Market Overview

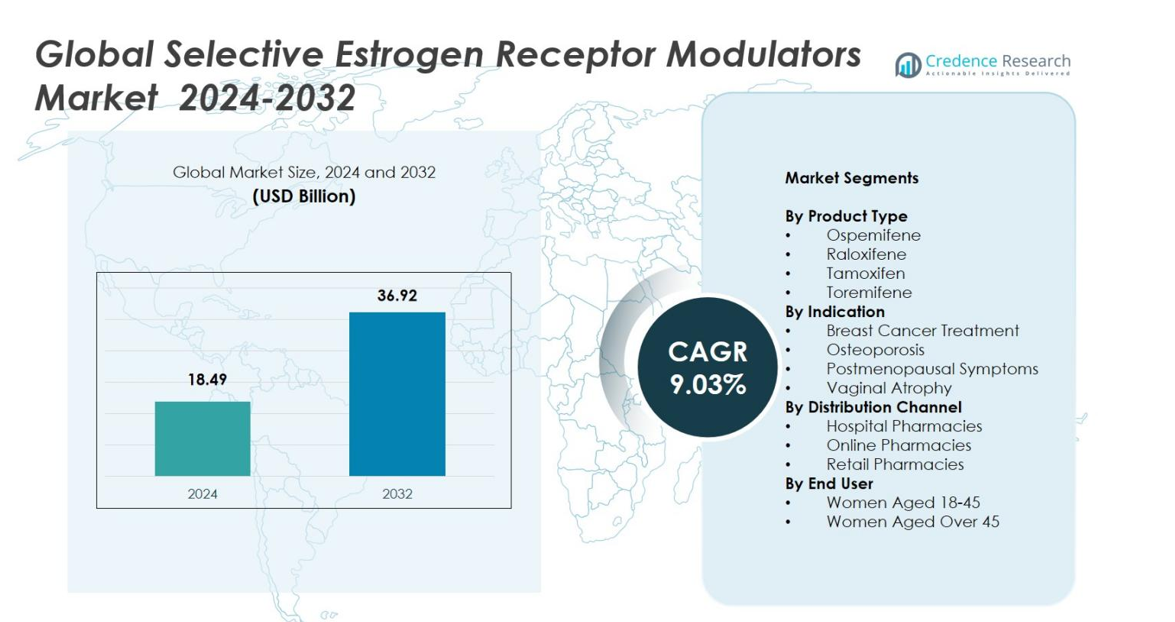

Global Selective Estrogen Receptor Modulators Market size was valued at USD 18.49 Billion in 2024 and is anticipated to reach USD 36.92 Billion by 2032, at a CAGR of 9.03% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Selective Estrogen Receptor Modulators (SERMs) Market Size 2024 |

USD 18.49 Billion |

| Selective Estrogen Receptor Modulators (SERMs) Market, CAGR |

9.03% |

| Selective Estrogen Receptor Modulators (SERMs) Market Size 2032 |

USD 36.92 Billion |

Global Selective Estrogen Receptor Modulators Market is shaped by leading pharmaceutical companies such as AstraZeneca, Eli Lilly and Company, Pfizer Inc., Shionogi & Co., Ltd., Ipsen S.A., Teva Pharmaceutical Industries Ltd., Mylan, Sun Pharmaceutical Industries Ltd., Amneal Pharmaceuticals, and Lupin Limited, all of which strengthen market expansion through oncology and women’s health portfolios. North America led the market with a 38.4% share in 2024, driven by strong adoption of SERMs in breast cancer and osteoporosis management, while Europe followed with 29.7% share, supported by robust screening programs and widespread clinical acceptance. Asia-Pacific held 22.6% share, reflecting rising diagnosis rates and improving healthcare infrastructure.

Market Insights

- Global Selective Estrogen Receptor Modulators Market reached USD 18.49 Billion in 2024 and will grow to USD 36.92 Billion by 2032 at a CAGR of 9.03%.

- Market expansion is driven by rising breast cancer prevalence and strong demand for SERMs, with Breast Cancer Treatment holding a 46.9% share and Tamoxifen leading product uptake with a 41.6% share in 2024.

- Key trends include increasing preference for non-hormonal therapies, digital pharmacy adoption, and growing use of SERMs for osteoporosis, which held a 32.1% segment share.

- Major players such as AstraZeneca, Pfizer Inc., Eli Lilly and Company, and Teva Pharmaceutical Industries Ltd. enhance market growth through strong oncology portfolios and expanding access to generics.

- Regionally, North America led with a 38.4% share, followed by Europe at 29.7% and Asia-Pacific at 22.6%, supported by strong screening programs, rising diagnosis rates, and improving healthcare systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Global Selective Estrogen Receptor Modulators Market is dominated by Tamoxifen, holding 41.6% share in 2024, driven by its long-standing clinical adoption in hormone-receptor–positive breast cancer and strong inclusion in global oncology treatment guidelines. Raloxifene accounted for 28.4% share, supported by its established role in osteoporosis management and fracture-risk reduction in postmenopausal women. Ospemifene captured 18.7% share, boosted by increasing prescriptions for dyspareunia associated with vulvovaginal atrophy, while Toremifene held 11.3% share, primarily driven by its targeted use in advanced breast cancer cases across select markets.

- For instance, Eli Lilly highlighted new real-world evidence showing that Evista (raloxifene) significantly reduced vertebral fracture incidence in postmenopausal women, reinforcing its position in osteoporosis management programs in the U.S. and EU.

By Indication

Breast Cancer Treatment led the market with a 46.9% share in 2024, propelled by rising global breast cancer prevalence and expanded utilization of SERMs as first-line endocrine therapy. Osteoporosis represented 32.1% share, supported by growing demand for bone health therapeutics among aging female populations. Postmenopausal Symptoms accounted for 12.8% share, driven by increasing preference for non-hormonal alternatives. Vaginal Atrophy held 8.2% share, aided by rising awareness of SERM-based therapies for genitourinary syndrome of menopause.

- For instance, the American Cancer Society reported over 310,000 new U.S. breast cancer diagnoses, reinforcing demand for guideline-supported SERM therapies such as tamoxifen for ER-positive cases.

By Distribution Channel

Hospital Pharmacies dominated the market with a 52.4% share in 2024, driven by higher uptake of SERMs for oncology and osteoporosis treatment within specialty care settings. Retail Pharmacies captured 34.7% share, supported by broad prescription volumes and accessibility for chronic therapy users. Online Pharmacies accounted for 12.9% share, benefitting from digital adoption, home-delivery convenience, and increasing patient preference for confidential purchasing channels, particularly for postmenopausal symptom management.

Key Growth Drivers

Rising Prevalence of Breast Cancer and Osteoporosis

The growing global incidence of hormone-receptor–positive breast cancer and osteoporosis significantly drives demand for Selective Estrogen Receptor Modulators (SERMs). Healthcare systems increasingly prioritize early detection and hormonal therapy integration, positioning SERMs as essential in long-term disease management. Widespread adoption of Tamoxifen and Raloxifene continues as clinical guidelines reinforce their efficacy in recurrence prevention and bone-density improvement. Expanding patient pools, coupled with rising awareness in emerging markets, strengthens market uptake across oncology, preventive care, and chronic disease treatment pathways.

- For instance, the International Osteoporosis Foundation confirmed that one in three women over 50 suffers osteoporotic fractures globally, supporting continued demand for raloxifene in fracture-risk reduction.

Shift Toward Non-Hormonal Therapeutic Alternatives

A strong transition toward non-hormonal treatment options for menopausal and postmenopausal conditions accelerates SERM adoption globally. Growing concerns about adverse effects associated with hormone-replacement therapy increase physician and patient preference for SERMs, particularly for managing dyspareunia, vaginal atrophy, and vasomotor symptoms. Ospemifene benefits from this shift as demand for safer, targeted endocrine modulators grows. Regulatory support for non-hormonal approaches and expanding clinical evidence further stimulate market penetration across women’s health segments.

- For instance, North American Menopause Society reaffirmed recommendations to limit long-term hormone-replacement therapy due to risks such as thromboembolism and breast cancer, increasing interest in non-hormonal options, including SERMs.

Advancements in Drug Development and Expanded Clinical Applications

Innovations in molecular modeling, receptor-selectivity profiling, and next-generation SERM formulations broaden the therapeutic landscape of these agents. Ongoing clinical trials aim to enhance efficacy, reduce resistance mechanisms, and explore novel applications in oncology, metabolic disorders, and reproductive health. Improved safety profiles and patient adherence technologies strengthen clinician confidence. Pharmaceutical companies invest in lifecycle management strategies and combination therapies, opening opportunities for differentiated SERM products tailored to specific indications and patient subgroups.

Key Trends & Opportunities

Increasing Digital Health Integration and Remote Therapy Management

Digital health platforms create significant opportunities for SERM manufacturers by enhancing patient engagement, monitoring adherence, and optimizing prescription renewals. Tele-oncology and virtual women’s health consultations are expanding access to endocrine therapies, particularly in underserved regions. Online pharmacies benefit from rising digital adoption, offering convenient channels for chronic prescriptions like SERMs. Data-driven care models support personalized therapy choices and enable pharmaceutical companies to develop targeted awareness programs, strengthening market presence across global digital ecosystems.

- For instance, Digital pharmacy and telepharmacy have gained traction: a 2024 literature review found that telepharmacy systems (remote dispensing, e-prescriptions, medication-management apps) improve medication adherence, reduce dispensing errors, and support personalized care.

Growing Expansion into Emerging Markets with Strengthened Healthcare Infrastructure

Improving healthcare access, rising cancer screening programs, and increasing osteoporosis diagnosis rates in Asia-Pacific, Latin America, and the Middle East create substantial growth opportunities. Governments and private insurers are expanding reimbursement frameworks, making SERMs more affordable. Local manufacturing initiatives by regional pharmaceutical companies reduce cost barriers and ensure consistent drug availability. As awareness campaigns intensify and healthcare literacy improves, emerging markets are projected to become high-growth hubs for SERM adoption across oncology and women’s health.

- For instance, in multiple Asia-Pacific countries, consensus guidelines published in 2024 endorse long-term and sequential anti-osteoporosis therapy including SERMs for fracture prevention in high-risk women.

Key Challenges

Adverse Side Effects and Therapy Discontinuation Rates

Despite their clinical benefits, SERMs face adoption challenges due to side effects such as thromboembolic events, hot flashes, and leg cramps, which affect long-term adherence. Patients and clinicians often shift to alternative therapies when tolerability issues arise, impacting overall treatment continuity. Safety concerns particularly limit SERM use in high-risk populations, prompting cautious prescribing patterns. These factors create a barrier to achieving optimal therapeutic outcomes and restrain broader market expansion, especially in preventive treatment segments.

Availability of Alternative Therapies and Patent Expirations

The market faces pressure from expanding treatment alternatives, including aromatase inhibitors, bisphosphonates, and hormone-replacement therapies, which compete across key indications. Additionally, patent expirations of widely used SERMs, such as Tamoxifen and Raloxifene, intensify generic competition and reduce pricing power for branded products. This shift constrains revenue growth for leading manufacturers while increasing price sensitivity in mature markets. Companies must focus on innovation, differentiation, and emerging-market penetration to overcome competitive headwinds.

Regional Analysis

North America

North America dominated the Global Selective Estrogen Receptor Modulators Market with a 38.4% share in 2024, supported by high breast cancer prevalence, strong oncology treatment standards, and widespread adoption of SERMs such as Tamoxifen and Raloxifene. Advanced diagnostic infrastructure, favorable reimbursement, and active awareness programs enhance therapeutic penetration. The presence of major pharmaceutical innovators contributes to continuous clinical advancements. Growing preference for non-hormonal postmenopausal therapies and rising use of online pharmacies further strengthen regional growth, positioning North America as a consistent revenue generator throughout the forecast period.

Europe

Europe held a 29.7% share in 2024, driven by strong clinical acceptance of SERMs in breast cancer and osteoporosis management. High screening participation rates and structured, well-funded healthcare systems promote early diagnosis and guideline-based endocrine therapy. The region benefits from collaborative oncology research, extensive clinical trial activity, and increasing availability of affordable generics. Growing demand for safer, non-hormonal menopausal management solutions supports sustained adoption. Regulatory harmonization across the EU enhances product accessibility and ensures consistent therapeutic standards, further reinforcing Europe’s substantial contribution to global market revenue.

Asia-Pacific

Asia-Pacific accounted for a 22.6% share in 2024 and continues to expand rapidly due to rising breast cancer incidence, increasing healthcare investments, and improved access to diagnostics. Aging populations across China, Japan, and India drive strong demand for osteoporosis treatments, boosting uptake of Raloxifene and other SERMs. Government initiatives supporting women’s health awareness and insurance penetration enhance treatment accessibility. Local pharmaceutical manufacturing strengthens supply reliability and cost efficiency. Expanding digital pharmacy platforms and urban healthcare modernization create favorable conditions for broader SERM adoption across diverse patient segments.

Latin America

Latin America captured a 6.4% share in 2024, supported by increasing awareness of breast cancer and menopausal health issues. Countries such as Brazil, Mexico, and Argentina lead regional demand due to their expanding oncology networks and improved availability of generic SERMs. Public health initiatives emphasizing early screening and osteoporosis prevention contribute to market growth. However, varying healthcare quality and reimbursement gaps limit uniform adoption across the region. Despite these constraints, improving access to women’s health services and growing interest in non-hormonal therapies provide steady development opportunities.

Middle East & Africa

The Middle East & Africa accounted for a 2.9% share in 2024, driven by gradual improvements in cancer care infrastructure and rising diagnosis rates in countries such as Saudi Arabia, the UAE, and South Africa. Increased investment in specialty hospitals and broader availability of oncology treatments support expanding SERM utilization. Limited screening programs, cost barriers, and lower awareness of osteoporosis management continue to restrict widespread adoption in several markets. Nonetheless, growing healthcare modernization initiatives, international collaborations, and enhanced access to generics create long-term opportunities for market expansion.

Market Segmentations

By Product Type

- Ospemifene

- Raloxifene

- Tamoxifen

- Toremifene

By Indication

- Breast Cancer Treatment

- Osteoporosis

- Postmenopausal Symptoms

- Vaginal Atrophy

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By End User

- Women Aged 18-45

- Women Aged Over 45

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Global Selective Estrogen Receptor Modulators Market is shaped by the presence of major companies such as AstraZeneca, Eli Lilly and Company, Pfizer Inc., Shionogi & Co., Ltd., Ipsen S.A., Teva Pharmaceutical Industries Ltd., Mylan, Sun Pharmaceutical Industries Ltd., Amneal Pharmaceuticals, and Lupin Limited. These companies strengthen market growth through extensive oncology portfolios, expanding women’s health therapeutics, and strategic investments in next-generation SERM development. Leading players focus on clinical innovation, lifecycle management of established products, and geographic expansion to enhance market reach. Generic manufacturers play a crucial role by increasing affordability and accessibility, particularly in emerging markets where demand for cost-effective endocrine therapies is rising. Partnerships with research institutions, commercialization alliances, and advancements in formulation technologies support product differentiation. As breast cancer and osteoporosis prevalence increases globally, companies continue prioritizing R&D, regulatory approvals, and targeted commercialization efforts to reinforce their market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Atossa Therapeutics announced advancement of its novel SERM/SERD candidate (Z)-endoxifen, describing progress in its development as a potential treatment in breast-cancer care continuum.

- In September 2025, Eli Lilly and Company received FDA approval for imlunestrant (brand name Inluriyo), representing a significant advancement in the selective estrogen receptor degrader (SERD) market.

- In 2025, a small-molecule Vepdegestrant (a PROTAC-based ER degrader) from Arvinas had its New Drug Application submitted to the U.S. Food and Drug Administration (FDA) for ESR1-mutant ER+/HER2- metastatic breast cancer.

- In January 2025, Cycle Pharmaceuticals completed the acquisition of Banner Life Sciences, LLC, which included the FDA-approved multiple sclerosis treatment BAFIERTAM® (monomethyl fumarate).

Report Coverage

The research report offers an in-depth analysis based on Product Type, Indication, Distribution Channel, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as breast cancer screening programs expand globally and increase early treatment rates.

- Demand for non-hormonal therapies will rise as patients and clinicians prioritize safer alternatives for menopausal and postmenopausal conditions.

- Advancements in next-generation SERMs with improved selectivity and reduced side effects will enhance long-term adoption.

- Digital health integration will support better treatment adherence and broaden access through online pharmacies and telehealth platforms.

- Emerging markets will contribute significantly to future growth as healthcare infrastructure and diagnosis rates improve.

- Increased investment in oncology and women’s health R&D will accelerate the introduction of innovative therapies.

- Wider availability of generics will make SERMs more accessible, expanding patient reach despite pricing pressures.

- Combination therapy research will open new clinical applications across oncology and metabolic health.

- Regulatory support for endocrine therapies will strengthen product uptake across major healthcare systems.

- Growing emphasis on personalized treatment will drive the development of targeted SERM formulations tailored to specific patient profiles.