Market Overview

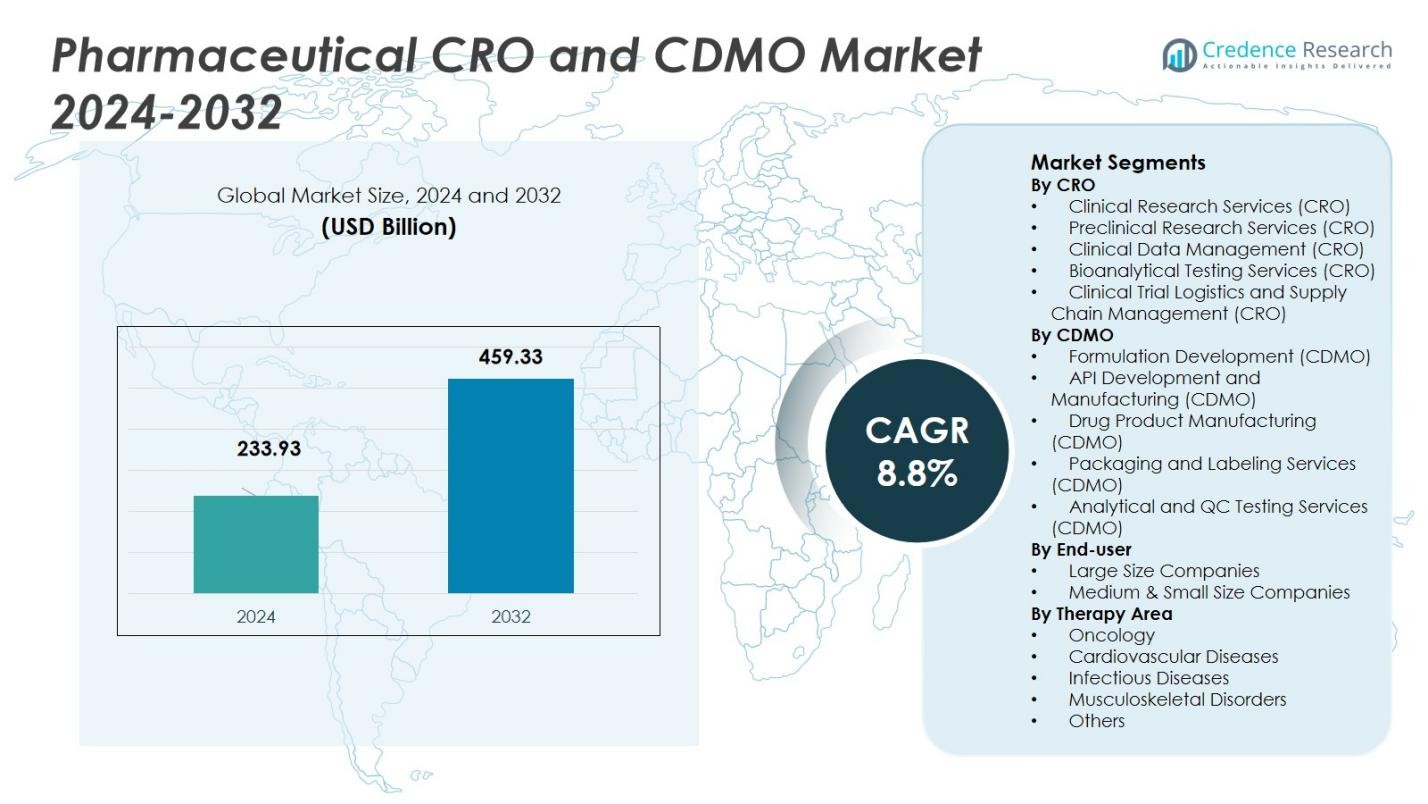

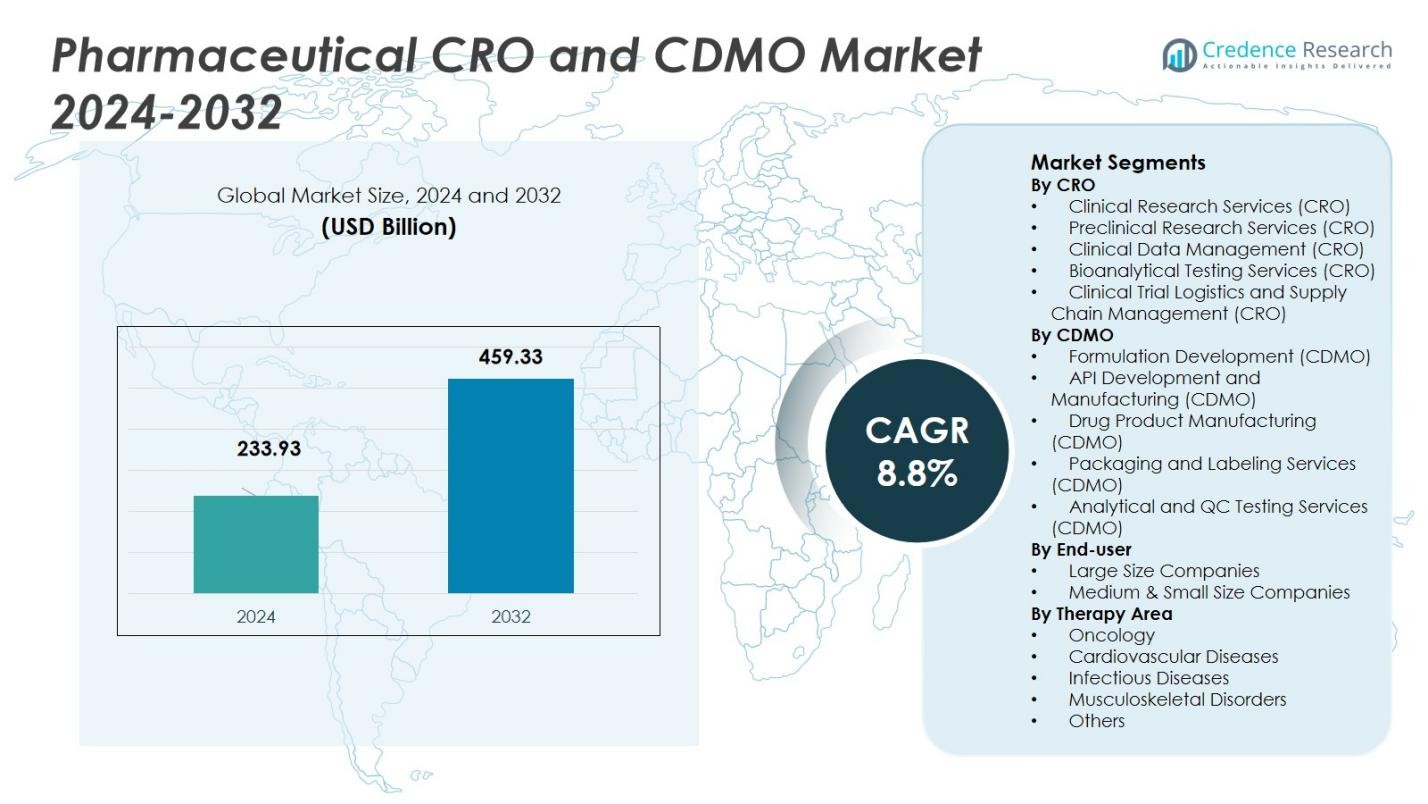

The Pharmaceutical CRO and CDMO Market size was valued at USD 233.93 Billion in 2024 and is anticipated to reach USD 459.33 Billion by 2032, at a CAGR of 8.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pharmaceutical CRO and CDMO Market Size 2024 |

USD 233.93 Billion |

| Pharmaceutical CRO and CDMO Market, CAGR |

8.8% |

| Pharmaceutical CRO and CDMO Market Size 2032 |

USD 459.33 Billion |

Pharmaceutical CRO and CDMO Market is shaped by top-tier players such as Catalent Inc., Lonza Group, Boehringer Ingelheim Group, Pfizer CentreSource, and Recipharm AB, among others. These firms leverage extensive global networks, diversified service portfolios across drug development and manufacturing, and strong quality‑compliance capabilities to capture significant market shares. The region leading this global market is North America with 38.59% market share in 2024, followed by Asia‑Pacific with 37.90%. These regions dominate because of robust pharmaceutical infrastructure, high outsourcing demand, regulatory maturity in North America, and cost‑effective manufacturing ecosystems plus growing pharmaceutical demand across APAC.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Pharmaceutical CRO and CDMO Market size was valued at USD 233.93 Billion in 2024 and is projected to reach USD 459.33 Billion by 2032, growing at a CAGR of 8.8% during the forecast period.

- Key drivers of market growth include increasing pharmaceutical R&D investments, a growing biologics market, and rising demand for regulatory compliance and high-quality drug development services.

- The adoption of digital technologies such as AI and data analytics is transforming clinical trials and manufacturing processes, offering growth opportunities in efficiency and decision-making.

- North America holds the largest market share at 38.59%, followed by Asia-Pacific at 37.90%. These regions benefit from strong pharmaceutical infrastructure and favorable outsourcing conditions, driving market expansion.

- Key restraints include intellectual property protection concerns and a shortage of skilled workforce, which could limit growth and operational scalability in the pharmaceutical CRO and CDMO sector.

Market Segmentation Analysis:

Market Segmentation Analysis:

By CRO (Clinical Research Organization)

In the Pharmaceutical CRO market, the dominant segment is Clinical Research Services (CRO), which holds a 40% market share in 2024. This segment is driven by the growing demand for outsourced clinical trials due to the high costs and complexity of drug development. CROs support pharmaceutical companies by managing clinical trials, including patient recruitment, monitoring, and regulatory compliance, thereby accelerating the drug development process. The advancement of clinical trial technologies and an increasing number of new therapies and drug developments further propel the growth of this segment.

- For instance, Novartis incorporates AI to improve trial feasibility and site selection, streamlining processes and accelerating timelines through adaptive trial protocols for autoimmune diseases.

By CDMO (Contract Development and Manufacturing Organization)

In the Pharmaceutical CDMO market, the dominant segment is API Development and Manufacturing (CDMO), which holds a 35% share in 2024. This segment benefits from the increasing outsourcing of active pharmaceutical ingredient (API) production as companies seek to minimize operational costs while maintaining high-quality standards. The growing demand for complex generics, biologics, and personalized medicines significantly contributes to the growth of this segment. The rising need for cost-efficient, high-quality manufacturing solutions is driving investment in API manufacturing services, enhancing this segment’s dominance.

- For instance, Thermo Fisher Scientific expanded its API manufacturing capabilities by acquiring a specialized European CDMO to boost production of high-potency APIs and peptides, reflecting the growing demand for complex biologics.

By End-User

In the Pharmaceutical CRO and CDMO market, large-size companies represent the dominant end-user segment, commanding 60% of the total market share in 2024. This dominance is due to the extensive resources and infrastructure that large companies possess, enabling them to outsource their research, development, and manufacturing processes on a large scale. Additionally, these companies benefit from the flexibility and cost-efficiency of CRO and CDMO services, which allow them to focus on core activities while ensuring high-quality product development and regulatory compliance. The segment’s growth is supported by increasing collaborations with specialized CROs and CDMOs to streamline production and accelerate time-to-market.

Key Growth Drivers

Increasing R&D Investment in Pharmaceuticals

One of the major growth drivers in the Pharmaceutical CRO and CDMO market is the rising investment in pharmaceutical research and development (R&D). Pharmaceutical companies are increasingly outsourcing R&D processes to CROs and CDMOs due to the high cost and complexity of in-house operations. This trend is fueled by the growing demand for new drug development, particularly in biologics, personalized medicine, and rare diseases. As drug development becomes more intricate, pharmaceutical companies are turning to specialized partners for cost-effective and efficient solutions to accelerate the R&D process.

- For instance, AstraZeneca collaborates extensively with CROs to accelerate clinical trials for its biologics portfolio, significantly shortening development timelines.

Expanding Biologics Market

The rapid growth of biologics and biosimilars is another key driver for the Pharmaceutical CRO and CDMO market. Biologics require specialized manufacturing capabilities and strict quality controls, which has led to a surge in outsourcing to CDMOs with expertise in biologics production. As more biopharmaceutical companies invest in developing complex biologics, such as monoclonal antibodies and gene therapies, the demand for tailored contract services continues to rise. This shift towards biologics significantly contributes to the growing market for CRO and CDMO services, with companies seeking specialized partners to meet regulatory and production requirements.

- For instance, AGC Biologics has expanded its mammalian cell culture manufacturing facilities in Copenhagen, Denmark, and Boulder, Colorado, to meet growing demand for protein-based biologics and advanced therapies, offering scalable commercial manufacturing capabilities.

Regulatory and Compliance Demands

Stringent regulatory requirements across global markets are pushing pharmaceutical companies to rely more on CROs and CDMOs for compliance-related services. Adherence to evolving regulations, such as Good Manufacturing Practices (GMP) and Good Clinical Practices (GCP), requires significant investment in infrastructure and expertise. By outsourcing these services, pharmaceutical companies can ensure compliance with international standards while mitigating risk and reducing operational costs. As regulatory frameworks become more complex, the demand for expert CRO and CDMO services to handle compliance is expected to increase, further driving market growth.

Key Trends & Opportunities

Adoption of Digital Technologies

The adoption of digital technologies, including artificial intelligence (AI), machine learning (ML), and data analytics, is revolutionizing the Pharmaceutical CRO and CDMO market. These technologies enable more efficient clinical trials, faster data analysis, and improved decision-making in drug development processes. CROs are utilizing AI to optimize clinical trial designs and patient recruitment, while CDMOs are incorporating digital platforms to streamline manufacturing processes and quality control. The increasing use of these technologies presents opportunities for CROs and CDMOs to enhance their service offerings and drive growth in the market.

- For instance, Lambda CRO employs predictive AI models and analytics on real-world data to accelerate disease understanding and guide site selection. These tools support innovative clinical study designs by enhancing patient matching and trial efficiency in preclinical and design phases.

Outsourcing to Emerging Markets

Emerging markets, particularly in Asia-Pacific, Latin America, and Eastern Europe, present significant opportunities for growth in the Pharmaceutical CRO and CDMO market. With lower labor costs, regulatory improvements, and increasing access to skilled talent, these regions have become attractive outsourcing destinations for pharmaceutical companies. CROs and CDMOs are expanding their presence in these markets to capitalize on cost efficiencies and gain access to new opportunities. The growing demand for contract services in emerging markets offers significant growth potential for companies operating in these regions.

- For instance, Indian CROs and CDMOs like Syngene and Dr. Reddy’s Laboratories are expanding their drug development and regulatory services driven by government initiatives such as Make in India and R&D incentives.

Key Challenges

Intellectual Property (IP) Protection Risks

A major challenge in the Pharmaceutical CRO and CDMO market is the risk to intellectual property (IP) when outsourcing critical research and manufacturing processes. Pharmaceutical companies are often hesitant to share proprietary information with external partners due to the potential for IP theft or misuse. This risk is heightened when working with global partners in regions with varying levels of IP protection. To mitigate these concerns, CROs and CDMOs must implement robust security measures and legally binding agreements to protect sensitive information, which can be complex and costly.

Shortage of Skilled Workforce

The Pharmaceutical CRO and CDMO market faces a shortage of highly skilled professionals, particularly in specialized areas such as biologics, gene therapies, and complex manufacturing. As the demand for advanced R&D and production capabilities grows, there is an increasing need for qualified scientists, technicians, and regulatory experts. The talent shortage presents a challenge for CROs and CDMOs to scale operations and maintain the quality of services. Companies must invest in training, recruitment, and retention strategies to overcome this challenge and meet the growing demand for specialized services.

Regional Analysis

North America

North America remains the largest region in the pharmaceutical CRO and CDMO market, holding 38.59% of the global market share in 2024. The region benefits from its highly developed pharmaceutical infrastructure, established regulatory environment, and concentration of large pharma and biotech firms. These conditions foster extensive outsourcing of both R&D and manufacturing to CROs and CDMOs. Strong demand for complex APIs, biologics, and specialized drug products in the U.S. also fuels the region’s demand for contract services, underpinning stable growth and solidifying its leadership position globally.

Asia‑Pacific

The Asia‑Pacific region captured 37.90% of the global pharmaceutical CDMO market share in 2024. Low-cost manufacturing environment, availability of skilled labor, and growing capacity in both API production and finished drug manufacturing attract global outsourcing. Countries such as China and India offer significant cost and scale advantages, leading to rising investments from multinational pharmaceutical companies. Combined with increasing domestic demand for affordable medicines and favorable government policies, Asia‑Pacific emerges as a critical hub for global drug development and manufacturing.

Europe

Europe holds 15.24% of the global pharmaceutical CRO and CDMO market share in 2024. The region is supported by its regulatory rigor, scientific expertise, and proximity to many pharmaceutical headquarters. European CDMOs especially in key markets such as Germany are specialized in high-quality API manufacturing, biologics, and advanced formulations, aligning with stringent EU regulatory standards and high compliance requirements. As demand grows for complex therapies, cell and gene therapies, and high-potency APIs in Europe, CRO and CDMO services remain essential, maintaining the region’s relevance despite increasing competition from lower‑cost regions.

Latin America

Latin America holds 4.87% of the global market share in the pharmaceutical CRO and CDMO industry in 2024. The region represents a growing opportunity driven by rising demand for cost-effective drug development and manufacturing solutions. The region benefits from growing healthcare infrastructure, expanding generics and biosimilars production, and increasing interest from multinational pharmaceutical companies in leveraging competitive operating costs relative to North America and Europe. As governments push for greater access to affordable medicines and local production, Latin America becomes increasingly attractive for outsourcing both small-molecule APIs and finished-dose drug products.

Middle East & Africa (MEA)

The Middle East & Africa (MEA) region holds 3.40% of the global pharmaceutical CRO and CDMO market share in 2024. The region is emerging as a niche but growing market, supported by improving regulatory frameworks, growing disease burden, and rising demand for affordable generics and biologics. Multinational drugmakers increasingly explore partnerships with regional CDMOs to tap into cost efficiencies and regional demand. While absolute share remains lower than leading regions, MEA presents an opportunity for growth as infrastructure and regulatory standards continue to evolve.

Market Segmentations:

By CRO

- Clinical Research Services (CRO)

- Preclinical Research Services (CRO)

- Clinical Data Management (CRO)

- Bioanalytical Testing Services (CRO)

- Clinical Trial Logistics and Supply Chain Management (CRO)

By CDMO

- Formulation Development (CDMO)

- API Development and Manufacturing (CDMO)

- Drug Product Manufacturing (CDMO)

- Packaging and Labeling Services (CDMO)

- Analytical and QC Testing Services (CDMO)

By End-user

- Large Size Companies

- Medium & Small Size Companies

By Therapy Area

- Oncology

- Cardiovascular Diseases

- Infectious Diseases

- Musculoskeletal Disorders

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Pharmaceutical CRO and CDMO market is highly competitive, with key players such as Catalent Inc., Lonza Group, Boehringer Ingelheim, Pfizer CentreSource, and Recipharm AB leading the market in 2024. These companies dominate due to their strong global presence, extensive service portfolios, and robust capabilities in drug development, manufacturing, and packaging. Catalent Inc. and Lonza Group are particularly prominent in biologics production and specialized drug delivery systems, while Boehringer Ingelheim and Pfizer CentreSource focus on high-quality contract manufacturing for both small-molecule and biologic drugs. Additionally, companies like Recipharm AB and Patheon (Thermo Fisher Scientific) leverage their expansive network of facilities to offer cost-effective services, appealing to large pharmaceutical and biotechnology firms. The competitive landscape is also shaped by increasing mergers and acquisitions, strategic partnerships, and technological advancements in data management and production automation, allowing companies to strengthen their service offerings and meet the evolving demands of the pharmaceutical industry. As the market grows, the emphasis on regulatory compliance and quality assurance remains critical.

Key Player Analysis

- Aenova Holding GmbH

- Boehringer Ingelheim Group

- Pfizer CentreSource

- Baxter Biopharma Solutions (Baxter International Inc.)

- Lonza Group

- Jubilant Pharmova Ltd

- Catalent Inc.

- Famar SA

- Recipharm AB

- Patheon Inc. (Thermo Fisher Scientific Inc.)

Recent Developments

- In September 2025, Symeres acquired DGr Pharma, a CRO/CDMO specialising in small‑molecule drug discovery and development.

- In February 2025, Ardena completed the acquisition of a drug‑product manufacturing facility from Catalent Inc. in Somerset, NJ, thereby expanding its bioanalytical and manufacturing services footprint in North America.

- In June 2025, OneSource Speciality Pharma Limited announced a collaboration with Xbrane Biopharma AB to manufacture Xbrane’s biosimilar portfolio.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on CRO, CDMO, End User, Therapy Area and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Pharmaceutical CRO and CDMO market is expected to experience continued growth due to increasing outsourcing by pharmaceutical companies for drug development and manufacturing.

- Demand for biologics and biosimilars will drive significant expansion, with CROs and CDMOs specializing in complex formulations and advanced manufacturing processes.

- The rise of personalized medicine and gene therapies will create new opportunities for CROs and CDMOs to provide tailored services, such as gene editing and cell-based therapies.

- Increasing regulatory complexity across global markets will lead to a higher need for specialized CRO and CDMO services to ensure compliance with local and international standards.

- Technological advancements in digitalization, AI, and automation will revolutionize clinical trials and manufacturing processes, improving efficiency and reducing costs.

- The demand for flexible manufacturing and rapid turnaround times will continue to grow, encouraging CROs and CDMOs to invest in scalable and adaptable production capabilities.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will offer significant growth opportunities due to cost advantages and expanding healthcare infrastructure.

- Strategic mergers and acquisitions will increase as companies seek to strengthen their service offerings, expand geographic reach, and diversify their capabilities.

- The need for high-quality, high-potency API manufacturing will remain strong, with CDMOs focusing on high standards for safety, purity, and compliance.

- Sustainability initiatives and eco-friendly practices will become increasingly important, with companies investing in green technologies and reducing their carbon footprint in manufacturing operations.

Market Segmentation Analysis:

Market Segmentation Analysis: