Market Overview

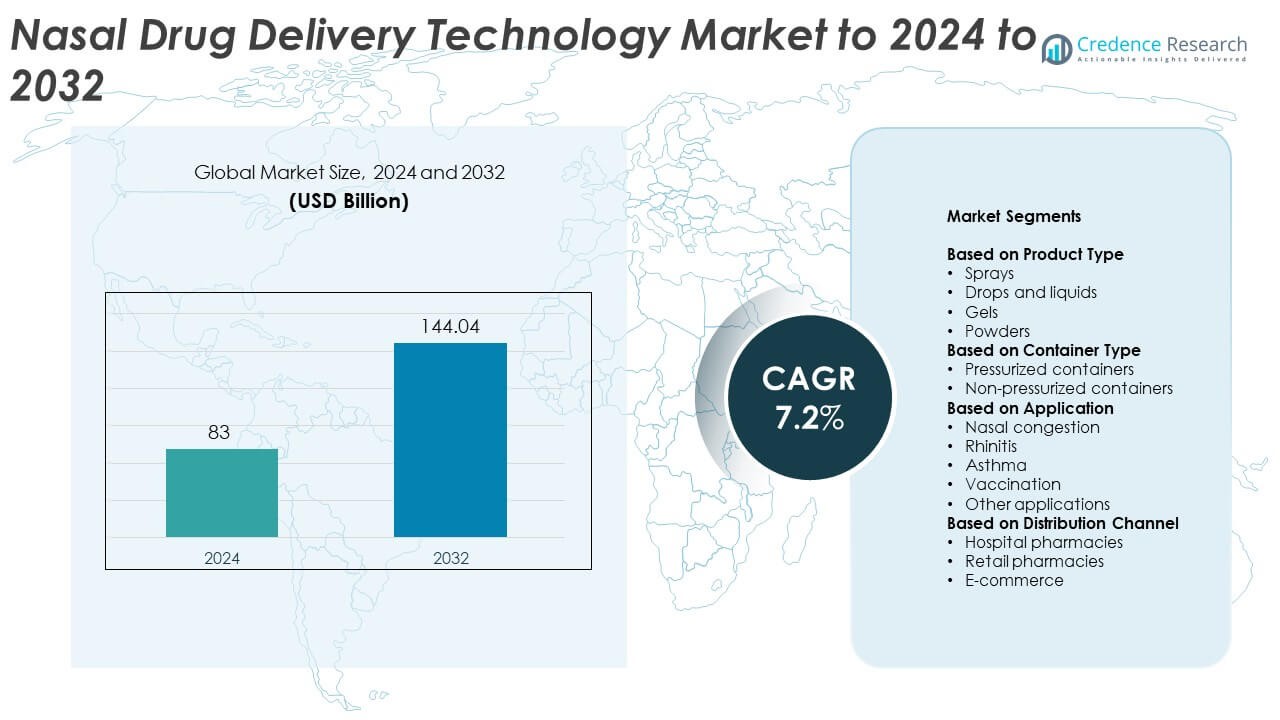

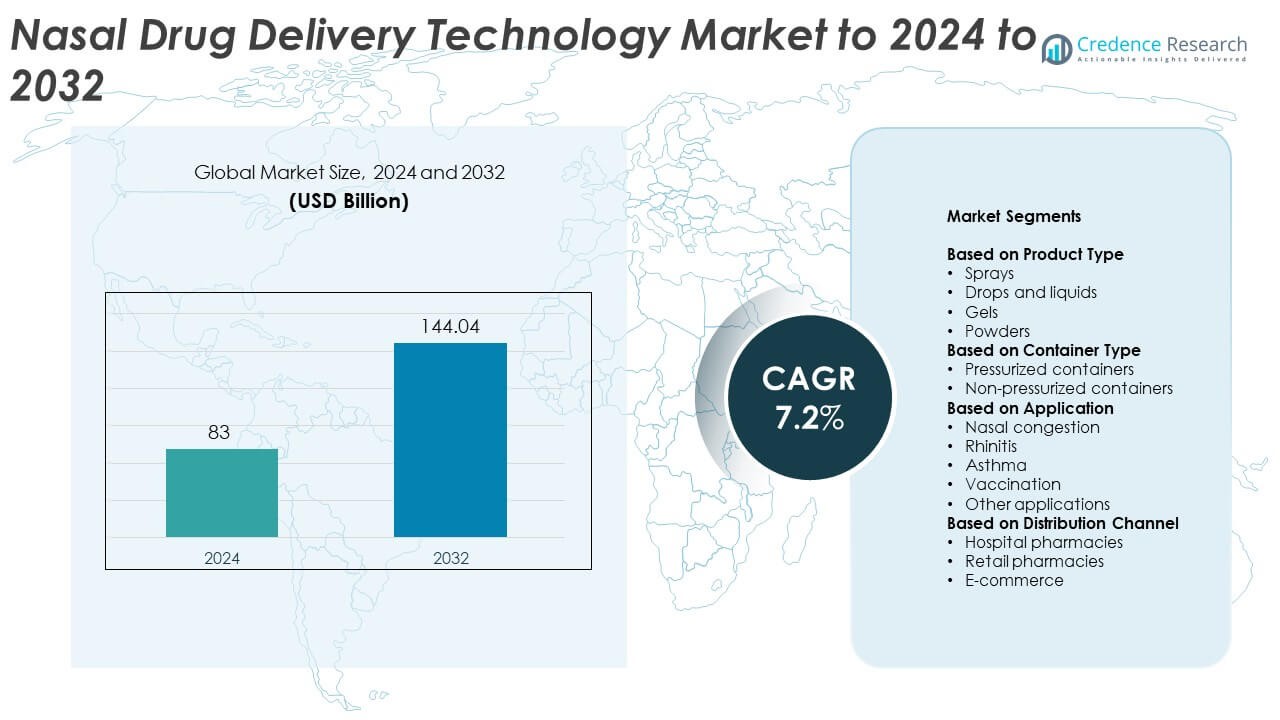

Nasal Drug Delivery Technology Market size was valued at USD 83 Billion in 2024 and is anticipated to reach USD 144.04 Billion by 2032, at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nasal Drug Delivery Technology Market Size 2024 |

USD 83 Billion |

| Nasal Drug Delivery Technology Market, CAGR |

7.2% |

| Nasal Drug Delivery Technology Market Size 2032 |

USD 144.04 Billion |

The nasal drug delivery technology market is led by major players including GlaxoSmithKline, Johnson & Johnson, Pfizer, Boehringer Ingelheim, Eli Lilly and Company, Merck, F. Hoffmann-La Roche AG, Takeda Pharmaceutical Company, Regeneron Pharmaceuticals, and AptarGroup. These companies dominate through extensive product portfolios, continuous innovation in intranasal formulations, and advanced device integration. Strategic partnerships and investments in R&D have strengthened their presence in both prescription and over-the-counter nasal therapies. Regionally, North America holds the largest share at 38.6% in 2024, supported by strong healthcare infrastructure and rapid adoption of nasal spray products, followed by Europe with 28.4% and Asia Pacific with 22.7%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The nasal drug delivery technology market was valued at USD 83 billion in 2024 and is projected to reach USD 144.04 billion by 2032, expanding at a CAGR of 7.2%.

- Rising demand for non-invasive, fast-acting drug delivery methods and growing cases of respiratory and allergic disorders are driving market expansion.

- Technological advances in smart nasal devices, powder formulations, and intranasal vaccines are shaping emerging trends and expanding therapeutic applications.

- The market remains highly competitive with strong participation from global pharmaceutical and biotech companies focusing on innovation and patient convenience.

- North America leads with a 38.6% share, followed by Europe at 28.4% and Asia Pacific at 22.7%, while sprays dominate by product type with a 46.7% segment share, supported by widespread adoption in allergy and pain management treatments.

Market Segmentation Analysis:

By Product Type

Sprays dominate the nasal drug delivery technology market with a 46.7% share in 2024. Their leadership is driven by ease of administration, rapid absorption, and suitability for self-medication. The growing adoption of metered-dose and multidose spray systems supports consistent dosing and patient compliance. Increased use of sprays for allergy, migraine, and pain therapies further strengthens their demand. Drops and liquids follow due to their effectiveness in pediatric and geriatric care, while gels and powders are expanding with innovations in controlled-release formulations and improved mucosal retention.

- For instance, Aptar Pharma reports “over 280” nasal spray and powder market references across Unidose/Bidose and multidose systems, showing wide spray adoption.

By Container Type

Non-pressurized containers lead the market with a 57.4% share in 2024. The segment benefits from lower manufacturing costs, lightweight design, and reduced environmental impact compared to pressurized formats. These containers are widely used in over-the-counter nasal sprays and solutions due to their convenience and safety. Rising adoption of pump bottles and squeezable containers enhances dosing precision. Pressurized containers maintain demand for aerosol-based and metered formulations, particularly in asthma and allergy treatments, where controlled spray patterns and fine mist dispersion remain critical for therapeutic efficiency.

- For instance, Glenmark confirms Ryaltris has launched in 34 markets as of March 2024, with later updates noting approvals and rollouts continuing across additional countries.

By Application

Nasal congestion holds the largest share of 39.6% in 2024, driven by the high prevalence of allergies, colds, and sinusitis globally. Decongestant sprays and saline formulations provide fast relief, boosting consumer preference for self-care products. Rhinitis and asthma segments are also expanding as nasal corticosteroids and bronchodilator therapies gain traction. Moreover, nasal vaccination emerges as a promising area due to needle-free delivery and rapid immune response, with ongoing research supporting intranasal vaccine formulations for influenza and other respiratory diseases.

Key Growth Drivers

Rising Demand for Non-Invasive Drug Delivery

Growing patient preference for non-invasive administration boosts nasal drug delivery adoption. The method offers rapid onset, improved bioavailability, and bypasses first-pass metabolism, enhancing therapeutic outcomes. Pharmaceutical companies increasingly develop intranasal formulations for pain, migraine, and hormone therapies to improve convenience and compliance. The expanding use of nasal routes for central nervous system and peptide-based drugs strengthens this trend, supporting continuous innovation in formulation and delivery systems.

- For instance, Amphastar’s Baqsimi (nasal glucagon) is marketed in 27 countries, evidencing patient pull for needle-free, rapid-onset delivery.

Advancements in Nasal Formulation Technologies

Technological innovation in nasal formulations drives market growth by improving absorption efficiency and stability. Developments in mucoadhesive gels, powder-based systems, and nanoparticle carriers enhance drug retention and controlled release. These advances enable the delivery of larger biomolecules such as proteins and vaccines, expanding therapeutic applications. Continuous R&D investments from leading pharmaceutical manufacturers promote better patient outcomes and broaden adoption across chronic disease treatments.

- For instance, SNBL’s SMART nasal powder platform has been evaluated in “more than 150” human subjects, supporting tech advances that improve retention and stability.

Increasing Incidence of Respiratory and Allergic Disorders

The surge in allergic rhinitis, sinusitis, and asthma cases globally accelerates demand for nasal delivery products. Urbanization, pollution, and lifestyle factors contribute to growing respiratory complications. Nasal sprays and decongestants remain first-line therapies, offering quick relief and ease of use. Rising awareness of self-care and availability of over-the-counter treatments further drive volume growth across both developed and emerging markets.

Key Trends and Opportunities

Emergence of Intranasal Vaccination Platforms

The development of needle-free nasal vaccines is transforming immunization practices. Intranasal delivery enables rapid mucosal immunity, reducing the need for trained healthcare professionals. Research on influenza, COVID-19, and RSV vaccines via nasal routes showcases expanding opportunities. This trend aligns with global healthcare focus on accessible, patient-friendly, and cost-effective vaccination models.

- For instance, CyanVac received U.S. BARDA Project NextGen support for an intranasal COVID-19 vaccine trial enrolling 10,000 volunteers, highlighting momentum in mucosal vaccination.

Integration of Smart and Digital Nasal Devices

Smart nasal delivery systems with sensors and Bluetooth connectivity are gaining traction. These devices allow dosage monitoring, compliance tracking, and real-time data integration with mobile apps. The combination of digital health and nasal delivery enhances patient adherence and treatment personalization. Pharmaceutical collaborations with medtech firms continue to expand this high-potential segment.

- For instance, Kurve Technology notes its ViaNase electronic atomizer has been used in numerous studies and research programs—specifically, an article published in a peer-reviewed journal in 2023 references 16 programs, 14 in-clinic, associated with the device, reflecting growing interest in smart/electronic nasal delivery systems for applications like nose-to-brain delivery.

Expansion into Central Nervous System Therapies

Nasal routes are emerging as efficient alternatives for brain-targeted drugs. Direct delivery through the olfactory region enables bypassing the blood-brain barrier, improving treatment for conditions such as epilepsy and depression. Pharmaceutical companies are exploring intranasal formulations for rapid-acting therapies, creating new growth avenues within neurological and psychiatric drug segments.

Key Challenges

Formulation Stability and Drug Absorption Limitations

Achieving consistent bioavailability and stability in nasal formulations remains a technical challenge. Factors like mucociliary clearance, enzymatic degradation, and variable absorption rates limit performance. Manufacturers must invest in advanced excipients and enhancers to ensure reliable therapeutic effects. These complexities slow development timelines and increase regulatory hurdles.

Stringent Regulatory and Manufacturing Constraints

The nasal drug delivery sector faces strict quality and safety regulations across global markets. Compliance with Good Manufacturing Practices and validation of device-drug combinations increase operational costs. Varying regional approval standards also delay commercialization. These regulatory pressures require continuous testing, documentation, and post-market surveillance, impacting product launch efficiency.

Regional Analysis

North America

North America leads the nasal drug delivery technology market with a 38.6% share in 2024. The dominance stems from advanced healthcare infrastructure, strong pharmaceutical innovation, and high adoption of self-administration drug systems. The U.S. drives market leadership through rapid uptake of nasal sprays for allergy, migraine, and pain management. Growing approvals of intranasal vaccines and emergency drugs, such as naloxone for opioid overdose, further expand market penetration. Increasing focus on patient convenience and digital integration in nasal devices continues to enhance growth across the region.

Europe

Europe holds a 28.4% share of the global market in 2024, supported by strong R&D investments and robust regulatory frameworks. The region benefits from rising prevalence of allergic rhinitis and chronic sinusitis, encouraging demand for over-the-counter nasal sprays. Germany, France, and the U.K. lead adoption due to advanced healthcare systems and growing awareness of non-invasive delivery methods. Strategic collaborations between pharmaceutical and biotech companies accelerate innovation in powder-based and controlled-release nasal formulations across the continent.

Asia Pacific

Asia Pacific accounts for a 22.7% share in 2024, emerging as the fastest-growing regional market. Expansion is driven by increasing respiratory disease prevalence, urban pollution, and rising healthcare expenditure. Japan and China lead adoption, supported by strong local manufacturing and government initiatives to promote intranasal vaccination. Rapid penetration of e-commerce channels and expanding access to affordable generic formulations boost consumer reach. Growing interest in innovative nasal drug delivery technologies for chronic and neurological diseases also strengthens market prospects across the region.

Latin America

Latin America captures a 6.2% share of the global market in 2024, driven by rising incidence of respiratory allergies and asthma. Brazil and Mexico dominate due to expanding pharmaceutical distribution networks and improved access to non-prescription nasal therapies. Increased awareness of nasal drug delivery benefits and the growing availability of cost-effective generics support steady growth. However, limited healthcare reimbursement and uneven regulatory harmonization across countries remain moderate restraints on faster adoption within the region.

Middle East and Africa

The Middle East and Africa region holds a 4.1% share in 2024, showing gradual but steady market growth. Expansion is supported by rising healthcare modernization, urbanization, and awareness of nasal delivery for allergy and cold treatment. Gulf countries such as Saudi Arabia and the UAE lead adoption due to improved healthcare access and strong retail pharmacy presence. Increasing partnerships between global pharmaceutical firms and regional distributors are expanding product availability. Nonetheless, affordability and infrastructure gaps continue to limit market penetration in several African nations.

Market Segmentations:

By Product Type

- Sprays

- Drops and liquids

- Gels

- Powders

By Container Type

- Pressurized containers

- Non-pressurized containers

By Application

- Nasal congestion

- Rhinitis

- Asthma

- Vaccination

- Other applications

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- E-commerce

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The nasal drug delivery technology market is characterized by strong competition among leading pharmaceutical, biotechnology, and device manufacturing companies such as GlaxoSmithKline, Regeneron Pharmaceuticals, Aegis Therapeutics, Johnson & Johnson, Neuralstem, Takeda Pharmaceutical Company, Boehringer Ingelheim, Pfizer, AptarGroup, F. Hoffmann-La Roche AG, Horizon Therapeutics, Merck, Eli Lilly and Company, and Nasal Technologies. The competitive environment is driven by innovation in formulation design, device integration, and patient-focused delivery systems. Market players are emphasizing the development of advanced nasal sprays, powders, and gels that ensure improved absorption, bioavailability, and dosing precision. Strategic collaborations between drug manufacturers and device engineers are enhancing the efficiency of combination therapies and expanding therapeutic reach into CNS, vaccine, and pain management areas. The growing adoption of smart inhalation technologies, coupled with regulatory support for needle-free delivery systems, continues to fuel new product launches and strengthen the overall competitive positioning of leading companies.

Key Player Analysis

- GlaxoSmithKline

- Regeneron Pharmaceuticals

- Aegis Therapeutics

- Johnson & Johnson

- Neuralstem

- Takeda Pharmaceutical Company

- Boehringer Ingelheim

- Pfizer

- AptarGroup

- F. Hoffmann-La Roche AG

- Horizon Therapeutics

- Merck

- Eli Lilly and Company

- Nasal Technologies

Recent Developments

- In 2025, Aptar’s nasal delivery system was used in a brain imaging study confirming effective delivery of intranasal insulin to brain memory regions, supporting new Alzheimer’s treatments.

- In 2024, Regeneron collaborated with healthcare providers to expand access to Dupixent® for nasal polyposis.

- In 2023, Aptar Pharma launched a recyclable, metal-free, multidose nasal spray pump.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Container Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow with rising preference for non-invasive drug delivery methods.

- Intranasal vaccines will gain momentum due to increased demand for needle-free immunization.

- Digital and smart nasal devices will improve patient adherence and remote monitoring capabilities.

- Advancements in powder and gel formulations will enhance stability and absorption.

- More pharmaceutical companies will invest in nasal delivery for CNS-targeted therapies.

- Over-the-counter nasal products will see steady demand from allergy and cold treatment segments.

- Emerging markets will drive future growth through improved access and awareness.

- Regulatory approvals for combination device-drug nasal products will expand product portfolios.

- E-commerce will play a bigger role in retail distribution and direct-to-consumer models.

- Collaborations between pharma and biotech firms will accelerate innovation in nasal delivery platforms.