Market Overview:

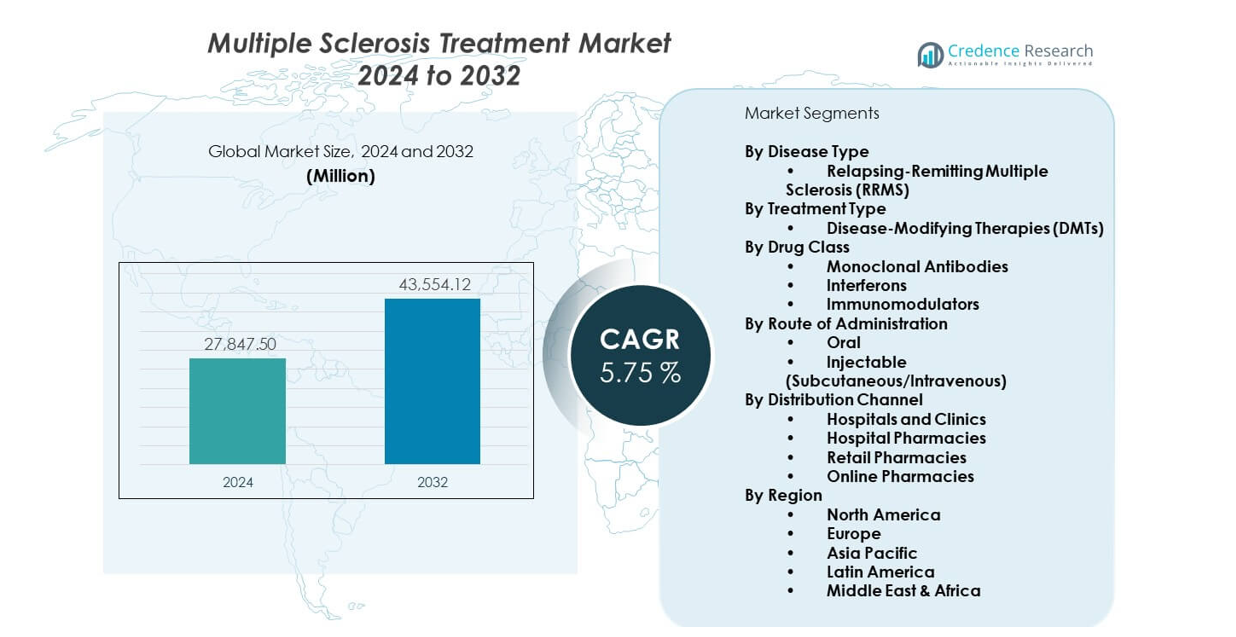

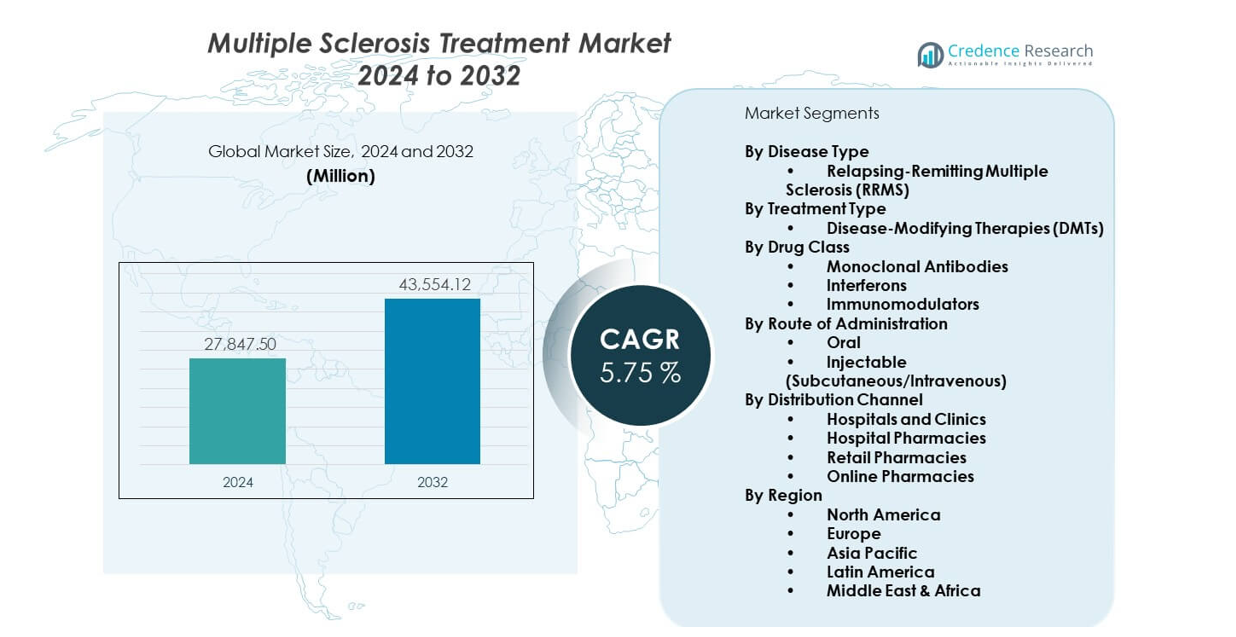

The Multiple sclerosis treatment market is projected to grow from USD 27,847.5 million in 2024 to USD 43,554.12 million by 2032, reflecting a CAGR of 5.75% from 2024 to 2032. Growth reflects rising diagnosis rates and strong demand for advanced therapies.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Multiple Sclerosis Treatment Market Size 2024 |

USD 27,847.5 million |

| Multiple Sclerosis Treatment Market, CAGR |

5.75% |

| Multiple Sclerosis Treatment Market Size 2032 |

USD 43,554.12 million |

Demand rises due to better imaging tools and early detection. New drug classes improve symptom control and slow disease activity. More patients receive long-term care because survival rates improve. Companies focus on targeted therapies that reduce relapse frequency.

North America leads due to strong access to neurologists and advanced drugs. Europe follows with broad insurance coverage and expanding clinical programs. Asia Pacific grows fast as awareness increases and treatment reach improves. Emerging markets show rising demand as healthcare systems expand and more specialists manage neurological diseases.

Market Insights:

- The multiple sclerosis treatment market reached USD 27,847.5 million in 2024 and is projected to hit USD 43,554.12 million by 2032, growing at a CAGR of 5.75% driven by rising adoption of advanced therapies.

- North America (over 40%), Europe (around 30%), and Asia Pacific (near 18%) hold the highest shares due to strong specialist availability, broad reimbursement coverage, and expanding diagnosis programs.

- Asia Pacific represents the fastest-growing region (over 18%), supported by rising awareness, improving access to biologics, and expanding neurological care centers across major countries.

- Relapsing-Remitting MS accounts for over 70% of disease-type share due to its high prevalence and strong response to early therapy.

- Disease-Modifying Therapies hold more than 60% of the treatment-type share, supported by strong efficacy, wide clinical adoption, and long-term disease control benefits.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Emphasis on Early Diagnosis and Timely Therapeutic Intervention

The Multiple sclerosis treatment market expands as awareness improves across major regions. Early diagnosis increases due to wider MRI access and stronger clinical guidelines. Physicians initiate therapy sooner to slow disability progression. Patients seek care earlier because symptoms receive more visibility in public health programs. Health systems adopt structured neurological screening that improves detection quality. The shift toward early therapeutic planning supports long-term disease management. Companies introduce tools that help clinicians track disease activity with more precision. This trend strengthens demand for timely intervention across care networks.

- For instance, Philips and Synthetic MR’s Smart Quant Neuro 3D platform delivers automatic segmentation and tissue volume measurement in under 10 seconds of post-processing, enabling clinicians to identify myelin loss and detect abnormalities that remain invisible on conventional MR scans, significantly improving early detection precision.

Rapid Development of Advanced Drug Classes Driving Clinical Adoption

Innovation fuels stronger adoption across hospitals and specialty clinics. New drug classes improve relapse control and support better patient adherence. Oral therapies gain traction due to ease of use and fewer treatment interruptions. Monoclonal antibodies offer targeted action that reduces disease activity. Physicians prefer agents with proven long-term safety records. Expanded clinical evidence strengthens trust among specialists. Patients move toward treatments that improve daily functioning and reduce flare frequency. It strengthens confidence in advanced therapeutic options across the Multiple sclerosis treatment market.

- For example, Novartis’ Gilenya (fingolimod) demonstrated a 54% reduction in annualized relapse rate compared to placebo in two-year studies, with 81.2% of patients remaining on therapy versus 72.5% on placebo, establishing superior treatment persistence.

Increasing Integration of Real-World Evidence Supporting Treatment Patterns

Real-world data programs help clinicians refine therapy decisions. Health systems collect outcome data from diverse patient groups. These insights reveal long-term performance trends beyond controlled trials. Payers rely on such data to support reimbursement approvals. Providers use digital tools to track treatment responses across wider patient pools. Pharmaceutical firms invest in registries to evaluate therapy durability. The approach supports personalized management strategies. It aligns treatment patterns with evolving patient needs across global markets.

Rising Patient Access Through Expanding Insurance and Reimbursement Coverage

Coverage expansion improves access for a larger patient base. Public programs include more disease-modifying therapies in reimbursement lists. Private insurers create structured plans that reduce out-of-pocket costs. Hospitals integrate support programs that guide patients through funding pathways. Patients continue therapy for longer cycles due to lower financial burdens. Policymakers update neurological care standards to support equitable access. It strengthens continuity of care for chronic disease management. This trend enhances long-term treatment adherence across regions.

Market Trends:

Growing Shift Toward Personalized and Precision-Centered Therapy Models

The Multiple sclerosis treatment market moves toward precision-centered care strategies. Biomarker use increases as clinicians target therapies more accurately. Genetic profiling gains relevance in selecting agents for complex cases. Providers explore immune pathway analysis for better response prediction. Companies invest in tools that support individualized treatment plans. Patients expect tailored care with clearer outcome projections. Data-driven clinical models improve therapy efficiency. It helps health systems adopt targeted approaches with fewer trial errors.

- For instance, genetic profiling identified HLA-A∗03:01 as a predictive biomarker enabling clinicians to determine that one-third of MS patients receiving glatiramer acetate experienced significantly slower disease progression (0.42 EDSS points per year versus 0.47 points per year with interferon-beta treatment), allowing physicians to select optimal first-line therapies before initiating treatment.

Expansion of Home-Based Care Models and Remote Treatment Monitoring

Remote monitoring tools reshape patient engagement across regions. Wearable devices help track symptoms with higher accuracy. Tele-neurology expands due to better digital infrastructure. Patients prefer home care models due to improved convenience. Clinicians supervise therapy adherence through digital dashboards. Hospitals integrate remote programs for stable cases requiring less frequent visits. The shift reduces travel burdens and supports better quality of life. It strengthens long-term disease control through continuous oversight.

- For example, tele-neurology encounters reduced missed workdays by 65%, saved an average of 258 km of travel, and reduced lodging costs by 17% for MS patients, while 97% of participants recommended telemedicine visits to others. Tele-neurology expands due to better digital infrastructure.

Increasing Adoption of High-Efficacy Monoclonal Antibodies Across Diverse Patient Groups

Monoclonal antibodies gain strong traction due to superior clinical outcomes. Physicians consider these agents for both early and advanced cases. Hospitals invest in infusion centers to support rising demand. New formulations enter trials with improved dosing schedules. Safety records continue to strengthen confidence among specialists. Patients prefer options that reduce relapse frequency. Manufacturers refine production pipelines to meet consistent global demand. It supports broader clinical use across the global market landscape.

Rising Influence of Digital Therapeutics and AI-Based Clinical Support Tools

Digital therapeutics support cognitive training and symptom management. AI platforms help physicians evaluate disease activity more precisely. Clinics adopt software tools that predict relapse risk. Pharmaceutical firms partner with tech companies to develop integrated care systems. Patients engage through structured mobile applications that track daily progress. Data collected supports timely therapeutic adjustments. Providers use AI decision aids to strengthen diagnosis accuracy. It improves clinical outcomes through technology-enabled pathways.

Market Challenges Analysis

High Treatment Costs and Uneven Access Across Global Healthcare Systems

The Multiple sclerosis treatment market faces major restraints linked to affordability barriers. Advanced therapies carry high prices that limit access in low-income regions. Patients struggle with out-of-pocket costs when insurance offers limited coverage. Hospitals experience budget pressure when adopting premium biologics. Payers apply strict reimbursement criteria that delay approvals. The supply of neurologists remains uneven across emerging countries. Long travel distances further restrict access to specialized care. It slows adoption of advanced options in underserved areas.

Complex Disease Variability and Limited Predictive Tools for Long-Term Response

Disease variability creates major challenges for clinicians across global settings. Patients respond differently to similar therapy classes due to biological diversity. Physicians lack consistent predictive tools for long-term outcomes. Trial data often excludes diverse real-world populations. Treatment adjustments require frequent monitoring that strains clinic capacity. Switching therapies creates uncertainty for patients and providers. Relapse patterns shift unpredictably across disease stages. It complicates management planning and reduces treatment consistency.

Market Opportunities

Rising Potential for Next-Generation Therapies Targeting Novel Immune Pathways

The Multiple sclerosis treatment market gains new opportunities through emerging immune-targeted therapies. Developers explore novel pathways that reduce disease activity with higher precision. Patients seek options with fewer long-term safety concerns. Clinical trials test molecules that improve relapse control. Providers anticipate drugs that support stable neurological function. Hospitals prepare for adoption of alternatives to traditional immunomodulators. It expands treatment choice across diverse patient categories. Growth prospects strengthen as innovation accelerates.

Expanding Scope for Digital Integration and Global Care Outreach Programs

Digitalization creates strong expansion opportunities for global care delivery. Remote treatment platforms reach patients in underserved regions. Hospitals improve neurological care access through telemedicine networks. Pharmaceutical firms invest in tools that guide therapy adherence. Patients rely on digital programs that support symptom tracking. Clinical teams use data to refine dosing adjustments. It improves disease management efficiency across regional markets. This trend broadens access and strengthens patient engagement.

Market Segmentation Analysis:

By Disease Type

Relapsing-Remitting Multiple Sclerosis (RRMS) dominates the Multiple sclerosis treatment market due to its high prevalence and stronger response to early therapies. RRMS patients often begin treatment soon after diagnosis, which drives steady uptake of advanced drug classes. It benefits from continuous clinical innovation targeting relapse reduction and better long-term stability.

By Treatment Type

Disease-Modifying Therapies (DMTs) lead uptake due to their proven ability to slow disease activity. These therapies support relapse control and reduce progression risk across broad patient groups. Physicians prioritize DMTs for early management, and it strengthens long-term adherence through structured treatment pathways.

- For example, Highly active RRMS patients treated with Tecfidera showed a 56% reduction in annualized relapse rate (p <0.0040) and a 78% reduction in time to 12-week sustained disability progression (p=0.0067) compared to placebo within two years, establishing DMTs as the standard of care.

By Drug Class

Monoclonal antibodies record strong demand due to high efficacy in controlling active disease. Interferons maintain relevance in stable cases due to established safety records. Immunomodulators deliver consistent benefits for patients needing flexible treatment choices. Each class supports a different clinical need and improves therapeutic reach.

By Route of Administration

Oral formulations see growing preference due to ease of use and improved patient adherence. Injectable options, including subcutaneous and intravenous routes, remain essential for severe or fast-progressing conditions. It helps clinicians tailor dosing plans to disease stage and patient comfort.

By Distribution Channel

Hospitals and clinics lead distribution due to strong specialist availability and regular monitoring needs. Hospital pharmacies support controlled dispensing for complex therapies. Retail pharmacies expand access for stable patients, while online pharmacies improve reach for remote users. Each channel strengthens continuity of care across regions.

Segmentation:

By Disease Type

- Relapsing-Remitting Multiple Sclerosis (RRMS)

By Treatment Type

- Disease-Modifying Therapies (DMTs)

By Drug Class

- Monoclonal Antibodies

- Interferons

- Immunomodulators

By Route of Administration

- Oral

- Injectable (Subcutaneous/Intravenous)

By Distribution Channel

- Hospitals and Clinics

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the multiple sclerosis treatment market due to strong access to advanced therapies and specialist networks. The region benefits from early diagnosis programs and broad insurance coverage that support rapid treatment initiation. Hospitals adopt high-efficacy monoclonal antibodies at a faster rate due to strong clinical infrastructure. Patients engage in structured long-term care programs supported by trained neurologists. Pharmaceutical companies launch new therapies in the region before global rollout. It maintains market leadership through high awareness and consistent therapy adoption.

Europe

Europe secures the second-largest share due to well-established healthcare systems and strong reimbursement frameworks. The region integrates standardized neurological care pathways that improve disease monitoring. Hospitals support wide adoption of interferons, immunomodulators, and advanced biologics across diverse patient groups. Research institutions conduct large clinical studies that expand treatment choices. Patients benefit from regional guidelines that promote early and sustained therapy use. It maintains a strong position supported by consistent regulatory support and broad treatment availability.

Asia Pacific

Asia Pacific emerges as the fastest-growing region with a rising share driven by expanding healthcare access and improving diagnostic capacity. Awareness campaigns increase early evaluation and specialty referrals across urban centers. Hospitals introduce advanced biologics as treatment guidelines evolve. Pharmaceutical companies expand regional footprint through local partnerships and targeted distribution. Patients gain better access to oral therapies due to improving affordability. It builds momentum as healthcare infrastructure strengthens and neurological care capacity grows across major markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Multiple sclerosis treatment market features strong competition among global pharmaceutical leaders focused on high-efficacy therapies and long-term patient outcomes. Companies invest in monoclonal antibodies, oral DMTs, and immunomodulators to strengthen product portfolios. Firms expand clinical pipelines to address unmet needs across progressive disease types. Hospitals adopt therapies backed by large-scale safety evidence, which increases competition in high-demand segments. Strategic partnerships support broader distribution across emerging regions. Pipeline diversity drives active competition across infusion, injectable, and oral categories. It maintains a dynamic landscape shaped by innovation and treatment differentiation.

Recent Developments:

- In October 2025, Novartis announced a $12 billion acquisition of Avidity Biosciences Inc., representing the Swiss drugmaker’s biggest acquisition in more than a decade. While this deal is primarily focused on adding several potential blockbuster treatments as generic competition looms for Novartis’s current top-sellers, it reflects the company’s continued strategic investment in expanding its pharmaceutical portfolio. Additionally, throughout 2025, Novartis declared plans to spend over $17 billion in licensing and acquisition deals aimed at strengthening its pipeline across various therapeutic areas. The company also licensed Monte Rosa, which develops protein degraders such as MRT-6160 designed to degrade the protein VAV1, a mechanism known to address autoimmune conditions including multiple sclerosis.

- In April 2025, Merck KGaA announced the acquisition of SpringWorks Therapeutics for $3.9 billion (or $47 per share), a transaction expected to close in the second half of 2025. While SpringWorks’ primary focus is on rare tumors including neurofibromatosis and desmoid tumors rather than MS directly, the deal strengthens Merck KGaA’s oncology and rare disease pipelines with potential implications for innovative therapeutic approaches. The acquisition reflects Merck KGaA’s strategy to add to its portfolio as the company faces imminent expiry of patents on its MS treatment Mavenclad (cladribine), beginning in 2026.

- In February 2025, Biogen CEO Chris Viehbacher highlighted the company’s focus on building up four recent drug launches—Skyclarys, Leqembi, Zurzuvae, and Qalsody—to offset the continued decline in its MS franchise revenue. While Biogen’s MS sales declined 9% at constant currencies in the fourth quarter of 2024 to slightly more than $1 billion, the company’s leadership remained confident that the newer launches would pick up the slack in the months and years to come. The MS franchise, including drugs like Tysabri and Tecfidera, declined 7% to $4.4 billion for all of 2024. Biogen has undergone a restructuring initiative to save around $1 billion by the end of 2025 as part of its strategy to adapt to the changing MS market landscape.

Report Coverage:

The research report offers an in-depth analysis based on By Disease Type (Relapsing-Remitting Multiple Sclerosis), By Treatment Type (Disease-Modifying Therapies), By Drug Class (Monoclonal Antibodies, Interferons, Immunomodulators), By Route of Administration (Oral, Injectable), and By Distribution Channel (Hospitals and Clinics, Hospital Pharmacies, Retail Pharmacies, Online Pharmacies). It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Innovation in monoclonal antibodies will strengthen clinical outcomes across advanced disease categories.

- Oral DMTs will gain broader adoption due to improved adherence and patient comfort.

- AI-supported diagnostic tools will enhance early disease detection and treatment planning.

- Real-world evidence programs will guide therapy optimization and long-term patient management.

- Digital platforms will expand remote monitoring capabilities across major regions.

- Hospitals will integrate advanced infusion centers to support biologic therapy demand.

- Partnerships between pharma and tech firms will increase treatment personalization.

- Emerging markets will expand access as neurological care networks improve.

- Regulatory support for high-efficacy therapies will accelerate product approvals.

- It will benefit from sustained investment in next-generation immune-targeted therapies.