most important growth driver in this market.

- For instance, InterSystems reports that solutions built on its technology manage more than 1 billion health records worldwide, supporting national and regional health information networks.

Expansion of AI and Predictive Analytics Use

AI tools help hospitals detect risks, improve diagnosis, and manage patient flow. Predictive analytics supports early intervention by analyzing large clinical datasets. Healthcare payers use these tools to reduce fraud, automate claims, and predict treatment costs. The wider use of machine learning boosts demand for strong storage and processing systems. Growing reliance on high-accuracy insights makes this a major market driver.

- For instance, DeepMind’s retinal OCT system was trained on 14,884 three-dimensional scans and achieved expert-level referral performance for multiple sight-threatening eye diseases.

Growth in Remote Care and Connected Health Systems

Remote care platforms generate high volumes of patient data from sensors, apps, and monitoring devices. Hospitals integrate these data streams to track chronic diseases and adjust treatment plans. Telehealth adoption encourages stronger data management frameworks to support real-time analysis. As patient monitoring expands, healthcare providers need advanced systems to process continuous data flow. This trend continues to push big data spending across care settings.

Key Trends & Opportunities

Shift Toward Cloud-Based Healthcare Platforms

Healthcare organizations move from on-premise systems to cloud models due to easier scalability. Cloud adoption supports faster data sharing between hospitals, labs, and payers. Many providers choose hybrid cloud setups to balance security and flexibility. This shift creates strong opportunities for vendors offering secure analytics, storage, and AI platforms. Cloud-first strategies also support remote care, disaster recovery, and real-time decision systems, making the trend a major opportunity.

- For instance, the Ukrainian national eHealth system, powered by Edenlab’s Kodjin FHIR server, is a large-scale, cloud-native project that manages health data for over 36.5 million registered users (patients and personal records) and is one of the world’s largest HL7 FHIR-based projects in production.

Growing Investment in Precision Medicine and Genomics

Precision medicine relies on large datasets from genomics, imaging, and clinical records. Research centers invest in high-performance computing to study genetic patterns. Hospitals use data platforms to plan personalized treatments for cancer and rare diseases. This creates opportunities for advanced analytics, multi-omics storage systems, and AI models. Expansion of research programs increases demand for powerful data infrastructure across global healthcare networks.

- For instance, Illumina’s NovaSeq X Plus can sequence up to 128 human genomes in a single high-output run, generating as much as 16 terabases of data.

Key Challenges

Data Privacy and Regulatory Compliance Pressure

Healthcare organizations face strict rules for storing and sharing patient data. Managing sensitive records across cloud, mobile, and analytics platforms increases risk. Providers must meet compliance rules such as HIPAA and GDPR, which require strong security controls. Breaches lead to financial penalties and loss of trust. Ensuring protection of large datasets becomes a major challenge as digital use grows.

Lack of Skilled Data and IT Professionals

Hospitals and payer groups struggle to hire enough experts in data science, analytics, cybersecurity, and cloud operations. Limited workforce skills slow adoption of advanced big data tools. Many healthcare facilities rely on outdated systems due to staffing gaps. The shortage also raises implementation costs and delays integration of new platforms. Skill gaps remain a key barrier to large-scale data transformation.

Regional Analysis

North America

North America holds the largest share of 38% due to strong adoption of digital health platforms, advanced analytics, and AI-driven clinical systems across hospitals and payer networks. The region benefits from high healthcare spending, mature IT infrastructure, and large-scale use of EHRs. Federal incentives for interoperability and value-based care also support market expansion. Growing emphasis on population health management, remote monitoring, and precision medicine boosts demand for scalable data solutions. The presence of major cloud, analytics, and IT service providers strengthens the ecosystem and accelerates technology deployment across healthcare organizations.

Europe

Europe accounts for 27% of the market, supported by rapid digital transformation across healthcare systems and strong regulatory focus on data security and interoperability. The region experiences rising adoption of clinical analytics, AI-based diagnostic tools, and integrated EHR platforms. Government-backed digital health programs in countries such as Germany, the U.K., and France drive significant investment in data infrastructure. Healthcare providers expand cloud migration and predictive analytics use to improve care delivery and reduce operational inefficiencies. Growth accelerates as research institutions adopt high-performance computing for genomics, drug discovery, and disease modeling.

Asia Pacific

Asia Pacific holds a 23% share and emerges as the fastest-growing region, driven by expanding healthcare digitalization, rising patient volumes, and increasing investment in hospital IT systems. Countries including China, India, Japan, and South Korea invest heavily in cloud platforms, AI-enabled diagnostics, and national health data programs. Growing demand for telemedicine, electronic medical records, and large-scale public health analytics accelerates adoption. Strong government initiatives toward digital health transformation and rapid growth of private healthcare networks also support spending. Regional research centers adopt advanced analytics for genomics, clinical trials, and epidemiology.

Latin America

Latin America represents an 8% share, supported by gradual adoption of healthcare IT, rising use of analytics in hospitals, and ongoing digitization of public health systems. Countries such as Brazil, Mexico, and Colombia invest in EHR implementation, telehealth platforms, and basic data integration frameworks. Healthcare providers increasingly adopt cloud services to reduce infrastructure costs and improve care coordination. Growing interest in fraud detection analytics among payers and rising interoperability projects strengthen demand. Despite budget constraints, international collaborations and private-sector investments help accelerate analytics and data management deployment across the region.

Middle East and Africa

The Middle East and Africa hold a 4% share, with growth driven by modernization of healthcare systems, rising investments in digital hospitals, and national e-health strategies. Gulf countries lead adoption with strong spending on cloud infrastructure, data analytics, and AI-based clinical tools. Public health authorities leverage data platforms for disease surveillance and population health management. In Africa, digital health adoption grows through telemedicine networks, mobile health programs, and donor-supported data initiatives. Increasing focus on improving healthcare quality and system efficiency supports steady demand for analytics and data management solutions.

Market Segmentations:

By Type

- Hardware

- Software

- IT Services

By Application

- Hospitals and Clinics

- Finance and Insurance Agencies

- Research Organizations

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Big Data Spending in Healthcare Market includes major players such as SAS Institute, Huf, Oracle, CI Car International, Microsoft, OMIX, Dorman Products, IBM, SAP, and Guangzhou Yishan Auto Parts. The market features strong competition as vendors focus on advanced analytics platforms, secure cloud solutions, and AI-driven healthcare applications. Companies invest heavily in improving data integration, interoperability, and automation to support hospitals, payers, and research organizations. Many competitors expand offerings across predictive analytics, real-time monitoring, and population health tools to strengthen market presence. Strategic partnerships with hospitals, digital health firms, and cloud providers help vendors scale solutions globally. Continuous product upgrades, improved cybersecurity layers, and flexible deployment models further enhance competitive positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Microsoft announced new healthcare AI models in Azure AI Studio designed to integrate and analyze diverse medical data types to accelerate AI deployment in healthcare.

- In 2024, Oracle announced significant enhancements to its Oracle Health Data Intelligence platform, leveraging AI and high-performance cloud infrastructure to improve patient care, financial performance, and decision-making across healthcare networks.

- In 2022, IBM announced the sale of its healthcare data and analytics assets to the private equity firm Francisco Partners for over $1 billion

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as hospitals increase adoption of advanced analytics tools.

- Cloud platforms will gain stronger use for faster data processing and storage.

- AI and machine learning models will support wider clinical and operational decisions.

- Predictive analytics will help healthcare providers improve early diagnosis and risk management.

- Remote monitoring systems will generate higher data volumes that drive new investments.

- Precision medicine programs will push demand for high-performance computing and multi-omics data tools.

- Payers will rely more on analytics for claims automation and fraud detection.

- Interoperability efforts will strengthen data exchange across hospitals and payer networks.

- Cybersecurity solutions will see higher demand due to growing digital health adoption.

- Global research collaborations will accelerate spending on large-scale healthcare data platforms.