Market Overview

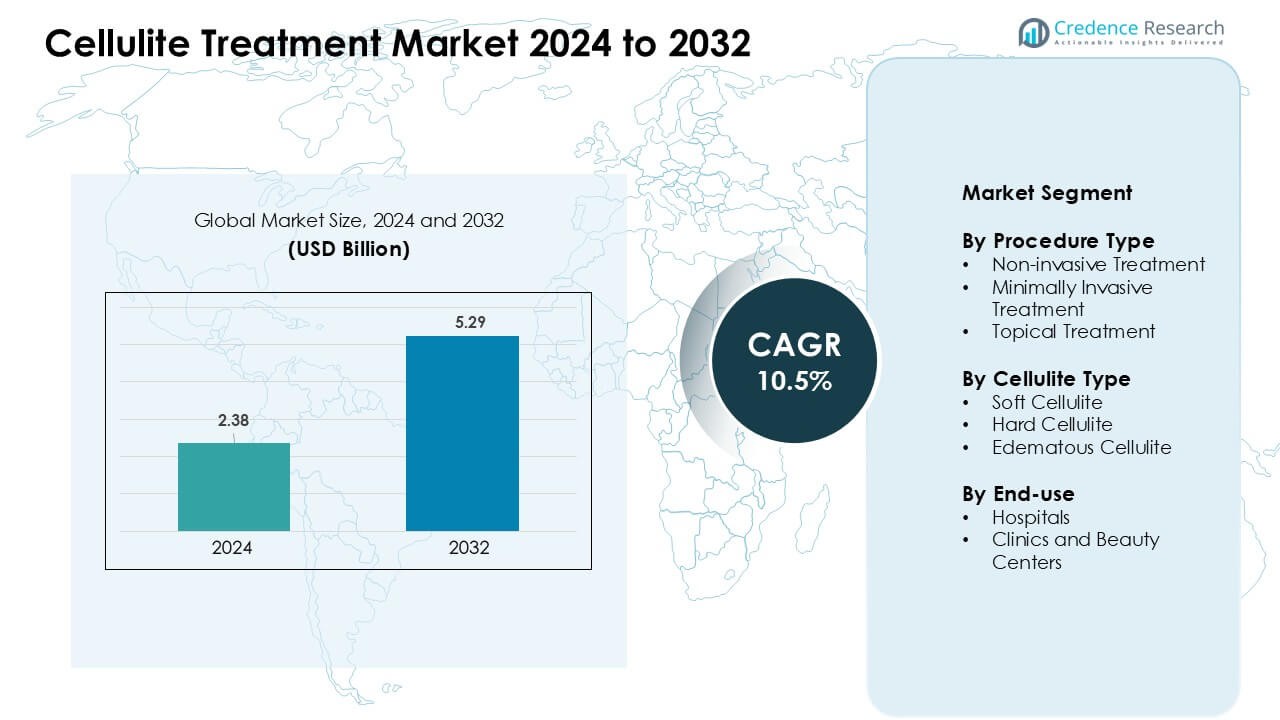

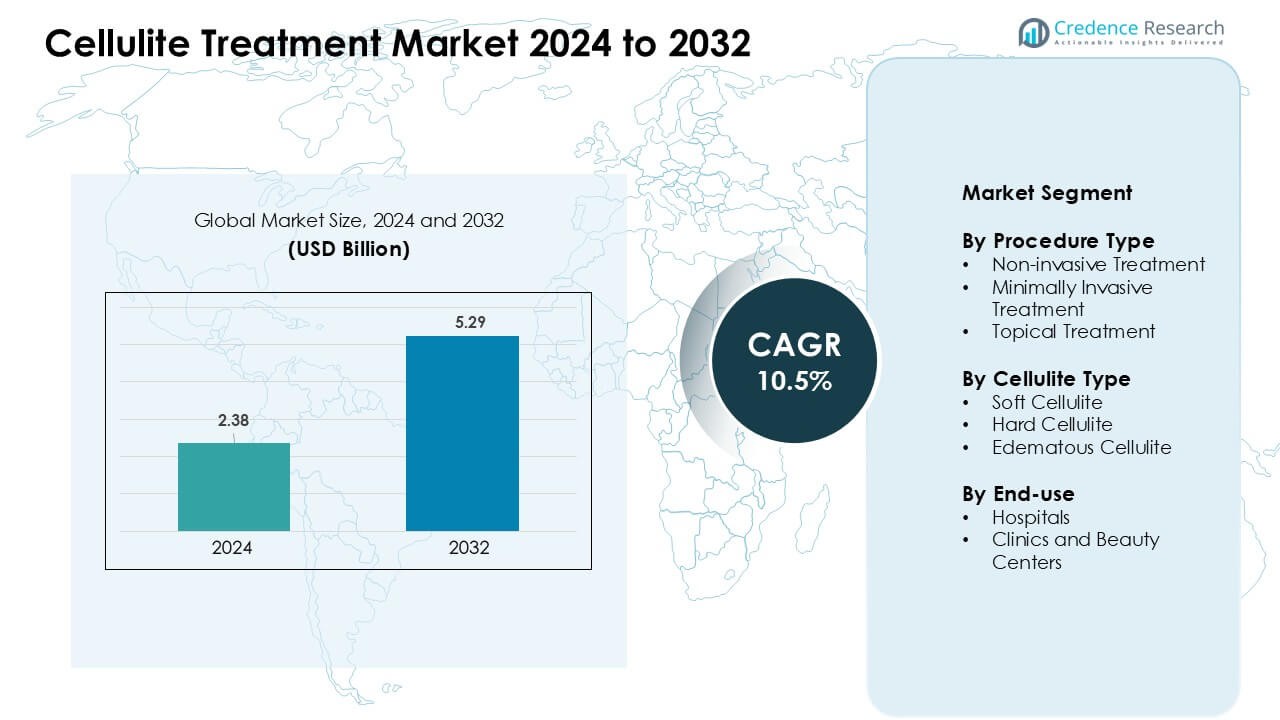

Cellulite Treatment Market was valued at USD 2.38 billion in 2024 and is anticipated to reach USD 5.29 billion by 2032, growing at a CAGR of 10.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cellulite Treatment Market Size 2024 |

USD 2.38 Billion |

| Cellulite Treatment Market, CAGR |

10.5 % |

| Cellulite Treatment Market Size 2032 |

USD 5.29 Billion |

The cellulite treatment market is shaped by key players such as Cynosure Inc. (Hologic), Zimmer Aesthetics, Alma Lasers, Merz Pharma GmbH & Co. KGaA, Syneron Medical Inc., Nubway, Cymedics, Tanceuticals LLC, and Inceler Medikal Co. Ltd. These companies compete through advanced energy-based devices, multimodal treatment platforms, and expanding clinical training programs that improve procedure outcomes. Innovation in radiofrequency, laser, and acoustic wave systems strengthens market penetration across clinics and beauty centers. North America led the market in 2024 with about 38% share, supported by strong consumer demand, high spending on aesthetic care, and early adoption of advanced technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Global cellulite treatment market value reached USD 2.38 billion in 2024, expected to grow at a CAGR of 10.5%.

- Rising demand for non-invasive treatments and growing wellness awareness drive market growth.

- Trend toward multimodal and home-use devices expands reach; combination therapies gain popularity across clinics.

- Key players such as Cynosure, Zimmer Aesthetics, Alma Lasers, Merz Pharma, Syneron, Nubway and others strengthen competitive landscape through device innovation and global distribution.

- High treatment costs and inconsistent outcomes restrain market adoption; insurance rarely covers cosmetic procedures.

- North America captured ~38% of the market in 2024; non-invasive procedure segment led with ~62% share, soft cellulite type about 48%, and clinics/beauty centers dominated end-use at ~57%.

Market Segmentation Analysis:

By Procedure Type

Non-invasive treatment held the dominant share in 2024 with about 62%. Strong demand came from safer methods such as radiofrequency, laser therapy, and acoustic wave therapy. These options appeal to patients who prefer short recovery time and lower risk compared with surgical approaches. Clinics also promote non-invasive systems due to higher patient turnover and predictable outcomes. Growing use of devices with temperature-controlled energy delivery further strengthened adoption across urban centers.

- For instance, the Venus Concept’s Venus Legacy device delivers multi-polar radiofrequency and pulsed electromagnetic fields with integrated RealTime Thermal Feedback, maintaining skin temperatures within ±2°C for optimal collagen remodeling and patient safety.

By Cellulite Type

Soft cellulite led the segment in 2024 with nearly 48%. This type appears more common in women aged 25–45, which supports steady demand for aesthetic correction. Clinics report higher treatment uptake because soft cellulite responds well to laser-based and mechanical massage systems. Rising awareness on early aesthetic care and visible results from combination therapies continue to push this segment ahead of hard and edematous cellulite.

- For instance, Cynosure’s Cellulaze laser system targets fibrous septae and subcutaneous fat with precision, typically completing treatments in 60–90 minutes and showing measurable reduction in skin dimpling within 12 weeks.

By End-use

Clinics and beauty centers dominated the segment in 2024 with around 57%. These facilities attract consumers due to flexible pricing, faster appointments, and broader device availability. Clinics also invest heavily in radiofrequency platforms and shockwave systems that provide consistent results. Growing urbanization and rising interest in non-surgical body contouring help expand the client base. Hospitals remain important for complex or minimally invasive procedures but trail clinics in overall treatment volume.

Key Growth Drivers

Rising Demand for Non-Invasive Aesthetic Procedures

Growing interest in non-invasive cosmetic care drives strong uptake in the cellulite treatment market. Many consumers prefer procedures with minimal discomfort, short recovery time, and lower complication risk. Clinics widely promote radiofrequency devices, laser systems, and acoustic wave technologies because these platforms allow high patient throughput and predictable outcomes. Demand also rises as younger consumers seek early aesthetic correction. Social media influences body-contouring choices and boosts awareness of treatment options. Expanding availability of FDA-cleared devices strengthens trust and adoption across clinics and beauty centers. This shift toward less-invasive care supports steady, long-term market growth.

- For instance, The Accent Prime is widely documented as using both proprietary ultrasound (US) and unipolar radiofrequency (RF) technologies.

Growing Focus on Body Contouring and Wellness Awareness

Global awareness of body aesthetics and wellness continues to rise, encouraging more people to explore cellulite reduction options. Many consumers adopt holistic beauty routines that combine diet, fitness, and aesthetic treatments. Clinics use this shift to promote packaged services that pair cellulite reduction with tightening and contouring procedures. Demand increases further in metropolitan areas where disposable income and beauty consciousness remain high. Marketing campaigns highlight visible improvement and short downtime, attracting first-time users. As the beauty and personal wellness industry expands worldwide, cellulite treatments gain a larger and more stable customer base.

- For instance, Syneron Candela’s VelaShape III integrates infrared light, bi-polar radiofrequency, and vacuum massage, treating an average of 20–30 body areas per day in busy aesthetic clinics, improving skin contour and reducing cellulite appearance in controlled clinical studies.

Advancements in Aesthetic Device Technology

New device technologies significantly accelerate market expansion. Manufacturers introduce systems with higher precision, better energy delivery control, and improved safety features. Multi-modal devices that combine radiofrequency, mechanical massage, and laser energy create stronger results and attract wider clinical adoption. These systems reduce session times and provide consistent outcomes across different cellulite types, improving patient satisfaction. Clinics invest in advanced platforms because they offer better return on investment through increased procedure volumes. Rising regulatory approvals and continuous R&D further support device innovation. As new technology enhances treatment efficacy, the market experiences sustained growth.

Key Trends & Opportunities

Shift Toward Combination and Customized Treatment Protocols

Clinics increasingly adopt combined treatment approaches to achieve more pronounced and longer-lasting results. Pairing radiofrequency with acoustic wave therapy or laser systems enhances collagen remodeling and tissue tightening. Personalized protocols based on cellulite type and skin profile improve patient satisfaction and differentiate clinic offerings. This trend creates opportunities for device makers to develop hybrid systems and integrated platforms. The push for tailored care also expands training programs and specialist certifications, strengthening professional capabilities within the aesthetic industry.

- For instance, BTL Exilis Ultra (also known as Exilis Ultra 360) is a device that integrates monopolar radiofrequency (RF) and ultrasound in a single platform.

Growing Penetration of Home-Use Aesthetic Devices

Home-use technologies emerge as a promising opportunity, supported by rising demand for affordable and flexible solutions. Compact RF massagers, vacuum-based tools, and LED devices offer mild improvements and attract price-sensitive users. Although less powerful than clinic-grade systems, their convenience encourages repeat purchases. Manufacturers develop smarter, app-connected devices that guide treatment sessions and track progress. With growing acceptance of at-home skincare tools, the segment opens an additional revenue pathway for brands and boosts overall market visibility.

Expansion Across Emerging Markets

Developing regions present strong potential due to urban growth, rising disposable income, and greater beauty awareness. Clinics expand into Southeast Asia, Latin America, and the Middle East to meet rising demand for body-contouring services. Influencer-driven trends accelerate cosmetic procedure adoption among younger groups. Device makers focus on cost-efficient platforms to increase penetration in these regions. As aesthetic tourism grows, emerging markets become key contributors to long-term expansion.

- For instance, Cynosure expanded its distributor presence in Brazil, the UAE, and Southeast Asia, including Thailand, to support growing demand for aesthetic procedures. The company supplies compact laser and RF platforms, such as TempSure Envi, which operate at 6.78 MHz RF and are widely adopted in space-constrained clinics for body contouring and cellulite treatment.

Key Challenges

High Treatment Costs and Limited Insurance Coverage

Cellulite treatments remain expensive for many consumers, especially when multiple sessions are required. Costs vary based on device type, operator expertise, and clinic location, making accessibility uneven across regions. Most cellulite procedures fall under cosmetic care and receive no insurance reimbursement, which restricts adoption among price-sensitive users. Clinics often struggle to balance affordability with investment in advanced technologies. As a result, cost barriers slow uptake in developing markets and limit treatment frequency for some patients.

Variability in Treatment Outcomes and Patient Expectations

Outcome inconsistency remains a major challenge in the cellulite treatment market. Results vary by cellulite type, skin elasticity, and treatment method, which sometimes leads to dissatisfaction. High consumer expectations often shaped by social media do not always align with achievable results. Clinics need skilled practitioners and proper patient assessment to ensure reliable outcomes. Training gaps and improper device use can reduce treatment effectiveness. This variability affects long-term trust and slows market adoption, especially among first-time users.

Regional Analysis

North America

North America led the cellulite treatment market in 2024 with about 38% share. Strong demand came from high adoption of non-invasive aesthetic procedures and early access to advanced medical devices. The region benefits from a large network of dermatology clinics, clear regulatory pathways, and strong consumer awareness of body-contouring solutions. Rising interest in wellness and cosmetic care among younger adults supports steady growth. The U.S. remains the primary revenue contributor due to high procedure volumes and greater spending on premium treatments.

Europe

Europe held roughly 29% share in 2024, driven by strong demand in countries such as Germany, France, Italy, and the U.K. The region shows high acceptance of energy-based devices and combination therapies, supported by well-established aesthetic clinics. Consumers favor treatments with minimal downtime, which boosts adoption of radiofrequency and laser platforms. Regulatory stability also encourages manufacturers to introduce new systems. Growing interest in wellness tourism and rising preference for customized aesthetic care continue to support regional expansion.

Asia Pacific

Asia Pacific accounted for nearly 23% share in 2024 and emerged as the fastest-growing region. Rising disposable income, expanding urban populations, and growing beauty consciousness increase demand for cellulite reduction services. Countries such as China, Japan, South Korea, and Australia lead adoption due to strong clinic networks and rapid acceptance of aesthetic technologies. Influencer culture drives awareness among younger consumers. Growing investments in advanced devices and wider availability of affordable treatment options accelerate market penetration across the region.

Latin America

Latin America captured about 6% share in 2024, supported by strong interest in cosmetic procedures, particularly in Brazil, Mexico, and Colombia. The region benefits from a high cultural emphasis on body aesthetics and a growing network of medical spas and cosmetic clinics. Rising popularity of non-invasive contouring treatments strengthens demand. However, limited purchasing power in some economies slows adoption of high-end technologies. Despite this, medical tourism and increasing device accessibility continue to create steady growth opportunities.

Middle East & Africa

The Middle East & Africa region held close to 4% share in 2024, driven by rising demand in the UAE, Saudi Arabia, and South Africa. Growth came from expanding aesthetic centers, increasing disposable income, and strong interest in premium cosmetic treatments. The Middle East shows faster adoption due to medical tourism and investment in advanced technologies. Africa grows at a slower pace due to affordability challenges but benefits from gradual clinic expansion. Overall, rising awareness and lifestyle shifts support continued regional development.

Market Segmentations:

By Procedure Type

- Non-invasive Treatment

- Minimally Invasive Treatment

- Topical Treatment

By Cellulite Type

- Soft Cellulite

- Hard Cellulite

- Edematous Cellulite

By End-use

- Hospitals

- Clinics and Beauty Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cellulite treatment market features a diverse mix of global device manufacturers, aesthetic technology companies, and specialized skincare brands. Leading players such as Cynosure Inc. (Hologic), Zimmer Aesthetics, Alma Lasers, Merz Pharma GmbH & Co. KGaA, and Syneron Medical Inc. strengthen their presence through advanced energy-based platforms, multimodal treatment systems, and expanding clinical partnerships. Companies focus on developing devices with improved energy delivery, enhanced safety features, and shorter treatment times to meet rising demand for non-invasive solutions. Many brands also expand training programs to support practitioner expertise and ensure consistent outcomes. Growing investment in R&D, wider regulatory approvals, and strategic distribution agreements help these firms reach new markets. As competition intensifies, players differentiate through technology innovation, stronger after-sales support, and bundled treatment protocols that appeal to clinics and beauty centers seeking reliable, high-performance systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cynosure Inc. (Sub. Hologic Inc.)

- Nubway

- Zimmer Aesthetics

- Alma Lasers

- Merz Pharma GmbH & Co. KGaA

- Syneron Medical Inc.

- BTL Industries

- Venus Concept

- Cutera Inc.

- Solta Medical

- Lumenis Ltd.

- InMode Ltd.

Recent Developments

- In November 2025, Venus Concept received FDA 510(k) clearance for its Venus NOVA platform, marking the rollout of its most advanced multi-application device for non-invasive body and skin treatments, including cellulite reduction.

- In December 2024, Zimmer announced the upcoming North American launches of new body-treatment devices (Z Stim and Z Shape) which together with their existing Z Wave cellulite device were promoted as a Transformation Trio to optimize cellulite, skin-tightening and contouring outcomes.

Report Coverage

The research report offers an in-depth analysis based on Procedure type, Cellulite type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Non-invasive procedures will continue to gain stronger adoption across clinics.

- Multi-technology devices combining RF, laser, and acoustic energy will become standard.

- Personalized treatment plans based on cellulite type will shape clinical practice.

- Home-use aesthetic devices will expand as consumer comfort with self-care grows.

- AI-enabled assessment tools will help practitioners measure treatment response more accurately.

- Medical tourism will rise as developing regions expand advanced aesthetic centers.

- Device manufacturers will increase investment in safety features and energy-control systems.

- Combination therapies with body-contouring and skin-tightening procedures will see rapid uptake.

- Training and certification programs will grow to improve practitioner skills and treatment results.

- Emerging markets in Asia Pacific and the Middle East will drive the next wave of market expansion.