Market Overview

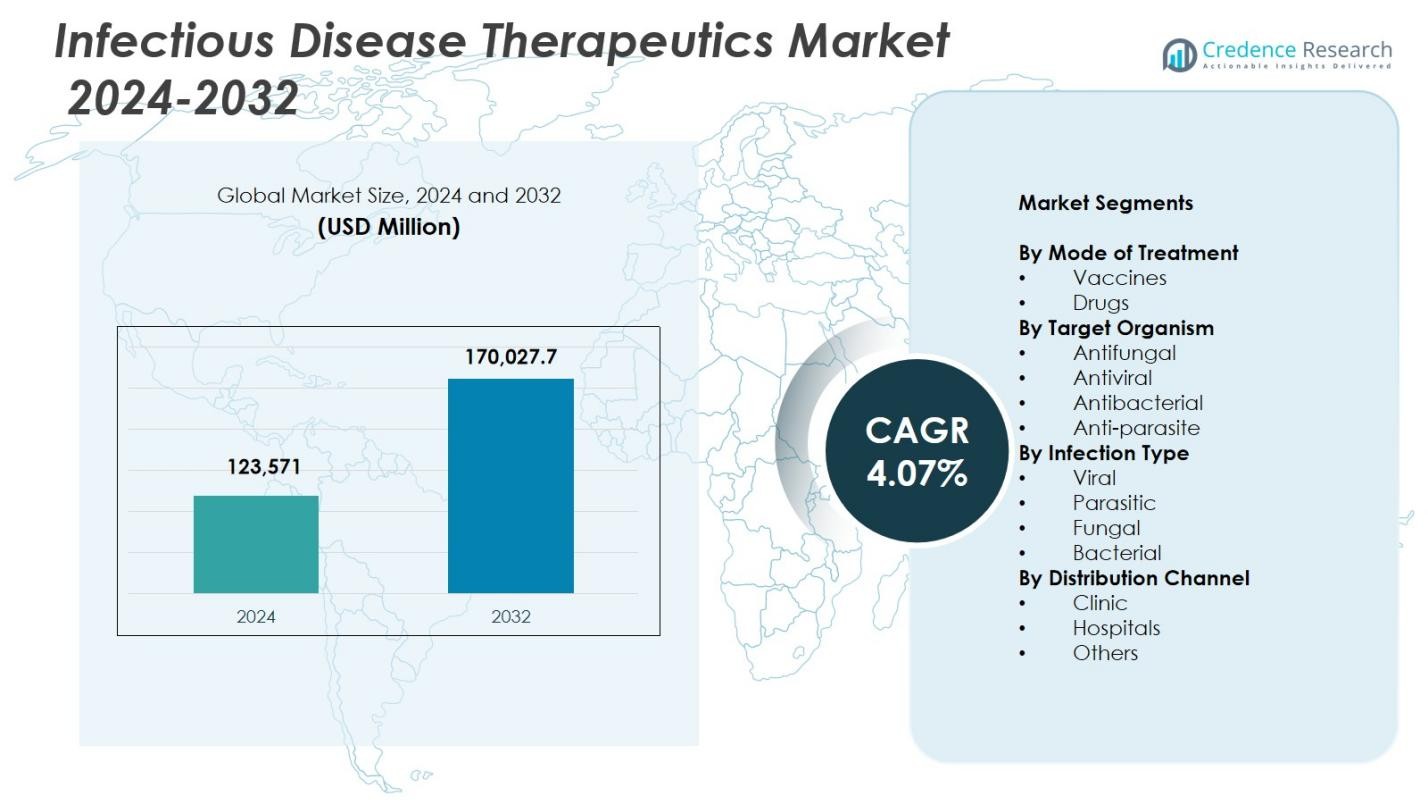

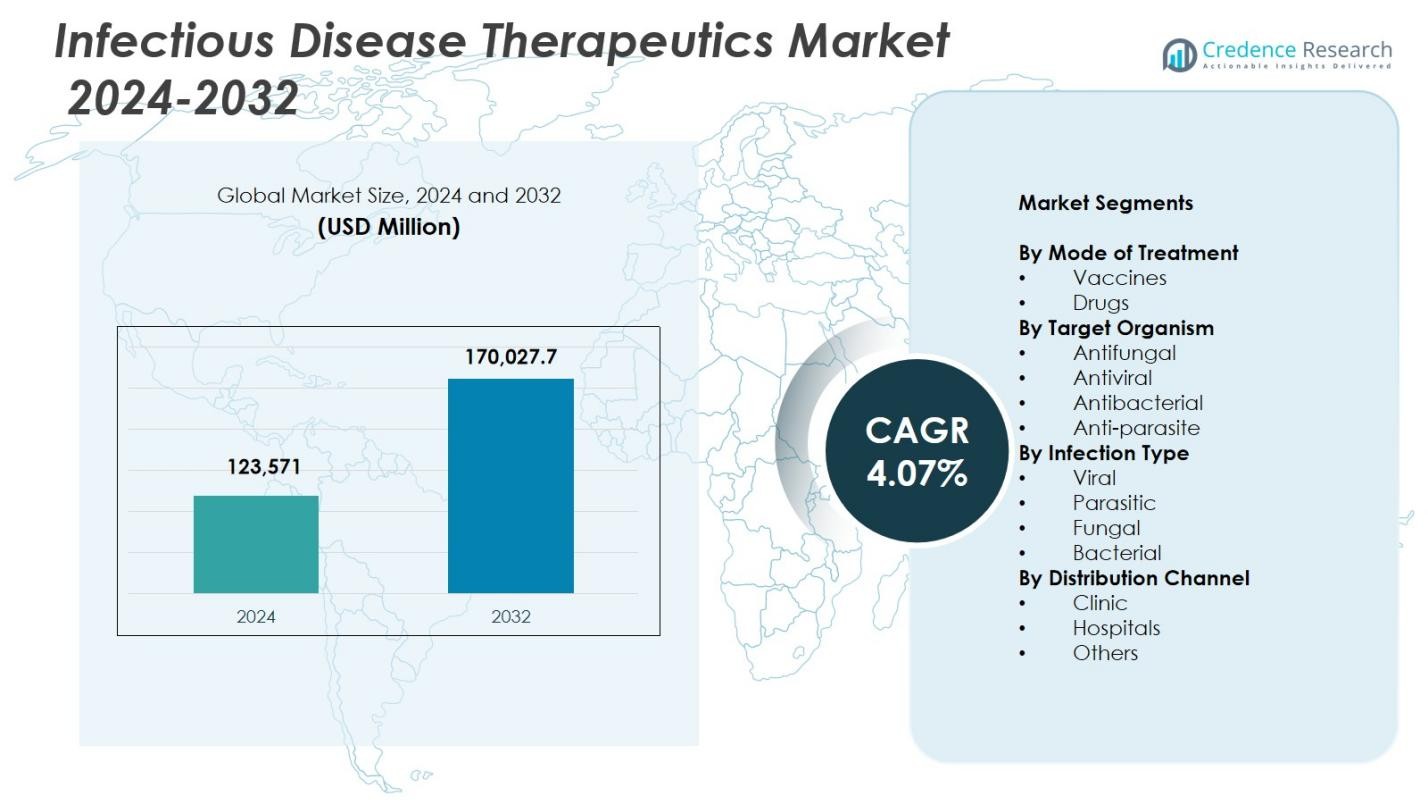

Infectious Disease Therapeutics Market size was valued at USD 123,571 Million in 2024 and is anticipated to reach USD 170,027.7 Million by 2032, at a CAGR of 4.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Infectious Disease Therapeutics Market Size 2024 |

USD 123,571 Million |

| Infectious Disease Therapeutics Market, CAGR |

4.07% |

| Infectious Disease Therapeutics Market Size 2032 |

USD 170,027.7 Million |

Infectious Disease Therapeutics Market features leading players such as GlaxoSmithKline (GSK), Bayer, Johnson & Johnson (Janssen Pharmaceuticals), AstraZeneca, Merck, Bristol-Myers Squibb, Boehringer Ingelheim International, F. Hoffmann-La Roche, Abbott Laboratories, and Gilead Sciences, each strengthening their presence through extensive antiviral, antibacterial, and vaccine portfolios. These companies drive innovation with advanced biologics, mRNA technologies, and broad-spectrum therapeutics addressing rising global disease burdens. North America leads the market with a 39.4% share, supported by strong healthcare infrastructure and high adoption of advanced therapies, while Europe and Asia-Pacific follow as major regions with accelerating treatment demand driven by expanding healthcare access and rising infection prevalence.

Market Insights

- The Infectious Disease Therapeutics Market was valued at USD 123,571 Million in 2024 and is projected to grow at a CAGR of 4.07% through 2032.

- Market growth is driven by rising global infection rates, strong demand for antibacterial and antiviral therapies, and expanding vaccine adoption across public health programs.

- Key trends include rapid advancements in mRNA platforms, increased development of long-acting formulations, and growing focus on precision therapies supported by genomic diagnostics.

- Leading players such as GSK, Merck, Roche, Abbott, and Gilead strengthen their positions through broad therapeutic portfolios, strong R&D pipelines, and strategic collaborations; the drugs segment leads with a 67.4% share.

- Regionally, North America holds the largest share at 39.4%, followed by Europe with 27.6% and Asia-Pacific with 23.1%, driven by expanding healthcare access, rising disease burdens, and increasing adoption of advanced treatment solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Mode of Treatment:

The Infectious Disease Therapeutics Market is dominated by the drugs segment, which accounted for 67.4% share in 2024, driven by the rising global burden of bacterial, viral, and fungal infections and the continuous introduction of targeted therapeutics. Strong R&D investments in antiviral, antimicrobial, and broad-spectrum drug portfolios further support its leadership. The vaccines segment, although smaller, continues to gain traction with expanding immunization campaigns, government-backed vaccination programs, and advancements in mRNA and recombinant technologies. Increasing focus on preventive healthcare and rapid vaccine development platforms will strengthen growth within this segment during the forecast period.

- For instance, Innoviva Specialty Therapeutics gained FDA approval for Xacduro (sulbactam-durlobactam) in May 2023 as the first pathogen-targeted therapy for hospital-acquired and ventilator-associated bacterial pneumonia caused by susceptible Acinetobacter baumannii-calcoaceticus complex in adults.

By Target Organism:

The antibacterial segment led the Infectious Disease Therapeutics Market in 2024 with a 41.2% share, supported by the high global incidence of bacterial infections across respiratory, bloodstream, and gastrointestinal conditions. Demand continues to rise due to increasing antimicrobial resistance, prompting accelerated development of novel antibiotics and combination therapies. Antiviral therapeutics also remain significant with expanding treatment needs for chronic and emerging viral diseases. Antifungal and anti-parasite treatments gain steady traction in regions facing higher prevalence of opportunistic infections, tropical diseases, and immunocompromised populations, reinforcing ongoing innovation toward safer, targeted pathogen-specific therapies.

- For instance, Roche advanced zosurabalpin (RG6006), a tethered macrocyclic peptide antibiotic targeting the lipopolysaccharide transporter in carbapenem-resistant Acinetobacter baumannii.

By Infection Type:

The bacterial infection segment dominated the Infectious Disease Therapeutics Market in 2024 with a 38.6% share, propelled by the widespread occurrence of bacterial illnesses and growing concerns around drug-resistant pathogens. Increased hospital-acquired infections, rising surgical procedures, and expanding outpatient care contribute to sustained demand for advanced antibacterial therapies. The viral infection segment also holds substantial market weight due to continued treatment needs for influenza, HIV, hepatitis, and newly emerging viral threats. Fungal and parasitic infections account for smaller yet growing shares, supported by increasing cases in immunocompromised patients and regions with persistent tropical disease burdens.

Key Growth Drivers

Rising Global Burden of Infectious Diseases

The rapid increase in infectious disease prevalence including bacterial, viral, fungal, and parasitic infections remains a major growth driver for the Infectious Disease Therapeutics Market. Expanding incidences of antimicrobial-resistant pathogens, recurrent outbreaks of influenza, dengue, and respiratory infections, and continued global HIV and hepatitis caseloads intensify demand for advanced therapeutic solutions. Aging populations, rising medical comorbidities, and increased hospitalization rates further elevate susceptibility to infections. These factors collectively accelerate investments in drug development and drive continuous evolution of targeted treatments across high-burden disease categories.

- For instance, Cidara Therapeutics’ CD388, a drug-Fc conjugate antiviral, received FDA Breakthrough Therapy designation for preventing influenza A and B in high-risk adults and adolescents.

Advancements in Drug Development and Vaccine Technologies

Accelerated innovation in vaccine platforms, biologics, and targeted therapeutics significantly strengthens market expansion. mRNA, viral vector, and recombinant technologies have shortened development timelines and enhanced efficacy profiles, enabling faster responses to emerging pathogens. Similarly, breakthroughs in monoclonal antibodies, broad-spectrum antivirals, and next-generation antibiotics address unmet clinical needs associated with resistance and complex infections. Pharmaceutical companies increasingly focus on precision therapies and host-directed treatments, supported by favorable regulatory pathways and global initiatives to promote research in infectious disease management.

- For instance, BioNTech developed mRNA sequences encoding patient-specific tumor antigens for personalized cancer vaccines, partnering with Pfizer to create one of the first approved mRNA vaccines for COVID-19 that demonstrated high efficacy and safety through sophisticated sequence modifications and delivery strategies.

Strong Government and Institutional Support

Government-backed immunization programs, infectious disease surveillance networks, and funding for antimicrobial resistance mitigation remain pivotal to market growth. Public health agencies, global health bodies, and non-profit organizations actively support R&D through grants, fast-track approvals, and strategic procurement of vaccines and therapeutics. Strengthening of national stockpiles, pandemic-preparedness frameworks, and reimbursement policies for high-impact therapies enhance adoption across both developed and emerging economies. These initiatives create a favorable ecosystem for ongoing innovation, market penetration, and long-term demand for infectious disease treatments.

Key Trends & Opportunities

Expansion of Personalized and Precision Infectious Disease Therapies

A growing shift toward personalized treatment approaches presents major opportunities in the Infectious Disease Therapeutics Market. Genomic profiling, rapid molecular diagnostics, and pathogen-specific resistance mapping enable clinicians to tailor therapies more effectively. Precision antimicrobials and targeted antivirals reduce adverse reactions and improve treatment outcomes, especially for multidrug-resistant infections. Integration of AI-driven decision tools and digital biomarkers accelerates accurate therapy selection, supporting the broader transition toward individualized infectious disease management and enabling new market opportunities for specialized drug formulations.

- For instance, Abbott’s ViroSeq system similarly analyzes HIV genotypes from samples with sufficient viral load to optimize treatments.

Growing Adoption of Long-Acting and Combination Therapeutics

Long-acting injectables, fixed-dose combinations, and extended-release formulations are gaining traction as they enhance patient compliance and reduce treatment burdens, particularly in chronic infections such as HIV, tuberculosis, and hepatitis. These therapies also help mitigate resistance development by ensuring consistent dosing and improved treatment adherence. Pharmaceutical companies increasingly invest in multi-mechanism regimens to address complex pathogen behavior and broaden therapeutic efficacy. The demand for simplified, durable treatment options continues to open new development pathways and commercial opportunities across high-priority disease areas.

- For instance, AbbVie’s VIEKIRA XR (dasabuvir, ombitasvir, paritaprevir, and ritonavir), FDA-approved in 2016 as an extended-release formulation, enables once-daily oral dosing for hepatitis C treatment.

Key Challenges

Escalating Antimicrobial Resistance

The rapid rise of antimicrobial-resistant pathogens poses a significant challenge to the Infectious Disease Therapeutics Market. Resistance reduces the efficacy of existing antibiotics and antivirals, increases treatment failures, and elevates healthcare costs. Pharmaceutical pipelines for new antibacterial agents remain limited, as development is complex and financially less attractive compared to other therapeutic categories. This imbalance strains healthcare systems and demands urgent innovation, stewardship programs, and collaboration between regulators, drug manufacturers, and global health organizations to sustain the effectiveness of infectious disease treatments.

High Development Costs and Regulatory Complexities

Developing new therapeutics for infectious diseases requires substantial investment, lengthy clinical trials, and rigorous regulatory scrutiny. High research costs, uncertainty in clinical outcomes, and stringent safety requirements often delay commercialization and limit the number of new therapies entering the market. Additionally, fluctuating demand during non-outbreak periods reduces the commercial viability of certain vaccines and anti-infective drugs. These challenges create barriers for both established pharmaceutical companies and emerging biotech firms, slowing innovation and restricting timely availability of advanced therapeutic solutions.

Regional Analysis

North America

North America dominated the Infectious Disease Therapeutics Market with a 39.4% share in 2024, driven by high infection prevalence, strong healthcare infrastructure, and robust adoption of advanced therapeutics. Extensive R&D investments, rapid vaccine innovation, and broad availability of antiviral, antibacterial, and immunotherapy pipelines support sustained regional leadership. Government initiatives for antimicrobial resistance mitigation and pandemic preparedness contribute to consistent therapeutic demand. High diagnostic penetration, strong reimbursement systems, and continuous product launches by major pharmaceutical companies further reinforce North America’s dominant position in the global market.

Europe

Europe held a 27.6% share in 2024, supported by comprehensive public health systems, strong vaccination programs, and established pharmaceutical manufacturing capabilities. Rising incidences of hospital-acquired infections, increasing antimicrobial resistance, and expanding surveillance initiatives drive demand for advanced treatment options. The region benefits from stringent regulatory oversight that encourages development of safe and effective antivirals, antibiotics, and vaccines. Investments in biotech research, government-backed innovation grants, and collaborative infectious disease control frameworks across EU nations strengthen market growth. Growing awareness and early diagnosis initiatives further enhance therapeutic adoption across major European economies.

Asia-Pacific

The Asia-Pacific region accounted for a 23.1% share in 2024, fueled by large population bases, high burden of infectious diseases, and rising healthcare expenditure across emerging economies. Rapid urbanization, expanding access to healthcare services, and increased frequency of viral and bacterial outbreaks elevate demand for advanced therapeutics. Government-led immunization drives, strengthening pharmaceutical manufacturing capacity, and growing investment in infectious disease R&D support regional market expansion. Rising prevalence of tuberculosis, dengue, influenza, and parasitic diseases further accelerates adoption of both preventive and curative therapies throughout the Asia-Pacific landscape.

Latin America

Latin America captured a 6.2% share in 2024, supported by strengthening healthcare systems, rising incidence of vector-borne and viral diseases, and expanding access to essential medicines. Increased public health investments and regional programs targeting dengue, Zika, HIV, and respiratory infections drive demand for advanced therapeutic options. Growing partnerships between governments, global health organizations, and pharmaceutical companies enhance availability of innovative treatments. Despite economic disparities, improving diagnostic capabilities and vaccination outreach programs continue to support steady market growth across key countries such as Brazil, Mexico, and Argentina.

Middle East & Africa

The Middle East & Africa region held a 3.7% share in 2024, influenced by rising infectious disease prevalence, growing urbanization, and uneven access to advanced healthcare infrastructure. High rates of parasitic, bacterial, and viral infections create sustained demand for broad-spectrum therapies and improved vaccination coverage. Ongoing investments in healthcare modernization, expansion of pharmaceutical distribution networks, and international aid programs strengthen therapeutic access. However, challenges such as limited R&D activity and affordability constraints moderate growth. Increasing screening initiatives and government focus on communicable disease control support gradual market expansion across the region.

Market Segmentations:

By Mode of Treatment

By Target Organism

- Antifungal

- Antiviral

- Antibacterial

- Anti-parasite

By Infection Type

- Viral

- Parasitic

- Fungal

- Bacterial

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Infectious Disease Therapeutics Market is shaped by leading players such as GlaxoSmithKline (GSK), Bayer, Johnson & Johnson (Janssen Pharmaceuticals), AstraZeneca, Merck, Bristol-Myers Squibb, Boehringer Ingelheim International, F. Hoffmann-La Roche, Abbott Laboratories, and Gilead Sciences. These companies maintain strong positions through extensive R&D pipelines, wide therapeutic portfolios, and continuous investment in vaccines, antivirals, antibacterials, and biologics. Strategic collaborations with research institutions, government agencies, and biotech firms accelerate innovation and support rapid development of new treatments for emerging pathogens. Market participants focus on expanding manufacturing capabilities, enhancing global distribution networks, and strengthening clinical trial programs to address the rising burden of infectious diseases. Advancements in mRNA technologies, long-acting therapies, and precision antimicrobials further intensify competition, while patent expiries and biosimilar penetration encourage ongoing product differentiation. Companies increasingly prioritize antimicrobial stewardship, resistance mitigation strategies, and data-driven drug development to sustain long-term competitiveness in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GlaxoSmithKline (GSK)

- Bayer

- Johnson & Johnson (Janssen Pharmaceuticals)

- AstraZeneca

- Merck

- Bristol-Myers Squibb

- Boehringer Ingelheim International

- F. Hoffmann-La Roche

- Abbott Laboratories

- Gilead Sciences

Recent Developments

- In December 2025, Merck announced its acquisition of Cidara Therapeutics for approximately $9.2 billion to advance CD388, a late-stage drug-Fc conjugate antiviral for influenza prevention targeting both influenza A and B viruses.

- In November 2025, GSK plc and its research partners announced a collaboration under the Fleming Initiative to develop new antifungal drugs targeting resistant fungal infections, beginning with efforts against Aspergillus.

- In July 2025, AN2 Therapeutics and Drugs for Neglected Diseases initiative (DNDi) signed an agreement to co-develop an oral compound for chronic Chagas disease, advancing efforts to treat parasitic infections.

Report Coverage

The research report offers an in-depth analysis based on Mode of Treatment, Target Organism, Infection Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience sustained growth as global infectious disease prevalence continues to rise.

- Advancements in vaccine technologies, including mRNA and recombinant platforms, will accelerate therapeutic innovation.

- Demand for precision and personalized infectious disease treatments will strengthen across major healthcare systems.

- Long-acting and combination therapies will gain wider adoption to improve compliance and reduce resistance risks.

- Government funding and public health initiatives will continue to support large-scale R&D and treatment access.

- Pharmaceutical companies will expand pipelines targeting antimicrobial-resistant pathogens.

- Integration of AI, genomic tools, and rapid diagnostics will enable more targeted therapy development.

- Emerging markets will see stronger adoption as healthcare infrastructure and diagnostic capabilities improve.

- Biologics and monoclonal antibodies will play an increasing role in managing complex and chronic infections.

- Global preparedness for pandemics and outbreaks will remain a central driver for continuous therapeutic investment.