Market Overview

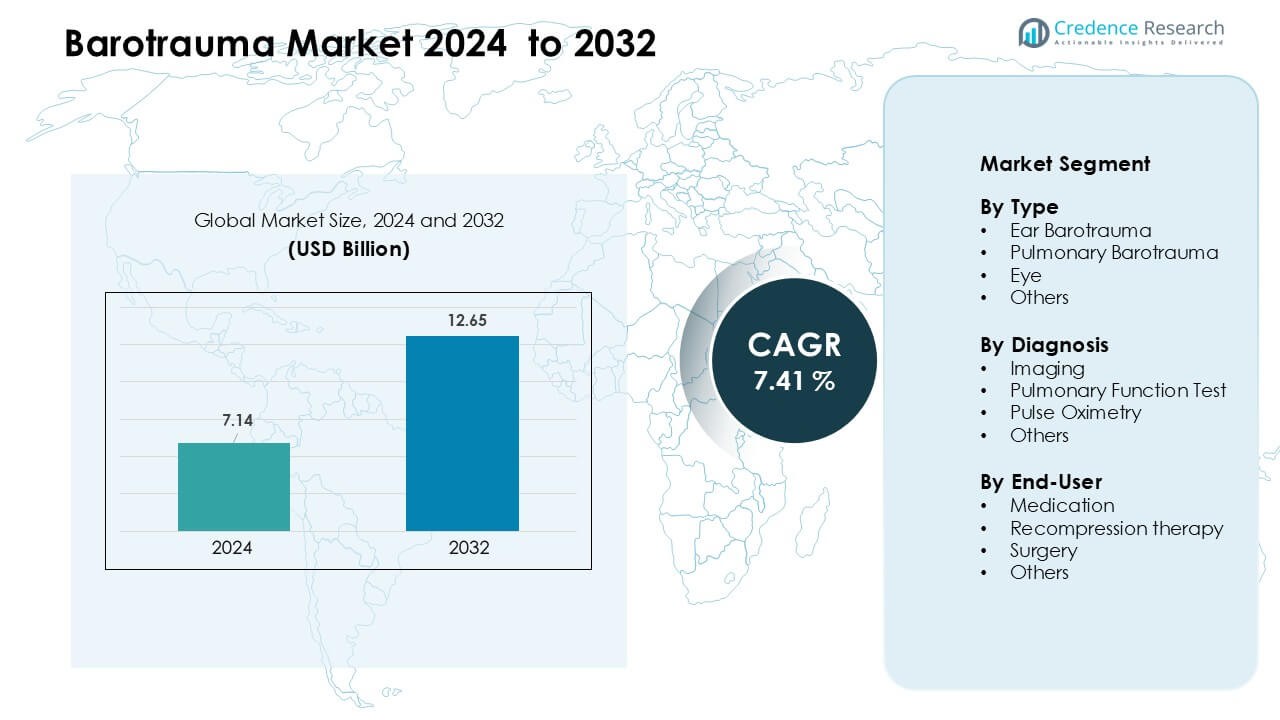

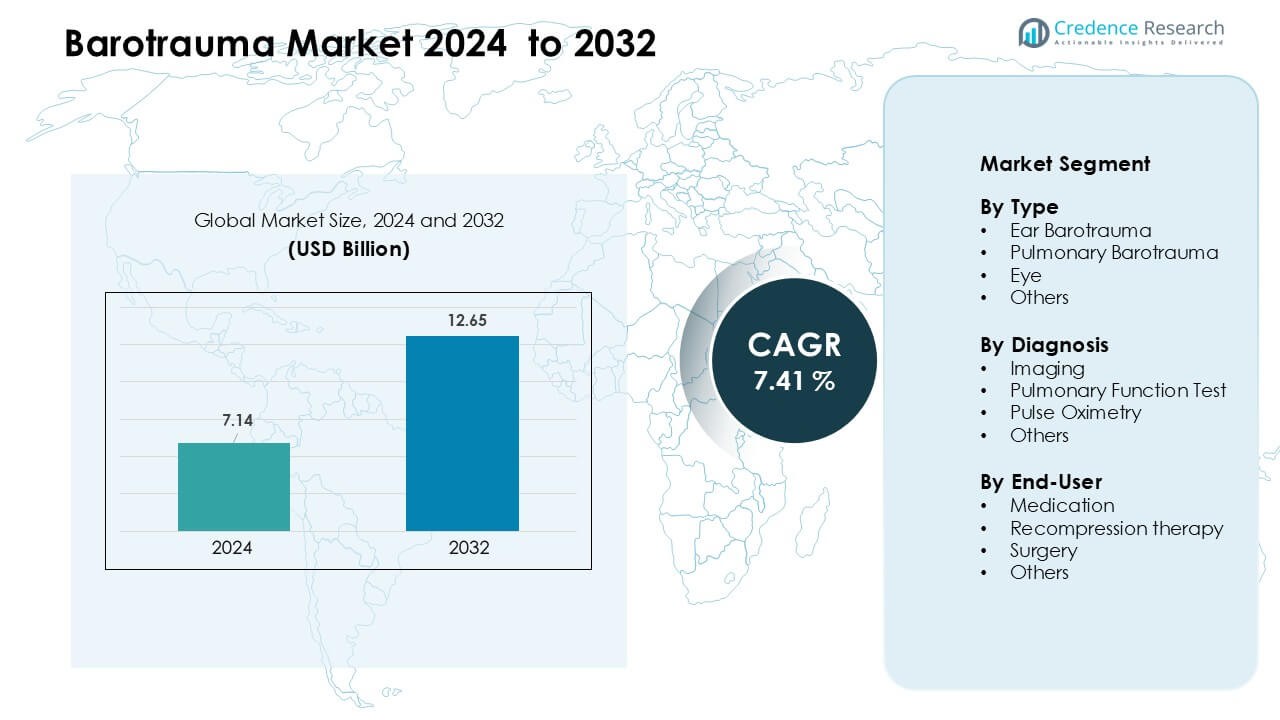

Barotrauma market was valued at USD 7.14 billion in 2024 and is anticipated to reach USD 12.65 billion by 2032, growing at a CAGR of 7.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Barotrauma Market Size 2024 |

USD 7.14 Billion |

| Barotrauma Market, CAGR |

7.41% |

| Barotrauma Market Size 2032 |

USD 12.65 Billion |

The barotrauma market is shaped by leading players such as Johnson & Johnson Consumer Inc., Nutra Respiro, Mallinckrodt, Cipla Health Ltd., Church & Dwight Co., Inc., Centaur Pharmaceuticals, GSK plc, Bayer AG, and Jabs Biotech Pvt. Ltd. These companies strengthen their presence through ENT care medicines, pulmonary relief products, and supportive therapies widely used for ear and lung pressure injuries. Their focus on product innovation, faster diagnosis support, and wider clinical outreach keeps competition active. North America remained the leading region in 2024 with about 38% market share, driven by strong critical-care infrastructure, high air-travel volume, and advanced diagnostic capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The barotrauma market reached USD 7.14 billion in 2024 and is projected to grow at a CAGR of 7.41% through 2032.

- Growth is driven by rising ICU ventilator use, increasing air-travel frequency, and expanding recreational diving activity, which together raise cases of ear and pulmonary pressure injuries.

- Trends include higher adoption of advanced CT/MRI imaging, expansion of hyperbaric centers, and greater clinical awareness in ENT and pulmonary care, improving early diagnosis rates.

- Key players such as Johnson & Johnson Consumer Inc., GSK plc, Bayer AG, Cipla Health Ltd., and Church & Dwight Co., Inc. compete through strong ENT portfolios and sinus-relief products, while smaller regional firms expand through targeted respiratory solutions.

- North America led the market with 38% share in 2024, followed by Europe at 29% and Asia Pacific at 22%; ear barotrauma dominated the type segment with about 52% share.

Market Segmentation Analysis:

By Type

Ear barotrauma held the dominant share in the barotrauma market in 2024 with about 52% share. Demand grew as frequent flyers, divers, and patients with sinus or Eustachian tube disorders reported rising pressure-related injuries. Ear conditions showed higher case volume than pulmonary and eye types due to wider exposure to altitude change. Growth was supported by increased air travel, higher recreational diving activity, and better clinical awareness among ENT specialists. Pulmonary barotrauma grew steadily, driven by ventilation-related complications in ICU settings, while eye-related injuries remained less common.

- For instance, AERA system’s U.S. launch in 2016 came from a pivotal randomized control trial involving 299 patients.

By Diagnosis

Imaging dominated the diagnosis segment in 2024 with nearly 55% market share. CT and MRI scans remained preferred tools for identifying pressure-related injuries in the lungs, ear, and sinus regions with high accuracy. Adoption grew due to wider availability of advanced radiology centers and faster assessment during emergency visits. Pulmonary function tests followed, driven by their role in assessing lung damage in severe cases. Pulse oximetry gained use in critical care units, but imaging stayed ahead due to broader diagnostic capability and stronger clinical guidelines.

- For instance, Siemens Healthineers reported that its SOMATOM Force dual-source CT system delivered ultra-high-speed scanning with a temporal resolution of 66 milliseconds, enabling precise visualization of barotrauma-related pulmonary tears.

By End-User

Medication led the end-user segment in 2024 with close to 48% share, supported by routine use of analgesics, decongestants, anti-inflammatory drugs, and antibiotics to treat mild to moderate barotrauma. The segment expanded as most ear and sinus injuries respond well to non-invasive therapy, reducing the need for surgical or high-cost interventions. Recompression therapy grew in diving-related cases but remained niche. Surgical procedures accounted for a smaller share, used mainly for chronic or severe complications. Medication maintained its lead due to high patient preference, lower cost, and easy accessibility.

Key Growth Drivers

Growing Incidence Linked to Air Travel and Diving Activity

Rising global mobility continues to drive stronger demand in the barotrauma market. Air travel has expanded worldwide, with more passengers exposed to rapid cabin-pressure fluctuations that trigger ear and sinus injuries. Recreational and professional diving also increased across coastal regions, raising the risk of pressure-related damage to the lungs, ears, and eyes. The boom in medical tourism and frequent business travel has pushed more individuals into high-altitude or underwater environments, leading to higher case volume in clinics and emergency units. Healthcare systems now track barotrauma more closely due to better diagnostic awareness, which further increases reported cases. Airlines and diving schools also promote education on risks, resulting in more early-stage consultations. These trends support consistent market expansion as more people engage in pressure-intense activities.

- For instance, PADI (Professional Association of Diving Instructors) has issued over 30 million scuba certifications since its founding, with 128,000 active PADI professionals working across 6,600 dive centers globally, increasing the number of divers potentially exposed to barotrauma risk.

Expansion of Critical Care and Mechanical Ventilation Use

Mechanical ventilation remains a major driver for pulmonary barotrauma cases, especially in intensive care units. Rising ICU admissions for respiratory diseases, trauma, and infectious outbreaks increased the number of patients requiring ventilator support, where incorrect pressure settings often trigger lung injury. Hospitals now operate larger ventilator fleets and advanced respiratory care systems, which strengthen detection and treatment demand. Older patients with chronic lung diseases, who require longer ventilation periods, also contribute to case growth. As global healthcare systems expand critical-care capacity, clinicians identify barotrauma more frequently and begin intervention earlier. Improvement in imaging tools further supports accurate assessment of ventilator-related injuries. This creates steady demand for medications, diagnostic imaging, and emergency interventions across advanced hospitals and regional medical centers.

- For instance, The Puritan Bennett™ 980 ventilator can deliver much lower tidal volumes, down to 2 mL for neonatal patients weighing as little as 0.3 kg.

Growing Awareness and Early Diagnosis in ENT and Pulmonary Care

Awareness among ENT and pulmonary specialists has increased significantly, pushing market growth. Clinics now identify pressure-related ear, sinus, and lung issues at earlier stages due to better training and standardized care pathways. Educational campaigns on safe diving, cabin-pressure effects, and ventilator management encourage early reporting of symptoms, which boosts patient visits. Advances in CT and MRI imaging improve detection accuracy, helping doctors classify the severity of barotrauma quickly. Telemedicine consultations also rise, allowing travelers and divers to seek rapid guidance after exposure to pressure changes. Hospitals integrate updated guidelines for barotrauma diagnosis, which further expands patient throughput. Overall, stronger awareness and improved clinical protocols create steady demand for preventive and therapeutic solutions.

Key Trends & Opportunities

Technological Advancements in Imaging and Monitoring

New imaging technologies offer clearer detection of barotrauma, creating strong growth opportunities. High-resolution CT and MRI scans now detect even minor tissue damage in the lungs, ears, and sinuses, supporting faster and more reliable diagnoses. Portable diagnostic tools also expand access in remote diving regions and smaller clinics. Artificial intelligence improves image interpretation, reducing diagnostic delays and improving case management. Continuous respiratory monitoring devices help ventilator teams detect abnormal pressure levels early, lowering risk. This combination of advanced tools strengthens clinical decision-making and expands the market for diagnostic equipment and specialized care. As hospitals invest more in radiology upgrades, imaging-led diagnosis becomes a major opportunity area.

- For instance, Siemens Healthineers’ NAEOTOM Alpha photon-counting CT system delivers a spatial resolution of 0.2 mm, enabling detection of micro-level pulmonary and sinus tissue disruptions associated with barotrauma.

Rising Demand for Specialized Diving and Aviation Medicine Services

Specialty care in diving medicine and aviation medicine is becoming more structured, which opens new market opportunities. Many coastal countries now operate dedicated hyperbaric centers that treat diving-related pulmonary and ear barotrauma. Aviation clinics near major airports also report higher patient flow due to frequent flyer issues such as ear blockage and sinus injuries. Training programs for pilots, divers, and military personnel now include barotrauma risk prevention, increasing clinical outreach. Hyperbaric oxygen therapy facilities expand across hospitals, offering a cost-effective and proven treatment option. These developments create a broader ecosystem for diagnosing, managing, and preventing barotrauma in high-risk populations.

- For instance, In Thailand, the Centre of Hyperbaric Medicine at Somdech Phra Pinklao Hospital, under the Royal Thai Navy, runs a multiplace hyperbaric chamber that accommodates up to 30 patients per session.

Key Challenges

Risk of Misdiagnosis Due to Overlapping Symptoms

Barotrauma symptoms often resemble common ENT and respiratory issues, which leads to delays and misdiagnosis. Ear pain, dizziness, sinus pressure, and shortness of breath overlap with infections, allergies, or asthma, causing general practitioners to miss pressure-related causes. Pulmonary barotrauma may also mimic pneumothorax or COPD exacerbations, requiring advanced imaging to confirm. Limited awareness in rural clinics increases misclassification risk. Misdiagnosis results in delayed treatment, which can worsen tissue damage and increase long-term complications. The challenge persists even with improved imaging availability, as many patients seek care only after symptoms escalate. Addressing this issue requires stronger training and wider adoption of diagnostic protocols.

High Treatment Costs for Severe and ICU-Related Cases

Severe pulmonary barotrauma linked to mechanical ventilation often requires costly hospital care, including imaging, oxygen therapy, and specialist intervention. Hyperbaric oxygen therapy, though effective, remains expensive and limited to specialized centers. These costs restrict access in low-income regions and delay treatment for uninsured patients. Surgical intervention for chronic damage adds further financial burden. Hospitals in developing markets may also lack trained staff or advanced ventilators capable of minimizing pressure risk. As healthcare budgets tighten, reimbursement gaps grow, making advanced care harder to access. High treatment expenditure remains a major barrier for patients and healthcare systems, limiting market penetration in cost-sensitive regions.

Regional Analysis

North America

North America led the barotrauma market in 2024 with about 38% share. Strong adoption of mechanical ventilation in ICUs, high air-travel frequency, and well-developed diving activity supported steady case volumes. The U.S. recorded a large number of pressure-related ear and pulmonary injuries due to widespread ventilator use in critical-care settings. Advanced diagnostic imaging and hyperbaric centers improved early detection and treatment. Rising awareness among ENT and pulmonary specialists, along with strong insurance coverage, increased patient access to care. These factors kept North America the leading contributor to regional demand.

Europe

Europe held nearly 29% of the barotrauma market in 2024, driven by strong aviation density and rising participation in recreational diving across the Mediterranean region. Hospitals in Germany, France, Italy, and the U.K. reported consistent demand for imaging-based diagnosis of ear and pulmonary barotrauma. Expanded use of ventilators in aging populations increased pulmonary complications, boosting diagnostic and treatment needs. Well-established hyperbaric facilities and strong clinical guidelines supported patient management. Increased travel within the EU further contributed to pressure-related injuries, keeping Europe a major regional contributor.

Asia Pacific

Asia Pacific accounted for around 22% of the market in 2024, supported by rising air traffic, expanding tourism, and growing diving activity in countries such as Thailand, Indonesia, and Australia. Rapid growth in critical-care infrastructure led to more ventilator-associated pulmonary barotrauma cases. China, Japan, and India invested heavily in imaging centers, which increased diagnostic accuracy and patient reporting. Awareness among ENT and pulmonary specialists improved, encouraging early treatment of ear and sinus barotrauma. Expanding coastal tourism strengthened the need for hyperbaric and emergency care facilities, making Asia Pacific a fast-growing region.

Latin America

Latin America captured close to 7% share in 2024, supported by rising diving tourism in Brazil, Mexico, and the Caribbean. Growing ICU capacity increased the number of patients on mechanical ventilation, contributing to pulmonary barotrauma diagnoses. Limited awareness in rural areas slowed early detection, but urban hospitals improved imaging access and specialist availability. Air-travel recovery across major cities raised cases of ear barotrauma among frequent travelers. Investments in hyperbaric centers remained modest but increased in tourist zones. These factors kept Latin America a small yet steadily expanding regional market.

Middle East & Africa

The Middle East & Africa region held nearly 4% market share in 2024, supported by strong aviation networks in the UAE, Qatar, and Saudi Arabia. High passenger traffic led to increased ear and sinus barotrauma incidence. Specialized diving activity in the Red Sea region added to case volumes, especially in Egypt and Saudi Arabia. ICU modernization improved detection of ventilator-related pulmonary barotrauma, though overall access remained uneven across Africa. Limited imaging and hyperbaric facilities restricted advanced care in several nations. Despite constraints, rising healthcare investment supports gradual regional growth.

Market Segmentations:

By Type

- Ear Barotrauma

- Pulmonary Barotrauma

- Eye

- Others

By Diagnosis

- Imaging

- Pulmonary Function Test

- Pulse Oximetry

- Others

By End-User

- Medication

- Recompression therapy

- Surgery

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the barotrauma market includes key players such as Johnson & Johnson Consumer Inc., Nutra Respiro, Mallinckrodt, Cipla Health Ltd., Church & Dwight Co., Inc., Centaur Pharmaceuticals, GSK plc, Bayer AG, and Jabs Biotech Pvt. Ltd. These companies strengthen their position through a mix of medications, ENT care products, and pulmonary support solutions used for treating pressure-related injuries. Firms expand reach by offering decongestants, anti-inflammatory formulations, and sinus-relief products that address mild and moderate cases. Imaging and diagnostic partnerships help hospitals improve accuracy in identifying barotrauma in ICU and emergency settings. Players also support hyperbaric centers with advanced treatment supplies used in diving and aviation injuries. Many companies invest in awareness programs for travelers and divers, helping patients detect symptoms early. With rising air travel, growing diving activity, and expanded ventilator use in hospitals, competition continues to increase, encouraging strong product innovation and wider service networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Johnson & Johnson Consumer Inc. (U.S.)

- Nutra Respiro (India)

- Mallinckrodt (U.K.)

- Cipla Health Ltd. (India)

- Church & Dwight Co., Inc. (U.S.)

- Centaur Pharmaceuticals (India)

- GSK plc (U.K.)

- Bayer AG (Germany)

- Jabs Biotech Pvt. Ltd. (India)

Recent Developments

- In November 2025, Jabs Biotech Pvt. Ltd. (India) Jabs Biotech’s current public product listings include ear drops and nasal sprays (OTC/OTC-style products) items that are commonly used for symptomatic ear care and nasal decongestion (relevant in management/prevention of ear and sinus barotrauma).

- In October 2025, Cipla, Launched Breathefree UAE (first phase) expanded its flagship respiratory patient-support initiative into the UAE with a localized bilingual website, educational videos and an on-ground awareness/engagement campaign to improve inhaler technique, adherence and respiratory disease awareness.

- In October 2025, Cipla Confirmed multiple upcoming respiratory asset launches: Cipla announced plans to bring four major respiratory assets to market by 2026 as part of a broader push to strengthen its respiratory franchise. These pipeline/launch plans support Cipla’s strategic focus on lung/airway therapies that are relevant to managing pressure-related respiratory complications

Report Coverage

The research report offers an in-depth analysis based on Type, Diagnosis, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as global air travel continues to rise each year.

- Mechanical ventilation use in ICUs will expand, increasing pulmonary barotrauma cases.

- Early diagnosis rates will improve due to wider access to advanced imaging tools.

- ENT clinics will adopt faster treatment pathways for ear and sinus barotrauma.

- Hyperbaric centers will expand in major diving and tourism regions.

- Companies will invest in safer ventilation technologies to reduce lung injury risk.

- Awareness programs for divers and frequent flyers will support preventive care.

- Pharmaceutical firms will launch improved nasal, sinus, and anti-inflammatory products.

- AI-based diagnostic support will help clinicians detect pressure injuries more accurately.

- Emerging markets will strengthen capacity for barotrauma treatment as healthcare investment grows.