Market Overview

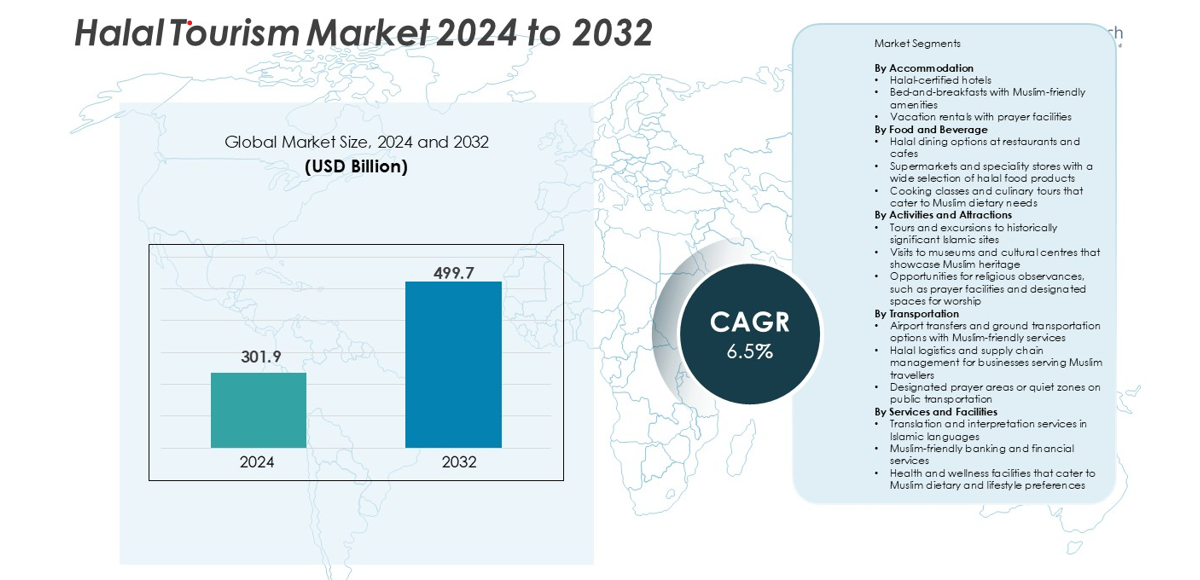

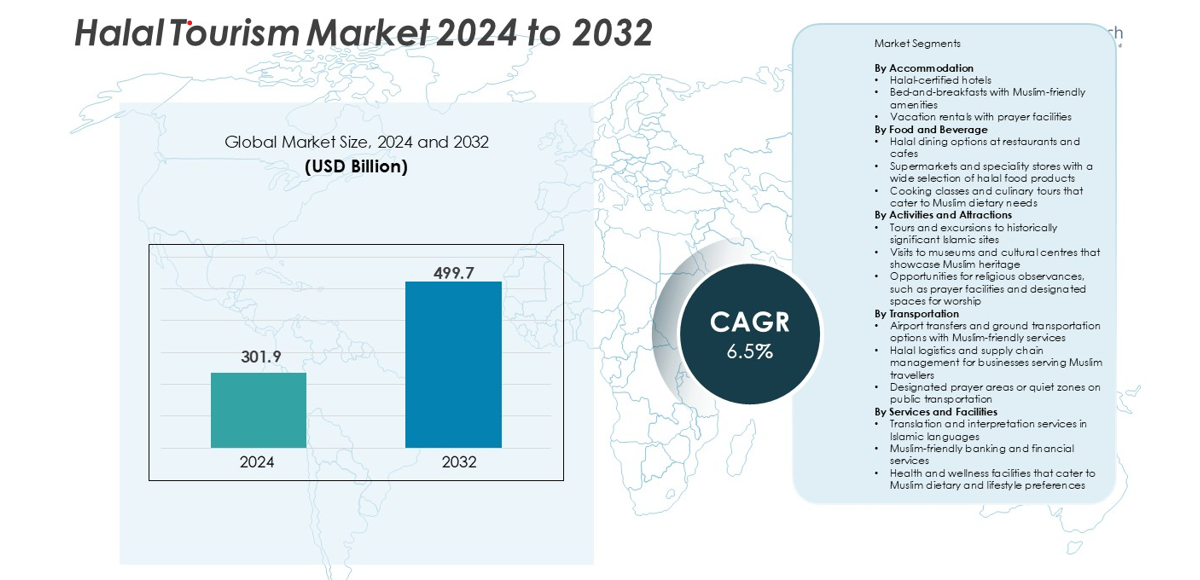

The Halal Tourism Market was valued at USD 301.9 billion in 2024 and is projected to reach USD 499.7 billion by 2032, growing at a CAGR of 6.5% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Halal Tourism Market Size 2024 |

USD 301.9 billion |

| Halal Tourism Market, CAGR |

6.5% |

| Halal Tourism Market Size 2032 |

USD 499.7 billion |

The Halal Tourism market is dominated by key players such as CrescentRating and Mastercard, HalalTrip, Expedia Group, Tripadvisor, Google Travel, Airbnb, and Salam Standard. These companies lead through digital innovation, halal certification systems, and partnerships with global tourism boards to enhance Muslim-friendly travel experiences. CrescentRating and HalalTrip specialize in rating standards and faith-based travel solutions, while Expedia and Tripadvisor integrate halal travel filters to attract a wider audience. Regionally, Asia Pacific held the largest share of 43% in 2024, supported by strong tourism infrastructure in Malaysia, Indonesia, and Thailand. Europe followed with 24%, driven by heritage tourism and inclusive hospitality offerings.

Market Insights

- The Halal Tourism market was valued at USD 301.9 billion in 2024 and is projected to reach USD 499.7 billion by 2032, growing at a CAGR of 6.5% during the forecast period.

- The market growth is driven by increasing Muslim population, higher travel spending, and expanding halal-certified infrastructure in accommodation, food, and cultural tourism.

- Key trends include digital transformation through halal-focused travel apps, AI-based booking systems, and rising interest in heritage and experiential Islamic travel.

- Major players such as CrescentRating and Mastercard, HalalTrip, Expedia Group, Tripadvisor, and Salam Standard dominate through innovation, partnerships, and global certification programs.

- Asia Pacific held 43% of the market in 2024, followed by Europe with 24% and North America at 17%; by segment, halal-certified hotels and Islamic heritage tours led the market, supported by strong regional investments and government-led halal tourism initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Accommodation

The accommodation segment in the Halal Tourism market is led by halal-certified hotels, which held over 45% market share in 2024. These hotels dominate due to their adherence to Islamic principles, offering halal food, prayer rooms, and non-alcoholic environments. The growing presence of Muslim travelers in countries like Malaysia, UAE, and Turkey drives the demand for certified stays. Rising awareness among global hotel chains, including Marriott and Hilton, to obtain halal certifications further supports this growth. Additionally, increasing online travel platforms promoting Muslim-friendly stays strengthen this segment’s dominance.

- For instance, the hotel’s dining outlets, including the main kitchen, hold halal certification from JAKIM, the Department of Islamic Development Malaysia. This ensures that the food served complies with halal standards.

By Food and Beverage:

The halal dining options at restaurants and cafes segment accounted for about 48% market share in 2024, making it the largest within food and beverage. The availability of halal-certified menus and ingredients attracts Muslim travelers seeking dietary assurance during trips. Expanding international halal certification networks and the rise of halal culinary tourism in regions like Southeast Asia and the Middle East drive growth. Furthermore, global food chains such as Subway, Nando’s, and KFC offering halal-certified outlets enhance accessibility and trust among Muslim tourists.

- For instance, in 2024, KFC Malaysia operated over 600 halal-certified restaurants, a number impacted by temporary closures earlier in the year. The restaurants are audited by JAKIM to ensure compliance with Islamic dietary standards.

By Activities and Attractions:

Within this category, tours and excursions to historically significant Islamic sites captured around 50% market share in 2024, emerging as the dominant sub-segment. Popular destinations such as Mecca, Medina, Istanbul, and Jerusalem attract millions of Muslim travelers annually. Rising interest in spiritual and heritage-based travel experiences fuels this segment’s expansion. Governments in Muslim-majority countries actively promote faith-based tourism through infrastructure investments and cultural programs. Additionally, improved accessibility, guided tours, and digital booking platforms encourage more participation in religious and cultural excursions.

Key Growth Drivers

Rising Muslim Travel Population and Spending Power

The rapid growth of the global Muslim population, projected to reach 2.2 billion by 2030, strongly supports the halal tourism market. Increasing disposable incomes among Muslim travelers in regions such as the Middle East, Southeast Asia, and Europe have significantly boosted international travel demand. Countries like Indonesia, Malaysia, and Saudi Arabia are investing in faith-based tourism infrastructure to cater to this expanding demographic. Additionally, the younger Muslim generation is more inclined to explore new destinations while maintaining religious compliance, driving the need for halal-certified accommodations, food, and leisure activities.

- For instance, in 2024, Saudi Arabia welcomed a record 16.9 million Umrah visitors, a milestone attributed to its Vision 2030 initiatives, which include allowing all visa types to perform Umrah and utilizing the Nusuk digital platform.

Government Initiatives and Certification Programs

Government-led initiatives and halal certification programs play a key role in shaping the market landscape. Countries such as Malaysia, the UAE, and Indonesia have introduced dedicated halal tourism policies and certification bodies to ensure compliance with Islamic standards. These initiatives improve destination credibility and promote international tourism partnerships. For instance, Malaysia’s Halal Tourism Master Plan has strengthened its position as a leading Muslim-friendly destination. Likewise, governments are investing in training hospitality providers to cater to Muslim travelers, ensuring consistent quality standards across accommodations, food services, and cultural experiences.

- For instance, the UAE’s Department of Culture and Tourism trained over 2,500 hospitality professionals in 2024 under its Muslim-Friendly Tourism Certification Program, while Malaysia’s Islamic Development Department (JAKIM) certified more than 15,000 tourism-related businesses for halal compliance by the end of the same year.

Expansion of Digital Platforms and Travel Apps

Digitalization is transforming how Muslim travelers plan and experience their trips. The rise of halal-focused travel apps, booking platforms, and AI-based itinerary planners has made it easier to locate halal restaurants, prayer spaces, and Muslim-friendly hotels. Platforms such as HalalBooking and Tripfez are expanding their global presence by offering verified halal-friendly options. Social media influencers and digital marketing also amplify awareness of Muslim-friendly destinations. The integration of online reviews, GPS-enabled maps, and virtual tours enhances travel convenience and boosts consumer confidence, significantly contributing to the market’s sustained growth.

Key Trends & Opportunities

Growing Preference for Experiential and Cultural Travel

Modern Muslim travelers increasingly seek authentic cultural and spiritual experiences beyond traditional pilgrimage tourism. Visits to historical Islamic landmarks, museums, and community-based cultural programs are becoming highly popular. Countries such as Turkey, Jordan, and Uzbekistan are leveraging their Islamic heritage to attract niche cultural tourists. The growing interest in experiential travel aligns with the demand for personalized itineraries that combine religious observance with leisure, wellness, and education. This trend presents opportunities for tour operators to design customized, faith-compliant packages that highlight heritage, local cuisine, and sustainable travel practices.

- For instance, Turkey’s Ministry of Culture and Tourism recorded over 5.2 million visitors to Islamic heritage destinations in 2024, including sites like the Blue Mosque and Mevlana Museum

Expansion of Halal Hospitality and Cross-Regional Collaboration

The growing collaboration between Muslim and non-Muslim countries is broadening halal tourism opportunities. Non-Islamic destinations like Japan, South Korea, and the UK are increasingly introducing halal-certified restaurants, prayer facilities, and modest travel options to attract Muslim visitors. Hotel chains and airlines are also expanding halal services, including prayer kits and in-flight halal meals. Industry partnerships between tourism boards and certification bodies are helping standardize halal tourism standards globally. This collaboration not only enhances accessibility for Muslim travelers but also opens new revenue streams for emerging destinations seeking to diversify their tourism base.

Key Challenges

Lack of Global Standardization in Halal Certification

One of the major challenges in the halal tourism market is the absence of a unified global certification framework. Different countries follow varying halal standards, creating confusion among travelers and service providers. For instance, what qualifies as halal-certified in Malaysia may differ from standards applied in Turkey or the UAE. This inconsistency affects traveler trust and limits cross-border partnerships. Additionally, small and medium-sized hospitality businesses face financial and administrative challenges in obtaining multiple certifications. Addressing this issue requires greater international cooperation and recognition of common halal tourism guidelines.

Limited Awareness and Infrastructure in Non-Muslim Countries

While awareness of halal tourism is rising globally, non-Muslim-majority destinations still face infrastructure and knowledge gaps. Many hotels, airports, and tourist sites lack prayer facilities, halal dining options, or Muslim-friendly amenities. Additionally, tourism operators often have limited understanding of Islamic cultural sensitivities, which can deter Muslim travelers. Countries like Japan and Thailand have made progress in recent years, but others still lag behind. Overcoming this challenge requires targeted training programs, partnerships with halal certifying agencies, and public-private initiatives to develop inclusive tourism environments that meet Muslim travelers’ expectations.

Regional Analysis

North America

North America accounted for 17% of the global halal tourism market in 2024, driven by growing Muslim populations in the U.S. and Canada. Major cities such as New York, Toronto, and Los Angeles are expanding halal-certified dining, accommodations, and cultural events. Governments and private operators are promoting Muslim-friendly travel services to attract inbound tourists from the Middle East and Southeast Asia. Increasing investments in halal-certified hotels and airport prayer facilities are enhancing accessibility. The region’s inclusivity, digital tourism platforms, and strong infrastructure further support steady market expansion through 2032.

Europe

Europe captured around 24% market share in 2024, supported by its deep Islamic heritage and established Muslim communities. Countries such as the United Kingdom, France, Germany, and Spain are developing halal-certified restaurants, modest fashion hubs, and cultural tours. The growing appeal of destinations like Bosnia, Turkey, and Italy for Islamic heritage tourism is fueling demand. European tourism boards are collaborating with halal certifying organizations to enhance trust among Muslim travelers. The region’s advanced infrastructure and multicultural environment position Europe as a leading destination for both faith-based and leisure halal travel.

Asia Pacific

Asia Pacific dominated the market with a 43% share in 2024, driven by strong Muslim populations in Indonesia, Malaysia, and India. Government-led initiatives promoting halal tourism, such as Malaysia’s Halal Tourism Master Plan, have elevated the region’s global standing. Popular destinations including Thailand, Japan, and Singapore are enhancing Muslim-friendly hospitality through certified dining, prayer facilities, and digital booking platforms. The combination of religious, cultural, and leisure offerings continues to attract both domestic and international Muslim tourists, solidifying Asia Pacific as the primary growth engine of the global halal tourism market.

Middle East & Africa

The Middle East and Africa region held 13% market share in 2024, primarily led by Saudi Arabia and the UAE. Pilgrimage tourism to Mecca and Medina remains a dominant contributor, while Dubai and Abu Dhabi continue to develop luxury halal travel experiences. North African nations such as Morocco and Egypt are promoting Islamic heritage and cultural tourism. Growing infrastructure investments, visa reforms, and the introduction of smart pilgrimage systems support market expansion. Increasing collaboration with international hospitality brands is further strengthening the region’s appeal to high-income Muslim travelers.

Latin America

Latin America accounted for about 3% of the global halal tourism market in 2024, representing a small but growing segment. Countries like Brazil, Argentina, and Mexico are seeing rising awareness of Muslim-friendly travel services. Expansion of halal-certified restaurants and cultural exchange programs is fostering inclusivity. Brazil’s large food export industry also supports halal supply chains, indirectly aiding tourism. Although infrastructure remains limited, collaborations with Middle Eastern nations and global tourism organizations are expected to accelerate development. The region’s potential lies in targeting niche Muslim travelers seeking cultural diversity and natural attractions.

Market Segmentations:

By Accommodation

- Halal-certified hotels

- Bed-and-breakfasts with Muslim-friendly amenities

- Vacation rentals with prayer facilities

By Food and Beverage

- Halal dining options at restaurants and cafes

- Supermarkets and speciality stores with a wide selection of halal food products

- Cooking classes and culinary tours that cater to Muslim dietary needs

By Activities and Attractions

- Tours and excursions to historically significant Islamic sites

- Visits to museums and cultural centres that showcase Muslim heritage

- Opportunities for religious observances, such as prayer facilities and designated spaces for worship

By Transportation

- Airport transfers and ground transportation options with Muslim-friendly services

- Halal logistics and supply chain management for businesses serving Muslim travellers

- Designated prayer areas or quiet zones on public transportation

By Services and Facilities

- Translation and interpretation services in Islamic languages

- Muslim-friendly banking and financial services

- Health and wellness facilities that cater to Muslim dietary and lifestyle preferences

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the Halal Tourism market is characterized by a mix of specialized halal-focused platforms and global travel giants expanding into Muslim-friendly services. Companies such as CrescentRating and Mastercard, HalalTrip, and Salam Standard lead with advanced rating systems, certification programs, and digital tools that enhance halal travel experiences. Global players like Expedia Group, Tripadvisor, Google Travel, and Airbnb are integrating halal filters and faith-based options to capture growing demand. Firms such as DinarStandard and Muslim 2 Travel focus on market intelligence and industry benchmarking. Meanwhile, GetYourGuide and Viator offer curated Islamic heritage tours and cultural experiences. Strategic partnerships, technological integration, and destination certification remain key competitive strategies. Increasing collaboration between travel platforms and hospitality providers continues to strengthen market positioning, while innovation in digital booking, AI recommendations, and customized faith-based itineraries defines the evolving competition across regions.

Key Player Analysis

- Crescent Rating and Mastercard

- Muslim 2 Travel

- Expedia Group

- Tripadvisor

- HalalTrip

- Salam Standard

- Viator

- DinarStandard

- Airbnb

- GetYourGuide

- Google Travel

Recent Developments

- In January 2025, HalalBooking Ltd launched a new partnership with international airline carriers offering exclusive halal-friendly flight options. The services include halal meal services, dedicated prayer spaces, and family-focused services in the flight. This new offer was created to ensure that Muslim travelers enjoy more comfort and convenience during their travels. The integration of flight services with hotel bookings and local tours will give a full halal travel experience, and it is where HalalBooking Ltd stands ahead in the space of halal tourism.

- In December 2024, Rooh Travel Limited added halal eco-tourism packages to its services. In response to the growing trend of conscious travel, the company developed new offers: halal eco-friendly retreats offered in Indonesia and Sri Lanka. The respective retreats are to be provided with halal-friendly accommodations bearing emphasis on sustainability as well as preservation of cultures to attract in such a manner eco-conscious Muslim travelers. Reviews for the new product have been positive, exceeding the booked amount for 2025.

- In September 2024, Carisa Travel Group recently introduced a new travel package specifically targeting honeymooning Muslims. The “Halal Romance” travel package features luxurious, private stays in halal-friendly resorts, candlelit dinners accompanied by halal-certified meals, and sightseeing tours that are Islamic-practice-insensitive. The group aims to change its path as it branches out from traditional tourism towards this niche avenue. Halal honeymoon tourism is a growing niche due to 10% growth in the number of bookings, especially in 2025.

- In August 2024, Halal Tours unveiled a series of guided halal tours in Europe, focusing on historical Islamic sites in Spain, Turkey, and Bosnia. Such tours offer tailored itineraries to Muslim travelers, including visiting mosques, historical landmarks, and dining experiences in restaurants that carry the halal certification. Its innovative approach has been to integrate cultural immersion with halal hospitality for travelers looking for heritage combined with halal-friendly travel solutions. This launch is projected to raise the number of customers to Halal Tours by 20% at the end of 2025.

- In July 2024, Tourism Malaysia has spearheaded a major campaign that addresses the halal-conscious traveler. The “Malaysia: Muslim-Friendly Travel Destination” campaign will have its new website and other promotional materials in multiple languages to show that the country offers extensive infrastructure of halal-friendly hotels, restaurants, and tourist attractions. Through cooperation with some of the most important global travel agencies, Malaysia is positioning itself as the largest halal tourism destination in Southeast Asia. This initiative aims to increase Malaysia’s share of the halal tourism market by 15% by 2025.

- In March 2024, HalalBooking recently developed an AI-enabled platform to enhance customers’ travel experiences. It features halal-friendly recommendations, where users can customize their itinerary according to their dietary, prayer, and accommodation demands. The system proves to be smart since its algorithms boost the overall experience of traveling among Muslims while providing superior accuracy in offering and supplying the right halal-certification information for hotels, restaurants, and destinations, positioning the company as a more tech-savvy player within the sector of halal tourism to respond to the increasingly personalized needs of travelers.

- In February 2024, The Al Habtoor Group expanded its portfolio with the opening of a new luxury resort for Muslim only travelers. The Dubai-based property has restaurants, prayer rooms, and family-friendly amenities. On top of that, the group opened up its selection of halal wellness and spa services that included private therapy sessions to ensure Muslim guests feel comfortable and relaxed. This expansion is in line with the strategy of the group to diversify its offerings and to tap into the rapidly growing halal tourism market in the UAE.

Report Coverage

The research report offers an in-depth analysis based on Accommodation, Food and Beverage, Activities and Attractions, Transportation, Services and Facilities and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Halal Tourism market will continue expanding due to rising global Muslim travel demand.

- Digital travel platforms will increasingly integrate halal-friendly filters and booking options.

- Governments will invest more in halal-certified infrastructure and tourism promotion.

- Muslim-friendly hospitality standards will become globally recognized and unified.

- Non-Muslim-majority countries will expand halal offerings to attract Muslim tourists.

- AI-driven travel planning tools will enhance personalized halal travel experiences.

- Faith-based and cultural tourism will merge with wellness and eco-tourism trends.

- Strategic collaborations between travel platforms and certification bodies will increase.

- The rise of Gen Z Muslim travelers will shape modern, tech-focused halal travel.

- Sustainable and ethical travel practices will gain greater importance in halal tourism development.