Market Overview:

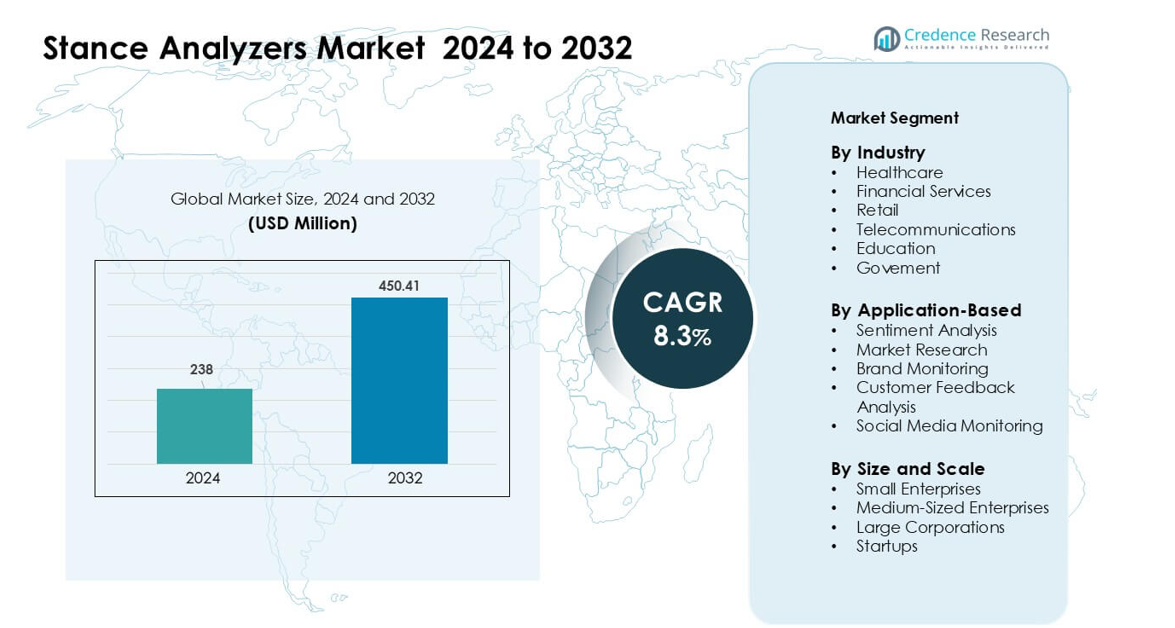

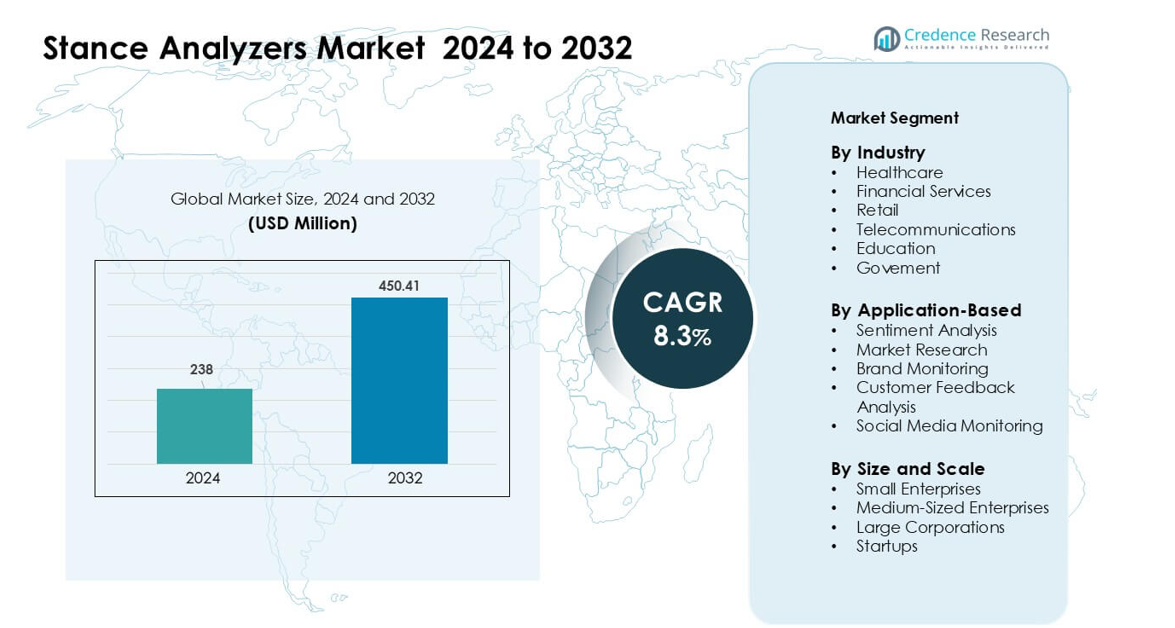

Stance Analyzers Market was valued at USD 238 million in 2024 and is anticipated to reach USD 450.41 million by 2032, growing at a CAGR of 8.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

Stance Analyzers Market Size 2024

|

USD 238 million |

| Stance Analyzers Market, CAGR |

8.3% |

| Stance Analyzers Market Size 2032 |

USD 450.41 million |

North America led the Stance Analyzers Market in 2024 with 38% share, driven by strong adoption across rehabilitation centers, sports institutes, and digital health programs. Key players such as Centaur Biomechanics, Noldus, Tekscan, LiteCure, TSE Systems, Zebris Medical, Viewpoint, GAIT4Dog (CIR Systems), Petsafe (Radio Systems Corporation), and Simi Reality Motion Systems strengthened market growth through advanced pressure-mapping platforms, gait evaluation systems, and multi-sensor motion analysis tools. These companies expanded their portfolios with AI-enabled diagnostics, portable assessment devices, and cloud-integrated reporting solutions. Their strong presence in clinical, sports, and veterinary applications positioned the market for steady global expansion.

Market Insights

- The Stance Analyzers Market was valued at USD 238 million in 2024 and is projected to reach USD 450.41 million by 2032, growing at a CAGR of 8.3% during the forecast period.

- Rising adoption of objective gait and balance assessment in healthcare drives strong demand, with the healthcare industry holding about 32% share due to wider use in rehabilitation and fall-risk prevention.

- Portable and AI-enabled systems shape key market trends as clinics and sports centers shift toward real-time, data-driven posture analysis, boosting usage across performance optimization and home-based therapy.

- Competition intensifies among Centaur Biomechanics, Tekscan, Zebris Medical, GAIT4Dog, and LiteCure, with companies expanding cloud connectivity, multi-sensor platforms, and advanced pressure-mapping features.

- North America led the market in 2024 with 38% share, followed by Europe at 29% and Asia-Pacific at 24%, driven by strong healthcare modernization and rising sports science adoption across major countries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Industry

Healthcare led the industry segment in 2024 with about 32% share, driven by rising adoption of stance analytics for patient rehabilitation, posture assessment, and balance monitoring. Hospitals and physiotherapy centers used these systems to track recovery progress and reduce fall risks among elderly patients. Financial services, retail, telecommunications, education, and government sectors gained steady traction, but their adoption remained smaller due to limited clinical relevance. Growing demand for data-supported diagnostics and integration of stance analyzers with electronic health records further strengthened healthcare’s dominant position in this segment.

- For instance, OneStep a health‑tech firm providing smartphone‑based gait and motion analysis for clinical use announced in late 2024 that its platform was in use by over 20 providers including hospitals and rehab centers, enabling gait measurements with no extra wearables and integrating with electronic health‑record workflows.

By Application-Based

Sentiment Analysis dominated the application-based segment in 2024 with nearly 35% share, supported by high use among enterprises aiming to understand customer attitudes across digital channels. Companies applied advanced stance models to detect opinions in text, speech, and social posts, allowing faster insight generation. Market research, brand monitoring, customer feedback analysis, and social media monitoring expanded gradually, but they held smaller shares due to narrower use cases. Increased focus on real-time behavioral analytics and improved AI model accuracy kept Sentiment Analysis as the preferred application within the market.

- For instance, Enterprises across sectors from retail to finance leveraged these integrations: in 2024, many of these tools supported multilingual analysis across more than 23 languages, enabling global brand‑monitoring efforts.

By Size and Scale

Large Corporations held the leading share in 2024 with around 41%, driven by strong budgets, established analytics teams, and adoption of enterprise-grade stance analysis platforms. These organizations used advanced tools to process high-volume customer interactions, workforce feedback, and brand-related data. Small enterprises, medium-sized businesses, and startups showed rising adoption as cloud-based tools became more affordable, yet their overall share remained lower. Expansion of scalable subscription models and demand for automated decision insights helped large corporations maintain leadership across the size and scale segment.

Key Growth Drivers:

Rising Demand for Objective Clinical Assessment Tools

The stance analyzers market grows strongly as healthcare providers seek objective measurement tools to support accurate diagnosis and rehabilitation planning. Hospitals, physiotherapy centers, and sports medicine clinics use stance analyzers to evaluate posture, balance, and gait more precisely than manual observation. Growing cases of mobility disorders among elderly populations further increase adoption, as clinicians rely on automated pressure mapping and weight distribution insights to design targeted treatment plans. The shift toward evidence-based medicine encourages higher use of quantified assessments, improving patient outcomes and lowering long-term care costs. Clinical studies linking early biomechanical analysis with reduced fall risks support wider integration of stance analyzers in preventive care programs. These demand patterns make diagnostic automation a leading driver of long-term market expansion.

- For instance, a 2024 meta‑analysis of 58 randomized controlled trials on sensor‑based interventions for older adults (total 2,713 participants) found that sensor‑based gait and balance training improved normal gait speed by 4.244 cm/s compared to traditional exercise in the optical‑sensor (OPTS) subgroup, and increased 6‑Minute Walk Test (6MWT) distance by 25.166 meters on average.

Expansion of Motion Analysis in Sports Performance and Injury Prevention

Sports training centers and athletic programs increasingly adopt stance analyzers to optimize performance and reduce injury risks. Coaches use these systems to track pressure shifts, identify biomechanical imbalances, and tailor training routines for athletes across football, basketball, running, and other disciplines. Real-time feedback helps athletes correct posture and movement patterns, supporting better agility and stability. Professional teams and elite sports institutions allocate larger budgets for advanced analytics, boosting demand for high-precision stance platforms. Awareness of overuse injuries and the need to prevent joint stress further accelerates adoption. Integration with wearable sensors and video analysis tools enhances data accuracy, while cloud-based performance dashboards allow long-term tracking. Rising investments in sports science and athlete monitoring sustain this key growth driver.

- For instance, a 2025 scoping review of sensor‑based sports motion‑analysis research covering 42 studies found that inertial measurement units (IMUs) often used in stance/gait analysis are the most common sensor type used in athletic injury assessment.

Increasing Integration of AI and Digital Health Platforms

Advanced stance analyzers increasingly rely on AI-driven analytics to deliver deeper insights into human movement. Machine learning models detect subtle pattern deviations that may signal early-stage musculoskeletal issues. Hospitals and rehabilitation centers connect these devices with digital health records, enabling automated progress tracking and data sharing among clinicians. AI-enabled flagging of abnormal gait behavior helps accelerate intervention decisions and supports personalized therapy. Increased use of telehealth and remote patient monitoring also boosts demand for compact, connected stance analyzers that enable home-based assessments. Cloud integration ensures secure storage of large datasets, improving long-term mobility tracking. As healthcare systems shift toward digital-first care models, the adoption of stance analyzers integrated with AI platforms grows rapidly, creating strong long-term market momentum.

Key Trends & Opportunities:

Adoption of Portable and Home-Based Stance Analysis Devices

A major market trend involves the shift toward portable stance analyzers designed for convenient use outside clinical settings. Home-based rehabilitation programs increasingly use compact pressure platforms that connect to mobile apps, allowing clinicians to monitor recovery remotely. This trend aligns with the rise of tele-rehabilitation, which enables continuous patient engagement without frequent hospital visits. Manufacturers see strong opportunity in elderly care, where fall-risk monitoring at home becomes essential. Lightweight, foldable devices with quick calibration features attract both patients and physiotherapists. Integration with smartphone dashboards enhances usability and encourages long-term adherence to therapy plans. As demand grows for decentralized healthcare, portable analyzers represent a major commercial opportunity for companies targeting consumer-oriented and remote-care markets.

- For instance, Tekscan offers a portable pressure‑sensing mat called MobileMat whose sensing area is just 48.7 × 44.7 cm and thickness 0.76 cm making it slim and easy to deploy in non‑clinical environments.

Integration of Cloud, Wearables, and Multi-Sensor Platforms

Stance analyzers benefit from increasing integration with cloud systems, motion sensors, and wearables, creating new opportunities for multi-modal biomechanical assessment. Users gain access to synchronized data from pressure plates, inertial measurement units, and smart shoes, giving a fuller picture of human balance and posture. Cloud access helps researchers compare large datasets, while sports teams use integrated analytics to track long-term performance metrics. Hospitals also benefit from synchronized monitoring across physiotherapy devices. This trend supports predictive modeling for injury risk assessment and movement disorder detection. As interoperability standards improve, vendors offering unified sensor ecosystems gain a competitive advantage, opening opportunities for partnerships with health-tech and wearable companies.

- For instance, a study of a wearable IMU‑based modular device showed that combining IMU sensors in a modular wearable architecture enables robust human motion classification allowing monitoring of individual limb movements or full‑body motion outside controlled lab settings.

Key Challenges:

High Equipment Cost and Limited Budget Access in Small Clinics

The cost of high-precision stance analyzers remains a major challenge for smaller hospitals, rural clinics, and physiotherapy centers operating with constrained budgets. Advanced systems with multi-sensor platforms, AI-driven analytics, and cloud connectivity require substantial upfront investment. Many small facilities opt for low-cost alternatives or traditional manual assessment, slowing broader adoption. Maintenance requirements and periodic calibration add additional expenses. Limited insurance reimbursement for stance analysis procedures also restricts financial feasibility. As a result, market penetration remains stronger in large hospitals, research institutions, and sports centers with adequate funding. Addressing cost barriers through leasing models and low-cost versions is essential to expand adoption.

Lack of Standardization and Limited Clinical Awareness

Despite strong technological progress, the stance analyzers market faces challenges related to inconsistent clinical guidelines and lack of standardized protocols. Variations in device calibration, data output formats, and interpretation methods create uncertainty for clinicians. Many physiotherapists and physicians are still unaware of the full diagnostic value of stance analysis, leading to underutilization. Training gaps and limited inclusion of biomechanical assessment in medical education restrict wider adoption. Inconsistent integration with electronic health records also reduces workflow efficiency. Without strong standardization and awareness programs, the technology’s clinical value may remain under-recognized, slowing market growth.

Regional Analysis:

North America

North America held the leading position in the stance analyzers market in 2024 with about 38% share, supported by widespread adoption across hospitals, physiotherapy centers, and sports institutions. The United States drove most demand due to strong investments in digital health, rehabilitation technologies, and athletic performance analytics. Clinics used advanced pressure-mapping systems for gait correction and injury prevention, while sports organizations applied motion analysis to optimize training. High awareness of fall-risk prevention among older adults supported broader usage in home-care programs. Favorable reimbursement policies and strong presence of major manufacturers continued to reinforce regional dominance.

Europe

Europe accounted for roughly 29% share in 2024, driven by strong adoption in Germany, the U.K., France, and Nordic countries. Rehabilitation centers widely used stance analyzers to support orthopedic recovery, while sports science programs in elite clubs accelerated demand for advanced balance assessment tools. Aging populations across Western Europe increased the need for fall-prevention solutions, boosting clinical usage. Government-funded healthcare systems encouraged integration of digital posture analysis into physiotherapy workflows. Growing investments in research centers and university biomechanics labs further strengthened the region’s contribution to global market growth.

Asia-Pacific

Asia-Pacific captured about 24% share in 2024 and showed the fastest growth due to rising healthcare modernization in China, India, Japan, and South Korea. Hospitals expanded their rehabilitation departments, increasing demand for objective gait and balance assessment tools. Sports training centers and academic institutions adopted stance analyzers to support athlete performance and research programs. Rapid urbanization and higher prevalence of mobility impairments among aging populations supported broader clinical usage. Increasing government investment in healthcare digitization and growing interest in home-based rehabilitation solutions positioned Asia-Pacific as a major expansion opportunity.

Latin America

Latin America held nearly 6% share in 2024, with Brazil, Mexico, and Argentina leading regional adoption. Physiotherapy and sports medicine clinics used stance analyzers to improve musculoskeletal assessment accuracy and design personalized recovery plans. Growing interest in injury prevention among amateur athletes supported steady equipment purchases. Regional healthcare providers expanded digital rehabilitation programs, increasing demand for pressure-based balance systems. Budget limitations remained a barrier, yet wider availability of mid-range devices encouraged gradual adoption. Training partnerships with global manufacturers helped improve awareness and increased the use of stance analysis tools across key markets.

Middle East & Africa

Middle East & Africa accounted for around 3% share in 2024, driven mainly by adoption in the UAE, Saudi Arabia, and South Africa. Advanced hospitals in Gulf countries invested in gait assessment technologies to support orthopedic and neurological rehabilitation. Sports academies and fitness centers used stance analyzers to enhance athlete monitoring, though adoption remained limited outside major cities. Budget constraints and lower clinical awareness slowed broader uptake across Africa. However, rising interest in digital health systems and expansion of physiotherapy services positioned the region for steady long-term growth.

Market Segmentations:

By Industry

- Healthcare

- Financial Services

- Retail

- Telecommunications

- Education

- Govement

By Application-Based

- Sentiment Analysis

- Market Research

- Brand Monitoring

- Customer Feedback Analysis

- Social Media Monitoring

By Size and Scale

- Small Enterprises

- Medium-Sized Enterprises

- Large Corporations

- Startups

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The stance analyzers market features active competition driven by technology innovation, product expansion, and increasing adoption across clinical and sports environments. Key players such as Centaur Biomechanics, Noldus, Tekscan, LiteCure, TSE Systems, Zebris Medical, Viewpoint, GAIT4Dog (CIR Systems), Petsafe (Radio Systems Corporation), and Simi Reality Motion Systems lead the landscape with advanced pressure-mapping platforms, gait assessment tools, and multi-sensor systems. Companies focus on enhancing accuracy, portability, and AI-enabled analytics to strengthen diagnostic value. Partnerships with hospitals, physiotherapy centers, and sports institutions help expand global reach, while veterinary-focused solutions open niche opportunities. Many manufacturers invest in cloud integration, real-time data reporting, and ergonomic design to improve user experience. The market remains moderately fragmented, with each brand targeting specific domains such as human biomechanics, sports science, veterinary gait analysis, or research-based motion evaluation. Competitive intensity continues to rise as firms adopt innovation-driven strategies to gain measurable advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Centaur Biomechanics

- Noldus

- Tekscan

- LiteCure

- TSE Systems

- Zebris Medical

- Viewpoint

- GAIT4Dog (CIR Systems)

- Petsafe (Radio Systems Corporation)

- Simi Reality Motion Systems

Recent Developments:

- In January 2025, Data Insights Market’s global Animal Stance Analyzer report profiled GAIT4Dog as a key vendor. The study noted its 2020 launch of GAIT4Dog Lite for clinics and pet stores.

- In May 2025, Centaur Biomechanics Centaur has been active in evidence-based equine welfare work related to measuring tack fit and pressure (including commentary and demonstrations around the FEI’s new measuring tool rollout), and posted about the FEI’s global rollout of an evidence-based noseband measuring device in May 2025. This ties into broader interest in objective measurement tools for horse comfort and stance/pressure assessment.

- In May 2024, Tekscan (F-Scan GO software update) Tekscan published a major software update for its F-Scan GO in-shoe gait system on 16 May 2024, adding the FootVIEW Pro suite (clinician and researcher configurations), higher capture rates (up to 500 Hz for research mode), and improved analytics a notable upgrade for in-shoe pressure/stance measurement workflows

Report Coverage:

The research report offers an in-depth analysis based on Industry, Application- Based, Size and Scale and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will grow as clinics adopt more objective gait and balance assessment tools.

- AI-driven analysis will enhance early detection of mobility issues and improve treatment precision.

- Portable and home-based stance devices will gain wider acceptance in remote rehabilitation.

- Sports science programs will increase use of real-time pressure mapping for injury prevention.

- Integration with cloud platforms will strengthen data sharing across clinical and research teams.

- Veterinary gait analysis will expand as providers adopt advanced stance evaluation systems.

- Wearable-linked multi-sensor platforms will drive deeper biomechanical insights.

- Adoption will rise in emerging markets as healthcare infrastructure modernizes.

- Standardized clinical protocols will encourage broader use in physiotherapy and orthopedic care.

- Partnerships between device makers and hospitals will boost product development and global reach.