Market Overview

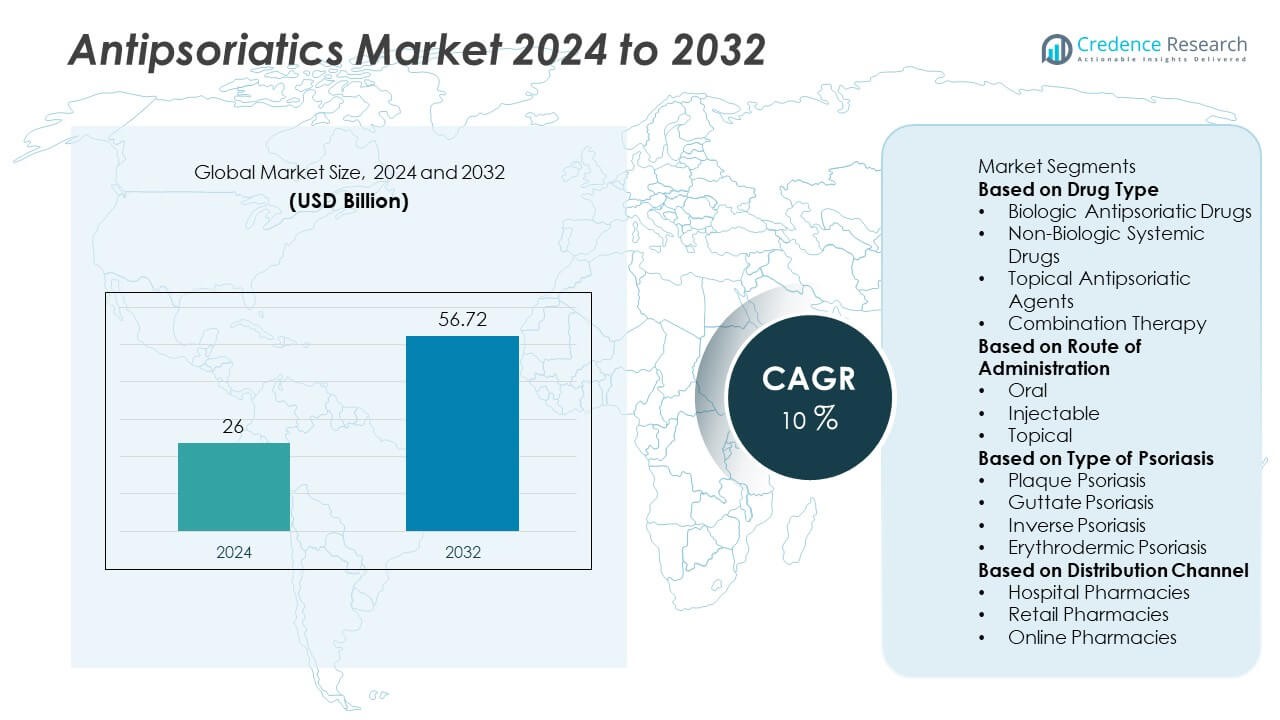

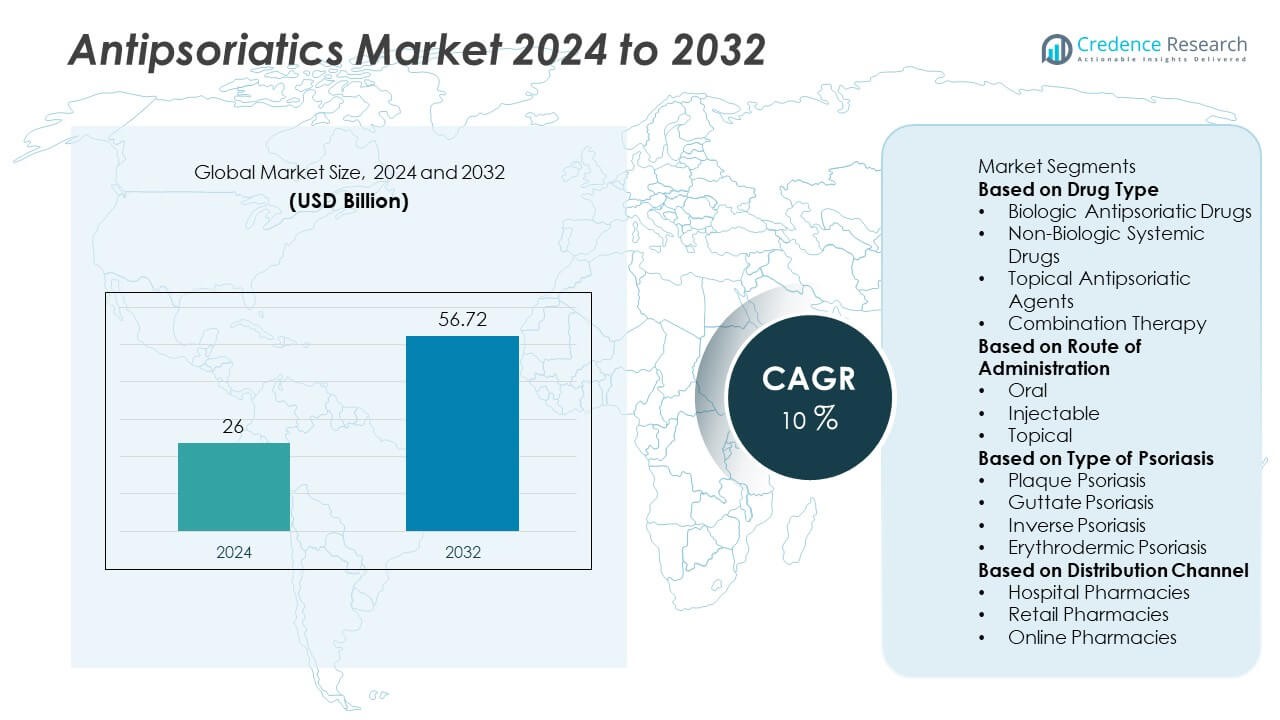

The Antipsoriatics Market was valued at USD 26 billion in 2024 and is projected to reach USD 56.72 billion by 2032, growing at a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antipsoriatics Market Size 2024 |

USD 26 Billion |

| Antipsoriatics Market, CAGR |

10% |

| Antipsoriatics Market Size 2032 |

USD 56.72 Billion |

The antipsoriatics market is dominated by major players including Novartis AG, AbbVie Inc., Amgen Inc., Johnson & Johnson Services, Inc., Pfizer Inc., Eli Lilly and Company, Bristol-Myers Squibb Company, UCB S.A., Sun Pharmaceutical Industries Ltd., and Leo Pharma A/S. These companies lead through extensive product portfolios in biologics, topical agents, and systemic therapies targeting psoriasis. North America holds the largest share at 38.5% in 2024, supported by advanced healthcare systems and high adoption of biologic drugs. Europe follows with a 31.2% share, driven by strong R&D investments, while Asia-Pacific accounts for 22.7%, emerging rapidly due to expanding healthcare access and growing awareness of chronic skin diseases.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The antipsoriatics market was valued at USD 26 billion in 2024 and is projected to reach USD 56.72 billion by 2032, growing at a CAGR of 10% during the forecast period.

- Rising psoriasis prevalence and increasing adoption of biologic and biosimilar therapies are driving market growth, with biologic drugs leading the market at a 56.8% share due to their superior efficacy.

- Key trends include the growing shift toward personalized medicine, expansion of biosimilar portfolios, and increased R&D investments in immunomodulators and targeted small-molecule drugs.

- Major players such as Novartis, AbbVie, Johnson & Johnson, and Amgen dominate through strong biologic pipelines, strategic partnerships, and global distribution networks.

- North America leads with a 38.5% share, followed by Europe at 31.2%, while Asia-Pacific holds 22.7% and is expected to grow fastest, driven by rising awareness, healthcare investment, and improved access to dermatological care.

Market Segmentation Analysis:

By Drug Type

The biologic antipsoriatic drugs segment dominates the market, holding a 56.8% share in 2024, driven by their high efficacy and targeted action in moderate to severe psoriasis. Biologics such as TNF inhibitors, IL-17 inhibitors, and IL-23 inhibitors are transforming treatment outcomes by offering long-term disease control with fewer side effects. Growing physician preference for biologics and increasing availability of biosimilars are further boosting adoption. Non-biologic systemic drugs and topical agents continue to serve as effective first-line options for mild cases, while combination therapies gain traction for enhanced clinical effectiveness and patient adherence.

- For instance, AbbVie’s Humira (adalimumab) generated over $21 billion in annual sales globally before extensive US biosimilar entry, while Novartis’ Cosentyx (secukinumab) treated more than 1 million patients worldwide across multiple indications (including psoriasis) through 2023, supported by continuous data on sustained PASI 90 response rates.

By Route of Administration

The injectable segment leads the antipsoriatics market with a 49.2% share in 2024, owing to the dominance of biologic drugs administered via subcutaneous or intravenous routes. This segment benefits from improved patient outcomes and sustained remission rates associated with targeted injectable treatments. Pharmaceutical innovation has led to extended dosing intervals, improving patient compliance. The oral route remains significant due to the availability of small-molecule inhibitors, while topical administration retains importance in mild psoriasis cases where localized therapy is sufficient, supported by widespread over-the-counter and prescription-based usage.

- For instance, Johnson & Johnson’s Stelara (ustekinumab) achieved dosing intervals of every 12 weeks and recorded over 1.9 million patient-years of use globally, while Amgen’s Enbrel (etanercept) surpassed 20 million patient-years of global exposure, demonstrating long-term safety and efficacy in plaque psoriasis management.

By Type of Psoriasis

The plaque psoriasis segment dominates the market, accounting for a 61.3% share in 2024, as it represents the most prevalent form of the disease globally. Its chronic and recurring nature drives strong demand for long-term treatment solutions, particularly biologics and topical corticosteroids. Increased awareness of disease severity and expanding diagnostic capabilities contribute to higher treatment rates. Guttate and inverse psoriasis segments are witnessing rising therapeutic attention, while erythrodermic psoriasis remains a smaller segment due to lower prevalence but requires intensive management using systemic and biologic therapies for effective disease control.

Key Growth Drivers

Rising Prevalence of Psoriasis and Related Comorbidities

The growing global prevalence of psoriasis, affecting millions of adults and children, is a major market driver. Increasing cases of moderate to severe psoriasis linked with lifestyle changes, stress, and autoimmune disorders continue to expand treatment demand. Psoriasis is also associated with comorbidities such as arthritis, cardiovascular diseases, and diabetes, which intensify the need for comprehensive treatment approaches. As awareness of disease management and diagnosis improves, healthcare systems are prioritizing early and effective intervention, fueling consistent growth in antipsoriatic drug adoption worldwide.

- For instance, the World Health Organization reports that more than 125 million people globally are affected by psoriasis, while studies indicate that approximately 30% of psoriasis patients develop psoriatic arthritis.

Increasing Adoption of Biologic Therapies

The rapid shift from conventional therapies to biologics is transforming psoriasis treatment. Biologics, including TNF-alpha, IL-17, and IL-23 inhibitors, provide superior efficacy and longer remission periods compared to traditional drugs. The rising number of clinical approvals and improved accessibility to biosimilars enhance market penetration. Patients and healthcare professionals increasingly favor biologics for their targeted mechanisms and safety profiles. Expanding reimbursement coverage and continuous pharmaceutical investment in advanced biologic formulations further accelerate market growth in developed and emerging economies.

- For instance, Eli Lilly’s Taltz (ixekizumab) demonstrated PASI 90 skin clearance in over 70% of trial participants, while Amgen’s Otezla (apremilast) has been prescribed to more than 1 million patients worldwide, underscoring the large-scale shift toward biologic and targeted therapies in clinical practice.

Technological and Research Advancements in Drug Development

Pharmaceutical innovation plays a key role in advancing the antipsoriatics market. The development of novel small-molecule inhibitors, next-generation biologics, and personalized therapies has enhanced treatment precision and safety. Advancements in immunopathology research are enabling better understanding of psoriasis at the molecular level, driving innovation in targeted drug design. Additionally, improvements in formulation technology—such as extended-release and combination therapies—are optimizing dosing convenience and efficacy. Growing investments in R&D and clinical trials continue to introduce new therapeutic options, expanding patient accessibility to modern psoriasis treatments.

Key Trends & Opportunities

Growing Demand for Biosimilars and Cost-Effective Therapies

The expiration of patents for major biologics has opened new opportunities for biosimilar development, offering comparable efficacy at lower costs. Biosimilars are driving affordability and expanding access to advanced psoriasis treatment in cost-sensitive markets. Pharmaceutical companies are focusing on biosimilar portfolios to strengthen market presence and compete in high-demand segments. Governments and healthcare providers are promoting biosimilar adoption through favorable regulatory frameworks, which will enhance market competitiveness and ensure long-term sustainability of biologic-based therapies globally.

- For instance, Samsung Bioepis and Biogen’s Imraldi, a biosimilar to Humira, is part of a portfolio that, combined with Benepali and Flixabi, has helped nearly 253,000 patients across Europe. Amgen’s Amjevita, the first FDA-approved adalimumab biosimilar, has been prescribed to more than 300,000 patients in over 60 countries, accumulating four years of real-world experience outside the United States.

Expansion of Personalized and Precision Medicine Approaches

Personalized medicine is emerging as a key trend in psoriasis care, focusing on patient-specific responses and genetic profiles. Biomarker-based drug selection and precision dosing are improving treatment success rates and reducing adverse effects. Pharmaceutical firms are investing in companion diagnostics and genomic research to develop individualized therapies. This trend is expected to redefine clinical practice by providing tailored treatment strategies that enhance patient satisfaction and long-term outcomes. The integration of AI and data analytics in dermatology further supports precision-based drug development and monitoring.

- For instance, Novartis uses real-world data and patient support programs for its Cosentyx treatment, which targets the IL-17A cytokine, with dosing based on large clinical trials. UCB is involved in dermatology and targets the IL-17 pathway with its drug Bimzelx, and genetic research is common in the field of psoriasis to identify genetic risk factors and inform potential precision medicine approaches.

Key Challenges

High Cost of Biologic and Targeted Therapies

Despite strong clinical efficacy, the high cost of biologic treatments remains a major barrier to widespread adoption. Many patients in low- and middle-income countries face limited access due to affordability issues and inadequate insurance coverage. High production and distribution costs associated with biologics also strain healthcare budgets. Although biosimilars offer some relief, pricing disparities continue to limit market reach. Reducing costs through manufacturing innovation, local production, and policy reforms is critical to improving global accessibility to advanced antipsoriatic treatments.

Adverse Effects and Long-Term Safety Concerns

The potential side effects and long-term safety issues associated with systemic and biologic therapies present ongoing challenges. Immunosuppressive drugs may increase the risk of infections, liver damage, or malignancies, leading to cautious prescribing practices. Continuous monitoring and stringent regulatory evaluations are necessary to ensure patient safety. Pharmaceutical companies must invest in robust post-market surveillance and clinical research to assess long-term efficacy and safety profiles. Addressing these concerns through innovation and patient education is essential to maintaining trust and adoption in the antipsoriatics market.

Regional Analysis

North America

North America dominates the antipsoriatics market with a 41.5% share in 2024, driven by high disease prevalence, strong healthcare infrastructure, and rapid adoption of biologic therapies. The United States leads the region with extensive use of advanced biologics and biosimilars, supported by favorable reimbursement policies. Continuous product launches and ongoing clinical research by key pharmaceutical players further strengthen regional growth. Canada also contributes significantly through increased awareness and early diagnosis initiatives. The presence of major market leaders and expanding access to specialty dermatology care continue to reinforce North America’s leadership position.

Europe

Europe holds a 28.4% share in 2024, supported by widespread awareness of psoriasis management and strong healthcare coverage systems. Countries such as Germany, the United Kingdom, and France are key contributors, with high adoption of biologic and biosimilar therapies. Government initiatives promoting affordable treatment access and robust regulatory support for biosimilars are driving steady growth. Ongoing investments in research and patient assistance programs enhance disease management. The region’s focus on innovation and early therapeutic adoption positions Europe as one of the most mature and stable markets for antipsoriatic treatments.

Asia-Pacific

Asia-Pacific accounts for a 21.9% share in 2024, emerging as the fastest-growing regional market due to increasing psoriasis prevalence and rising healthcare expenditure. China, Japan, and India are leading countries with expanding access to dermatological care and growing acceptance of biologic therapies. Improved awareness, rapid urbanization, and expansion of pharmaceutical manufacturing capabilities further support regional growth. Governments are focusing on enhancing healthcare accessibility and approval processes for innovative drugs. The rising presence of global and local pharmaceutical companies is driving affordability and accessibility across diverse patient populations in Asia-Pacific.

Latin America

Latin America represents a 5.2% share in 2024, with Brazil and Mexico serving as key markets driven by rising awareness and expanding healthcare investments. Growing diagnosis rates and access to biologic drugs are enhancing treatment adoption. However, cost barriers and uneven insurance coverage limit broader market penetration. Governments are promoting public health initiatives to improve dermatology services and reduce disease burden. Partnerships between global pharmaceutical firms and regional distributors are improving product availability, helping the region advance toward greater treatment accessibility and awareness of psoriasis management.

Middle East & Africa

The Middle East & Africa region holds a 3.0% share in 2024, supported by increasing investment in healthcare infrastructure and a gradual rise in dermatological care awareness. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are leading in adopting advanced therapies. Growing private healthcare expenditure and improved availability of branded medications are driving growth. However, limited affordability and shortage of specialized dermatologists continue to restrain market expansion. Efforts toward healthcare modernization and the introduction of cost-effective biosimilars are expected to strengthen the region’s future market potential.

Market Segmentations:

By Drug Type

- Biologic Antipsoriatic Drugs

- Non-Biologic Systemic Drugs

- Topical Antipsoriatic Agents

- Combination Therapy

By Route of Administration

By Type of Psoriasis

- Plaque Psoriasis

- Guttate Psoriasis

- Inverse Psoriasis

- Erythrodermic Psoriasis

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the antipsoriatics market highlights the presence of major players such as Novartis AG, Johnson & Johnson Services, Inc., AbbVie Inc., Amgen Inc., Pfizer Inc., Eli Lilly and Company, Bristol-Myers Squibb Company, UCB S.A., Sun Pharmaceutical Industries Ltd., and Leo Pharma A/S. These companies dominate the global market through extensive product portfolios of biologics, biosimilars, and topical formulations. The market is moderately consolidated, with continuous innovation in immunomodulators and targeted therapies driving competition. Strategic collaborations, clinical trials, and regulatory approvals are expanding market reach and product differentiation. Companies are investing heavily in R&D to develop next-generation biologics and oral small molecules with improved efficacy and safety. Additionally, expansion into emerging economies and patient-centric pricing strategies are key focus areas to enhance accessibility and strengthen global competitiveness in psoriasis treatment solutions.

Key Player Analysis

- Novartis AG

- Johnson & Johnson Services, Inc.

- AbbVie Inc.

- Amgen Inc.

- Pfizer Inc.

- Eli Lilly and Company

- Bristol-Myers Squibb Company

- UCB S.A.

- Sun Pharmaceutical Industries Ltd.

- Leo Pharma A/S

Recent Developments

- In June 2025, Sun Pharmaceutical Industries Ltd. reported top-line results from a Phase 2 trial of its S1P₁ receptor modulator candidate SCD‑044 in moderate-to-severe plaque psoriasis (263 patients enrolled) — the trial did not meet its primary endpoint.

- In November 2023, Amgen Inc. announced results from the global Phase 4 FOREMOST study of its oral small-molecule drug Otezla® (apremilast) in early oligoarticular psoriatic arthritis, a related indication to psoriasis care.

- In March 2023, AbbVie Inc. released 52-week results from an open-label study of its IL-23 inhibitor SKYRIZI® (risankizumab) in plaque-psoriasis patients who had prior sub-optimal response to IL-17 inhibitor therapy.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Drug Type, Route of Administration, Type of Psoriasis, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biologic and targeted therapies will continue to grow with better treatment outcomes.

- Biosimilars will gain wider acceptance, improving affordability and access in developing regions.

- Personalized and precision medicine will shape future psoriasis management strategies.

- Oral small-molecule inhibitors will expand as convenient alternatives to injectable biologics.

- Increased R&D investment will lead to next-generation immunomodulatory drug development.

- Digital dermatology and telemedicine will enhance diagnosis and treatment monitoring.

- Pharmaceutical collaborations will accelerate innovation and global market expansion.

- Growing awareness and early diagnosis programs will boost patient treatment rates.

- Regulatory support for biosimilars and cost-effective therapies will strengthen market competitiveness.

- Asia-Pacific will emerge as a key growth region due to expanding healthcare access and rising patient awareness.